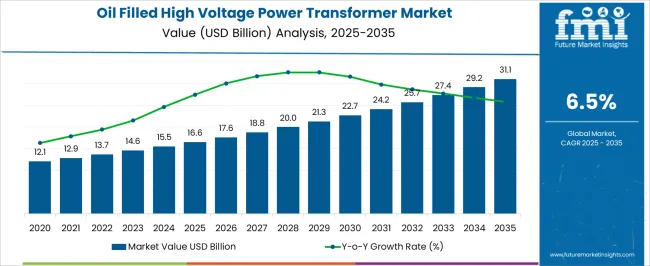

The oil filled power transformer market is estimated to be valued at USD 14.9 billion in 2025 and is projected to reach USD 27.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. The global construction worker safety market is anticipated to rise from USD 3.5 billion in 2025 to USD 7.0 billion by 2035, reflecting a CAGR of 7.0%. An analysis of volume versus price contribution highlights how market expansion is influenced by both increasing unit adoption and changes in product pricing over the decade.

Between 2025 and 2030, the market grows from USD 3.5 billion to USD 5.0 billion, with volume-driven growth accounting for the majority of revenue expansion. This early phase reflects rising adoption of personal protective equipment (PPE), fall protection systems, helmets, and safety harnesses, driven by stricter occupational safety regulations, increasing construction activities, and heightened awareness of worker health and safety standards globally.

From 2030 to 2035, the market further advances from USD 5.0 billion to USD 7.0 billion, with price growth contributing more noticeably to overall expansion. This late-stage phase is characterized by the introduction of technologically advanced, smart, and high-durability safety equipment, including connected wearable devices and sensor-enabled protective gear, which command premium pricing. Regional dynamics show Asia-Pacific leading volume adoption due to booming infrastructure projects, while North America and Europe drive price growth through premium and innovative safety solutions.

| Metric | Value |

|---|---|

| Oil Filled Power Transformer Market Estimated Value in (2025 E) | USD 14.9 billion |

| Oil Filled Power Transformer Market Forecast Value in (2035 F) | USD 27.2 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The construction worker safety market is primarily driven by the personal protective equipment (PPE) market, which accounts for approximately 40–45% of total demand, as helmets, safety vests, gloves, and protective footwear are essential for safeguarding construction workers against injuries and occupational hazards. The construction and infrastructure market contributes around 20–22%, reflecting the rise in industrial, commercial, and urban development projects that require comprehensive safety measures for on-site personnel.

The occupational safety and health services market holds roughly 15–17%, driven by training programs, risk assessments, safety audits, and compliance solutions that ensure adherence to workplace safety standards. The wearable technology and IoT in construction market contributes approximately 12–14%, as smart helmets, sensor-enabled vests, and biometric devices enable real-time monitoring, accident prevention, and workforce health management. The government regulations and safety compliance market accounts for 5–6%, promoting adoption through mandatory labor laws, inspection frameworks, and safety standards enforcement. These parent markets define the technological, operational, and regulatory ecosystem of the construction worker safety market, enabling contractors, safety managers, and construction firms to protect workers, reduce accidents, and enhance productivity across global construction projects.

The oil filled power transformer market is on a steady growth trajectory, supported by rising electricity demand, grid modernization projects, and replacement of aging transmission infrastructure. Utilities and industrial operators are increasingly investing in high-efficiency transformers to reduce energy losses and enhance system reliability.

Regulatory mandates for improved energy performance and the integration of renewable energy sources have further increased the need for robust transformer technology. Advancements in insulation fluids, design optimization, and remote monitoring capabilities are also enhancing operational lifespans and performance reliability.

As electricity consumption continues to expand in both developed and emerging economies, infrastructure upgrades and the expansion of high-voltage transmission networks are expected to sustain demand. Growth is particularly pronounced in segments emphasizing self-cooled designs for operational efficiency, medium-to-low power ratings for versatile deployment, and utility-based applications that dominate large-scale installations.

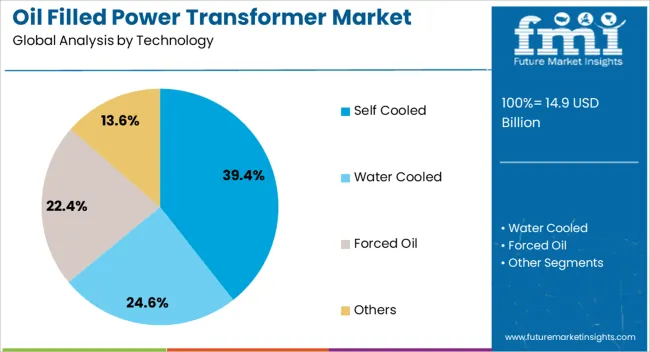

The oil filled power transformer market is segmented by technology, rating, application, and geographic regions. By technology, the oil-filled power transformer market is divided into Self-Cooled, Water-Cooled, Forced Oil, and Others. In terms of rating, oil filled power transformer market is classified into ≤ 100 MVA, > 100 MVA to ≤ 500 MVA, > 500 MVA to ≤ 800 MVA, and > 800 MVA.

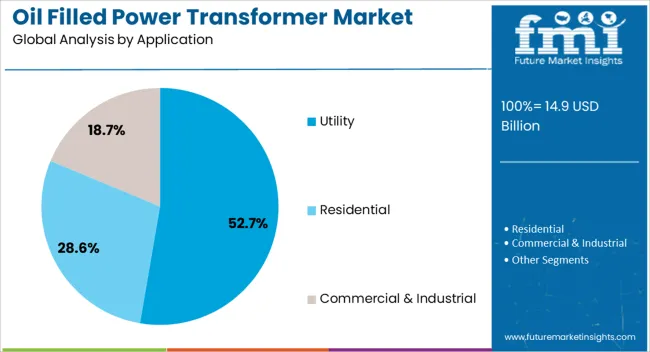

Based on application, oil filled power transformer market is segmented into Utility, Residential, and Commercial & Industrial. Regionally, the oil filled power transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Self Cooled segment is projected to hold 39.4% of the oil filled power transformer market revenue in 2025, reflecting its preference in environments where mechanical simplicity and operational cost efficiency are prioritized. This design eliminates the need for additional cooling systems, reducing maintenance requirements and improving reliability in varied climatic conditions. Utilities and industrial facilities have adopted self-cooled transformers for medium-voltage applications due to their lower installation complexity and stable thermal performance.

Moreover, the absence of forced cooling components reduces potential failure points, ensuring dependable service over long operational lifespans.

As the focus on minimizing downtime and optimizing the total cost of ownership intensifies, the self-cooled segment is expected to remain a significant contributor to market growth.

The ≤ 100 MVA rating segment is projected to contribute 44.8% of the market revenue in 2025, making it the leading power range. Transformers in this capacity range offer versatility, supporting applications from regional grid distribution to industrial power supply. Their relatively compact footprint and lower capital cost compared to higher-capacity units have made them highly sought after for urban substations, renewable energy integration, and localized power distribution networks.

Utilities have favored this category for its ease of deployment and scalability, enabling phased infrastructure upgrades.

With expanding rural electrification projects and distributed generation systems, demand for ≤ 100 MVA transformers is expected to grow steadily.

The Utility segment is forecasted to account for 52.7% of the oil filled power transformer market revenue in 2025, maintaining its dominance due to the extensive use of transformers in transmission and distribution networks.

Utilities require reliable, long-life equipment to handle varying load profiles and integrate renewable generation sources into existing grids. Investment in grid expansion, refurbishment, and interconnection projects has continued to drive utility demand for oil filled power transformers.

Additionally, utilities have increasingly adopted transformers with enhanced monitoring systems, enabling predictive maintenance and improved asset management. With government-led infrastructure programs and private sector investments aligning to strengthen grid resilience, the utility segment is poised to retain its leading market position.

The oil filled power transformer market is growing due to rising electricity demand, renewable energy integration, and industrial expansion. Products, including mineral, synthetic, and ester-based oil transformers, are used in transmission, distribution, and industrial applications. Challenges include high capital costs, maintenance, thermal management, and regulatory compliance.

Opportunities exist in renewable integration, industrial power supply, high-capacity transformers, and digital monitoring solutions. Manufacturers providing energy-efficient, digitally monitored, environmentally compliant, and technically supported transformers are best positioned to capture global growth. Asia-Pacific, North America, and Europe remain key regions due to urbanization, electrification programs, and large-scale industrial and renewable projects.

The oil filled power transformer market is expanding as utilities, industries, and infrastructure developers increasingly adopt these transformers for reliable voltage regulation, load management, and grid stability. Oil filled transformers, including mineral oil, synthetic oil, and ester-based types, are widely used in transmission, distribution, and industrial applications.

Growth is driven by rising electricity demand, renewable energy integration, and modernization of aging grids across Asia-Pacific, North America, and Europe. Manufacturers such as ABB, Siemens, Schneider Electric, and Toshiba focus on high-capacity, energy-efficient, and thermally stable designs. Advancements in cooling techniques, insulation systems, and monitoring solutions enhance performance. Expansion of urbanization, industrialization, and large-scale renewable projects further fuels adoption, positioning oil filled transformers as critical infrastructure for uninterrupted power supply globally.

Despite growth, the oil filled power transformer market faces challenges from high capital expenditure, maintenance costs, and environmental compliance. Mineral oil handling, leak prevention, and fire safety regulations add operational complexity. Technical challenges include managing thermal aging, dielectric breakdown, and load fluctuations in high-voltage systems. Compliance with IEC, ANSI, IEEE, and regional safety standards is critical. Supply chain constraints for high-quality insulation materials, core steel, and transformers’ components can impact delivery timelines. Customers increasingly demand certified, reliable, and long-lifespan transformers with predictive maintenance capabilities. Manufacturers investing in optimized cooling systems, monitoring solutions, and environmentally friendly insulating oils can mitigate operational risks while meeting stringent technical and regulatory requirements worldwide.

Opportunities in the oil filled power transformer market are driven by integration of solar, wind, and hydroelectric power projects, industrial expansion, and utility grid modernization. Growing electrification programs in Asia-Pacific, North America, and Europe create demand for high-capacity, efficient transformers. Industrial applications include power-intensive sectors such as steel, cement, and petrochemicals. Manufacturers offering eco-friendly oils, modular designs, and intelligent monitoring systems gain a competitive advantage. Collaboration with EPC contractors, utilities, and renewable project developers ensures lifecycle support. Increasing focus on energy efficiency, load management, and digital monitoring further supports adoption. Companies providing turnkey solutions, technical guidance, and high-performance transformers are well-positioned for sustained market growth globally.

Technological trends in the oil filled power transformer market include IoT-based monitoring, predictive maintenance, advanced cooling systems, and high-voltage capacity designs. Digital sensors and SCADA integration allow real-time performance tracking, fault detection, and operational optimization. Manufacturers are adopting ester-based and biodegradable insulating oils for improved thermal stability and environmental compliance. Modular and compact designs enable faster installation, maintenance, and scalability in urban and industrial grids. Advanced thermal modeling and load management enhance efficiency and extend transformer lifespan. Providers delivering digitally integrated, certified, and high-performance oil filled transformers are positioned to meet global electricity demand, renewable energy adoption, and industrial power requirements while improving grid reliability.

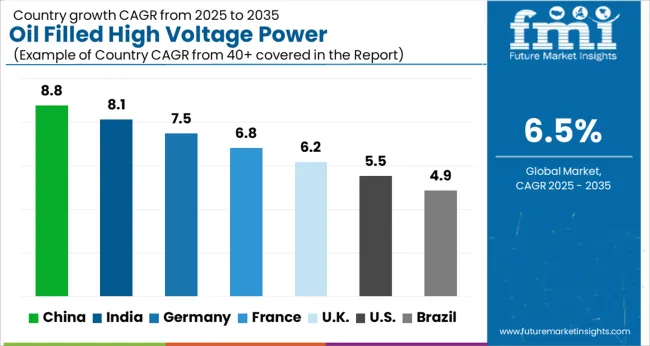

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

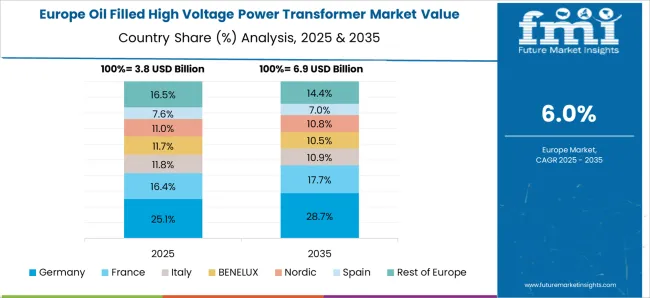

| Germany | 7.1% |

| France | 6.5% |

| U.K. | 5.9% |

| U.S. | 5.3% |

| Brazil | 4.7% |

The global construction worker safety market is projected to grow at a CAGR of 7.0% from 2025 to 2035. China leads with 9.5%, followed by India at 8.8%, Germany at 8.1%, the U.K. at 6.7%, and the U.S. at 6.0%. Growth is driven by rising construction and industrial projects, strict safety regulations, and increased awareness of workplace hazards. Adoption of helmets, gloves, harnesses, high-visibility clothing, and smart PPE devices is accelerating. Digital monitoring, IoT-enabled wearables, and modular solutions are further enhancing safety standards. Asia remains the fastest-growing market, while Europe and North America focus on compliance, technology integration, and ergonomic equipment. The analysis includes over 40+ countries, with the leading markets detailed below.

The oil filled power transformer market in China is expected to expand at a CAGR of 8.4% from 2025 to 2035, driven by rapid growth in electricity demand across residential, commercial, and industrial sectors. Government initiatives for grid modernization, high-voltage transmission projects, and smart grid deployment are supporting widespread adoption. The renewable energy sector, particularly solar and wind power projects, is fueling demand for high-capacity, reliable transformers capable of handling fluctuating loads. Manufacturers are introducing advanced insulation, low-loss cores, and efficient cooling technologies to improve performance and reduce maintenance. Urbanization, industrial expansion, and large-scale infrastructure projects contribute to consistent growth.

The oil filled power transformer market in India is set to grow at a CAGR of 7.8% from 2025 to 2035. Expansion of the national grid, industrial growth, and rising electricity demand are major growth drivers. Utilities are investing in high-capacity transformers to improve reliability and reduce technical losses. Adoption is accelerated by government programs such as rural electrification, smart city projects, and renewable energy integration. Manufacturers are developing transformers with enhanced insulation, low-loss cores, and better cooling to meet growing infrastructure needs. Industrial and commercial sectors are increasingly deploying these transformers for stable power supply. Strategic collaborations with global suppliers, coupled with technological upgrades and predictive maintenance solutions, are further supporting market growth. Urbanization and industrialization trends continue to expand demand in tier-1 and tier-2 cities.

The oil-filled power transformer market in France is projected to grow at a CAGR of 6.5% from 2025 to 2035. Upgrading aging electrical infrastructure and integrating renewable energy sources such as wind and solar are major growth drivers. Utilities are replacing older transformers with advanced oil filled units to improve reliability, efficiency, and operational life. Manufacturers are innovating with low-loss cores, enhanced cooling systems, and noise reduction technologies. Integration with smart grid systems is increasing adoption for real-time monitoring and predictive maintenance. The country’s regulatory environment and energy efficiency standards encourage investments in high-performance transformers. Industrial facilities and urban infrastructure upgrades are further supporting demand. Partnerships between equipment manufacturers and utilities, along with government incentives, ensure that advanced transformer technologies are implemented efficiently.

The U.K. market is expected to expand at a CAGR of 5.9% from 2025 to 2035. Growth is supported by modernization of substations, transmission network upgrades, and renewable energy integration. Utilities and industrial users are increasingly deploying oil filled transformers with advanced insulation, thermal management, and low-loss cores to meet efficiency and reliability goals. Commercial and residential infrastructure upgrades further drive market adoption. Manufacturers are introducing compact designs suitable for urban substations, along with predictive maintenance solutions for operational optimization. Government initiatives and private sector investments encourage digital monitoring and smart grid implementation. Increased demand for energy-efficient transformers in commercial projects and renewable energy plants also supports steady growth.

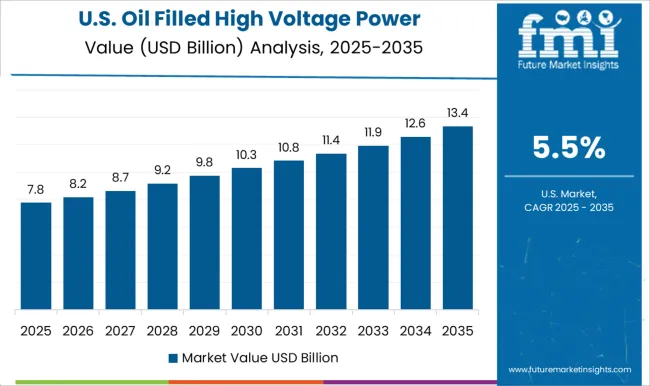

The U.S. market is projected to grow at a CAGR of 5.3% from 2025 to 2035. Expansion of transmission and distribution infrastructure, combined with rising industrial electricity demand, is driving adoption. Utilities are investing in oil filled transformers featuring low-loss cores, advanced insulation, and improved cooling systems to enhance operational efficiency. Smart grid integration and predictive maintenance solutions further accelerate market growth. Industrial and commercial infrastructure upgrades, along with urban electrification, create steady demand. Manufacturers are focusing on environmentally compliant transformer oils, low-noise designs, and improved reliability. Partnerships with OEMs and technology providers are enhancing adoption across utilities and commercial facilities. The U.S. market emphasizes large-scale deployment, operational efficiency, and advanced monitoring technologies to ensure consistent power supply and grid stability.

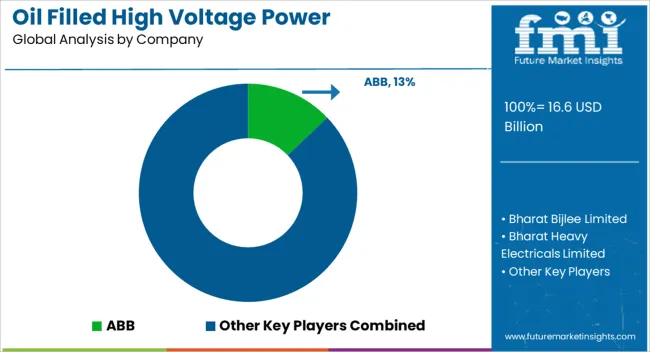

The oil filled power transformer market is highly competitive, driven by technological innovation, reliability, and efficiency. Key players include ABB, Bharat Heavy Electricals Limited (BHEL), Celme S.r.l., CG Power & Industrial Solutions Ltd., Eaton, Elsewedy Electric, Fuji Electric Co., Ltd., GE, Hitachi Energy Ltd., Hyosung Heavy Industries, LS ELECTRIC Co., Ltd., Ormazabal, Schneider Electric, Siemens Energy, and Toshiba Energy Systems & Solutions Corporation. ABB focuses on advanced insulation technologies, energy-efficient designs, and compact transformer solutions. Product brochures highlight load management, temperature monitoring, and long-term operational reliability. BHEL emphasizes high-capacity, robust transformers suitable for industrial and utility applications, with brochures detailing voltage regulation, oil preservation, and maintenance efficiency. GE and Siemens Energy concentrate on digitalized and smart transformer solutions. Their product portfolios showcase monitoring systems, predictive maintenance capabilities, and optimized load handling.

Toshiba Energy Systems & Solutions and Hitachi Energy Ltd. highlight environmentally compliant oil and cooling systems, enhanced safety features, and reduced lifecycle costs. Eaton, Schneider Electric, and LS ELECTRIC Co., Ltd. focus on compact, modular designs suitable for urban and industrial grids. Product brochures emphasize energy efficiency, low-loss cores, and flexible installation options. Celme S.r.l., Ormazabal, and Elsewedy Electric target specialized industrial applications with tailored designs, high reliability, and resilience under extreme conditions. Hyosung Heavy Industries and Fuji Electric Co., Ltd. emphasize smart grid compatibility, low-noise operation, and thermal management. Market competition is influenced by transformer capacity, efficiency, durability, digital integration, and maintenance solutions. Product brochures remain a primary tool to communicate technical specifications, operational advantages, and application versatility. Companies leverage brochures to demonstrate innovation, compliance with standards, and the ability to meet the evolving demands of power utilities and industrial customers across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.9 Billion |

| Technology | Self Cooled, Water Cooled, Forced Oil, and Others |

| Rating | ≤ 100 MVA, > 100 MVA to ≤ 500 MVA, > 500 MVA to ≤ 800 MVA, and > 800 MVA |

| Application | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals Limited (BHEL), Celme S.r.l., CG Power & Industrial Solutions Ltd., Eaton, Elsewedy Electric, Fuji Electric Co., Ltd., GE, Hitachi Energy Ltd., Hyosung Heavy Industries, LS ELECTRIC Co., Ltd., Ormazabal, Schneider Electric, Siemens Energy, and Toshiba Energy Systems & Solutions Corporation |

| Additional Attributes | Dollar sales by transformer type (power, distribution, shunt reactors), voltage rating (low, medium, high, ultra-high), and application (utilities, industrial, renewable energy integration). Demand is fueled by grid expansion, renewable energy adoption, and infrastructure modernization. Regional trends show strong growth in North America, Europe, and Asia-Pacific, supported by increasing electricity demand, aging infrastructure replacement, and smart grid investments. |

The global oil filled power transformer market is estimated to be valued at USD 14.9 billion in 2025.

The market size for the oil filled power transformer market is projected to reach USD 27.2 billion by 2035.

The oil filled power transformer market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in oil filled power transformer market are self cooled, water cooled, forced oil and others.

In terms of rating, ≤ 100 mva segment to command 44.8% share in the oil filled power transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA