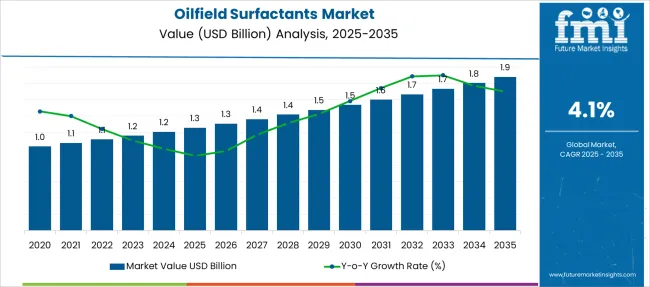

The Oilfield Surfactants Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Oilfield Surfactants Market Estimated Value in (2025 E) | USD 1.3 billion |

| Oilfield Surfactants Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The oilfield surfactants market is undergoing measured growth, supported by increasing demand for improved oil recovery techniques and the rising complexity of reservoir conditions. Advancements in chemical formulations tailored to harsh environments and high-salinity reservoirs are contributing to the expanding use of surfactants in upstream operations.

Regulatory scrutiny over environmental impact and operational efficiency is prompting operators to adopt more effective and sustainable surfactant solutions. Emerging oilfields in unconventional and offshore regions are creating opportunities for product innovation and localization.

Future growth is anticipated to stem from the development of biodegradable and high-performance surfactants, alongside greater investment in secondary and tertiary recovery methods aimed at maximizing extraction rates and extending field life. Evolving technical requirements and economic incentives for enhanced recovery are shaping the trajectory of this market.

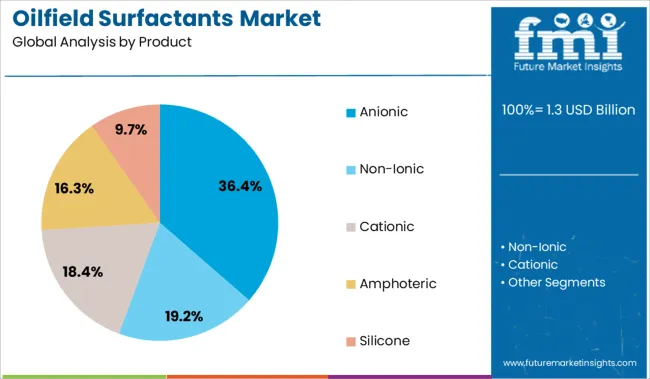

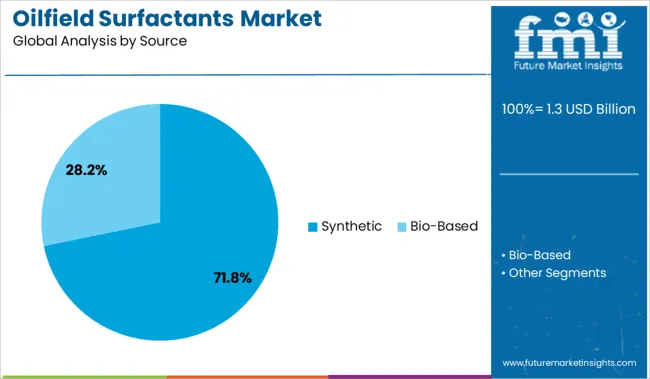

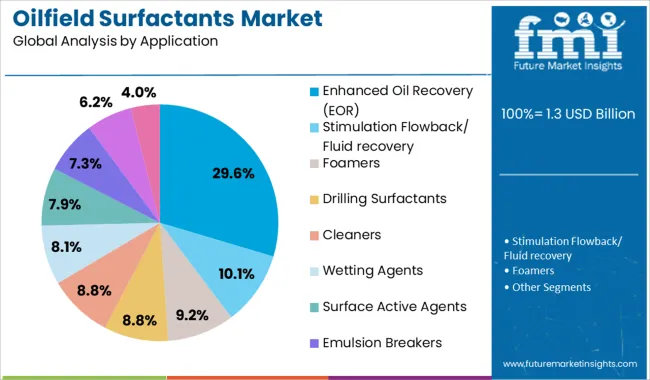

The market is segmented by Product, Source, and Application and region. By Product, the market is divided into Anionic, Non-Ionic, Cationic, Amphoteric, and Silicone. In terms of Source, the market is classified into Synthetic and Bio-Based. Based on Application, the market is segmented into Enhanced Oil Recovery (EOR), Stimulation Flowback/ Fluid recovery, Foamers, Drilling Surfactants, Cleaners, Wetting Agents, Surface Active Agents, Emulsion Breakers, Non-emulsifiers, and Spacers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the anionic category is expected to account for 36.4% of total market revenue in 2025, establishing itself as the leading product segment. This leadership is supported by the favorable interaction of anionic surfactants with a wide range of reservoir rock and fluid conditions, enhancing wettability alteration and reducing interfacial tension effectively.

Their relatively lower cost compared to other chemistries and compatibility with different salinity levels have made them preferred choices in diverse oilfield scenarios. Their proven efficacy in both sandstone and carbonate reservoirs, along with established supply chains and formulation flexibility, have reinforced their prominence.

The ability to deliver predictable performance under various operational constraints has positioned anionic surfactants as a reliable solution, maintaining their strong adoption in the field.

Segmented by source, the synthetic segment is projected to hold 71.8% of the total market revenue in 2025, maintaining its dominant share. This dominance has been reinforced by the consistent quality, scalability, and performance characteristics of synthetic surfactants that meet the stringent demands of oilfield operations.

Their ability to withstand extreme temperatures, pressures, and salinity levels has made them indispensable for enhanced recovery in challenging reservoirs. Manufacturing advancements have enabled cost-efficient production at industrial scale while ensuring tight control over chemical properties and environmental compliance.

The extensive portfolio of synthetic formulations tailored for specific applications has allowed operators to optimize performance while adhering to operational budgets and field-specific constraints. This combination of reliability, versatility, and economic feasibility has cemented the leading position of synthetic surfactants in the market.

When segmented by application, enhanced oil recovery is forecast to account for 29.6% of total market revenue in 2025, marking it as the leading application segment. This prominence is underpinned by the critical role of surfactants in improving sweep efficiency, mobilizing trapped hydrocarbons, and extending the productive life of mature reservoirs.

As recovery rates from conventional methods decline, operators are increasingly turning to chemical EOR techniques where surfactants are integral. The capability of surfactants to modify wettability, reduce capillary forces, and lower interfacial tension has enhanced recovery performance, particularly in challenging reservoirs.

Field operators have prioritized investments in EOR to maximize asset value and reduce per-barrel costs, which has reinforced demand. The continued focus on optimizing oil output from existing fields has positioned EOR as a vital application area sustaining the growth of the surfactants market.

Drilling and enhanced oil recovery demands are fueling oilfield surfactant adoption. Expansion is supported by engineered formulations, environmental compliance, and partnerships targeting unconventional hydrocarbon fields.

The oilfield surfactants market is growing rapidly as operators seek improved recovery rates in unconventional and mature fields. Surfactants play a vital role in enabling foam-flooding, alkali-surfactant-polymer injection, and steam-assisted recovery processes by reducing interfacial tension and improving fluid mobility.

As easily accessible reserves decline, enhanced oil recovery techniques driven by tailored surfactant chemistry unlock trapped hydrocarbons and extend field life.

Tech companies and producers collaborate to create specific chemistries that withstand harsh reservoir conditions-like high temperature, salinity, and reservoir heterogeneity-to optimize displacement efficiency. This push, especially prevalent in the Middle East, North America shales, and deepwater plays, is driving demand for high-performance oilfield surfactant solutions.

Market expansion is emerging through development of biodegradable, non-toxic surfactants that meet stricter environmental regulations in offshore and sensitive-land operations. Customized formulations tailored to field-specific reservoir conditions created via modular blending at local service facilities reduce logistics cost and improve responsiveness.

Pilot testing programs with operators drive adoption by demonstrating improved hydrocarbon recovery and reduced chemical usage. There are opportunities to integrate surfactant services with workflow platforms offered by drilling and completion service firms, presenting packaged EOR-ready solutions.

Entering new onshore and offshore markets in regions with emerging unconventional play development offers significant upside. Strategic alliances with national oil companies and local chemical blending partners can accelerate market entry and adoption.

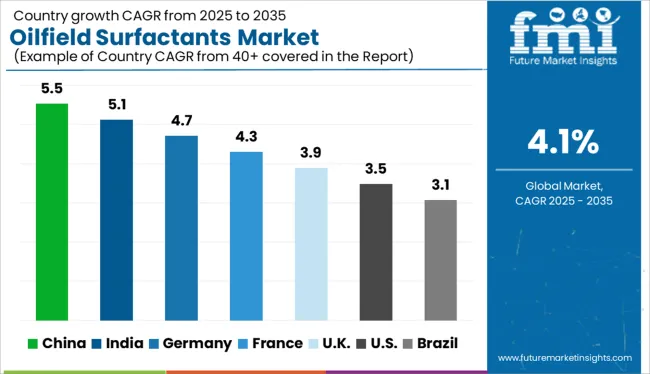

| Countries | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global oilfield surfactants market is expected to grow at a CAGR of 4.1% from 2025 to 2035, driven by increasing EOR (Enhanced Oil Recovery) activities, chemical performance optimization, and shifting drilling technologies. Among BRICS countries, China leads with a 5.5% CAGR due to aggressive upstream expansion, shale development, and investment in chemical flooding. India follows at 5.1%, driven by aging wells, cost-effective surfactant solutions, and domestic oilfield service growth.

Germany, representing the OECD group, shows 4.7% CAGR as the country balances fossil extraction with advanced recovery methods to support energy resilience. In contrast, the United Kingdom (3.9%) and the United States (3.5%) exhibit slower growth, reflecting regulatory constraints, mature reserves, and gradual decarbonization of oilfield operations. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

Expanding upstream activity and shifting reservoir conditions are fueling the oilfield surfactants market in China, projected to grow at a 5.5% CAGR through 2035. Chemical EOR (enhanced oil recovery) technologies are being scaled up in mature wells, necessitating custom surfactant formulations.

Domestic manufacturers are increasing production capacity for anionic and amphoteric surfactants that enhance mobility and reduce interfacial tension. Demand is also influenced by deepwater and shale exploration projects requiring specialized surfactant blends compatible with harsh brine and high-temperature conditions. Multinational oilfield service providers are forging joint ventures with local chemical firms to tailor product supply.

India is experiencing growing demand for oilfield surfactants, with the market expected to expand at a 5.1% CAGR between 2025 and 2035. Domestic E&P companies are increasingly deploying surfactant-polymer flooding in tertiary recovery operations. The reliance on synthetic surfactants is gradually giving way to eco-friendly, biodegradable alternatives, especially in ONGC and OIL projects.

Regulatory bodies are emphasizing environmental compliance, which is pushing manufacturers to shift toward green chemistry principles. Demand is rising fastest in Western India, where aging oilfields require improved sweep efficiency. The shift toward indigenous sourcing is helping reduce project costs and streamline logistics.

Oilfield surfactants market in Germany,is on a moderate growth trajectory with a 4.7% CAGR expected through 2035. Although overall upstream activity is limited compared to global peers, the country maintains niche demand for high-purity surfactants in geothermal and brownfield redevelopment projects.

Regulatory emphasis on groundwater safety and chemical traceability is shaping demand for environment-safe, non-toxic formulations. Customized blends for controlled foaming and improved emulsion stability are increasingly in use. Domestic chemical firms are focusing on performance optimization at low concentrations, aligning with EU green production mandates.

The oilfield surfactants market in the United Kingdom is expanding at a 3.9% CAGR, largely supported by activities in the North Sea and brownfield reactivation. Demand is being influenced by the UK’s push toward environmentally responsible EOR techniques, including biosurfactants and low-impact polymers.

Cost-conscious operators are shifting from imported to locally produced formulations that align with both REACH and UK HSE compliance standards. There is rising demand for surfactants that reduce formation damage and are compatible with carbon storage pilot sites. Research partnerships between universities and chemical manufacturers are accelerating innovation in green EOR chemistries.

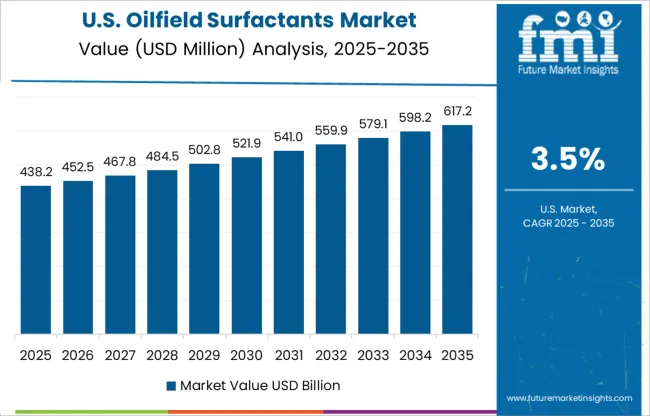

The oilfield surfactants market in the United States is advancing at a 3.5% CAGR, with enhanced oil recovery (EOR) operations in the Permian and Bakken basins fueling demand. Most surfactant usage is linked to chemical flooding and foam-based mobility control, which help maximize output in declining wells.

The trend toward multifunctional surfactants those that combine wettability alteration, emulsification, and corrosion control is strengthening. Stringent water discharge standards from the EPA are influencing surfactant formulation design, with increased preference for biodegradable options. Growth is further supported by the deployment of smart chemical dosing systems in onshore fields.

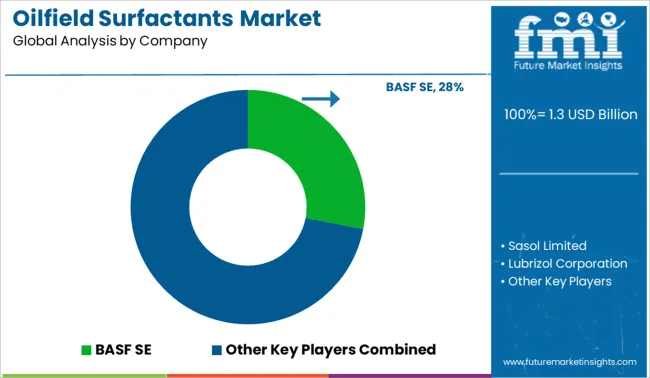

The oilfield surfactants market is moderately consolidated, with BASF SE holding a dominant 28.0% share due to its expansive product portfolio, global supply network, and technological innovation in enhanced oil recovery (EOR) and drilling fluid applications. BASF leverages advanced chemistry to improve emulsification, wettability, and flow assurance under extreme reservoir conditions.

Other Tier 1 players such as Sasol Limited, Lubrizol Corporation, and Evonik Industries focus on specialty surfactants tailored for shale, offshore, and unconventional oil fields. Tier 2 companies like Clariant, Croda, and Solvay compete through sustainable formulations and regional partnerships. Market demand is fueled by the shift toward more efficient E&P operations, cost optimization, and environmentally friendly chemical solutions.

On May 29, 2024, Evonik opened the world’s first industrial-scale rhamnolipid biosurfactant plant in Slovenská Ľupča, Slovakia. The facility produces biodegradable, renewable surfactants via fermentation, targeting oilfield and industrial applications, offering a sustainable alternative to conventional fossil-based surfactants.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product | Anionic, Non-Ionic, Cationic, Amphoteric, and Silicone |

| Source | Synthetic and Bio-Based |

| Application | Enhanced Oil Recovery (EOR), Stimulation Flowback/ Fluid recovery, Foamers, Drilling Surfactants, Cleaners, Wetting Agents, Surface Active Agents, Emulsion Breakers, Non emulsifiers, and Spacers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Sasol Limited, Lubrizol Corporation, Oxiteno USA LLC, Evonik Industries AG, Kao Corporation, Croda International PLC, Clariant AG, Solvay, and 3M Company |

| Additional Attributes | Dollar sales by surfactant type, formulation, and application stage; regional demand driven by shale activity, enhanced oil recovery, and offshore exploration; innovation in biodegradable and high-temperature-resistant surfactants; cost dynamics shaped by raw material volatility and production scalability; environmental impact related to chemical discharge and regulatory compliance; and emerging use cases in green chemistry, drilling fluid optimization, and water flooding operations. |

The global oilfield surfactants market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the oilfield surfactants market is projected to reach USD 1.9 billion by 2035.

The oilfield surfactants market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in oilfield surfactants market are anionic, non-ionic, cationic, amphoteric and silicone.

In terms of source, synthetic segment to command 71.8% share in the oilfield surfactants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Oilfield Roller Chain Market

Rig and Oilfield Mat Market Size and Share Forecast Outlook 2025 to 2035

Digital Oilfield Solutions Market Growth - Trends & Forecast 2025 to 2035

Digital Oilfield Market Growth – Trends & Forecast 2024-2034

Operational Digital Oilfield Solution Market Size and Share Forecast Outlook 2025 to 2035

Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Bio-surfactants Market

Competitive Overview of Fluorosurfactants Companies

Anionic Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Silicone Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pharmaceutical Surfactants Market

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA