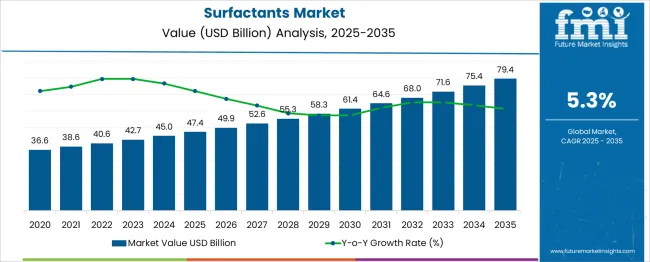

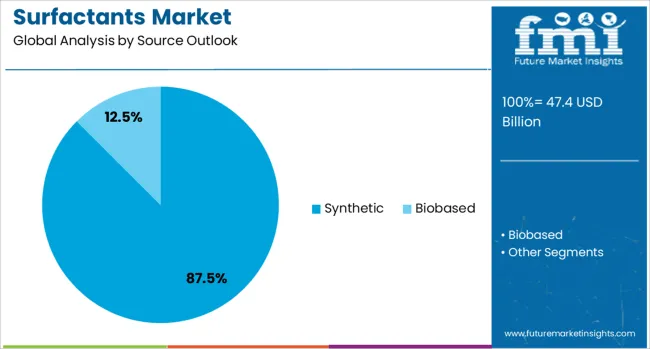

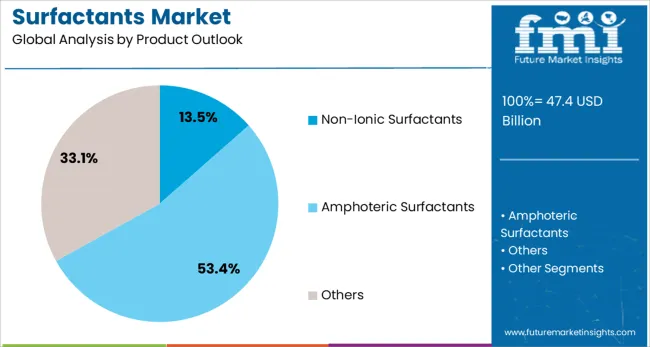

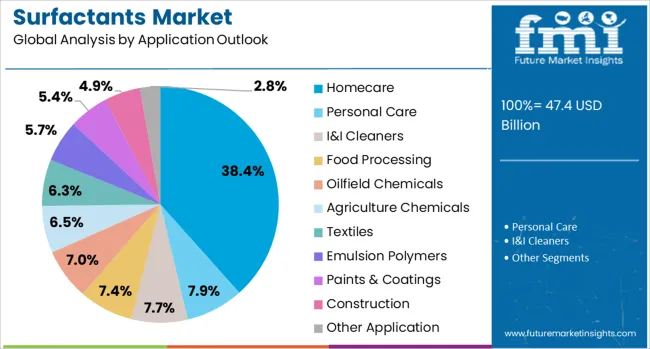

The surfactants market is valued at USD 47.4 billion in 2025 and is projected to reach USD 79.4 billion by 2035, rising at a 5.3% CAGR, reflecting steady growth driven by increasing demand across homecare, personal care, and industrial cleaning applications. The growth is propelled by heightened consumer hygiene awareness and expanding industrial sectors, such as textiles, agriculture, and oilfield chemicals. The synthetic surfactant segment dominates with a 87.5% market share, thanks to established manufacturing capabilities, cost-effectiveness, and consistent product performance. Non-ionic surfactants lead the product segment with 13.5% of market share, benefiting from their versatility in cleaning and industrial applications.

Surfactants are key ingredients in shampoos, soaps, detergents, and other cleaning products, as they help to break down oils, dirt, and grease. The growing consumer demand for hygiene, cleanliness, and personal grooming products is fueling the adoption of surfactants in these sectors. Additionally, the increasing preference for eco-friendly and natural products is driving demand for bio-based and biodegradable surfactants. As consumer awareness about the harmful effects of synthetic chemicals grows, there is a shift towards more sustainable and environmentally friendly surfactant options, further boosting market growth.

Technological advancements in surfactant formulations are also driving market growth. Innovations in surfactant chemistry are leading to the development of more efficient and multifunctional products that offer better performance, greater stability, and improved environmental compatibility. The rise of multifunctional surfactants, which can perform multiple roles such as emulsification, foaming, and wetting in a single formulation, is particularly driving demand in industries like personal care, cleaning, and agriculture. Additionally, the development of surfactants with improved performance at lower concentrations is contributing to more cost-effective solutions, particularly in industries where cost reduction is a key focus.

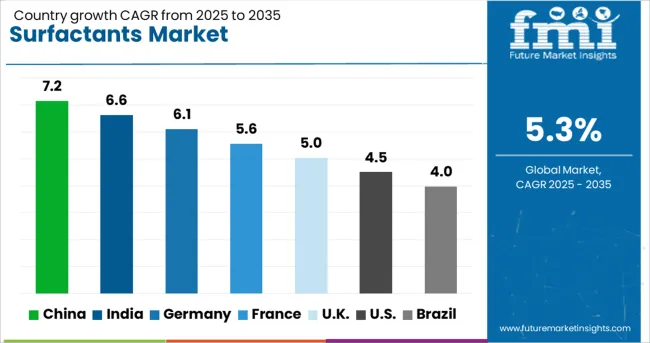

Asia Pacific leads the market, with China (7.2% CAGR) and India (6.6% CAGR) driving growth due to expanding manufacturing capacities and rising consumer demand for personal care products. In Europe, Germany (6.1% CAGR) and France (5.6% CAGR) continue to dominate, thanks to their advanced chemical production technologies and strong consumer goods industries. The USA shows steady growth at 4.5% CAGR, supported by established industrial demand and innovation in renewable surfactant formulations. Competitive dynamics center around major players like BASF SE, AkzoNobel, and Evonik Industries AG, who lead in product innovation and sustainable manufacturing processes. The competitive edge lies in developing bio-based surfactants and enhancing performance characteristics for eco-conscious markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 47.4 billion |

| Forecast Value in (2035F) | USD 79.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

Market expansion is being supported by increasing consumer awareness of hygiene and cleanliness, driving demand for household cleaning products, personal care items, and industrial cleaning solutions that rely on surfactant technologies for effective performance. The growing global population and rising living standards in emerging economies are creating steady demand for detergents, soaps, cosmetics, and specialty cleaning products that utilize various surfactant formulations.

The expanding industrial activities across manufacturing, textiles, agriculture, and oilfield operations are driving demand for specialized surfactants that enhance processing efficiency, product performance, and operational effectiveness. Technological advancement in surfactant chemistry is enabling development of high-performance formulations that meet specific industry requirements while supporting environmental goals through biodegradable and eco-friendly surfactant solutions.

The market is segmented by source, product type, application, and region. By source, the market is divided into synthetic and bio-based surfactants. Based on product type, the market is categorized into non-ionic surfactants, amphoteric surfactants, and others. In terms of application, the market is segmented into homecare, personal care, I&I cleaners, food processing, oilfield chemicals, agriculture chemicals, textiles, emulsion polymers, paints & coatings, construction, and other applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Synthetic surfactants are projected to account for 87.5% of the Surfactants market in 2025. This leading share is supported by the established manufacturing infrastructure, cost-effectiveness, and proven performance characteristics of synthetic surfactant formulations across diverse applications. Synthetic surfactants provide consistent quality, reliable supply availability, and comprehensive performance properties that meet demanding industrial and consumer requirements. The segment benefits from mature production technologies and extensive application development across multiple end-use industries.

Non-ionic surfactants are expected to represent 13.5% of surfactant product demand in 2025. This segment includes alcohol ethoxylates, alkyl phenol ethoxylates, fatty acid esters, fatty amine ethoxylates, EO-PO co-ethoxylates, and other non-ionic formulations that provide effective cleaning and processing capabilities. Non-ionic surfactants offer excellent stability, compatibility with other ingredients, and versatile performance characteristics across various pH conditions and temperature ranges. The segment benefits from growing demand for gentle cleaning formulations and specialized industrial applications.

Homecare applications are projected to contribute 38.4% of the market in 2025, representing household cleaning products including detergents, dishwashing liquids, and surface cleaners that rely on surfactant technologies for cleaning effectiveness. These applications require surfactants that provide superior cleaning performance, foam characteristics, and consumer safety. The segment is supported by growing consumer focus on household hygiene, increasing urbanization, and rising disposable income driving demand for effective cleaning products.

The Surfactants market is advancing steadily due to increasing hygiene awareness and expanding industrial applications requiring surface-active agents. However, the market faces challenges including raw material price volatility, environmental regulations affecting certain surfactant types, and increasing demand for renewable alternatives that require significant research and development investments. Innovation in bio-based surfactants and specialty formulations continue to influence market development patterns.

The growing focus on environmental preservation is driving development of bio-based surfactants derived from renewable feedstocks that offer comparable performance to traditional synthetic formulations. Advanced biotechnology and green chemistry processes enable production of biodegradable surfactants that meet environmental regulations while maintaining cleaning effectiveness. These renewable alternatives support corporate goals and consumer preferences for environmentally responsible products.

Modern surfactant manufacturers are developing specialized formulations for emerging applications in agriculture, oilfield operations, and advanced manufacturing processes that require specific surface tension modification, emulsification, and dispersion properties. Advanced surfactant chemistry enables tailored solutions for complex industrial processes including enhanced oil recovery, crop protection formulations, and specialty polymer production that demand precise performance characteristics.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| United Kingdom | 5 % |

| United States | 4.5% |

| Brazil | 4% |

The surfactants market is growing rapidly across global markets, with China leading at a 7.2% CAGR through 2035, driven by expanding industrial development, large-scale chemical manufacturing capabilities, and growing consumer markets for household and personal care products. India follows at 6.6%, supported by rapid economic growth, increasing middle-class population, and expanding manufacturing sector demand for surfactant applications. Germany records 6.1%, emphasizing advanced chemical technology development and specialty surfactant formulations, while France grows at 5.6% with established personal care and homecare industries driving consistent market demand.

The report covers an in-depth analysis of 40+ countries; top-performing markets are highlighted below.

Revenue from surfactants in China is projected to exhibit the highest growth rate with a CAGR of 7.2% through 2035, driven by rapid industrial development, expanding manufacturing activities, and growing consumer markets for household and personal care products requiring surfactant formulations. The country's large-scale chemical production capabilities and increasing domestic consumption are creating substantial demand for diverse surfactant applications. Major chemical manufacturers are establishing comprehensive surfactant production facilities to serve domestic and export markets across multiple industries including textiles, agriculture chemicals, and industrial cleaning applications.

Revenue from surfactants in India is expanding at a CAGR of 6.6%, supported by rapid economic development, a growing middle-class population, and increasing consumer spending on household and personal care products that utilize surfactant technologies. The country's expanding manufacturing sector and urbanization trends are driving demand for industrial cleaning chemicals and specialty surfactant applications. Domestic and international companies are investing in surfactant production facilities to serve growing market demand across homecare, personal care, and industrial applications.

Demand for surfactants in Germany is projected to grow at a CAGR of 6.1%, supported by the country's leadership in chemical technology development and comprehensive manufacturing capabilities for specialty surfactant formulations. German chemical companies are implementing advanced production processes that optimize surfactant performance characteristics while meeting stringent environmental and quality standards. The market is characterized by focus on high-value specialty applications and renewable surfactant development across personal care, industrial cleaners, and specialty chemical sectors.

Demand for surfactants in France is expanding at a CAGR of 5.6%, driven by established personal care and homecare industries, comprehensive chemical manufacturing infrastructure, and growing specialty applications in agriculture chemicals and industrial processing. French companies are implementing renewable surfactant production technologies that meet evolving environmental regulations while maintaining product performance standards. The market benefits from strong consumer awareness of product quality and established distribution networks serving diverse end-use applications.

Demand for surfactants in the UK is growing at a CAGR of 5.0%, supported by established chemical industry infrastructure, focus on specialty surfactant applications, and growing focus on renewable and biodegradable formulations. British companies are developing innovative surfactant technologies that meet stringent environmental regulations while serving demanding applications in personal care, industrial cleaning, and specialty chemical processing. The market is characterized by focus on high-value applications and premium product segments.

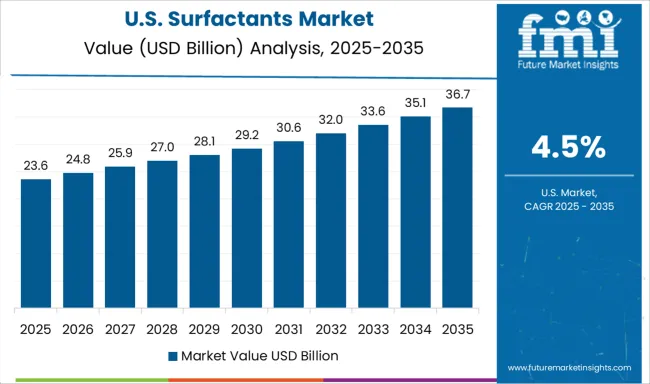

Demand for surfactants in the USA is expanding at a CAGR of 4.5%, driven by mature consumer markets, established chemical industry infrastructure, and growing specialty applications in agriculture, oilfield operations, and advanced manufacturing processes. Large chemical companies are implementing comprehensive surfactant product portfolios that serve diverse end-use industries with specialized formulations. The market benefits from established regulatory frameworks and comprehensive research capabilities supporting surfactant innovation across multiple application sectors.

Revenue from surfactants in Brazil is growing at a CAGR of 4.0%, driven by expanding agricultural sector, growing manufacturing activities, and increasing consumer markets for household products requiring surfactant formulations. The country's large agricultural industry creates substantial demand for agricultural chemical formulations that utilize surfactant technologies for enhanced product effectiveness. Industrial development and urbanization are supporting demand for cleaning chemicals and personal care applications across urban and rural markets.

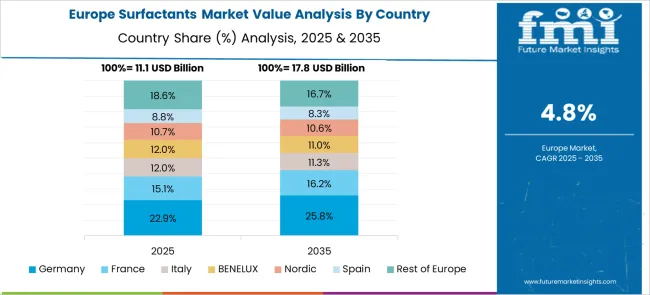

The surfactants market is growing across European countries, with Germany leading at a 6.1% CAGR through 2035, driven by strong chemical industry infrastructure, advanced manufacturing capabilities, and comprehensive research and development activities in surfactant technologies. France follows at 5.6%, supported by established personal care and homecare industries that drive consistent demand for surfactant formulations. The United Kingdom grows at 5.0%, emphasizing specialty applications and renewable surfactant development initiatives.

The European surfactants market is characterized by mature regulatory frameworks and advanced manufacturing technologies. Countries across the region are implementing stringent environmental regulations that promote development of biodegradable and eco-friendly surfactant alternatives. The market benefits from established chemical industry clusters, comprehensive research infrastructure, and strong consumer awareness of product quality and environmental impact considerations.

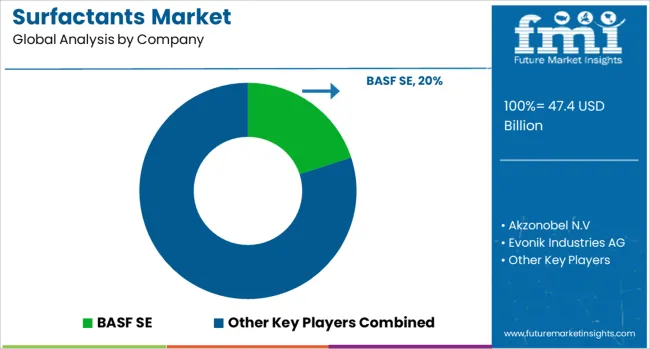

The surfactants market consists of 12–15 key players, with the top five companies controlling around 60–65% of the global market share. The market is driven by increasing demand for detergents, personal care products, industrial cleaning, agrochemicals, and oilfield chemicals, as well as advancements in eco-friendly surfactant technologies. Competition in the market focuses on formulation innovation, sustainability, cost-effectiveness, and the ability to provide customized solutions for various industries, rather than just price. BASF SE leads the market with an 20.0% share, supported by its broad portfolio of surfactants and strong presence in consumer care, industrial applications, and environmental performance.

Other major players such as AkzoNobel, Evonik Industries AG, Solvay S.A., and Clariant AG maintain strong positions through their diverse surfactant product lines that cater to personal care, detergents, industrial cleaners, and agrochemical formulations. These companies leverage their global manufacturing networks, R&D capabilities, and commitment to sustainable chemistry to meet the evolving needs of their customers in both developed and emerging markets.

Challengers such as Huntsman International LLC, DOW, and Kao Corporation focus on offering innovative surfactant solutions for specialized applications, including oil and gas, pharmaceuticals, and biotechnology. Players like Henkel Adhesives Technologies India Private Limited, Bayer AG, Godrej Industries Limited, and Stepan Company continue to expand their market presence by offering cost-effective, environmentally friendly surfactants and deepening their focus on personal care, home care, and industrial cleaning products, particularly in Asia and Latin America.

| Item | Value |

|---|---|

| Quantitative Units | USD 47.4 billion |

| Source | Synthetic, Bio-based |

| Product Type | Non-Ionic Surfactants (Alcohol Ethoxylates, Alkyl Phenol Ethoxylates, Fatty Acid Esters, Fatty Amine Ethoxylates, EO-PO co-ethoxylates, Other Non-Ionic Surfactants), Amphoteric Surfactants, Others |

| Application | Homecare, Personal Care, I&I Cleaners, Food Processing, Oilfield Chemicals, Agriculture Chemicals, Textiles, Emulsion Polymers, Paints & Coatings, Construction, Other Applications |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF SE, AkzoNobel, Evonik Industries AG, Solvay S.A., Clariant AG, Huntsman International LLC, DOW, Kao Corporation, Henkel Adhesives Technologies India Private Limited, Bayer AG, Godrej Industries Limited, and Stepan Company |

| Additional Attributes | Dollar sales by source, product type, and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established chemical companies and emerging specialty manufacturers, adoption of bio-based and renewable surfactant technologies, integration with gresusren chemistry and environmentally responsible manufacturing processes, innovations in specialty surfactant formulations and application development, and advancement of high-performance surfactant solutions for demanding industrial and consumer applications. |

The global surfactants market is estimated to be valued at USD 47.4 billion in 2025.

The market size for the surfactants market is projected to reach USD 79.4 billion by 2035.

The surfactants market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in surfactants market are synthetic and biobased.

In terms of product outlook, non-ionic surfactants segment to command 13.5% share in the surfactants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-surfactants Market

Competitive Overview of Fluorosurfactants Companies

Anionic Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Silicone Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Agricultural Surfactants Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pharmaceutical Surfactants Market

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA