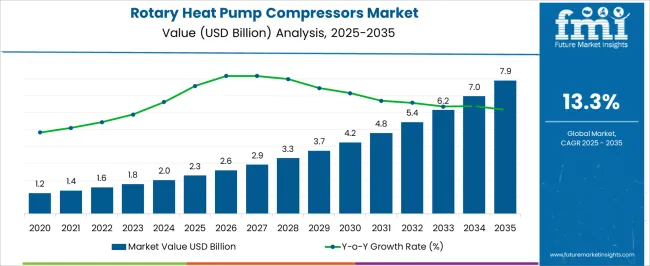

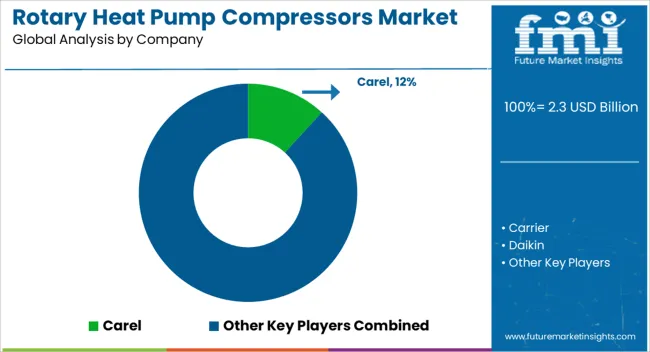

The rotary heat pump compressors market, with an estimated value of USD 2.3 billion in 2025 and a projected value of USD 7.9 billion by 2035, growing at a CAGR of 13.3%, illustrates a clear trajectory along the market maturity curve and adoption lifecycle. The market is currently transitioning from early majority adoption into a rapid growth phase, driven by increasing demand for energy-efficient heating and cooling solutions across residential, commercial, and industrial segments.

Initial market penetration was constrained by higher upfront costs and limited awareness of performance benefits, which kept adoption primarily among early adopters and energy-conscious enterprises. Over the forecast period, a gradual reduction in production costs, improvements in efficiency, and enhanced integration with smart building management systems are enabling broader acceptance across mainstream consumers and commercial operators. This phase of adoption reflects the early majority segment embracing the technology as cost-performance trade-offs become favorable. Later in the lifecycle, the market is expected to approach maturity as the technology reaches saturation in key regions, supported by regulatory incentives, energy efficiency standards, and increased replacement of legacy compressors.

The steep growth observed between 2025 and 2035 indicates that the market is in a high-velocity expansion phase, yet still has room for adoption in emerging economies and retrofit applications. The market demonstrates a classic adoption curve, where early adoption leads to mainstream uptake, with continued expansion fueled by cost reductions, regulatory support, and technological improvements, positioning rotary heat pump compressors for sustained long-term growth.

| Metric | Value |

|---|---|

| Rotary Heat Pump Compressors Market Estimated Value in (2025 E) | USD 2.3 billion |

| Rotary Heat Pump Compressors Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The rotary heat pump compressors market represents a specialized segment within the HVAC and refrigeration industry, emphasizing energy efficiency, reliability, and compact design. Within the broader heat pump and compressor market, it accounts for about 4.7%, driven by demand in residential, commercial, and industrial heating and cooling applications. In the HVAC systems and climate control equipment sector, it holds nearly 5.3%, reflecting adoption for space heating, water heating, and air conditioning solutions.

Across the energy-efficient building and sustainable construction segment, the market captures 4.1%, supporting integration with renewable energy and low-emission systems. Within the refrigeration and cooling equipment category, it represents 3.8%, highlighting use in industrial cold storage and commercial refrigeration. In the global thermal management and energy optimization sector, it secures 3.5%, emphasizing performance, durability, and reduced operational costs.

Recent developments in this market have focused on noise reduction, efficiency optimization, and refrigerant compatibility. Innovations include variable speed rotary compressors, low GWP refrigerant adaptation, and compact designs for tighter installation spaces. Key players are collaborating with HVAC manufacturers, energy service companies, and research institutions to improve the coefficient of performance and system integration. Advanced control technologies and smart sensors are being integrated to enable real-time monitoring, predictive maintenance, and adaptive operation. Additionally, efforts are underway to enhance lifecycle reliability, reduce maintenance requirements, and comply with stringent energy efficiency regulations.

The rotary heat pump compressors market is experiencing consistent expansion, driven by the global push toward energy efficiency and the transition to low-carbon heating and cooling solutions. Industry announcements and HVAC sector updates have emphasized the increasing adoption of heat pump technology in residential, commercial, and light industrial applications as a replacement for fossil fuel-based systems.

Regulatory policies promoting high-efficiency heating equipment, coupled with incentives for renewable energy integration, have bolstered demand for advanced compressor technologies. Continuous improvements in rotary compressor design have enhanced performance, reduced noise, and extended operational lifespans, making them more attractive for widespread use.

Additionally, rising energy costs and heightened environmental awareness among consumers have accelerated the shift toward heat pump installations. Urban development trends, retrofitting of older heating systems, and the incorporation of heat pumps in new construction projects further support market growth. Over the forecast period, product innovation, refrigerant transitions, and regional climate adaptation measures are expected to sustain demand, with air source units holding a significant share due to their versatile applications and relatively low installation complexity.

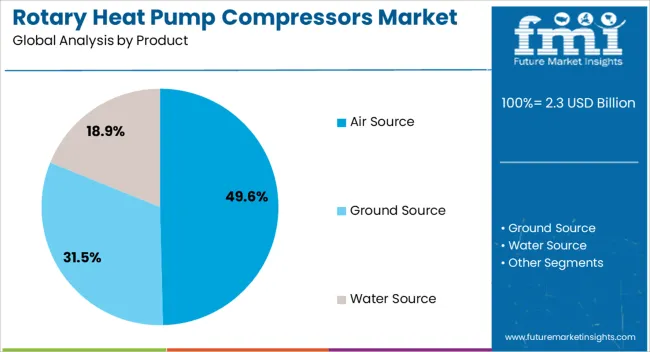

The rotary heat pump compressors market is segmented by product, and geographic regions. By product, rotary heat pump compressors market is divided into Air Source, Ground Source, and Water Source. Regionally, the rotary heat pump compressors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Air Source segment is projected to account for 49.6% of the rotary heat pump compressors market revenue in 2025, maintaining its position as the leading product category. This dominance has been driven by the segment’s adaptability across diverse climates and its comparatively lower installation costs versus ground or water source systems.

Industry studies have highlighted that air source compressors have benefited from advancements in inverter technology and variable-speed operation, improving seasonal efficiency and performance in both heating and cooling modes. Manufacturers have optimized designs to ensure reliable operation at lower ambient temperatures, expanding their applicability in colder regions.

Additionally, the reduced infrastructure requirements for air source systems have supported rapid adoption in urban residential and commercial settings, where space and installation time are critical considerations. Government subsidies and building code incentives have further accelerated market penetration. As decarbonization targets continue to reshape heating and cooling markets, the Air Source segment is expected to retain its leadership due to its balance of performance, affordability, and installation flexibility.

The market has expanded due to increasing demand for energy-efficient heating, ventilation, and cooling solutions in residential, commercial, and industrial applications. Rotary compressors are favored for their compact design, high reliability, and continuous operation capabilities, supporting heat pump systems that provide both heating and cooling functions. Technological improvements in motor efficiency, noise reduction, and refrigerant compatibility have enhanced overall system performance. Adoption is further driven by global energy efficiency regulations, government incentives for low-carbon technologies, and increasing consumer awareness of environmentally friendly HVAC solutions.

Residential and commercial HVAC systems have been major drivers for rotary heat pump compressors, particularly in regions with high heating and cooling demand. Compact and efficient compressor designs allow for easy integration into split, packaged, and multi-zone heat pump systems. Homeowners and facility managers prefer rotary compressors due to their ability to maintain consistent temperature control, reduce energy consumption, and minimize noise levels. Commercial buildings, including offices, hotels, and retail spaces, benefit from scalable compressor solutions that can manage varying load requirements. The integration of advanced refrigerants and inverter technology allows rotary compressors to operate efficiently across different seasonal conditions. Rising construction activity, urban development, and smart building adoption continue to expand market penetration for these compressors.

Technological advancements have improved the performance, durability, and energy efficiency of rotary heat pump compressors. Innovations include variable-speed motors, advanced lubrication systems, and optimized rotor design to reduce friction and mechanical wear. Enhanced refrigerant compatibility with low-global-warming-potential (GWP) refrigerants has reduced environmental impact and improved system efficiency. Noise and vibration reduction technologies have increased adoption in residential and commercial environments where comfort is critical. IoT-enabled monitoring, predictive maintenance, and integration with smart thermostats allow users to optimize performance and reduce operational costs. These innovations have positioned rotary compressors as competitive solutions compared to scroll and reciprocating compressors, ensuring sustained demand in modern HVAC and energy management applications.

Industrial facilities and process heating applications contribute significantly to the market for rotary heat pump compressors. Factories, food processing plants, and chemical industries use heat pumps for temperature control, process heating, and energy recovery operations. Rotary compressors are preferred due to their ability to handle continuous loads, withstand variable operating conditions, and maintain reliability in industrial environments. Energy efficiency and compliance with industrial energy standards are important considerations, prompting the adoption of advanced compressors with optimized motor efficiency and robust performance. Integration with thermal storage, combined heat and power systems, and renewable energy sources enhances overall operational efficiency. This industrial adoption complements residential and commercial usage, expanding overall market growth and opportunities for innovation.

Despite widespread adoption, the rotary heat pump compressors market faces challenges related to installation complexity, environmental conditions, and refrigerant regulations. System performance can be affected by ambient temperature extremes, requiring careful site evaluation and sizing. High upfront costs and the need for skilled technicians to install and maintain advanced compressors can limit adoption in smaller projects. Regulatory pressures related to refrigerant phase-outs, low-GWP compliance, and safety standards necessitate continual technological adaptation. The vibration and noise control must be addressed in sensitive applications. Manufacturers and service providers focus on training programs, modular designs, and integrated monitoring solutions to overcome these challenges, enabling broader adoption of rotary heat pump compressors across global HVAC and industrial markets.

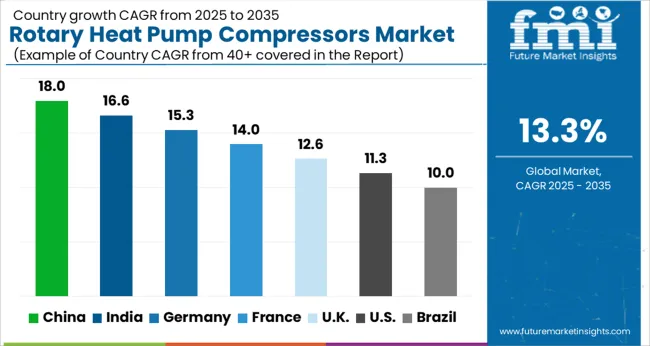

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

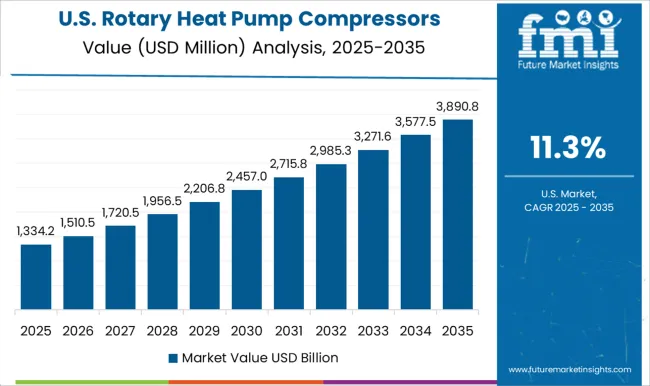

| USA | 11.3% |

| Brazil | 10.0% |

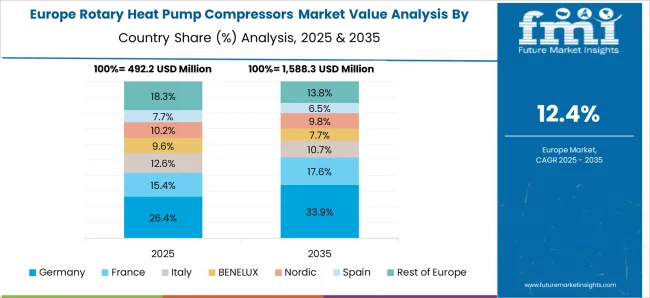

The market is growing steadily, with Germany recording 15.3%, driven by the adoption of energy-efficient heating and cooling solutions in commercial and residential sectors. China leads at 18.0%, supported by large-scale construction projects and industrial modernization initiatives. India follows at 16.6%, reflecting rising demand for sustainable HVAC systems. The United Kingdom posts 12.6%, fueled by investments in green building technologies. The United States shows 11.3%, with market growth sustained by technological upgrades in residential and commercial HVAC applications. These countries collectively represent a diversified landscape of manufacturing, deployment, and innovation shaping the global market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 18.0%, driven by increasing adoption of energy-efficient heating and cooling systems across commercial, residential, and industrial sectors. Rising urban development and the expansion of smart building infrastructure are encouraging the use of advanced compressor technologies. Government initiatives promoting energy conservation and reduction of greenhouse gas emissions further support market growth. The shift towards sustainable HVAC solutions and integration of automation and monitoring features in heat pump systems is enhancing operational efficiency. China’s focus on renewable energy-compatible HVAC technologies positions the country as a key market for rotary heat pump compressors.

India’s market for rotary heat pump compressors is expected to grow at a CAGR of 16.6%, supported by increasing urbanization and rising investments in energy-efficient building technologies. The adoption of modern HVAC systems in residential and commercial spaces is creating strong demand. Government policies promoting energy conservation and incentives for efficient equipment further encourage the use of rotary compressors. Technological innovations, including variable speed drives, intelligent control systems, and noise reduction features, are enhancing performance and adoption. The growing awareness of sustainability and the need for reliable heating and cooling systems position India as a significant market for advanced rotary heat pump compressors.

Germany’s market is projected to grow at a CAGR of 15.3%, propelled by the demand for environmentally friendly and energy-efficient heating and cooling solutions. Adoption of rotary compressors is supported by stringent energy efficiency regulations and policies promoting sustainable building technologies. Technological advancements, including noise reduction, variable speed operation, and integrated automation, improve overall system performance. Industrial and commercial sectors, including manufacturing and office infrastructure, are key drivers of market growth. Germany’s continued focus on reducing energy consumption in HVAC applications reinforces the adoption of rotary heat pump compressors and positions the country as a leading market in Europe.

The United Kingdom’s market is expected to expand at a CAGR of 12.6%, supported by demand for energy-efficient and reliable heating and cooling solutions in residential, commercial, and industrial applications. Government incentives, sustainability initiatives, and energy-saving regulations encourage the adoption of rotary heat pump compressors. Technological improvements in noise reduction, automation, and operational efficiency further enhance market growth. The rising need for low-carbon HVAC systems, coupled with retrofitting of older infrastructure, contributes to steady market expansion. The focus on sustainable urban development and green building projects positions the United Kingdom as an increasingly important market for rotary heat pump compressors.

The United States’ market is projected to grow at a CAGR of 11.3%, driven by demand for energy-efficient heating and cooling solutions in residential, commercial, and industrial sectors. Rising awareness of sustainability and stricter energy codes for HVAC systems are supporting adoption. Technological innovations, including variable speed compressors, integrated automation, and performance monitoring, enhance system efficiency and reliability. Growth is further supported by the need to retrofit older buildings with modern HVAC systems and adopt low-carbon solutions. The United States’ emphasis on energy conservation and smart infrastructure development positions the country as a key market for rotary heat pump compressors.

The market comprises key global and regional manufacturers delivering energy-efficient and reliable compressor solutions for residential, commercial, and industrial heating, ventilation, and air conditioning applications. Carel, Carrier, Daikin, and Danfoss are prominent for their high-performance rotary compressors, integrating advanced control technologies and environmentally friendly refrigerant compatibility. Johnson Controls, LG, Panasonic, and Samsung focus on solutions that combine efficiency, durability, and noise reduction, addressing both commercial HVAC systems and large-scale industrial applications.

Midea, Mayekawa, Rechi, and Tecumseh provide versatile compressor models designed to meet diverse market requirements, offering customizable performance and adaptability to varying load conditions. Specialized manufacturers such as Secop and Siam Compressor emphasize compact designs and energy optimization for small-to-medium heat pump systems, supporting sustainable operations and reduced operational costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Product | Air Source, Ground Source, and Water Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carel, Carrier, Daikin, Danfoss, Glen, Johnson Controls, LG, Mayekawa, Midea, Panasonic, Rechi, Samsung, Secop, Siam Compressor, and Tecumseh |

| Additional Attributes | Dollar sales by compressor type and application, demand dynamics across residential, commercial, and industrial HVAC and refrigeration sectors, regional trends in energy-efficient technology adoption, innovation in compression efficiency, durability, and noise reduction, environmental impact of energy consumption and refrigerant management, and emerging use cases in heat recovery, smart climate control, and sustainable building solutions. |

The global rotary heat pump compressors market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the rotary heat pump compressors market is projected to reach USD 7.9 billion by 2035.

The rotary heat pump compressors market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in rotary heat pump compressors market are air source, ground source and water source.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Rotary and RF Rotary Joints Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tool Market Size and Share Forecast Outlook 2025 to 2035

Rotary Scroll Air Compressor Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tray Sealers Market Size and Share Forecast Outlook 2025 to 2035

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Rotary Hopper Market Analysis by Material, Capacity, Application and Region: Forecast for 2025 and 2035

Rotary Limit Switches Market Growth - Trends & Forecast 2025 to 2035

Rotary Encoder Market

Rotary Steerable System Market

Rotary Knife Cutters Market

Rotary Sealers Market

Rotary Band Heat Sealer Market Size and Share Forecast Outlook 2025 to 2035

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Industrial Rotary Table Market Analysis by By Type of Motion, Drive Mechanism, Size and Load Capacity, Application, Construction Material, and Region: Forecast for 2025 to 2035

Intelligent Rotary Kiln Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA