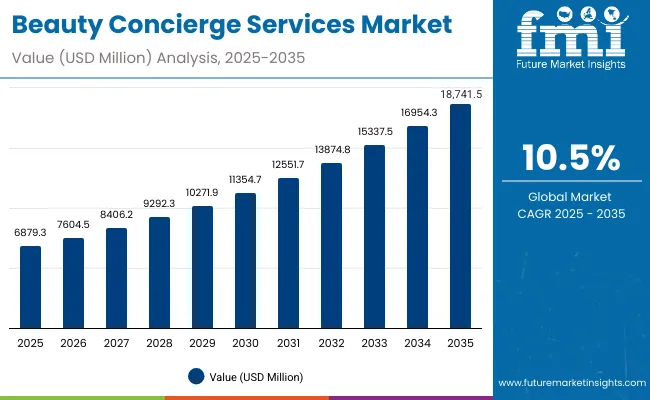

The Beauty Concierge Services Market is expected to record a valuation of USD 6,879.3 million in 2025 and USD 18,741.5 million in 2035, with an increase of USD 11,862.2 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 10.5% and a 2X increase in market size.

Global Beauty Concierge Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 6,879.3 million |

| Market Forecast Value in (2035F) | USD 18,741.5 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 6,879.3 million to USD 11,354.7 million, adding USD 4,475.4 million, which accounts for 37.7% of the total decade growth. This phase records steady adoption in at-home services, bridal/event packages, and skincare routines, driven by the need for personalized luxury. At-home hair & makeup dominates this period as it caters to over 42% of client demand requiring on-demand convenience and customization.

The second half from 2030 to 2035 contributes USD 7,386.8 million, equal to 62.3% of total growth, as the market jumps from USD 11,354.7 million to USD 18,741.5 million. This acceleration is powered by widespread deployment of app-based concierge bookings, VIP hospitality partnerships, and virtual consultations in premium segments. In-home / on-site and hotel/resort concierge together capture a larger share above 70% by the end of the decade. Platform-managed technician networks and cloud-based booking ecosystems add recurring revenue, increasing the digital share beyond 50% in total value.

From 2020 to 2024, the Global Beauty Concierge Services Market grew from USD 4,900 million to USD 6,500 million, driven by in-home and salon-based concierge models. During this period, the competitive landscape was dominated by luxury retailers and department store groups controlling nearly 60% of revenue, with leaders such as Harrods, Selfridges, and Nordstrom focusing on premium in-person experiences for bridal and event-based clientele. Competitive differentiation relied on brand exclusivity, stylist expertise, and bundled product-service offerings, while digital booking channels were auxiliary rather than a primary revenue stream. Subscription-based and virtual consultation models had minimal traction, contributing less than 15% of the total market value.

Demand for beauty concierge services will expand to USD 6,879.3 million in 2025, and the revenue mix will shift as app-based bookings and virtual consultations grow to over 50% share. Traditional department store leaders face rising competition from digital-first platforms offering personalized recommendations, AI-driven beauty matching, and subscription-based concierge memberships. Major service providers are pivoting to hybrid models, integrating virtual consultations, product delivery, and retainer-based beauty memberships to retain relevance. Emerging entrants specializing in cloud booking, influencer-driven beauty ecosystems, and corporate event tie-ups are gaining share. The competitive advantage is moving away from retail location dominance alone to ecosystem strength, digital scalability, and recurring revenue streams.

Advances in digital booking platforms have improved accessibility and speed, allowing for more efficient scheduling across diverse beauty services. At-home hair & makeup has gained popularity due to its suitability for events, weddings, and VIP personalization. The rise of app-based booking and virtual consultation technology has contributed to enhanced convenience and real-time beauty support. Industries such as hospitality, events, and personal care are driving demand for concierge services that can integrate seamlessly into luxury lifestyle experiences.

Expansion of corporate contracts, bridal packages, and hospitality concierge desks has fueled market growth. Innovations in freelance collectives, platform-managed networks, and bundled memberships are expected to open new application areas. Segment growth is expected to be led by at-home services, in-home delivery settings, and app-based booking channels due to their scalability and adaptability.

The market is segmented by service type, delivery setting, provider type, booking channel, pricing model, customer type, consultation mode, and region. Service types include at-home hair & makeup, skincare/facial, lash & brow services, personal shopping concierge, bridal/event packages, and aesthetics coordination. Delivery settings cover in-home/on-site, in-salon concierge desk, hotel/resort & cruise concierge, and virtual consults to cater to different client needs. Based on provider type, the segmentation includes retailer-led concierge programs, platform-managed technician networks, freelance collectives/agencies, and salon & spa group concierge.

In terms of booking channel, categories encompass app, web, and phone/in-person desk. Pricing models include per-service, bundles, membership/retainer, and corporate/event contracts. Customer types span individual clients, bridal/couples & parties, corporate/production sets, and hospitality/VIP services. Consultation modes include in-person and virtual. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa.

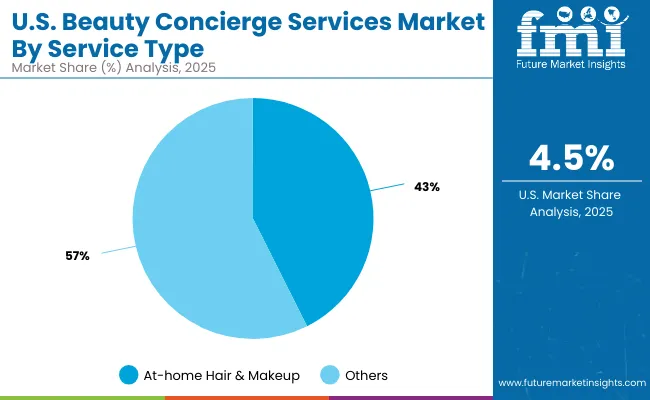

| Service Type Segment | Market Value Share, 2025 |

|---|---|

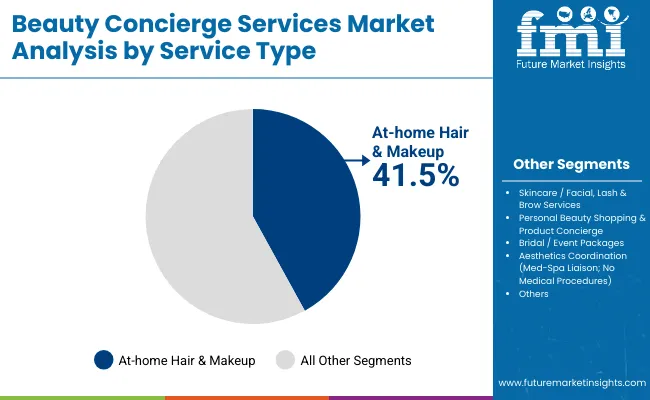

| At-home Hair & Makeup | 41.5% |

| Others | 58.5% |

The at-home hair & makeup segment is projected to contribute 41.5% of the Global Beauty Concierge Services Market revenue in 2025, maintaining its lead as the dominant service category. This is driven by ongoing demand for personalized, on-demand styling solutions for events, weddings, and daily routines. Consumers are increasingly prioritizing convenience, flexibility, and premium at-home experiences, which supports the strong adoption of this segment. The segment’s growth is also supported by the expansion of freelance beauty professionals and app-based platforms that enhance accessibility and service customization. As digital booking integration and real-time scheduling become more prevalent, at-home providers are enhancing offerings with bundled packages and VIP experiences. The at-home hair & makeup segment is expected to retain its position as the backbone of beauty concierge services.

| Delivery Setting Segment | Market Value Share, 2025 |

|---|---|

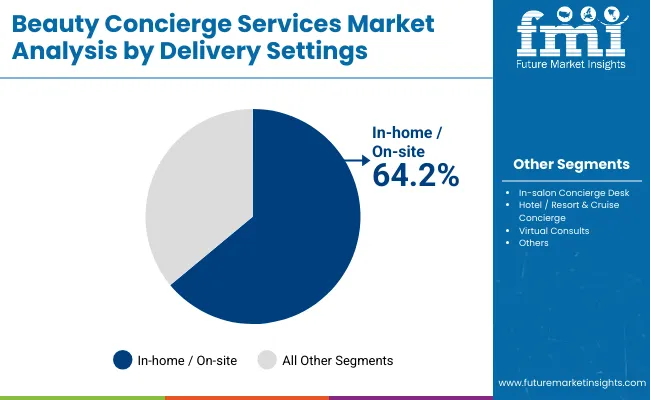

| In-home / on-site | 64.2% |

| Others | 35.8% |

The in-home / on-site segment is projected to contribute 64.2% of the Global Beauty Concierge Services Market revenue in 2025, establishing itself as the dominant delivery setting. This is driven by the shift towards convenience-first luxury services, where clients prefer personalized experiences in private settings. From weddings to corporate events, in-home services reduce logistical challenges and ensure exclusivity.

The segment’s expansion is also supported by the hospitality industry’s partnerships with concierge networks to offer private suites, VIP packages, and on-demand in-room services. As hybrid booking models emerge, in-home providers are integrating membership plans and corporate event contracts to enhance recurring revenues. The in-home / on-site delivery setting is expected to remain the primary driver of beauty concierge growth globally.

| Booking Channel Segment | Market Value Share, 2025 |

|---|---|

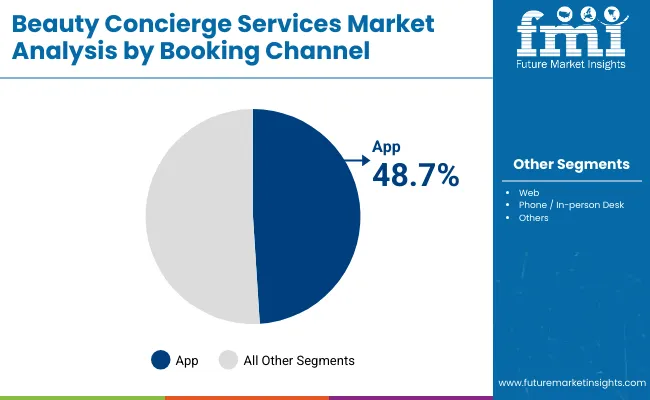

| App-based Platforms | 48.7% |

| Others | 51.3% |

The app-based booking channel is projected to contribute 48.7% of the Global Beauty Concierge Services Market revenue in 2025, making it the leading digital engagement mode. This is driven by the rise of mobile-first consumers who demand instant access to beauty services with personalized recommendations, reviews, and seamless payments. App-led convenience has become a critical differentiator in the global market. The segment’s growth is also supported by AI-driven personalization and influencer-led integrations, which enhance user experience and increase repeat bookings. As platforms expand to include bundled memberships, loyalty programs, and corporate partnerships, the reliance on apps is expected to grow further. The app channel is expected to surpass 50% share by the end of the decade, cementing its role as the central driver of digital transformation in beauty concierge services.

Drivers

Rising Demand for Personalized At-home Services

One of the strongest drivers for the Global Beauty Concierge Services Market is the rising demand for personalized, at-home beauty services, which accounted for 41.5% of global revenue in 2025. Modern consumers are increasingly leaning toward convenience-oriented solutions that align with their busy schedules, heightened expectations for exclusivity, and desire for tailored beauty experiences. This trend is particularly prominent in urban centers across North America, Europe, and Asia, where clients are willing to pay a premium for professional stylists, makeup artists, and skincare experts to deliver services directly to their homes, hotels, or event venues.

Weddings, corporate events, and social gatherings remain the largest demand drivers, as consumers view on-demand beauty services as a necessity rather than a luxury for high-profile occasions. The expansion of freelance collectives, platform-managed technician networks, and digital marketplaces has further boosted accessibility by connecting professionals directly with clients. Consumers now enjoy greater transparency in pricing, access to reviews, and real-time booking, which reduces friction compared to traditional salon visits.

Additionally, the shift toward personalized beauty regimens and bespoke styling packages enhances client loyalty and repeat engagement. Platforms such as Glam squad, Urban Company Beauty, and Style Bee are capitalizing on this by offering membership-based services and subscription models, ensuring recurring revenues while building long-term client relationships.

Digital Platforms Driving Accessibility

Another critical growth driver for the Global Beauty Concierge Services Market is the rise of app-based booking platforms, which accounted for 48.7% of revenue in 2025 and are projected to exceed 50% by 2030. Digital platforms have fundamentally reshaped consumer expectations by offering instant access to vetted beauty professionals, transparent pricing, seamless scheduling, and integrated payment options. This mobile-first trend is particularly strong among millennial and Gen Z consumers, who prioritize speed, convenience, and digital engagement in their lifestyle choices.

App-driven platforms such as PRIV, Blow LTD, and Urban Company are leading the way in delivering AI-powered personalization, matching clients with stylists or skincare specialists based on preferences, prior history, and geolocation. These platforms also incorporate user reviews, influencer endorsements, and curated service bundles, making them a powerful tool for discovery and repeat engagement. Importantly, app ecosystems are no longer limited to bookings alone they are evolving into full-service hubs offering product recommendations, retail tie-ins, loyalty rewards, and membership programs. This creates a more holistic beauty experience that extends beyond single-service appointments, positioning digital platforms as both service and product marketplaces.

Restraints

Fragmented Service Quality Standards

Despite strong growth prospects, the Global Beauty Concierge Services Market faces a significant restraint in the form of fragmented service quality standards. Unlike traditional salon chains or branded retailers, where service protocols and training are standardized, beauty concierge services rely heavily on freelance professionals, independent agencies, and decentralized networks. This creates variability in service delivery, leading to inconsistent customer experiences that can hinder repeat engagement. For a market that depends on trust, personalization, and premium service positioning, a single negative experience can substantially impact brand reputation and consumer adoption rates.

The issue is more pronounced in emerging and mid-tier markets where training, skill certification, and professional vetting are not uniformly enforced. Even in mature markets like the USA and UK, variations in stylist expertise, punctuality, and product quality contribute to customer dissatisfaction. Platforms attempt to mitigate this through rating systems, background checks, and training modules, but achieving true consistency remains a challenge. Luxury retailers such as Harrods and Selfridges enjoy an advantage in this area due to established brand equity and in-house stylist teams, yet they still face competition from less-regulated freelance networks offering lower prices.

High Dependency on Urban Premium Consumers

Another restraint limiting growth is the market’s high dependency on urban, premium consumer bases. Beauty concierge services are overwhelmingly concentrated in affluent metropolitan cities where disposable incomes are high, consumer awareness of luxury services is greater, and demand for personalization is strongest. While this positioning aligns with the industry’s premium value proposition, it also limits scalability into broader markets. Suburban and rural areas often lack the infrastructure, willingness to pay, or sufficient stylist networks to support concierge services.

This dependency also creates vulnerability during economic downturns. When discretionary spending contracts, premium services like beauty concierge are among the first categories to experience cutbacks. This was evident during the pandemic when high-spending urban clients paused luxury consumption, temporarily slowing service adoption despite long-term recovery prospects. Furthermore, this reliance restricts customer diversity markets such as India, which show 11.7% CAGR growth, remain largely limited to tier-1 cities, leaving vast portions of potential clientele untapped.

Key Trends

Shift Toward Hybrid Models (In-person + Virtual Consults)

One of the most defining trends shaping the Global Beauty Concierge Services Market is the shift toward hybrid models that combine in-person services with virtual consultations. While in-home and on-site services dominate (64.2% share in 2025), digital add-ons like video consultations, product curation sessions, and follow-up skincare advice are becoming increasingly common. This dual-channel engagement ensures that consumers can maintain continuity in their beauty routines, blending convenience with premium personalization.

The hybrid model is particularly attractive to younger, digitally native consumers who view virtual consultations as a natural extension of lifestyle management. It also benefits providers by creating recurring touchpoints with clients beyond physical appointments. Virtual consultations often serve as gateways to premium in-person services, while also boosting product upselling and cross-selling opportunities. Retailers such as Sephora and Nordstrom are already leveraging hybrid models by integrating beauty concierge services with e-commerce platforms, loyalty programs, and digital try-on tools.

Hospitality and Corporate Partnerships Expanding Reach

Another major trend is the rapid integration of beauty concierge services into hospitality, events, and corporate contracts. Hotels, resorts, and cruise operators are increasingly offering beauty concierge services as part of their luxury and VIP experience packages, recognizing the strong demand for personalized styling during travel and events. Similarly, corporate clients including film production sets, fashion shows, and large-scale event organizers are emerging as high-value customer segments.

This trend is expanding the revenue mix beyond individuals to large-scale, recurring contracts that provide greater stability and higher margins. In 2025, corporate and hospitality bookings already represented a notable share of concierge demand, particularly in regions like Europe and Asia where destination weddings, luxury travel, and large-scale events are growing rapidly. Providers such as Blow LTD and PRIV are actively developing corporate tie-ups, offering on-demand teams of stylists for backstage support, conferences, and branded hospitality experiences.

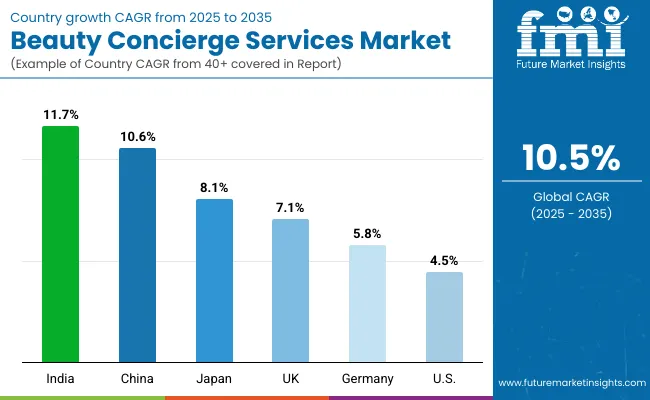

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 10.6% |

| USA | 4.5% |

| India | 11.7% |

| UK | 7.1% |

| Germany | 5.8% |

| Japan | 8.1% |

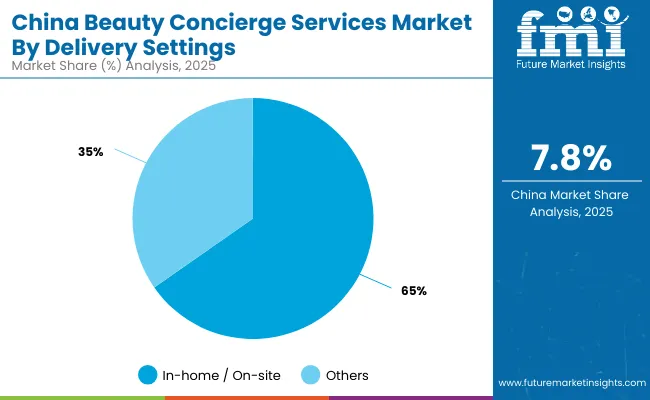

The Global Beauty Concierge Services Market shows a pronounced regional disparity in adoption speed, strongly influenced by digital platform penetration, luxury retail expansion, and hospitality partnerships. Asia-Pacific emerges as the fastest-growing region, anchored by India at 11.7% CAGR and China at 10.6% CAGR. This acceleration is driven by rising middle-class affluence, the rapid growth of app-based booking platforms, and the integration of concierge services into destination weddings, luxury travel, and premium hospitality ecosystems. China’s market momentum is further fueled by the dominance of in-home/on-site services, which accounted for 65.3% of value in 2025, while India’s surge reflects urban adoption of bridal/event packages and expansion into tier-2 city markets.

Europe maintains a strong growth profile, led by Germany at 5.8%, France at 6.2%, and the UK at 7.1%, supported by retailer-led concierge programs from Harrods, Selfridges, and department store chains. Stringent service quality expectations, high demand for luxury events, and partnerships with museums, hotels, and heritage institutions drive expansion. North America shows more moderate expansion, with the USA at 4.5% CAGR, reflecting a mature market where department stores and digital-first platforms compete. Growth in the USA is more service-driven, with greater emphasis on bridal/event concierge, VIP memberships, and AR/VR-integrated virtual consultations. Latin America, led by Brazil at 6.5% CAGR, is beginning to see concierge expansion through luxury hospitality, particularly in Rio de Janeiro and São Paulo.

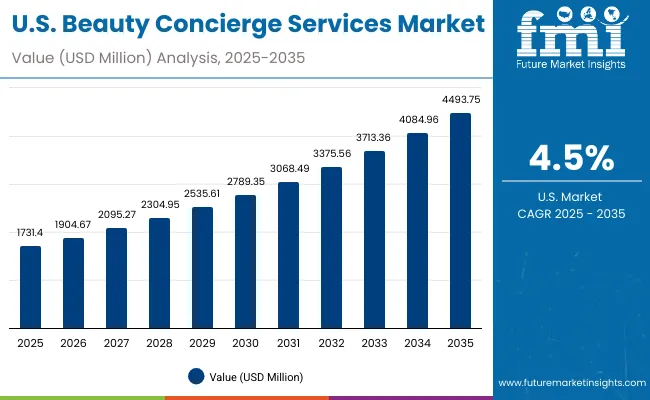

| Year | USA Beauty Concierge Services Market (USD Million) |

|---|---|

| 2025 | 1731.4 |

| 2026 | 1904.7 |

| 2027 | 2095.3 |

| 2028 | 2304.9 |

| 2029 | 2535.6 |

| 2030 | 2789.4 |

| 2031 | 3068.5 |

| 2032 | 3375.6 |

| 2033 | 3713.4 |

| 2034 | 4085.0 |

| 2035 | 4493.8 |

The Beauty Concierge Services Market in the United States is projected to grow at a CAGR of 4.5%, reflecting a mature yet evolving ecosystem. Growth is led by steady expansion across at-home styling, bridal/event packages, and department store-led concierge desks. Luxury retailers such as Nordstrom Beauty Stylists and Saks Fifth Avenue Beauty continue to play a central role by offering premium services inside stores and exclusive membership programs. At-home and app-based booking platforms such as Glam squad and Style Bee are accelerating adoption among urban millennials and Gen Z, who value convenience and real-time availability.

The Beauty Concierge Services Market in the United Kingdom is forecast to grow at a CAGR of 7.1%, making it one of Europe’s most dynamic luxury service ecosystems. The UK market is anchored by its retail-led concierge hubs, with Harrods and Selfridges spearheading innovation in bespoke beauty experiences. High demand comes from bridal packages, VIP tourism, and event-based services, as well as strong integration with the fashion and luxury industries. App-based bookings are growing rapidly, with younger consumers opting for last-minute styling, skincare, and virtual consultations through mobile platforms. London, Manchester, and Edinburgh are emerging hotspots where concierge services are expanding beyond retail into hospitality-driven models.

India is the fastest-growing market, projected to expand at a CAGR of 11.7% through 2035. The country’s trajectory is heavily influenced by its booming bridal and event industry, which drives continuous demand for at-home and on-site styling. Rising disposable incomes and tier-2 and tier-3 city adoption are unlocking massive new opportunities. App-based platforms such as Urban Company Beauty dominate in India, offering affordability, convenience, and reliability to both premium and mass-market clients. Destination weddings and corporate hospitality are strong growth drivers, with luxury hotels increasingly adding beauty concierge services to attract high-value clientele.

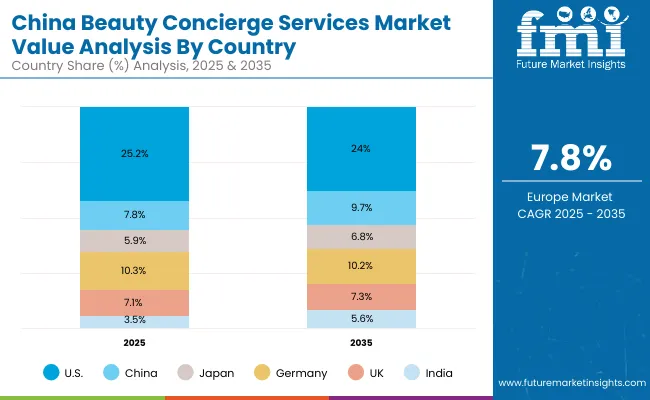

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.2% |

| China | 7.8% |

| Japan | 5.9% |

| Germany | 10.3% |

| UK | 7.1% |

| India | 3.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 24.0% |

| China | 9.7% |

| Japan | 6.8% |

| Germany | 10.2% |

| UK | 7.3% |

| India | 5.6% |

China is projected to grow at a CAGR of 10.6%, making it one of the largest and fastest-growing markets globally. The country’s market strength lies in its dominance of in-home/on-site services, which accounted for 65.3% of total market value in 2025. This reflects a cultural shift toward privacy-driven, exclusive luxury experiences, particularly in tier-1 cities such as Beijing, Shanghai, and Guangzhou. The rapid rise of digital platforms and influencer-driven ecosystems also fuels demand. Partnerships between local beauty apps and hospitality players, e-commerce giants, and fashion brands have expanded reach. Moreover, the Chinese market benefits from strong demand in luxury travel, where concierge services are integrated into high-end hotels, resorts, and cruise packages.

The Global Beauty Concierge Services Market shows clear regional realignment in market share between 2025 and 2035. The USA retains its position as the single largest market with 25.2% share in 2025, but this moderates slightly to 24.0% by 2035, reflecting a mature landscape where growth is slower compared to emerging markets. Europe maintains steady performance, with Germany at 10.3% in 2025, slipping marginally to 10.2% by 2035, and the UK rising slightly from 7.1% to 7.3%, highlighting sustained demand from luxury retail and hospitality ecosystems.

Japan also strengthens its role, growing from 5.9% to 6.8%, supported by expanding digital adoption and high-quality service expectations. In contrast, Asia emerges as the main growth engine, with China’s share expanding from 7.8% in 2025 to 9.7% in 2035, and India nearly doubling from 3.5% to 5.6%, making them the fastest-growing contributors globally. These shifts underline the region’s rising middle class, growing bridal/event industry, and rapid uptake of app-based platforms. The overall trend highlights that while the USA and Europe continue to dominate in absolute size, Asia is steadily capturing a larger share of the global beauty concierge services market, reshaping the competitive balance and setting the stage for stronger cross-border expansion by both global and local players.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| At-home hair & makeup | 42.6% |

| Others | 57.4% |

The USA Beauty Concierge Services Market presents strong opportunities in at-home hair & makeup services, which accounted for 42.6% of the market in 2025. This segment reflects consumer demand for personalized, convenience-first beauty solutions, particularly for weddings, corporate events, and social gatherings. The ability to bring professional services directly to private spaces supports the USA market’s luxury positioning. Growth in this segment also benefits from app-based bookings, loyalty memberships, and hybrid models where in-home styling is complemented by virtual consultations. With department stores and digital-first platforms competing for affluent urban clients, at-home services represent a core opportunity for sustained growth in the USA through 2035.

| Delivery Setting Segment | Market Value Share, 2025 |

|---|---|

| In-home / on-site | 65.3% |

| Others | 34.7% |

The China Beauty Concierge Services Market shows a dominant opportunity in in-home / on-site delivery settings, which contributed 65.3% of total revenue in 2025. This reflects strong cultural preferences for privacy, exclusivity, and high-touch luxury experiences in major urban centers such as Shanghai, Beijing, and Guangzhou. The segment is being amplified by digital booking platforms that integrate real-time availability, influencer endorsements, and bundled service packages, making concierge services more accessible to a growing middle class. As hospitality, e-commerce, and beauty platforms converge, in-home services are positioned to remain the backbone of growth in China, offering providers the chance to expand through premium memberships, destination events, and corporate tie-ups.

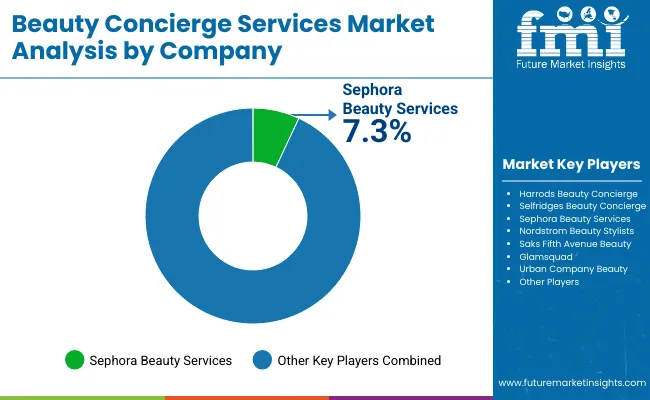

The Global Beauty Concierge Services Market is moderately fragmented, with luxury retailers, department store-led programs, platform-based networks, and freelance collectives competing across diverse service categories. Global leaders such as Sephora Beauty Services, Harrods Beauty Concierge, and Selfridges Beauty Concierge hold strong brand influence, leveraging established retail footprints, exclusive product tie-ins, and high-value customer memberships. Their strategies emphasize integrated beauty experiences that combine product retail with personalized services, loyalty-driven packages, and premium in-store concierge lounges.

Established mid-sized players, including Nordstrom Beauty Stylists, Saks Fifth Avenue Beauty, and Blow LTD, cater to growing demand for curated luxury experiences and app-based bookings. These companies are accelerating adoption by blending in-store experiences with on-demand beauty styling for weddings, events, and corporate clients. They differentiate themselves through personalized client engagement, stylist expertise, and integration of digital booking ecosystems, making them highly relevant in both North America and Europe. Specialized providers such as Glam squad, Urban Company Beauty, PRIV, and Style Bee focus on mobile-first, app-driven service delivery that enables flexible scheduling, real-time availability, and affordability across urban centers.

Their strength lies in scalability, digital integration, and regional adaptability, particularly in fast-growing Asian and emerging markets where app-based beauty adoption is rapidly expanding. Competitive differentiation is shifting away from purely retail location strength toward hybrid service ecosystems that include virtual consultations, influencer-led engagement, and subscription-based concierge memberships. Players that integrate digital-first models with premium partnerships in hospitality, events, and corporate contracts are gaining a competitive edge, positioning themselves to capture long-term recurring revenue and sustain double-digit market growth through 2035.

Key Developments in Global Beauty Concierge Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 6,879.3 million |

| Service Type | At-home hair & makeup, Skincare/facial, lash & brow services, Personal beauty shopping & concierge, Bridal/event packages, Aesthetics coordination (med-spa liaison; no medical procedures) |

| Delivery Setting | In-home/on-site, In-salon concierge desk, Hotel/resort & cruise concierg e, Virtual consults |

| Provider Type | Retailer-led concierge programs, Platform-managed technician networks, Freelance collectives/agencies, Salon & spa group concierge |

| Booking Channel | App, Web, Phone/in-person desk |

| Pricing Model | Per-service (à la carte), Packages/bundles, Membership/retainer, Corporate & events contracts |

| Customer Type | Individual clients, Bridal/couples & parties, Corporate/production sets, Hospitality & VIP services |

| Consultation Mode | In-person, Virtual |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harrods Beauty Concierge, Selfridges Beauty Concierge, Sephora Beauty Services, Nordstrom Beauty Stylists, Saks Fifth Avenue Beauty, Glam squad, Urban Company Beauty, Blow LTD, PRIV, Style Bee |

| Additional Attributes | Dollar sales by service type and delivery setting, adoption trends in at-home and virtual concierge services, rising demand for app-based booking channels, sector-specific growth in weddings, hospitality, and corporate events, digital-first and membership-based revenue segmentation, integration with AI-driven personalization, AR/VR consultations, and influencer-led engagement, regional trends influenced by retail innovation and luxury hospitality partnerships. |

The Global Beauty Concierge Services Market is estimated to be valued at USD 6,879.3 million in 2025.

The market size for the Global Beauty Concierge Services Market is projected to reach USD 18,741.5 million by 2035.

The Global Beauty Concierge Services Market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key service types in the Global Beauty Concierge Services Market are at-home hair & makeup, skincare/facial & lash/brow services, personal shopping concierge, bridal/event packages, and aesthetics coordination.

In terms of delivery, the in-home/on-site segment is expected to command a 64.2% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA