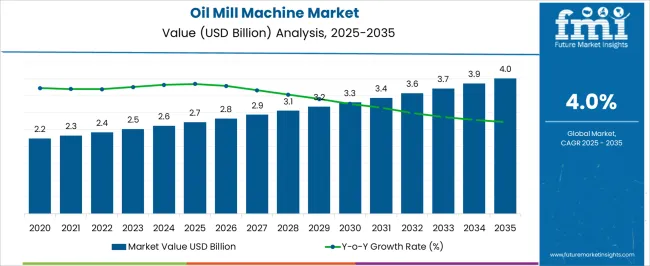

The Oil Mill Machine Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Oil Mill Machine Market Estimated Value in (2025 E) | USD 2.7 billion |

| Oil Mill Machine Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The oil mill machine market is undergoing steady growth driven by the rising demand for edible oils, modernization of small and medium enterprises, and the increasing focus on efficiency and hygiene in oil production. Industry dynamics indicate that technological improvements and supportive policies for agro-processing industries have encouraged the adoption of advanced machinery across emerging and developed markets alike.

Ground-level observations suggest that players are investing in equipment capable of handling diverse oilseeds while minimizing energy consumption and maximizing yield. Future growth is expected to benefit from rising health-conscious consumption trends, government incentives to promote local oil production, and greater awareness about food safety standards.

Innovation in automation and materials is paving the way for improved reliability and scalability, positioning the market for sustained expansion as businesses strive for cost competitiveness and quality enhancement.

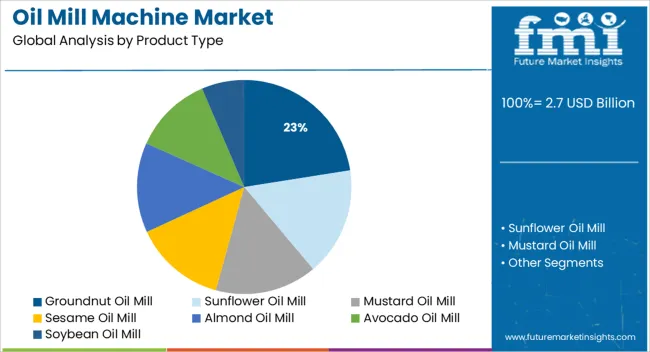

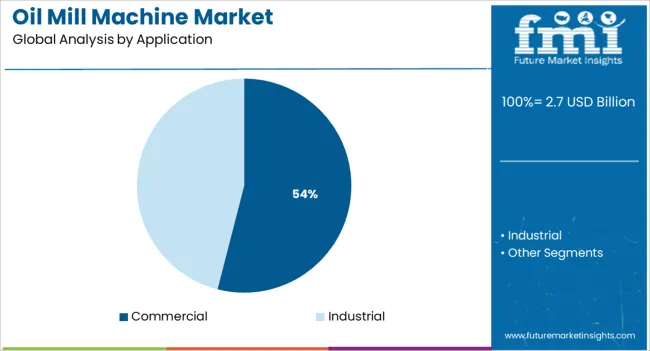

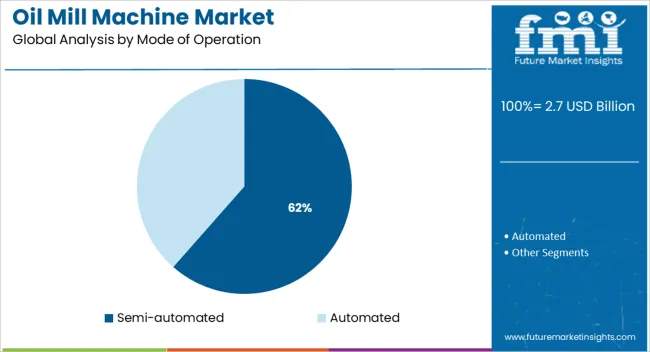

The market is segmented by Product Type, Application, and Mode of Operation and region. By Product Type, the market is divided into Groundnut Oil Mill, Sunflower Oil Mill, Mustard Oil Mill, Sesame Oil Mill, Almond Oil Mill, Avocado Oil Mill, and Soybean Oil Mill. In terms of Application, the market is classified into Commercial and Industrial. Based on Mode of Operation, the market is segmented into Semi-automated and Automated. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, groundnut oil mill machines are projected to contribute 22.5 % of the total market revenue in 2025, establishing themselves as the leading product type. This leadership has been shaped by the widespread cultivation and popularity of groundnuts as a versatile oilseed in both domestic and export markets.

The robustness of groundnut oil’s consumer demand and its high extraction yield have influenced manufacturers to prioritize machinery optimized for groundnut processing. Additionally, the durability of these machines, ease of maintenance, and adaptability to varying production scales have made them favorable among processors.

Enhanced designs that reduce wastage and improve oil quality have further bolstered their adoption, reinforcing their stronghold in the market as processors increasingly aim for higher throughput and profitability.

Segmented by application, the commercial segment is expected to account for 54.0 % of the oil mill machine market revenue in 2025, maintaining its top position. This dominance has been driven by the expansive requirements of commercial processors to handle large volumes of oilseeds with consistent output and efficiency.

Businesses in this segment have been observed investing in machinery that ensures continuous operation, minimal downtime, and compliance with stringent food quality regulations. The preference for scalable solutions that can accommodate future capacity expansions has also contributed to the segment’s growth.

Moreover, the ability to achieve economies of scale and improve margins through automation and optimized processes has encouraged commercial enterprises to lead the adoption of advanced oil mill machinery, ensuring their prominence in the industry.

When segmented by mode of operation, semi-automated oil mill machines are projected to hold 61.5 % of the market revenue in 2025, establishing themselves as the preferred choice. This leadership has been attributed to the balance they offer between cost efficiency and operational control, making them suitable for a wide range of processors.

Semi-automated systems have been favored for their ability to reduce labor intensity while still allowing operators to intervene when needed, ensuring flexibility and reliability. Their lower initial investment compared to fully automated systems, combined with ease of training and maintenance, has made them attractive to small and medium enterprises as well as commercial operators.

The segment’s growth has been reinforced by continuous design enhancements that improve throughput and energy efficiency while preserving affordability, ensuring their continued relevance in diverse production environments.

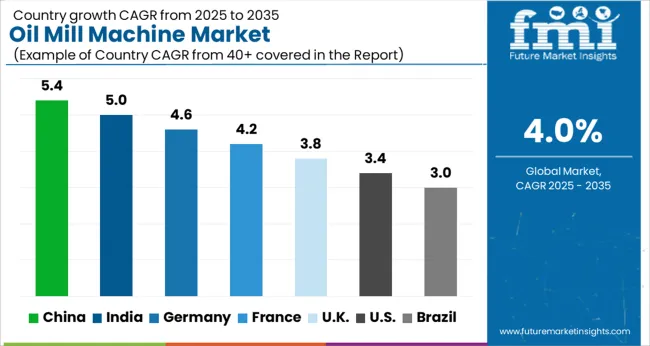

The global oil mill machine market is expected to grow at a CAGR of around 4.0% during the forecast period from 2025 to 2035. As per FMI, the market showcased steady growth at a CAGR of 2.2% during the historical period of 2020 to 2025.

The increasing need for biodiesel to replace conventional fossil fuels in automotive and power generation applications is one of the major factors pushing sales of oil mill machines. Biodiesel is nowadays being preferred by automakers as it emits less greenhouse gas.

As per the USA Environmental Protection Agency (EPA), in 2010, industries generated around 21% of global greenhouse gas emissions. It mainly involved fossil fuels burned on-site at various facilities for energy. The sector also included emissions from mineral, metallurgical, and chemical transformation processes, which are not related to emissions from waste management activities or energy consumption.

Oil mill machines are also expected to be extensively used in the marine industry with the rising demand for biodiesel. As biodiesel is non-toxic, biodegradable, and free of sulfur & aromatics, it is projected to be demanded by the marine industry.

A number of influential factors have been identified to stir the soup in the oil mill machine market. Apart from the proliferating aspects prevailing in the market, analysts at FMI have analyzed the restraining elements, lucrative opportunities, and upcoming threats that can pose a challenge to the progression of the global market.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Development of Tight Oil Resources in the USA to Spur Sales of Oil Manufacturing Machines

Oil production in the USA is expected to grow significantly in the next ten years fueled by rising demand from the transportation and petrochemical industries. The USA is projected to lead North America, followed by Canada and Mexico. A large number of projects have been planned or are underway across the country, which will further boost demand.

As per the Center for Strategic & International Studies, the development of abundant unconventional natural gas and tight oil resources would create a historic opportunity to improve economic growth across North America. This will further help to enhance the region’s competitiveness in global markets. This factor is projected to foster sales of oil mill machines in the USA during the assessment period.

Production of Highly Durable Oil Extraction Machines in Germany to Aid Sales by 2035

Germany is considered to be the largest producer of oil mill machines in Europe. It has been dominant across the Europe market since the historical period. Various Germany-based companies are constantly producing highly durable and efficient oil mill machines that are set to be utilized by numerous countries across Europe.

The German government also provides financial support to companies that produce oil mill machines, which helps to keep their prices down. Germany is also a major exporter of oil mill machines, with most of its exports going to other European countries.

International Firms to Set Up their Oil Grinding Machine Manufacturing Facilities in China

China is considered to be a key oil mill machine producer across the Asia Pacific, says FMI. The country has a vast aging population and an increasingly affluent middle-class population. It is also rich in terms of raw materials, including oil, which is essential for industrial growth.

China is therefore set to be an attractive market for oil mill manufacturers. The easy availability of raw materials and low cost of labor in China is compelling international oil mill machine manufacturers to develop their manufacturing facilities in the country.

Demand for Sunflower Oil Milling Machines to Surge among Vegan Food Manufacturers

Based on product type, the sunflower oil mill segment is anticipated to remain at the forefront in the next ten years. Increasing consumption of healthy cooking oil and frying oil among food manufacturing companies, as well as households is set to drive the segment. Besides, the rising use of sunflower oil to make vegan spreads, cheese, and mayonnaise would push sales of oil mill machines.

In October 2025, for instance, Ambrosia Organic Farm, which is India’s first organic firm, introduced the world’s first flavored peanut butter. It is available in two distinct flavors, namely, mango and blueberry. The company has more than 50 organic products, including sunflower oil, wild honey, rice cakes, and peanut oil. Thus, the launch of similar unique products infused with sunflower oil by key companies would propel sales of oil mill machines.

Some of the key players in the global market are United Engineering Eastern Ration LLP, Andavar Lathe Works, AGI Mill Tec, Devi Industries, Confider, Fowler Westrup, Kumar Metal Industries, Lakshmi Machineries, and SS Engineering Works among others.

The majority of the key companies are investing huge sums in research & development activities to come up with technologically advanced oil mill machines. A few other players are focusing on collaborations, joint ventures, and acquisitions of local companies to expand their product portfolios, as well as their geographic presence worldwide.

One of the leading companies providing oil mill machines include:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.7 billion |

| Projected Market Valuation (2035) | USD 4.0 billion |

| Value-based CAGR (2025 to 2035) | 4.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Application, Mode of Operation, Region |

| Key Companies Profiled | United Engineering Eastern Ration LLP; Andavar Lathe Works; AGI Milltec; Devi industries; Confider; Fowler Westrup; Kumar Metal Industries; Lakshmi Machineries; SS Engineering Works |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global oil mill machine market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the oil mill machine market is projected to reach USD 4.0 billion by 2035.

The oil mill machine market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in oil mill machine market are groundnut oil mill, sunflower oil mill, mustard oil mill, sesame oil mill, almond oil mill, avocado oil mill and soybean oil mill.

In terms of application, commercial segment to command 54.0% share in the oil mill machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milling Machine Market Growth – Trends & Forecast 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Dal Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Coil Winding Machine Market Growth – Trends & Forecast 2024 to 2034

Rice Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Foil Embossing Machine Market Size and Share Forecast Outlook 2025 to 2035

End Milling Machine Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tree Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Maize Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Universal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA