The Oil and Gas Pipeline Coating market is experiencing significant growth driven by the increasing need to ensure the integrity, durability, and safety of pipelines across upstream, midstream, and downstream operations. The future outlook of this market is shaped by the ongoing expansion of oil and gas infrastructure globally, particularly in regions investing heavily in energy distribution and exploration. Growing emphasis on pipeline corrosion protection and long-term maintenance has accelerated the adoption of advanced coating technologies.

Rising regulatory standards and environmental compliance requirements further support market growth, compelling operators to adopt high-performance coating solutions. Additionally, the demand for energy transportation efficiency and prevention of leakages has driven investments in innovative formulations that offer superior adhesion, corrosion resistance, and environmental sustainability.

The market is also being influenced by the modernization of aging pipeline networks and the increasing deployment of new pipelines in remote and challenging terrains As energy demand continues to rise globally, the Oil and Gas Pipeline Coating market is anticipated to maintain robust growth, driven by technological advancements and infrastructure development initiatives.

| Metric | Value |

|---|---|

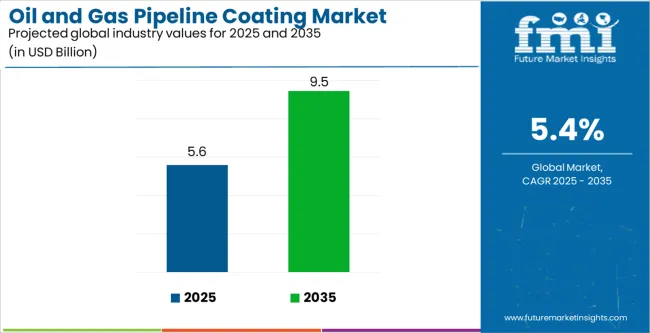

| Oil and Gas Pipeline Coating Market Estimated Value in (2025 E) | USD 5.6 billion |

| Oil and Gas Pipeline Coating Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

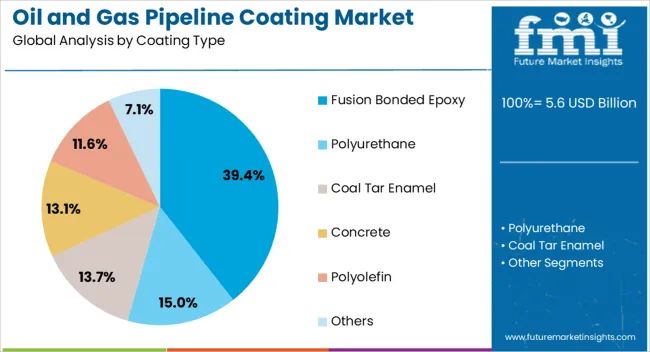

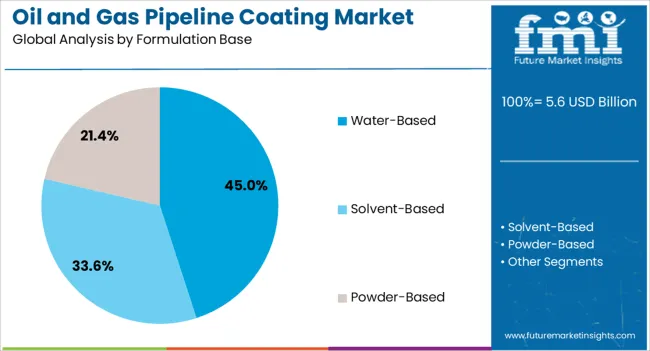

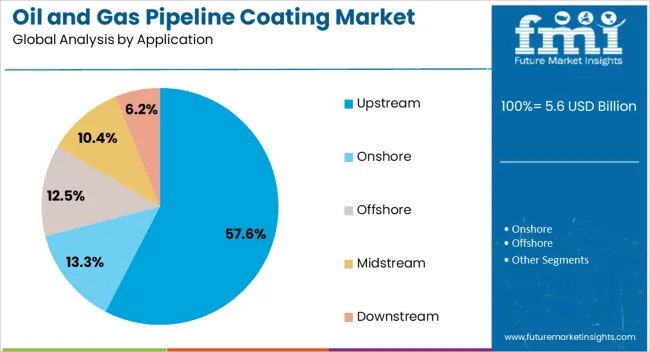

The market is segmented by Coating Type, Formulation Base, and Application and region. By Coating Type, the market is divided into Fusion Bonded Epoxy, Polyurethane, Coal Tar Enamel, Concrete, Polyolefin, and Others. In terms of Formulation Base, the market is classified into Water-Based, Solvent-Based, and Powder-Based. Based on Application, the market is segmented into Upstream, Onshore, Offshore, Midstream, and Downstream. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fusion Bonded Epoxy coating type segment is projected to hold 39.40% of the Oil and Gas Pipeline Coating market revenue share in 2025, making it the leading coating type. This growth is primarily driven by its excellent adhesion properties, corrosion resistance, and ability to withstand extreme environmental conditions.

Fusion Bonded Epoxy coatings are widely adopted in pipelines exposed to high temperature and pressure, providing long-term protection and reducing maintenance costs. The increasing demand for durable and reliable coatings in upstream oil and gas operations has further strengthened the position of this segment.

Additionally, advancements in application techniques, such as automated coating systems, have enhanced operational efficiency and uniformity in coverage, making Fusion Bonded Epoxy a preferred choice among operators The segment benefits from the growing focus on sustainable and high-performance pipeline protection solutions that extend the operational life of infrastructure.

The Water-Based formulation base segment is expected to capture 45.00% of the Oil and Gas Pipeline Coating market revenue share in 2025, positioning it as the leading formulation type. The growth of this segment has been influenced by increasing environmental regulations and sustainability initiatives that favor low-VOC and eco-friendly coating solutions.

Water-Based coatings offer reduced environmental impact, improved safety during application, and compliance with stricter emission standards, which have encouraged their adoption. Their effective corrosion resistance, ease of application, and compatibility with various coating systems have also contributed to their prominence in the market.

Furthermore, operators are increasingly prioritizing sustainable maintenance practices and environmentally responsible materials, supporting the expansion of the Water-Based segment The combination of regulatory compliance, operational efficiency, and environmental benefits continues to drive the segment’s adoption across global pipeline networks.

The Upstream application segment is anticipated to account for 57.60% of the Oil and Gas Pipeline Coating market revenue in 2025, making it the leading application segment. This dominance is driven by the critical need to protect pipelines in exploration and production areas, where extreme temperatures, high pressures, and corrosive conditions are common.

Coatings in upstream operations play a vital role in preventing pipeline degradation, ensuring operational safety, and minimizing downtime. The adoption of advanced coating technologies, such as Fusion Bonded Epoxy and Water-Based systems, has significantly improved pipeline reliability and longevity in these environments.

Additionally, the expansion of upstream infrastructure in regions rich in hydrocarbon reserves has further fueled the demand for high-performance coating solutions The emphasis on regulatory compliance, environmental protection, and operational efficiency continues to support the robust growth of the upstream segment in the Oil and Gas Pipeline Coating market.

Sustainable Coatings Trends Fuel the Global Oil and Gas Pipeline Coating Market Size and Share

With the growing emphasis on environmental protection, Leading oil and gas pipeline coating companies are encouraged to meet sustainability and environmental safety standards. The goal can be achieved by regulating VOC emissions, which has been an emerging trend in the industry, governing the oil and gas pipeline coating market valuation and size.

Technological innovation spurred in the industry has encouraged leading oil and gas pipeline coating companies to innovate sustainable coatings that meet all environmental standards. Various efforts have been taken to reduce carbon emissions and curb carbon footprints. Such efforts leverage better popularity for such companies, allowing firms to gain consumer attention. The longevity of such coatings can also add to the quality of services provided under the title of sustainability products, ensuring the completion of all necessary regulatory and legal compliances.

The Oil and Gas Industry Fuels the Oil and Gas Pipeline Coating Market Valuation and Size

With the rising energy demands of the rapidly growing population, the energy sector has been propelling. The oil and gas ecosystem is a key growing industry that demands an extensive pipeline network, subsequently requiring better coating to ensure pipeline safety. As a result, this is a key factor boosting the global oil and gas pipeline coating market size and share.

The expansion of the parent industry creates lucrative opportunities for various players in the allied sector. With the focus increasing on better energy supply and distribution in the consumer market, the demand for storage and transport systems will likely surge. This demand will be coupled with the demand for paint, preventing pipes from corrosion and other harmful reactions. Due to such key factors, the industry will be driven, enlarging its valuation.

Price Volatility Affects the Global Oil and Gas Pipeline Coating Market Size and Share

With the volatile geopolitical conditions, prices for oils and natural gases might fluctuate, affecting the operational costs of different plants. Allied industries are also heavily affected due to the changing price. The subject sector will likely be affected adversely, as price volatility might affect the cash flow of the industry.

This factor might hinder the oil and gas pipeline coating market valuation and size. Disturbances in supply chains might also affect the prices of raw materials adversely, hampering leading oil and gas pipeline coating companies. Such key factors might refrain the sector from progressing freely, curbing the prospects.

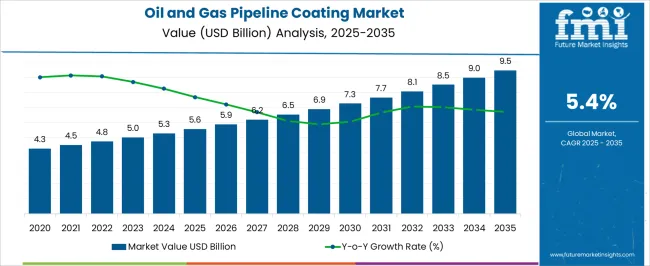

The global oil and gas pipeline coating market size and share elevated from USD 4.3 billion to USD 5 billion from 2020 to 2025. With the rising demands for coatings, the oil and gas pipeline coating market valuation and size traversed the progression path at a CAGR of 4.3.4.3% through the historical period.

With the rising shale gas exploration activities in the historical period drove the demand for oil and gas transport. Due to this, the pipeline construction and the maintenance of existing pipelines were prioritized. Key players in the oil and gas pipeline coating market benefitted from this scaling demand.

With the emerging opportunities to innovate in the industry with the help of cutting-edge technology like nanotechnology, prospects for the industry grow. This factor will likely drive the oil and gas pipeline coating market valuation and size during the forecasted period.

With the better technological infrastructure in North America, key players in the oil and gas pipeline coating market will gain better opportunities, contributing to the oil and gas pipeline coating market valuation and size.

The growing inclination toward sustainability in Europe will help the region add significant contribution to the global oil and gas pipeline coating market size and share.

Government initiatives in the developing countries of Asia-Pacific will develop better prospects for the competitive landscape.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| The United Kingdom | 2.1% |

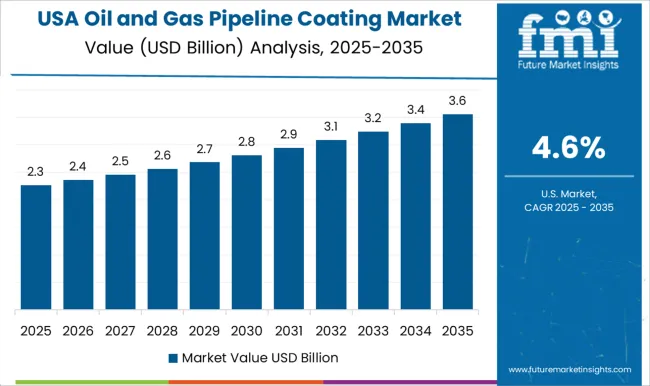

| The United States of America | 3% |

| India | 8.1% |

The United States of America will contribute to the global oil and gas pipeline coating market size and share enlargement at a sluggish CAGR of 3% through 2035.

With the growing shale gas exploration in the country, the demand for pipelines and storage systems will increase. This exploration is assisted by government funding and larger investments by key players in the oil and gas pipeline coating market.

Technological developments and the infrastructure help organizations capitalize on resources to innovate. Coating formulations and types can be enhanced. This will drive industrial growth in the country.

The United Kingdom will ensure the oil and gas pipeline coating market valuation and size occurs at 2.1% through the forecasted period.

With the growing emphasis on renewable energy projects, green energy projects like off-shore wind farms are growing in the country. Incentivization of local businesses will likely reduce the operational cost of the industry.

The rising demand for corrosion protection, energy transport systems, and storage systems will induce traction to pipeline coating, therefore driving the oil and gas pipeline coating market valuation and size.

With the growing population and urbanization in India, the demand for energy has been rising recently. Government initiatives are growing to expand energy distribution systems across the country.

Pradhan Mantri Urja Ganga Project is a key initiative aiming to develop pipeline systems across the country, generating demand for pipeline coating.

Such factors will likely drive the enlargement of the local industry at a promising CAGR of 8.1% through 2035, helping the country contribute to the global oil and gas pipeline coating market size and share.

Considering the widened applications and efficient performance, downstream applications and fusion-bonded epoxy material lead segments. With the higher standards of performance, key players in the oil and gas pipeline coating market prefer to operate more in such categories.

| Category | Downstream |

|---|---|

| Industry Share in 2025 | 57.6% |

Industries like the petrochemical industry require corrosion-protective layers for pipelines. The effectiveness of downstream applications reduces the risk of high-corrosive acids and chemicals reacting with pipelines and corroding pipes.

Due to the less frictional resistance in the downstream applications, losses are reduced in the downstream application, enhancing operational efficiency. As a result, such factors strengthen the popularity of the segment, driving the oil and gas pipeline coating market valuation and size.

| Category | Fusion-bonded Epoxy |

|---|---|

| Industry Share in 2025 | 39.4% |

The ability of fusion-bonded epoxy coatings to withstand extreme temperatures increases the popularity of the segment. Coupled with excellent mechanical and chemical resistance, lesser reactivity of coatings increases the lifespan.

Due to the higher impact strength of the coating, the longevity of coatings can be ensured, driving the segment, which consequently increases the global oil and gas pipeline coating market size and share.

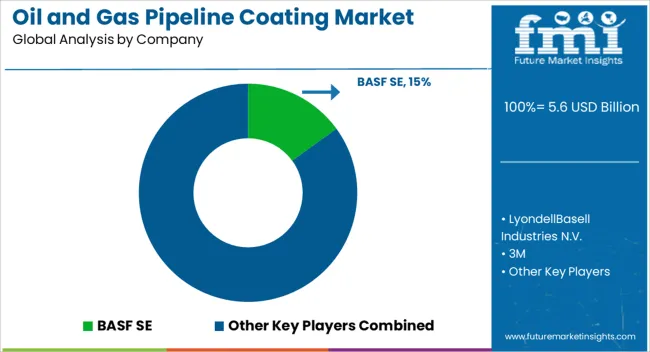

Key players in the oil and gas pipeline coating market will occupy a larger space in the sector through many strategic initiatives. Such moves include acquisitions, mergers, collaborations, and product development.

New entrants have less negotiating power due to the high competitiveness of the industry. To mitigate the threat of existing players, new entrants can expand using product differentiation, innovation, and strategic alliances.

The ecosystem will enhance the global oil and gas pipeline coating market size and share. Recent developments in the landscape are as follows-

BASF SE, LyondellBasell Industries N.V., 3M, Sherwin-Williams Company, PPG Industries, Inc., Koninklijke DSM N.V., Akzo Nobel N.V., Arkema S.A., RPM International Inc., Axalta Coating Systems, Shawcor, Wah Seong Corporation Berhad, Chase Corporation, The Jotun Group, Teknos Group, Borouge, Seal for Life Industries, LLC, and Jining Xunda Pipe Coating Material Co., LTD are key competitors in the ecosystem.

Based on the type of coating used for the pipeline, the sector is classified into Fusion Bonded Epoxy, Polyurethane, Coal Tar Enamel, Concrete, Polyolefin, and Others.

Depending on the chemical formulations of coatings used for pipelines, the sector is segmented into water-based, solvent-based, and powder-based coatings.

Upstream, Onshore, Offshore, Midstream, and Downstream are key applications of coatings, and therefore, the industry is classified into such sub-segments.

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and The Middle East and Africa are the key contributing regions to the industry.

The global oil and gas pipeline coating market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the oil and gas pipeline coating market is projected to reach USD 9.5 billion by 2035.

The oil and gas pipeline coating market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in oil and gas pipeline coating market are fusion bonded epoxy, polyurethane, coal tar enamel, concrete, polyolefin and others.

In terms of formulation base, water-based segment to command 45.0% share in the oil and gas pipeline coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA