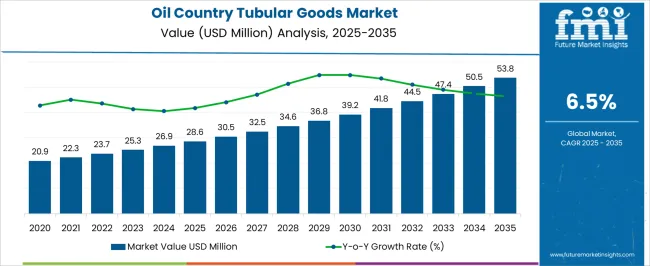

The Oil Country Tubular Goods Market is estimated to be valued at USD 28.6 million in 2025 and is projected to reach USD 53.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Oil Country Tubular Goods Market Estimated Value in (2025 E) | USD 28.6 million |

| Oil Country Tubular Goods Market Forecast Value in (2035 F) | USD 53.8 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The oil country tubular goods market is experiencing steady growth, supported by rising global energy demand and continued investment in oil and gas exploration and production activities. Increasing drilling operations in both onshore and offshore fields are driving the adoption of high-strength tubular goods, which are critical for wellbore integrity and operational safety. Technological advancements in manufacturing processes such as heat treatment and thread design are improving product durability, enabling pipes to withstand high pressure and corrosive environments.

Expansion of unconventional resources, particularly shale and deepwater reserves, is further contributing to market momentum. Regulatory standards on well performance and safety are reinforcing the adoption of premium grades and advanced tubular products, ensuring compliance and reliability.

Moreover, strategic investments by energy companies in upgrading pipeline infrastructure and extending production life cycles are shaping the demand outlook positively As exploration shifts to more complex reservoirs, the reliance on tubular goods with enhanced performance characteristics is expected to increase, positioning the market for continued long-term growth across key producing regions.

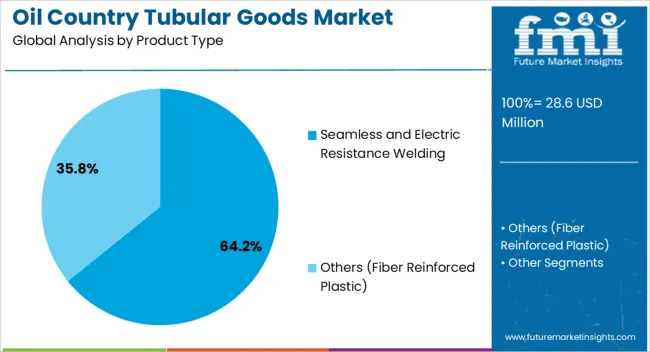

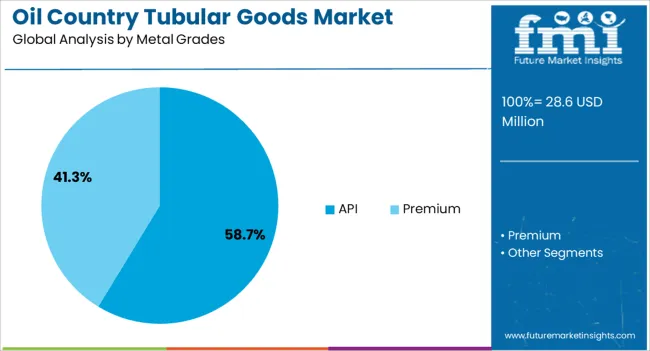

The oil country tubular goods market is segmented by product type, metal grades, and geographic regions. By product type, oil country tubular goods market is divided into Seamless and Electric Resistance Welding and Others (Fiber Reinforced Plastic). In terms of metal grades, oil country tubular goods market is classified into API and Premium. Regionally, the oil country tubular goods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The seamless and electric resistance welding product type segment is projected to hold 64.2% of the oil country tubular goods market revenue share in 2025, making it the leading product type. This dominance is being driven by the segment’s superior strength, durability, and ability to withstand extreme pressure and temperature conditions encountered in drilling environments. Seamless pipes, in particular, are being favored for their reliability in critical applications such as deepwater and unconventional drilling, where material failure risks must be minimized.

Electric resistance welded pipes are also supporting the segment’s position by providing cost-effective solutions for standard applications while maintaining high structural integrity. The rising demand for efficient and safe tubular products in expanding oil and gas projects is reinforcing the adoption of this category.

Continuous improvements in metallurgical processes and inspection technologies are ensuring consistent quality and compliance with international standards The balance between performance, safety, and cost efficiency has positioned this segment as the primary choice for operators worldwide, ensuring its continued leadership within the market.

The API metal grades segment is anticipated to account for 58.7% of the oil country tubular goods market revenue share in 2025, establishing it as the leading metal grade. Its dominance is being supported by wide acceptance in drilling and production operations due to standardized specifications, reliability, and cost efficiency. API grades are being adopted extensively because they meet the essential requirements for tensile strength, yield performance, and corrosion resistance across conventional drilling operations.

This widespread standardization reduces procurement complexities and ensures compatibility across global oilfield operations, which strengthens their position in the market. The availability of API grades in various categories that address both shallow and moderate depth drilling needs is further driving their demand.

Additionally, the cost competitiveness of API grades compared to premium grades is appealing to operators seeking to balance performance with capital efficiency As drilling activities expand in established and emerging energy-producing regions, the preference for standardized and widely recognized API grades is expected to sustain their leadership in the global market.

A notable trend in the oil country tubular goods market is an increase in rig count, which is accompanied by an increase in good footage. Furthermore, the ongoing implementation of hydraulic fracturing technology and horizontal drilling is expected to significantly boost industry growth.

The United States Energy Information Administration (EIA) predicts that crude oil production in the United States Federal Gulf of Mexico (GOM) will increase over the next two years. Furthermore, by the end of 2025, 13 new projects could account for approximately 12% of total Gulf of Mexico crude oil production, or approximately 200,000 barrels per day (b/d), creating a significant demand for high grade oil country tubular goods during the forecast period.

Over the next few years, North America is expected to be the largest market. This is because offshore drilling operations are expanding in several regions, including the Gulf of Mexico. Furthermore, the widespread development of oil and gas fields in both onshore and offshore regions is expected to provide huge business opportunities for companies operating in the oil country tubular goods business during the forecast period, further fueling the region's growth.

Vallourec S.A., Tenaris S.A., Tenergy Equipment and Services Ltd., National oil well Varco, Inc., Arcelor Mittal S.A., Nippon Steel & Sumitomo Metal Corp., and Sumitomo Metal Corporation are among the market leaders in Oil Country Tubular Goods. USA Steel Tubular Products, Inc., Tmk Ipsco Enterprise, Inc., JFE Steel Corp., SB International, Inc., and Evraz PLC are among the emerging market players. Due to the growing industrial demand for advanced drilling technology, companies are focusing more on developing advanced technology-based products. Recent market developments include:

In January 2025, Jindal SAW announced that it had formed a joint venture (JV) with Hunting Energy Services to establish an oil country tubular goods (OCTG) threading plant in Nashik, India. The plant will produce equipment for oil and gas drilling services. The initial investment will be in the range of US$ 20-25 million, with Jindal SAW holding a 51:49 stake. The facility is expected to open by the end of 2025.

Ever-increasing demand and succeeding energy production is considered as one of the biggest driver for the increasing demand of the oil country tubular goods and global oil country tubular goods market penetration.

The key driving forces for the global oil country tubular goods market are increasing drilling and production activities, mounting shale gas exploration and rise in the number of oil wells per rig. Also, there is a growing investment in the unconventional sources of oil and gas which is rising the need of oil country tubular goods immensely.

The global oil country tubular goods market is expected to register a favourable growth for the forecast period, 2025?2025. Asia-Pacific is likely to dominate the global oil country tubular goods market. The key countries in the mentioned region is projected to be China as an outcome of the strong growth in exploration and production of oil and gas.

The North American market is expected to depict the high growth rate in the forecast period due to the abundant shale gas reserves resulting in the higher demand of drilling activities.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

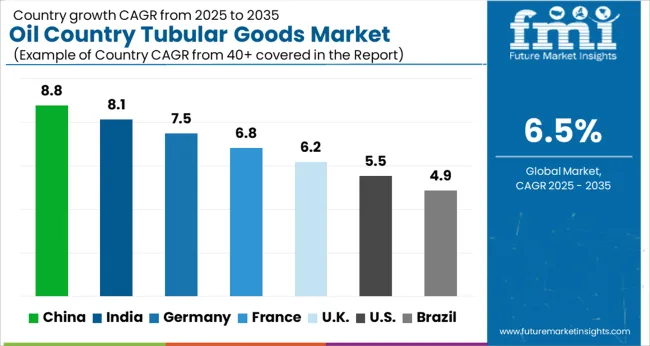

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Oil Country Tubular Goods Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Oil Country Tubular Goods Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Oil Country Tubular Goods Market is estimated to be valued at USD 10.5 million in 2025 and is anticipated to reach a valuation of USD 17.9 million by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.5 million and USD 883.8 thousand respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.6 Million |

| Product Type | Seamless and Electric Resistance Welding and Others (Fiber Reinforced Plastic) |

| Metal Grades | API and Premium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

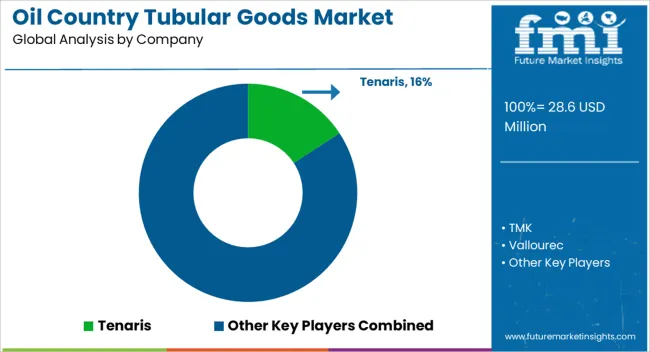

| Key Companies Profiled | Tenaris, TMK, Vallourec, United States Steel Corporation, National Oilwell Varco, Sumitomo Corporation, JFE Steel Corporation, Weatherford, Schlumberger, ArcelorMittal, Tenergy Equipment & Service Ltd., SB International Inc., and ILJIN Steel Co. Ltd. |

The global oil country tubular goods market is estimated to be valued at USD 28.6 million in 2025.

The market size for the oil country tubular goods market is projected to reach USD 53.8 million by 2035.

The oil country tubular goods market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in oil country tubular goods market are seamless and electric resistance welding and others (fiber reinforced plastic).

In terms of metal grades, api segment to command 58.7% share in the oil country tubular goods market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA