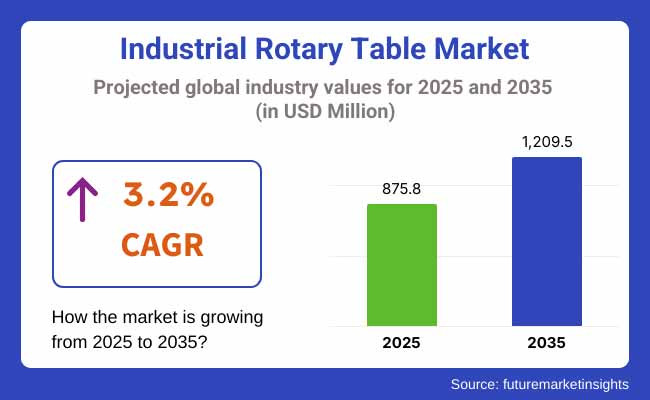

The Global Industrial Rotary Table industry is expected to grow steadily and is estimated to be valued at USD 875.8 million by 2025 and rise to USD 1,209.5 million in 2035, with a CAGR of 3.2%. Growth drivers primarily involve increasingly automated manufacturing processes, rising demand for precision machining, and corresponding innovation in robotics. Major industries that have adopted rotary tables include aerospace, automotive, and electronics, which have seen significant improvement in their operational efficiency.

With IoT and Industry 4.0 integrations, it is predicted that rotary tables will also become smart in the sense that they will do things like improving accuracy and assisting in reducing downtime. While a few specific countries within Asia-Pacific show an exceptional presence in the industry, sustained progress of the North American and European regions is due to their advanced manufacturing capabilities. The widespread adoption of rotary tables may be hampered due to high initial investments and maintenance requirements.

Technological trends such as AI predictive maintenance and hybrid rotary tables will transform the market by 2035. It is expected that the demand for custom-made rotary tables and custom-built high-load rotary tables will rise to meet the demands of various industries. Companies that make investments in sustainable and energy-efficient designs would create a competitive edge. All in all, the industry seems to be growing steadily, driven in the course of changing trends in industrial automation.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 875.8 Million |

| Industry Value (2035F) | USD 1,209.5 Million |

| CAGR (2025 to 2035) | 3.2% |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady demand with a CAGR of 3.2% | Continued expansion with the same CAGR |

| Adoption of CNC automation and initial IoT integration | AI-driven automation, advanced IoT, and predictive analytics |

| Precision machining and Industry 4.0 influence | Fully autonomous smart rotary tables with self-calibration |

| Use of lightweight and durable materials | Sustainable, energy-efficient materials and designs |

| Growth driven by aerospace, automotive, and electronics industries | Expansion into robotics, medical, and renewable energy industries |

| Strong industry presence in APAC, steady growth in NA & Europe | Accelerated adoption in emerging industries, high-tech adoption in developed regions |

| High implementation costs and skilled labor shortage as key challenges | Cybersecurity risks and increasing demand for eco-friendly solutions |

| Gradual automation and efficiency improvements | Fully integrated, AI-driven, and sustainable manufacturing |

FMI Survey Results: Industrial Rotary Table Market Dynamics Based on Stakeholder Perspectives

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in the USA, Western Europe, Japan, South Korea, and India

The Industrial Rotary Table market continues to evolve, driven by increasing automation, Industry 4.0 adoption, and demand for precision machining. Future Market Insights (FMI) conducted a comprehensive survey in Q4 2024 with 500 industry stakeholders across key industries-the USA, Western Europe, Japan, South Korea, and India-to assess industry dynamics, growth drivers, challenges, and future opportunities.

Key Findings

Growing Automation & Industry 4.0 Integration

Industry Expansion & Regional Trends

Material Innovations & Sustainability Focus

Challenges Hindering Growth

Future Growth Opportunities

The Industrial Rotary Table market in the USA is driven by advancements in precision machining, automation, and increasing adoption of smart manufacturing technologies. A steady demand is generated by the presence of major industries in aerospace, automotive, and electronics. As Industry dawned, manufacturers are beginning to pour investments into IoT-enabled and AI-assisted rotary tables that maximize efficiency and minimize downtime.

The expansion of this industry is also driven by the booming robotics and semiconductor industries. On the contrary, high initial investment costs and the shortage of skilled labor are impediments to widespread adoption. FMI opines that the growth of this industry in the United States will grow at nearly 3.0% through 2025 to 2035.

United Kingdom Industrial Rotary Table industry is projected to grow steadily owing to the increasing adoption of automation in manufacturing and precision engineering. It has an increasing demand for high-precision rotary tables that are mainly driven by the automotive, aerospace, and medical device sectors within the country. Institutions and government initiatives for promoting advanced manufacturing technology will eventually lead to speedy adaptation.

However, economic fluctuations and Brexit-related trade uncertainties pose a challenge. The increased emphasis on energy-efficient and sustainable manufacturing solutions has been driving the adoption of next-generation low-energy rotary tables. FMI opines that the growth of this industry in the United Kingdom will grow at nearly 2.8% through 2025 to 2035.

Germany, being a centralized hub of high-precision engineering and automation technologies, is one of the major industrial markets for Industrial Rotary Tables. High-speed CNC-controlled rotary tables continue to be developed and demanded based on the promising production from Germany's automotive, aerospace, and robotics industries. Increasing employee productivity further develops high-speed environments through the increased integration of AI or predictive maintenance systems.

In the course of the emerging Industry 4.0 and smart factories, manufacturers will focus on automated, customized solutions to ensure higher production efficiency. The operational efficiency further drives demand for high-load and multi-axis rotary tables owing to the advanced metalworking and electronic industries in Germany.. FMI opines that the growth of this industry in Germany will grow at nearly 3.5% through 2025 to 2035.

France’s Industrial Rotary Table industry is witnessing growth due to the country’s booming aerospace, automotive, and industrial automation sectors. With a strong focus on precision engineering and robotics, manufacturers are investing in advanced CNC and IoT-enabled rotary tables. The French government’s push for digital transformation and smart factories is further fostering demand. However, high costs and stringent environmental regulations may pose challenges.

Increasing investments in renewable energy and medical technology industries are expected to create new opportunities for customized rotary tables in specialized applications. FMI opines that the growth of this industry in France will grow at nearly 3.1% through 2025 to 2035.

Italy’s Industrial Rotary Table industry is expanding due to increasing demand from its automotive, industrial machinery, and robotics industries. The country’s reputation for precision manufacturing has led to higher adoption of automated rotary tables with AI-powered control systems. Government incentives promoting advanced manufacturing and digitalization are further boosting industry penetration.

The rising use of robotics in production lines is driving the need for high-speed, multi-axis rotary tables. However, industry growth may be slightly hindered by economic fluctuations and slow SME adoption of automation technologies. FMI opines that the growth of this industry in Italy will grow at nearly 3.0% through 2025 to 2035.

The Industrial Rotary Table industry in Australia is seeing stable growth, driven by increasing adoption in mining, manufacturing, and precision engineering sectors. With the rise of automation and digital transformation, manufacturers are shifting towards CNC and IoT-integrated rotary tables to improve efficiency. The aerospace and defense industries are also contributing to demand, especially for high-load rotary tables used in advanced manufacturing.

However, limited industrial infrastructure and high costs remain challenges. The push for energy-efficient and sustainable solutions is likely to influence future growth trends in the region. FMI opines that the growth of this industry in Australia will grow at nearly 2.9% through 2025 to 2035.

New Zealand’s Industrial Rotary Table industry is growing at a slower pace due to a smaller industrial base. However, demand from precision engineering, defense, and agricultural machinery industries is providing growth opportunities. With increasing investments in automated production lines, industries are gradually adopting smart rotary tables with advanced control mechanisms.

The rise in customized, high-speed rotary tables for specialized applications in renewable energy and electronics is expected to drive future demand. However, higher costs and lower industrial adoption rates could limit rapid expansion. FMI opines that the growth of this industry in New Zealand will grow at nearly 2.7% through 2025 to 2035.

China remains the fastest-growing industry for Industrial Rotary Tables, driven by rapid industrialization, automation, and robotics adoption. The country’s automotive, electronics, and heavy machinery sectors are fueling high demand for CNC-enabled rotary tables. Government initiatives promoting smart manufacturing and Industry 4.0 are further propelling growth.

The expanding aerospace and semiconductor sectors are pushing demand for high-precision rotary tables with AI integration. Despite strong growth, challenges such as intense local competition and fluctuating raw material prices persist. FMI opines that the growth of this industry in China will grow at nearly 3.8% through 2025 to 2035.

South Korea’s Industrial Rotary Table industry is growing due to its strong electronics, semiconductor, and robotics industries. The country’s leadership in automation technology and precision engineering has increased the demand for high-speed and multi-axis rotary tables. With heavy investment in AI-driven predictive maintenance, manufacturers are focusing on developing self-monitoring rotary tables for improved efficiency.

The demand from automotive and defense industries is also rising, further strengthening industry expansion. However, high R&D costs and regulatory challenges may slightly impact growth. FMI opines that the growth of this industry in South Korea will grow at nearly 3.6% through 2025 to 2035.

Japan’s Industrial Rotary Table industry is experiencing significant demand from its robotics, semiconductor, and aerospace sectors. With the country’s strong emphasis on precision engineering and automation, rotary tables with IoT-enabled control systems are becoming standard in manufacturing facilities. The rise of digital twins and AI-driven automation is further enhancing operational efficiency. Japan’s investment in smart factories and robotics integration is expected to accelerate growth.

Despite its technological leadership, high costs and an aging workforce pose challenges. However, increased adoption in medical technology and renewable energy industries will drive future expansion. FMI opines that the growth of this industry in Japan will grow at nearly 3.4% through 2025 to 2035.

India’s Industrial Rotary Table industry is set for rapid growth, fueled by government-led industrial expansion, increasing automation, and rising manufacturing investments. The country’s booming automotive, electronics, and precision machining industries are creating substantial demand. With Make in India and Industry 4.0 initiatives, manufacturers are integrating AI-based automation and IoT into rotary tables for better efficiency.

The growing SME sector and foreign investments in industrial automation are further accelerating adoption. While cost-sensitive industries pose affordability challenges, increasing demand for customized, high-speed rotary tables will drive expansion. FMI opines that the growth of this industry in India will grow at nearly 4.0% through 2025 to 2035.

The Type of Motion segment is expected to dominate the Industrial Rotary Table industry with a CAGR of 5.3% from 2025 to 2035. The Industrial Rotary Table industry is segmented into Indexing Rotary Tables and Continuous Rotary Tables, both of which will see substantial demand during the 2025 to 2035 forecast period. Indexing rotary tables are highly valued in precision machining and automated assembly lines due to their ability to rotate at fixed intervals with high repeatability.

They play a crucial role in industries such as automotive, aerospace, and electronics, where precise positioning and repeatability are critical. Continuous rotary tables, on the other hand, provide uninterrupted motion, making them ideal for applications such as robotic automation, inspection systems, and conveyor-based manufacturing processes. These tables support high-speed and multi-axis movement, enhancing the efficiency of production lines.

With the increasing adoption of Industry 4.0 technologies, manufacturers are focusing on integrating smart sensors and automation into rotary tables to improve performance and reduce operational downtime. The expansion of CNC machining, robotic welding, and smart assembly processes will significantly drive the demand for both indexing and continuous rotary tables.

As industries seek enhanced precision, reduced cycle times, and greater flexibility, rotary tables with advanced servo control, IoT capabilities, and programmable motion functions will gain prominence, shaping the industry landscape throughout the forecast period.

The drive mechanism segment of the Industrial Rotary Table industry includes Manual Rotary Tables, Motorized Rotary Tables, and Hydraulic or Pneumatic Rotary Tables. Manual rotary tables remain relevant in low-cost precision machining and educational setups, where automated control is not a priority. These tables provide simple, reliable operation and are widely used in metalworking and toolroom applications.

However, motorized rotary tables are expected to dominate the industry due to their high-speed operation, automation compatibility, and CNC integration. Industries such as automotive, semiconductor manufacturing, and precision machining increasingly rely on servo and stepper motor-driven rotary tables for enhanced accuracy and productivity. Hydraulic and pneumatic rotary tables are used in heavy-load applications where high torque and rapid positioning are required, such as metal fabrication, shipbuilding, and industrial automation.

The growing emphasis on automated manufacturing, robotics, and predictive maintenance is driving manufacturers to develop smart motorized rotary tables with real-time performance monitoring and AI-driven control. As industries continue to adopt high-speed, multi-axis machining and robotic assembly, the demand for motorized rotary tables with programmable motion profiles and adaptive speed controls will increase, making them the preferred choice for advanced manufacturing environments.

The size and load capacity segment of the Industrial Rotary Table industry is divided into Small, Medium, and Large Rotary Tables, each serving different industrial needs. Small rotary tables are gaining popularity in electronics, medical device manufacturing, and micro-machining industries, where compact designs and precise movement are essential. These tables are often servo-driven and used in laser cutting, PCB manufacturing, and fine engraving applications.

Medium rotary tables are the most versatile, catering to industries such as automotive, aerospace, and general machining, where moderate load handling and multi-axis rotation are required. They provide an optimal balance of size, power, and flexibility, making them suitable for CNC machining centers and automated production lines. Large rotary tables are essential in heavy-duty applications such as shipbuilding, defense, and energy sectors, where high-load capacity and robust construction are crucial.

These tables often incorporate hydraulic and servo-driven mechanisms to handle large components with high precision and efficiency. As industries increasingly demand customized solutions for complex machining tasks, manufacturers are innovating with lightweight materials, AI-driven load optimization, and automated calibration systems to enhance the functionality of rotary tables across different size categories.

The application segment of the Industrial Rotary Table industry consists of CNC Rotary Tables, Welding Rotary Tables, Assembly Rotary Tables, and Inspection Rotary Tables, each serving a vital role in modern manufacturing. CNC rotary tables are the most in-demand due to their integration with multi-axis machining centers, allowing precise positioning, milling, and drilling operations.

They are widely used in automotive, aerospace, and die & mold industries where high accuracy and automation are essential. Welding rotary tables enhance productivity in robotic and manual welding by providing consistent positioning for stronger and more uniform welds.

These are commonly used in metal fabrication, pipeline construction, and automotive body welding. Assembly rotary tables streamline industrial production lines by enabling automated positioning of components, reducing manual errors, and improving throughput. They play a significant role in electronics, medical device manufacturing, and precision assembly applications. Inspection rotary tables facilitate dimensional accuracy and quality control, allowing manufacturers to conduct non-destructive testing, scanning, and laser measurement with greater precision.

With the rise of AI-driven automation and Industry 4.0 integration, rotary tables with smart sensors, predictive maintenance features, and real-time motion tracking will gain popularity, driving innovation and efficiency across multiple applications.

The construction material segment of the Industrial Rotary Table industry includes Cast Iron Rotary Tables, Aluminum Rotary Tables, and Steel Rotary Tables, each catering to different industrial requirements. Cast iron rotary tables are widely used in precision machining and heavy-duty applications due to their high durability and vibration-dampening properties, ensuring stable and accurate operations in CNC machines. They are the preferred choice for metalworking, tooling, and heavy engineering industries.

Aluminum rotary tables offer advantages such as lightweight construction, corrosion resistance, and ease of mobility, making them ideal for electronics, medical equipment, and aerospace applications where reduced weight and high-speed rotation are crucial. Steel rotary tables provide exceptional strength, wear resistance, and longevity, making them suitable for high-load machining, industrial automation, and harsh operating environments.

With advancements in material science and manufacturing techniques, companies are developing rotary tables with composite materials, enhanced coatings, and thermal-resistant properties to improve performance and longevity.

As industries seek higher efficiency and greater durability, the demand for rotary tables made from custom-engineered materials with improved load-bearing capabilities will continue to rise, shaping the industry dynamics over the forecast period.

The Industrial Rotary Table industry falls under the machine tool and automation equipment industry, which is a crucial segment of the broader industrial manufacturing sector. This industry is heavily influenced by macroeconomic factors such as global manufacturing output, capital investments in automation, economic cycles, and technological advancements.

The period from 2025 to 2035 is expected to witness steady growth in industrial automation, CNC machining, and precision engineering, which will drive the demand for rotary tables across various industries, including automotive, aerospace, metal fabrication, and electronics.

One of the key macroeconomic drivers is the increasing adoption of Industry 4.0 and smart manufacturing, leading to greater demand for automated, high-precision rotary tables integrated with IoT, AI, and predictive maintenance capabilities. Additionally, the rising trend of reshoring and localized production in major economies will boost machine tool investments, including rotary tables.

Economic growth in emerging industries such as India and China will further fuel industrial expansion, increasing the demand for advanced machining solutions. However, inflation, fluctuating raw material prices, and global supply chain disruptions could pose challenges to industry growth. Despite these challenges, the industry is poised for steady expansion, supported by technological innovations, automation trends, and increasing capital expenditure in industrial machinery.

The Industrial Rotary Table industry presents numerous growth opportunities driven by technological advancements, increasing automation, and evolving manufacturing needs. The growing adoption of CNC machining and multi-axis manufacturing is a key driver, creating demand for high precision, motorized rotary tables integrated with servo motors and smart control systems.

Additionally, the rise of Industry 4.0, AI-driven automation, and IoT-enabled monitoring will fuel demand for rotary tables that offer real-time performance tracking and predictive maintenance. Expanding applications in industries such as aerospace, medical device manufacturing, semiconductor fabrication, and electric vehicle (EV) production provides significant industry potential. Emerging industries, including India, China, and Southeast Asia, are witnessing increased industrialization and investment in machine tools, creating strong growth avenues.

To capitalize on these opportunities, manufacturers should focus on innovation, automation, and customization. Investing in lightweight, high-strength materials such as carbon fiber composites can improve efficiency and durability. Strategic partnerships with CNC machine manufacturers, robotics companies, and smart factory integrators can drive industry expansion. Additionally, companies should explore aftermarket services, including maintenance, retrofitting, and software upgrades, to enhance customer value.

Expanding global supply chains, reducing lead times, and offering localized production and service support will be crucial for maintaining a competitive edge. A focus on sustainable and energy-efficient rotary table designs can also align with the increasing emphasis on green manufacturing and carbon footprint reduction.

| Leading Companies | Market Share |

|---|---|

| Haas Automation, Inc. | 22% |

| NSK Ltd. | 18% |

| TOS Varnsdorf a.s. | 15% |

| FIBRO GmbH | 12% |

| Hardinge Inc. | 10% |

| Tsudakoma Corp. | 8% |

| Shibaura Machine | 7% |

| Others | 8% |

Key Developments in 2024

Indexing Rotary Tables, Continuous Rotary Tables

Manual Rotary Table, Motorized Rotary Tables, Hydraulic or Pneumatic Rotary Tables

Small Rotary Tables, Medium Rotary Tables, Large Rotary Tables

CNC Rotary Tables, Welding Rotary Tables, Assembly Rotary Tables, Inspection Rotary Tables

Cast Iron Rotary Tables, Aluminum Rotary Tables, Steel Rotary Tables

North America, Latin America, Western Europe, Eastern Europe, Middle East and Africa, East Asia, South Asia and Pacific

The increasing adoption of automation, CNC machining, and precision engineering is boosting demand. Industries such as aerospace, automotive, and electronics require high accuracy positioning solutions, leading to greater usage of rotary tables.

Innovations such as servo motor integration, IoT-enabled monitoring, and AI-driven automation are enhancing precision, efficiency, and real-time performance tracking. These advancements improve productivity and reduce downtime in manufacturing processes.

Industrial rotary tables are widely used in aerospace, automotive, metal fabrication, electronics, medical device manufacturing, and semiconductor production. They support applications like CNC machining, welding, assembly, and inspection.

Key considerations include load capacity, rotation precision, speed, drive mechanism, and integration with existing machinery. The choice depends on application needs, such as CNC machining, robotic automation, or heavy-duty metalworking.

Growing investments in smart manufacturing, automation, and high-precision engineering will drive continued adoption. Expanding industrial production, particularly in emerging economies, will further increase the need for advanced rotary tables.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 & 2033

Table 11: Global Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 12: Global Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 17: North America Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 18: North America Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 19: North America Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 20: North America Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 21: North America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 22: North America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 23: North America Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 24: North America Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 28: Latin America Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 30: Latin America Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 32: Latin America Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 34: Latin America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 36: Latin America Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 40: Western Europe Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 42: Western Europe Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 44: Western Europe Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 46: Western Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 48: Western Europe Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 64: East Asia Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 66: East Asia Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 68: East Asia Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 71: East Asia Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 72: East Asia Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 73: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 74: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 75: South Asia Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 76: South Asia Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 77: South Asia Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 78: South Asia Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 79: South Asia Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 80: South Asia Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 81: South Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 82: South Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 83: South Asia Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 84: South Asia Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Table 85: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 86: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 87: MEA Market Value (US$ Million) Forecast by Type of Motion, 2018 & 2033

Table 88: MEA Market Volume (Units) Forecast by Type of Motion, 2018 & 2033

Table 89: MEA Market Value (US$ Million) Forecast by Driver Mechanism, 2018 & 2033

Table 90: MEA Market Volume (Units) Forecast by Driver Mechanism, 2018 & 2033

Table 91: MEA Market Value (US$ Million) Forecast by Size and Load Capacity, 2018 & 2033

Table 92: MEA Market Volume (Units) Forecast by Size and Load Capacity, 2018 & 2033

Table 93: MEA Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 94: MEA Market Volume (Units) Forecast by Application, 2018 & 2033

Table 95: MEA Market Value (US$ Million) Forecast by Construction Material, 2018 & 2033

Table 96: MEA Market Volume (Units) Forecast by Construction Material, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 & 2033

Figure 5: Global Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 12: Global Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 16: Global Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 20: Global Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 24: Global Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 28: Global Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 31: Global Market Attractiveness by Type of Motion, 2023 to 2033

Figure 32: Global Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 33: Global Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 34: Global Market Attractiveness by Application, 2023 to 2033

Figure 35: Global Market Attractiveness by Construction Material, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 38: North America Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 39: North America Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 40: North America Market Value (US$ Million) by Application, 2023 & 2033

Figure 41: North America Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 48: North America Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 52: North America Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 56: North America Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 60: North America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 64: North America Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 67: North America Market Attractiveness by Type of Motion, 2023 to 2033

Figure 68: North America Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 69: North America Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 70: North America Market Attractiveness by Application, 2023 to 2033

Figure 71: North America Market Attractiveness by Construction Material, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 74: Latin America Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 75: Latin America Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 76: Latin America Market Value (US$ Million) by Application, 2023 & 2033

Figure 77: Latin America Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 84: Latin America Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 88: Latin America Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 92: Latin America Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 96: Latin America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 100: Latin America Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Type of Motion, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Construction Material, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 110: Western Europe Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 111: Western Europe Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 112: Western Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 113: Western Europe Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Type of Motion, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Construction Material, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Type of Motion, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Construction Material, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 182: East Asia Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 183: East Asia Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 185: East Asia Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 188: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 189: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 190: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: East Asia Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 192: East Asia Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 193: East Asia Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 194: East Asia Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 195: East Asia Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 196: East Asia Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 200: East Asia Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 201: East Asia Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 202: East Asia Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 203: East Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 204: East Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 205: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 206: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 207: East Asia Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 208: East Asia Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 209: East Asia Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 210: East Asia Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 211: East Asia Market Attractiveness by Type of Motion, 2023 to 2033

Figure 212: East Asia Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 213: East Asia Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 214: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 215: East Asia Market Attractiveness by Construction Material, 2023 to 2033

Figure 216: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 217: South Asia Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 218: South Asia Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 219: South Asia Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 220: South Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 221: South Asia Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 222: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 223: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 224: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 225: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 226: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: South Asia Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 228: South Asia Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 229: South Asia Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 230: South Asia Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 231: South Asia Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 232: South Asia Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 233: South Asia Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 234: South Asia Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 235: South Asia Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 236: South Asia Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 237: South Asia Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 238: South Asia Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 239: South Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 240: South Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 241: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 242: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 243: South Asia Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 244: South Asia Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 245: South Asia Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 246: South Asia Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 247: South Asia Market Attractiveness by Type of Motion, 2023 to 2033

Figure 248: South Asia Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 249: South Asia Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 250: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 251: South Asia Market Attractiveness by Construction Material, 2023 to 2033

Figure 252: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: MEA Market Value (US$ Million) by Type of Motion, 2023 & 2033

Figure 254: MEA Market Value (US$ Million) by Driver Mechanism, 2023 & 2033

Figure 255: MEA Market Value (US$ Million) by Size and Load Capacity, 2023 & 2033

Figure 256: MEA Market Value (US$ Million) by Application, 2023 & 2033

Figure 257: MEA Market Value (US$ Million) by Construction Material, 2023 & 2033

Figure 258: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 259: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 260: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 261: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 262: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: MEA Market Value (US$ Million) Analysis by Type of Motion, 2018 & 2033

Figure 264: MEA Market Volume (Units) Analysis by Type of Motion, 2018 & 2033

Figure 265: MEA Market Value Share (%) and BPS Analysis by Type of Motion, 2023 & 2033

Figure 266: MEA Market Y-o-Y Growth (%) Projections by Type of Motion, 2023 to 2033

Figure 267: MEA Market Value (US$ Million) Analysis by Driver Mechanism, 2018 & 2033

Figure 268: MEA Market Volume (Units) Analysis by Driver Mechanism, 2018 & 2033

Figure 269: MEA Market Value Share (%) and BPS Analysis by Driver Mechanism, 2023 & 2033

Figure 270: MEA Market Y-o-Y Growth (%) Projections by Driver Mechanism, 2023 to 2033

Figure 271: MEA Market Value (US$ Million) Analysis by Size and Load Capacity, 2018 & 2033

Figure 272: MEA Market Volume (Units) Analysis by Size and Load Capacity, 2018 & 2033

Figure 273: MEA Market Value Share (%) and BPS Analysis by Size and Load Capacity, 2023 & 2033

Figure 274: MEA Market Y-o-Y Growth (%) Projections by Size and Load Capacity, 2023 to 2033

Figure 275: MEA Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 276: MEA Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 277: MEA Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 278: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 279: MEA Market Value (US$ Million) Analysis by Construction Material, 2018 & 2033

Figure 280: MEA Market Volume (Units) Analysis by Construction Material, 2018 & 2033

Figure 281: MEA Market Value Share (%) and BPS Analysis by Construction Material, 2023 & 2033

Figure 282: MEA Market Y-o-Y Growth (%) Projections by Construction Material, 2023 to 2033

Figure 283: MEA Market Attractiveness by Type of Motion, 2023 to 2033

Figure 284: MEA Market Attractiveness by Driver Mechanism, 2023 to 2033

Figure 285: MEA Market Attractiveness by Size and Load Capacity, 2023 to 2033

Figure 286: MEA Market Attractiveness by Application, 2023 to 2033

Figure 287: MEA Market Attractiveness by Construction Material, 2023 to 2033

Figure 288: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Table Knife Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Rotary Shaping File Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Rotary DIP Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA