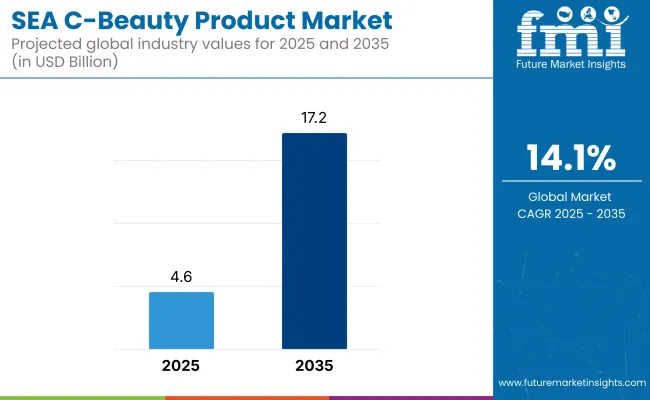

The SEA C-beauty product market is projected to reach from USD 4.6 billion in 2025 to approximately USD 17.2 billion by 2035, registering a CAGR of 14.1%. Sales in 2024 were recorded at USD 4.1 billion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.6 billion |

| Industry Value (2035F) | USD 17.2 billion |

| CAGR (2025 to 2035) | 3.2% |

Growth in the Chinese beauty products market is being driven by rising demand for personalized and functional skincare, the emergence of scene-based product usage, and greater integration of technology in retail. Consumer interest is also increasing in beauty equipment and men's grooming items. Shifting preferences and evolving market dynamics continue to influence product development and purchasing behavior across the sector.

The SEA C- beauty product market accounts for approximately 40% of the cosmetics and toiletries market, driven by consistent demand for skincare, facial care, and color cosmetics. It holds a 30% share of the personal care market, as daily grooming and hygiene products increasingly include beauty-enhancing features.

Around 25% of the luxury goods market is linked to beauty products, supported by premium skincare and fragrance sales across tier 1 and tier 2 cities. The market contributes about 20% to the health and wellness market, where functional and clean-label beauty solutions are influencing consumer choices. In the consumer goods market, it holds a 10% share due to its presence in packaged retail products sold through both online and offline distribution platforms in China.

The SEA C-beauty product market is projected to grow from USD 4.6 billion in 2025 to USD 17.2 billion by 2035, creating an absolute dollar opportunity of USD 12.6 billion. This translates to a 274% expansion over ten years, driven by the mainstreaming of Chinese-origin formulations, the cultural revalidation of traditional ingredients, and increasing adoption across Southeast Asia, Europe, and North America. The CAGR of 14.1% reflects accelerated global interest in skin microbiome compatibility, hyper-personalized skincare routines, and science-backed botanicals.

By 2030, the market is expected to reach nearly USD 8.8 billion, suggesting that about USD 4.2 billion in new value will be created in the first half of the decade. The remaining USD 8.4 billion, or 67% of the absolute opportunity, is projected for the second half, indicating increasing brand acceptance and stronger retail penetration through international collaborations and digital-first marketing strategies.

Leading players such as Perfect Diary and Proya have been scaling cross-border distribution through curated social commerce models, while smaller labels are entering dermocosmetic sub-segments via biotech R&D partnerships. This market’s long-term outlook remains structurally sound, as consumer fatigue from overengineered Western skincare formats continues to be replaced by demand for locally resonant, clinically tested, and culturally adaptable beauty solutions.

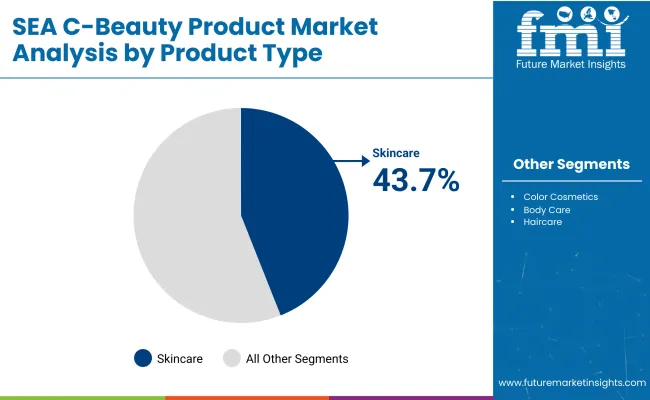

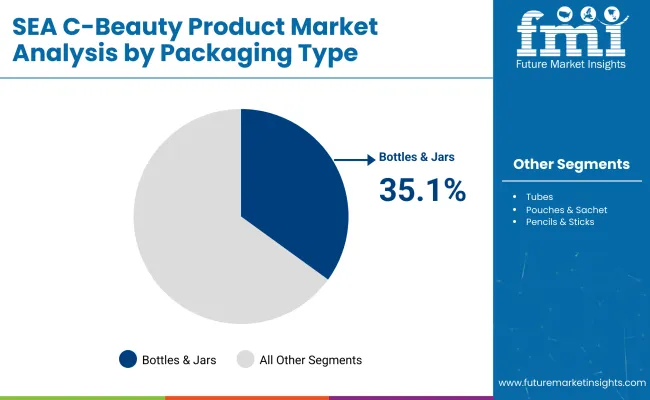

Facial skincare is expected to hold 43.7% of the total C-beauty market in SEA in 2025. Bottles and jars are projected to lead packaging types with a 35.1% share, while herbal or TCM-based products will make up 28.5%. Offline retail remains dominant, contributing 61.3% of overall revenue.

Facial skincare will account for 43.7% of total market value in 2025, driven by skin whitening, acne control, and hydration needs in humid climates. Pechoin, Herborist, and Biohyalux continue to adapt their product lines to Southeast Asian skin types and affordability thresholds. Pechoin’s creams priced below USD 10 have found success in Malaysia and Thailand. Herborist has optimized its whitening and oil-control formulations for Indonesia’s tropical environment. Biohyalux’s serums with hyaluronic acid appeal to Singapore’s urban middle-income segment.

Bottles and jars will contribute 35.1% of the total packaging share in 2025 across SEA, reflecting user demand for durable, easy-to-store containers suited for creams, essences, and facial oils. One Leaf’s pipette-based bottles and Chando’s temperature-stable jars are widely distributed in Malaysia and Singapore. Glass jars enhance brand perception in the anti-aging segment, while squeezable and dropper bottles enable controlled use of lightweight serums.

Offline retail formats are projected to contribute 61.3% of market value by 2025 due to consumer trust in product trials, in-store promotions, and advisor support. Physical stores in Vietnam, Indonesia, and Thailand serve as discovery platforms for C-beauty brands. Pechoin’s mall activations in Vietnam and Judydoll’s counter partnerships in Thailand are contributing to higher trial-to-purchase conversions. Department store visibility continues to influence sales for mid and premium skincare ranges.

Herbal and Traditional Chinese Medicine-based products will generate 28.5% of SEA C-beauty market value in 2025, supported by demand for ginseng, goji berry, and licorice root among natural product users. Pechoin and Herborist use ancestral ingredients to position their formulas as skin-safe and affordable. In Thailand, Yunnan Baiyao’s herbal line is retailed through traditional clinics and wellness stores. These products are especially accepted by Buddhist and Muslim consumers seeking clean-label alternatives.

Demand for Chinese beauty brands across Southeast Asia has surged as digital-native consumers favor affordable, trendy and culturally resonant products. Colour cosmetics and skincare items from bbeauty brands are rapidly gaining share via ecommerce platforms and social commerce channels.

Country-Specific Brand Penetration and Consumer Trends

Indonesia has witnessed growth in mass colour brands such as O.TWO.O and Focallure capturing nearly 16% of lip and eye makeup sales in 2024. Products priced between USD 2 and 6 align well with Indonesian Gen Z preferences, where over two-thirds of young buyers spend under USD 6 per beauty item.

Thailand’s young consumers are favoring skincare formats leaning into clean aesthetic and ingredient-led claims, while Malaysia’s urban markets are increasingly adopting halal-compliant Chinese beauty products alongside mainstream local brands. Vietnam shows stronger demand for affordable facial makeup and remover formats, while Singapore features premium positioning with rising interest in heritage-inspired C-beauty brands.

Digital Commerce Strategies and Operational Execution

Chinese brands have leveraged livestream commerce on platforms like Shopee, TikTok Shop and Lazada across Southeast Asia, accounting for over half of product sales volume in marketplaces. Many brands use customer-to-manufacturer (C2M) models to customize SKUs based on local trends rapidly. Bulk SKU deployment exceeding 200 per country store supports trend responsiveness.

Influencer collaborations in each country amplify product awareness within days of launch. Some firms have established local production facilities in Thailand, Indonesia and Malaysia to reduce costs and improve regional responsiveness. Brands that mask overt Chinese origin and focus on regional aesthetics, like Skintific and SACELADY, have gained traction by appealing to local preferences without cultural friction.

Market Entry Barriers and Consumer Trust Constraints

Challenges include regulatory certification complexity, such as halal validation in Indonesia and Malaysia, which delays product rollout by weeks. Quality consistency and product claims vary across batches, resulting in up to 4% refund or review-triggered returns in some markets. Consumer loyalty remains fragile, as many SEA buyers switch between brands driven by price promotions rather than brand trust.

Patent infringement issues have emerged, especially in partnerships across Vietnam and Thailand, complicating licensing and brand reputation. Smaller local retailers often lack supply chain resilience when cross-border stock delays exceed 3 weeks. Brand longevity depends on deeper emotional storytelling and sustained influencer alignment rather than promotional spikes alone.

Competitive Landscape and Strategic Differentiation

Major Cbeauty entrants include Perfect Diary, Judydoll, Florasis, Focallure and Colorkey. Perfect Diary focuses on seasonal collection drops that match SEA festival trends with influencer seeding in each market. Florasis leverages guócháo (Chinachic) packaging stories adapted into limited-edition lines targeting high-income shoppers in Singapore and Vietnam.

Skintific and Y.O.U have emphasized science-led formulations paired with local influencer campaigns, subtly distancing from Chinese origin identity. SACELADY executes price parity with product innovation, trading on compact skincare kits tailored for Muslim consumers needing halal-certified formats. Local giants like Wardah (Indonesia), Mistine (Thailand) and ESQA have responded by introducing premium lines and botanical-based variants to offset Chinese brand momentum via premiumization strategies.

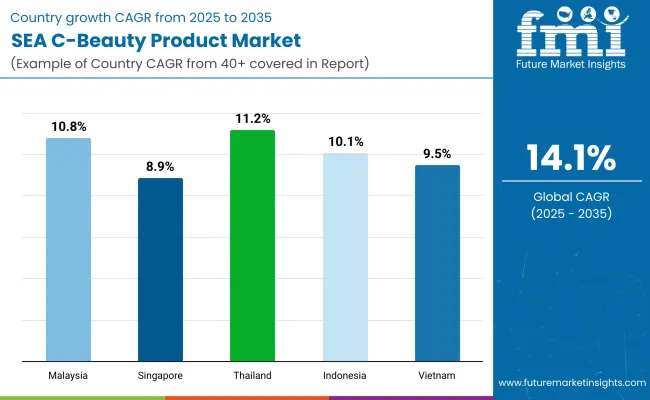

The Southeast Asia C-beauty product market is projected to grow at a CAGR of 14.1% from 2025 to 2035, driven by shifts in retail formats, local influencer marketing, and cross-border e-commerce flows. Among ASEAN countries, Thailand posts 11.2%, underperforming the global rate by 2.9 percentage points, with interest concentrated in skin-whitening serums and minimalist facial care kits.

Malaysia records 10.8%, supported by a growing Gen Z user base and increasing presence of Chinese brands through halal-compliant product lines. Indonesia follows at 10.1%, where KOL-driven skincare trends and mobile-first shopping behavior shape demand. Vietnam registers 9.5%, reflecting modest adoption of acne solutions and herbal-based cleansers.

Singapore trails with 8.9%, driven by niche dermatology brands and urban consumers seeking clinically-formulated offerings. While none of the five ASEAN countries match the global growth rate, demand is expected to strengthen as cross-border logistics improve and Chinese C-beauty labels scale localized branding strategies.

The C-beauty market in Malaysia expanded at a CAGR of 10.8% between 2025 and 2035, driven by increasing interest in tone-up bases, halal skincare, and Chinese product aesthetics. Approximately 45% of cosmetics purchases were influenced by short-form video platforms and livestream selling. Halal-certified Chinese brands were localized through Bahasa packaging and ingredient transparency, accelerating their placement in pharmacy retail chains. SPF-enhanced moisturizers, brightening bases, and acne solutions were among the highest-performing SKUs.

The C-beauty product industry in Singapore recorded a CAGR of 8.9% between 2025 and 2035, with functional skincare, scientific formulations, and INCI-labeled ingredients dominating consumer choices. High adoption of cosmeceuticals and wellness-infused products created a market for dermatologically tested Chinese brands, especially those with TCM-backed ingredients. Over 50% of beauty sales in 2025 were processed online, with multibrand retailers and luxury pharmacies allocating shelf space to clinically tested Chinese serums, cleansers, and overnight masks.

The C-beauty products in Thailand grew at a CAGR of 11.2% between 2025 and 2035, with traction driven by multi-step skincare and tone-up creams. Chinese brands adapted shade palettes for Thai complexions and offered skin-brightening products compatible with high humidity. Limited edition makeup and influencer-curated skincare launches were introduced via livestream sales. Flash sales and exclusive drops became common during promotional weeks, helping maintain high turnover and repurchase rates.

The C-beauty market in Indonesia maintained a CAGR of 10.1% from 2025 to 2035, with demand led by affordability, halal labeling, and digital-first selling strategies. Over 60% of young female consumers used Chinese cosmetics, with TikTok Shop and Shopee as primary purchase platforms. Chinese brands introduced starter kits, acne-clearing formulas, and lip tints priced below IDR 70,000 to meet the expectations of middle-income buyers. Resellers imported Bahasa-labeled units while aligning with local packaging standards.

The C-beauty product demand in Vietnam reached a CAGR of 9.5% between 2025 and 2035, with growth linked to low-fragrance serums, whitening creams, and budget-friendly skincare kits. Livestream commerce and visual tutorials led by Vietnamese content creators were core purchase triggers. Price-conscious consumers under 35 preferred skin-enhancing products under USD 10, particularly when presented through social proof. White-label partnerships and e-commerce integration allowed over 50 Chinese brands to enter the Vietnamese market in 2025.

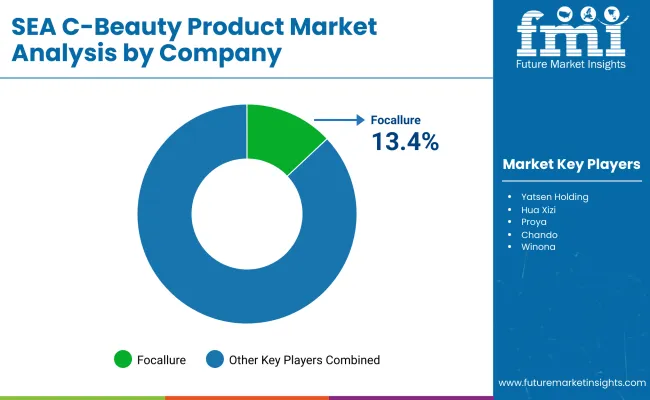

The market in Southeast Asia has attracted both established brands and emerging entrants. Companies like Focallure and Colorkey have expanded aggressively through social media campaigns and exclusive online collaborations. Yatsen Holding, the parent of Perfect Diary, has prioritized influencer-driven marketing and diversified product ranges tailored to Southeast Asian preferences.

Hua Xizi and Winona have emphasized traditional Chinese medicine-based formulations to differentiate their offerings. Proya and Chando are advancing through regional partnerships and localized product development, while Marie Dalgar and Maogeping Beauty are targeting niche segments such as artistic makeup.

ZEESEA and Venus Skin are focusing on e-commerce distribution, whereas INOHERB and YUE-SAI rely on herbal-based ingredients to cater to demand for mild formulations. Entry barriers remain moderate due to rising brand saturation, regulatory differences between countries, and reliance on cross-border logistics. Local consumer preferences and the dominance of regional e-commerce platforms also present strategic and operational challenges for new market entrants.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.6 billion |

| Projected Market Size (2035) | USD 17.2 billion |

| CAGR (2025 to 2035) | 14.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for volume |

| Product Types Analyzed (Segment 1) | Facial Skincare (Moisturizers, Cleansers, Face Masks, Serums & Essences, Toners), Color Cosmetics (Lipsticks, Foundations, Eye Makeup, Blushers), Body Care (Lotions, Washes, Scrubs), Haircare (Shampoo, Masks, Scalp Treatments), Fragrances (EDT, EDP, Mists), Men’s Grooming (Face Wash, Beard Oils, Multi-use Skincare) |

| Packaging Types Analyzed (Segment 2) | Bottles & Jars, Tubes, Pouches & Sachets, Pencils & Sticks, Others (Pump Dispensers, Spray Bottles, Compacts, Roll-ons) segmented by volume (ml/g) range |

| Sales Channels (Segment 3) | Online Channels (E-Commerce, Brand Websites), Offline Channels (Department Stores, Drugstores, Beauty Specialty Stores, Hypermarkets, Pop-up Stores) |

| Ingredient Types (Segment 4) | Herbal / TCM, Plant-Based Extracts, Synthetic Actives, Functional Ingredients (HA, Peptides, Retinol), Fermented Ingredients, Marine-based Ingredients |

| Regions Covered | Southeast Asia |

| Countries Covered | Malaysia, Singapore, Thailand, Indonesia, Vietnam |

| Key Players Influencing the Market | Focallure, Yatsen Holding, Hua Xizi, Proya, Chando, Winona, Shanghai Jahwa, Marie Dalgar, INOHERB, YUE-SAI, Colorkey, ZEESEA, Venus Skin, Maogeping Beauty |

| Additional Attributes | Dollar sales by C b eauty product types (skincare, color cosmetics, hair care) and applications (clean/halal beauty, dermocosmetics, affordable luxury), demand driven by Gen Z digital shoppers, regional trends led by Indonesia and Vietnam with SEA catching up, innovation in ingredient-led clean formulations, halal-certified offerings, and influencer driven social commerce, and environmental impact via sustainable packaging, ingredient transparency, and reduced waste in fast turnover products. |

The market is projected to reach USD 17.2 billion by 2035, growing from USD 4.6 billion in 2025.

A CAGR of 14.1% is expected over the forecast period.

Skincare is set to dominate with a 43.7% market share in 2025.

Bottles and jars will contribute 35.1% of the packaging market in 2025.

Yatsen Holding, parent of Perfect Diary, leads through influencer campaigns and regional product adaptation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Sealing & Strapping Packaging Tape Market Size and Share Forecast Outlook 2025 to 2035

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Seaport Security Management Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Extracts Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Allergy Market Size and Share Forecast Outlook 2025 to 2035

Seaweed-Based Anti-Aging Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Seasoning Market Size and Share Forecast Outlook 2025 to 2035

Seating And Positioning Belts Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Takeout Market Size and Share Forecast Outlook 2025 to 2035

Sealed Wax Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seasonal Influenza Vaccines Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA