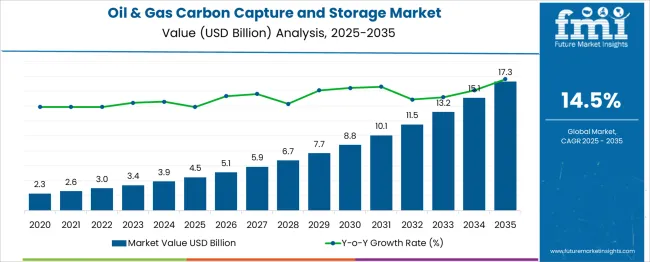

The Oil & Gas Carbon Capture and Storage Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 17.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.5% over the forecast period.

The oil & gas carbon capture and storage market represents a growth multiplier of 3.84x, driven by large-scale deployment of CCS infrastructure to meet emission-reduction mandates and carbon-neutral targets. The CAGR of 14.5% underscores a high-growth scenario across upstream, midstream, and downstream segments.

Phase-wise analysis indicates that from 2025 to 2030, the market is expected to rise from USD 4.5 billion to approximately USD 8.9 billion, delivering an incremental gain of USD 4.4 billion, which accounts for 34% of the total opportunity. This early-phase growth is anchored by investments in pilot projects, enhanced oil recovery (EOR) initiatives, and regional carbon hubs in North America and Europe. The second phase, 2030 to 2035, is projected to contribute USD 8.4 billion, representing 66% of incremental growth, driven by commercialization of large-scale CCS plants, offshore sequestration expansion, and integration with hydrogen production facilities.

This back-loaded growth pattern indicates significant acceleration post-2030, favoring companies investing early in pipeline networks, storage reservoirs, and proprietary capture technologies to leverage this USD 12.8 billion market expansion.

| Metric | Value |

|---|---|

| Oil & Gas Carbon Capture and Storage Market Estimated Value in (2025 E) | USD 4.5 billion |

| Oil & Gas Carbon Capture and Storage Market Forecast Value in (2035 F) | USD 17.3 billion |

| Forecast CAGR (2025 to 2035) | 14.5% |

The oil and gas carbon capture and storage (CCS) market holds a strategic position in decarbonization efforts within the energy sector. In the carbon capture, utilization, and storage (CCUS) market, its share is significant at approximately 45–50%, as oil and gas operations are among the largest sources of carbon emissions targeted for capture. Within the oilfield services market, its share is smaller, around 4–5%, since this segment includes drilling, completion, and other services unrelated to emissions control.

In the enhanced oil recovery (EOR) market, CCS represents nearly 20–22%, as captured CO₂ is widely used for tertiary oil recovery techniques. For the industrial emission control and management market, its share stands at 8–10%, given that other heavy industries such as steel and cement also contribute to emissions management. In the energy transition and decarbonization technologies market, the share is about 12–15%, reflecting its growing relevance among multiple low-carbon solutions like hydrogen and renewables.

Growth is driven by global net-zero targets, regulatory mandates, and large-scale investments by oil majors in CCS infrastructure. Technological innovations in capture efficiency, storage security, and cost reduction are further strengthening adoption. As governments incentivize carbon-neutral operations, oil and gas CCS is positioned to expand its influence across these parent markets.

The oil and gas carbon capture and storage market is undergoing significant transformation as industries prioritize decarbonization strategies to comply with climate commitments and regulatory frameworks. Growing awareness of greenhouse gas emissions and the pressing need to mitigate climate impact have accelerated the deployment of carbon capture solutions across upstream and downstream operations.

The market is benefiting from advancements in capture efficiency, reduced operational costs, and integration of storage networks with existing oilfield infrastructure. Future growth is expected to be driven by supportive government incentives, increased investments in carbon management technologies, and the emergence of large-scale industrial clusters aimed at reducing emissions collectively.

Rising stakeholder expectations for sustainable operations and the opportunity to leverage captured carbon for enhanced oil recovery are paving the way for broader adoption and long-term scalability in this sector.

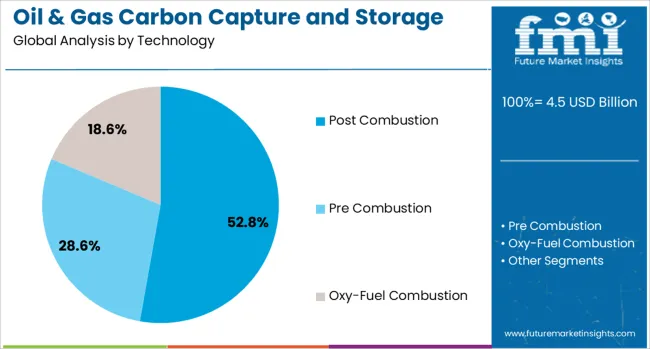

The oil & gas carbon capture and storage market is segmented by technology and geographic regions. The technology of the oil & gas carbon capture and storage market is divided into Post Combustion, Pre Combustion, and Oxy-Fuel Combustion. Regionally, the oil & gas carbon capture and storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by technology, the post combustion segment is expected to account for 52.80% of the total market revenue in 2025, positioning it as the leading technology. This dominance has been supported by its compatibility with existing oil and gas infrastructure, allowing retrofitting of current facilities without substantial redesign.

The ability to capture carbon dioxide directly from flue gases after combustion has facilitated its widespread deployment, especially where operational continuity is critical. Continuous improvements in solvent-based capture efficiency and reductions in energy penalty have strengthened its economic feasibility and appeal.

The segment’s leadership has also been reinforced by its suitability for large-scale projects and its demonstrated reliability in diverse operating conditions, enabling operators to achieve emissions targets while maintaining production stability. These factors collectively have secured the post combustion segment’s preeminence within the oil and gas carbon capture and storage market.

The oil and gas carbon capture and storage (CCS) market is driven by emission reduction mandates, large-scale storage projects, and corporate commitments to low-carbon operations. Opportunities exist in offshore CO₂ storage and integration of CCS with enhanced oil recovery. Emerging trends include long-term CO₂ transportation networks, hub-based infrastructure, and utilization projects for synthetic fuels.

Restraints such as high capital intensity, fluctuating crude prices, and limited policy incentives hinder broad adoption. Companies investing in scalable storage sites and collaborative CCS clusters are considered better positioned for long-term competitive advantage in this evolving sector.

The oil and gas CCS market is experiencing growth due to rising investments in emission reduction strategies by leading energy companies. In 2024, ExxonMobil and Chevron announced multi-billion-dollar CCS hubs in the US Gulf Coast to support industrial decarbonization. Similar projects were observed in Norway with Equinor expanding offshore CO₂ injection facilities. Government-backed tax credits and carbon trading systems in North America and Europe have reinforced adoption.

It is believed that large-scale infrastructure development for permanent storage and EOR applications has become a core pillar of operational planning for oil producers globally.

Opportunities are being shaped by offshore geological formations and emerging CO₂ shipping corridors enabling cost-efficient cross-border storage. In 2025, new agreements were signed in the North Sea for shared pipeline networks connecting multiple emitters to consolidated storage hubs. Offshore saline aquifers have gained importance for their large capacity and security profile. It is considered that EPC contractors and oil majors leveraging maritime logistics for CO₂ transportation can capture long-term contracts with heavy industries. These opportunities are anticipated to expand significantly as regional carbon pricing frameworks and climate targets continue to influence energy sector strategies.

A trend gaining momentum is the development of large CCS hubs servicing clusters of industrial emitters along with integrated CO₂ utilization for fuels and chemicals. In 2024, multi-user facilities in Canada and Europe began operations, reducing unit costs through shared infrastructure. Startups were observed introducing CO₂-to-synthetic-fuel processes aligned with petrochemical feedstock supply chains. Digital tools enabling reservoir monitoring and injection optimization are being widely adopted to ensure storage integrity. These initiatives are viewed as transforming CCS from isolated projects to scalable systems, allowing oil companies to position themselves as key players in carbon management networks.

A major restraint in the oil and gas CCS market is the capital-intensive nature of capture facilities and storage infrastructure. In 2024, cost overruns were reported for several pipeline and compression projects in North America, leading to delayed commissioning. Limited policy consistency and slow approval processes in Asia and Latin America have hindered investments. Fluctuations in crude oil prices add complexity, making returns on CCS projects less predictable. It is believed that without stronger fiscal incentives and risk-sharing frameworks, smaller firms and independent producers will struggle to adopt CCS technologies at a competitive scale.

| Country | CAGR |

|---|---|

| China | 19.6% |

| India | 18.1% |

| Germany | 16.7% |

| France | 15.2% |

| UK | 13.8% |

| USA | 12.3% |

| Brazil | 10.9% |

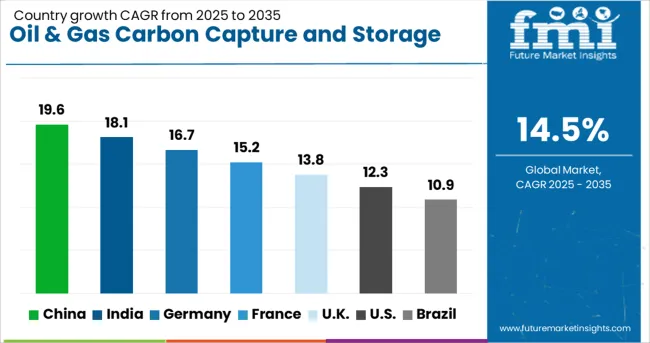

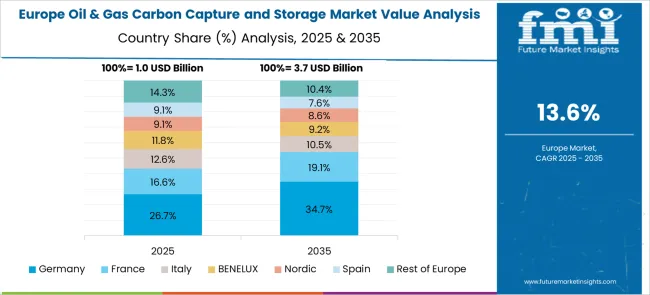

The global oil & gas carbon capture and storage (CCS) market is projected to grow at a CAGR of 14.5% from 2025 to 2035. China leads with 19.6%, followed by India at 18.1% and Germany at 16.7%. France records 15.2%, while the United Kingdom posts 13.8%. Growth is driven by stricter emission reduction mandates, large-scale CCS pilot projects, and integration with enhanced oil recovery (EOR) initiatives. China and India dominate adoption due to industrial decarbonization goals, while Germany focuses on pipeline transport infrastructure. France and the UK prioritize offshore storage and regulatory compliance for carbon neutrality targets.

The oil & gas CCS market in China is forecast to grow at 19.6%, driven by aggressive decarbonization policies and large-scale industrial cluster projects. Post-combustion capture dominates in power and petrochemical sectors. Manufacturers invest in advanced amine-based solvent systems to improve capture efficiency. Strategic partnerships with state-owned oil companies accelerate CCS integration in enhanced oil recovery projects.

The oil & gas CCS market in India is projected to grow at 18.1%, supported by industrial decarbonization initiatives and investments in low-carbon technologies. Pre-combustion capture dominates adoption in gasification plants and refineries. Manufacturers develop cost-effective sorbent technologies to reduce operational costs. Government-backed pilot projects in major oil basins enhance confidence in large-scale CCS deployment.

The oil & gas CCS market in Germany is expected to grow at 16.7%, driven by expansion of CO₂ transport pipelines and integration with hydrogen projects. Oxy-fuel combustion capture dominates for industrial energy efficiency. Manufacturers prioritize carbon utilization technologies to produce synthetic fuels. EU regulatory frameworks supporting carbon neutrality accelerate investments in onshore and offshore storage sites.

The oil & gas CCS market in France is forecast to grow at 15.2%, supported by offshore storage initiatives and integration of CCS into existing refineries. Post-combustion capture dominates use in natural gas processing plants. Manufacturers introduce modular CCS systems for retrofitting older infrastructure. Collaborative European CCS projects enhance knowledge sharing and cost optimization.

The oil & gas CCS market in the UK is projected to grow at 13.8%, driven by North Sea offshore storage initiatives and net-zero targets. Post-combustion capture dominates implementation across gas-fired power plants. Manufacturers develop solvent regeneration technologies to reduce capture costs. Government funding under the CCS Infrastructure Fund accelerates industrial-scale adoption.

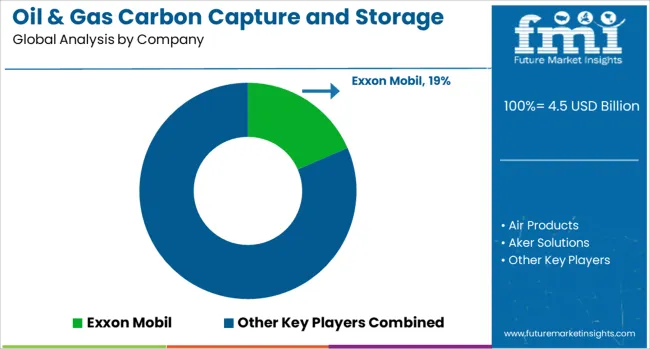

The oil & gas carbon capture and storage (CCS) market is moderately consolidated, with Exxon Mobil recognized as a leading player through large-scale CCS projects and partnerships aimed at reducing emissions in upstream and downstream operations. The company’s investments in advanced CO₂ capture technologies and integration with enhanced oil recovery (EOR) solutions have solidified its leadership in the sector.

Key players include Air Products, Aker Solutions, Chevron, Dakota Gasification Company, Equinor, Fluor, General Electric, Halliburton, Linde, Mitsubishi Heavy Industries, NRG Energy, Shell, Siemens, SLB (Schlumberger), Sulzer, and TotalEnergies. These companies offer end-to-end CCS solutions encompassing capture technologies (amine-based, oxy-fuel, membrane systems), compression, transportation, and long-term geological storage.

Their strategies focus on leveraging proprietary technologies, digital monitoring, and scalable systems to improve cost efficiency and reliability in industrial-scale deployments. Market growth is driven by tightening global emissions regulations, rising demand for decarbonization in the oil and gas value chain, and increased investment in carbon capture hubs. Leading companies are pursuing partnerships with governments and energy-intensive industries to accelerate large-scale CCS projects.

Emerging trends include the development of modular CCS units, integration with blue hydrogen production, and utilization of captured CO₂ for value-added applications such as synthetic fuels and chemicals. North America leads the market, followed by Europe and the Middle East, while Asia-Pacific is gaining momentum with industrial decarbonization initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Technology | Post Combustion, Pre Combustion, and Oxy-Fuel Combustion |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil, Air Products, Aker Solutions, Chevron, Dakota Gasification Company, Equinor, Fluor, General Electric, Halliburton, Linde, Mitsubishi Heavy Industries, NRG Energy, Shell, Siemens, SLB, Sulzer, and TotalEnergies |

| Additional Attributes | Dollar sales by capture, transport, and storage segments, and by end-use (oil & gas, power, cement); regional demand trends; competitive landscape of oil majors and CCS specialists; buyer preference for enhanced oil recovery and permanent storage; integration with hydrogen-hybrid and EOR systems; innovations in modular capture technology and cost-efficient solvent formulations. |

The global oil & gas carbon capture and storage market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the oil & gas carbon capture and storage market is projected to reach USD 17.3 billion by 2035.

The oil & gas carbon capture and storage market is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types in oil & gas carbon capture and storage market are post combustion, pre combustion and oxy-fuel combustion.

In terms of , segment to command 0.0% share in the oil & gas carbon capture and storage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA