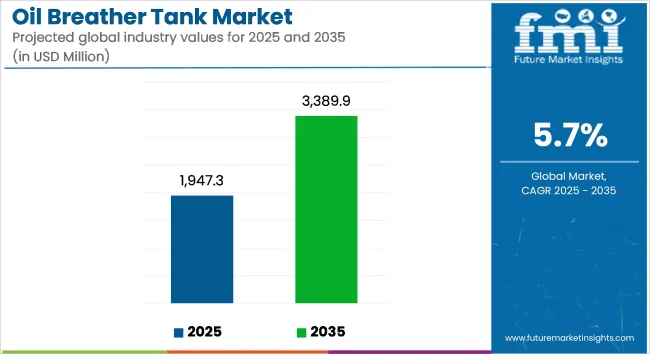

The global oil breather tank market is estimated at USD 1,947.3 million in 2025 and is projected to grow to USD 3,389.9 million by 2035, recording a compound annual growth rate (CAGR) of 5.7% during the forecast period. Market expansion is being driven by regulatory emphasis on crankcase emissions control, adoption in performance-focused powertrains, and rising demand from the motorsport and aftermarket sectors.

Breather tanks are now widely adopted in turbocharged and high-performance engines to address oil mist management. Demon Tweeks, a motorsport performance supplier, offers a range of oil catch tanks engineered with internal baffles and filtration assemblies, designed to improve crankcase ventilation and prevent re-ingestion of oil vapors into intake systems. These units are targeted at applications with elevated engine loads and sustained operating temperatures.

JEGS Performance, a USA automotive retailer, lists both aluminum and stainless-steel breather tanks featuring integrated filters. These are rated for operating pressures up to 10 psi, with product recommendations focused on forced-induction systems such as supercharged and turbocharged platforms. Verified customer reviews indicate improvements in throttle response consistency and reduced oil fouling in intercooler systems during track use.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,947.3 million |

| Industry Value (2035F) | USD 3,389.9 million |

| CAGR (2025 to 2035) | 5.7% |

Patent literature also reflects technical advancement in this category. A Chinese utility model patent (CN212708938U) discloses a breather tank design incorporating an oil-air separation chamber and an integrated drain valve, which enhances oil vapor separation and simplifies maintenance operations. The internal geometry was explicitly configured to improve separation efficiency under variable flow conditions.

Original equipment manufacturers (OEMs) in the performance and motorsport segments have begun integrating breather tanks to comply with stricter crankcase ventilation requirements. These installations are typically observed in endurance and rally vehicles, where oil mist carryover and pressure buildup can compromise performance reliability.

Geographically, North America remains a leading market, supported by strong aftermarket activity and a dense base of motorsport users. Europe is witnessing growth due to tightening Euro 6 and proposed Euro 7 standards, which place emphasis on full-system crankcase emission controls. In Asia-Pacific, increased customization trends and heightened awareness of engine longevity are contributing to higher adoption rates.

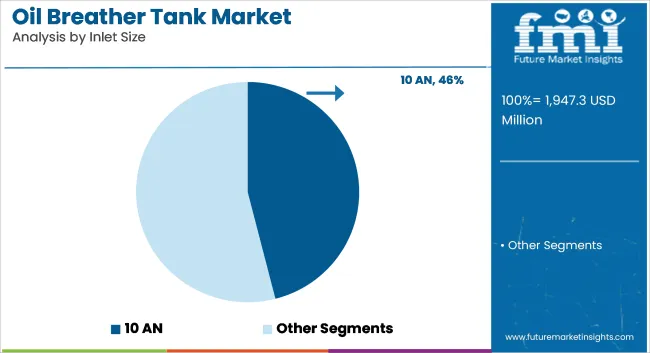

10 AN inlet breather tanks are estimated to hold approximately 46% of the global market share in 2025 and are projected to grow at a CAGR of 5.8% through 2035. Their popularity stems from compatibility with a broad range of turbocharged and naturally aspirated engines, especially in motorsports, off-road, and modified street applications.

10 AN fittings offer a balanced flow rate for efficient crankcase ventilation while maintaining structural rigidity and pressure resistance. As engine bay packaging becomes tighter and emissions control more precise, 10 AN inlet designs remain a preferred choice for aftermarket upgrades and OEM-specified breather systems in mid-displacement engines.

Manufacturers continue to refine threading precision, vibration isolation, and hose routing options to support both universal and platform-specific installations.

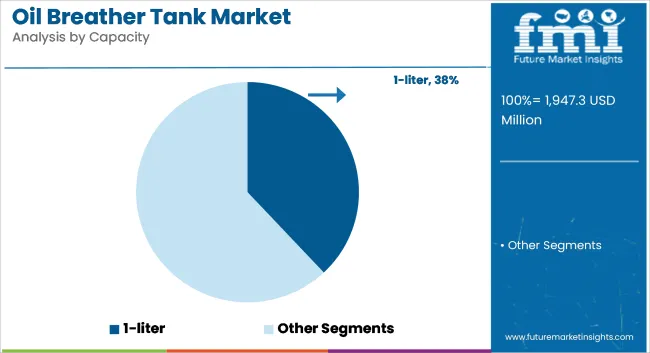

1-liter oil breather tanks are projected to account for approximately 38% of global market share in 2025 and are expected to grow at a CAGR of 5.9% through 2035. This capacity strikes a practical balance between compact design and oil vapor holding volume, making it ideal for applications in sports cars, tuner vehicles, and light-duty performance trucks.

Vehicle owners and tuning professionals prefer 1-liter units for daily driving and track-day setups, where frequent high-RPM operation leads to increased blow-by and oil mist that must be effectively captured.

As emissions compliance and engine longevity gain greater focus, 1-liter tanks often equipped with internal baffling, washable filters, and drain valves continue to serve as a scalable solution across gasoline and diesel platforms. The segment benefits from strong demand in North America, Europe, and Japan’s high-performance aftermarket sector.

Tighter Emission Regulations

Governments everywhere are tightening their emission standards, particularly for internal combustion engines, and this has necessitated more stringent testing of crankcase ventilation system oil mist emissions. Complying with evolving regulation means manufacturers incur expenditure on new technology in filtration as well as on emission-reduction products, thereby boosting manufacturing costs.

Moreover, the shift to electric vehicles presents a long-term threat to the traditional oil breather tank market and therefore diversification into hybrid and battery cooling markets is unavoidable.

New Filtration Technology

The most promising in the oil breather tank market is high-efficiency filters. Multistage filtration technology with high oil capture and low emission is the most interesting area of focus for the producers. More advancement in self-cleaning technology in the filtration system and vapor recovery units must be driving the industrial and heavy-duty application innovation.

Another growth sector is the installation of smart monitoring systems in oil breather tanks. Monitoring of the level of oil vapor, pressure variations, and filtration in real-time can keep maintenance schedules simple and avoid damage to engines, and hence it becomes more prudent for fleet owners and high-performance vehicle owners as well to install such systems.

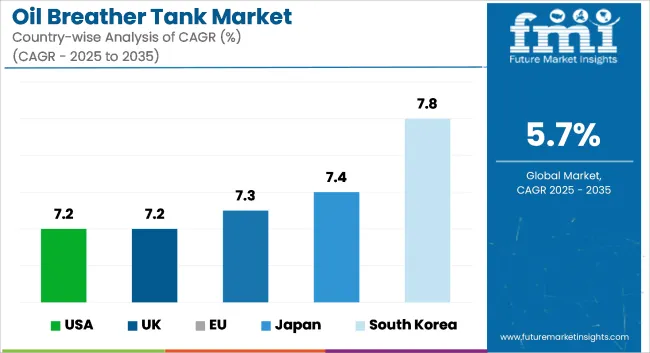

United States oil breather tank market is evolving increasingly because of the strength of the automotive and industrial machinery sectors. Improved production of motor vehicles, with sophisticated engine technologies, require effective crankcase ventilation systems that guarantee the use of oil breather tanks.

Moreover, environmental regulations for emissions reduction also promote the use of sophisticated oil breather systems for manufacturers to meet the requirements. For example, the American automobile manufacturing sector, producing more than 10 million automobiles every year, depends significantly on these products for keeping engines in good condition and maintaining emission standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

United Kingdom's demand for oil breather tanks is increasing moderately with the rising automotive and aerospace sectors. The UK's quest for carbon reduction has seen the auto manufacturers equip vehicles with superior oil breather systems to reduce fuel consumption and emissions.

Additionally, the highly increasing electric vehicle (EV) market in the UK, 76% year-on-year registration growth in EVs in the recent years, offers new prospects for oil breather tank application, as the systems play a critical role in the management of thermal efficiency within EV powertrains.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.2% |

European Union's oil breather tank industry is dominated by strong growth underpinned by strict environmental norms and an established automotive manufacturing platform. Germany, France, and Italy are leading countries with their top automobile industries. The EU's high emissions standards, including the Euro 6 directives, force producers to implement cost-effective oil breather systems in order to lower particulate emissions.

For instance, Germany's automobile industry, worth close to €400 billion, heavily employs advanced oil breather tanks in order to meet such strict standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.3% |

Japanese oil breather tank market is growing with its dominating automotive and electronic industries. In a country that focuses on technology advancement and accurate engineering, it requires effective oil breather systems to achieve maximum performance by cars and machinery.

Japan's automotive industry, which manufactures more than 9 million vehicles per year, features high-tech oil breather tanks to improve engine performance and satisfy strict emission regulations. Additional fuel for the market is the demand for energy-efficient and space-saving components by the electronics industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

The market for South Korea's oil breather tank is growing with the development of the automobile and machinery production industries. Environmental friendly industrial policies and technological innovation have boosted the uptake of new oil breather systems within the country.

The South Korean automobile industry, manufacturing almost 4 million automobiles a year, utilizes such systems in enhancing the efficiency of the engines as well as complying with environmental regulations. Additionally, heightened industrial automation as well as machine production supports fuelling the surging demand for oil breather tanks.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

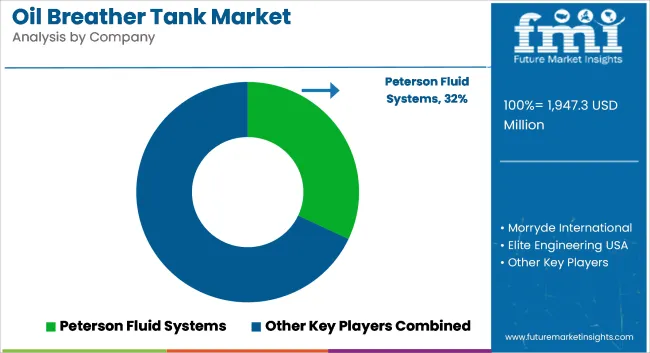

The oil breather tank market is an active competitive marketplace dominated by strong global manufacturers and a combination of niche regional players. Major companies enjoy strong market positions with continuous development of filtration technology, efficiency of material usage, and reduced space design to enhance engine performance.

The companies work on reducing emissions, heat endurance, and maximizing car ventilation system optimization and other industrial and maritime uses. The market consists of established brands as well as new upcoming producers who enhance breather tank technology.

The overall market size for the oil breather tank market was approximately USD 1,947.3 million in 2025.

The oil breather tank market is expected to reach approximately USD 3,389.9 million by 2035.

The increasing demand for vehicles, stringent emission regulations, and advancements in engine technologies are expected to drive the oil breather tank market during the forecast period.

The top 5 countries contributing to the development of the oil breather tank market are the United States, China, Japan, Germany, and India.

On the basis of application, the passenger car segment is expected to command a significant share over the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA