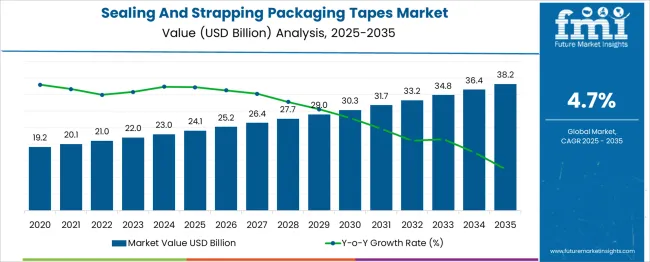

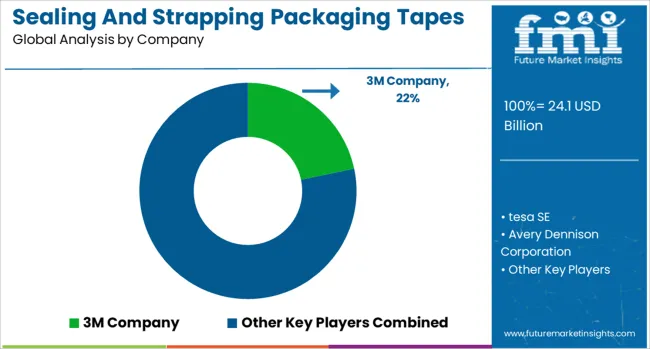

The Sealing And Strapping Packaging Tapes Market is estimated to be valued at USD 24.1 billion in 2025 and is projected to reach USD 38.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Sealing And Strapping Packaging Tapes Market Estimated Value in (2025 E) | USD 24.1 billion |

| Sealing And Strapping Packaging Tapes Market Forecast Value in (2035 F) | USD 38.2 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The sealing and strapping packaging tapes market is experiencing consistent growth, driven by rising global trade volumes, expanding e-commerce activity, and the increasing emphasis on secure and efficient product handling. The demand for reliable packaging materials has intensified across industries, prompting manufacturers to develop innovative tapes that offer durability, tamper resistance, and sustainability.

Regulatory and consumer pressure to reduce plastic use has also accelerated the shift toward eco-friendly tape materials and adhesives. As supply chain resilience becomes a top priority, packaging tapes play a critical role in maintaining product integrity during transit and storage.

With automation in packaging lines gaining traction, demand for tapes that are compatible with high-speed dispensers and automated systems continues to rise. Looking ahead, the market is projected to expand steadily as businesses invest in advanced packaging solutions that align with sustainability, performance, and cost-efficiency goals.

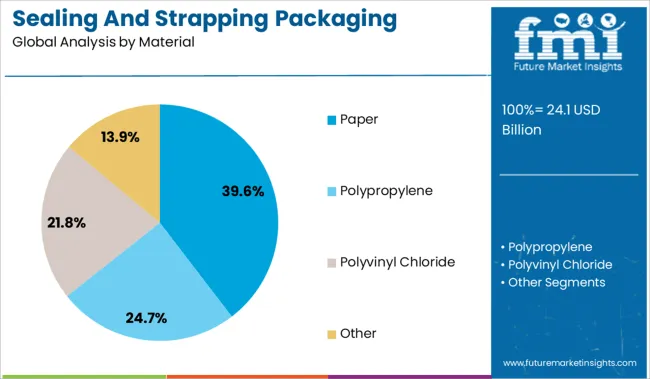

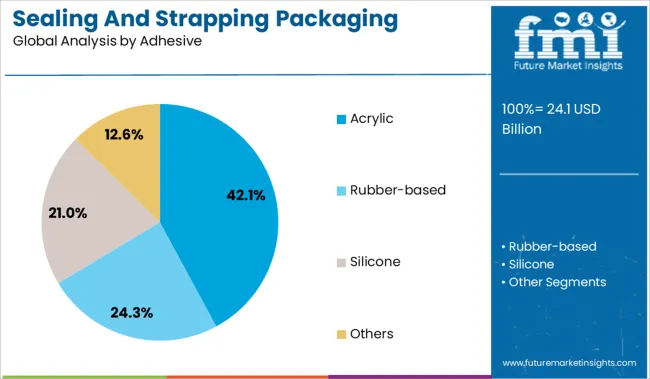

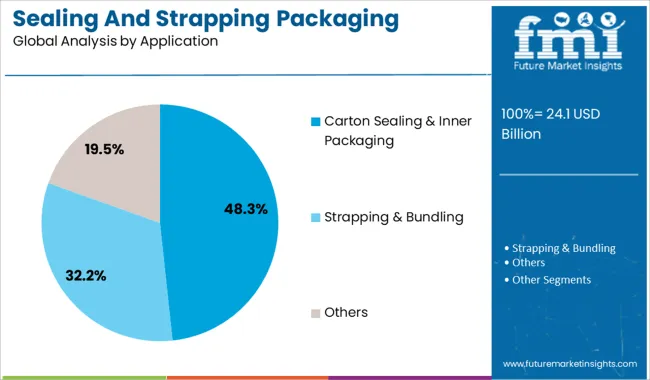

The sealing and strapping packaging tapes market is segmented by material, adhesive, and application and geographic regions. The market for sealing and strapping packaging tapes is divided by material into Paper, Polypropylene, Polyvinyl Chloride, and Other. In terms of adhesive, the sealing and strapping packaging tapes market is classified into Acrylic, Rubber-based, Silicone, and Others. Based on the application of the sealing and strapping packaging tapes, the market is segmented into Carton Sealing & Inner Packaging, Strapping & Bundling, and Others. Regionally, the sealing and strapping packaging tapes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper material segment leads the market with a 39.6% share, driven by growing environmental awareness and the increasing shift toward recyclable and biodegradable packaging solutions. Paper-based tapes are favored for their ease of use, strong adhesion, and compatibility with eco-conscious packaging systems, particularly in sectors like retail, food, and consumer goods.

The rise of sustainable packaging mandates and corporate responsibility initiatives has further elevated the adoption of paper materials over plastic-based alternatives. This segment benefits from innovation in reinforced paper tapes and water-activated variants that enhance sealing strength without compromising recyclability.

As industries align with global sustainability targets and implement greener supply chain practices, the paper segment is expected to maintain its lead, supported by expanding regulations and rising consumer preference for plastic-free packaging materials.

The acrylic adhesive segment accounts for 42.1% of the market, reflecting its widespread use in sealing applications that require long-lasting adhesion, clarity, and resistance to environmental factors. Acrylic adhesives are favored for their excellent UV stability, temperature tolerance, and durability across various substrates, making them suitable for indoor and outdoor packaging needs.

These adhesives are particularly effective for lightweight to medium-duty applications and offer strong performance over time without yellowing or degradation. The segment has grown in tandem with the rising use of pressure-sensitive tapes in automated and manual packaging operations.

Additionally, acrylic formulations are increasingly optimized for environmental compliance and reduced VOC emissions. As packaging lines demand consistent, cost-effective, and high-performing adhesive technologies, the acrylic segment is expected to sustain steady growth across multiple industrial and commercial sectors.

The carton sealing and inner packaging segment leads the application category with a 48.3% share, highlighting its essential role in protecting goods during handling, storage, and transit. This segment is driven by the explosive growth of e-commerce, retail logistics, and global trade, where secure packaging is critical to prevent damage and ensure customer satisfaction.

Tapes used in carton sealing are selected for their ability to provide quick, strong bonding to corrugated surfaces and withstand rough handling throughout the supply chain. As fulfillment centers and distribution hubs scale operations, demand for high-performance sealing tapes that reduce packaging errors and increase throughput continues to rise.

Inner packaging applications also benefit from specialized tape solutions that prevent movement, contamination, and breakage of contents. This segment is expected to remain dominant as businesses prioritize packaging reliability, operational efficiency, and damage prevention in competitive supply chains.

The sealing and strapping packaging tapes market is driven by rising e-commerce shipments, industrial logistics, and demand for machine-compatible solutions. Cost efficiency, raw material optimization, and enhanced adhesive performance are key factors influencing product adoption.

The sealing and strapping packaging tapes industry has been shaped by the growth of online retail and industrial trade, where reliable packaging solutions have become essential for product security during transit. Increased shipment volumes have created a consistent requirement for tapes with higher tensile strength and superior adhesion, particularly for heavy or irregular loads. Manufacturers have been prioritizing tamper-evident and water-resistant features to meet stringent safety and quality standards in cross-border deliveries. The demand for automated packaging solutions in warehouses and fulfillment centers has fueled the adoption of machine-compatible strapping tapes. This shift toward operational efficiency and reduced downtime has resulted in the rapid integration of advanced tape solutions across logistics and manufacturing sectors.

The market has experienced strong momentum as businesses seek packaging tapes that combine cost-effectiveness with durability. The fluctuating prices of raw materials such as polypropylene and polyester have led companies to optimize formulations that reduce material usage while maintaining strength. Lightweight tapes with improved elongation properties have been widely accepted in sectors handling bulk consignments. In addition, resistance to varying temperature conditions has become a critical factor, driving innovations in adhesive formulations for long-haul transportation. End-users have increasingly evaluated lifecycle costs rather than just purchase price, leading to a preference for products that minimize wastage and reduce overall packaging expenses while ensuring consistent performance in demanding supply chain environments.

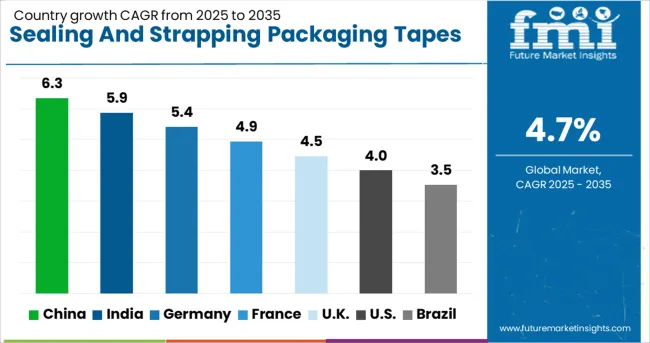

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The sealing and strapping packaging tapes market, projected to grow at a global CAGR of 4.7% from 2025 to 2035, demonstrates significant growth variation among leading economies. China, a BRICS nation, leads with a CAGR of 6.3%, fueled by rapid e-commerce expansion, large-scale manufacturing output, and increased automation in packaging operations. India follows at 5.9%, supported by rising demand in FMCG, retail distribution, and food processing sectors, driven by organized trade penetration. Germany records 5.4%, benefiting from the strong adoption of eco-friendly adhesive tapes and integration of automated carton-sealing systems in logistics hubs.

The UK posts a 4.5% CAGR, influenced by robust parcel shipping volumes and sustainability-focused reforms, though tempered by elevated operational costs. The USA rows at 4.0%, driven by industrial packaging demand and retail shipments, but constrained by mature market conditions and pressure for cost optimization. BRICS economies are capturing high-growth opportunities through cost-competitive production and export capabilities, while OECD nations focus on sustainable adhesives and smart tape technologies integrated with automation. The report provides detailed insights across 40+ countries, with the five fastest-growing markets highlighted as reference.

The CAGR in the United Kingdom shifted from about 3.1% during 2020–2024 to nearly 4.5% for the 2025–2035 period, a stronger packaging demand environment. The initial period saw slower growth due to limited warehouse automation adoption and higher dependency on manual sealing in regional logistics. Increased e-commerce penetration after 2024, coupled with the consolidation of fulfillment hubs, accelerated demand for machine-compatible strapping tapes. The regulatory emphasis on safe transport in food and pharma further pushed the adoption of heavy-duty solutions. Cost-conscious importers prioritized hybrid tape systems that offer high adhesion and moisture resistance to reduce return rates and transit damage. Automation-driven logistics by major retailers added consistent procurement volumes.

The China market moved from an approximate 5.2% CAGR in 2020–2024 to nearly 6.3% during 2025–2035, as industrial trade and export-driven logistics remained key drivers. The initial phase recorded healthy performance due to strong manufacturing output, but the later stage saw structural gains from integrated smart warehousing and automated carton sealing in cross-border e-commerce. National policies promoting safe packaging for electronics and pharmaceuticals accelerated material innovation in adhesive formulations. Large-scale distribution centers in Guangdong and Jiangsu provinces contributed to the bulk demand for water-resistant strapping tapes. Local producers expanded capacity using cost-efficient polypropylene blends, targeting both domestic and Belt & Road economies.

The CAGR value advanced from 4.8% during 2020–2024 to approximately 5.9% for the 2025–2035 period, driven by warehouse digitization and broader retail network integration. Early growth was moderated by manual packaging reliance and fluctuating adhesive material availability. After 2025, organized retail chains and 3PL providers adopted automated carton sealing to improve throughput in high-volume shipment hubs. Preference for lightweight but tensile tapes rose due to logistics cost control. Domestic tape producers benefited from capacity expansion supported by tax incentives in states like Gujarat and Tamil Nadu. Procurement in food and beverage distribution expanded significantly because of hygiene compliance norms in long-distance shipments.

Germany recorded a CAGR of 3.6% during 2020–2024, supported by industrial packaging needs in automotive and engineering sectors. The growth rate strengthened to 5.4% between 2025 and 2035, attributed to the rapid modernization of logistics networks and the adoption of smart packaging lines across manufacturing clusters. German e-commerce operators increasingly implemented automated strapping systems for sustainability-linked cost optimization, while premium adhesive technologies were integrated into sealing products to handle cold-chain and high-moisture conditions. Domestic producers enhanced capabilities in low-emission tape manufacturing to align with EU directives on packaging safety, further pushing demand for specialized solutions. The market outlook has remained positive with a surge in export-led packaging requirements for industrial goods.

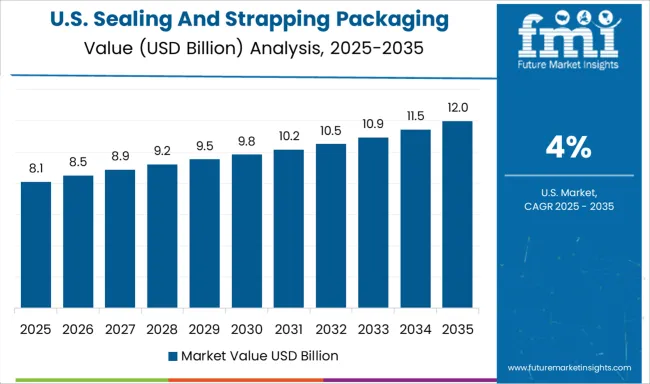

The USA market grew at an estimated 2.9% CAGR from 2020 to 2024, supported by e-commerce fulfillment and expanding 3PL operations. This growth moved higher to 4.0% during 2025–2035, driven by large-scale investments in automated packaging systems by retailers and omnichannel logistics providers. Post-pandemic supply chain restructuring created additional layers of quality assurance, increasing adoption of tamper-evident tapes for food and healthcare shipments. Rising demand for lightweight but durable tapes in high-speed distribution networks has encouraged innovation in hybrid adhesive systems. Sustainability certifications such as OCC recyclability became procurement benchmarks for major USA retailers, pushing suppliers toward fiber-reinforced paper-based sealing options for bulk packaging applications.

In the sealing and strapping packaging tapes segment, leading players are focusing on strength optimization, automated compatibility, and adhesive innovation to meet the needs of logistics, e-commerce, and industrial packaging. Companies like 3M Company, Tesa SE, and Avery Dennison Corporation have emphasized advanced polymer formulations and enhanced adhesion to improve performance on varied surfaces and temperature ranges. Intertape Polymer Group Inc. and Nitto Denko Corporation are driving the adoption of eco-oriented adhesive systems and lightweight designs aimed at cost efficiency and resource optimization. Prominent manufacturers such as Scapa Group plc, Shurtape Technologies LLC, and Bostik SA are leveraging strong distribution networks to expand into high-growth regions. Saint-Gobain Performance Plastics Corporation and Advance Tapes International Ltd. are strengthening their foothold through industrial-grade solutions designed for high-tension strapping and tamper-evident requirements.

In March 2025, 3M launched a next-generation water-resistant carton sealing tape optimized for automated packaging systems in fulfillment centers.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.1 Billion |

| Material | Paper, Polypropylene, Polyvinyl Chloride, and Other |

| Adhesive | Acrylic, Rubber-based, Silicone, and Others |

| Application | Carton Sealing & Inner Packaging, Strapping & Bundling, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, tesa SE, Avery Dennison Corporation, Intertape Polymer Group Inc, Nitto Denko Corporation, Scapa Group plc, Shurtape Technologies LLC, Bostik SA, Saint-Gobain Performance Plastics Corporation, and Advance Tapes International Ltd. |

| Additional Attributes | Dollar sales by region, share by product type and end-use sector, competitive landscape, pricing trends, raw material cost analysis, e-commerce growth impact, automation-driven demand, regulatory compliance, and future capacity expansion opportunities. |

The global sealing and strapping packaging tapes market is estimated to be valued at USD 24.1 billion in 2025.

The market size for the sealing and strapping packaging tapes market is projected to reach USD 38.2 billion by 2035.

The sealing and strapping packaging tapes market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in sealing and strapping packaging tapes market are paper, polypropylene, polyvinyl chloride and other.

In terms of adhesive, acrylic segment to command 42.1% share in the sealing and strapping packaging tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Sealing & Strapping Packaging Tape Market Size and Share Forecast Outlook 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Self-sealing Ziplock Bag Market Size and Share Forecast Outlook 2025 to 2035

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealing Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Sealing Bags Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Competitive Breakdown of Tube Sealing Machines Providers

Industry Share Analysis for Self-Sealing Bags Companies

Heat Sealing Tester Market

Heat Sealing Bags Market

Self-Sealing Paper Bands Market

Pouch Sealing Machine Market

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Vessel-sealing Devices Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA