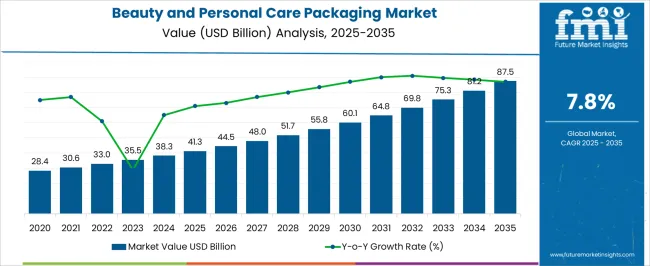

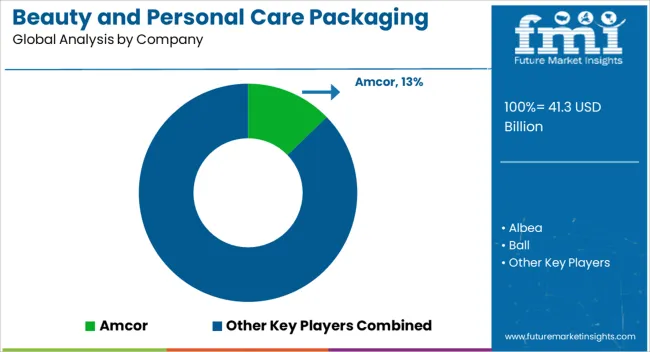

The beauty and personal care packaging market is expected to grow from USD 41.3 billion in 2025 to USD 87.5 billion by 2035, representing a CAGR of 7.8%. A growth contribution index analysis highlights the relative impact of key segments, regions, and innovations on overall market expansion. Between 2025 and 2030, the market rises from USD 41.3 billion to USD 60.1 billion, with significant contributions from premium skincare and cosmetics packaging, particularly glass and recyclable materials.

Innovations in sustainable, lightweight, and aesthetically appealing packaging solutions account for a substantial portion of growth, while expanding e-commerce channels amplify demand for protective and functional packaging. Asia-Pacific, led by China, India, and Southeast Asia, contributes heavily to volume growth, driven by rising disposable income and increasing penetration of international beauty brands. From 2030 to 2035, the market further accelerates from USD 60.1 billion to USD 87.5 billion, reflecting continued adoption of smart packaging technologies, airless pumps, refillable formats, and luxury packaging designs. North America and Europe remain strong in value terms due to premium brand consumption and regulatory incentives for sustainable materials. Overall, the growth contribution index indicates that product innovation accounts for nearly 40–45% of market expansion, regional volume growth accounts for 30–35%, and channel expansion accounts for 20–25%, highlighting a well-distributed set of growth drivers.

| Metric | Value |

|---|---|

| Beauty and Personal Care Packaging Market Estimated Value in (2025 E) | USD 41.3 billion |

| Beauty and Personal Care Packaging Market Forecast Value in (2035 F) | USD 87.5 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The beauty and personal care packaging market is primarily driven by the cosmetics and personal care products market, which accounts for approximately 40–45% of total demand, as skincare, haircare, and makeup products require functional, attractive, and protective packaging solutions. The perfume and fragrance market contributes around 20–22%, reflecting demand for premium, decorative, and secure packaging for bottles, sprays, and gift sets. The sustainable packaging market holds roughly 15–17%, driven by the adoption of recyclable, biodegradable, and refillable packaging solutions to meet increasing consumer and regulatory sustainability requirements. The e-commerce and retail distribution market contributes approximately 10–12%, as growing online and offline sales require packaging that ensures product safety, shelf appeal, and brand differentiation. Lastly, the plastic, glass, and metal packaging materials market accounts for 5–6%, supporting the supply of bottles, jars, tubes, caps, and closures necessary for the industry. Collectively, these parent markets define the operational, technological, and material ecosystem of the beauty and personal care packaging market, enabling manufacturers, brands, and distributors to deliver safe, appealing, and sustainable packaging solutions across global cosmetic, fragrance, and personal care segments.

The beauty and personal care packaging market is witnessing robust growth, underpinned by rising global consumption of cosmetics, skincare, and personal grooming products. Increasing disposable incomes, urbanization, and evolving lifestyle trends are stimulating demand for premium and sustainable packaging solutions. The market is benefiting from advancements in material science, enabling the development of lightweight, durable, and aesthetically appealing formats.

Regulatory emphasis on eco-friendly materials and recyclable solutions is influencing product innovation, prompting manufacturers to adopt bio-based and post-consumer recycled inputs. Brand differentiation strategies are increasingly centered around unique packaging designs, advanced printing technologies, and functional dispensing systems, enhancing consumer experience and loyalty.

Digital commerce expansion is further accelerating demand for packaging that ensures product protection during transit while maintaining visual appeal Over the forecast period, the sector is expected to capitalize on premiumization trends, growth in emerging markets, and continued investment in sustainable manufacturing practices, ensuring a steady trajectory of revenue expansion and competitive positioning across global regions.

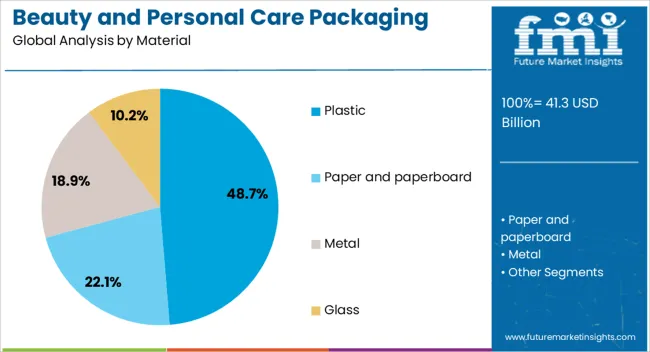

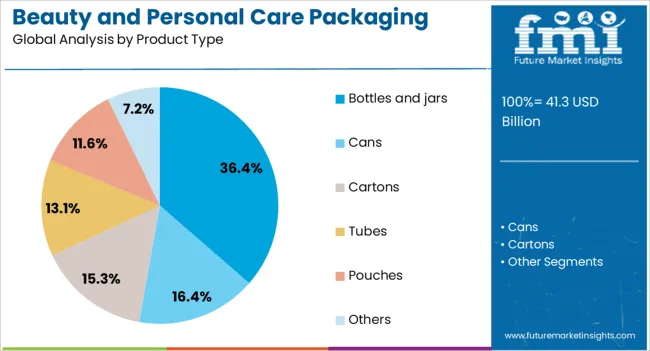

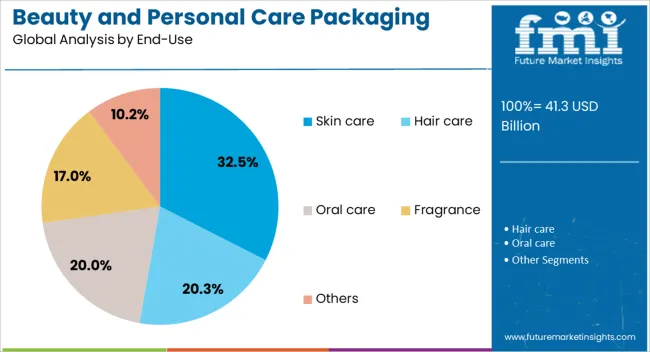

The beauty and personal care packaging market is segmented by material, product type, end-use, and geographic regions. By material, beauty and personal care packaging market is divided into Plastic, Paper and paperboard, Metal, and Glass. In terms of product type, beauty and personal care packaging market is classified into Bottles and jars, Cans, Cartons, Tubes, Pouches, and Others. Based on end-use, beauty and personal care packaging market is segmented into Skin care, Hair care, Oral care, Fragrance, and Others. Regionally, the beauty and personal care packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment, accounting for 48.7% of the material category, continues to dominate due to its versatility, cost efficiency, and adaptability to a wide range of packaging formats. Its extensive use is supported by high production scalability, lightweight properties, and design flexibility that accommodates intricate shapes and branding requirements.

Technological innovations in resin formulation and processing have improved durability, barrier properties, and sustainability credentials through increased recyclability. The segment benefits from strong penetration in both mass-market and premium product lines, aided by compatibility with advanced decoration techniques such as embossing, labeling, and digital printing.

While regulatory pressures and consumer demand for eco-friendly alternatives are prompting shifts toward biodegradable and recycled plastics, the established infrastructure for plastic packaging production and distribution ensures its continued prominence Strategic initiatives by manufacturers to integrate post-consumer recycled content and reduce environmental impact are expected to sustain the segment’s leading position over the forecast period.

Bottles and jars, holding 36.4% of the product type category, lead the market due to their widespread application across skincare, haircare, fragrance, and cosmetic products. Their dominance is supported by robust consumer preference for convenient, durable, and visually appealing containers that preserve product integrity. The segment benefits from versatility in design, allowing for customization in size, shape, and dispensing mechanisms to suit diverse formulations.

Advancements in manufacturing technologies, such as blow molding and injection molding, have enhanced production efficiency and enabled cost-effective scalability. Additionally, the integration of eco-friendly materials and refillable designs is gaining traction, aligning with sustainability trends and regulatory expectations.

Premium branding opportunities are further enhanced through the use of decorative finishes, transparent windows, and innovative closures, driving brand differentiation Continued growth in e-commerce and travel retail is expected to further boost demand for bottles and jars, given their ability to combine functionality with strong shelf appeal.

The skin care segment, representing 32.5% of the end-use category, maintains its leadership position due to sustained consumer investment in anti-aging, hydration, and protection-oriented products. Rising awareness of personal wellness, combined with the influence of social media and beauty influencers, has bolstered product launches and packaging innovation in this category. The segment benefits from frequent product replenishment cycles, premium positioning opportunities, and high packaging-to-product value ratios.

Packaging for skin care emphasizes aesthetic appeal, product protection, and controlled dispensing to enhance user experience and extend shelf life. Manufacturers are increasingly adopting airless pumps, UV-protective coatings, and recyclable materials to address both performance and sustainability requirements.

The proliferation of serums, creams, and lotions in varying formats has expanded the scope for innovative packaging designs, driving market differentiation As skincare routines become more elaborate and consumer demand for personalized solutions rises, the segment is expected to sustain steady growth, reinforcing its dominant role in the overall beauty and personal care packaging market.

Rising e-commerce and direct-to-consumer sales are driving innovation in beauty and personal care packaging, as brands seek formats that protect products, enhance convenience, and improve user experience. Skincare bottles, cosmetic compacts, haircare dispensers, and hygiene containers require precise filling, durable closures, and attractive designs to maintain product integrity during shipping and handling. Portability and ease-of-use are increasingly critical for travel-size products and on-the-go consumers. Premium finishes, ergonomic designs, and visually appealing packaging help boost brand recognition and attract customers in competitive retail and online environments.

Consumers are increasingly demanding packaging that combines functionality with visual appeal, influencing the design of bottles, jars, tubes, and dispensers across skincare, cosmetics, haircare, and personal hygiene segments. Key priorities include product protection, precise dispensing, ease of handling, and maintaining formulation stability. Compact, travel-friendly, and easy-to-open designs are gaining prominence as consumers seek convenience and portability. Rising awareness of premium experiences, social media influence, and unboxing aesthetics are accelerating adoption of innovative finishes, closures, and labeling formats. Brands also focus on minimizing product wastage and improving shelf visibility. Suppliers delivering high-quality, ergonomically designed packaging with technical support, customization options, and consistent production capabilities are best positioned to meet these evolving consumer expectations while enabling manufacturers to strengthen brand loyalty, product differentiation, and market share.

High raw material costs, including glass, plastics, aluminum, and specialty polymers, are major constraints for beauty and personal care packaging manufacturers. Production requires precise technologies, impacting capital and operational expenditure. Regulatory compliance for labeling, safety, and product compatibility adds complexity, particularly for products in direct contact with skin or oral care applications. Technical challenges include maintaining barrier properties, preventing chemical interactions, ensuring consistent fill volumes, and producing lightweight yet durable containers. Supply chain disruptions, seasonal demand spikes, and variable material quality can affect timelines and production efficiency. Buyers increasingly seek suppliers with certified materials, quality assurance processes, design support, and reliable delivery schedules to ensure operational consistency, product safety, and regulatory compliance while minimizing risk of damage, spoilage, or consumer dissatisfaction.

Smart packaging solutions, such as QR codes, NFC/RFID tags, and interactive labels, offer brands ways to engage consumers, communicate product information, and improve traceability. Modular and refillable packaging systems provide convenience, personalization, and cost-effective options for premium segments. Enhanced finishes, ergonomic closures, and innovative dispensing mechanisms boost usability and product perception. Rapid growth in Asia-Pacific, North America, and Europe, fueled by rising disposable incomes and increasing cosmetic consumption, is expanding adoption. Suppliers offering design services, technical guidance, and end-to-end packaging solutions with turnkey support are best positioned to capitalize on these opportunities. Collaboration with brands, contract manufacturers, and retailers strengthens product innovation, market reach, and brand differentiation, ensuring packaging solutions meet both functional and aesthetic demands globally.

Pump dispensers, airless bottles, and easy-open closures are increasingly used across skincare, haircare, cosmetics, and hygiene products. Ergonomic shapes, high-gloss or matte finishes, and visually appealing textures are helping brands create premium experiences while maintaining product protection. Travel-friendly and multipurpose designs are gaining popularity for consumers seeking convenience without compromising performance. Integration with automated filling lines and advanced quality monitoring improves production efficiency and reduces defects. Suppliers offering application-ready packaging solutions, design flexibility, and technical support are best positioned to meet evolving demands, enabling beauty and personal care brands to deliver convenience, aesthetics, and durability across competitive global markets.

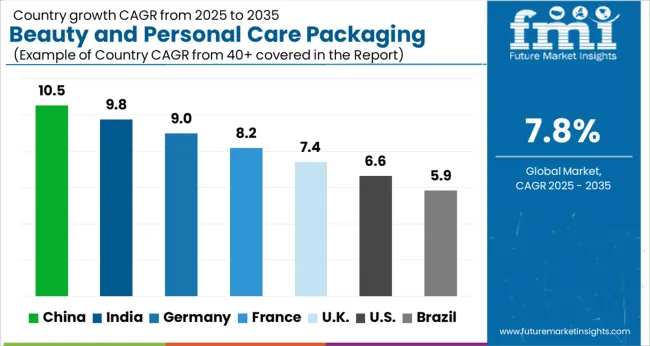

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

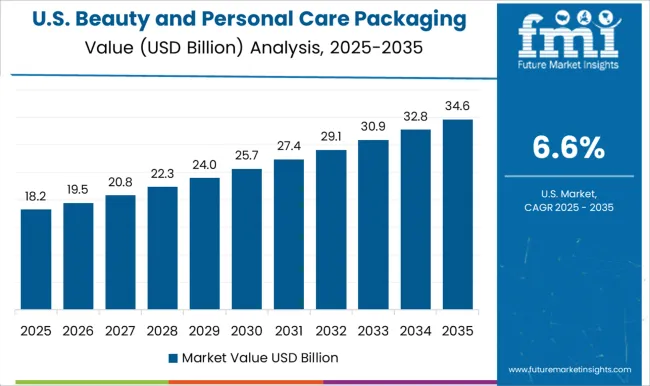

| USA | 6.6% |

| Brazil | 5.9% |

The global beauty and personal care packaging market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads at 10.5%, followed by India at 9.8%, Germany at 9.0%, the UK at 7.4%, and the USA at 6.6%. Growth is fueled by premiumization, urbanization, e-commerce expansion, and rising consumer awareness. Innovative, durable, and functional packaging formats, including airless pumps, jars, and refillable containers, are gaining adoption. Automation, digital printing, and collaborations with international technology providers enhance operational efficiency, design, and material performance. Increasing demand for aesthetically appealing, safe, and travel-friendly solutions supports market growth globally. The analysis covers over 40 countries, with the leading markets shown below.

The beauty and personal care packaging market in China is projected to grow at a CAGR of 10.5% from 2025 to 2035, driven by rising consumer awareness, e-commerce expansion, and premiumization trends. Demand for innovative, aesthetically appealing, and sustainable packaging formats such as airless pumps, jars, and refillable containers is increasing. Domestic manufacturers are investing in automation, digital printing, and high-precision molding technologies to improve product presentation, durability, and differentiation. Collaborations with international technology providers support design innovation and advanced material adoption. The rise of influencer marketing, online beauty communities, and cross-border e-commerce platforms is further fueling market penetration. Personalization and travel-friendly packaging formats also enhance consumer appeal, creating new revenue streams for manufacturers.

India is expected to grow at a CAGR of 9.8% from 2025 to 2035, fueled by rising disposable incomes, growing beauty and personal care consumption, and expansion of urban retail. Increasing adoption of innovative packaging formats such as tubes, jars, bottles, and eco-friendly containers is observed across skincare, haircare, and color cosmetics products. Domestic manufacturers are investing in high-quality injection molding, blow molding, and digital decoration to meet rising demand for premium and functional packaging. Industrial hubs in Mumbai, Delhi, and Bengaluru support rapid production and distribution. E-commerce platforms, beauty subscription boxes, and modern trade are driving accessibility and adoption. Growing awareness about product safety, hygiene, and aesthetic appeal is encouraging brands to upgrade packaging designs. Collaborations with international packaging technology providers enable Indian companies to enhance durability, design versatility, and material innovation.

Germany’s market is projected to grow at a CAGR of 9.0% from 2025 to 2035, supported by a strong cosmetics and personal care industry focused on premium, eco-friendly, and innovative packaging. Demand for refillable, lightweight, and recyclable packaging formats is rising. Manufacturers are investing in automation, high-precision molding, and advanced labeling technologies to improve product presentation and compliance with EU regulations. Industrial clusters in Bavaria, Baden-Württemberg, and North Rhine-Westphalia provide strong production capacity, R&D, and after-sales services. Collaboration with international design and packaging firms enhances product differentiation and brand identity. Growth is fueled by beauty trends, high consumer expectations for aesthetics and usability, and e-commerce expansion. Multi-purpose packaging, smart dispensers, and travel-friendly solutions are gaining traction, particularly in luxury skincare, color cosmetics, and personal hygiene segments.

The UK market is expected to grow at a CAGR of 7.4% from 2025 to 2035, driven by rising demand for aesthetically appealing, hygienic, and innovative packaging for skincare, haircare, and personal hygiene products. Brands are investing in lightweight, functional, and sustainable materials, alongside automation in molding, filling, and labeling. Industrial clusters in London, Manchester, and Birmingham support production and distribution. E-commerce and subscription-based beauty services enhance consumer access to new packaging formats. Increasing consumer focus on product safety, usability, and design aesthetics encourages manufacturers to adopt advanced techniques such as digital printing, airless pumps, and smart dispensers. Partnerships with global packaging technology providers improve material performance, operational efficiency, and innovation capabilities.

The USA market is projected to grow at a CAGR of 6.6% from 2025 to 2035, supported by strong demand for premium, personalized, and functional packaging in skincare, haircare, and cosmetics. Manufacturers focus on airless pumps, jars, and multi-layer packaging with precise labeling and digital decoration. Industrial hubs in California, New York, and Texas facilitate rapid production and distribution. E-commerce, direct-to-consumer platforms, and beauty subscription boxes accelerate adoption of innovative packaging formats. Increasing consumer preference for hygiene, safety, and sustainable options encourages manufacturers to integrate lightweight, durable, and travel-friendly packaging solutions. Collaborations with international technology providers support design innovation, advanced material usage, and production efficiency. Rising trends in personalization, premium branding, and multi-functional packaging are expected to drive steady market growth.

The beauty and personal care packaging market is driven by rising consumer demand for premium, innovative, and visually appealing packaging that enhances product experience and shelf presence. Packaging solutions include bottles, jars, tubes, pumps, airless systems, closures, and secondary cartons, catering to cosmetics, skincare, haircare, and fragrance segments. Growth is fueled by e-commerce expansion, personalized beauty trends, and the need for functional, durable, and convenient packaging. Design aesthetics, ease of use, and protection of sensitive formulations remain key decision factors for manufacturers and brand owners. Competition is defined by material innovation, design flexibility, regulatory compliance, and speed to market. Amcor, Albea, and Berry Global lead with high-quality polymer, glass, and hybrid packaging systems designed for premium beauty products. Ball, Crown, and Rieke Packaging differentiate with metal packaging solutions, emphasizing durability, aesthetics, and printability. Flexible packaging players such as Constantia Flexibles, Coveris, and DS Smith compete with laminated tubes, sachets, and pouches optimized for brand differentiation and lightweight performance. Gerresheimer, Greiner Packaging, and HCP Packaging focus on precision molding, airless pumps, and complex closures for sensitive formulations. Regional and niche players including Huhtamaki, International Paper, Mondi, Quadpack, Silgan, Smurfit Kappa, Sonoco, Stora Enso, and WestRock provide paperboard, carton, and innovative packaging solutions tailored to client specifications. Strategies emphasize material innovation, modularity, and multi-layer barrier technologies. Lightweighting, refillable designs, and anti-counterfeiting features are prioritized. Product brochures highlight container type, material composition, volume, compatibility with cosmetics or personal care formulations, closure and dispensing mechanisms, and customization options. Printing and finishing options, durability, and transport performance are detailed. Additional content includes recommended handling, storage guidelines, and packaging lifecycle information. Marketing emphasizes visual appeal, functional performance, and compliance with regional packaging regulations, reflecting a market focused on innovation, efficiency, and enhanced consumer experience.

| Item | Value |

|---|---|

| Quantitative Units | USD 41.3 Billion |

| Material | Plastic, Paper and paperboard, Metal, and Glass |

| Product Type | Bottles and jars, Cans, Cartons, Tubes, Pouches, and Others |

| End-Use | Skin care, Hair care, Oral care, Fragrance, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Albea, Ball, Berry Global, Constantia Flexibles, Coveris, Crown, DS Smith, EPL, Gerresheimer, Graphic Packaging, Greiner Packaging, HCP Packaging, Huhtamaki, International Paper, Mondi, Quadpack, Rieke Packaging, Silgan, Smurfit Kappa, Sonoco, Stora Enso, and WestRock |

| Additional Attributes | Dollar sales by packaging type (bottles, jars, tubes, closures, pumps), material type (plastic, glass, metal, fiber-based), and end-use (skincare, haircare, cosmetics, fragrances). Demand is driven by growing beauty and personal care consumption, sustainability trends, and premiumization of products. Regional trends show strong growth in North America and Europe due to mature markets and brand-driven demand, while Asia-Pacific exhibits rapid expansion fueled by rising disposable income, urbanization, and increasing adoption of premium beauty products. |

The global beauty and personal care packaging market is estimated to be valued at USD 41.3 billion in 2025.

The market size for the beauty and personal care packaging market is projected to reach USD 87.5 billion by 2035.

The beauty and personal care packaging market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in beauty and personal care packaging market are plastic, paper and paperboard, metal and glass.

In terms of product type, bottles and jars segment to command 36.4% share in the beauty and personal care packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA