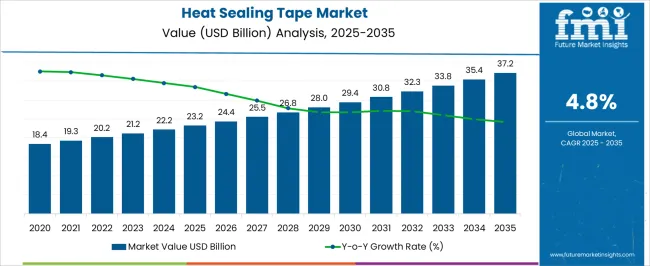

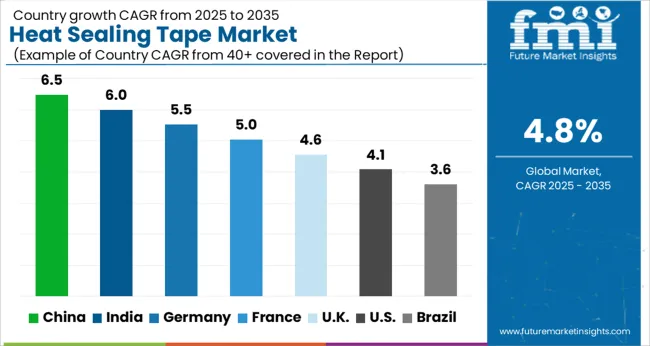

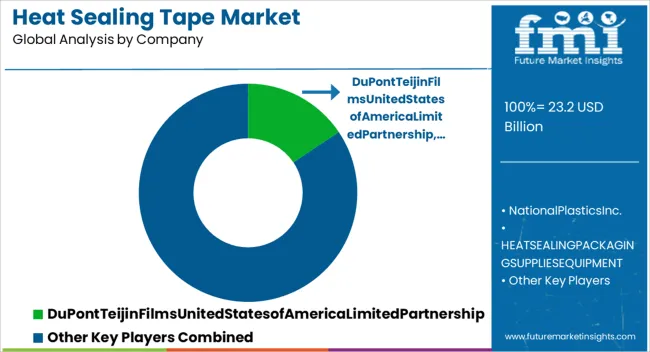

The Heat Sealing Tape Market is estimated to be valued at USD 23.2 billion in 2025 and is projected to reach USD 37.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Heat Sealing Tape Market Estimated Value in (2025 E) | USD 23.2 billion |

| Heat Sealing Tape Market Forecast Value in (2035 F) | USD 37.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The heat sealing tape market is experiencing steady growth as industries prioritize tamper-evident packaging, food-grade sealing, and high-performance bonding solutions. Advances in adhesive chemistry and substrate compatibility are enabling reliable seals across variable temperatures and challenging surfaces. Food safety compliance, shelf-life extension, and contamination prevention are acting as primary drivers, especially in sectors such as food packaging and medical supplies.

Manufacturers are enhancing production with pressure-sensitive and thermal activation technologies, allowing faster throughput and reduced waste. Demand is also rising from electronics and industrial applications, where moisture resistance and temperature stability are critical. As e-commerce and retail logistics evolve, the need for durable and secure packaging continues to climb.

Ongoing investments in recyclable materials and eco-friendly adhesive systems are aligning with sustainability targets and shifting consumer expectations. With product innovations and global trade accelerating, the heat sealing tape market is positioned to scale across both emerging and established industries.

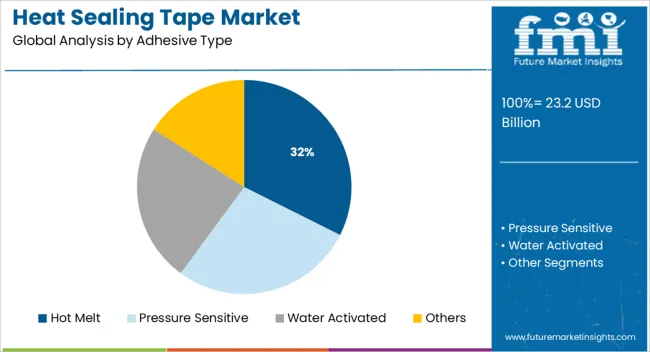

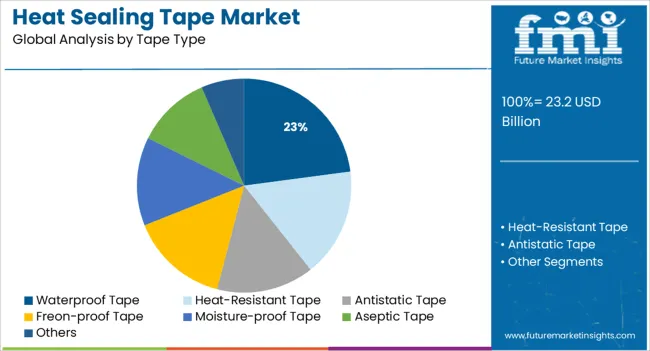

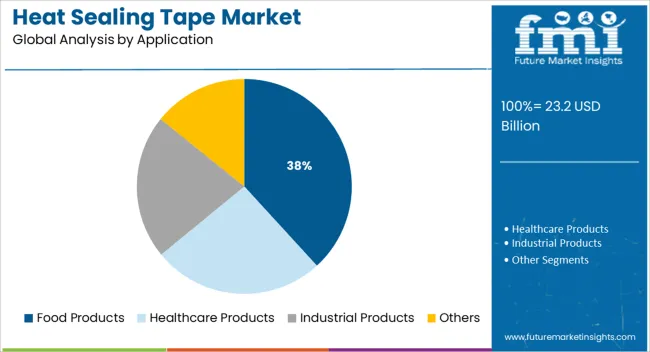

The market is segmented by Adhesive Type, Tape Type, and Application and region. By Adhesive Type, the market is divided into Hot Melt, Pressure Sensitive, Water Activated, and Others. In terms of Tape Type, the market is classified into Waterproof Tape, Heat-Resistant Tape, Antistatic Tape, Freon-proof Tape, Moisture-proof Tape, Aseptic Tape, and Others. Based on Application, the market is segmented into Food Products, Healthcare Products, Industrial Products, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hot melt adhesives are projected to capture 32.4% of revenue share in 2025 within the adhesive type category, making them the leading adhesive formulation in the heat sealing tape market. This leadership is being driven by their fast-setting properties, high bonding strength, and excellent thermal resistance which make them ideal for high-speed packaging lines and industrial-scale production.

Hot melt adhesives offer enhanced compatibility with a wide variety of surfaces including plastic, paper, and foil, improving operational flexibility. Their solvent-free nature supports environmentally conscious manufacturing, while reduced drying times contribute to cost efficiency and higher throughput.

With improved heat tolerance and adhesion reliability under dynamic conditions, hot melt formulations continue to be preferred in sectors such as food packaging and electronics assembly where consistent performance is essential.

Waterproof tape is expected to contribute 22.9% of total revenue in 2025 under the tape type category, establishing it as the leading variant within this segment. The dominance of waterproof tape is supported by increasing requirements for moisture resistance, leak prevention, and outdoor durability in both consumer and industrial packaging applications.

Its utility spans across food packaging, electronics protection, and logistics sealing where exposure to moisture and humidity is a concern. Manufacturers have enhanced waterproof tape offerings with improved tensile strength, temperature tolerance, and longer shelf life, making them suitable for harsh environments.

Consumer preferences for resealable and reliable protective packaging have further accelerated adoption. The segment’s versatility and expanding use in temperature-sensitive or perishable goods packaging continue to support its market share growth.

The food products segment is forecasted to account for 38.2% of the market revenue in 2025 by application, positioning it as the dominant use case. This prominence is being driven by strict food safety regulations, demand for contamination-free packaging, and the rapid expansion of processed and ready-to-eat food categories.

Heat sealing tape is increasingly used for ensuring product integrity, preventing tampering, and preserving freshness across cold chain and ambient storage formats. Its compatibility with plastic films, trays, and foil-based packaging supports seamless integration into automated sealing lines.

The focus on extended shelf life, minimal leakage, and product visibility has made heat sealing tapes an indispensable component in modern food packaging systems. As consumer demand rises for secure, hygienic, and easy-to-handle packaging, the food products application continues to hold a commanding position in driving heat sealing tape adoption.

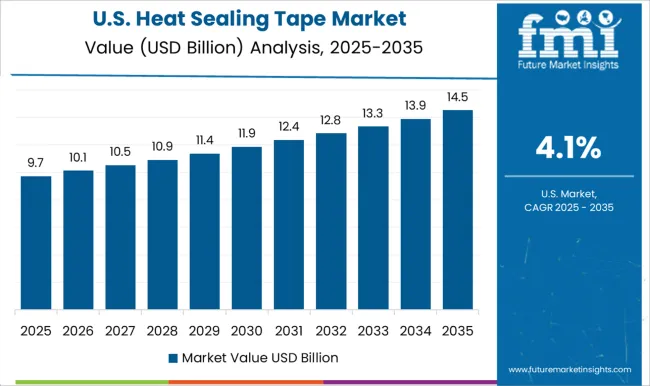

The global heat sealing tape market is expected to accumulate USD 20,196.0 Million in value by 2025-end. During the forecast period ranging from 2025 to 2035, a CAGR worth 4.8% has been projected for the market, with an expected closing value worth USD 32,275.9 Million.

During 2020 to 2024 historical period, the industry grew at a value CAGR worth 3.4%.

Increasing penetration of packaged foods along with the growth in demand for heat sealing tapes in the pharmaceutical industry is positively influencing the demand for heat sealing tapes. In the upcoming years, the establishment of E-commerce websites along with advanced healthcare industries are expected to bolster the demand for heat sealing tapes.

The E-commerce industry bolstering the growth of Heat Sealing Tapes

Growth in e-commerce, as well as the growing adoption of online food and grocery delivery, has led to the necessity for packaged food, thereby widening the scope for growth in the heat-sealing tape market.

In addition, increasing demand for packaged food along with a rise in the pharmaceutical industry is accelerating the demand for heat-sealing tapes

The convenience of shipping products owing to the widening presence of the E-commerce industry is further augmenting the growth of heat sealing tapes. In the upcoming years, the demand for sustainable heat-sealing tapes is expected to drive innovation and the product portfolio of the industry.

Effectiveness of heat sealing tapes Maximizing Increase

Over the forthcoming years, the heat-sealing tape industry is poised to increase at a healthy rate. The fact that these tapes are inexpensive, effective, and simple to use is an important factor responsible for the growth of the heat-sealing tape market.

The heat-sealing tape market is expected to grow leading to excessive consumption and demand for food, industrial, and consumer goods.

Material accessibility restraining market growth

The diverse variations of raw material accessibility are restraining the growth of heat-sealing tapes. Moreover, the increase in energy prices is creating obstacles to the growth of heat sealing tapes. Furthermore, the increasing availability of alternative heat-sealing packaging methods such as ultrasonic sealing may impede the global heat-sealing tape market.

Healthy FMCG and pharmaceutical Packaging bolstering the growth of heat sealing tapes in the region

North America is expected to account for a 24% share of the heat-sealing tape market in 2025. The market growth is attributed to the swelling need for consumer goods and packaged food and the availability of supermarkets and hypermarkets in the region. The United States and Canada are major contributors to the regional market.

According to a USA Census Bureau estimate, total e-commerce retail sales in North America elevated by 7.8 percent in the first quarter of 2024 compared to the first quarter of 2024, reaching USD 1,581.4 Million, as the e-commerce industry is forecasted to expand in North America.

The vast number of food service suppliers who are effectively digitalizing their operations is estimated to propel.

Because of its massive food manufacturing base, the United States emerged as the largest food packaging market in North America in 2024.

The ease of selecting food items based on taste and health preferences, combined with convenient payment methods, is increasing food item and food packaging sales, bolstering the heat-sealing tape market in the United States.

There is a significant expansion in a healthy FMCG (fast-moving consumer goods) industry and pharmaceutical packaging, along with capital efficiency from multinational companies to tap the rising demand of hypermarkets and supermarkets, which is expected to drive growth in the heat seal banding tape market in this region.

Some of the primary reasons for the growth of the heat seal banding tape market are technological advancement and product differentiation. Furthermore, the expansion of manufacturing facilities is projected to augment heat seal banding tape during the forecast period in this region.

Development of the retail industry bolstering the growth of heat-sealing tapes

As per Future Market Insights, in 2025, Europe is expected to capture 28% of the global heat sealing tape market revenue and is poised to maintain high growth throughout the upcoming forecast period. In recent years, European consumers, retailers, and policymakers have prioritized sustainability, and internet retailing has received more scrutiny than ever before.

Concerns about the environmental impacts of cross-border purchase decisions have grown among Europeans, as have supply chain issues involving human rights, labor conditions, and raw material collection.

As a result of the development of the retailing industry and the food packaging industry in Europe, the demand for heat-sealing tape is expected to rise.

E-commerce sites along with convenience food increasing demand for heat sealing tapes

The expansion of the food & beverage industries has opened doors of opportunities for heat sealing tapes. The variety of food products present in the market needs weather and damage protection.

In addition, the growing penetration of packaged food along with the establishment of e-commerce websites is increasing the dependency on heat sealing types. Thus, by application, food products are expected to procure a 40% market share for heat sealing tapes in 2025.

The swelling dispersion of start-ups in the heat sealing tape market has modified product quality and inclined global sales. Besides, to gain a competitive edge, new start-ups are working on novel developments and releasing the latest products such as:

A few of the major manufacturers identified across the globe in the heat sealing tape market are DuPont Teijin Films USA Limited Partnership, National Plastics, Inc., HEAT SEALING PACKAGING SUPPLIES & EQUIPMENT, HEAT SEAL, LLC., Prairie State Group, Venus Packaging, Blisterpak, Inc., Petra Manufacturing Company and Janco Inc, LLC., Shenzhen Hero-PAK Technology Co., Ltd., Guangzhou Xinghang Insulating Material Co., Ltd., Cangnan Huaxiang Textile Co., Ltd. Key development in the Heat Sealing Tape market is as follows:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 20,196.0 Million |

| Market Value in 2035 | USD 32,275.9 Million |

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Adhesive, Tape, Usage, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | DuPont Teijin Films USA Limited Partnership; National Plastics, Inc.; Heat Sealing Packaging Supplies & Equipment; Heat Seal, LLC; Prairie State Group; Venus Packaging; Blisterpak Inc.; Petra Manufacturing Company; Janco Inc. LLC.; Shenzhen Hero-PAK Technology Co. Ltd.; Guangzhou Xinghang Insulating Material Co. |

| Customization | Available Upon Request |

The global heat sealing tape market is estimated to be valued at USD 23.2 billion in 2025.

The market size for the heat sealing tape market is projected to reach USD 37.2 billion by 2035.

The heat sealing tape market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in heat sealing tape market are hot melt, pressure sensitive, water activated and others.

In terms of tape type, waterproof tape segment to command 22.9% share in the heat sealing tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat-Treated NiTi Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Fitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Heat Induction Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Heat Treating Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat-Activated Beauty Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Sealable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heat Recovery System Generator Market Size and Share Forecast Outlook 2025 to 2035

Heat Shrink Tubes Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA