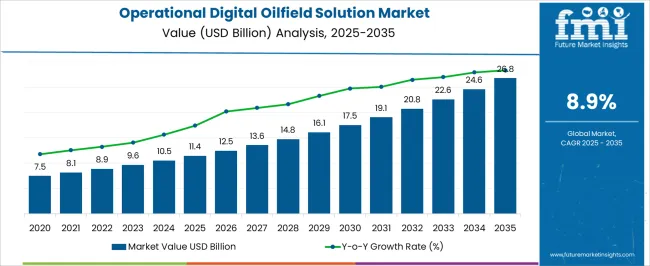

The Operational Digital Oilfield Solution Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 26.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Operational Digital Oilfield Solution Market Estimated Value in (2025 E) | USD 11.4 billion |

| Operational Digital Oilfield Solution Market Forecast Value in (2035 F) | USD 26.8 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The operational digital oilfield solution market is experiencing steady growth, supported by the rising need for enhanced productivity, operational efficiency, and cost optimization across the oil and gas sector. Increasing reliance on digital technologies to streamline exploration, drilling, production, and asset management processes is reinforcing adoption. The integration of advanced analytics, automation, and real-time monitoring systems is enabling operators to make faster and more informed decisions, thereby improving reservoir recovery rates and reducing downtime.

Growing industry focus on safety compliance, environmental sustainability, and effective utilization of resources is further accelerating digital adoption. The ability of these solutions to optimize workflows, predict equipment failures, and extend asset lifecycles is proving highly valuable in a volatile oil price environment.

Investments in cloud-based platforms, IoT-enabled devices, and AI-driven analytics are expanding the scope of operational digital oilfield solutions As global energy demand continues to rise and companies face increasing pressure to balance cost efficiency with sustainability goals, the market is projected to grow significantly with strong opportunities for innovation and long-term deployment.

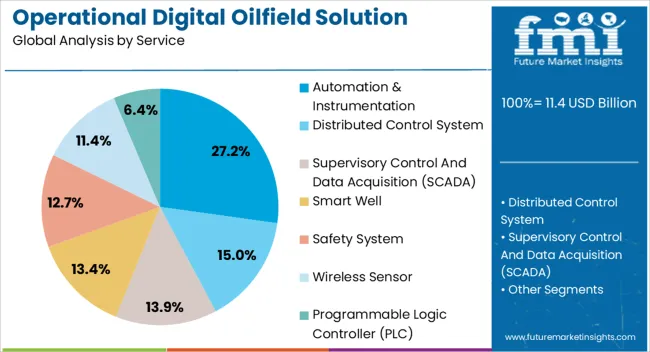

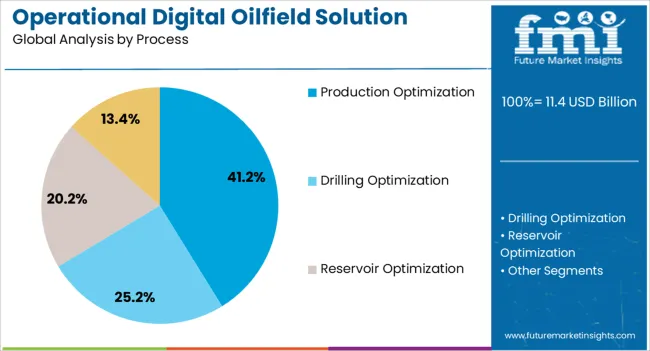

The operational digital oilfield solution market is segmented by service, process, and geographic regions. By service, operational digital oilfield solution market is divided into Automation & Instrumentation, Distributed Control System, Supervisory Control And Data Acquisition (SCADA), Smart Well, Safety System, Wireless Sensor, and Programmable Logic Controller (PLC). In terms of process, operational digital oilfield solution market is classified into Production Optimization, Drilling Optimization, Reservoir Optimization, and Others (Asset management, Safety Management, Maintenance & repair). Regionally, the operational digital oilfield solution industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automation and instrumentation service segment is projected to account for 27.2% of the operational digital oilfield solution market revenue share in 2025, making it the leading service category. This leadership is being driven by the critical role automation and precision instruments play in optimizing oilfield processes and enhancing production efficiency.

The deployment of automated control systems, advanced sensors, and measurement technologies is enabling real-time monitoring and regulation of critical oilfield parameters, reducing human error and minimizing operational risks. The ability to collect accurate field data and integrate it into centralized digital platforms supports predictive analytics, condition-based maintenance, and performance optimization across assets.

Growing demand for scalable solutions that reduce downtime, improve safety standards, and enhance cost management is reinforcing the segment’s expansion As oil and gas operators increasingly adopt smart field technologies to address operational challenges and regulatory requirements, automation and instrumentation services are expected to remain a key enabler of digital transformation in the industry.

The production optimization process segment is anticipated to represent 41.2% of the operational digital oilfield solution market revenue share in 2025, making it the dominant process category. This dominance is being supported by the growing focus on maximizing hydrocarbon recovery and improving efficiency of field operations through digital integration. Advanced software platforms, machine learning algorithms, and real-time data analytics are being applied to monitor reservoir performance, detect anomalies, and adjust production strategies dynamically.

The use of production optimization solutions is enabling operators to identify bottlenecks, reduce non-productive time, and extend the economic life of oilfields. Regulatory emphasis on minimizing carbon emissions and optimizing energy usage is further driving adoption of intelligent optimization processes.

The ability to balance production output with environmental compliance and cost efficiency is creating strong demand in both upstream and midstream operations As global operators continue to modernize legacy systems and embrace digital innovation, production optimization is expected to sustain its leadership and play a pivotal role in shaping the future of oilfield operations.

Operational digital oilfield solution is a combination of business process management and advance information technology, with the initiative to maximize oilfield recovery.

The new digital oilfield concept will eliminate non-productive time and increase productivity by deploying integrated workflows. Operational digital oilfield market includes “Intelligent Wells” which have fiber-optic sensors buried in the drilling apparatus that are being controlled manually by the operators on site or sometimes controlled automatically through closed loop information systems.

These fiber- optic sensors transmit a constant stream of data about the oil wells and its environment. The digital oilfields also have “advance alarming” system which predict the performance levels and provide an early indication in case of potential equipment failure.

Operational digital oilfield solution concept has brought a revolutionary change in the oilfield market and is projected to grow at an increasing pace in coming years.

Some of the major benefits of this concept include operational efficiency, production optimization, collaboration, decision support, data integration and workflow automation.

The operational digital oilfield solution market caters to various stakeholders such as oilfield operators, exploration companies, government & research organizations, energy associations, private equity investors, and environment research institutes.

Demand for operational digital oilfield solutions is increasing due to limited oil or fuel supply to the growing number of vehicles in the market which is forcing the oil industry to adopt new and improved technology.

Apart from this, shortage of skilled labor in the oil industry has been a major problem faced by the industry over the last few years. Introduction of digital oilfield solution will help oil industry to eliminate such problems.

Rapid urbanization and growing dependency on digital medium is also one of the major factors which is driving the growth of digital oil field market.

The key issue in implementing the digital oil field technology at field level of the organization is the restriction issues of the operating personnel.

It is an entirely novel method of operation in oilfields and requires proper education and training to the employees for updating them on time to time basis.

Geographically, digital oilfield solutionmarket can be divided in major regions which include North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japanand the Middle East and Africa (MEA).

MEA with its low oil production cost as compared with current prevailing oil prices of other regions is anticipated to dominate the global operational digital oilfield solutions market in terms of value during the forecast period.

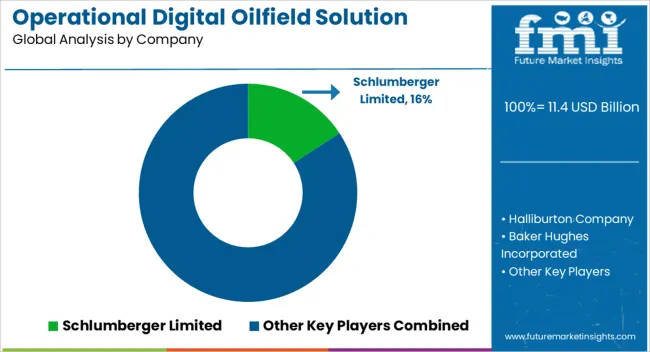

The key players in global digital oilfield solution market are:

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

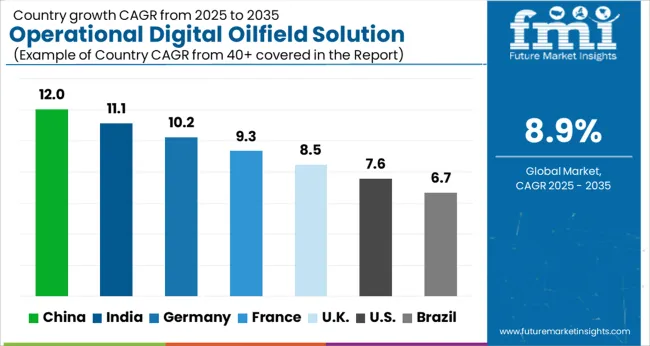

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The Operational Digital Oilfield Solution Market is expected to register a CAGR of 8.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.0%, followed by India at 11.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.7%, yet still underscores a broadly positive trajectory for the global Operational Digital Oilfield Solution Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.2%. The USA Operational Digital Oilfield Solution Market is estimated to be valued at USD 4.3 billion in 2025 and is anticipated to reach a valuation of USD 9.0 billion by 2035. Sales are projected to rise at a CAGR of 7.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 540.3 million and USD 330.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.4 Billion |

| Service | Automation & Instrumentation, Distributed Control System, Supervisory Control And Data Acquisition (SCADA), Smart Well, Safety System, Wireless Sensor, and Programmable Logic Controller (PLC) |

| Process | Production Optimization, Drilling Optimization, Reservoir Optimization, and Others (Asset management, Safety Management, Maintenance & repair) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger Limited, Halliburton Company, Baker Hughes Incorporated, National Oil well Varco, Inc., Weatherford International PLC, Paradigm Limited, HIS Inc., Point cross Inc., Katalyst Data Management, Rockwell automation, Siemens AG, and Pason system, Inc. |

The global operational digital oilfield solution market is estimated to be valued at USD 11.4 billion in 2025.

The market size for the operational digital oilfield solution market is projected to reach USD 26.8 billion by 2035.

The operational digital oilfield solution market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in operational digital oilfield solution market are automation & instrumentation, distributed control system, supervisory control and data acquisition (scada), smart well, safety system, wireless sensor and programmable logic controller (plc).

In terms of process, production optimization segment to command 41.2% share in the operational digital oilfield solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Oilfield Solutions Market Growth - Trends & Forecast 2025 to 2035

Digital Oilfield Market Growth – Trends & Forecast 2024-2034

Women Digital Health Solutions Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Operational Intelligence Solutions Market Size and Share Forecast Outlook 2025 to 2035

Financial Services Operational Risk Management Solution Market

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Group Dining Service Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA