The anionic surfactants market is estimated to be valued at USD 23.8 billion in 2025 and is projected to reach USD 40.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Between 2020 and 2024, the market expanded from USD 18.2 billion to 22.6 billion, marking the early adoption phase. During this period, growth was driven by specialized applications in cleaning, personal care, and industrial processes. Early adopters, including niche manufacturers and regional distributors, tested product performance and reliability, creating initial market credibility. Incremental adoption during these years allowed companies to refine production processes and distribution strategies, laying the foundation for wider market acceptance. This phase was essential for establishing confidence among new users and preparing for the next stage of growth.

From 2025 to 2030, the market enters a scaling phase, increasing from USD 23.8 billion to approximately 31.2 billion. Broader adoption occurs as the product reaches more industries and geographies, supported by improved availability and supply chain networks. By 2030, with the market surpassing USD 31.2 billion, the industry begins the consolidation phase. From 2030 to 2035, growth continues steadily to USD 40.7 billion, as leading manufacturers consolidate market share, standardize product offerings, and optimize operations. This phase reflects a mature market with stable demand and predictable expansion.

| Metric | Value |

|---|---|

| Anionic Surfactants Market Estimated Value in (2025 E) | USD 23.8 billion |

| Anionic Surfactants Market Forecast Value in (2035 F) | USD 40.7 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The market is experiencing robust growth, driven by the expanding demand for effective and economical cleaning agents across household and industrial sectors. The current market scenario reflects a strong alignment with rising hygiene awareness, population growth, and evolving consumer preferences for high-performance surfactants in everyday cleaning applications.

Cost efficiency, wide applicability, and compatibility with other surfactant types have further strengthened their market position. Increasing urbanization and the growing middle-class population are creating sustained demand for detergents and personal care products, directly influencing the consumption of anionic surfactants.

Environmental and regulatory pressures are encouraging the development of biodegradable and low-toxicity variants, paving the way for innovation and future product differentiation As global consumption patterns continue to shift toward performance-based formulations with improved foaming and emulsifying properties, the market is expected to maintain upward momentum with manufacturers focusing on scalable production and regional supply chain efficiency.

The anionic surfactants market is segmented by type, application, and geographic regions. By type, the market is divided into linear alkyl benzene sulphonate, lignosulfates, alcohol ether sulfates, alcohol sulfates, liquid & paste, sulfosuccinates, phosphate esters, sarcosinates, glycinates, glutamates, Isethionates, and others. In terms of application, the market is classified into household detergents, personal care, industrial cleaners, food processing, oil-field chemicals, agrochemicals, textiles, emulsion polymers, paints & coatings, construction, and others. Regionally, the anionic surfactants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Linear alkyl benzene sulphonate is projected to account for 24.6% of the overall market revenue in 2025, making it the most prominent type in this segment. This position is being supported by its wide use in detergent formulations, especially in powder and liquid laundry products.

High biodegradability, effective cleaning performance, and cost competitiveness have led to its preference across both industrial and consumer applications. Its compatibility with other ingredients and stability in hard water conditions have reinforced its adoption, particularly in regions where water quality affects detergent efficacy.

Production scalability and the availability of raw materials have further facilitated its widespread use As detergent manufacturers prioritize high-foaming and deep-cleaning surfactants that can be easily blended into various formulations, Linear Alkyl Benzene Sulphonate continues to serve as a core component in mainstream product lines, driving its market share and long-term relevance.

The household detergents segment is expected to hold 38.2% of the total market revenue in 2025, securing its position as the dominant application area. This dominance is being attributed to the growing global demand for effective cleaning solutions driven by rising hygiene standards and consumer spending on home care products.

Anionic surfactants are a preferred ingredient in household detergents due to their strong cleansing, emulsifying, and foaming properties. The segment has benefited from increased production of powder, liquid, and gel-based detergents that rely heavily on anionic surfactants for stain removal and grease breakdown.

The rise in automated washing practices and the penetration of washing machines in emerging economies have also contributed to the increased consumption of surfactants within this application Additionally, evolving formulations aimed at enhancing fragrance, softness, and stain-fighting performance without increasing costs have supported the continued use of anionic surfactants in household cleaning products.

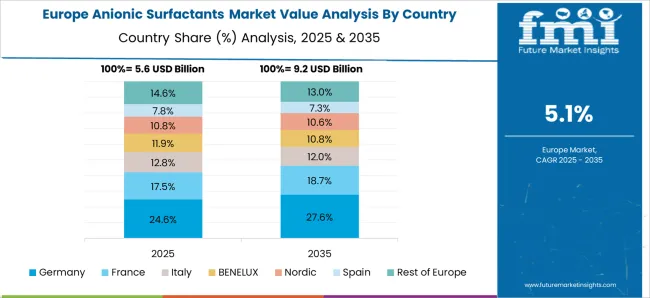

The anionic surfactants market is growing steadily, driven by demand from household detergents, personal care products, and industrial cleaning applications. Known for their excellent foaming, emulsifying, and cleaning properties, anionic surfactants are widely used in laundry, dishwashing, shampoos, and cosmetics. North America and Europe lead due to high consumer awareness and stringent product quality standards, while Asia-Pacific exhibits robust growth fueled by rising urbanization and industrialization. Market expansion is supported by innovations in eco-friendly formulations, biodegradable surfactants, and multi-functional blends. Companies focus on product differentiation through sustainability, performance, and compliance with environmental regulations.

Consistent raw material sourcing and quality standardization remain major challenges for anionic surfactant manufacturers. Feedstock variability, such as differences in fatty alcohols or petroleum-derived inputs, affects performance, foaming, and solubility. Lack of standardized production protocols can result in batch-to-batch inconsistencies, impacting household and industrial applications. Manufacturers supplying personal care or high-performance cleaning products require validated assays, traceable sourcing, and compliance with eco-certifications. Until harmonized quality and testing standards are adopted industry-wide, variability in feedstock and final product performance constrains market reliability and brand differentiation.

Technological advancements are enhancing anionic surfactant performance and environmental sustainability. Innovations in biodegradable surfactants, enzyme-stabilized formulations, and concentrated liquid blends improve cleaning efficiency while reducing ecological impact. Development of mild anionic surfactants for personal care applications addresses skin sensitivity and regulatory requirements. Advanced production techniques, including green chemistry methods and low-foaming formulations, expand application versatility in industrial and household segments. Companies collaborating with R&D institutions gain credibility and deliver high-performance, eco-friendly products. These innovations enable differentiation and support growth across detergents, cosmetics, and industrial cleaning sectors.

The anionic surfactants market is highly influenced by regulatory and environmental standards. Surfactants must comply with REACH, EPA, and regional safety guidelines regarding toxicity, biodegradability, and aquatic impact. Personal care formulations require adherence to cosmetic safety regulations, while industrial applications face discharge and environmental restrictions. Non-compliance can limit market access or result in penalties. Suppliers aligning products with recognized eco-labels and safety certifications strengthen market credibility. Until international regulatory frameworks converge, navigating diverse regional compliance requirements remains a challenge for manufacturers and formulators.

Competition in the anionic surfactants market is intense, with global chemical manufacturers and regional producers vying for market share. Feedstock dependence on fatty alcohols, petroleum derivatives, or renewable sources introduces price volatility and supply risks. Seasonal demand fluctuations, logistics challenges, and production lead times affect availability. Companies adopting vertical integration, alternative feedstocks, or geographic diversification gain supply reliability and cost advantages. Competitive differentiation is increasingly achieved through eco-friendly formulations, performance optimization, and certifications. Until supply chain stability and scalability improve, competitive rivalry and raw material limitations remain critical factors shaping market growth and adoption.

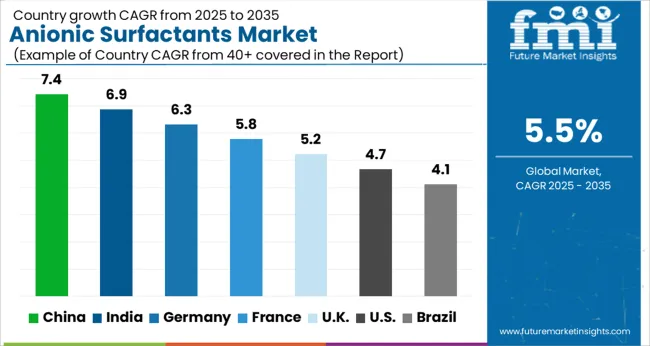

The global anionic surfactants market is projected to grow at a CAGR of 5.5% through 2035, supported by rising demand across detergents, personal care products, and industrial cleaners. Among BRICS nations, China has been recorded with 7.4% growth, driven by large-scale production and expanding industrial consumption, while India has been observed at 6.9%, supported by growth in household and commercial cleaning applications. In the OECD region, Germany has been measured at 6.3%, where production for industrial and personal care applications has been steadily maintained. The United Kingdom has been noted at 5.2%, reflecting consistent use in cleaning and hygiene products, while the USA has been recorded at 4.7%, with steady adoption in household, industrial, and personal care segments being consistently increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The anionic surfactants market in China is growing at a CAGR of 7.4%, driven by increasing demand from the personal care, household, and industrial cleaning sectors. Anionic surfactants are widely used in detergents, shampoos, and cleaning agents due to their excellent foaming and cleaning properties. China’s rapid urbanization, rising disposable income, and expanding retail sector are fueling the consumption of personal care and household products, which in turn drives surfactant demand. Industrial applications in textile, pulp and paper, and oilfield chemicals also contribute to growth. Manufacturers in China are investing in research and development to produce eco-friendly and biodegradable surfactants to meet environmental regulations. With growing awareness of sustainable cleaning solutions and increasing industrial production, the anionic surfactants market in China is poised for steady growth over the forecast period.

The anionic surfactants market in India is expanding at a CAGR of 6.9%, supported by growth in the personal care and household cleaning sectors. India’s rising population, urbanization, and increasing disposable income are boosting the consumption of detergents, shampoos, and cleaning agents. Industrial sectors, including textiles, paper, and oilfield chemicals, also drive demand for anionic surfactants. Manufacturers are focusing on producing high-quality, biodegradable, and environmentally friendly surfactants to comply with regulatory standards and address consumer demand for sustainable products. Government initiatives promoting hygiene and sanitation further enhance market growth. With a rapidly growing middle-class population and expanding industrial base, the anionic surfactants market in India is expected to maintain a steady growth trajectory throughout the forecast period.

The anionic surfactants market in Germany is growing at a CAGR of 6.3%, influenced by stringent environmental regulations and a strong focus on sustainable products. Germany’s industrial and household sectors use anionic surfactants in detergents, personal care products, and industrial cleaning agents. Manufacturers prioritize eco-friendly and biodegradable surfactants to meet both consumer expectations and regulatory requirements. Industrial applications in textiles, pulp and paper, and oilfield chemicals further support market growth. Consumer preference for sustainable and high-performance cleaning and personal care products drives adoption across multiple sectors. Germany’s commitment to environmental sustainability and technological advancement in chemical manufacturing ensures that the anionic surfactants market continues to expand steadily in the forecast period.

The anionic surfactants market in the United Kingdom is expanding at a CAGR of 5.2%, driven by increasing consumption in household cleaning, personal care, and industrial sectors. Anionic surfactants are widely used in detergents, shampoos, and cleaning agents for their foaming and cleansing efficiency. Growing consumer awareness of hygiene and sustainability is boosting demand for eco-friendly surfactants. Industrial applications in textiles, pulp and paper, and oilfield chemicals further enhance market growth. Manufacturers are investing in the development of biodegradable and environmentally compliant products to meet regulatory standards and consumer expectations. The UK market continues to witness steady growth due to a combination of rising household product consumption, industrial usage, and emphasis on sustainable and safe chemical solutions.

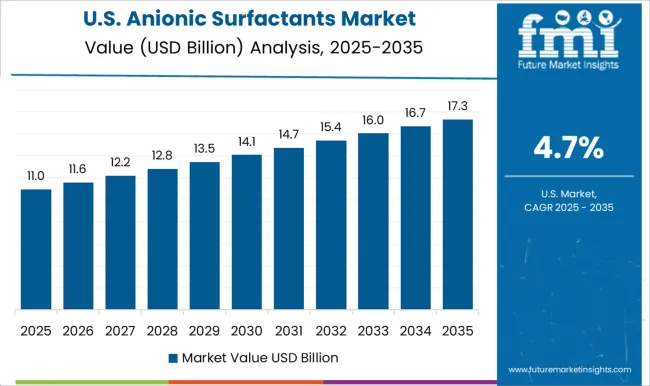

The anionic surfactants market in the United States is growing at a CAGR of 4.7%, supported by strong demand from the personal care, household cleaning, and industrial sectors. Anionic surfactants are widely used in detergents, shampoos, and cleaning agents due to their high foaming and cleansing capabilities. Industrial applications in textiles, paper, and oilfield chemicals also contribute to market growth. Regulatory focus on sustainable and biodegradable surfactants encourages manufacturers to innovate environmentally friendly solutions. Rising consumer preference for safe and effective cleaning products further fuels market expansion. With continuous adoption across industrial and household sectors and technological improvements in surfactant formulations, the anionic surfactants market in the United States is expected to witness consistent growth during the forecast period.

The anionic surfactants market is a vital segment of the global chemical industry, driven by demand from detergents, personal care, cosmetics, and industrial cleaning products. Anionic surfactants are valued for their excellent foaming, emulsifying, and cleansing properties, making them essential in both household and industrial formulations. Market growth is increasingly fueled by the shift toward environmentally friendly and biodegradable surfactants, as well as rising awareness of sustainable chemical production. Stepan Company is a global leader in anionic surfactants, offering a wide portfolio for household and industrial cleaning applications. Its focus on research and sustainable sourcing has strengthened its position in major markets worldwide. Galaxy Surfactants Limited, based in India, specializes in surfactants for personal care and cosmetic applications, providing innovative and high-quality solutions for shampoos, body washes, and skin care products.

Huntsman produces anionic surfactants for industrial and specialty uses, emphasizing performance and process efficiency. Kao Corporation focuses on high-performance anionic surfactants primarily for personal care, household cleaning, and cosmetic applications, leveraging research-driven innovation. AkzoNobel offers specialty surfactants with an emphasis on sustainable and eco-friendly formulations, supporting the growing demand for green chemistry. Lion Corporation supplies anionic surfactants mainly for detergents and cleaning solutions, maintaining a strong presence in the Asia-Pacific market. These manufacturers continually expand their product portfolios through research and development, eco-friendly product lines, and strategic collaborations. With increasing global demand for cleaning and personal care products, these leading companies are expected to remain at the forefront of the anionic surfactants market, driving innovation, sustainability, and efficiency across the value chain.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.8 Billion |

| Type | Linear Alkyl Benzene sulphonate, Lignosulfates, Alcohol Ether sulfates, Alcohol sulfates, Liquid & Paste, Sulfosuccinates, Phosphate Esters, Sarcosinates, Glycinates, Glutamates, Isethionates, and Others |

| Application | Household Detergents, Personal Care, Industrial Cleaners, Food Processing, Oil-field Chemicals, Agrochemicals, Textiles, Emulsion Polymers, Paints & Coatings, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stepan Company, Galaxy Surfactants Limited, Huntsman, Kao Corporation, AkzoNobel, and Lion Corporation |

| Additional Attributes | Dollar sales by type including linear alkylbenzene sulfonates, alkyl sulfates, and sulfonates, application across household cleaning, personal care, and industrial detergents, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for cleaning products, increasing industrial applications, and growing awareness of sustainable and biodegradable surfactants. |

The global anionic surfactants market is estimated to be valued at USD 23.8 billion in 2025.

The market size for the anionic surfactants market is projected to reach USD 40.7 billion by 2035.

The anionic surfactants market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in anionic surfactants market are linear alkyl benzene sulphonate, lignosulfates, alcohol ether sulfates, alcohol sulfates, liquid & paste, sulfosuccinates, phosphate esters, sarcosinates, glycinates, glutamates, isethionates and others.

In terms of application, household detergents segment to command 38.2% share in the anionic surfactants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Bio-surfactants Market

Competitive Overview of Fluorosurfactants Companies

Silicone Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pharmaceutical Surfactants Market

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA