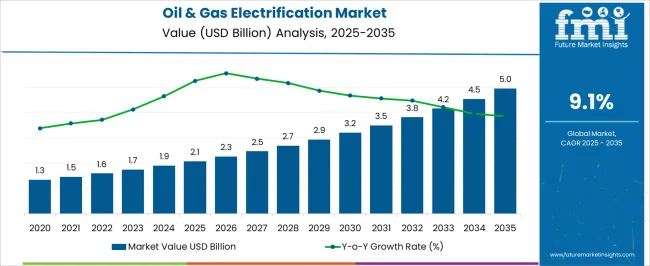

The oil & gas electrification market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period. The oil & gas electrification market is projected to generate an absolute gain of USD 2.9 billion and a growth multiplier of 2.38x over the decade. This strong growth, supported by a CAGR of 9.1%, reflects increasing investments in sustainable electrification solutions within the oil and gas sector, driven by decarbonization goals and the shift toward more energy-efficient operations. During the first five years (2025–2030), the market will grow from USD 2.1 billion to USD 3.2 billion, adding USD 1.1 billion, which accounts for 38% of the total incremental growth, with a 5-year multiplier of 1.52x.

The second phase (2030–2035) contributes USD 1.8 billion, representing 62% of the total growth, reflecting stronger momentum driven by the ongoing transition to renewable energy, digitalization of oil and gas operations, and advancements in electric technologies. Annual increments rise from USD 0.3 billion in early years to USD 0.5 billion by 2035, signaling stronger growth in electrification projects as the industry adapts to cleaner and more efficient energy solutions. Manufacturers focusing on advanced electrification technologies and integration with renewable energy systems will capture the largest share of this USD 2.9 billion opportunity.

| Metric | Value |

|---|---|

| Oil & Gas Electrification Market Estimated Value in (2025 E) | USD 2.1 billion |

| Oil & Gas Electrification Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

Electrification solutions are increasingly being deployed to reduce greenhouse gas emissions and improve operational efficiency across offshore and onshore assets. Heightened regulatory pressures, investor expectations for ESG compliance, and growing governmental support for renewable energy integration into traditional oil and gas infrastructure are influencing this market.

Industry news and corporate briefings have highlighted the rising investments in offshore grid connectivity, the use of floating wind turbines, and subsea electrification technologies, all aimed at replacing diesel-powered systems. Future growth is expected to be shaped by innovations in HVDC transmission, digital monitoring platforms, and modular electrification units.

The convergence of renewables with traditional energy infrastructure is allowing oil and gas operators to reduce costs, enhance safety, and comply with emission targets. As a result, the electrification of oil and gas assets is emerging as a critical pathway in the global shift toward cleaner energy systems.

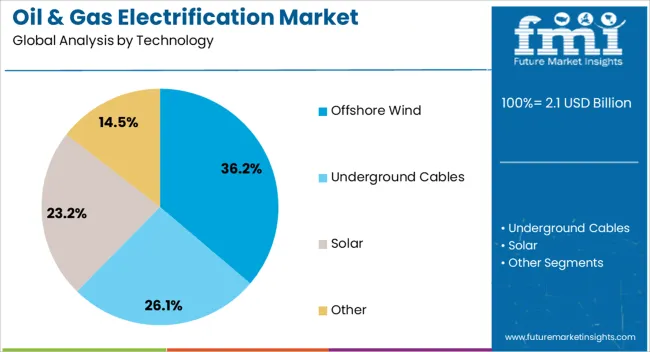

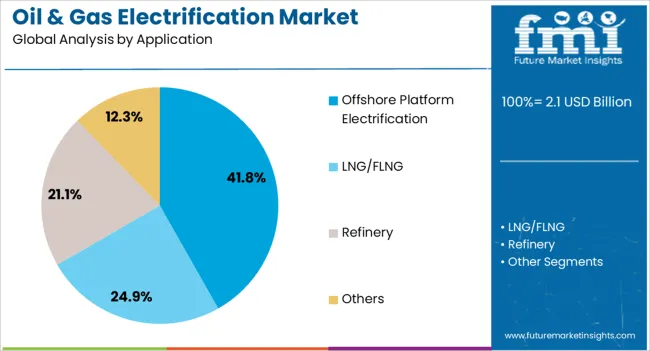

The oil & gas electrification market is segmented by technology, application, and geographic regions. By technology, the oil & gas electrification market is divided into Offshore Wind, Underground Cables, Solar, and Other. In terms of application, the oil & gas electrification market is classified into Offshore Platform Electrification, LNG/FLNG, Refinery, and Others. Regionally, the oil & gas electrification industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The offshore wind technology segment is projected to account for 36.2% of the Oil & Gas Electrification Market revenue share in 2025, establishing it as the leading technology segment. This growth is being driven by the ability of offshore wind systems to deliver stable, renewable energy to remote oil and gas platforms, eliminating the need for fossil fuel-based power generation. Offshore wind has been widely implemented due to its scalability, high capacity factor, and minimal carbon footprint.

Press releases from energy companies have indicated that collaborations between oil majors and offshore wind developers are accelerating the deployment of hybrid power solutions. Additionally, offshore wind infrastructure has been designed to integrate efficiently with subsea cabling and floating production units, making it suitable for deepwater and harsh environments.

Governmental policy incentives and long-term power purchase agreements have also encouraged investment in this segment. These factors have collectively contributed to offshore wind maintaining its lead in the technology category of the Oil & Gas Electrification Market.

The offshore platform electrification application segment is expected to hold 41.8% of the Oil & Gas Electrification Market revenue share in 2025, positioning it as the dominant application area. This prominence is being supported by rising efforts to reduce operational emissions and meet environmental compliance targets. Offshore platforms are among the highest energy consumers in upstream operations, and their electrification has been prioritized to replace diesel generators with cleaner, renewable or grid-supplied electricity.

Annual reports from energy operators have outlined significant cost savings and reduced maintenance needs as major benefits of this transition. Furthermore, platform electrification has enabled operators to implement advanced monitoring and automation systems, improving efficiency and safety.

The adoption of high-voltage subsea transmission and dynamic cable technologies has made it feasible to connect platforms located in remote deepwater fields. With regulatory agencies mandating lower emission thresholds and stakeholders demanding sustainable operations, offshore platform electrification has emerged as a core focus in the decarbonization strategy of the oil and gas sector.

The oil & gas electrification market is driven by rising demand for efficient, energy-saving power systems, especially in offshore operations. Opportunities in renewable energy integration and expanding energy requirements offer substantial market growth potential. However, high capital costs and infrastructure constraints pose challenges. By 2025, overcoming these challenges with cost-effective solutions and infrastructure enhancements will be key for continued market expansion and adoption of electrification solutions.

The oil & gas electrification market is expanding due to the increasing demand for efficient power systems within the oil and gas industry. As operations move toward electrification, the industry is seeking more reliable and cost-effective solutions to reduce operational costs and enhance productivity. The push for automation, better energy management, and reducing the reliance on fossil fuels in offshore and onshore operations is expected to drive growth in this market. By 2025, the need for energy-efficient electrification systems will continue to rise.

Opportunities in the oil & gas electrification market are growing with the expansion of offshore oil and gas operations. As offshore drilling and production activities increase, the demand for electrification solutions to power equipment and reduce emissions is rising. Electrification can improve energy efficiency and reduce the need for diesel and gas engines. By 2025, these opportunities in offshore oil fields will create a significant market for advanced electrification solutions to meet the increasing energy needs.

Emerging trends in the oil & gas electrification market include the integration of renewable energy sources, such as wind and solar, into power systems. This integration allows for a cleaner, more reliable energy supply to oil and gas operations, reducing dependence on traditional fossil fuel-based power. As more oil and gas companies explore renewable energy options to complement their operations, these trends are expected to gain traction by 2025, reshaping the electrification landscape in the industry.

Despite growth, challenges related to high capital costs and infrastructure constraints persist in the oil & gas electrification market. The upfront investment required to implement electrification solutions, particularly for remote or offshore operations, is substantial. Additionally, the lack of suitable infrastructure in certain regions can limit the adoption of these systems. By 2025, addressing these barriers through cost-effective, scalable solutions and efficient infrastructure development will be critical for enabling wider adoption in the oil and gas sector.

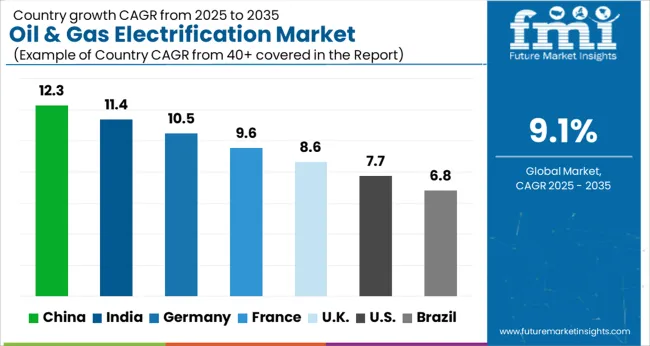

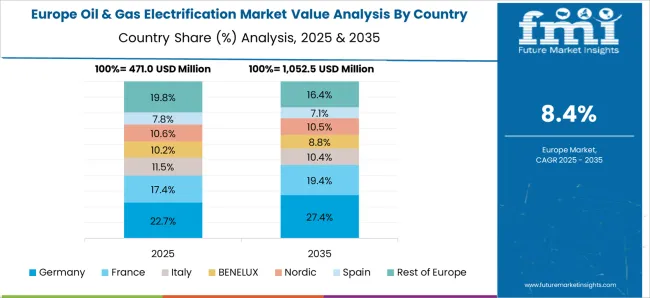

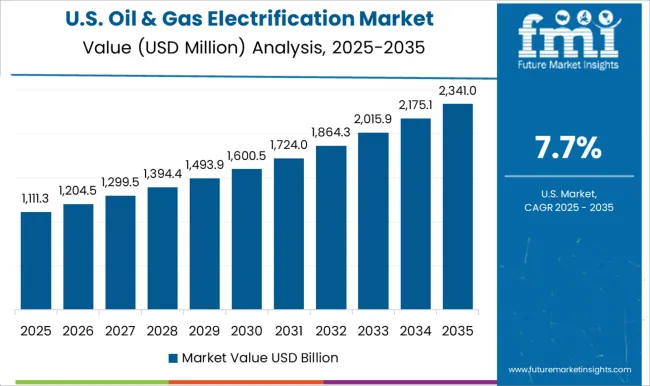

The global oil & gas electrification market is projected to grow at a 9.1% CAGR from 2025 to 2035. China leads with a growth rate of 12.3%, followed by India at 11.4%, and Germany at 10.5%. The United Kingdom records a growth rate of 8.6%, while the United States shows the slowest growth at 7.7%. These varying growth rates are driven by factors such as the increasing adoption of renewable energy sources in the oil and gas industry, advancements in energy-efficient technologies, and the push for sustainability and reduced carbon emissions. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, growing energy demands, and government support for clean energy technologies, while more mature markets like the USA and the UK see steady growth driven by technological innovations, environmental policies, and regulatory frameworks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The oil & gas electrification market in China is growing at a robust pace, with a projected CAGR of 12.3%. China’s rapid industrialization, coupled with its growing focus on reducing carbon emissions and transitioning toward cleaner energy sources, is driving significant demand for electrification technologies in the oil and gas industry. The country’s increasing adoption of renewable energy, alongside investments in energy-efficient systems and electric power distribution infrastructure, further accelerates market growth. Additionally, China’s government policies aimed at improving energy sustainability and supporting electrified oil and gas operations contribute to the strong demand for electrification solutions.

The oil & gas electrification market in India is projected to grow at a CAGR of 11.4%. India’s growing energy demands, coupled with a strong push from the government to reduce reliance on fossil fuels and adopt cleaner energy solutions, are significantly driving the demand for electrification technologies in the oil and gas sector. The increasing focus on renewable energy, along with the adoption of energy-efficient solutions and the electrification of oil and gas infrastructure, is accelerating market growth. Additionally, India’s expanding industrial base and the need for sustainable energy solutions in the oil and gas industry further contribute to the rising demand for electrification.

The oil & gas electrification market in Germany is projected to grow at a CAGR of 10.5%. Germany’s commitment to sustainability, renewable energy adoption, and reducing carbon emissions is contributing to steady demand for electrification technologies in the oil and gas sector. The country’s strong industrial base and investments in energy-efficient systems, along with a growing focus on decarbonizing the energy supply, further accelerate the adoption of electrification solutions. Germany’s regulatory frameworks, which prioritize reducing environmental impact and increasing the integration of renewable energy sources into oil and gas operations, are contributing to the market’s growth.

The oil & gas electrification market in the United Kingdom is projected to grow at a CAGR of 8.6%. The UK’s ongoing commitment to decarbonizing the energy sector, along with government incentives to adopt renewable energy and energy-efficient technologies, is driving steady demand for electrification solutions in the oil and gas industry. The UK’s focus on integrating renewable energy sources, along with its regulatory standards for carbon emissions reduction and energy sustainability, is further contributing to the adoption of electrification technologies. The country’s advanced infrastructure and investments in low-carbon technologies support the continued growth of the market.

The oil & gas electrification market in the United States is expected to grow at a CAGR of 7.7%. The USA market remains steady, driven by the increasing demand for energy-efficient and sustainable technologies in the oil and gas industry. The rising focus on reducing carbon emissions, adopting renewable energy solutions, and improving energy efficiency in oil and gas operations continues to drive the demand for electrification technologies. Additionally, the USA government’s regulations on environmental impact and the growing investment in sustainable energy solutions further support the market’s steady growth.

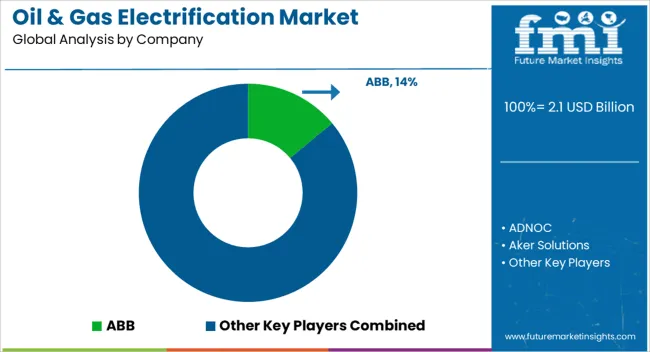

The oil and gas electrification market is dominated by ABB, which leads with its comprehensive range of electrification solutions designed to improve energy efficiency, reduce emissions, and enhance operational reliability in the oil and gas industry. ABB’s dominance is supported by its advanced technologies, global presence, and strong partnerships with major oil and gas players. Key players such as GE Vernova, Siemens, and Schneider Electric maintain significant market shares by offering innovative electrification systems that enable sustainable energy transitions, including smart grids, energy storage, and power distribution systems for offshore and onshore oil and gas operations.

These companies focus on providing high-performance, cost-effective solutions for energy management, automation, and renewable energy integration. Emerging players like ADNOC, Aker Solutions, and Cerulean Winds are expanding their market presence by offering specialized electrification solutions for niche applications, such as offshore wind integration and floating platforms. Their strategies include leveraging renewable energy sources, enhancing grid stability, and improving system efficiencies in remote locations. Market growth is driven by increasing regulatory pressures on emissions, the rising adoption of renewable energy, and the oil and gas industry’s push toward decarbonization. Innovations in offshore electrification, hybrid power solutions, and energy storage integration are expected to continue shaping competitive dynamics and fuel further growth in the global oil and gas electrification market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Technology | Offshore Wind, Underground Cables, Solar, and Other |

| Application | Offshore Platform Electrification, LNG/FLNG, Refinery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, ADNOC, Aker Solutions, BP, Cerulean Winds, Chevron, ConocoPhillips, Equinor, GE Vernova, Havfram, LS Cable, Marathon Oil, Nexans, Norddeutsche Seekabelwerke, Prysmian, Saudi Aramco, Shell, Siemens, SLB, Southwire, TotalEnergies, and ZTT |

| Additional Attributes | Dollar sales by technology type and application, demand dynamics across upstream, midstream, and downstream oil and gas sectors, regional trends in oil and gas electrification adoption, innovation in renewable energy integration and energy-efficient technologies, impact of regulatory standards on emissions and safety, and emerging use cases in remote operations and offshore energy systems. |

The global oil & gas electrification market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the oil & gas electrification market is projected to reach USD 5.0 billion by 2035.

The oil & gas electrification market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in oil & gas electrification market are offshore wind, underground cables, solar and other.

In terms of application, offshore platform electrification segment to command 41.8% share in the oil & gas electrification market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA