Demand for oil and fuel filter is expected to rise significantly, with the industry projected to be worth USD 5 billion in 2025 and USD 9.5 billion in 2035. This represents a CAGR of 6.58% from the year 2025 to 2035, indicating strong demand in developed as well as emerging economies.

Several key growth factors contribute to this trend. First, the global vehicle fleet is expanding, especially in the Asia-Pacific region, North America, and Europe, which leads to demand for all sorts of routine maintenance and replacement parts, including oil and fuel filters.

Secondly, the new regulatory frameworks evolving to cut emissions and improve fuel efficiency in automotive and commercial vehicle use have further ensured the growth of high-quality filtration systems being adopted in both sectors. These regulations often stipulate that manufacturers equip vehicles with advanced filters, which provide minimal emissions of particulates and higher combustion efficiency.

The strong growth trend of the industry is also highly driven by the aftermarket segment. There is increasing awareness among consumers regarding the importance of timely filter replacement, especially under harsh working conditions, which has contributed to healthy sales of replacement filters through online sales and third-party service centers. To reduce engine wear and prolong vehicle life, fleet owners and logistics companies are investing increasingly in premium filters, thus stimulating demand in this industry.

The other major innovation trends in this industry include filter design and material technology. The advent of synthetic filter media, multi-layer filtration systems, and sensors integrated within the filter assembly has propelled filter performance, durability, and service intervals. These innovations meet the needs of the modern engine, which works under higher pressures and higher temperatures and thus increases the relevance of premium filter products.

Although electric vehicles are potentially going to challenge the demand for oil in the long run, it should be noted that hybrid cars still depend on oil and fuel filters, as their engines are still combustion engines. Heavy engines in the fields of agriculture, construction, marine, and industrial power run mostly using fuel, giving filter manufacturers a steady revenue stream outside the automotive space.

Overall, during the upcoming decade, the industry will continue to rise steadily due to the burgeoning vehicle fleet, increasing regulatory pressures, new aftermarket demands, and fresh technological innovations. The industry is anticipated to reach almost USD 9.5 billion by 2035, so a major value chain that includes OEMs, component suppliers, distributors, and end users is expected to gain from the trends stressing the importance of engine efficiency, durability, and sustainability.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 5 billion |

| Industry Value (2035F) | USD 9.5 billion |

| CAGR (2025 to 2035) | 6.58% |

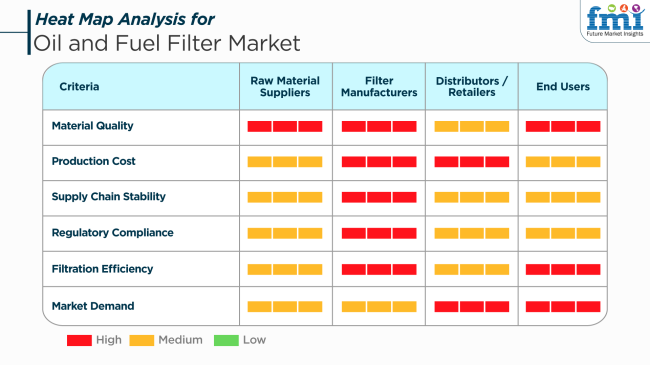

Oil and Fuel Filter Market (Stakeholders: Raw Material Suppliers, Filter Manufacturers, Distributors/Retailers, End Users - e.g., Automotive, Industrial)

he industry is sustained by performance, safety, and compliance across its automotive, industrial, and heavy machinery sectors. Filter manufacturers and end users highly emphasize material quality and filtration efficiency since these directly influence engine performance and the environment. High production costs and stringent regulatory compliance standards are additional burdens on manufacturers (red), translating into obligatory innovation to meet the emission and safety norms.

Retailers and distributors consider production cost and industry demand, as they are mainly concerned about stocking cheap, in-demand products. End users, a lot of whom are fleet operators and consumers of oil and fuel filters-are more concerned with filtration performance, durability, and value for their money, so they emphasize quality and demand.

Even if regulatory compliance is of moderate importance to end users (green), upstream stakeholders are expected to ensure that the product meets all technical standards. A layered matrix such as this illustrates the interdependencies that exist within the oil and fuel filter ecosystem, with the emphasis slowly shifting from raw material quality to performance outcome.

During 2020 to 2024, the industry grew consistently based on the growth of the automotive industry and greater focus on vehicle maintenance. The increased production of vehicles and the requirement for effective engine performance created more demand for oil and fuel filters. Apart from that, tight pollution control measures forced the adoption of advanced filtration technology to curb emissions and enhance fuel economy. After-market sales also saw growth with increasing concerns about the replacement of the filters at regular intervals.

Between 2025 and the period of 2025 to 2035, the future appears bright for the industry to develop along with the rising technology and shifting consumer point of view. The solution proposed, as smart sensors and IoT, will digitize the filtration system of the vehicle as well as preventive maintenance inspection which will improve the performance of the vehicle while having less down time.

The shift to EVs will reduce demand for conventional oil and fuel filters. Yet, penetration with hybrid vehicles and popularity of internal combustion engines in some areas will help the industry. Energy conservation and sustainability initiatives will increase demand for green and recyclable filter fabrics.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in automotive industry, emphasis on vehicle maintenance | Innovation in technology, sustainable measures |

| Introduction of new filtration technologies for environmental standards | Convergence of IoT and smart sensors for real-time monitoring |

| Mainly internal combustion engine vehicles | Hybrid vehicle growth, continued usage in a few industries |

| More emphasis on regular replacement of filters | Movement towards green and recyclable filter materials |

| More stringent emissions laws driving the filter design | Continued emphasis on green credentials and legislative compliance |

| Low uptake of smart technology | Global penetration of predictive maintenance and real-time monitoring technology |

| Expansion in emerging industries with growing car ownership | Sustained demand in those industries with sluggish EV adoption |

There are risk aspects with respect to industry trends for the industry, mainly because it is reliant on the automotive sector. Any change in vehicle production activity due to the global economic crisis, supply chain distractions like shortages of semiconductors, or even labor discontent could have direct impacts on filter demands.

Other long-term threats to industry growth could stem from the global switch towards EVs, which generally do not require oil or fuel filters. Laws aimed at reducing carbon footprint through cuts in fossil fuel usage would further aggravate potential declines in filter demand and in technological innovations that are in favor of alternative propulsion technologies.

The critical risk from an operational point of view would still be the constant instability of supply. Price volatility and availability problems are always potential threats to raw materials like filter media, plastics, or metals, which might impact manufacturing processes and lead to an escalation in operational costs. Furthermore, counterfeit or inferior filters in the aftermarket are a major threat to brand reputation and may erode customer trust, particularly for companies lacking stringent quality assurance mechanisms.

Technology-related risks are also paramount. Enhanced filter technology, like extended-lifetime or maintenance-free filters, could negatively impact the aftermarket revenue by reducing the frequency of replacement. If OEMs turn to proprietary or integrated filtration systems, it will become increasingly difficult for third-party suppliers to sustain their industry share.

The competitive pressure in the industry is very high, especially in the price-sensitive aftermarket segment. Many low-cost manufacturers, particularly in the Asia-Pacific region, create intense price competition that squeezes profit margins. Additionally, companies heavily dependent on a few OEM contracts run the risk of revenues declining when contracts are lost due to cost, performance, or delivery considerations.

The market is exposed to geopolitical and environmental risks. Tariffs, import/export restrictions, and political disagreements between major international jurisdictions, specifically the USA and China or the EU and Asia, would hamper international operations. Environmental legislation regulating the manufacturing process, particularly pollution control and the more stringent disposal operations in recent times, would act in favor of raising compliance costs for firms based in regulated industries like North America and Europe.

Reputation and legal risks are other serious concerns. Product recalls due to faulty filters would bring massive financial losses and adversely affect brand credibility, especially in connection with engine failures. Besides, appeals for failure to meet regional or global emissions standards could be initiated by the OEM supplier. This means that compliance assurance and evolving high product standards remain key to sustaining competitiveness and customer trust in this industry.

Passenger cars represent the key segment of the industry in 2025, with a dominating industry share of 52%, followed by light commercial vehicles (LCVs) at 28%.

In numbers, personal vehicles lead the industry with respect to filters as they make the greatest share of the global vehicle parc. Owing to the increased demand for personal mobility in many emerging industries in Asia-Pacific and Latin America, oil and fuel filters are being replaced regularly.

These filters play an integral role in engine performance, the protection of fuel injectors, and effective fuel consumption. Major automakers have integrated high-performance filtration systems to adapt to changing regulations concerning emissions and customer expectations of durability.

Major automakers such as Toyota, Hyundai, and Volkswagen manufacture these filters. Besides Bosch, MANN+HUMMEL, and MAHLE, others also provide OE and aftermarket filters with respect to passenger automobiles, and they give both spin-on and cartridge filters.

Light commercial vehicles (LCVs) contribute about 28% of the industry, which is very important, as they are used in logistics, last-mile delivery, and utility services. This sort of vehicle is usually subjected to harsher conditions while running longer service cycles, making frequent changes to its filters necessary.

These maintenance activities are necessitated by the performance of the engine concerning combustion efficiency and reliability, as employing an OEM such as Ford (Transit), Nissan (NV200), and Tata Motors (Ace series) ensures that their LCVs are equipped with efficient oil and fuel filters. Another major contributor to the rapid growth of filter demand in this category is the segment boosted by the e-commerce industry and urban freight sector.

Aftermarket players like WIX Filters and Donaldson are known to offer heavy-duty filtration options that are distinctive to the operational needs of this type of vehicle.

The global industry forecast for 2025 divides the filters into oil and fuel filters, with oil filters holding a slightly larger share in the industry of approximately 55% while fuel filters account for the remaining 45%.

Due to their importance in engine health by removing contaminants from engine oil, Oil Filters hold the major industry share. The new engine designs and stringent emissions standards have prompted a growing demand for high-efficiency oil filters. These filters are important for lowering engine wear, extending oil life, and ensuring long service intervals.

Advanced oil filtration systems, reinforced with anti-drain back valves and pressure relief features, are increasingly entrusted by OEMs such as Honda, BMW, and General Motors. Aftermarket leaders MANN+HUMMEL, Fram, and K&N have developed a spectrum of spin-on and cartridge oil filters for conventional and synthetic oils.

Fuel filters occupy almost 45% of the industry and are crucial for ensuring clean fuel for combustion chambers, particularly in diesel and direct-injection gasoline engines. They aid in removing particulates, water, and other impurities that can clog injectors and impair engine performance.

As turbocharged and GDI engines gain popularity, high-performance fuel filters are now becoming increasingly critical components. Diesel engines are largely used in trucks, buses, and agricultural vehicles and very much depend on robust multi-stage fuel filtration. Companies such as Bosch, Donaldson, and Fleetguard (Cummins Filtration) manufacture advanced fuel filters that separate water and offer high filtration efficiency for heavy-duty and commercial applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.7% |

| France | 4.3% |

| Germany | 4.9% |

| Italy | 4.1% |

| South Korea | 4.5% |

| Japan | 4.2% |

| China | 5.8% |

| Australia | 4% |

| New Zealand | 3.7% |

The USA industry will grow at a 5.4% CAGR during 2025 to 2035, driven by sustained demand from commercial fleets, industrial equipment and the aftermarket automotive sector. Emissions control and engine performance regulatory issues support the extensive use of high-performance filtration systems. Robust automotive sales and farm equipment activity also support sustained industry support.

Industry leaders Donaldson Company, Parker Hannifin, and Cummins Filtration are investing in new filter media and extended-life solutions. Merging filtration technologies into smart maintenance systems improves preventive maintenance and decreases downtime in operation. Increased vehicle electrification is prompting diversification into hybrid-compatible filter products to fulfill evolving powertrains.

The UK industry is anticipated to post a CAGR of 4.7% over the forecast period owing to demand from industrial machinery, agriculture, and logistics use. The life of vehicles and stringent emission standards under country-level environment policies are promoting higher usage of premium filtration solutions in both original equipment manufacturers and aftermarket segments.

Leading suppliers such as MANN+HUMMEL, UFI Filters, and Delphi Technologies are developing eco-efficient filters with recyclable materials and greater filtration precision. The move towards hybrid and plug-in cars also stimulates innovation for compact filtration packs. Commercial fleet service interval optimization and low-emission zone limitations stimulate industry demand.

France is expected to record a CAGR of 4.3% during 2025 to 2035 in the industry. The industry is driven by the nation's car culture and its emphasis on lowering greenhouse gas emissions. Filters are critical in improving combustion efficiency and enabling cleaner exhaust systems, particularly in high-density urban operations.

Industry leaders like Valeo, Sogefi Group, and Faurecia are providing innovative filter designs to address changing regulatory requirements. The aftermarket is experiencing steady growth with growing vehicle maintenance awareness and replacement cycles. Commercial diesel engines are increasingly being used in the logistics and construction sectors, and long-life fuel filter demand continues to be strong.

The German industry will develop at a CAGR of 4.9% during 2025 to 2035. The value chain of automotive manufacturing, along with the stringent emission standards, is driving the demand for effective filtration technology. Filters are the most vital devices in sustaining engine performance, particularly in diesel and industrial engines.

Major players like Mahle GmbH, MANN+HUMMEL, and Bosch are focusing on nanofiber material technology and intelligent filter monitoring systems. The availability of high-end automobile brands requires better filtration during the manufacturing and maintenance processes. Industrial equipment, including construction and farm machinery, also lends support to the frequent need for filter replacement throughout the country.

Italy's industry is anticipated to post a growth of 4.1% CAGR during 2025 to 2035, driven by growth in farm equipment, transportation, and after-sales. Focus on engine power, along with reducing environmental damage, creates opportunities for increased use of efficient filter elements.

Local manufacturers like UFI Filters and Sofima are beefing up filtration systems with multi-layered configurations and technologies for extended lifespans. The aftermarket is strongly based on Italy's old car park, which is demanding continual maintenance and the replacement of filters. Environmental legislation, consistent with EU policy, promotes the use of particulate filtering and clean fuel system filters.

The South Korean industry is projected to grow at a CAGR of 4.5% during the forecast period. Demand is fueled by the country's strong automotive sector and the growing need for the maintenance of commercial vehicles. Environmental regulations on low-emission cars are adding to the demand for improved filter technology.

Key players such as MANN+HUMMEL Korea, S&S Filters, and Hyundai Mobis are emphasizing high-performance filters with compact, modular designs. Hybrid system integration and extended drain use are a common trend. In the industrial market, more construction and logistics activity is accelerating replacement levels on fleets of equipment for oil and fuel filters.

Japan is anticipated to experience a CAGR of 4.2% in the industry from 2025 to 2035. The industry is driven by a robust automotive sector, high technical level, and strict environmental standards. With long vehicle life cycles and routine service intervals, filters become crucial to ensure system efficiency and conformity.

Industry leaders like Denso Corporation, Toyota Boshoku, and Nippon Micro Filter lead the field in filtration efficiency and sustainability. Biodegradable filters with superior thermal resistance are increasingly popular. It is used in heavy machinery and public transport, which also generates consistent demand for oil and fuel filtration systems.

China is projected to dominate the industry with a CAGR of 5.8% between 2025 and 2035. High demand for high-end filtration products comes from increased commercial transport, construction machinery, and industrial activities in urban and rural areas. Emission reduction and energy-saving initiatives by the government also spur adoption.

Industry leaders like Weifu Group, YBM Group, and Guangzhou Yifeng Automotive Equipment are ramping up production and incorporating smart filter monitoring capabilities across their offerings. Increasing automotive aftermarkets and improved vehicle ownership fuel the requirement for greater frequency of filter replacement. Strategically localized factory plants enable cost-effective solutions across an enormous universe of engine platforms.

The Australian industry is projected to expand during the forecast period at a rate of 4%, driven mainly by resource industries and commercial vehicle businesses. Severe operating conditions encountered in agriculture and mining necessitate high-volume and aggressive filtration systems to protect against engine reliability and fuel purity.

Companies such as Ryco Filters, Wesfil, and Donaldson Australia are producing application-specific filters with corrosion and multi-stage filtration properties. Increased equipment life and regulatory needs in emissions and occupational safety enable filter adoption. Segment growth in the aftermarket is derived from large service networks and offsite operating requirements.

New Zealand will most likely expand at a CAGR of 3.7% in the industry during 2025 to 2035. Agricultural mechanization, maintenance of off-road equipment, and a stable internal combustion vehicle fleet propel the industry. Environmental consciousness and better fuel management practices propel filter use across industries.

Local dealerships and overseas manufacturers offer distinct filters for light vehicles, commercial fleets, and farm machinery. Industries have a growing need for effective filter systems that can resist rural use conditions and extended maintenance schedules. As sustainability practice goes mainstream, industry players are exploring the use of environmentally friendly filtration media and recyclable designs.

The industry is fiercely competitive globally for filtration specialists. It tends to focus greatly on high-efficiency filtration, long service life, and incorporation into modern engine technologies. The top three players in the industry are Mann+Hummel, Donaldson, and MAHLE, who can leverage modern, advanced filters, incorporate nanofiber technology, and bring innovations that link up to sustainability. Their focus on high-performance filtration for IC engines, hybrid systems and new alternative fuel vehicles distinguishes them from the other players in this niche.

Strategic mergers and acquisitions continue to reshape the terrain, with Cummins Inc. and Rank Group Limited (UCI-FRAM) funneling huge investments into aftermarket distribution networks and linking up with OEM partners. Sogefi SpA has made even more significant investments into multi-layer filtration technology and further breakthroughs related to the development of lighter, eco-friendly filter materials to meet stringent emission standards and increase fuel economy.

Much smaller but extremely significant players are Ahlstrom Corporation and Hengst SE & Co. KG, who are now engaged in developing innovative and application-oriented customized filtration solutions for the industrial and off-highway sectors, with potential compliance with changing engine standards. Meanwhile, Denso Corporation and AC Delco Inc. continue to dominate both automotive OEM and aftermarket channels by providing integrated filtering solutions for gasoline, diesel, and hybrid vehicle systems.

Smart filters and IoT-based condition monitoring are the emerging areas for filtration systems compatible with biofuels. Companies that combine digital diagnostics, sustainability, and extended filter life cycles will likely hold a competitive advantage in the global marketplace for oil and fuel filters.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Mann+Hummel Group | 20-24% |

| Donaldson Company, Inc. | 16-20% |

| MAHLE GmbH | 14-18% |

| Cummins Inc. | 12-16% |

| Rank Group Limited (UCI-FRAM) | 10-14% |

| Combined Others | 20-30% |

| Company Name | Offerings & Activities |

|---|---|

| Mann+Hummel Group | Advanced filtration technology with nanofiber-based synthetic media for extended service life. |

| Donaldson Company, Inc. | High-efficiency oil and fuel filters for automotive, industrial, and off-road applications. |

| MAHLE GmbH | OEM-grade filtration solutions for fuel injection systems and alternative fuel vehicles. |

| Cummins Inc. | Integrated filtration systems with IoT monitoring for heavy-duty engines. |

| Rank Group Limited (UCI-FRAM) | Aftermarket and OEM-compatible oil and fuel filters with eco-friendly materials. |

Key Company Insights

Mann+Hummel Group (20-24%)

Mann+Hummel leads in nanofiber-based filtration, smart filter diagnostics, and sustainability initiatives, supporting high-efficiency engine performance and extended maintenance cycles.

Donaldson Company, Inc. (16-20%)

Donaldson focuses on multi-stage filtration for high-durability engines, integrating synthetic media for superior fuel and oil filtration performance.

MAHLE GmbH (14-18%)

MAHLE innovates in OEM-grade fuel filtration, optimizing engine efficiency and emission control for hybrid and next-generation vehicles.

Cummins Inc. (12-16%)

Cummins provides IoT-enabled oil and fuel filters, improving predictive maintenance and reducing downtime in commercial and industrial vehicle applications.

Rank Group Limited (UCI-FRAM) (10-14%)

UCI-FRAM expands aftermarket reach with extended-life filters, prioritizing recyclable materials and environmental compliance.

Other Key Players

By vehicle type, the industry is categorized into passenger car, LCV (light commercial vehicle), and HCV (heavy commercial vehicle).

By sales channel, the industry is divided into OEM (original equipment manufacturer) and aftermarket.

By filter type, the industry is segmented into oil filter and fuel filter.

By filter media, the industry is classified into cellulose, synthetic-laminated, and pure glass.

By region, the industry is segmented into North America, Latin America, Europe, South Asia & Pacific, East Asia, and Middle East & Africa (MEA).

The industry is estimated to reach USD 5 billion in 2025.

By 2035, the industry is expected to grow to USD 9.5 billion.

China is leading with a 5.8% growth rate.

The industry is primarily dominated by passenger cars due to the routine need for oil and fuel filtration in combustion engines.

Key companies operating in this space include Mann+Hummel Group, Donaldson Company, Inc., MAHLE GmbH, Cummins Inc., Rank Group Limited (UCI-FRAM), Ahlstrom Corporation, Sogefi SpA, Clarcor Inc., Denso Corporation, Hengst SE & Co. KG, AC Delco Inc., and GUD Holdings Limited.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA