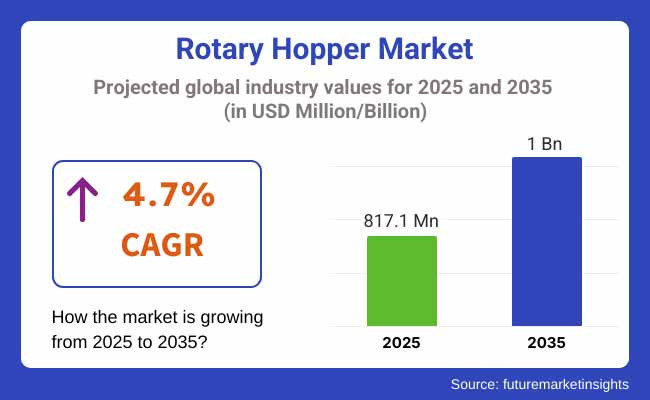

The Rotary Hopper Market is poised to achieve a revenue of USD 817.1 million in 2025. Over the projection period from 2025 to 2035, the market will expand at a CAGR of 4.7% and will surge to USD 1.27 billion.

The Rotary Hopper industry made steady growth with the rise of automation in manufacturing and the growing need for accuracy in material handling in 2024. The growth of the industry was driven by the development of food processing, pharmaceutical, and packaging industries integrating more efficient bulk handling techniques.

One of the most critical drivers during the past year was the combination of IoT and AI-based monitoring systems, enabling makers to enhance throughput and minimize downtime. Moreover, increasing labour expenses and strict regulatory needs compelled businesses to invest in automated and sanitary rotary hopper solutions, especially in industries such as pharmaceuticals and food & beverages.

The industry is estimated to continue continuously during the forecast period between 2025 and 2035. Customizable, energy-efficient hoppers with more advanced automation capabilities are expected to be the areas of interest. New industries, especially in Asia-Pacific, will be drivers of demand. Sustainability issues are also likely to drive manufacturers towards sustainable and recyclable products, influencing long-term industry patterns.

The Rotary Hopper industry is on a steady growth path, fueled by expanding automation in production, growing labour costs, and strict regulatory needs in industries such as food processing and pharmaceuticals. Firms investing in intelligent, energy-efficient, and sanitary material-handling equipment will be rewarded with a competitive advantage, while conventional manufacturers depending on outdated technologies could see themselves left behind.

Developing industries, especially in the Asia-Pacific, are big growth opportunities because demand for automated solutions keeps expanding.

Accelerate Automation & Smart Technology Integration

Invest in AI-driven monitoring, IoT-enabled tracking, and predictive maintenance to enhance operational efficiency and minimize downtime. Companies that embrace smart rotary hoppers will gain a competitive edge in precision material handling.

Align with Sustainability & Regulatory Trends

Develop eco-friendly, energy-efficient, and compliant solutions to meet evolving industry regulations, especially in food, pharma, and packaging. Prioritizing sustainability will attract environmentally conscious clients and secure long-term industry positioning.

Expand Through Emerging Markets & Strategic Partnerships

Strengthen distribution networks in high-growth regions like Asia-Pacific and form alliances with OEMs and automation providers. Mergers, acquisitions, or joint ventures with key players can drive faster industry penetration and technological advancement.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions - Fluctuations in raw material availability and global logistics constraints could lead to cost increases and production delays. | Medium Probability, High Impact |

| Regulatory Compliance Challenges - Stricter environmental and safety regulations may require costly modifications to existing products and processes. | High Probability, Medium-High Impact |

| Technological Disruption & Competition - Rapid advancements in automation and smart systems could render traditional rotary hoppers obsolete, impacting legacy players. | Medium-High Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| Supply Chain Resilience | Conduct a feasibility study on alternative raw material sourcing and establish backup suppliers to mitigate disruptions. |

| Product Innovation & Compliance | Initiate an OEM feedback loop to assess demand for smart, energy-efficient rotary hoppers that align with evolving regulations. |

| Market Expansion & Partnerships | Launch an incentive program for aftermarket channel partners to drive sales growth in emerging markets. |

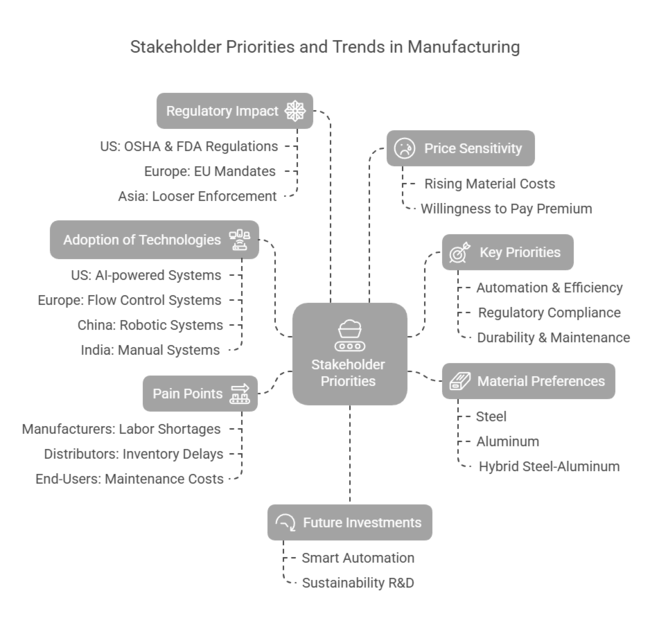

To stay ahead, Companies must focus on automation, material technology, and local adaptation to remain competitive. IoT-enabled rotary hoppers will improve efficiency, while alliances with local distributors will help solidify industry presence.

Compliance with regulations, particularly in the food and pharma industries, will need to be a priority. Growth in high-growth industries such as China and India will provide new revenue streams. A differentiated strategy that balances cost-effectiveness and cutting-edge technology will be essential for long-term success.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in the USA, Western Europe, China, and India)

Regional Insights:

High Variance by Region:

ROI Perception on Automation:

Manufacturers:

Distributors:

End-Users (Factories & Warehouses):

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | OSHA (Occupational Safety & Health Administration) mandates workplace safety standards for rotary hoppers used in industrial environments. The FDA (Food & Drug Administration) enforces material safety requirements for food and pharmaceutical applications. Increasing pressure from EPA (Environmental Protection Agency) on sustainable manufacturing. UL (Underwriters Laboratories) certification is required for electrical components in automated hoppers. |

| Western Europe | CE Marking (Conformité Européenne) is mandatory for all rotary hoppers sold in the EU, ensuring compliance with health, safety, and environmental protection standards. The EU Machinery Directive (2006/42/EC) regulates safety requirements for automated material-handling systems. The EcoDesign Directive influences manufacturers to adopt energy-efficient and recyclable materials. Stricter REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations impact material choices. |

| China | CCC (China Compulsory Certification) is required for rotary hoppers with electrical components. The MIIT (Ministry of Industry and Information Technology) enforces regulations on smart automation and industrial safety. Recent "Made in China 2025" policies incentivize the adoption of domestic, high-tech manufacturing solutions over imported equipment. New sustainability initiatives push for energy-efficient industrial equipment. |

| India | BIS (Bureau of Indian Standards) certification is mandatory for mechanical and electrical safety compliance. FSSAI (Food Safety and Standards Authority of India) regulates rotary hoppers used in the food and beverage industries. The Make in India initiative offers incentives for local manufacturers to reduce reliance on imports. Growing state-level environmental policies may soon impact material sourcing and disposal. |

| Japan | JIS (Japanese Industrial Standards) certification ensures product safety and performance compliance. The METI (Ministry of Economy, Trade, and Industry) has introduced stricter automation safety guidelines for smart manufacturing. Recent government initiatives encourage investments in space-saving, high-efficiency industrial equipment to combat land-use constraints. |

| South Korea | KC (Korea Certification) mark is required for industrial and electronic equipment. The KOSHA (Korea Occupational Safety and Health Agency) enforces workplace safety compliance, particularly for material-handling systems. Government subsidies are available for smart factory automation and robotics, pushing manufacturers to integrate AI-driven rotary hoppers. |

The USA rotary hopper industry is backed by increasing industrial automation and compliance with regulations. The OSHA and FDA standards require stringent safety and hygiene regulations, especially in the food, pharma, and chemical industries. The use of IoT-enabled hoppers is rising as there is a growing demand for predictive maintenance.

The growth of e-commerce and logistics automation further fuels the demand for sophisticated material-handling systems. Supply chain interruptions and manufacturing labor shortages are the challenges. Federal incentives for green manufacturing and energy-efficient equipment create huge growth prospects. Top companies are investing in modular and AI-based solutions to keep their competitive advantage in this mature but innovation-led industry.

FMI opines that the United States rotary hopper sales will grow at nearly 5.2% CAGR through 2025 to 2035.

The UK rotary hopper industry is steadily expanding based on rising investment in automation, sustainability regulations, and post-Brexit industrial policy. The emphasis on carbon-neutral production within the country fits the UK Net Zero Strategy, urging manufacturers to go for energy-efficient rotary hoppers. The food and beverage industry, one of the principal end-users, has stringent FSA (Food Standards Agency) and CE marking specifications. Automating logistics, especially in warehouses, is also a key driver of demand. However, profitability is hurt by post-Brexit imported material costs and supply chain constraints. Investments in intelligent factories and AI-enabled automation are pivotal trends as companies aim to improve operations amidst the rise of labor costs and increased regulatory scrutiny.

FMI opines that the United Kingdom rotary hopper sales will grow at nearly 5.2% CAGR through 2025 to 2035.

The rotary hopper industry in France is driven by stringent EU regulations on sustainability and the nation's focus on industrial automation. French Environmental Law and the EcoDesign Directive propel the take-up of low-carbon, energy-efficient manufacturing solutions. Key end-users include the food and pharmaceutical sectors, complying with ANSES (French Agency for Food, Environmental and Occupational Health & Safety) regulations.

Intelligent material-handling solutions are gaining ground in the logistics and aerospace industries, which are important sectors of the French economy. But high energy prices and regulatory complexity are issues. Companies that are investing in environmentally friendly technology and AI-driven automation are likely to be ahead of the curve in this changing landscape.

FMI opines that France rotary hopper sales will grow at nearly 4.6% CAGR through 2025 to 2035.

The rotary hopper industry in Germany is expected to grow during the projection period, given its Industry 4.0 plans and industrial automation leadership. The nation has strict CE and TÜV certification regulations, which compel manufacturers to spend on high-precision, robotics-based rotary hoppers. The logistics, automotive, and pharmaceutical industries are the main drivers of demand. Sustainability is also a significant factor, as firms comply with the EU's Green Deal and Germany's Energiewende policy to minimize carbon footprints.

R&D incentives and subsidies for smart factories promote local innovation. However, the industry will be confronted by increasing labor charges and competition with low-cost providers from Eastern Europe. Strong demand for customized, AI-based material handling solutions will drive long-term growth.

FMI opines that Germany rotary hopper sales will grow at nearly 4.9% CAGR through 2025 to 2035.

The industry for rotary hoppers in Italy is driven by investments in the packaging, food processing, and pharmaceutical industries. EU Machinery Directive and CE Marking regulations safeguard product safety and environmental compliance, encouraging local suppliers to modernize their systems. The nation's robust manufacturing industry, especially for textiles and automobile components, is driving demand for automation.

However, economic cycles and high energy prices are threatening it. The emphasis of Italy on circular economy strategies and environmentally friendly industrial policies is driving investment in recyclable material and efficient machinery. The adoption of industrial IoT and smart manufacturing through incentives by the government will define the decade of development for this sector.

FMI opines that Italy rotary hopper sales will grow at nearly 4.4% CAGR through 2025 to 2035.

The South Korean rotary hopper industry is expected to grow by 2035 due to the nation's fast-paced adoption of smart factory automation and robust manufacturing base. The government's "Manufacturing Renaissance Vision 2030" favors AI-based automation, which is favorable for the rotary hopper sector. KOSHA (Korea Occupational Safety and Health Agency) and KC (Korea Certification) regulations impose strict workplace safety standards, favoring automated and enclosed rotary hoppers.

The electronics, semiconductor, and logistics industries push demand for high-value material-handling solutions with customization. Competing with low-cost Chinese imports and unstable export industries, however, is an ongoing issue. Firms' spending on AI, robotics, and IoT-integrated rotary hoppers will dominate the market.

FMI opines that the South Korea rotary hopper sales will grow at nearly 5.2% CAGR through 2025 to 2035.

The Japanese rotary hopper industry will increase with aging workforce issues driving demand, with compact, precision automation solutions also in demand. JIS (Japanese Industrial Standards) and METI (Ministry of Economy, Trade, and Industry) compliance governs safety and performance with high product quality. Demand for precision-engineered rotary hoppers is driven by the electronics, robotics, and pharmaceutical sectors. Japan's culture of space-saving, multi-functional automation influences product innovation.

High manufacturing costs and sluggish economic growth, however, affect expansion. Government subsidies for AI-based automation and energy-efficient manufacturing are strong drivers of innovation in this industry.

FMI opines that the Japan rotary hopper sales will grow at nearly 4.1% CAGR through 2025 to 2035.

China's rotary hopper industry ranks among the fastest-growing markets. The nation's "Made in China 2025" plan and robust industrial growth fuel high demand for automated material handling solutions. CCC (China Compulsory Certification) and MIIT regulations guarantee product safety and quality conformity. The electronics, automotive, and logistics sectors are leaders in adoption. However, increasing raw material prices and trade tensions are raising uncertainties.

The government's efforts to promote smart manufacturing, AI-based automation, and sustainability are creating new opportunities. Chinese companies are investing fast in local R&D to decrease dependence on overseas suppliers and improve global competitiveness.

FMI opines that China rotary hopper sales will grow at nearly 5.5% CAGR through 2025 to 2035.

The Australian and New Zealand rotary hopper industry is driven by industries such as mining, agriculture, and food processing. Regulations such as Safe Work Australia and FSANZ (Food Standards Australia New Zealand) mandate stringent standards of safety and hygiene, resulting in automation within material handling. Sustainability is paramount, with sectors moving towards efficient energy use and recyclable materials.

However, high logistics costs and a comparatively small industrial base constrain industry growth. Investments in mining automation, agritech, and warehousing robotics are defining growth. The growing use of AI-driven rotary hoppers in intelligent supply chains will continue to fuel demand over the next decade.

FMI opines that the Australia-NZ rotary hopper sales will grow at nearly 4.8% CAGR through 2025 to 2035.

Global food security and supply chain efficiency will be among the top priorities, with grains driving rotary hopper demand. Modern hoppers for bulk agricultural processing & international commodity grain trade must focus on down-stream air regulation and material contamination elimination. Manufacturers will focus on designs that are resistant to corrosion and dust to improve durability.

Seed processors and farmers will increasingly adopt rotary hoppers for handling seeds. Farmers, as well as seed processors, will invest in contamination-proof storage and dispensing systems to protect the integrity of the seed.

Bulk handling and product caking will also be minimised with the help of advanced rotary hoppers. The increasing food safety regulations will drive demand for dust-controlled systems that can help avoid contamination. Operational efficiency will be improved with automated dispensing along with anti-static coatings. Higher output of sugar substitutes will demand adjustable hoppers for different particle sizes, while easy-to-clean designs will minimize downtime in high-volume operations.

Growth of the bakery and processed food industries will fuel flour handling. Rotary hoppers, with precise flow control, will ensure ingredient quality. The necessity for adherence to hygiene regulations will create new opportunities in the stainless steel & polymer-coated hoppers. This will push digital inventory management in milling.

As with the demand for animal feed and biofuels, Feedstock processing (i.e. fats, proteins) will expand. Soy, corn and biomass will be handled by rotary hoppers. Growth in livestock will spur investment in aerated bulk feed storage.

Rotary hoppers will also be needed for other materials, such as powders, minerals and specialty chemicals. The miners will require heavy-duty hoppers for bulk ore management. Specialty Chemicals will demand contamination-free, anti-static solutions. Ultrahygienic hoppers dispensing accuracy will be embraced by pharmaceutical and nutraceutical industries. With the ongoing diversification of industries, manufacturers will build modular, customizing hoppers for niche handling applications.

Small-capacity rotary hoppers will gain traction with small-scale food processors, independent grain merchants, and specialty agricultural companies. The emergence of localized production will make companies look toward small hoppers for precise ingredient dispensing.

Rotary hoppers with mid-capacity will continue to be crucial for mid-sized manufacturers, cooperatives and industrial processors. These hoppers will offer a balance in cost and performance, making them suitable for grain storage, feed production, and food processing. Automated systems will facilitate material transfer while adhering to regulatory standards.

Large-capacity rotary hoppers will be the norm in food processing, agriculture, and mining bulk material handling. High-volume operations will necessitate sophisticated automation and sensor-based hoppers for efficient material flow. Logistics providers will incorporate large-capacity hoppers into automated storage systems. Sustainability will lead to demand for energy-efficient, recyclable designs.

The demand for animal feed in regional or international industries has been conducive to the continued expansion of the animal feed production sector. Rotary hoppers are being utilized for effective blending of all ingredient types. With sustainability considerations pushing R&D towards recyclable hopper materials, automation will enhance feed formulation accuracy.

Small and medium farms will move closer to efficient handling systems supported by government support to produce local feed. With IoT-based monitoring, feed and inventory can be managed well, thus fostering productivity.

Rotary hoppers will be used in food processing industries for accurate quantity of ingredients and contamination-free storage. Process Automation, Material Handling & Storage- The Rising demand for processed food would drive the investment in integrated technology-based automated material-handling solutions, which would deliver responsiveness and flexibility.

Stainless steel hoppers will be manufactured as food safety standards will compel the manufacturers to comply with them. Hoppers with sensors allow for better monitoring of material flow, leading to less waste. New opportunities for custom hopper designs will be created by the rise in plant-based food production.

Grain trade operations will need high-efficiency rotary hoppers for bulk storage and fluid transfer of materials. International grain exports will be helped by sophisticated handling solutions that minimize losses. Intelligent hoppers with real-time monitoring will optimize inventory management. Investment in dust-controlled and aerated hoppers will enhance hygiene and safety. Electronic commodity trading will propel automated bulk-handling technologies for efficient logistics.

Biofuel manufacturing will rely upon rotary hoppers to process biomass feedstocks effectively. Wear-resistant coatings on high-throughput hoppers will be necessary. Automated material-handling systems will save downtime and maximize feedstock use. Sustainability programs will spur demand for energy-efficient, eco-friendly hoppers. More stringent emissions standards will compel biofuel manufacturers towards advanced handling systems that create less waste during operation.

There are other uses, such as mining, pharma, and agri-supply chains, that will demand purpose-built rotary hoppers. Heavy-duty ore and aggregate handling hoppers will be the need of the mining industry. Ultra-hygienic precision dispensing hoppers will be the choice of the pharmaceutical industry. Storage solutions for the agricultural industry will be contamination-proof. Manufacturers will make module-based hopper designs to serve niche industrial purposes.

The cattle grooming chute industry is relatively fragmented, with a combination of long-standing firms and nascent companies. Major players contend based on aggressive pricing, new product offerings, alliances and collaborations, and geographic expansions to drive their industry standing.

In May 2024, MJE Livestock Equipment made a strategic partnership with Pearson Livestock Equipment to supply ranchers with innovative squeeze chutes, boosting operational efficiency and livestock handling capabilities.

Moreover, Cattler Corporation announced in August 2024 a tripling of Q2 sales from a year ago and released an interface with Micromachine, making feed planning and automation functionalities a part of their platform to increase efficiency in cattle operations. The news highlights how the industry maintains a drive for innovation and collaborative strategies to capture changing industry demand.

grains, seeds, sugar, flour, feedstock and others

small capacity, medium capacity, large capacity

animal feed, food processing, grain trading, biofuel production, pharmaceuticals, agriculture, mining and others

North America, Latin America, Western Europe, East Asia, South Asia and Pacific, The Middle East and Africa

Automation, efficiency, and increased use in food, agriculture, and pharmaceuticals.

Food processing, pharmaceuticals, mining, agriculture, and biofuels.

IoT integration, automated flow control, and durable materials.

North America, Western Europe, China, and India.

Certifications like FDA and CE ensure safety and compliance in key industries.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 & 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 30: Western Europe Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 44: East Asia Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 46: East Asia Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 48: East Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 49: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 50: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 52: South Asia Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 54: South Asia Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 56: South Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 58: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 59: MEA Market Value (US$ Million) Forecast by Material Type, 2018 & 2033

Table 60: MEA Market Volume (Units) Forecast by Material Type, 2018 & 2033

Table 61: MEA Market Value (US$ Million) Forecast by Capacity, 2018 & 2033

Table 62: MEA Market Volume (Units) Forecast by Capacity, 2018 & 2033

Table 63: MEA Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 64: MEA Market Volume (Units) Forecast by Application, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 14: Global Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 26: North America Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 & 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 38: North America Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 & 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 62: Latin America Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 74: Western Europe Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 122: East Asia Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 123: East Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 126: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 127: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 128: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 130: East Asia Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 131: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 132: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 134: East Asia Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 138: East Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 139: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 140: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 142: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 143: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 144: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: South Asia Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 146: South Asia Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 147: South Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 148: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 149: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 150: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 151: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 152: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 154: South Asia Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 155: South Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 156: South Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: South Asia Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 158: South Asia Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 159: South Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 160: South Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 161: South Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 162: South Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 163: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 164: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: South Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: South Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 167: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Material Type, 2023 & 2033

Figure 170: MEA Market Value (US$ Million) by Capacity, 2023 & 2033

Figure 171: MEA Market Value (US$ Million) by Application, 2023 & 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 174: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Material Type, 2018 & 2033

Figure 178: MEA Market Volume (Units) Analysis by Material Type, 2018 & 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 & 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Capacity, 2018 & 2033

Figure 182: MEA Market Volume (Units) Analysis by Capacity, 2018 & 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Capacity, 2023 & 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 186: MEA Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by Capacity, 2023 to 2033

Figure 191: MEA Market Attractiveness by Application, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Rotary Band Heat Sealer Market Size and Share Forecast Outlook 2025 to 2035

Rotary Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Rotary and RF Rotary Joints Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tool Market Size and Share Forecast Outlook 2025 to 2035

Rotary Scroll Air Compressor Market Size and Share Forecast Outlook 2025 to 2035

Rotary Tray Sealers Market Size and Share Forecast Outlook 2025 to 2035

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Rotary Limit Switches Market Growth - Trends & Forecast 2025 to 2035

Rotary Encoder Market

Rotary Steerable System Market

Rotary Knife Cutters Market

Rotary Sealers Market

Oil Rotary Pump Market Size and Share Forecast Outlook 2025 to 2035

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Industrial Rotary Table Market Analysis by By Type of Motion, Drive Mechanism, Size and Load Capacity, Application, Construction Material, and Region: Forecast for 2025 to 2035

Intelligent Rotary Kiln Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA