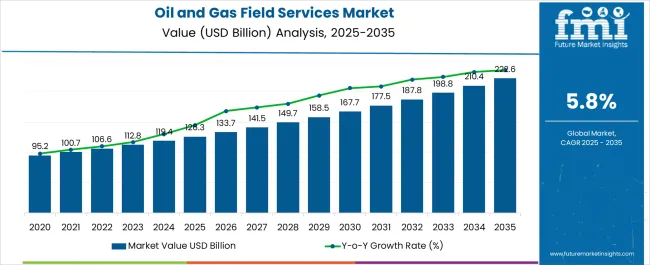

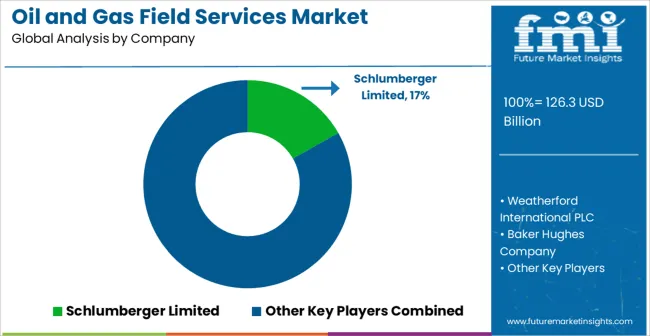

The Oil and Gas Field Services Market is estimated to be valued at USD 126.3 billion in 2025 and is projected to reach USD 222.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Oil and Gas Field Services Market Estimated Value in (2025 E) | USD 126.3 billion |

| Oil and Gas Field Services Market Forecast Value in (2035 F) | USD 222.6 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Oil and Gas Field Services market is witnessing steady growth, driven by the increasing demand for exploration, production, and maintenance solutions across global oil and gas operations. Rising energy consumption, coupled with expanding onshore and offshore infrastructure, is fueling the adoption of specialized field services. Advanced technologies in drilling, well maintenance, and reservoir management are enhancing operational efficiency, reducing downtime, and optimizing production output.

Regulatory emphasis on environmental safety, operational reliability, and risk mitigation is further supporting market expansion. Service providers are increasingly integrating digital solutions such as real-time monitoring, predictive maintenance, and automated reporting to improve performance and ensure compliance. Investments in upstream exploration, infrastructure modernization, and energy transition initiatives are creating opportunities for field services providers.

As companies aim to maximize production efficiency while adhering to stringent operational and environmental standards, the market is expected to sustain long-term growth Continuous innovation in drilling, intervention, and support services is anticipated to remain a key driver, positioning the Oil and Gas Field Services market for future expansion.

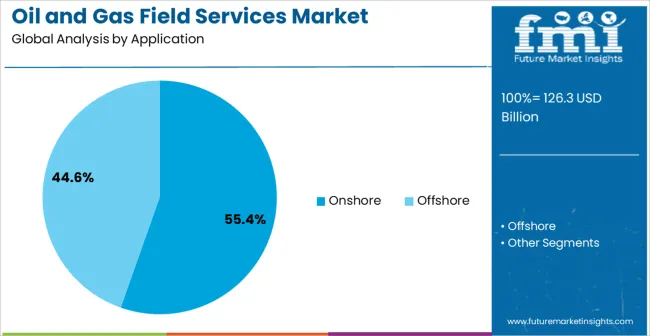

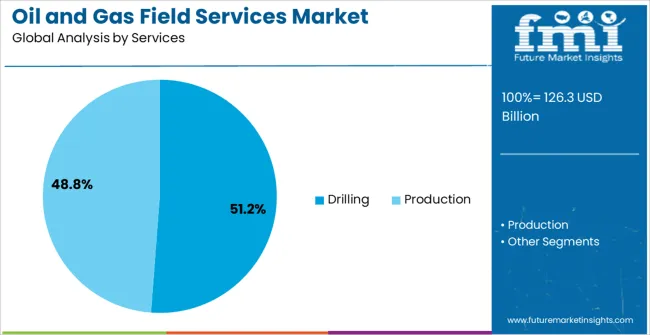

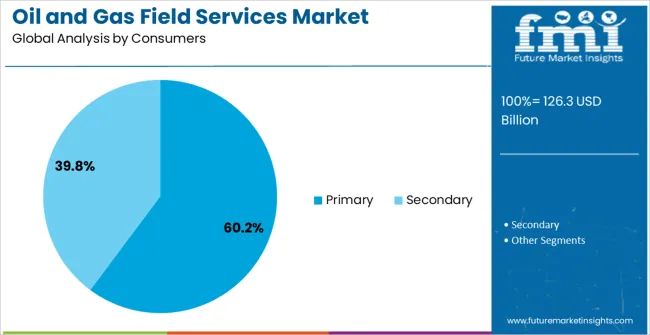

The oil and gas field services market is segmented by application, services, consumers, and geographic regions. By application, oil and gas field services market is divided into Onshore and Offshore. In terms of services, oil and gas field services market is classified into Drilling and Production. Based on consumers, oil and gas field services market is segmented into Primary and Secondary. Regionally, the oil and gas field services industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The onshore application segment is projected to hold 55.4% of the market revenue in 2025, establishing it as the leading application category. Growth in this segment is being driven by the increasing number of onshore exploration and production projects, which require comprehensive field services to ensure operational efficiency and safety. Onshore operations benefit from the accessibility of resources and lower logistical challenges compared with offshore sites, enabling the deployment of advanced drilling and maintenance solutions.

High demand for cost-effective and scalable field services, including well construction, maintenance, and monitoring, further supports adoption. Environmental regulations and safety standards necessitate the use of specialized services to minimize risks and optimize performance.

Integration of digital technologies, real-time monitoring, and predictive maintenance is enhancing operational control, reducing downtime, and improving decision-making As global energy demand continues to rise and onshore resource development expands, this segment is expected to maintain its leading market share, driven by technological innovation and operational reliability.

The drilling services segment is anticipated to account for 51.2% of the market revenue in 2025, making it the leading service category. Growth is being driven by the critical role drilling services play in exploration and production, enabling access to hydrocarbon reserves efficiently and safely. Advanced drilling technologies, including directional drilling, automated rigs, and real-time monitoring systems, are enhancing operational precision, reducing risks, and optimizing production outcomes.

Service providers are increasingly focusing on integrated drilling solutions that combine engineering expertise, equipment reliability, and digital monitoring to improve project efficiency. The need to minimize operational costs while meeting environmental and safety regulations has further strengthened adoption.

Rising investments in upstream projects, combined with the increasing complexity of reservoirs and unconventional resources, are further driving demand for drilling services As energy companies continue to expand exploration and production capabilities, drilling services are expected to remain the dominant service segment, supported by innovation, efficiency improvements, and enhanced operational safety.

The primary consumers segment is projected to hold 60.2% of the market revenue in 2025, establishing it as the largest consumer category. Growth in this segment is being driven by the extensive operations of upstream companies, which require comprehensive field services to support exploration, production, and well maintenance. Primary consumers rely on field services to enhance operational efficiency, reduce downtime, and ensure regulatory compliance in their exploration and production activities.

Integration of digital technologies, including predictive analytics, remote monitoring, and automated reporting, is further enhancing the value delivered by service providers. High demand for cost-effective, scalable, and reliable services supports the adoption of advanced field solutions.

Investments in upstream infrastructure, unconventional resource development, and energy efficiency initiatives are creating additional opportunities for primary consumers As energy demand grows globally and production requirements become more complex, primary consumers are expected to continue driving the Oil and Gas Field Services market, reinforcing the importance of innovative, efficient, and technology-enabled solutions.

Oil and Gas field service companies offers services to various oil & gas explorations companies helping in various oil-related activities, such as extraction, drilling, exploration, completion, stimulation, intervention production and transportation among others, for fulfilling different purposes over the entire oil well exploration life cycle.

The primary consumers comprises of oil and gas production and exploration companies which require drilling equipment and services whereas the secondary consumers are the companies which convert oil and gas into other forms of energy. Examples of secondary consumers include oil processing power plants, refineries, etc.

Efforts are being made to discover new oil and gas fields to cater to the escalating demand of energy and petroleum products, especially from end-user sectors, such as, power plants, transportation and other industries. Besides the fact that crude oil production is increasing with every passing day, this is expected to be the primary driver for this market over the forecast period.

Liberation of Mexican oil and gas industry as well as the combined shale gas revolution in the USA and China is anticipated to fuel the oil and gas field services market globa

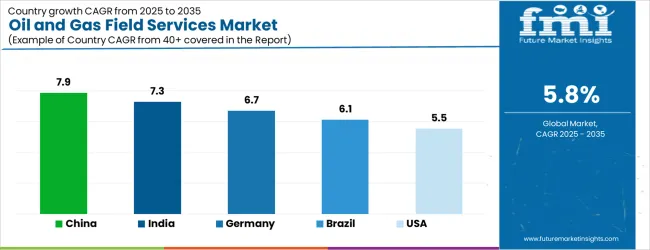

| Country | CAGR |

|---|---|

| China | 7.9% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 5.0% |

| Japan | 4.4% |

The Oil and Gas Field Services Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.9%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Oil and Gas Field Services Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Oil and Gas Field Services Market is estimated to be valued at USD 46.5 billion in 2025 and is anticipated to reach a valuation of USD 46.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 6.7 billion and USD 4.1 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 126.3 Billion |

| Application | Onshore and Offshore |

| Services | Drilling and Production |

| Consumers | Primary and Secondary |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger Limited, Weatherford International PLC, Baker Hughes Company, Halliburton Company, Transocean Ltd, Valaris PLC, China Oilfield Services Limited, Nabors Industries Inc., Basic Energy Services Inc., OiLSERV, and Expro Group |

The global oil and gas field services market is estimated to be valued at USD 126.3 billion in 2025.

The market size for the oil and gas field services market is projected to reach USD 222.6 billion by 2035.

The oil and gas field services market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in oil and gas field services market are onshore and offshore.

In terms of services, drilling segment to command 51.2% share in the oil and gas field services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil And Gas Security And Services Market

Upstream Oil & Gas Services Market Growth – Trends & Forecast 2022-2032

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Oilfield Roller Chain Market

Oil Field Drill Bits Market Growth - Trends & Forecast 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Soil Field Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA