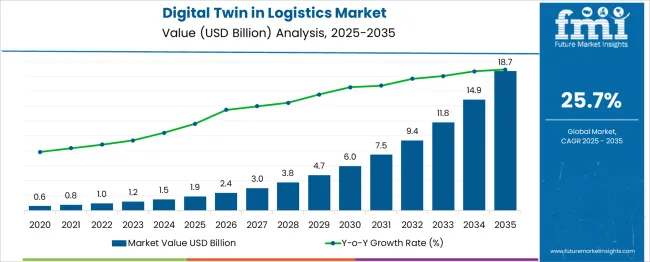

The digital twin in logistics market is projected to grow from USD 1.9 billion in 2025 to USD 18.7 billion by 2035, creating an absolute gain of USD 16.8 billion and a growth multiplier of 9.84x over the decade. This growth, supported by an impressive CAGR of 25.7%, is driven by the increasing adoption of digital twins for supply chain optimization, predictive analytics, and real-time monitoring in logistics operations. In the first five years (2025–2030), the market will rise from USD 1.9 billion to USD 6.0 billion, adding USD 4.1 billion, which accounts for 24.4% of total incremental growth, with a 5-year multiplier of 3.16x.

The second phase (2030–2035) contributes USD 12.7 billion, representing 75.6% of incremental growth, signaling strong demand as digital twin technologies become integral to smart logistics, autonomous transportation, and warehouse management systems. Annual increments increase from USD 0.9 billion in early years to USD 2.9 billion by 2035, reflecting rapid technological integration and expanding application in real-time fleet tracking, dynamic route optimization, and warehouse automation. Manufacturers focusing on high-resolution simulations, advanced IoT integration, and predictive models will capture the largest share of this USD 16.8 billion opportunity.

| Metric | Value |

|---|---|

| Digital Twin In Logistics Market Estimated Value in (2025 E) | USD 1.9 billion |

| Digital Twin In Logistics Market Forecast Value in (2035 F) | USD 18.7 billion |

| Forecast CAGR (2025 to 2035) | 25.7% |

The Digital Twin in Logistics market is experiencing strong momentum as enterprises increasingly adopt advanced simulation and real-time analytics to optimize operations. Growth is being shaped by rising demand for predictive insights, operational efficiency, and cost reduction across logistics networks, as highlighted in corporate announcements and investor briefings.

The current scenario reflects how supply chain disruptions, labor constraints, and rising customer expectations have driven companies to deploy digital twin technologies for better visibility and resilience. Press releases from leading technology firms indicate that the integration of AI, IoT, and cloud platforms into digital twins is enabling more granular monitoring and decision-making.

Future growth prospects are being reinforced by ongoing investments in smart warehouses, autonomous logistics solutions, and sustainable operations, as discussed in annual reports and industry news. This evolving landscape is expected to create lasting opportunities for vendors and end-users, ensuring that digital twin solutions become a cornerstone of logistics modernization initiatives globally.

The digital twin in logistics market is segmented by component, deployment model, application end user, and geographic regions. By component of the digital twin in logistics market is divided into Software Services. In terms of deployment model of the digital twin in logistics market is classified into Cloud-based On-premises. Based on application of the digital twin in logistics market is segmented into Warehouse and inventory management, Route optimization, Predictive maintenance, Asset tracking Others. By end user of the digital twin in logistics market is segmented into Manufacturing, Automotive, Aerospace & defense, Retail & E-commerce, Energy & utilities Others. Regionally, the digital twin in logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

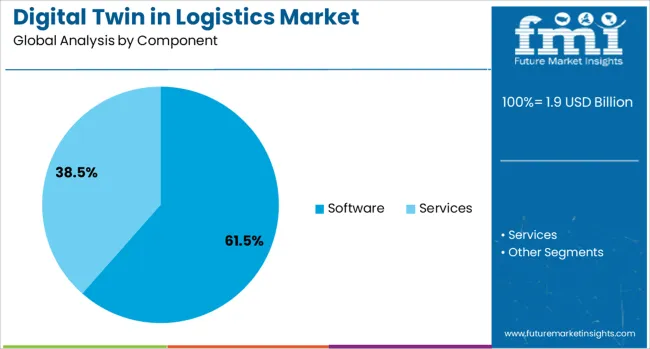

The software component is expected to account for 61.5% of the Digital Twin in Logistics market revenue share in 2025, making it the leading component segment. This prominence is being driven by the rising need for advanced modeling, simulation, and analytics capabilities that enable real-time decision-making, as reported in product announcements and technology updates.

Software platforms have been increasingly preferred for their scalability and ability to integrate with existing logistics infrastructure while offering high customization. Investor presentations have indicated that demand is being strengthened by the flexibility to deploy on various hardware environments and the ability to adapt quickly to changing operational conditions.

Additionally, cloud-enabled software offerings have improved accessibility and affordability for small and medium enterprises, further boosting adoption. These factors have positioned software as the most critical element in enabling the functionalities of digital twin ecosystems, reinforcing its leadership in the component segment.

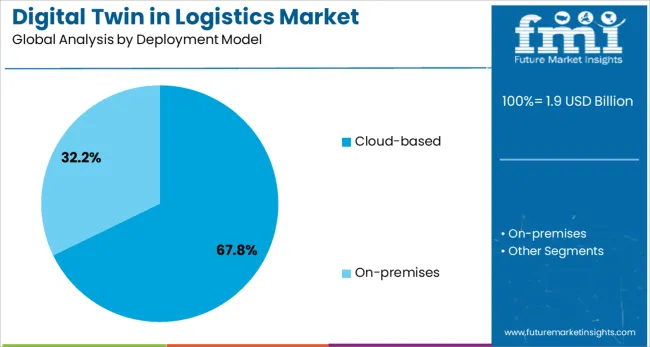

The cloud-based deployment model is projected to hold 67.8% of the Digital Twin in Logistics market revenue share in 2025, establishing it as the dominant deployment model. This leadership is being shaped by the increasing adoption of cloud technologies that offer scalability, flexibility, and cost-efficiency, as emphasized in technology vendor briefings and industry articles.

Cloud-based solutions have been preferred by enterprises seeking rapid deployment without significant upfront capital investments. Corporate communications have highlighted that cloud deployments facilitate seamless updates, global accessibility, and easy integration with other digital platforms, which align with the dynamic needs of logistics operations.

Furthermore, ongoing innovations in data security and compliance have enhanced trust in cloud solutions among businesses operating in regulated environments. These advantages have collectively strengthened the preference for cloud-based deployment, ensuring its leading position within the digital twin landscape in logistics.

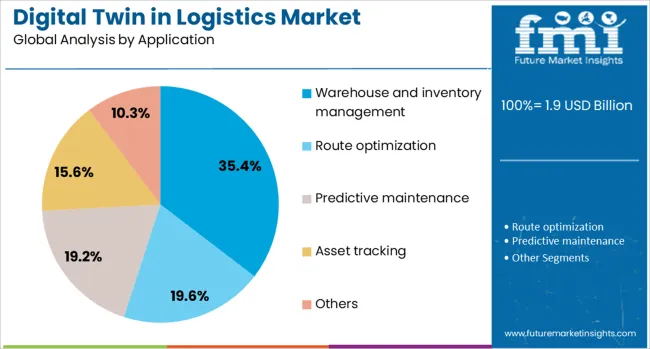

The warehouse and inventory management application is anticipated to contribute 35.4% of the Digital Twin in Logistics market revenue share in 2025, maintaining its status as the top application segment. This position is being reinforced by the growing complexity of managing warehouse operations and inventory flows in the face of fluctuating demand and supply chain uncertainties, as noted in logistics industry publications and corporate strategy updates.

Digital twin technologies have been widely deployed to optimize space utilization, streamline workflows, and predict inventory requirements, reducing inefficiencies and costs. Annual reports have highlighted that real-time visualization and predictive analytics provided by digital twins are increasingly seen as essential tools for warehouse managers to enhance operational resilience.

Moreover, the ability to simulate scenarios and plan for contingencies has further driven adoption in this application area. These factors have established warehouse and inventory management as the most impactful use case of digital twin technology in the logistics sector.

The digital twin in logistics market is experiencing significant growth, driven by the demand for real-time tracking and improved supply chain management. Major growth drivers include the need for enhanced operational efficiency and predictive maintenance. Opportunities exist in the expansion of smart warehouses and real-time data analytics integration. Emerging trends highlight the increasing adoption of AI and IoT to enhance digital twin capabilities. However, market restraints such as high implementation costs and data security concerns continue to limit widespread adoption.

The major growth driver in the digital twin in logistics market is the increasing demand for real-time tracking and monitoring in supply chains. In 2024, logistics companies sought digital twin solutions to track goods more efficiently, reducing delays and improving inventory management. The use of digital twins for predictive maintenance also gained traction, improving equipment reliability and reducing downtime. This demand is expected to rise further as companies focus on operational efficiency and customer satisfaction.

Opportunities in the digital twin in logistics market are emerging through the expansion of smart warehouses. By 2025, companies began leveraging digital twin technology to improve warehouse operations, utilizing real-time data to optimize inventory management and streamline processes. The integration of AI and IoT technologies within these smart warehouses offers opportunities to enhance operational efficiency and reduce operational costs. This trend is expected to drive further market growth as companies invest in digital twin solutions to stay competitive.

Emerging trends in the digital twin in logistics market focus on the increasing adoption of AI and IoT technologies. In 2024, logistics companies incorporated AI-powered predictive analytics and IoT sensors to enhance digital twin capabilities. This integration improved forecasting accuracy and enabled more efficient route planning, reducing costs and increasing customer satisfaction. As these technologies evolve, they are expected to drive further innovation, making digital twin systems more efficient and accessible for businesses of all sizes.

The major market restraints in the digital twin in logistics market are high implementation costs and data security concerns. In 2025, small to medium-sized enterprises (SMEs) faced challenges in adopting digital twin technology due to the significant upfront investment required for system deployment and integration. Additionally, the reliance on real-time data created concerns around cybersecurity, as logistics companies needed to safeguard sensitive information. These factors are limiting the widespread adoption of digital twin solutions, particularly in regions with less advanced infrastructure.

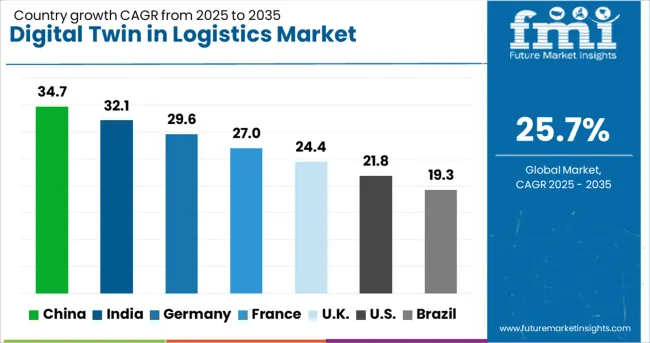

| Country | CAGR |

|---|---|

| China | 34.7% |

| India | 32.1% |

| Germany | 29.6% |

| France | 27.0% |

| UK | 24.4% |

| USA | 21.8% |

| Brazil | 19.3% |

The global digital twin in logistics market is projected to grow at a remarkable CAGR of 25.7% from 2025 to 2035. China leads with an exceptional growth rate of 34.7%, followed by India at 32.1%, and Germany at 29.6%. The United Kingdom records a growth rate of 24.4%, while the United States exhibits the slowest growth among the profiled markets at 21.8%. These differences in growth rates are driven by regional advancements in logistics infrastructure, digitalization initiatives, and the adoption of smart technologies. Emerging markets like China and India are experiencing rapid adoption due to the increasing demand for digitalization in supply chains, while more mature markets like the USA and the UK show more steady growth due to established logistics systems.

The digital twin in logistics market in China is growing at a phenomenal rate of 34.7% CAGR. The country’s massive investments in logistics infrastructure, combined with rapid industrialization and urbanization, are driving this impressive growth. China’s focus on integrating digital technologies into its supply chains is leading to widespread adoption of digital twin solutions in logistics, offering enhanced visibility, predictive analytics, and real-time tracking. With government backing and increased demand for smarter logistics and transportation systems, China is set to remain the dominant market for digital twin applications in logistics for the foreseeable future.

The digital twin in logistics market in India is projected to grow at a CAGR of 32.1%. India’s rapid economic growth, along with a shift toward digital logistics solutions, is driving significant demand for digital twin technologies. As the country modernizes its supply chain and transportation networks, the adoption of digital twins for tracking, optimization, and predictive maintenance is becoming essential. Furthermore, India’s growing focus on e-commerce and last-mile delivery services further drives the need for smarter logistics solutions. With increasing government investments in logistics infrastructure and technology, India is expected to maintain strong growth in the digital twin logistics market.

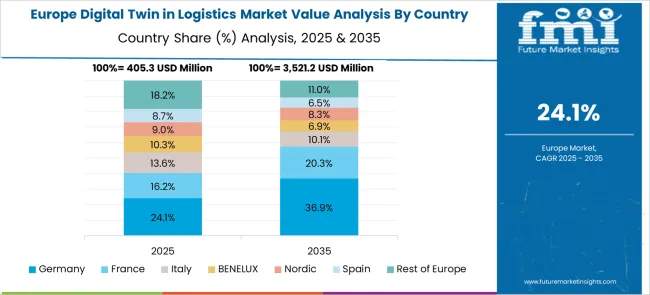

The digital twin in logistics market in Germany is projected to grow at a CAGR of 29.6%. Germany’s strong manufacturing and automotive sectors are key drivers behind the adoption of digital twin technologies in logistics. The country’s focus on Industry 4.0 and smart manufacturing further boosts the demand for digital twin solutions, which are essential for optimizing logistics operations, improving asset management, and enhancing supply chain efficiency. As a European leader in logistics and transportation, Germany is well-positioned to benefit from the growing trend of digitalization in the logistics industry, ensuring continued market growth.

The digital twin in logistics market in the United Kingdom is expected to grow at a CAGR of 24.4%. The UK is actively adopting digital twin technologies to enhance supply chain operations and improve logistics efficiency. The demand for digital twins in sectors such as retail, e-commerce, and transportation is increasing as companies look for ways to optimize their supply chains and reduce costs. The UK government’s focus on smart infrastructure and digitalization in logistics, combined with growing investments in research and development, supports the continued adoption of digital twin technologies.

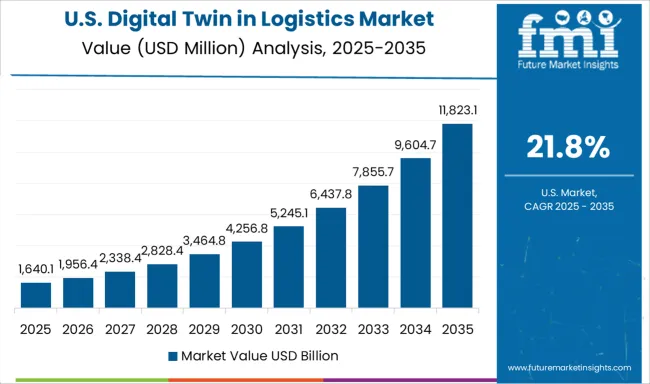

The digital twin in logistics market in the United States is projected to grow at a CAGR of 21.8%. Despite being a mature market, the USA continues to see steady growth in the adoption of digital twin technologies in logistics. The increasing need for real-time data analysis, predictive maintenance, and supply chain optimization is driving demand for digital twins across various sectors. The USA is also witnessing an increased focus on automation and artificial intelligence in logistics, further fueling the need for digital twin applications. While the growth rate is slower compared to emerging markets, the demand for digital twins remains strong.

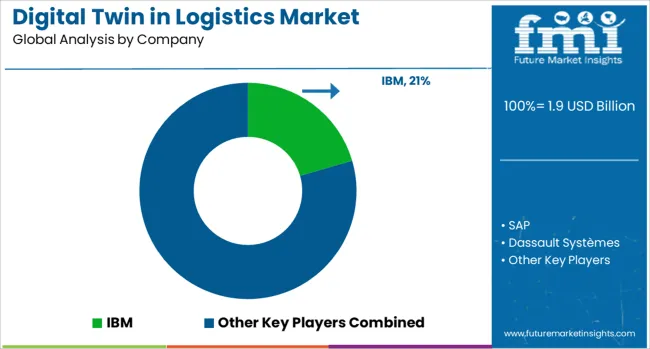

The digital twin in logistics market is dominated by IBM, which leads through its advanced AI-driven solutions that create real-time digital replicas of logistics networks, optimizing operations and supply chain management. IBM’s dominance is reinforced by its extensive expertise in analytics, machine learning, and IoT, enabling businesses to simulate, predict, and enhance logistics processes. Key players such as SAP, Oracle Corporation, and Siemens Digital Industries Software maintain significant market shares by offering integrated digital twin technologies that improve efficiency, reduce costs, and provide visibility into the entire supply chain. These companies focus on delivering end-to-end solutions for inventory management, predictive maintenance, and route optimization to streamline logistics operations.

Emerging players like Dassault Systèmes, Kinaxis, and Blue Yonder are expanding their presence by offering specialized digital twin solutions tailored to the logistics and transportation sectors. Their strategies include providing real-time insights, enhancing supply chain resilience, and developing scalable platforms that integrate seamlessly with existing systems. Market growth is driven by the increasing demand for real-time data-driven decision-making, the rise of smart supply chains, and the need for enhanced visibility and control in logistics operations. Innovations in simulation technologies, AI, and real-time analytics are expected to continue shaping competitive dynamics and driving growth in the digital twin in logistics market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Component | Software and Services |

| Deployment Model | Cloud-based and On-premises |

| Application | Warehouse and inventory management, Route optimization, Predictive maintenance, Asset tracking, and Others |

| End User | Manufacturing, Automotive, Aerospace & defense, Retail & E-commerce, Energy & utilities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, SAP, Dassault Systèmes, Oracle Corporation, Kinaxis, Blue Yonder, and Siemens Digital Industries Software |

| Additional Attributes | Dollar sales by application type and sector, demand dynamics across supply chain, warehouse management, and transportation industries, regional trends in digital twin adoption, innovation in real-time tracking and predictive analytics, impact of regulatory standards on data privacy and security, and emerging use cases in smart logistics and autonomous delivery systems. |

The global digital twin in logistics market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the digital twin in logistics market is projected to reach USD 18.7 billion by 2035.

The digital twin in logistics market is expected to grow at a 25.7% CAGR between 2025 and 2035.

The key product types in digital twin in logistics market are software, services, _managed services and _professional services.

In terms of deployment model, cloud-based segment to command 67.8% share in the digital twin in logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Digital Signature Market Size and Share Forecast Outlook 2025 to 2035

Digital Map Market Size and Share Forecast Outlook 2025 to 2035

Digital Credential Management Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Transaction Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Trust Market Size and Share Forecast Outlook 2025 to 2035

Digital Psychotherapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA