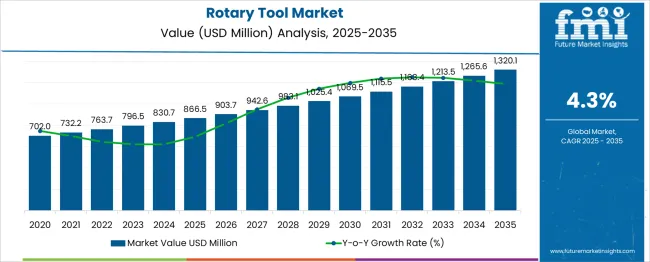

The Rotary Tool Market is estimated to be valued at USD 866.5 million in 2025 and is projected to reach USD 1320.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. Inflection point mapping highlights a transitional phase around 2029, where growth shifts from steady to accelerated due to converging demand drivers. From 2025 to 2028, the market adds approximately USD 36 million annually, moving from USD 830.7 million to 903.7 million, which suggests a conservative growth cycle linked to replacement demand and incremental DIY adoption.

Post-2029, the annual increase rises beyond USD 40 million, peaking near USD 50 million by 2034, signaling heightened elasticity in end-use demand. This acceleration is aligned with cordless rotary tools penetrating industrial maintenance, coupled with rapid e-commerce expansion in consumer segments. The inflection coincides with competitive differentiation based on variable-speed control, lithium-ion battery systems, and modular accessory ecosystems, which unlock multi-purpose utility and higher lifetime value. Notably, the second half of the decade contributes nearly USD 354.6 million, accounting for 63% of total incremental growth, indicating a back-weighted curve favoring late adopters and technology-driven buyers. Manufacturers that recalibrate portfolios toward high-precision applications and bundled service models during this phase are positioned to outperform peers as the market enters an adoption-intensive trajectory beyond 2030.

| Metric | Value |

|---|---|

| Rotary Tool Market Estimated Value in (2025 E) | USD 866.5 million |

| Rotary Tool Market Forecast Value in (2035 F) | USD 1320.1 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The rotary tool market occupies a small but strategically important niche within broader tool segments. In the overarching power tools market, rotary tools account for around 2–3% of revenue, overshadowed by higher selling product classes like drills and saws. Among handheld power tools, they make up about 4–5% reflecting their specialized utility in finishing, detailing, and precision tasks. Within the DIY and hobbyist tool segment, rotary tools hold a substantially larger share, around 20–25% driven by widespread use among craft enthusiasts and at-home users for sanding, engraving, and cutting operations. In professional and industrial settings, their share stands at about 8–10% as rotary tools serve critical applications in sectors like automotive, construction, and electronics manufacturing for precise material removal and finishing.

Within the broad electric tools market, rotary variants represent approximately 2–3% of the total, underscoring their niche status in comparison to battery-operated or grid-powered general-purpose tools. While not dominant in size, rotary tools deliver high functional value within targeted precision and craft-focused workflows.

The rotary tool market is witnessing robust expansion, driven by growing industrial precision needs, widespread adoption across DIY applications, and enhancements in speed control technologies. Rising demand for compact, multi-functional tools across fabrication, automotive repair, and electronics sectors has strengthened product development efforts.

Shifts toward ergonomic design, noise reduction, and advanced brushless motor systems are improving operator efficiency and safety, especially in professional use cases. Moreover, supply chain localization and increased focus on high-speed machining tools in emerging markets are reshaping product availability and customization.

Sustainability factors, including lower energy usage and recyclable components, are also becoming key differentiators. Demand will be further sustained by growth in industrial automation, increased adoption of small business tools, and integration of rotary tools with IoT-enabled monitoring platforms.

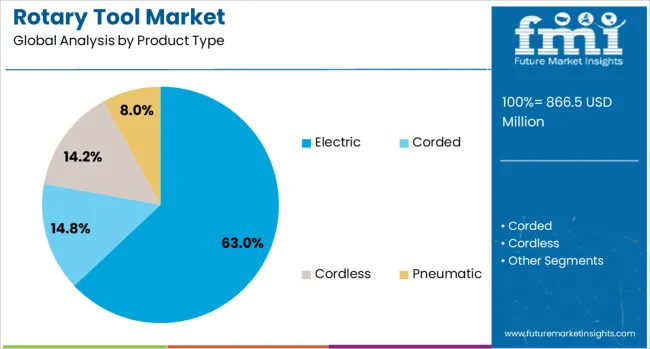

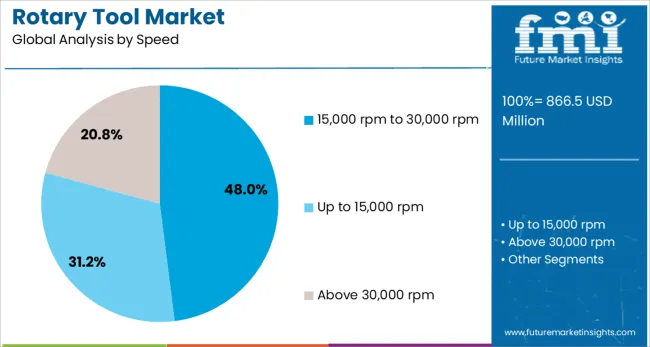

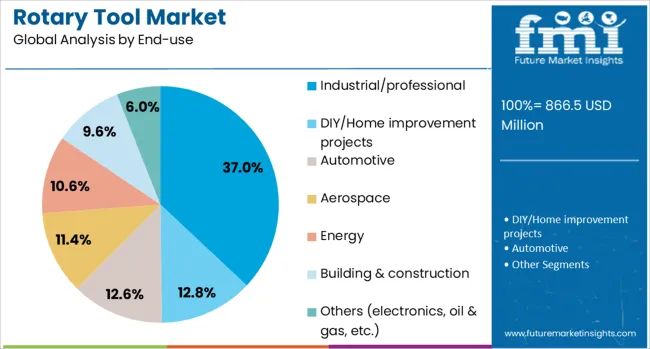

The rotary tool market is segmented by product type, speed, end-use, distribution channel, and geographic regions. By product type of the rotary tool market is divided into Electric, Corded, Cordless, and Pneumatic. In terms of speed, the rotary tool market is classified into 15,000 rpm to 30,000 rpm, up to 15,000 rpm, and above 30,000 rpm. The rotary tool market is segmented based on end-use into Industrial/professional, DIY/Home improvement projects, Automotive, Aerospace, Energy, Building & construction, and Others (electronics, oil & gas, etc.). The distribution channel of the rotary tool market is segmented into Offline and Online. Regionally, the rotary tool industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electric rotary tools are projected to dominate the market with a 63.00% revenue share in 2025. This leadership is being maintained due to their high torque delivery, consistent speed control, and plug-and-play usability across professional and personal tasks.

Their ability to support extended use without power drop-offs has made them indispensable in industrial maintenance, woodworking, and detailed engraving applications. Manufacturers have prioritized durability and heat resistance in electric models, supporting long-term cost-efficiency and tool reliability.

The continued evolution of lightweight electric designs with multiple attachment compatibility is further contributing to their market penetration, particularly in regions with advanced infrastructure and power availability.

Rotary tools operating within the 15,000 rpm to 30,000 rpm range are expected to command 48.00% of the market revenue in 2025, making them the preferred speed category. This segment benefits from its adaptability across materials and applications, offering sufficient rotational force for tasks like cutting, sanding, grinding, and polishing without overheating.

The balanced performance between power and control supports precision work while minimizing material wear or tool damage. Enhanced user demand for tools that can toggle between multiple speed settings has also made this range a standard benchmark in new product launches.

Additionally, reduced operational noise and vibration at this speed band contribute to workplace safety and user comfort.

The industrial/professional segment is expected to capture 37.00% of the total rotary tool market revenue in 2025, marking it as the leading end-user category. This dominance is attributed to the increased reliance on rotary tools for high-accuracy machining, repair work, and precision detailing within manufacturing and heavy engineering environments.

These users prioritize tool consistency, durability, and compatibility with advanced materials, all of which are delivered through professional-grade rotary models. The segment’s growth is also being driven by rising capital investments in skilled trades and vocational training, along with expanded product availability via B2B digital procurement platforms.

Compliance with industrial safety norms and upgradability to handle automated or semi-automated operations are further encouraging adoption in this space.

Rotary tools are compact, high-speed power tools used for applications such as cutting, grinding, sanding, polishing, and engraving across industrial, automotive, and DIY sectors. These tools are equipped with interchangeable accessories, making them versatile for precision tasks. Growth has been supported by rising adoption in home improvement projects, increased demand for lightweight and portable tools, and innovations in cordless technology. Manufacturers are emphasizing ergonomic designs, variable speed control, and improved motor efficiency to enhance performance. Expansion in hobbyist communities and small-scale workshops continues to drive global market penetration.

Adoption of rotary tools has been driven by increasing popularity of home improvement and hobby-based activities, particularly in regions with a strong DIY culture. Industrial applications in automotive repair, electronics assembly, and metalworking have further supported demand for precision rotary tools. Enhanced functionality through quick accessory change systems and variable speed features has broadened use cases. Growth in small-scale manufacturing and customization activities, including crafting and jewelry making, has reinforced the need for versatile tools. Cordless variants equipped with advanced battery technology have gained preference for portability and convenience across both professional and personal applications.

Market growth has faced constraints due to the high price of premium rotary tool kits, which affects affordability in price-sensitive markets. Performance limitations in heavy-duty applications, such as extended cutting of dense materials, have restricted usage to light and medium tasks. Frequent accessory replacements and compatibility concerns across brands add recurring costs for users. Heat buildup during prolonged operation poses reliability challenges, necessitating design improvements. The presence of low-quality counterfeit products in developing markets creates additional concerns regarding safety and durability. Limited awareness of advanced rotary tool features among new users has further slowed market expansion in some regions.

Significant opportunities exist in the development of cordless rotary tools with enhanced battery life and fast-charging capabilities to meet mobility requirements. Integration of smart features, such as digital speed control and overload protection, provides scope for differentiation. Demand for accessory kits tailored to specific applications like wood carving, engraving, and precision polishing offers additional revenue potential. Growth of e-commerce platforms and subscription-based accessory delivery models is expanding reach to DIY enthusiasts. Collaborations with craft and repair tool brands for bundled solutions are expected to strengthen consumer adoption. Expansion in emerging markets with growing home renovation activities offers further potential.

Recent trends highlight the shift toward lightweight and ergonomically designed rotary tools that reduce user fatigue during extended operations. Advanced motor technologies are being introduced for consistent torque delivery across varying speed ranges. Adoption of brushless motors is gaining attention for improved energy efficiency and longer service life. Customizable speed presets and integrated LED lighting for enhanced visibility are becoming standard in premium models. Manufacturers are leveraging digital marketing and interactive tutorials to target hobbyists and professional users alike. Growth in compact, multi-functional rotary tools reflects an increasing demand for space-saving and user-friendly power tools.

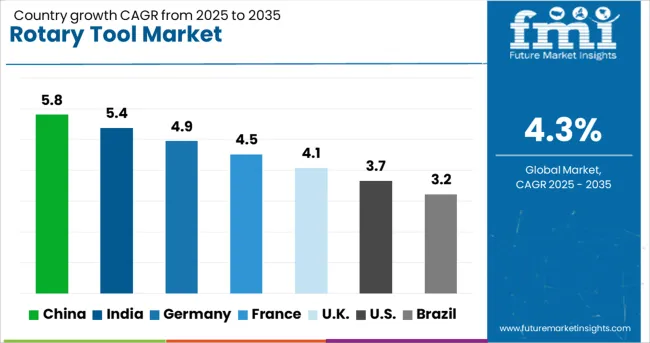

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The rotary tool market is projected to expand at a CAGR of 4.3% from 2025 to 2035. Among the top five profiled markets, China leads at 5.8%, followed by India at 5.4%, while France posts 4.5%, the United Kingdom records 4.1%, and the United States stands at 3.7%. These growth rates represent a premium of +35% for China and +26% for India over the global baseline, whereas France remains slightly ahead at +5%, while the UK and the US trail at –5% and –14%, respectively. Regional divergence is attributed to BRICS economies like China and India witnessing increased DIY adoption, industrial automation, and small-scale fabrication, while OECD markets such as France, the UK, and the US show moderate growth driven by professional tool upgrades and demand for precision work in automotive and construction segments. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 5.8% through 2035, driven by a booming manufacturing base, DIY culture, and urban housing upgrades. Automotive, electronics, and precision engineering sectors account for a significant share of demand, as rotary tools are widely used for cutting, polishing, and surface finishing. Domestic manufacturers are focusing on affordable yet feature-rich products to cater to both industrial and household users. Cordless rotary tools with lithium-ion batteries are gaining momentum due to portability and ease of use, especially in urban renovation projects. Increasing e-commerce penetration further accelerates product accessibility in tier-2 and tier-3 cities. Integration of variable speed controls and multi-attachment kits remains a key trend, enhancing tool versatility for diverse applications.

India is expected to achieve a CAGR of 5.4% through 2035, supported by infrastructure development, rising DIY culture, and growing adoption in woodworking, furniture manufacturing, and light engineering. The increasing popularity of home renovation and creative crafts has strengthened retail demand, particularly in semi-urban and urban markets. Local manufacturers are offering cost-efficient corded models, while global brands focus on cordless tools with extended battery performance for professional-grade applications. Online retail platforms have boosted market reach, making branded tools accessible at competitive pricing. Demand from automobile workshops and small-scale fabrication units further contributes to growth. Ergonomic designs, noise-reduction technology, and energy-efficient motors are among the innovation trends gaining traction in this segment.

France is forecasted to post a CAGR of 4.5% through 2035, driven by strong adoption in furniture restoration, hobbyist activities, and professional applications in automotive repair and construction. The demand for lightweight, multi-functional rotary tools is expanding as consumers prioritize convenience and efficiency for precision work. Premium cordless models featuring brushless motors and enhanced torque control are gaining traction among professionals seeking durability and performance. Local suppliers are innovating with ergonomic designs and vibration-reduction technologies to improve user comfort during prolonged operations. Compliance with European energy-efficiency and safety regulations is shaping design parameters across the market. DIY enthusiasts and professional contractors alike are increasingly opting for modular attachment kits that allow quick adaptation for sanding, engraving, or grinding.

The United Kingdom is expected to grow at a CAGR of 4.1% through 2035, supported by a rising culture of DIY home improvement and strong penetration of multi-purpose power tools. Demand for rotary tools in professional segments, such as automotive repair and light construction, remains steady due to their versatility in polishing, grinding, and cutting. Manufacturers are focusing on compact, cordless designs integrated with advanced features such as noise reduction and variable speed control. Modular accessory kits continue to gain popularity, enabling a single tool to perform diverse functions. Increasing interest in craft-based hobbies and precision applications also contributes to demand growth. Sustainability-focused procurement policies in public infrastructure projects are encouraging use of energy-efficient power tools across industrial and commercial sectors.

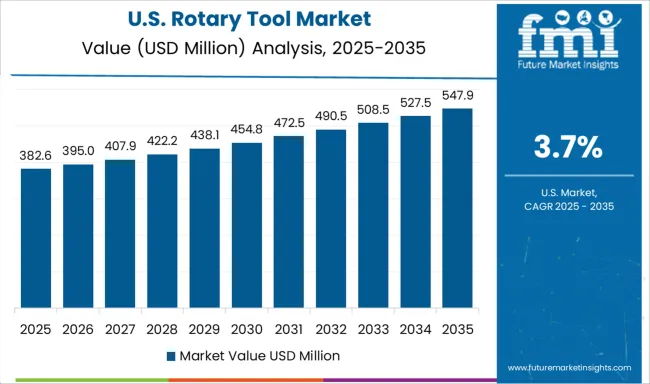

The United States is projected to post a CAGR of 3.7% through 2035, driven by industrial applications, niche hobbyist markets, and professional use in automotive and construction sectors. Rotary tools with variable speed settings dominate workshops, enabling precision cutting, deburring, and finishing. Brushless motor technology and advanced heat dissipation systems are key innovations aimed at enhancing tool durability and energy efficiency. Demand for cordless rotary tools with extended battery life is rising in both professional and DIY segments, driven by convenience and portability. Manufacturers are increasingly integrating digital monitoring features, allowing real-time torque control for enhanced safety. While the market is mature, opportunities lie in smart tool systems and ergonomic designs catering to specialized applications in aerospace and energy industries.

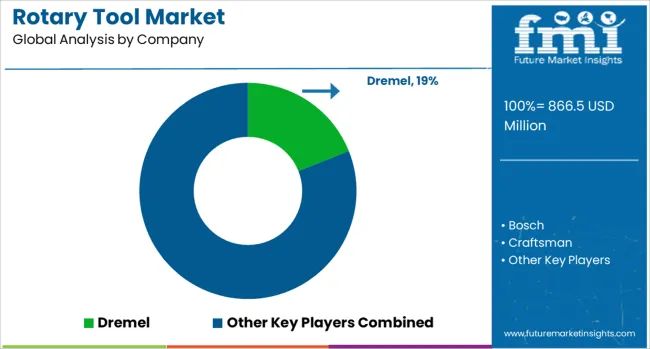

The rotary tool market is led by global power tool manufacturers and specialized brands catering to DIY, hobbyist, and professional applications across woodworking, metalworking, and precision crafting. Dremel, a subsidiary of Bosch, is the market leader with an extensive portfolio of high-speed rotary tools and accessories widely used for cutting, grinding, sanding, and engraving. Bosch complements this leadership with robust cordless rotary tools emphasizing ergonomic design and battery efficiency. Makita and Milwaukee dominate in professional-grade rotary tools, offering brushless motor technologies and extended runtime for heavy-duty tasks. Craftsman, Ryobi, and Worx target the mid-range consumer segment with affordable yet durable rotary tools, while Stanley focuses on industrial-grade tools with advanced performance features. Proxxon differentiates by specializing in miniature precision rotary tools for hobbyists and model-making enthusiasts.

WEN Products and Duratool cater to budget-conscious markets, offering compact tools suitable for light-duty applications. Emerson maintains its footprint in North America through versatile rotary tool solutions for both household and commercial use. Competitive differentiation is based on motor power, RPM range, durability, accessory compatibility, and cordless technology integration. Barriers to entry include strong brand loyalty, large accessory ecosystems, and innovation requirements to maintain market share in both consumer and professional segments. Strategic priorities include expanding cordless platforms, integrating variable-speed and smart control features, and enhancing tool ergonomics for precision work.

On June 3, 2025, Bosch Power Tools announced the expansion of its 18V cordless and accessory portfolio with new tools engineered for greater power, versatility, and efficiency. The additions include solutions for nailing, drilling, grinding, and layout applications, designed to deliver reliability and performance for professional tradespeople across diverse jobsite requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 866.5 Million |

| Product Type | Electric, Corded, Cordless, and Pneumatic |

| Speed | 15,000 rpm to 30,000 rpm, Up to 15,000 rpm, and Above 30,000 rpm |

| End-use | Industrial/professional, DIY/Home improvement projects, Automotive, Aerospace, Energy, Building & construction, and Others (electronics, oil & gas, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dremel, Bosch, Craftsman, Duratool, Emerson, Makita, Milwaukee, Proxxon, Ryobi, Stanley, WEN Products, and Worx |

| Additional Attributes | Dollar sales by product type (corded rotary tools, cordless rotary tools) and end-use segments (DIY/home improvement, professional workshops, hobbyist crafts). Demand dynamics are driven by the growth of home improvement trends, precision engineering requirements, and rising adoption of cordless tools for convenience. Regional trends show North America and Europe leading in premium tool adoption, while Asia-Pacific experiences rapid growth due to industrial applications and increasing DIY culture. Innovation focuses on brushless motor integration for improved lifespan, quick-change collet systems for faster accessory swaps, and vibration-dampening technologies for operator comfort. |

The global rotary tool market is estimated to be valued at USD 866.5 million in 2025.

The market size for the rotary tool market is projected to reach USD 1,320.1 million by 2035.

The rotary tool market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in rotary tool market are electric, corded, cordless and pneumatic.

In terms of speed, 15,000 rpm to 30,000 rpm segment to command 48.0% share in the rotary tool market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Rotary Shaping File Market Size and Share Forecast Outlook 2025 to 2035

Rotary DIP Switch Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Rotary Band Heat Sealer Market Size and Share Forecast Outlook 2025 to 2035

Rotary Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Rotary and RF Rotary Joints Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Rotary Scroll Air Compressor Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tray Sealers Market Size and Share Forecast Outlook 2025 to 2035

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Rotary Hopper Market Analysis by Material, Capacity, Application and Region: Forecast for 2025 and 2035

Rotary Limit Switches Market Growth - Trends & Forecast 2025 to 2035

Rotary Encoder Market

Rotary Steerable System Market

Rotary Knife Cutters Market

Rotary Sealers Market

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

NiTi Rotary File Market Size and Share Forecast Outlook 2025 to 2035

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA