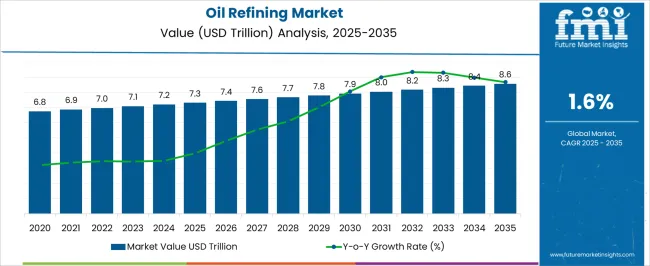

The Oil Refining Market is estimated to be valued at USD 7315.2 billion in 2025 and is projected to reach USD 8573.6 billion by 2035, registering a compound annual growth rate (CAGR) of 1.6% over the forecast period. The period from 2020 to 2025 shows fluctuating market dynamics, with values dipping to USD 0.2 billion in 2021 and USD 0.3 billion in 2022, followed by a rapid rebound to USD 6.8 billion in 2023. This volatility is attributed to geopolitical tensions, unstable crude oil prices, and shifts in demand patterns influenced by the COVID-19 pandemic and related economic disruptions.

Starting in 2024, the market stabilizes and embarks on a steady growth path fueled by rising global energy demand, expanding refining capacities, and investments in upgrading refineries to comply with stricter environmental and fuel quality regulations. From 2026 to 2030, the market advances moderately from USD 7.0 billion to USD 7.6 billion, supported by growing demand for cleaner fuels, technological enhancements in refining processes, and market growth in emerging economies. Refiners are focusing on boosting efficiency and product yield by adopting advanced catalytic technologies and digital transformation initiatives.

The final phase from 2031 to 2035 reflects further growth from USD 7.7 billion to USD 8.6 billion, driven by the global shift towards sustainable fuel production, including investments in renewable diesel and biofuel blending. Regulatory mandates targeting sulfur content reduction and emissions control further stimulate market expansion. Overall, the oil refining market is positioned for robust, resilient growth through 2035, shaped by evolving energy policies, technological progress, and increasing energy consumption globally.

| Metric | Value |

|---|---|

| Oil Refining Market Estimated Value in (2025 E) | USD 7315.2 billion |

| Oil Refining Market Forecast Value in (2035 F) | USD 8573.6 billion |

| Forecast CAGR (2025 to 2035) | 1.6% |

The oil refining market is undergoing structural transformation driven by regulatory shifts, fuel demand diversification, and increasing investments in cleaner processing technologies. Refineries across the globe are upgrading their configurations to meet tightening sulfur content regulations and to respond to changing product demand profiles, particularly with the rise of middle distillates and petrochemical feedstocks.

Operational efficiency is being enhanced through deeper integration of catalytic cracking, hydrocracking, and residue upgrading technologies. In parallel, refiners are balancing crude slate flexibility with emissions control targets.

Industry stakeholders are directing capital toward digital optimization, feedstock adaptability, and waste minimization to stay aligned with energy transition pathways. Future growth is expected to emerge from markets prioritizing fuel quality, export potential, and complex refining outputs, especially in Asia and the Middle East.

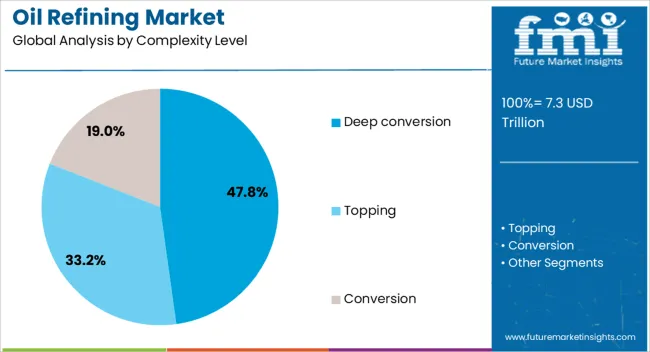

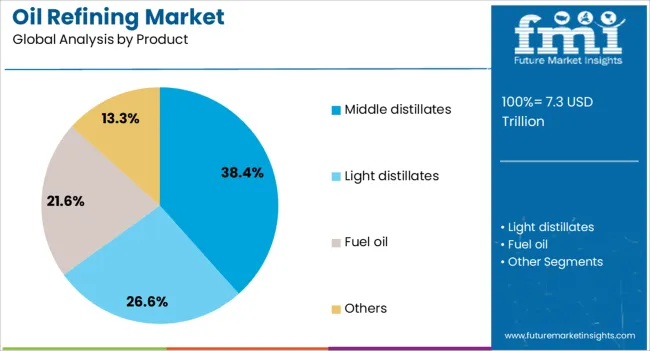

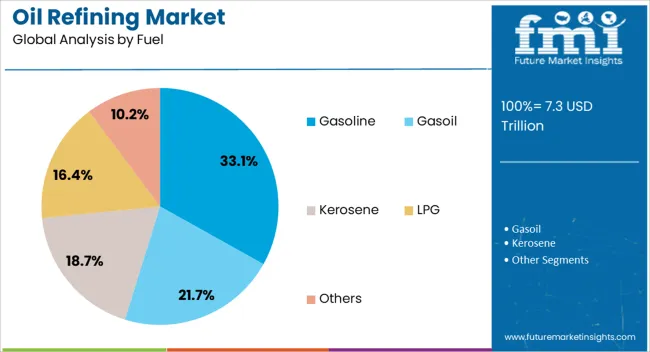

The oil refining market is segmented by complexity level, product, fuel, application, and geographic regions. By complexity level of the oil refining market is divided into Deep conversion, Topping, and Conversion. In terms of the product, the oil refining market is classified into Middle distillates, Light distillates, Fuel oil, and Others. The oil refining market is segmented based on fuel into Gasoline, Gasoil, Kerosene, LPG, and Others.

The oil refining market is segmented by application into Road transport, Aviation, Marine bunker, Petrochemical, Other industry, Residential/Commercial/Agriculture, Electricity generation, and Rail & domestic. Regionally, the oil refining industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Deep conversion refineries are projected to contribute 47.80% of the total revenue in the oil refining market by 2025, making them the leading segment by complexity level. Their dominance is being driven by the ability to maximize valuable product yield from heavy, sour crude through advanced processing units such as delayed cokers and hydrocrackers.

This configuration significantly reduces residual fuel oil production while enhancing distillate output, which aligns with evolving fuel quality standards and higher-margin product preferences. Strategic investments in residue upgrading and cleaner fuels compliance have made deep conversion facilities increasingly vital in both developed and developing regions.

Moreover, their capability to handle diverse crude grades has positioned them favorably amid shifting global supply dynamics and carbon intensity regulations.

Middle distillates are expected to account for 38.40% of the total oil refining market revenue in 2025, establishing this as the leading product segment. The dominance of this category is being supported by robust demand across transportation, aviation, and industrial sectors, especially in emerging economies.

Tightening emissions norms and phase-outs of high-sulfur fuels are compelling refiners to boost hydroprocessing capacity to produce ultra-low sulfur diesel (ULSD) and jet fuel. Middle distillates offer higher value realization per barrel and have become a focal point of refinery optimization strategies aimed at meeting export-grade fuel specifications.

Their versatility in end use, combined with cleaner burn properties, continues to drive both domestic and international trade volumes, strengthening their position in refinery product slates.

Gasoline is projected to hold a 33.10% share of the total oil refining market revenue in 2025, making it the top fuel segment in terms of consumption value. This prominence is attributed to the sustained global demand from personal mobility sectors, particularly in regions where internal combustion engine vehicles remain dominant.

Continued urbanization, rising vehicle ownership in Asia-Pacific, and favorable taxation frameworks for gasoline versus diesel have reinforced demand stability. In addition, regulatory focus on octane enhancement and cleaner-burning formulations is prompting refiners to upgrade reforming and blending capabilities.

Despite long-term electrification trends, short- to medium-term consumption patterns indicate that gasoline will retain a substantial role in energy mix strategies and refinery output planning.

The oil refining market is shaped by evolving fuel demand, efficiency-driven operations, petrochemical integration, and tightening regulations. Competitive success depends on flexibility, cost control, and strategic market positioning.

The oil refining market is experiencing demand realignment influenced by changes in transportation fuel consumption, regional economic growth, and evolving energy policies. Gasoline and diesel remain dominant outputs, yet growth in petrochemical feedstock production is expanding the product slate. Emerging markets are seeing higher consumption due to industrialization and vehicle fleet expansion, while developed markets face stable or declining fuel demand from efficiency improvements and alternative energy adoption. Seasonal fluctuations, trade flows, and regional refining margins create opportunities for operators to adjust output strategies. Refineries are increasingly focusing on flexibility in processing capabilities to meet varying product demands while optimizing yields for profitability in volatile market conditions.

Refining operations are under constant pressure to maximize throughput and minimize operational costs. Investments in advanced process control, catalyst improvements, and energy efficiency measures have become standard to enhance margins. Maintenance turnaround planning and predictive asset management play a significant role in reducing downtime. Operators are also optimizing crude slate selection to balance feedstock costs with product value recovery. Strategic expansions, debottlenecking, and refinery upgrades help capture additional market share without excessive capital expenditure. These measures enable refiners to stay competitive in a market where margins are sensitive to global oil price shifts and regional demand variations.

Integration of refining operations with petrochemical production has emerged as a profitable strategy to counter cyclical fuel demand fluctuations. By converting refinery by-products such as naphtha into high-value chemicals and polymers, operators can access faster-growing markets. This approach improves asset utilization and broadens revenue streams, especially during periods of weak transport fuel margins. Petrochemical-linked refineries also benefit from more stable long-term contracts with industrial buyers. The trend toward refinery-to-chemicals complexes in strategic locations allows operators to leverage logistics, scale advantages, and feedstock availability. This integration strengthens resilience against market volatility and ensures steady returns in both energy and materials supply chains.

Refiners face stringent regulations on emissions, fuel quality, and operational safety, which drive investments in upgrading units and adopting cleaner processes. Mandates such as ultra-low sulfur fuels and restrictions on high-emission feedstocks require continuous process adjustments. Meeting these requirements often involves capital-intensive projects, yet compliance secures access to key markets with strict import standards. Regional differences in regulation create competitive dynamics, as compliant refineries can export to premium markets. Additionally, geopolitical factors and trade agreements influence where refined products can be sold profitably. Navigating these constraints successfully allows refiners to maintain or expand their market presence despite shifting regulatory landscapes.

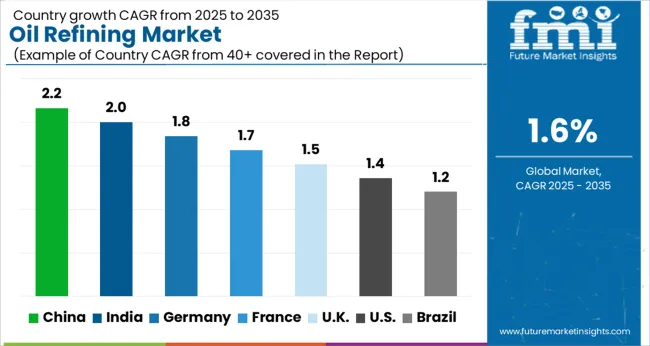

The oil refining market is projected to grow globally at a CAGR of 1.6% from 2025 to 2035, driven by the need for increased fuel production, regulatory compliance, and the transition to more efficient refining technologies. China leads with a CAGR of 2.2%, fueled by rapid industrial growth, high energy demand, and the expansion of its refining capacities. India follows closely with a CAGR of 2.0%, supported by expanding infrastructure, increased demand for petrochemical products, and significant investments in upgrading refinery technologies. France achieves a CAGR of 1.7%, driven by its push for cleaner fuels and the integration of advanced refining technologies to meet stricter environmental standards. The United Kingdom grows at 1.5%, reflecting its steady demand for refined products, along with efforts to modernize aging refinery infrastructure. The United States records a CAGR of 1.4%, influenced by stable demand for transportation fuels and ongoing investments in refining efficiency. This growth outlook underscores the critical role of technological advancements, regulatory compliance, and the increasing focus on sustainability in the global oil refining sector.

The United Kingdom’s oil refining market is projected to grow at a CAGR of 1.5% during 2025–2035, slightly below the global CAGR of 1.6%. During 2020–2024, the market grew at a CAGR of 1.2%, driven by steady demand for refined petroleum products and regulatory compliance. The slight increase in growth rate in the next decade is expected due to ongoing efforts in modernizing refinery technologies and the shift towards cleaner fuels. Key growth drivers include stringent environmental regulations, the adoption of energy-efficient refining processes, and investments in upgrading aging refineries. The UK’s move towards achieving net-zero emissions by 2050 will likely support the continued adoption of advanced technologies to improve refinery output and minimize carbon footprints.

China is expected to grow at a CAGR of 2.2% during 2025–2035, surpassing the global average of 1.6%. During 2020–2024, the market grew at a CAGR of 1.8%, driven by the country’s rapid industrialization and urban expansion, which created significant demand for refined petroleum products. The strong rise in the coming decade will be fueled by China’s focus on expanding its refining capacity, upgrading its refineries to meet stricter environmental regulations, and increasing domestic consumption. Investments in cleaner technologies, coupled with the country’s energy security strategies and the expansion of electric vehicle infrastructure, will further boost market growth.

India’s oil refining market is expected to grow at a CAGR of 2.0% from 2025 to 2035, slightly above the global average of 1.6%. During 2020–2024, the market saw a growth rate of 1.6%, reflecting steady but moderate growth as investments in refinery upgrades and modernization were balanced by economic constraints. The accelerated growth in the following decade is linked to India’s expanding industrial base, rising transportation demand, and increasing government policies that support energy efficiency and refinery upgrades. India’s growing demand for petroleum products for urbanization and infrastructure projects is expected to drive the need for increased refining capacity and advanced technologies.

France’s oil refining market is anticipated to grow at a CAGR of 1.7% during 2025–2035, just above the global rate of 1.6%. During 2020–2024, the market grew at a CAGR of 1.5%, driven by stable demand for refined petroleum products, especially in the automotive and industrial sectors. The moderate rise in the next decade will be due to ongoing regulatory changes, particularly the shift toward low-carbon fuels and cleaner technologies in refining processes. France’s commitment to achieving climate goals by 2050 will likely influence investments in green refining technologies, reducing environmental impacts and boosting efficiency.

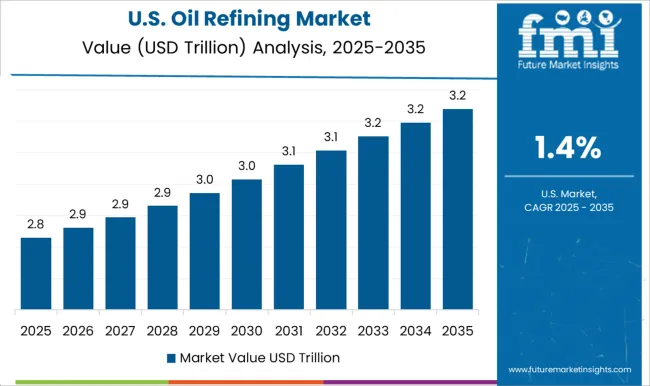

The oil refining market in the United States is projected to grow at a CAGR of 1.4% during 2025–2035, slightly below the global average of 1.6%. During 2020–2024, the market experienced a growth of 1.3%, driven by consistent demand for refined petroleum products and upgrades to refining technologies. The market is expected to see a slow but steady increase as older refineries undergo modernization to meet stricter environmental standards and improve efficiency. The United States’ continued focus on energy independence and the expansion of natural gas and renewable energy sources will shape the future of its refining market.

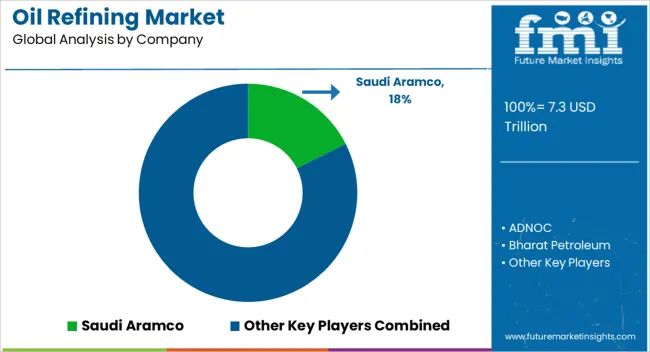

The oil refining market is dominated by a mix of global energy giants and regionally significant players with extensive downstream capabilities. Saudi Aramco leads with vast refining capacities integrated into its global crude supply chain, leveraging joint ventures in Asia, Europe, and the USA ADNOC focuses on expanding complex refining assets in the Middle East, emphasizing petrochemical integration. Bharat Petroleum, Hindustan Petroleum, and Indian Oil maintain strong positions in South Asia with extensive domestic networks and modernization programs. BP and Shell pursue global refining portfolios tied to trading, marketing, and energy transition strategies. Chevron, ExxonMobil, and Phillips 66 focus on high-value fuels and lubricants, alongside investments in refinery optimization. CNPC and S-Oil play a key role in the Asian market, with strategic upgrades to improve product yields.

Kuwait Petroleum and Marathon Petroleum maintain competitive scale in North America and the Middle East through capacity expansions and efficiency programs. PBF Energy and Valero concentrate on refining flexibility and export markets, while Reliance Industries operates one of the largest integrated refining and petrochemical complexes globally. Fluor supports the sector as a major engineering and project management partner for refinery upgrades. Competitive strategies center on enhancing processing complexity, integrating petrochemical output, and expanding export capabilities to capture premium market opportunities.

In response to tightening environmental regulations and increasing demand for cleaner fuels, refineries are shifting towards producing low-sulfur fuels and biofuels. The push for sulfur reduction has led to the widespread implementation of desulfurization technologies like hydrotreating and alkylation. Additionally, the market is seeing the rise of bio-refineries, which integrate traditional refining processes with biomass feedstocks to produce biofuels such as biodiesel and biojet fuel.

| Item | Value |

|---|---|

| Quantitative Units | USD 7315.2 Billion |

| Complexity Level | Deep conversion, Topping, and Conversion |

| Product | Middle distillates, Light distillates, Fuel oil, and Others |

| Fuel | Gasoline, Gasoil, Kerosene, LPG, and Others |

| Application | Road transport, Aviation, Marine bunker, Petrochemical, Other industry, Residential/Commercial/Agriculture, Electricity generation, and Rail & domestic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saudi Aramco, ADNOC, Bharat Petroleum, BP, Chevron, CNPC, ExxonMobil, Fluor, Hindustan Petroleum, Indian Oil, Kuwait Petroleum, Marathon Petroleum, PBF Energy, Phillips 66, Reliance Industries, S-Oil, Shell, and Valero |

| Additional Attributes | Dollar sales, share, regional capacity trends, crude supply security, refining margin analysis, product mix profitability, regulatory impacts, technology upgrades, competitive benchmarking, trade flows, end-user demand forecasts. |

The global oil refining market is estimated to be valued at USD 7.3 trillion in 2025.

The market size for the oil refining market is projected to reach USD 8.6 trillion by 2035.

The oil refining market is expected to grow at a 1.6% CAGR between 2025 and 2035.

The key product types in oil refining market are deep conversion, topping and conversion.

In terms of product, middle distillates segment to command 38.4% share in the oil refining market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA