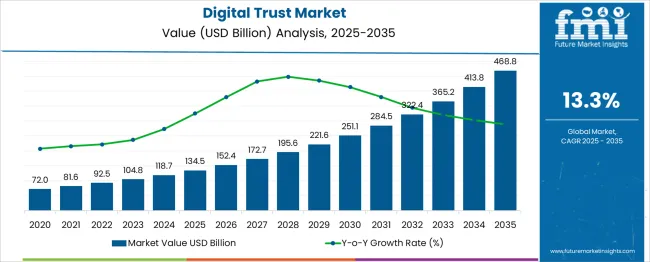

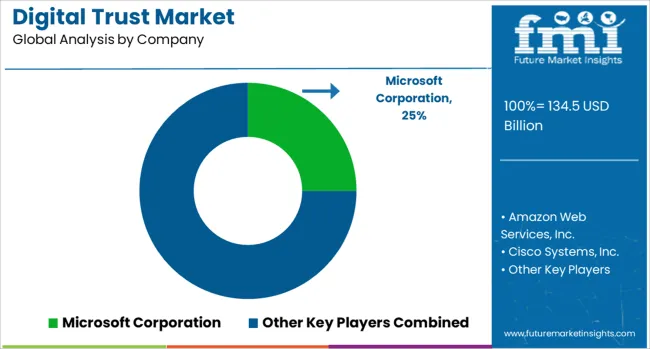

The global digital trust market is expected to grow from USD 134.5 billion in 2025 to approximately USD 468.8 billion by 2035, recording an absolute increase of USD 334.3 billion over the forecast period. This translates into a total growth of 248.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.3% between 2025 and 2035. The overall market size is expected to grow by nearly 3.49X during the same period, supported by increasing cybersecurity threats, rising digital transformation initiatives, and growing regulatory compliance requirements across industries.

Between 2025 and 2030, the digital trust market is projected to expand from USD 134.5 billion to USD 245.7 billion, resulting in a value increase of USD 111.2 billion, which represents 33.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising cyber threats, increasing adoption of cloud computing, and growing demand for privacy-enhancing technologies. Organizations are expanding their digital trust investments to address the growing complexity of cybersecurity challenges and regulatory compliance requirements.

| Metric | Value |

| Estimated Value in (2025E) | USD 134.5 billion |

| Forecast Value in (2035F) | USD 468.8 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

From 2030 to 2035, the market is forecast to grow from USD 245.7 billion to USD 468.8 billion, adding another USD 223.1 billion, which constitutes 66.7% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of artificial intelligence and machine learning technologies, integration of advanced authentication systems, and development of comprehensive privacy-enhancing solutions. The growing emphasis on zero-trust security models and quantum-safe cryptography will drive demand for next-generation digital trust solutions.

Between 2020 and 2025, the digital trust market experienced accelerated expansion, driven by the COVID-19 pandemic's impact on digital transformation and remote work adoption. The market developed as organizations recognized the critical need for robust security frameworks to protect against sophisticated cyber threats and maintain customer confidence in digital interactions. Regulatory requirements like GDPR, CCPA, and emerging data privacy laws began emphasizing the importance of digital trust in business operations.

Market expansion is being supported by the exponential increase in cyber threats and sophisticated attack vectors targeting organizations across all industries. Modern enterprises are increasingly focused on building comprehensive security frameworks that can protect against advanced persistent threats, ransomware attacks, and data breaches. Digital trust solutions provide essential capabilities for identity verification, data protection, and secure communications that organizations require to maintain operational continuity and customer confidence.

The growing emphasis on digital transformation initiatives and cloud migration is driving demand for integrated security platforms that can provide end-to-end protection across hybrid and multi-cloud environments. Consumer awareness of data privacy rights and regulatory compliance requirements is creating opportunities for privacy-enhancing technologies and transparent data handling practices. The rising influence of artificial intelligence and machine learning in threat detection and response is also contributing to increased adoption of advanced digital trust solutions across different sectors and use cases.

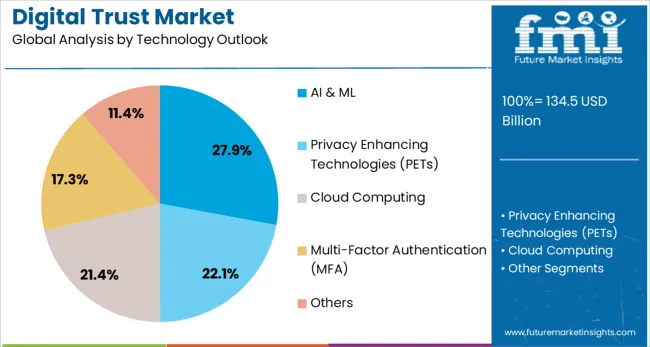

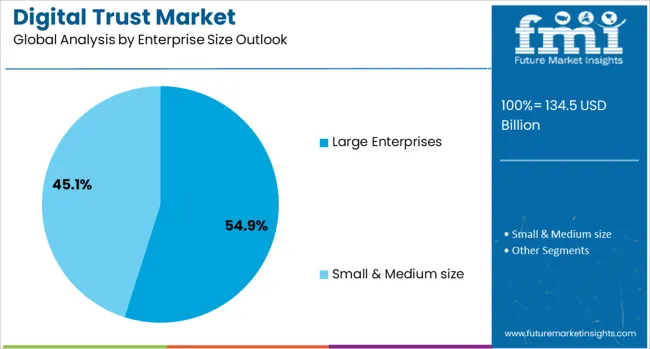

The market is segmented by component outlook, technology outlook, enterprise size outlook, end use outlook, and region. By component outlook, the market is divided into solutions and services. Based on technology outlook, the market is categorized into AI & ML, privacy enhancing technologies (PETs), cloud computing, multi-factor authentication (MFA), and others. In terms of enterprise size outlook, the market is segmented into large enterprises and small & medium enterprises. By end use outlook, the market is classified into banking, financial services, and insurance (BFSI), healthcare and life sciences, retail and e-commerce, IT and telecommunications, government sector, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The solutions segment is projected to account for 58.6% of the digital trust market in 2025, reaffirming its position as the primary driver of market growth. Organizations increasingly prefer comprehensive software platforms that provide integrated security capabilities rather than point solutions. Digital trust solutions offer end-to-end protection including identity and access management, encryption, threat detection, and compliance monitoring in unified platforms.

This segment forms the foundation of enterprise security strategies, as it represents the core technology infrastructure required to establish and maintain digital trust. The growing complexity of cyber threats and regulatory requirements continues to drive demand for sophisticated solution platforms. With organizations seeking to consolidate their security stack and reduce operational complexity, integrated solutions align with both cost optimization and security effectiveness goals. The broad appeal across enterprise sizes ensures sustained dominance, making solutions the central growth driver of digital trust market expansion.

AI & ML technologies are projected to represent 27.9% of digital trust market demand in 2025, underscoring their role as essential components for next-generation security platforms. Organizations leverage artificial intelligence and machine learning for advanced threat detection, behavioral analysis, and automated response capabilities that traditional security tools cannot provide. These technologies enable real-time analysis of vast amounts of security data to identify patterns and anomalies that indicate potential threats.

The segment is supported by the increasing sophistication of cyber-attacks that require intelligent defense mechanisms. AI and ML capabilities enhance threat intelligence, reduce false positives, and enable predictive security analytics that help organizations proactively address vulnerabilities. As security teams face skills shortages and growing threat volumes, AI-powered automation becomes critical for scaling security operations and maintaining effective protection across complex digital environments.

The large enterprises segment is forecasted to contribute 54.9% of the digital trust market in 2025, reflecting the complex security requirements and substantial IT budgets of major corporations. Large organizations face sophisticated threat landscapes, regulatory compliance obligations, and the need to protect extensive digital assets across multiple business units and geographic locations. These enterprises typically implement comprehensive digital trust frameworks that include advanced threat protection, identity governance, and data privacy solutions.

Large enterprises drive innovation in digital trust technologies through their willingness to invest in cutting-edge security platforms and their collaboration with technology vendors on custom solutions. The segment benefits from dedicated security teams, substantial compliance requirements, and the financial resources to implement enterprise-wide security transformations. With increasing digital transformation initiatives and growing cyber insurance requirements, large enterprises continue to represent the primary market for advanced digital trust solutions and services.

The digital trust market is advancing rapidly due to escalating cyber threats, increasing regulatory compliance requirements, and growing digital transformation initiatives. However, the market faces challenges including skills shortages in cybersecurity, integration complexity with legacy systems, and high implementation costs for comprehensive solutions. Innovation in artificial intelligence, zero-trust architecture, and quantum-safe cryptography continue to influence product development and market expansion patterns.

The increasing frequency and sophistication of cyber-attacks are driving organizations to invest in comprehensive digital trust solutions. Ransomware attacks, data breaches, and nation-state sponsored threats create significant financial and reputational risks that require advanced protection capabilities. Organizations are implementing multi-layered security strategies that include threat detection, incident response, and recovery solutions to maintain business continuity and protect sensitive information.

Growing data privacy regulations such as GDPR, CCPA, and emerging legislation worldwide are creating mandatory requirements for digital trust capabilities. Organizations must implement solutions that demonstrate compliance with data protection laws, provide audit trails, and ensure transparent data handling practices. Regulatory enforcement and penalty structures are driving investment in privacy-enhancing technologies and comprehensive data governance platforms.

The rapid adoption of cloud computing, remote work, and digital business models is expanding the attack surface and creating new security requirements. Organizations are implementing zero-trust security models that verify every user and device before granting access to corporate resources. Cloud-native security solutions and hybrid security architectures are becoming essential for protecting distributed digital environments and maintaining security consistency across multiple platforms.

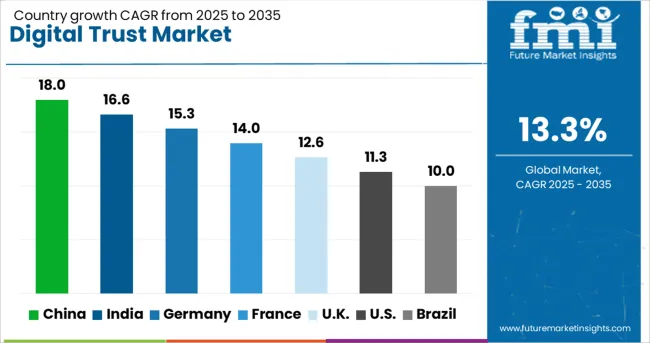

| Country | CAGR (2025-2035) |

| China | 18% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14% |

| UK | 12.6% |

| USA | 11.3% |

The digital trust market is experiencing robust growth globally, with China leading at a 18% CAGR through 2035, driven by massive digital transformation initiatives, government cybersecurity mandates, and rapid adoption of emerging technologies across industries. India follows at 16.6%, supported by expanding IT infrastructure, increasing digital payments adoption, and growing regulatory compliance requirements. Germany shows strong growth at 15.3%, emphasizing Industry 4.0 initiatives and strict data protection standards. France records 14.0%, focusing on digital sovereignty and comprehensive cybersecurity strategies. The UK demonstrates 12.6% growth, prioritizing financial services security and post-Brexit data governance frameworks.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from digital trust solutions in China is projected to exhibit exceptional growth with a CAGR of 18% through 2035, driven by the country's massive digital economy, government cybersecurity initiatives, and rapid adoption of artificial intelligence and cloud technologies. China's focus on data sovereignty and national security is creating substantial demand for indigenous digital trust platforms that can protect critical infrastructure and sensitive information across government and commercial sectors.

Revenue from digital trust solutions in India is expanding at a CAGR of 16.6%, supported by increasing digital transformation initiatives, growing IT services sector, and rising cybersecurity awareness among enterprises and government agencies. The country's Digital India programs and data localization requirements are driving demand for comprehensive security solutions that can support both public and private sector digitalization efforts.

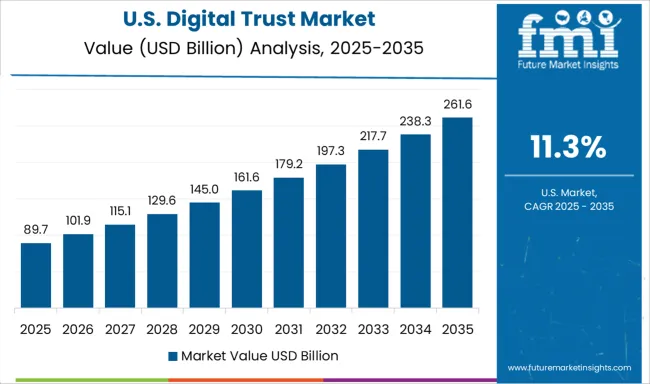

Demand for digital trust solutions in the USA is projected to grow at a CAGR of 11.3%, supported by sophisticated threat landscapes, stringent regulatory requirements, and substantial cybersecurity investments across government and commercial sectors. American organizations are increasingly focused on zero-trust security models, artificial intelligence-powered threat detection, and comprehensive data protection frameworks that can address evolving cyber risks.

Revenue from digital trust solutions in Germany is projected to grow at a CAGR of 15.3% through 2035, driven by the country's Industry 4.0 initiatives, strict data protection regulations, and sophisticated manufacturing sector requiring advanced cybersecurity capabilities. German organizations consistently demand high-quality, compliance-focused solutions that deliver measurable security improvements while supporting operational efficiency.

Revenue from digital trust solutions in the UK is projected to grow at a CAGR of 12.6% through 2035, supported by robust financial services sector, post-Brexit data governance requirements, and increasing cyber threat sophistication targeting critical national infrastructure. British organizations value regulatory compliance, operational resilience, and advanced threat protection capabilities.

Revenue from digital trust solutions in France is projected to grow at a CAGR of 14% through 2035, supported by the country's digital sovereignty initiatives, comprehensive cybersecurity strategies, and strong emphasis on data protection and privacy rights. French organizations prioritize indigenous security solutions, regulatory compliance, and advanced threat protection capabilities that align with national security objectives.

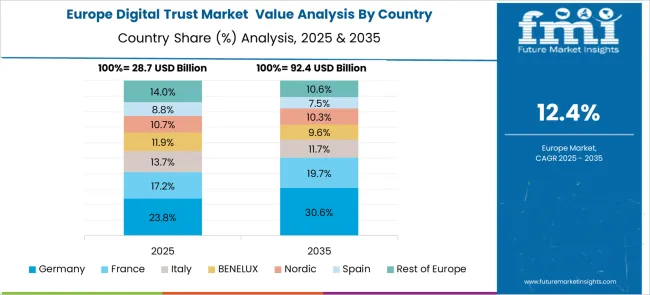

The European digital trust market demonstrates sophisticated development across major economies with Germany leading through its precision cybersecurity excellence and advanced industrial security capabilities, supported by companies emphasizing Industry 4.0 initiatives, GDPR compliance frameworks, and comprehensive data protection solutions while maintaining strict regulatory standards and operational efficiency. The UK shows strength in financial services security and post-Brexit data governance requirements, with organizations specializing in advanced threat protection, regulatory compliance, and operational resilience.

France contributes through its digital sovereignty initiatives and comprehensive cybersecurity strategies, delivering indigenous security solutions that combine national security objectives with modern data protection science. Sweden and Nordic countries emphasize privacy-enhancing technologies and sustainable digital infrastructure. Italy and Spain demonstrate growth in specialized cybersecurity solutions for traditional industries and emerging digital services. The market benefits from stringent EU data protection regulations, established cybersecurity infrastructure, and growing enterprise demand for comprehensive digital trust frameworks.

The Japanese digital trust market demonstrates steady growth driven by precision cybersecurity focus, advanced technology integration, and consumer preference for high-quality security solutions that ensure superior data protection and compliance throughout digital operations. Japanese organizations prioritize sophisticated threat detection systems and stringent security standards, creating demand for digital trust solutions featuring advanced artificial intelligence capabilities, comprehensive threat intelligence, and multi-layered security architectures that align with Japanese quality expectations.

The market emphasizes technological innovation in cybersecurity, zero-trust security models, and advanced authentication systems that reflect Japanese attention to detail in security implementation and risk management processes. Growing investment in smart manufacturing and digital transformation supports intelligent security systems with real-time threat monitoring, predictive analytics, and automated response capabilities for enhanced operational security. Japanese enterprises focus on solution reliability, consistent security outcomes, and long-term protection effectiveness.

The South Korean digital trust market shows exceptional growth potential driven by expanding 5G infrastructure deployment, increasing adoption of smart city technologies, and growing enterprise demand for advanced cybersecurity solutions requiring comprehensive threat protection and regulatory compliance systems. The market benefits from South Korea's technological leadership in telecommunications and increasing focus on national cybersecurity initiatives that drive investment in domestic security capabilities meeting international standards.

Korean organizations increasingly adopt zero-trust security frameworks, artificial intelligence-powered threat detection, and integrated privacy protection systems to improve operational security and regulatory compliance while ensuring data sovereignty requirements. Growing influence of Korean technology companies in global markets supports demand for sophisticated digital trust platforms that ensure comprehensive protection while maintaining cost-effectiveness and operational reliability. The integration of advanced manufacturing technologies and smart infrastructure creates opportunities for intelligent security systems with IoT protection capabilities.

The digital trust market is characterized by intense competition among established technology giants, specialized cybersecurity vendors, and emerging innovation companies. Organizations are investing in artificial intelligence capabilities, cloud-native architectures, comprehensive compliance frameworks, and strategic partnerships to deliver effective, scalable, and cost-efficient digital trust solutions. Product innovation, market expansion, and channel development are central to strengthening competitive positioning and market presence.

Microsoft Corporation, USA-based, leads the market with significant global presence, offering comprehensive digital trust solutions including Azure Active Directory, Microsoft Defender, and compliance management platforms with focus on enterprise integration and cloud security. Amazon Web Services Inc., USA, provides extensive cloud security services, identity and access management, and data protection solutions with emphasis on scalability and performance. Cisco Systems Inc., USA, delivers network security, identity management, and threat intelligence solutions with focus on infrastructure protection and secure connectivity.

DigiCert Inc., USA, specializes in digital certificates, public key infrastructure, and identity verification solutions with emphasis on authentication and encryption. IBM Corporation, USA, offers comprehensive security platforms including threat detection, identity governance, and risk management solutions. Oracle Corporation provides database security, identity management, and cloud protection services with focus on enterprise applications and data protection.

OneTrust LLC, USA, focuses on privacy management, data governance, and compliance automation solutions. RSA Security USA LLC specializes in identity and access management, fraud prevention, and risk-based authentication solutions. Salesforce Inc. provides customer identity management, data protection, and compliance solutions integrated with CRM platforms. Symantec (by Broadcom) offers endpoint protection, threat intelligence, and comprehensive security management solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 134.5 billion |

| Component | Solutions, Services |

| Technology | AI & ML, Privacy Enhancing Technologies (PETs), Cloud Computing, Multi-Factor Authentication (MFA), Others |

| Enterprise Size | Large Enterprises, Small & Medium Enterprises |

| End Use | Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT and Telecommunications, Government Sector, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Microsoft Corporation, Amazon Web Services Inc., Cisco Systems Inc., DigiCert Inc., IBM Corporation, Oracle, OneTrust LLC, RSA Security USA LLC, Salesforce Inc., and Symantec (by Broadcom) |

| Additional Attributes | Dollar sales by solution type and deployment model, regional adoption trends, competitive landscape, buyer preferences for cloud versus on-premises solutions, integration with artificial intelligence and machine learning technologies, innovations in zero-trust architecture, quantum-safe cryptography, and privacy-enhancing technologies |

Component Outlook:

Technology Outlook:

Enterprise Size Outlook:

End Use Outlook:

Region:

The global digital trust market is estimated to be valued at USD 134.5 billion in 2025.

The market size for the digital trust market is projected to reach USD 468.8 billion by 2035.

The digital trust market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in digital trust market are solution and services.

In terms of technology outlook, AI & ml segment to command 27.9% share in the digital trust market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printer Market Size and Share Forecast Outlook 2025 to 2035

Digital Thermo Anemometer Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA