The Beauty and Personal Care Surfactants Market is estimated to be valued at USD 11.6 billion in 2025 and is projected to reach USD 22.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The absolute dollar opportunity analysis highlights the market’s substantial growth potential over the forecast period. Between 2025 and 2029, the market expands from USD 8.4 billion to USD 11.6 billion, with an absolute dollar opportunity of USD 3.2 billion. This initial growth phase is driven by increasing consumer demand for personal care products such as shampoos, body washes, and facial cleansers, all of which rely heavily on surfactants for their cleansing properties and foaming effects.

From 2029 to 2031, the market continues to grow, with a rise from USD 12.3 billion to USD 14.1 billion, contributing an additional USD 1.8 billion in opportunity. This growth is driven by evolving consumer preferences for natural and sustainable surfactant solutions, particularly in eco-conscious personal care products. Between 2031 and 2035, the market experiences significant growth, reaching USD 22.1 billion by 2035, with an absolute dollar opportunity of USD 8.0 billion. This phase reflects growing investments in cleaner formulations, green chemistry, and technological advancements in surfactant production.

| Metric | Value |

|---|---|

| Beauty and Personal Care Surfactants Market Estimated Value in (2025 E) | USD 11.6 billion |

| Beauty and Personal Care Surfactants Market Forecast Value in (2035 F) | USD 22.1 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The beauty and personal care surfactants market is witnessing substantial transformation driven by evolving consumer preferences for skin-friendly, sulfate-free, and biodegradable formulations. Surfactants, as key emulsifying and cleansing agents, are being redefined by regulatory shifts and increasing demand for natural and plant-derived alternatives. With personal care brands prioritizing functional performance without compromising dermatological safety, innovations in green chemistry and enzymatic processing are increasingly being adopted.

The integration of biotechnology in surfactant development is also enabling the production of mild yet effective ingredients that align with the global trend toward minimalism and transparency in cosmetic labeling. Emerging economies are experiencing a surge in beauty and grooming consciousness, further contributing to the market’s expansion.

Additionally, digital-first cosmetic brands and private-label launches have increased product variety, accelerating surfactant demand across hair, skin, and hygiene segments In the near future, the market is expected to benefit from collaborations between cosmetic formulators and specialty chemical companies to deliver tailored, performance-optimized solutions with reduced environmental impact.

The beauty and personal care surfactants market is segmented by product, application, and geographic regions. By product, the beauty and personal care surfactants market is divided into Nonionic, Cationic, Amphoteric, Anionic, and Others. In terms of application, the beauty and personal care surfactants market is classified into Hair Care, Skin Care, and Others.

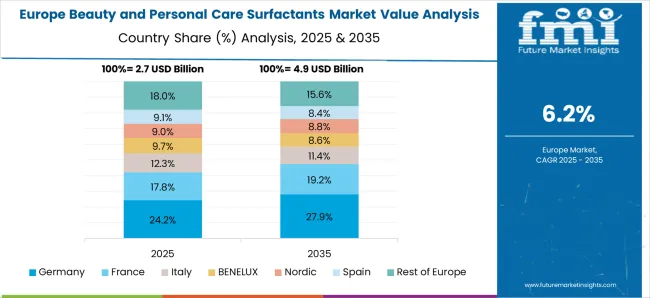

Regionally, the beauty and personal care surfactants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The nonionic segment is projected to account for 36.5% of the total revenue share in the beauty and personal care surfactants market in 2025, making it the leading product category. This dominance is supported by the high compatibility of nonionic surfactants with various cosmetic ingredients and their low irritation potential, making them ideal for sensitive skin formulations.

Nonionic variants are widely used in emulsions, creams, lotions, and hair products due to their superior solubilizing and emulsifying capabilities under different pH conditions. The absence of electrical charge in these surfactants allows better stability across formulations containing active ingredients, essential oils, or botanical extracts.

Their versatile functionality has supported their adoption in both rinse-off and leave-on applications, aligning with the consumer demand for gentle, multipurpose beauty products. Additionally, the scalability of nonionic surfactants from synthetic and naturally derived feedstocks has enabled manufacturers to cater to both cost-sensitive and premium product segments, reinforcing their position in global formulations.

The hair care segment is expected to capture 53.2% of the total revenue share in the beauty and personal care surfactants market in 2025, emerging as the most dominant application area. This growth has been influenced by rising consumer demand for specialized hair treatments addressing scalp health, hair fall, frizz, and pollution-related damage. The incorporation of surfactants in shampoos, conditioners, serums, and styling formulations has been instrumental in enhancing texture, cleansing efficiency, and product spreadability.

With the proliferation of clean beauty standards, there has been a noticeable shift toward sulfate-free and mild surfactant systems, which has fueled the uptake of advanced surfactant technologies in hair care. Brands are increasingly leveraging customized surfactant blends to deliver sensorial appeal, manageability, and long-lasting fragrance retention.

Additionally, growing urbanization, exposure to hard water, and the increasing frequency of hair wash routines are further driving consumption. The evolving retail landscape, supported by e-commerce and influencer-driven marketing, continues to reinforce the leadership of hair care in surfactant applications.

The beauty and personal care surfactants market is growing rapidly, driven by the increasing demand for effective, gentle, and multifunctional products in the personal care and cosmetic sectors. Surfactants, key ingredients in products like shampoos, cleansers, and skin care formulations, play a crucial role in improving texture, foaming, emulsifying, and cleaning properties. As consumers become more conscious of the ingredients in their beauty and personal care products, there is a growing preference for natural, sustainable, and dermatologically safe surfactants. This trend, along with innovations in formulation, is propelling the market forward, especially in emerging markets where the demand for personal care products is on the rise.

The beauty and personal care surfactants market is primarily driven by the increasing consumer demand for natural and eco-friendly ingredients. As consumers become more concerned about the safety and environmental impact of synthetic chemicals, they are opting for products that contain milder and more sustainable ingredients. This shift is driving the use of plant-based and biodegradable surfactants in formulations. Surfactants derived from renewable sources, such as coconut and palm oils, are gaining popularity due to their gentle properties and lower environmental footprint. This growing preference for natural and sustainable alternatives is influencing the market, leading manufacturers to innovate and adapt their offerings to meet consumer expectations for cleaner and greener products.

Despite the market's growth, the beauty and personal care surfactants market faces challenges related to regulatory pressure and the cost of natural surfactants. As consumer demand for natural ingredients increases, regulations surrounding the sourcing, production, and labeling of these ingredients have become more stringent. Manufacturers must ensure compliance with various regional and international regulations, which can increase costs and complicate supply chains. Natural surfactants, while preferred for their environmental and skin-friendly properties, are often more expensive to produce than their synthetic counterparts. This cost disparity can limit the adoption of natural surfactants, especially in budget-conscious product lines, posing a challenge for companies trying to balance cost-effectiveness with consumer preferences.

The beauty and personal care surfactants market presents significant opportunities, especially in emerging markets and through product innovations. The growing middle class, rising disposable incomes, and increasing awareness of personal care in regions such as Asia-Pacific, Latin America, and the Middle East are driving demand for beauty and personal care products. As these markets expand, the need for surfactants in formulations for both mass-market and luxury products increases. Additionally, product innovation, such as the development of multifunctional surfactants that provide additional benefits like anti-aging, moisturization, and sun protection, is creating new opportunities. Manufacturers who invest in research and development to create more efficient, eco-friendly, and effective surfactants are well-positioned to capitalize on these growth opportunities.

A key trend in the beauty and personal care surfactants market is the increasing integration of multifunctional surfactants in various products. Consumers are now seeking personal care items that provide multiple benefits, such as hydration, anti-aging, and deep cleansing, all in one formulation. To meet this demand, manufacturers are developing surfactants that can serve multiple purposes, such as conditioning agents, moisturizers, and emulsifiers, in addition to their cleaning functions. This trend is being driven by the desire for convenience and efficiency in daily routines. As the market continues to evolve, surfactants that combine these features while maintaining their effectiveness and mildness on skin and hair are expected to dominate the market.

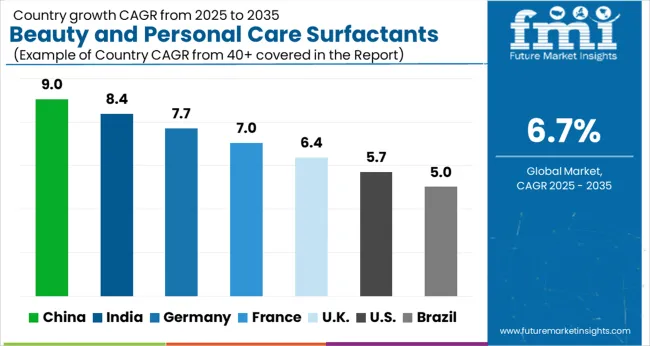

| Countries | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

Global beauty and personal care surfactants market demand is projected to rise at a 6.7% CAGR from 2025 to 2035. China leads at 9.0%, followed by India at 8.4%, and Germany at 7.7%, while the United Kingdom records 6.4% and the United States posts 5.7%. These rates translate to a growth premium of +35% for China, +25% for India, and +10% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing consumer demand for beauty products and the growth of personal care sectors in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established consumption patterns. The analysis includes over 40+ countries, with the leading markets detailed below.

The beauty and personal care surfactants market in China is growing rapidly at a CAGR of 9.0%, driven by increasing demand for beauty products, particularly in skincare, hair care, and cosmetics. The growing middle class, rising disposable incomes, and a growing focus on personal grooming are key drivers of this market. The demand for both mass-market and premium personal care products is increasing as consumers become more focused on product quality and safety. Additionally, China’s large e-commerce sector and expanding retail infrastructure further contribute to the market’s growth, along with an increasing preference for natural and eco-friendly ingredients.

Demand for beauty and personal care surfactants market in India is expanding at a CAGR of 8.4%, supported by a rapidly growing population, urbanization, and increasing consumer interest in personal grooming and skincare. The demand for personal care products, especially hair care and skincare, is rising with growing awareness about health and wellness. India’s young population is driving the growth of cosmetic and grooming products, and this demographic is increasingly aware of the ingredients in beauty products. Government initiatives to support the beauty and personal care industry, along with increasing disposable income, further contribute to the market’s rapid growth.

The beauty and personal care surfactants market in Germany is growing at a CAGR of 7.7%, supported by a strong focus on innovation and quality in the personal care and cosmetic sectors. As one of the leading markets in Europe, Germany sees rising demand for both high-end and mass-market beauty products. The shift toward natural and organic ingredients in personal care items is driving the market for surfactants that meet consumer expectations for both efficacy and sustainability. Regulatory standards for product safety and ingredient transparency further support the adoption of safe and effective surfactants in personal care products.

The United Kingdom’s beauty and personal care surfactants market is growing at a CAGR of 6.4%, with strong demand from the skincare and hair care segments. As a leader in the European beauty industry, the UK is experiencing increased consumer interest in premium beauty products, as well as growing awareness around product ingredients. The market is also seeing a shift toward more natural, vegan, and cruelty-free products, which is driving the use of eco-friendly surfactants. The UK’s well-established retail and e-commerce infrastructure further supports the expansion of the beauty and personal care market.

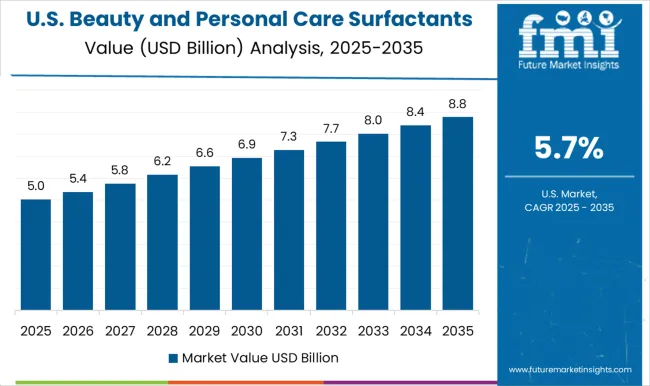

The USA beauty and personal care surfactants market is growing at a CAGR of 5.7%, with consistent demand for personal care and cosmetic products. The USA market is led by strong consumer demand for skincare, hair care, and cosmetic products, with increasing attention to ingredient transparency and effectiveness. The rise of clean beauty trends, focused on non-toxic, natural, and sustainable ingredients, is driving the adoption of eco-friendly surfactants. The growth of e-commerce platforms and direct-to-consumer brands is contributing to the expansion of the market, offering consumers more product choices and convenience.

BASF SE is a major player, providing a broad range of surfactants known for their mildness, efficiency, and versatility in personal care formulations. Evonik Industries AG (RAG Stiftung) specializes in producing sustainable, high-quality surfactants, offering solutions that enhance product performance in haircare, skincare, and body care products.

DuPont Industrial Biosciences offers bio-based surfactants that cater to the growing demand for eco-friendly, effective ingredients in beauty and personal care products. Huntsman International provides a range of surfactants used in personal care applications, with a focus on improving the texture and efficacy of formulations, ensuring high performance and skin compatibility. Clariant AG manufactures mild surfactants for cosmetics and personal care products, focusing on enhancing product formulation while meeting consumer preferences for safe, effective, and sustainable ingredients. Kao Corporation is recognized for its high-quality surfactants used in haircare, skincare, and other beauty products, with an emphasis on innovation and consumer safety. AkzoNobel N.V. offers a wide variety of surfactants used in personal care formulations, focusing on high performance, environmental compatibility, and superior product characteristics. These companies differentiate themselves through the development of sustainable and bio-based surfactants, with innovations that address both efficacy and environmental concerns in the beauty and personal care industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.6 Billion |

| Product | Nonionic, Cationic, Amphoteric, Anionics, and Others |

| Application | Hair Care, Skin Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASFSE, EvonikIndustriesAG(RAGStiftung), DuPontIndustrialBiosciences, HuntsmanInternational, ClariantAG, KaoCorporation, and AkzoNobelN.V. |

| Additional Attributes | Dollar sales by product type (anionic surfactants, nonionic surfactants, amphoteric surfactants, cationic surfactants) and end-use segments (skincare, haircare, body care, oral care). Demand dynamics are driven by the increasing consumer preference for natural and gentle personal care products, the growing demand for eco-friendly ingredients, and innovations in surfactant formulations that enhance product efficacy. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with rising disposable income, a growing awareness of product safety, and increasing demand for high-quality, sustainable personal care products driving market expansion. |

The global beauty and personal care surfactants market is estimated to be valued at USD 11.6 billion in 2025.

The market size for the beauty and personal care surfactants market is projected to reach USD 22.1 billion by 2035.

The beauty and personal care surfactants market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in beauty and personal care surfactants market are nonionic, cationic, amphoteric, anionics and others.

In terms of application, hair care segment to command 53.2% share in the beauty and personal care surfactants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA