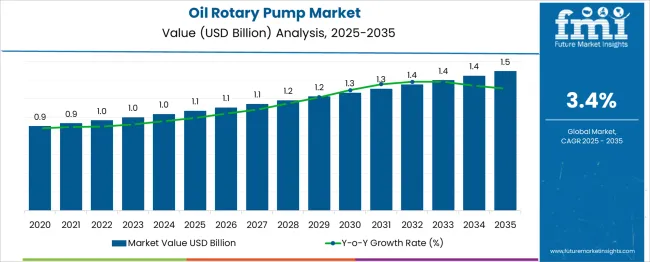

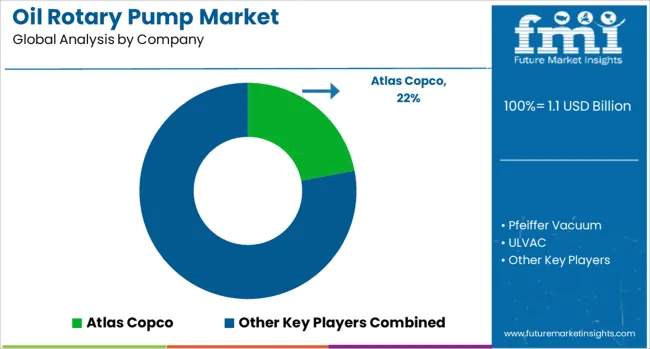

The oil rotary pump market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period. The market is creating an absolute dollar opportunity of USD 0.4 billion at a CAGR of 3.4%. In the first five-year phase (2025–2030), the market expands modestly from USD 1.1 billion to USD 1.3 billion, delivering an incremental gain of USD 0.2 billion, which accounts for 50% of the total growth. This early phase reflects stable demand from oil refineries, lubrication systems, and midstream facilities, supported by routine maintenance and gradual modernization of pumping infrastructure across mature oil markets.

The second half (2030–2035) contributes an additional USD 0.2 billion, representing 50% of incremental growth, indicating a balanced growth pattern across both phases. Year-on-year increments remain marginal, averaging USD 0.02–0.03 billion annually, reflecting the market’s maturity and dependency on replacement demand rather than new installations. Later-phase growth is expected to benefit from energy efficiency requirements and integration of advanced sealing technologies to minimize leakage and operational downtime. Manufacturers focusing on precision-engineered pumps, digital monitoring solutions, and long-life rotary designs will be well-positioned to capitalize on this USD 0.4 billion opportunity in a slow but steady expansion environment.

| Metric | Value |

|---|---|

| Oil Rotary Pump Market Estimated Value in (2025 E) | USD 1.1 billion |

| Oil Rotary Pump Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The oil rotary pump market holds a significant position within several industrial and energy-related sectors. In the industrial pumps market, its share is approximately 6–8%, as this segment includes centrifugal, diaphragm, and other pump types for diverse applications. Within the positive displacement pumps market, oil rotary pumps account for about 18–20%, given their high efficiency in handling viscous fluids and precise flow control. In the oil and gas equipment market, their share stands at around 4–5%, since drilling, extraction, and refining equipment dominate overall investment.

For the lubrication systems market, oil rotary pumps represent nearly 25–28%, as they play a critical role in delivering consistent lubrication in machinery and engines. In the power generation and energy equipment market, the share is relatively small at 3–4%, reflecting their specialized use in turbine and generator lubrication systems. Growth is driven by the rising demand for efficient fluid transfer systems in automotive, marine, industrial manufacturing, and energy sectors. The advantages of rotary pumps, including smooth flow, low pulsation, and the ability to handle high-viscosity oils, make them ideal for precision applications. With ongoing industrial automation and increased focus on operational reliability, the oil rotary pump market is expected to expand its footprint across these parent markets globally.

The Oil Rotary Pump market is witnessing steady growth, driven by increasing industrial automation, energy efficiency demands, and advancements in vacuum technologies. A notable rise in deployment across sectors such as petrochemical, pharmaceutical, food processing, and automotive has created a sustained demand for oil rotary pumps. Growth is further supported by the rising need for low-vibration and low-noise pump systems that deliver reliable performance in continuous operations.

Manufacturers are increasingly focused on developing compact, modular designs that enable easy maintenance and extended operational lifespan. Investments in industrial infrastructure across emerging economies, coupled with stricter energy and emission regulations, are further propelling the adoption of energy-efficient rotary pumps.

Technological upgrades that allow integration of digital control systems and enhanced vacuum control features are also shaping the future trajectory of the market. As industrial sectors pursue greater operational reliability and fluid handling precision, oil rotary pumps are anticipated to remain essential components in a wide array of production and utility processes..

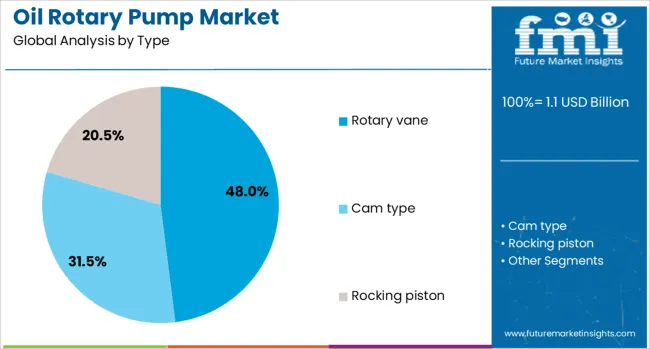

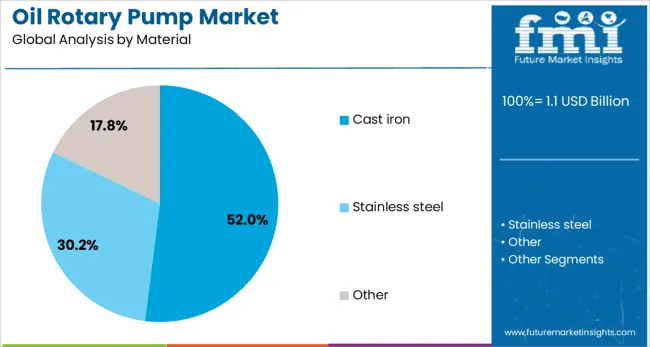

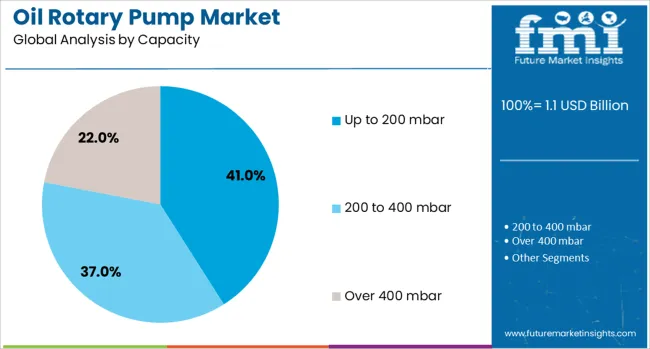

The oil rotary pump market is segmented by type, material, capacity, flow rate, application, distribution channel, and geographic regions. The oil rotary pump market is divided by type into Rotary vane, Cam type, and Rocking piston. The material of the oil rotary pump market is classified into Cast iron, Stainless steel, and Other. The capacity of the oil rotary pump market is segmented into Up to 200 mbar, 200 to 400 mbar, and Over 400 mbar. The oil rotary pump market is segmented by flow rate into 25 - 600 M3H, 600 - 3000 M3H, 3000 - 10000 M3H, and over 10000 M3H. The oil rotary pump market is segmented by application into Petrochemical & chemical, Pharmaceutical, Food manufacturing, Aircraft, Automobile, Water treatment, Oil & gas, Power generation, EPS and plastics, Pulp & paper, and Others. The distribution channel of the oil rotary pump market is segmented into Direct and Indirect. Regionally, the oil rotary pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary vane segment is projected to account for 48% of the market revenue share in 2025, positioning it as the leading type in the industry. Growth in this segment has been driven by the segment’s superior efficiency, compact design, and suitability for continuous-duty operations. Rotary vane pumps have been widely adopted due to their ability to generate consistent vacuum levels and their relatively low maintenance requirements.

The sealed oil-lubricated configuration ensures high performance in environments where contaminant-free and stable vacuum conditions are critical. Their adaptability to various industrial settings, including chemical processing, food packaging, and laboratory applications, has significantly boosted their preference over other pump types.

Their long service life and reduced operational noise have also contributed to their growing acceptance. As industrial processes increasingly demand reliable and energy-conscious vacuum solutions, the rotary vane configuration continues to dominate due to its technical and economic advantages across a broad range of applications..

The cast iron segment is expected to hold 52% of the market revenue share in 2025, making it the dominant material used in pump construction. Cast iron has been favored due to its exceptional durability, resistance to mechanical stress, and cost-effectiveness in industrial-grade equipment. The ability of cast iron to withstand high operational pressure and thermal cycling without deformation has reinforced its adoption in heavy-duty rotary pump applications.

Its structural stability and corrosion resistance have made it a preferred material in sectors such as wastewater treatment, petrochemical, and general manufacturing. Moreover, cast iron provides excellent vibration-damping characteristics, which enhance operational stability and pump longevity.

The widespread availability and lower production cost of cast iron further contribute to its continued use. As industrial buyers prioritize long-term reliability and total cost of ownership, the cast iron segment is expected to maintain a stronghold in the material selection for oil rotary pumps..

The up to 200 mbar capacity segment is projected to capture 41% of the Oil Rotary Pump market revenue share in 2025, making it the leading capacity range in demand. This growth has been largely influenced by the segment’s suitability for a wide spectrum of low to medium-vacuum applications across multiple industries. Pumps with capacities up to 200 mbar have been favored for operations that require stable vacuum levels without excessive energy consumption.

These systems are commonly deployed in packaging, degassing, and filtration processes, where moderate vacuum performance is sufficient to achieve operational goals. The segment’s popularity has also been driven by its compatibility with compact equipment designs and lower noise output.

Its ability to offer dependable vacuum conditions while minimizing mechanical complexity and maintenance needs has made it an efficient solution for many mid-scale operations. As industries focus on optimizing energy use and process efficiency, this capacity range is expected to retain a leading position in the market..

The oil rotary pump market is advancing thanks to increased demand from expanding oil and gas operations, chemical processing, and industrial infrastructure upgrades. Growth is supported by rising procurement of high-performance pumps that handle viscous and multiphase fluids. Opportunities are being realized in aftermarket maintenance contracts and rising demand for vacuum pump systems in semiconductor, pharmaceutical, and packaging industries. Trends include adoption of remote monitoring and predictive maintenance, as well as seal-less pump variants. Restraints encompass high initial costs, competition from centrifugal alternatives, and price volatility of raw materials, slowing deployment in budget-constrained segments.

The primary growth driver is the increasing need for robust fluid handling in oil and gas infrastructure. In 2024 and 2025, deployment across upstream and downstream operations surged, as new pipelines, refineries, and offshore platforms required heavy-duty rotary pumps. High-viscosity crude transfer and multistage pumping for processing units contributed significantly. Demand in chemical plants and wastewater treatment also intensified. These pumps were preferred for their durability and reliability in handling fluids with complex rheology. Market expansion was especially notable in regions with major energy project investments and tightening equipment performance standards.

Significant opportunities emerged in aftermarket service contracts and vacuum pump integration. In 2024, demand increased in semiconductor fabs, pharmaceutical labs, and packaging lines for vacuum systems featuring oil-lubricated rotary vacuum pumps. Partnerships between pump suppliers and OEMs for long-term service and spare parts ensured steady revenue. Industrial facilities adopted rotary pumps for fluid transfer, lubrication, and vacuum generation in process controls. This diversification beyond oil and gas expanded addressable sectors for vendors, enabling cross-industry penetration and growth across multiple end-use segments.

Emerging trends include the introduction of digital monitoring systems and seal-less pump architectures. In 2025, real-time performance tracking and predictive maintenance platforms were adopted in oil, gas, and chemical plants to minimize downtime and optimize operations. Magnetic-drive seal-less designs gained attention in response to stricter emissions regulations, reducing leakage risks. These configurations were increasingly preferred in hygienic environments like food and pharmaceuticals. Such trends underline a market shift toward smarter, cleaner pump designs that address regulatory demands and drive operational efficiency.

Major restraints stem from the elevated purchase and maintenance costs of rotary pumps compared to centrifugal alternatives. In 2024 and 2025, capital-intensive procurement and lifecycle expenses deterred adoption among smaller operators and cost-sensitive users. Growing preference for centrifugal pumps has limited rotary growth in certain applications. Price sensitivity and competition from energy-efficient dry vacuum systems further constrained market expansion. These pressures necessitate cost-optimized designs and flexible financing models for broader appeal in competitive settings.

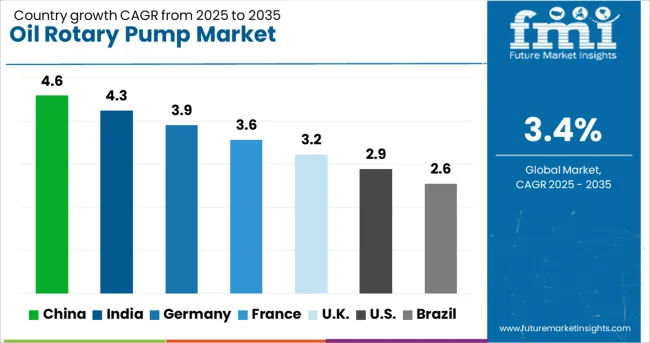

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global oil rotary pump market is projected to grow at 3.4% CAGR between 2025 and 2035. China leads at 4.6% CAGR, driven by oil refining capacity expansion and industrial manufacturing growth. India follows at 4.3%, supported by investments in petrochemical plants and downstream processing. France posts 3.6% CAGR, benefiting from refinery upgrades and demand in chemical industries. The UK grows at 3.2%, while the United States records 2.9%, reflecting a mature market where modernization and energy efficiency drive incremental growth. Asia-Pacific dominates global expansion with heavy infrastructure investments, while developed markets prioritize compliance-driven upgrades and predictive maintenance solutions for rotary pump systems.

China remains the largest growth contributor in the oil rotary pump market with a projected 4.6% CAGR through 2035. Strong demand stems from the expansion of refinery capacities, large-scale petrochemical complexes, and manufacturing sectors. Government-backed projects in energy infrastructure stimulate adoption of high-capacity rotary pumps for crude transfer, distillation, and blending operations. Increasing automation in oil handling facilities drives innovation in pump design, focusing on energy efficiency and digital monitoring features. Local manufacturers dominate the standard pump segment, while international brands supply premium pumps for heavy-duty and corrosive environments.

The oil rotary pump market in India is forecast to grow at 4.3% CAGR, driven by expanding refining capacities and growing investments in petrochemical and lubricant manufacturing. Increasing consumption of petroleum products and the push for energy security strengthen demand for rotary pumps in midstream and downstream operations. Projects under national energy programs enhance the need for efficient fluid transfer systems in pipeline terminals and storage facilities. Domestic manufacturers cater to cost-sensitive segments, while global brands introduce high-performance pumps with enhanced durability for corrosive and abrasive handling.

France is projected to post 3.6% CAGR, supported by refinery upgrades, offshore oil handling, and chemical processing facilities. Energy transition policies drive modernization of pump systems for efficiency and emissions compliance. French industries increasingly demand rotary pumps with enhanced sealing technology and leak prevention for hazardous fluid applications. Digital integration for predictive maintenance is gaining traction, reducing operational downtime. Manufacturers are focusing on energy-efficient designs and modular systems compatible with automation and remote monitoring platforms to align with sustainability standards.

The United Kingdom market is expected to grow at 3.2% CAGR, primarily driven by offshore oilfield operations, storage facilities, and marine transport applications. Modernization of pump systems in existing refineries and terminals focuses on improving efficiency and reducing maintenance costs. Demand for compact and energy-efficient rotary pumps is increasing in applications where space optimization is critical. Suppliers emphasize developing pumps that comply with ATEX standards and are equipped for digital monitoring. Retrofit projects for aging infrastructure present steady opportunities for both OEMs and aftermarket service providers.

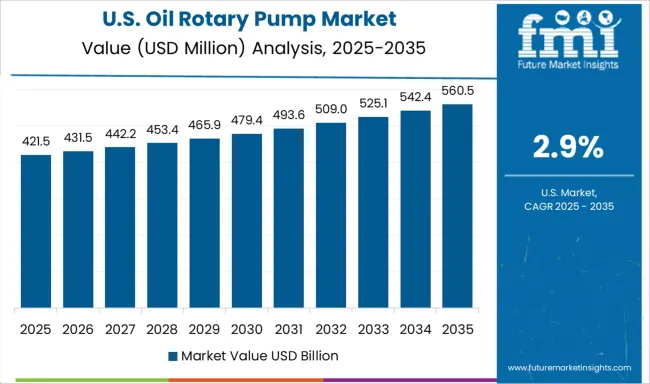

The United States records a 2.9% CAGR, reflecting slower growth in a mature market where oil rotary pump installations are well established. However, demand persists in refinery revamps, petrochemical expansions, and pipeline upgrades to enhance operational efficiency. The adoption of rotary pumps in shale oil processing remains steady, supported by modular pump systems for mobile operations. Increasing emphasis on predictive maintenance and energy optimization encourages the use of smart pumps with remote diagnostics. Leading suppliers focus on offering integrated systems for hazardous environments with high reliability and safety compliance.

The plastic tube packaging market is moderately consolidated, with Albea recognized as a leading player due to its comprehensive portfolio of laminated and extruded tubes designed for personal care, pharmaceutical, and food applications. The company’s global manufacturing footprint and innovation in lightweight, recyclable tube solutions strengthen its leadership position. Key players include Alpla Group, Amcor, Antilla Propack, Aphena Pharma Solutions, Berry Global, CCL Industries, EPL, Evergreen Resources, HCT Group, Hoffmann Neopac, Huhtamaki, I.TA Plastics Tube, Kaufman Container, Petro Packaging Company, Pirlo Holding, Sonoco Products, Tubapack, VisiPak, and Weltrade.

These companies specialize in high-quality tubes incorporating barrier properties, customizable shapes, and advanced decoration techniques for branding. Market growth is driven by increasing demand from cosmetics, personal care, and pharmaceutical sectors due to convenience and cost-efficiency. Leading manufacturers are investing in sustainable materials such as bio-based plastics and PCR (post-consumer recycled) resins, alongside innovations in airless dispensing systems for product protection.

Digital printing and smart labeling technologies are gaining traction for enhancing customization and consumer engagement. Asia-Pacific remains the fastest-growing region due to rising consumption in beauty and healthcare markets, while North America and Europe continue to lead in sustainable packaging adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Type | Rotary vane, Cam type, and Rocking piston |

| Material | Cast iron, Stainless steel, and Other |

| Capacity | Up to 200 mbar, 200 to 400 mbar, and Over 400 mbar |

| Flow Rate | 25 - 600 M3H, 600 - 3000 M3H, 3000 - 10000 M3H, and Over 10000 M3H |

| Application | Petrochemical & chemical, Pharmaceutical, Food manufacturing, Aircraft, Automobile, Water treatment, Oil & gas, Power generation, EPS and plastics, Pulp & paper, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Pfeiffer Vacuum, ULVAC, Busch Vacuum Solutions, Gardner Denver, Ebara Corporation, and Tuthill Corporation |

| Additional Attributes | Dollar sales by pump type (vane, gear, screw, lobe) and material (stainless steel, cast iron, alloy). Asia-Pacific leads with ~38% share in 2023, driven by industrial expansion, while North America holds ~19%, supported by regulatory compliance and downstream upgrades. Buyers prioritize energy-efficient, corrosion-resistant pumps. Innovations include IoT-enabled predictive diagnostics and seal-less, dry-gas variants. |

The global oil rotary pump market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the oil rotary pump market is projected to reach USD 1.5 billion by 2035.

The oil rotary pump market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in oil rotary pump market are rotary vane, cam type and rocking piston.

In terms of material, cast iron segment to command 52.0% share in the oil rotary pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA