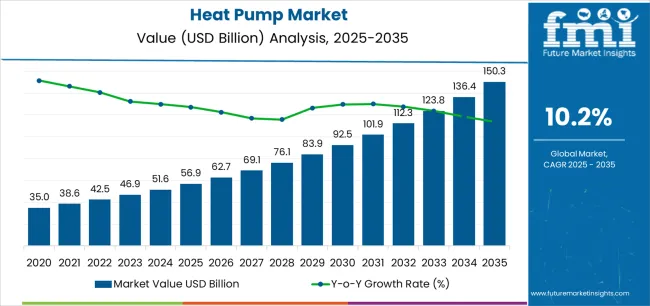

The global heat pump market is projected to grow from USD 56.9 billion in 2025 to approximately USD 150.3 billion by 2035, recording an absolute increase of USD 93.2 billion over the forecast period. This translates into a total growth of 163.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.2% between 2025 and 2035. The overall market size is expected to grow by nearly 2.64X during the same period, supported by the rising demand for energy-efficient heating and cooling solutions, expanding residential and commercial construction, and increasing government initiatives promoting renewable energy technologies.

Between 2025 and 2030, the heat pump market is projected to expand from USD 56.9 billion to USD 95.4 billion, resulting in a value increase of USD 38.5 billion, which represents 41.3% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of renewable energy solutions, expanding government incentives for heat pump installations, and growing consumer awareness of energy efficiency benefits. Property developers and homeowners are investing in heat pump technologies to reduce energy costs and meet environmental sustainability targets.

From 2030 to 2035, the market is forecast to grow from USD 95.4 billion to USD 150.3 billion, adding another USD 54.7 billion, which constitutes 58.7% of the overall ten-year expansion. This period is expected to be characterized by technological advancements in heat pump efficiency, development of smart heating systems, and widespread adoption across commercial and industrial applications. The growing emphasis on carbon neutrality and electrification of heating systems will drive demand for advanced heat pump solutions that integrate with renewable energy sources.

Between 2020 and 2025, the heat pump market experienced accelerated expansion, driven by increasing energy costs, rising environmental consciousness, and growing government support for renewable heating technologies. The market developed as consumers recognized the long-term cost benefits and environmental advantages of heat pump systems compared to traditional heating methods. Energy providers and governments began emphasizing heat pump adoption as a key component of decarbonization strategies and energy security initiatives.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 56.9 billion |

| Forecast Market Value (2035) | USD 150.3 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

Market expansion is being supported by the rapid increase in energy efficiency requirements worldwide and the corresponding need for sustainable heating and cooling solutions that reduce carbon emissions and energy consumption. Modern heat pump systems provide superior energy efficiency compared to conventional heating systems while offering both heating and cooling capabilities in a single unit. Even existing buildings can significantly benefit from heat pump installations that reduce energy costs and environmental impact.

The growing complexity of energy regulations and increasing focus on carbon reduction are driving demand for advanced heat pump solutions from certified manufacturers with appropriate technical expertise and installation capabilities. Building owners are increasingly requiring comprehensive heat pump systems to meet energy efficiency standards while maintaining comfort levels throughout the year. Regulatory requirements and environmental standards are establishing stringent efficiency criteria that require specialized technologies and professional installation services.

The market is segmented by product type, refrigerant, power source, system type, power level, end user, and region. By product type, the market covers air-water heat pump, air-air heat pump, ground source heat pump, and hybrid heat pump. By refrigerant, the market includes hydro-fluorocarbon (HFC), ammonia, CO2, hydrocarbons, and others (blended refrigerants and natural refrigerant alternatives). By power source, the market is segmented into electric and others such as (gas-powered).

By system type, the market includes air-source heat pumps, ductless mini-split heat pumps, geothermal heat pumps, and absorption heat pumps. By power level, the market is divided into small (< 10 kW), medium (10-100 kW), and large (> 100 kW). By end user, the market is categorized into residential (heating and cooling homes, water heating, radiant floor heating, hybrid heating systems), commercial (HVAC system, commercial refrigeration, geothermal heating and cooling), and industrial (waste heat recovery, industrial drying, industrial refrigeration, process cooling, combined heat and power (CHP) systems). Regionally, the market is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

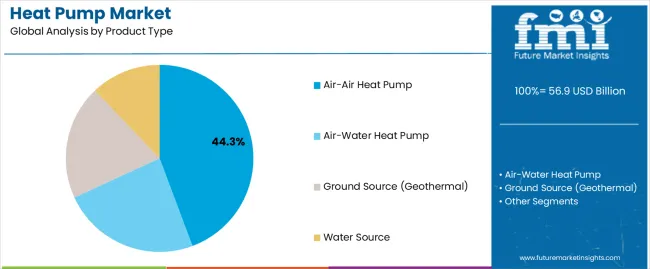

Air-air heat pump is projected to account for 44.3% of the heat pump market in 2035. This leading share is supported by the widespread adoption of air-to-air systems for their versatility, cost-effectiveness, and ease of installation in both residential and commercial applications. Air-air heat pumps provide efficient heating and cooling solutions without requiring extensive ground work or water connections, making them suitable for diverse building types and climatic conditions. The segment benefits from established technology platforms and comprehensive product availability from multiple manufacturers.

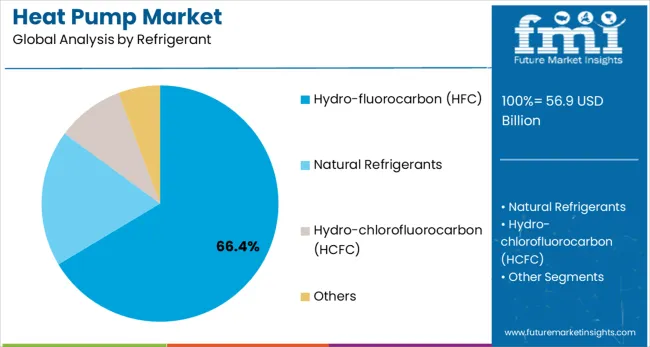

Hydro-fluorocarbon (HFC) is expected to represent 66.4% of heat pump refrigerant demand in 2035. This dominant share reflects the widespread use of HFC refrigerants in current heat pump systems due to their proven performance characteristics and established supply chains. Modern HFC refrigerants provide reliable operation across various temperature conditions while meeting safety and performance requirements for residential and commercial applications. The segment benefits from extensive manufacturer experience and comprehensive service infrastructure supporting HFC-based heat pump systems.

The heat pump market is advancing rapidly due to increasing energy efficiency requirements and growing recognition of renewable heating technology importance. However, the market faces challenges including high upfront installation costs, need for skilled technicians for proper installation and maintenance, and varying performance efficiency in extreme climate conditions. Technology advancement efforts and government incentive programs continue to influence market adoption and growth patterns.

The growing deployment of smart home technologies is enabling advanced heat pump systems that integrate with home automation platforms and energy management systems. Smart heat pumps provide remote monitoring, predictive maintenance capabilities, and optimized operation based on occupancy patterns and energy pricing. These systems are particularly valuable for maximizing energy efficiency and reducing operating costs while providing enhanced user convenience and system reliability.

Modern heat pump manufacturers are incorporating renewable energy integration capabilities that enable seamless connection with solar panels, wind systems, and smart grid technologies. Integration of energy storage systems and grid-interactive features allows heat pumps to optimize energy consumption based on renewable energy availability and electricity pricing. Advanced systems also support grid stabilization services while providing cost-effective heating and cooling for building owners.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.2% |

| Nordics | 10.9% |

| China | 10.7% |

| Canada | 9.6% |

| United States | 8.9% |

| India | 8.3% |

| Australia & New Zealand | 8.0% |

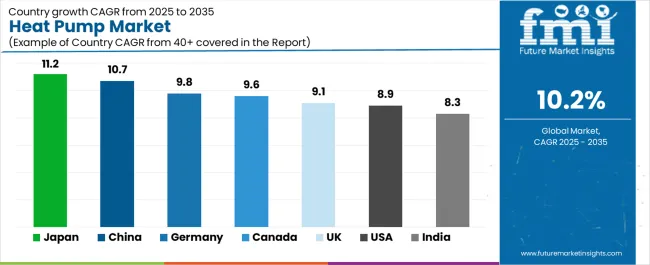

The heat pump market is experiencing robust growth across key countries, with Japan leading at an 11.2% CAGR through 2035, driven by advanced technology adoption and government incentives for energy-efficient heating systems. Nordics follow at 10.9%, supported by cold climate applications and renewable energy integration. China records 10.7% growth, emphasizing manufacturing capabilities and domestic demand expansion. Canada shows strong growth at 9.6%, focusing on cold climate heat pump technologies. The United States demonstrates 8.9% growth, driven by residential and commercial adoption. India and Australia & New Zealand show steady growth at 8.3% and 8.0% respectively, reflecting emerging market opportunities and climate-appropriate applications.

Revenue from heat pump systems in Japan is projected to exhibit the highest growth rate with a CAGR of 11.2% through 2035, driven by government initiatives promoting energy efficiency and advanced heating technology adoption across residential and commercial sectors. The country's emphasis on energy security and carbon reduction is creating significant opportunities for heat pump manufacturers and installation service providers. Major technology companies and HVAC manufacturers are establishing comprehensive product portfolios to serve diverse climate zones and building applications throughout Japan.

Revenue from heat pump systems in Nordics is expanding at a CAGR of 10.9%, supported by extensive experience with cold climate heating applications and growing emphasis on renewable energy integration that serves both residential and commercial markets. The region's advanced building energy standards and established heat pump infrastructure are driving demand for sophisticated heating solutions. Installation companies are investing in cold-climate heat pump technologies to meet demanding performance requirements. Energy sector modernization programs are facilitating adoption of advanced heat pump technologies that support comprehensive heating capabilities across extreme climate conditions.

Demand for heat pump systems in China is projected to grow at a CAGR of 10.7%, supported by the country's leadership in heat pump manufacturing and focus on domestic market development that serves both urban and rural heating requirements. Chinese manufacturers are implementing comprehensive heat pump production capabilities that meet diverse climate conditions while supporting export market expansion. Industrial development programs are prioritizing advanced heat pump manufacturing technologies that demonstrate superior efficiency and cost-effectiveness while meeting Chinese environmental and energy standards.

Demand for heat pump systems in Canada is expanding at a CAGR of 9.6%, driven by cold climate technology advancement and increasing emphasis on renewable heating solutions that serve both residential and commercial sectors across diverse Canadian climate zones. Canadian technology companies are implementing comprehensive heat pump solutions that meet extreme weather performance requirements while supporting energy independence initiatives. Energy efficiency programs are enabling adoption of advanced cold-climate heat pump technologies that support comprehensive heating capabilities across Canadian climate conditions.

Demand for heat pump systems in the United States is projected to grow at a CAGR of 8.9%, supported by increasing residential and commercial adoption and growing emphasis on energy efficiency improvements across diverse climate regions. American manufacturers and service providers are establishing comprehensive heat pump capabilities to serve domestic demand and support export market opportunities. Building energy efficiency modernization is enabling standardized heat pump installations across multiple climate zones, providing consistent performance standards and comprehensive coverage throughout American residential and commercial markets.

Revenue from heat pump systems in India is growing at a CAGR of 8.3%, supported by increasing commercial and industrial adoption and growing awareness of energy-efficient heating and cooling solutions across diverse climate regions. Indian manufacturers and service providers are implementing heat pump technologies that meet local climate requirements while supporting energy cost reduction objectives. Industrial energy efficiency programs are facilitating adoption of heat pump technologies that support manufacturing and commercial facility requirements across major industrial regions.

Revenue from heat pump systems in Australia & New Zealand is expanding at a CAGR of 8.0%, driven by residential and commercial adoption and increasing emphasis on energy-efficient climate control solutions that serve diverse climate conditions across both countries. Regional manufacturers and service providers are establishing heat pump capabilities that meet specific climate requirements while supporting energy cost reduction and environmental objectives. Building energy efficiency development programs are enabling heat pump adoption that supports comprehensive climate control across residential and commercial applications.

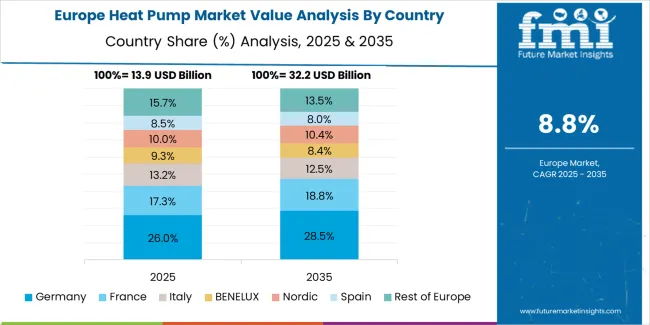

The heat pump market in Europe is projected to reach USD 43.4 billion by 2035, representing 28.9% of the global market with steady growth supported by aggressive decarbonization policies and energy efficiency mandates across European Union member states.

In Europe, air-air heat pumps lead with 45% market share, driven by residential renovation projects and new construction requirements. Air-water heat pumps hold 33% share, primarily used in hydronic heating systems. HFC refrigerants represent 65% of the market, while natural refrigerants account for 20% of regional demand, reflecting the transition toward more sustainable refrigerant technologies.

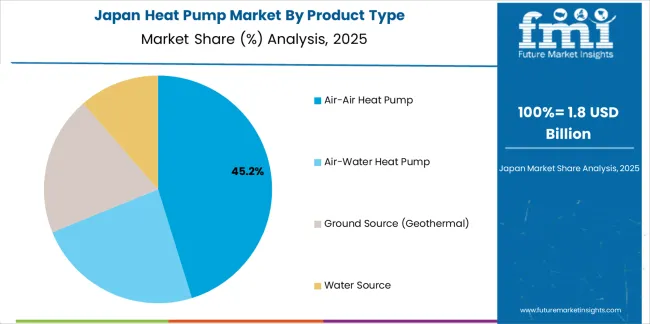

In Japan, the heat pump market demonstrates advanced technology adoption with emphasis on high-efficiency systems and compact designs suitable for urban residential applications. Air-air heat pumps dominate with 46% market share, supported by widespread residential adoption and replacement of traditional heating systems.

HFC refrigerants maintain 68% market share in Japan, while natural refrigerants represent 17% of demand, driven by environmental regulations and manufacturer innovation. Air-water heat pumps account for 31% of product type demand, supported by integration with existing hydronic systems and commercial applications throughout the country.

The heat pump market is defined by competition among specialized HVAC manufacturers, energy technology companies, and building systems providers. Companies are investing in advanced heat pump technologies, smart system integration, energy efficiency innovations, and technical expertise to deliver reliable, efficient, and cost-effective heating and cooling solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

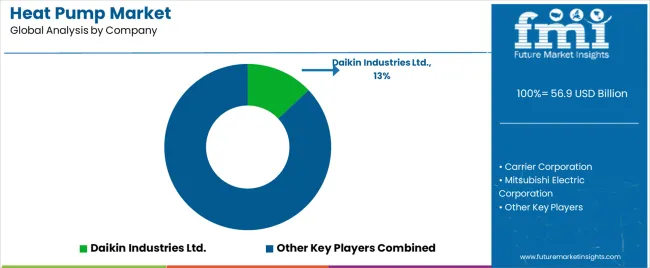

Daikin Industries Ltd., Japan-based, leads the market with 13% share, offering comprehensive heat pump solutions with focus on innovation, energy efficiency, and advanced climate control technologies across residential and commercial applications. Carrier Corporation, USA-based, holds 10.4% market share, providing advanced HVAC systems and heat pump technologies for diverse building applications. Mitsubishi Electric Corporation, Japan-based, maintains 9.7% share, delivering specialized heat pump solutions with emphasis on reliability and performance excellence.

Johnson Controls, USA-based, accounts for 8.2% market share, focusing on building systems integration and smart heat pump technologies with emphasis on energy management and automation capabilities. Trane Technologies, USA-based, holds 7.1% share, offering commercial and residential heat pump solutions with emphasis on sustainability and operational efficiency across diverse climate applications.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 56.9 billion |

| Product Type | Air-Air Heat Pump, Air-Water Heat Pump, Ground Source Heat Pump, and Water Source Heat Pump |

| Refrigerant Type | Hydro-fluorocarbon (HFC), Natural Refrigerants, Hydro-chlorofluorocarbon (HCFC), and Others |

| Power Source | Electric, Others (Gas) |

| System Type | Air-source Heat Pumps, Ductless Mini-Split Heat Pumps, Geothermal Heat Pumps, and Absorption Heat Pumps |

| Power Level | Small (<10 kW), Medium (10-100 kW), and Large (>100 kW) |

| End User | Residential (Heating and Cooling Homes, Water Heating, Radiant Floor Heating, Hybrid Heating Systems), Commercial (HVAC System, Commercial Refrigeration, Geothermal Heating and Cooling), and Industrial (Waste heat recovery, Industrial Drying, Industrial Refrigeration, Process Cooling, Combined Heat and Power (CHP) Systems) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Panasonic Corporation, Mitsubishi Electric Corporation, Daikin Industries Ltd, The Bosch Group, Johnson Controls, NIBE Group, Carrier Global Corp, Viessmann Group, Danfoss Group, Glen Dimplex Group, STIEBEL ELTRON GROUP, Trane Technologies, Midea Group, Rheem Manufacturing Company, Emerson, Haier Group Corporation, Hisense Group Co., Ltd, Foshan Uwotec New Energy Co., Ltd, TCL Corporation, and Aux Group Co., Ltd |

| Additional Attributes | Dollar sales by product type and refrigerant type, regional demand trends across Asia Pacific, Europe, and North America, competitive landscape with established manufacturers and emerging companies, technological developments in heat pump efficiency and smart system integration, integration with renewable energy systems and building automation platforms, innovations in cold climate performance and variable refrigerant flow technologies, and adoption of natural refrigerants and sustainable manufacturing processes for enhanced environmental performance and regulatory compliance. |

The global heat pump market is estimated to be valued at USD 56.9 billion in 2025.

The market size for the heat pump market is projected to reach USD 150.3 billion by 2035.

The heat pump market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in heat pump market are air-air heat pump, air-water heat pump, ground source heat pump and water source heat pump.

In terms of refrigerant, hydro-fluorocarbon (hfc) segment to command 66.4% share in the heat pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Rotary Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Ducted Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Air to Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Air Source Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Water Source Heat Pump Market Growth - Trends & Forecast 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Large Scale Natural Refrigerant Heat Pump Market Growth – Trends & Forecast (2024-2034)

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Heated Sampling Composite Tube Market Size and Share Forecast Outlook 2025 to 2035

Heat Seal Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA