The Oil & Gas Terminal Automation Market will expand greatly between 2025 and 2035, as industries seek to increase efficiency, safety, and regulatory compliance. Terminal Automation refers to applying new technologies like distributed control systems (DCS), programmable logic controllers (PLCs) and supervisory control and data acquisition (SCADA) systems to streamline the storage, transport and delivery of oil and energy products.

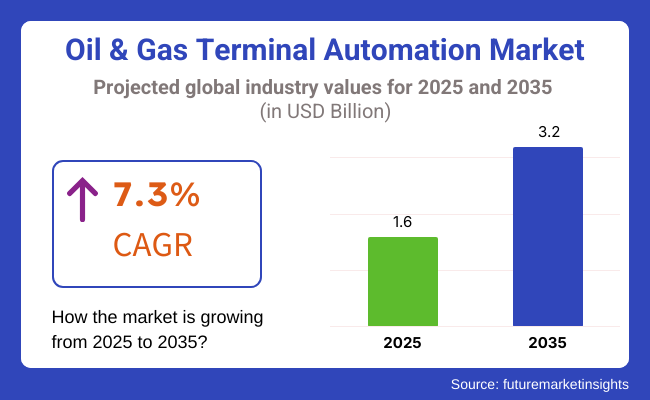

The market is expected to be worth USD 1.6 Billion in 2025 and USD 3.2 Billion in 2035, reflecting a potential CAGR of 7.3%, based on key metrics. The benefits of integrated automation solutions and even shorter lengths of global supply chains, combined with more stringent environmental regulations that require effective resource and emissions management, continue to fuel the growth of this space.

The shift to IoT-enabled devices and edge-based computing solutions are also allowing operators to gain more control over terminal operations and respond faster, and more effectively, to changes in the market. Innovative automation solutions give firms the ability to maximize throughput, optimize inventory management, and maintain regulatory seamlessness.

In response, the Oil & Gas Terminal Automation Market is expected to remain a key investment segment in the energy sector as firms seek to gain a competitive edge in their markets while responding to growing demand for cleaner, safer, and more dependable energy solutions.

Supervisory Control and Data Acquisition (SCADA) and Programmable Logic Controller (PLC) dominate the majority of the oil & gas terminal automation market because operators in the sector are increasingly adopting high-end automation solutions to enhance operational efficiency, safety, and real-time decision support. These hardware components are tasked with delivering seamless terminal management, optimized inventory control, and improved energy distribution, driving the digitization of the oil & gas sector.

SCADA has entered oil & gas terminal automation as a requirement for real-time data collection, remote monitoring, and centralized control of terminal operations. SCADA allows oil & gas operators to monitor storage tanks, pipelines, and distribution lines from a single control room, which leads to increased efficiency, reduced downtime, and enhanced safety.

Increased requirements for monitoring real-time operations and managing processes have made SCADA technology widely accepted in oil & gas terminals as the organizations compete towards the achievement of optimum utilization of assets, automated operation, and efficient energy distribution networks Research has shown that automation by SCADA-based solutions improves decision-making, reduces operational expenses, and reduces safety risks involving manual monitoring.

The convergence of SCADA to cloud-based technologies and Industrial Internet of Things has cemented market demand with connected automation offering predictive maintenance, real-time diagnostics for equipment, and remote management of assets. Cloud-based SCADA platforms enable sharing data across various terminal sites, offering increased asset visibility and operational awareness to global supply chains.

The growth of SCADA solutions with embedded cybersecurity has additionally bolstered deployment across oil & gas infrastructure, with corporations putting emphasis on data protection, cyber resilience, and adherence to regulatory guidelines. Firewall-secured SCADA networks, AI-powered threat identification, and blockchain-enabled transaction monitoring guarantee safe, tamper-evident terminal operations.

The evolution of AI-based SCADA systems with machine learning capabilities for anomaly identification and automated alerts has maximized terminal efficiency, predictive maintenance planning, and fuel inventory management, enabling improved management of volatile demand and supply patterns.

In spite of its operational intelligence advantage, SCADA is plagued by high deployment costs, integration issues, and cybersecurity threats. Yet, new advancements in AI-fueled automation, cloud SCADA offerings, and real-time digital twin simulation are enhancing system robustness, data precision, and uptake rates, guaranteeing sustained market growth for SCADA in oil & gas terminal automation.

Programmable Logic Controllers have seen robust market acceptance, especially in oil terminal storage, loading and unloading stations, and refinery terminals, with companies depending increasingly on PLC-based automation for process control, system reliability, and operational safety. In comparison to conventional relay-based control systems, PLCs provide superior programmable functionality that allows easy interfacing with SCADA, sensors, and IoT devices.

Growing demand for intelligent automation in fuel terminal distribution has been driving PLC implementation, with automated process control and real-time monitoring ensuring optimized fuel flow, reduced wastage, and improved asset performance Research reveals that PLC-based automation boosts the accuracy of fuel metering, minimizes process downtime, and optimizes workflow coordination in oil & gas distribution networks.

The convergence of PLCs with machine learning and AI-based analytics has fueled market demand, as predictive control systems enhance efficiency in blending operations, inventory management, and emergency response processes.

Expansion of PLC-based terminal automation in liquefied natural gas (LNG) terminals, refineries, and offshore oil terminals has been the driving force behind market growth, as automated control systems enable accurate flow control, reduced emissions, and improved regulatory compliance.

While PLC systems are advantageous with automatic process control, they are beset with the drawback of high initial investment expenses, compatibility with legacy infrastructure, and complex programming requirements. Nevertheless, new developments in AI-aided PLC programming, wireless PLC connectivity, and real-time cloud integration are enhancing cost-effectiveness, deployment ease, and user convenience, which will continue to drive market growth for PLCs in oil & gas terminal automation.

Terminal & Inventory Management and Business System Integration Fuel Market Expansion as Digital Transformation Redefines Oil & Gas Operations

The terminal & inventory management and business system integration segments are two of the largest market drivers, as oil & gas operators increasingly adopt cloud-based software solutions to maximize fuel storage, automate supply chain operations, and improve real-time decision-making.

Terminal & inventory management software is becoming one of the most critical building blocks of oil & gas terminal automation, allowing fuel stock levels to be monitored in real time, automated inventory reconciliation, and predictive demand forecasting. In contrast to traditional manual inventory monitoring, automated inventory management platforms leverage AI-powered analytics, IIoT-based sensors, and real-time SCADA integration to provide precise fuel tracking and operational effectiveness.

Growing demand for optimized fuel storage management, regulatory compliance, and loss prevention of inventory has driven adoption of terminal & inventory management software as oil & gas organizations look to improve supply chain visibility, eliminate storage-related inefficiencies, and avoid operational bottlenecks. Research shows that automated inventory management enhances fuel reconciliation accuracy, eliminates excess stockholding costs, and increases overall terminal productivity.

The use of AI-driven predictive analytics in inventory control has fortified market demand since machine learning algorithms maximize inventory allocation, reduce overstocking, and avoid fuel shortages during surges in demand.

Terminal automation software expanded on a cloud basis, with automated reporting, remote monitoring of inventory, and data-driven insights, further fueled market growth since real-time analytics in dashboards enhance operator decision-making and simplify coordination of logistics.

The use of blockchain-based inventory tracking systems has improved supply chain transparency, tamper-evident transaction history, and secure compliance reporting, which ensures greater regulatory compliance and lower fraud risk.

Though it has benefits in inventory management, terminal & inventory management software is challenged with integration complexity, data synchronization difficulties, and security threats. Despite this, forthcoming innovations in AI-based fuel prediction, cloud-computing-based predictive modeling, and automated anomalous detection technology are enhancing accuracy in data, system robustness, and efficiency, guaranteeing ongoing market growth for terminal & inventory management products.

Business system integration software has achieved robust market uptake, especially among multinational oil companies, pipeline distribution systems, and offshore drilling activities, as organizations pursue end-to-end connectivity between financial, operational, and logistics processes. In contrast to conventional siloed software systems, integrated business platforms facilitate end-to-end automation, avoiding manual data reconciliation, enhancing decision-making, and minimizing administrative overhead.

The growing demand for integrated software platforms that combine transaction processing, supply chain logistics, and asset management has driven the adoption of business system integration software, with businesses concentrating on workflow automation, compliance with regulations, and financial reconciliation. Studies reveal that combined business platforms provide enhanced transparency in supply chain transactions, minimize data mismatches, and improve fuel price analytics.

The use of AI-based data analytics in business system integration has consolidated market demand, as predictive models enhance demand forecasting, enhance risk assessment, and automate cost allocation processes.

The growth of cloud-based ERP systems and digital twin modeling has consolidated market growth, as real-time simulation of terminal operations enhances operational resilience, system adaptability, and workforce coordination.

In spite of its process automation advantages, business system integration software is confronted with compatibility challenges associated with legacy infrastructure, a high cost of implementation, and the need for workforce training. Nevertheless, new developments in AI-driven automation, blockchain-transacting processing, and cloud-native system integration are enhancing scalability, efficiency, and digital transformation preparedness, guaranteeing ongoing market growth for business system integration solutions.

The Oil & Gas Terminal Automation Market in North America, accounts for a significant share, due to continuous investments in energy infrastructure, advancements in terminal automation technology, and stringent environmental norms. North America has a high adoption rate of smart control systems for oil storage terminal, pipelines, and refinery owing to which USA and Canada collectively dominate the oil storage terminal market in North America.

These technologies maintain the accuracy inventory management, safety protective measures, and compliance with the government. Recent modernization of pipeline and modernization of aging infrastructure are driving the demand for SCADA systems, advanced metering solutions, and digital twin technologies.

In examples, the utilization of cloud-based platforms and wireless sensors has enabled the operator to review real-time data, predict maintenance requirements, and optimize loading and unloading processes to ensure operational continuity.

Also, the North American oil and gas industry is harnessing machine learning algorithms and artificial intelligence (AI) to improve decision-making and reduce operational risks. These developments have been instrumental in minimizing manual intercessions, reducing energy costs, and extending the life of essential equipment consequently, making North America a key terminal automation solutions market for providers.

Due to a focus on sustainability and stiff regulatory frameworks, Europe is a significant player in the Oil & Gas Terminal Automation Market. Germany, the United Kingdom, and Norway are investing heavily in automation technologies to reduce emissions, improve energy efficiency, and accelerate the transition toward cleaner energy sources. That is why automation represents a key element in the terminals infrastructure upgrade plans, as European terminal operators have put highest emphasis on operating carbon neutrally.

As a result, under the push of the government for environmental measures by the EU, many companies have looked at systems to be able to do real-time monitoring, automated tank gauging, and advanced flow measurement devices that go beyond destiny meters. This provides better tracking of hydrocarbons, reduces waste, and assists in compliance with strict environmental standards.

The adoption of advanced automation systems has also been driven by Europe’s substantial investments in renewable energy storage terminals. European operators can enhance safety standards, efficiently run terminal operations, and address the region’s ambitious sustainability targets with predictive maintenance tools, remote monitoring solutions and automated shutdown systems.

The Oil & Gas Terminal Automation Market is projected to grow at the highest rate in the Asia-Pacific region due to steep industrialization, swift urbanization, and the growth in energy demand. Demand is simply rising too far and fast for countries including China, India, and Australia not to invest heavily in modernizing their energy infrastructure and making their supply chains more efficient.

The large new oil storage facilities and expansions of strategic petroleum reserves still under construction in China have promoted the implementation of automated inventory control systems, advanced metering technologies, and real-time data analytics platforms. Such solutions enhance the efficiency of operations while also reducing risks in dynamic market conditions. The energy sector in India is metamorphosing, with a diverse array of private and public companies adopting advanced terminal automation solutions.

SCADA integration, digital twin technology and IoT-enabled devices are now being used to optimize terminal throughput, ensure environmental regulation compliance and ensure stable product quality. Furthermore, the growing dependency on oil and gas products being imported has resulted in the need to design better terminal infrastructure, which in turn is boosting demand for advanced automation.

This is also highly effective especially in highly automated offshore oil and gas facilities in Australia with the use of high-performance automation tools in the field for safety, resource efficiency, and minimizing human efforts. The report continued to add that with the ongoing investment in innovative process controls, wireless communication systems, and smart pipeline monitoring, Asia-Pacific market is set to be a global hub for innovation terminal automation.

Challenges

Complex Integration and High Initial Costs: The complexity of integrating automation technologies with existing infrastructure is one of the main challenges terminal operators face. This often involves a high upfront investment, consisting of new hardware, installation, and staff training. Such expenses may be prohibitive for smaller operators, inhibiting wide uptake.

Cyber Risk and Data Security: Since the automation systems at the terminals will leverage cloud infrastructures, IoT devices and digital data communications networks, the automation processes will be vulnerable to risks of cyber intrusions. Secure solutions must be implemented for the protection of high-value operational information, which ensures terminal safety and reliability.

Opportunities

Expansion of LNG and Renewable Energy Terminals: A growing demand for liquefied natural gas (LNG) and renewable-energy products creates a large market for terminal automation providers. LNG terminal and renewable energy storage systems can also be automated to optimize costs and efficiency, as well as balance the increasing demand in the markets.

IoT Adoption and Digital Transformation: Used in conjunction with already-existing IoT sensors, predictive analysis and digital twin technology are revolutionizing terminal operations. With the free flow of real-time data, streamlining of workflows, greater safety and improved decision making are coming into play that will pave the way for smarter, more resilient terminal infrastructures.

From between 2020 to 2024, the oil and gas terminal automation market experienced substantial growth, driven by the growing demand for operational efficiency, improved security, and real-time data analytics. Automation, to unload, store, transport, and to distribute with minimal human involvement, was on the agendas of all companies.

And the impetus for cost optimization, safety compliance, and digital transformation propelled oil and gas companies to adopt automated control systems, remote monitoring technologies, and AI-powered predictive maintenance.

Oil, gas, and water companies adopted automated safety protocols, real-time leak detection systems, AI-driven risk assessment tools and more in the wake of regulatory bodies, including the American Petroleum Institute (API), Occupational Safety and Health Administration (OSHA) and International Maritime Organization (IMO), tightening safety and environmental compliance standards. Automation also enhanced cybersecurity as oil and gas terminals faced an increasing number of cyberattack threats against critical infrastructure.

New technologies such as AI, machine learning and robotic process automation (RPA) helped to change oil and gas terminal operations as they allowed for automatic scheduling of cargo, tankers and performance of assets. By virtue of block chain technology, transaction transparency was heightened significantly as well, and so was fuel quality tracking, and secure data exchange between terminals, while preventing fraud and creating operational reliability. By creating digital twins of terminals, companies were able to simulate their performance in real time, using digital twin technology that optimized efficiency.

However, high implementation costs, resistance to change challenges, and cybersecurity vulnerabilities among others, had hampered adoption. Many legacy terminal operators struggled to integrate legacy infrastructure with modern automation technologies, delaying their digital transformation initiatives.

Moreover, the fluctuating oil prices and geopolitical uncertainties made smaller operators reluctant to invest in full-scale terminal automation. However, when energy companies finally saw the long-range potential of automated asset management, such as predictive maintenance and operation within the cloud, they steadily adopted these technologies, paving the way for innovations in later years.

From 2025 to 2035, the oil and gas terminal automation market will evolve, featuring AI-powered autonomous terminals, block chain-secured data management systems, and predictive analytics for operational optimization. With data security being of utmost importance, companies will move to fully automated and self-regulating terminal systems that also require minimal human intervention and reduce operational costs as well as improve efficiency.

Automation through AI will empower real-time optimization of processes, enabling anomaly detection and AI-enhanced decision-making to run oil and gas terminals in a smart way that is more agile to market-going changes.

Energy firms will be able to predict demand fluctuations, optimize fuel distribution plans, and enhance crisis response strategies through the integrated approach of quantum computing and AI-based analytics. The AI-enabled edge computing will deploy real-time capabilities across terminal locations, ensuring low latency and immediate capable decision making for resolving critical operational challenges. Cloud automation will become the norm, providing the ability to interconnect many terminals, refineries and distribution centres.

AI-powered security systems will detect and eliminate potential cyber-attacks before they can even operate - making cybersecurity a major focus of 2024, as it will a priority across all business sectors. With this technology, fuel tracking will become more reliable, transaction processes more secure, and regulatory compliance will become more transparent. Replace outdated access control methods with advanced biometric access security, eliminating the risk of unauthorized personnel managing terminal operations.

As the emergence of robotics and autonomous drones continue to grow, so will drone applications in terminal inspections, pipeline monitoring and leak detection. Real-time safety inspections using AI-powered drones to spot potential failures between maintenance intervals.

Automated robotic systems in cargo handling, fuel transfer operations, and maintenance of various storage facilities reducing downtime and improving operational safety. Automated maintenance bots will supplants traditional manual inspections that were performed, and predictive maintenance strategies will be in place preventing equipment failures before they disrupt operations.

The future of oil and gas terminal automation will also be greatly influenced by sustainability. To meet global decarbonisation targets, companies will invest in carbon capture technologies, AI-driven energy efficiency solutions, and renewable energy-powered automation systems.

Smart, predictive automation will achieve efficiencies in energy consumption, minimizing waste and reducing GHG emissions. Oil terminals will not just simply disappear, rather they will also have hydrogen ready infrastructure and biofuel compatible storage solutions, ushering in the transition into a better energy mix.

New terminal processes using a mix of AI-assisted automation, AI-enabled real-time digital twins, and decentralized block chain-based transaction systems will transform the oil and gas industry by 2035, enabling terminal operations to become hyper-efficient, secure, and sustainable! AI driven analytics, robotic automation and IoT-based predictive maintenance will help eradicate inefficiencies, reduce operational risk and extend asset life.

The industry will move toward fully autonomous, self-optimising terminals that guarantee maximum efficiency, safety, and regulatory compliance.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance focused on safety automation, cybersecurity protocols, and emissions control measures. |

| Technological Advancements | Companies adopted SCADA, IIoT, and cloud-based automation platforms to enhance operations. |

| Industry Applications | Automation improved inventory management, remote monitoring, and predictive maintenance. |

| Adoption of Smart Equipment | Companies implemented remote sensors, IoT tracking, and AI-enhanced fuel management. |

| Sustainability & Cost Efficiency | Firms focused on energy-efficient automation, digital tracking for emissions, and optimized supply chain workflows. |

| Data Analytics & Predictive Modelling | AI-driven predictive maintenance and anomaly detection improved terminal safety and efficiency. |

| Production & Supply Chain Dynamics | Market faced supply chain disruptions, oil price volatility, and digital transformation challenges. |

| Market Growth Drivers | Growth was fuelled by increasing demand for automation, remote monitoring, and real-time operational analytics. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments will mandate AI-powered cybersecurity enforcement, block chain-based regulatory tracking, and fully automated safety compliance. |

| Technological Advancements | Adoption of AI-driven predictive automation, quantum computing for real-time analytics, and robotic-assisted terminal operations will become widespread. |

| Industry Applications | Expansion into autonomous terminal operations, AI-powered risk detection, and real-time AI decision support systems. |

| Adoption of Smart Equipment | Growth in autonomous drone inspections, robotic maintenance units, and AI-powered self-optimizing fuel terminals. |

| Sustainability & Cost Efficiency | AI-powered energy optimization, carbon capture-integrated automation, and hybrid renewable-powered terminal operations will become industry standards. |

| Data Analytics & Predictive Modelling | Expansion of real-time AI-powered digital twins, federated AI risk analytics, and predictive cybersecurity threat detection. |

| Production & Supply Chain Dynamics | Blockchain-enabled supply chain transparency, AI-optimized logistics, and autonomous fuel distribution will enhance global terminal operations. |

| Market Growth Drivers | Expansion will be driven by fully autonomous oil terminals, AI-based asset optimization, and sustainability-driven automation. |

The USA oil & gas terminal automation industry is expanding incrementally with the assistance of increased investments in digital oilfield technologies, increased cybersecurity mandates, and increased adoption of IoT-based automation solutions.

Since the USA remains one of the global leaders in oil & gas production, there has been growing interest in efficient, automated terminal operating systems. Giant oil companies such as ExxonMobil, Chevron, and ConocoPhillips are spending considerably on SCADA (Supervisory Control and Data Acquisition) systems, artificial intelligence-driven predictive analytics, and cloud-based automation solutions to make terminals more efficient and minimize risks of operations.

The Biden administration's focus on carbon emissions and energy transition has also spurred the deployment of smart automation solutions for peak fuel efficiency and emissions monitoring at oil storage terminals. Secondly, the growing focus on cybersecurity to infrastructure has also spurred the deployment of AI-powered threat intelligence and real-time security monitoring solutions for oil & gas terminals.

Beyond that, USA Liquefied Natural Gas (LNG) terminal growth is propelling demand for high-end automated systems for improving asset management, reducing human touch, and maximizing inventory tracking.

Owing to continued growth of oilfield digitalization, growing need for heightened regulatory compliance along with increased investment being injected into smart terminal operations, the USA oil & gas terminal automation market is expected to experience stupendous growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

UK oil & gas terminal automation market is growing steadily due to government sustainability programs, rising utilization of smart automation solutions, and the expanding role of LNG terminals in energy security.

With the UK's transition towards renewable energy resources, oil & gas operators are retro-fitting old terminal infrastructure with cutting-edge automation solutions to boost efficiency, minimize emissions, and meet net-zero targets. Automation of storage, distribution, and safety surveillance systems is becoming a high priority for firms like BP, Shell, and Total Energies in the UK market.

In addition, LNG terminal expansion and hydrogen fuel integration are driving the need for sophisticated control systems that provide accurate inventory tracking, optimize fuel blending operations, and improve remote monitoring capabilities.

The UK's stringent regulatory environment for energy industry cybersecurity has also driven greater use of cloud-based automation, AI-based predictive maintenance, and blockchain-based fuel transaction monitoring systems to avoid data breaches and operational disruptions.

With deep investments in automation, growing LNG infrastructure development, and rising emphasis on sustainability and cyber-secure terminal operations, the UK oil & gas terminal automation market will expand enormously.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

The European oil & gas terminal automation market is experiencing strong growth, driven by growing LNG uptake, growing digitalization of oil & gas logistics, and high investments in AI-driven terminal management systems

With the EU's emphasis on lowering dependence on Russian energy supplies, the growth of LNG import terminals in Germany, France, Italy, and the Netherlands is fuelling demand for smart automation solutions that provide real-time monitoring of assets, optimize operations in fuel transfer, and minimize manual intervention in key terminal operations.

Moreover, the EU's Digitalization Strategy for Energy and Industrial Sectors is also urging oil & gas operators to adopt IoT-based automation, predictive maintenance solutions, and machine learning algorithms to enhance terminal efficiency and minimize unplanned downtime

The area is also witnessing growing investments in cybersecurity automation for key infrastructure, with digital oil terminals being safeguarded against cyber-attacks, data breaches, and operational disruptions.

As increasing LNG terminal expansions, increasing investments in automation, and stringent regulatory adherence for oil & gas logistics take place, the EU oil & gas terminal automation market is bound to witness tremendous growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.3% |

The Japanese oil & gas terminal automation market is also rising steadily with growing LNG terminal capacity, growing rates of refinery operation automation, and rising investment in AI-driven monitoring systems.

With continued dependence of Japan on LNG imports for energy security, automation of storage, handling, and delivery of LNG has emerged as a top priority. Japanese energy companies like JERA, Tokyo Gas, and INPEX are investing in real-time data analysis, AI-based tank monitoring systems, and automated safety compliance systems to optimize terminal efficiency and minimize operating risks.

Use of advanced automation and robotics using artificial intelligence is also picking up pace in terminal and refinery facilities so that firms can automate fuel transfer operations, streamline logistics, and enhance predictive maintenance ability.

Moreover, Japan's emphasis on hydrogen as a future fuel is also generating investments in automation technologies that ensure safe handling and effective terminal management of hydrogen fuels.

As terminal automation with AI becomes more sophisticated, investment in LNG facilities keeps growing and smart energy management gains more government support, the Japanese oil & gas terminal automation industry will keep expanding steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

South Korean oil and gas terminal automation market is continuously increasing with an increase in the development of LNG infrastructure, the increasing adoption of intelligent automation technologies, and initiatives by the government to adopt digital oil & gas operations.

With more dependence on LNG imports by South Korea, the government is accelerating investment in automating the LNG terminals to enhance safety, efficiency, and real-time monitoring. Companies such as KOGAS (Korea Gas Corporation) and SK Energy are adopting AI-based automation, cloud analytics, and IoT-based monitoring systems to rationalize fuel storage and distribution.

In addition, the emphasis of South Korea on digitalization in the oil & gas sector has led to increased applications of blockchain-based fuel tracking systems, automated unloading and loading terminals, and remote operation technology.

This emphasis on becoming carbon neutral by 2050 in the nation is also driving the application of automation systems that optimize fuel blending, optimize emissions measurement, and optimize energy efficiency in terminal operations.

With increasing investment in smart LNG terminals, high government support towards digital oil & gas operations and increasing adoption of AI-based automation, the market for South Korean oil & gas terminal automation is expected to rise significantly.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The oil & gas terminal automation industry is growing with rising demand for real-time monitoring of assets, digitalization in energy logistics, and AI-based control over operations. Organizations are concentrating on SCADA-based automation, IoT-connected process control, and security-enhanced terminal management solutions to increase efficiency, safety, and regulatory compliance in fuel storage and distribution terminals.

The market entails international automation vendors and specialized terminal management system integrators who all contribute to technological advances in pipeline automation, digital twin modeling, and AI-driven predictive maintenance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric SE | 15-20% |

| Siemens AG | 12-16% |

| Rockwell Automation, Inc. | 10-14% |

| ABB Ltd. | 8-12% |

| Emerson Electric Co. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric SE | Develops EcoStruxure™ for terminal automation, integrating AI-based remote monitoring, predictive analytics, and cybersecurity. |

| Siemens AG | Specializes in SCADA-based terminal control systems, AI-assisted pipeline automation, and cloud-enabled operational intelligence. |

| Rockwell Automation, Inc. | Manufactures PlantPAx® DCS for oil & gas terminal control, AI-driven tank farm automation, and advanced safety instrumented systems (SIS). |

| ABB Ltd. | Provides Distributed Control Systems (DCS), automated metering solutions, and smart pipeline automation for real-time energy asset optimization. |

| Emerson Electric Co. | Offers DeltaV™ automation solutions, wireless IoT sensors, and AI-powered process control for enhanced terminal efficiency. |

Key Company Insights

Schneider Electric SE (15-20%)

Schneider Electric dominates the oil & gas terminal automation industry with EcoStruxure™ energy automation solutions that include predictive maintenance, cybersecurity solutions, and AI-driven terminal control systems.

Siemens AG (12-16%)

Siemens excels at SCADA-based oil & gas terminal automation through cloud-enabled asset management and AI-facilitated operational risk mitigation.

Rockwell Automation, Inc. (10-14%)

Rockwell Automation offers PlantPAx® DCS and industrial IoT-based terminal automation solutions for improved remote monitoring, real-time diagnostics, and digital twin integration.

ABB Ltd. (8-12%)

ABB designs smart pipeline automation, distributed control systems (DCS), and predictive analytics based on AI to assure optimized energy distribution and increased safety compliance.

Emerson Electric Co. (5-9%)

Emerson delivers DeltaV™ automation platforms, wireless flow metering solutions, and cloud-integrated process control to optimize fuel terminal efficiency and minimize operational downtime.

Some energy automation and digital transformation companies play a role in next-generation oil & gas terminal control, AI-powered predictive monitoring, and cyber-secure automation solutions. Some of them are:

Global Oil & Gas Terminal Automation Market size is projected to reach USD 1.6 Billion by 2025.

Increases in energy consumption, increasing adoption of digital technologies for operational efficiency, strict safety regulations and need for cost-effective and secure storage and distribution of fuel will drive demand of the oil & gas terminal automation market.

Top 5 Oil & Gas Terminal Automation Market Developing Countries are USA, UK, Europe Union, Japan and South Korea.

Terminal & Inventory Management Leads Market share is expected to dominate the above-mentioned period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Hardware, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Software, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Software, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 17: Global Market Attractiveness by Hardware, 2023 to 2033

Figure 18: Global Market Attractiveness by Software, 2023 to 2033

Figure 19: Global Market Attractiveness by Services, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Software, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 37: North America Market Attractiveness by Hardware, 2023 to 2033

Figure 38: North America Market Attractiveness by Software, 2023 to 2033

Figure 39: North America Market Attractiveness by Services, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Software, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Hardware, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Software, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Software, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Hardware, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Software, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Services, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Software, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Hardware, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Software, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Services, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Software, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Services, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Hardware, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Software, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Services, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Software, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Hardware, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Software, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Hardware, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Software, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Services, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Hardware, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Hardware, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Hardware, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Software, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Software, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Software, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Hardware, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Software, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Services, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA