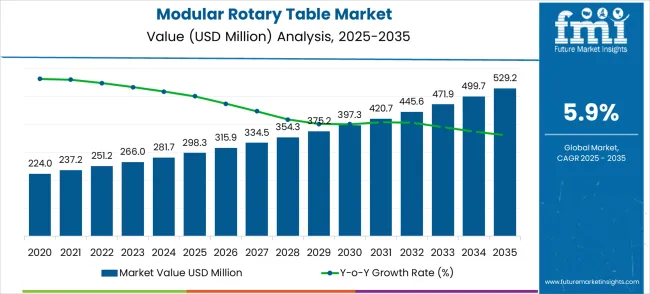

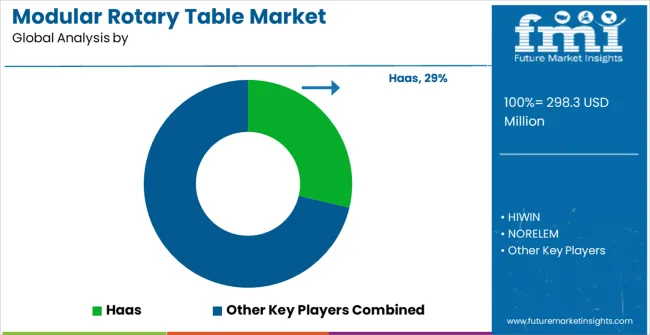

The global modular rotary table market is projected to reach USD 529.2 million by 2035, recording an absolute increase of USD 230.9 million over the forecast period. The market is valued at USD 298.3 million in 2025 and is set to rise at a CAGR of 5.9% during the assessment period. The overall market size is expected to grow by nearly 1.77 times during the same period, supported by increasing demand for precision machining solutions, expanding automation in manufacturing processes, and growing adoption of advanced CNC technologies across global industrial manufacturing operations. Market expansion faces constraints from high initial investment costs and technical complexity requirements in precision positioning applications.

Between 2025 and 2030, the modular rotary table market is projected to expand from USD 298.3 million to USD 397.3 million, resulting in a value increase of USD 99.0 million, which represents 42.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for automated manufacturing solutions, product innovation in electric drive systems and precision positioning technologies, and expanding applications across CNC machining centers and semiconductor manufacturing facilities. Companies are establishing competitive positions through investment in modular design optimization, strategic partnerships with machine tool manufacturers, and market expansion across automotive manufacturing plants, aerospace component producers, and emerging industrial automation applications.

From 2030 to 2035, the market is forecast to grow from USD 397.3 million to USD 529.2 million, adding another USD 131.9 million, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized positioning solutions including multi-axis rotary systems and Industry 4.0-integrated platforms tailored for specific manufacturing applications, strategic collaborations between rotary table manufacturers and automation technology developers, and enhanced integration with smart manufacturing systems and digital production platforms. The growing emphasis on flexible manufacturing and mass customization will drive demand for advanced modular rotary table capabilities across diverse industrial and precision manufacturing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 298.3 million |

| Market Forecast Value (2035) | USD 529.2 million |

| Forecast CAGR (2025-2035) | 5.9% |

The modular rotary table market grows by enabling manufacturers and machine tool operators to achieve enhanced machining flexibility that improves production efficiency and enables complex multi-axis operations. Demand drivers include expanding CNC machining center installations requiring precision positioning capabilities, increasing semiconductor manufacturing where rotary tables support wafer handling and processing operations, and growing adoption in robotics applications where modular positioning systems enable flexible automation solutions. Priority segments include machine tool manufacturers and industrial automation companies, with China and India representing key growth geographies due to expanding manufacturing capabilities and increasing industrial automation investments. Market growth faces constraints from high precision engineering costs and the need for specialized technical expertise to integrate advanced positioning systems with existing manufacturing equipment.

The Modular Rotary Table market is entering a technology-driven growth phase, driven by demand for manufacturing flexibility, expanding automation adoption, and evolving precision machining standards across global manufacturing operations. By 2035, these pathways together can unlock USD 720-920 million in incremental revenue opportunities beyond baseline growth.

Pathway A - CNC Machining Center Leadership (Multi-Axis Manufacturing) The CNC machining center segment already holds the largest share due to its critical role in precision manufacturing and complex component production. Expanding multi-axis capabilities, automated tool changing integration, and specialized aerospace applications can consolidate leadership. Opportunity pool: USD 220-280 million.

Pathway B - Electric Drive System Dominance (Precision Positioning) Electric drive systems account for significant market demand. Growing requirements for positioning accuracy and programmable control, especially in high-precision manufacturing, will drive higher adoption of advanced electric drive platforms. Opportunity pool: USD 180-230 million.

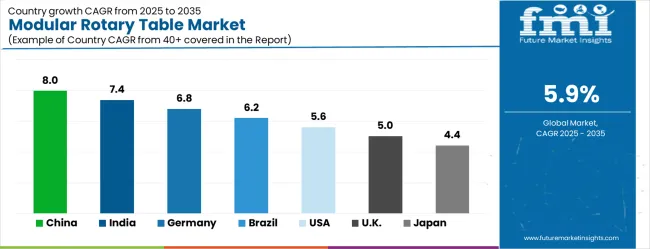

Pathway C - China & India Market Expansion (Manufacturing Growth) China and India present the highest growth potential with CAGRs of 8.0% and 7.4% respectively. Targeting expanding manufacturing capabilities and government industrial automation initiatives will accelerate adoption. Opportunity pool: USD 140-180 million.

Pathway D - Semiconductor Applications (Wafer Processing) Semiconductor manufacturing and wafer handling applications represent significant growth potential with expanding chip production and advanced packaging requirements. Opportunity pool: USD 100-130 million.

Pathway E - Industry 4.0 Integration Advanced digital connectivity, real-time monitoring, and smart manufacturing capabilities create opportunities for next-generation rotary tables with enhanced automation and data integration. Opportunity pool: USD 80-100 million.

Pathway F - Robotics Integration (Flexible Automation) Systems optimized for robotic applications, automated assembly lines, and flexible manufacturing cells offer premium positioning for advanced automation market segments. Opportunity pool: USD 60-80 million.

Pathway G - Modular Design Innovation Advanced modular architectures enabling rapid reconfiguration, multi-application flexibility, and scalable positioning solutions can capture growing demand for manufacturing adaptability. Opportunity pool: USD 45-60 million.

Pathway H - Service and Support Revenue Comprehensive service packages including precision calibration, predictive maintenance, and technical training create long-term revenue streams across global manufacturing operations. Opportunity pool: USD 35-45 million.

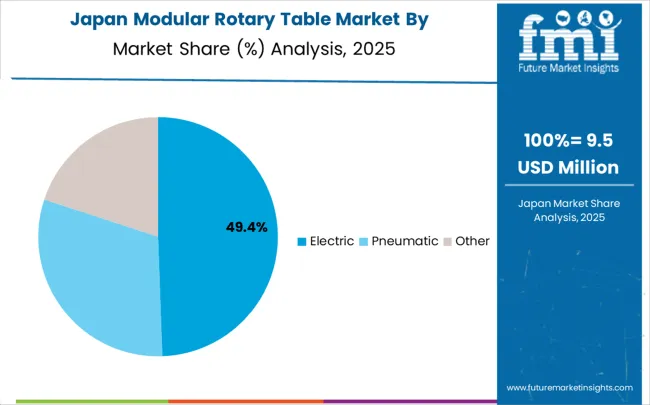

The market is segmented by drive type, application, end-user, technology, and region. By drive type, the market is divided into electric, pneumatic, and other drive systems. Based on application, the market is categorized into CNC machining centers, semiconductor manufacturing, robotics, and other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

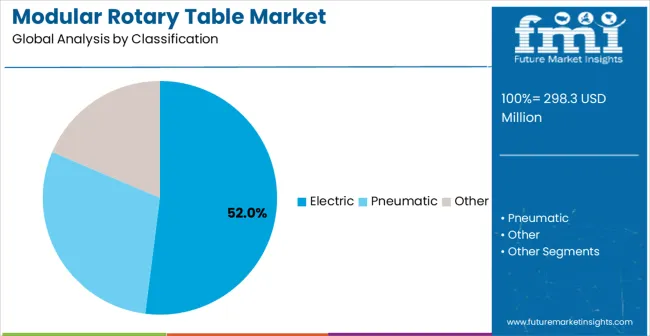

Electric drive modular rotary tables are projected to account for a substantial portion of 58% of the modular rotary table market in 2025. This share is supported by superior precision control capabilities and advanced positioning accuracy characteristics. Electric drive systems provide reliable rotation performance with programmable control interfaces that enable integration with CNC systems and automated manufacturing processes. The segment enables stakeholders to benefit from enhanced accuracy and repeatable positioning performance for demanding precision machining applications. The dominance of electric drive systems reflects the manufacturing industry's accelerating transition toward precision automation and digital integration. These sophisticated systems incorporate advanced servo motor technologies, high-resolution encoders, and programmable logic controllers that deliver exceptional positioning accuracy within arc-second tolerances, making them indispensable for aerospace and medical device manufacturing.

Manufacturing facilities operating in high-precision environments particularly value the seamless integration capabilities that electric systems provide with existing CNC infrastructure and enterprise resource planning systems. The ability to program complex rotational sequences while maintaining consistent positioning accuracy enables manufacturers to optimize cycle times and reduce waste in critical applications. Electric drive systems also offer superior torque control and speed regulation compared to pneumatic alternatives, allowing precise control over cutting forces and surface finish quality. The integration of Industry 4.0 technologies, including real-time monitoring, predictive maintenance capabilities, and remote diagnostics, further enhances operational efficiency and reduces unplanned downtime, positioning electric drive systems for market leadership.

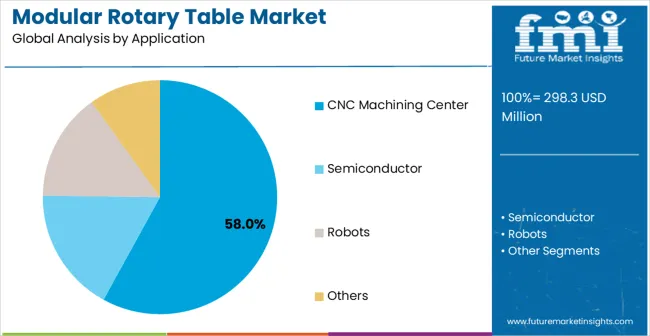

CNC machining center applications are expected to represent the largest share of 52% of the modular rotary table applications in 2025. This dominant share reflects the critical need for multi-axis machining capabilities that appeals to precision manufacturers and automotive component suppliers. The segment provides essential positioning support for complex part geometries requiring rotational access during machining operations. Growing demand for aerospace components and precision manufacturing drives adoption in this application area. The CNC machining center segment's market leadership stems from the fundamental transformation of global manufacturing toward complex, multi-axis operations requiring sophisticated positioning solutions for competitive advantage. Modern horizontal and vertical machining centers increasingly rely on integrated rotary tables to achieve complete part access in single setups, dramatically reducing handling time while improving dimensional accuracy and surface finish consistency. Aerospace manufacturers particularly benefit from this capability when producing intricate turbine blades, engine components, and structural parts that require precise angular positioning during multiple machining operations across different faces.

The automotive industry's evolution toward lightweight materials, electric vehicle components, and complex powertrain parts drives significant demand for rotary table integration in high-volume production environments. The manufacturing trend toward lights-out operations and unmanned production shifts makes rotary tables essential for maximizing machine utilization by enabling complete part processing without operator intervention. The integration of advanced work holding systems with modular rotary tables creates comprehensive solutions addressing evolving precision manufacturing needs across multiple industrial sectors.

Market drivers include expanding precision manufacturing requiring multi-axis machining capabilities, increasing semiconductor production where rotary tables support automated wafer processing and handling operations, and growing adoption in robotics applications where modular positioning systems enable flexible automation and assembly processes. These drivers reflect direct manufacturing outcomes including improved production efficiency, enhanced machining capabilities, and reduced setup times across multiple industrial applications. The aerospace sector's demand for complex geometries and lightweight materials necessitates advanced rotary positioning for turbine components and structural parts. Electric vehicle manufacturing creates new opportunities as battery housing and powertrain components require precise multi-axis access during production. Medical device manufacturing increasingly relies on rotary tables for implant production and surgical instrument fabrication where dimensional accuracy is critical.

Market restraints encompass high initial investment costs that limit adoption among smaller manufacturing facilities, technical complexity requiring specialized engineering expertise for precision positioning applications, and long integration cycles with existing manufacturing systems that slow market penetration. Additional constraints include maintenance requirements for precision mechanical components and the need for continuous calibration that increases operational complexity and costs. Skills shortages in precision engineering and programming expertise create implementation barriers for many manufacturers seeking automation upgrades.

Key trends show adoption accelerating in China and India where expanding manufacturing capabilities and industrial automation investments drive demand, while technology shifts toward electric drive systems and Industry 4.0 integration enable broader market access. Technology advancement focuses on enhanced positioning accuracy and modular design flexibility that expand application possibilities across demanding manufacturing environments. Market thesis faces risk from alternative positioning technologies that could provide similar functionality at lower costs or with simplified integration requirements. Technology advancement focuses on enhanced positioning accuracy and modular design flexibility that expand application possibilities across demanding manufacturing environments. Predictive maintenance capabilities and cloud connectivity are becoming standard features. Market thesis faces risk from alternative positioning technologies that could provide similar functionality at lower costs or with simplified integration requirements, including direct-drive systems and advanced linear motor technologies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| Brazil | 6.2% |

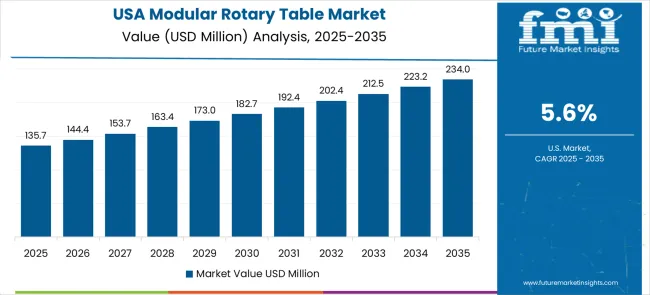

| USA | 5.6% |

| UK | 5.0% |

| Japan | 4.4% |

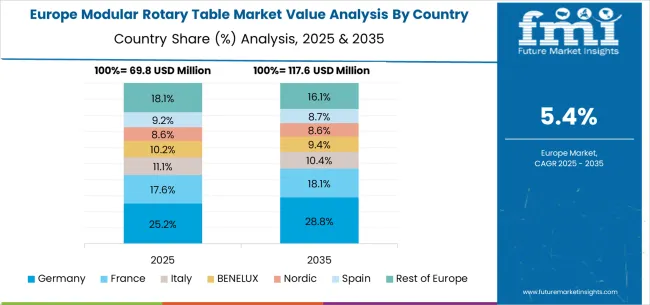

The modular rotary table market shows robust growth dynamics across key countries from 2025–2035. China leads globally with a CAGR of 8.0%, fueled by massive manufacturing sector expansion, government industrial automation initiatives, and growing precision machining capabilities. India follows closely at 7.4%, driven by increasing manufacturing investments, industrial modernization programs, and strong government support for domestic manufacturing development.

Germany maintains Europe's leadership with 6.8%, leveraging its advanced machine tool sector and established precision manufacturing infrastructure. Brazil records 6.2%, reflecting opportunities in automotive manufacturing and industrial automation despite economic challenges. The United States maintains solid expansion at 5.6%, supported by manufacturing reshoring initiatives and advanced automation technology adoption. Growth in the United Kingdom (5.0%) and Japan (4.4%) remains stable, backed by established manufacturing companies and precision engineering capabilities, though comparatively slower than emerging manufacturing markets.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China is projected to lead the modular rotary table market with a growth rate of 8.0% CAGR from 2025 to 2035. The demand for modular rotary tables in China is driven by the rapid expansion of its manufacturing sector, especially in industries such as automotive, aerospace, electronics, and industrial automation. The increasing CNC machining installations, expanding semiconductor manufacturing facilities, and growing adoption across precision manufacturing operations in Guangdong, Jiangsu, and Zhejiang provinces. Chinese manufacturers are adopting modular rotary tables for automated production lines and multi-axis machining applications, with particular emphasis on cost-effective integration and production efficiency optimization. Government support for manufacturing upgrade initiatives and industrial automation development expand deployment across automotive component production, electronics manufacturing, and emerging precision engineering applications.

The country's massive investment in electric vehicle manufacturing creates significant demand for precision machining capabilities in battery housing and powertrain component production. State-owned enterprises and private manufacturers alike are modernizing facilities with advanced positioning systems to compete in global markets. China's focus on semiconductor self-sufficiency drives demand for wafer handling and processing equipment incorporating rotary positioning technologies. The integration of smart manufacturing initiatives and Industry 4.0 technologies accelerates adoption across traditional manufacturing sectors. The government's emphasis on high-quality development and technological innovation supports continued investment in precision manufacturing equipment, positioning China as the dominant growth market for modular rotary table applications.

The modular rotary table market reflects strong potential based on expanding manufacturing infrastructure and increasing industrial automation investments. The market is projected to grow at a CAGR of 7.4% through 2035, with growth accelerating through cost-effective automation strategies under productivity and quality improvement constraints, particularly in automotive component manufacturing and precision engineering applications in Maharashtra, Tamil Nadu, and Karnataka. Indian manufacturers and automation companies are adopting modular rotary tables for CNC machining and automated assembly applications, with growing emphasis on operational efficiency and manufacturing flexibility. Strategic partnerships with international equipment suppliers expand access to advanced positioning technologies and technical support. The government's Make in India initiative drives domestic manufacturing capabilities while attracting foreign investment in advanced production technologies.

India's growing automotive sector, including electric vehicle manufacturing, creates substantial demand for precision machining solutions capable of handling complex geometries and tight tolerances. The country's expanding aerospace and defense manufacturing requires advanced positioning systems for critical component production. The emerging semiconductor assembly and packaging industry presents new opportunities for rotary table applications in wafer processing and device manufacturing. The availability of skilled technical workforce and competitive manufacturing costs make India attractive for global manufacturers seeking cost-effective precision manufacturing solutions. Educational institutions and technical training programs are developing specialized expertise in automation technologies, supporting market growth and technology adoption across diverse industrial sectors.

Germany demonstrates established strength in the modular rotary table market through its advanced machine tool sector and robust precision manufacturing infrastructure. The market shows strong growth at a CAGR of 6.8% through 2035, with established machine tool companies and precision manufacturers driving demand in Baden-Württemberg, Bavaria, and North Rhine-Westphalia. German manufacturers focus on high-precision rotary table applications and advanced machining systems, particularly in automotive and aerospace sectors requiring sophisticated positioning capabilities. The country's strong engineering capabilities and established technology partnerships support consistent market development across multiple manufacturing applications. Germany's automotive industry transformation toward electric vehicles creates new demands for precision manufacturing of battery components, electric motors, and power electronics requiring advanced rotary positioning systems.

The aerospace sector's emphasis on lightweight materials and complex geometries drives adoption of multi-axis machining solutions incorporating rotary tables. German machine tool manufacturers are global leaders in precision engineering, often incorporating rotary positioning systems as standard features in advanced machining centers. The country's Industry 4.0 initiative promotes smart manufacturing technologies, including connected rotary tables with real-time monitoring and predictive maintenance capabilities. Research and development investments in precision manufacturing technologies maintain Germany's competitive advantage in high-value applications. The strong export orientation of German machine tool companies helps drive global adoption of advanced rotary table technologies while maintaining domestic market leadership in precision manufacturing applications.

The modular rotary table market in Brazil shows significant growth potential at a CAGR of 6.2% through 2035, driven by expanding automotive manufacturing and industrial modernization initiatives. The market benefits from increasing production automation and precision manufacturing requirements, with particular strength in automotive component production and machinery manufacturing. Brazilian manufacturers and automation companies adopt modular rotary tables for CNC machining and automated production applications, addressing both productivity and quality requirements.

Market development benefits from growing industrial automation awareness and expanding manufacturing technology adoption across key industrial regions. The country's automotive sector modernization, including electric vehicle component manufacturing, creates demand for precision machining capabilities in powertrain and chassis component production. Brazil's agricultural machinery industry requires advanced manufacturing solutions for complex hydraulic components and engine parts demanding multi-axis machining capabilities.

Mining equipment manufacturing represents another significant application area where rotary tables enable efficient production of large, complex components. Government initiatives promoting industrial modernization and productivity improvements support technology adoption across manufacturing sectors. The availability of skilled workforce and established industrial infrastructure provide foundation for continued market growth. Strategic partnerships with international technology providers enhance access to advanced rotary table technologies while supporting local technical expertise development in precision manufacturing applications.

The United States maintains strong growth in the modular rotary table market through its established precision manufacturing sector and advanced automation technology capabilities. Market expansion at a CAGR of 5.6% through 2035 reflects consistent demand from aerospace manufacturers, automotive suppliers, and precision machining companies requiring advanced positioning capabilities. American manufacturers utilize modular rotary tables across CNC machining, semiconductor processing, and automated assembly applications, with particular emphasis on precision and reliability optimization. The country's strong technology development programs and established supplier networks support stable market conditions and continued innovation advancement. The aerospace and defense sectors drive significant demand for precision manufacturing capabilities, with rotary tables essential for turbine component production, structural parts manufacturing, and weapons system components.

Manufacturing reshoring initiatives create opportunities for domestic production facilities requiring advanced automation technologies, including precision positioning systems. The medical device industry's growth demands exceptional accuracy in implant manufacturing, surgical instrument production, and diagnostic equipment assembly applications. Energy sector transformation, including renewable energy equipment manufacturing, creates new markets for precision machining capabilities. The automotive industry's evolution toward electric vehicles requires advanced manufacturing solutions for battery components, electric motor production, and power electronics assembly.

The United Kingdom demonstrates consistent progress in the modular rotary table market with a CAGR of 5.0% through 2035, supported by established precision manufacturers and automation technology developers. British manufacturing companies and machine tool suppliers adopt modular rotary tables for advanced machining and automation applications, with particular focus on precision engineering and quality control capabilities.

The market benefits from strong manufacturing partnerships and established relationships with European technology suppliers. Development remains steady across multiple manufacturing applications despite economic uncertainties affecting industrial investment levels. The aerospace sector, including major manufacturers and supply chain partners, drives demand for precision machining capabilities in engine component production, structural parts manufacturing, and systems integration applications. The automotive industry's transformation toward electric vehicles creates opportunities for advanced manufacturing of battery systems, electric drivetrains, and charging infrastructure components.

The country's strong engineering heritage and technical expertise support adoption of sophisticated manufacturing technologies across diverse industrial sectors. Nuclear energy sector requirements for precision manufacturing of reactor components and safety systems drive demand for exceptional accuracy positioning capabilities. The medical device industry's growth, particularly in surgical instruments and implant manufacturing, requires advanced machining solutions with multi-axis capabilities. Research institutions and universities collaborate with industry to develop next-generation manufacturing technologies, supporting innovation in precision positioning systems.

The modular rotary table market in Japan shows steady development with a CAGR of 4.4% through 2035, as established manufacturing companies and machine tool manufacturers maintain consistent demand. Market growth reflects mature market conditions and established precision manufacturing capabilities across automotive and industrial sectors. Japanese manufacturers and technology companies utilize modular rotary tables for high-precision machining applications and automated production systems, particularly in automotive electronics and precision component manufacturing. The market benefits from domestic machine tool manufacturing expertise and strong technical support infrastructure, though growth remains moderate compared to emerging manufacturing markets.

The country's aging workforce and labor shortages accelerate automation adoption across manufacturing sectors, creating opportunities for advanced positioning systems that reduce manual intervention requirements. Industrial robot manufacturing represents a significant application area where rotary tables enable production of precision mechanical components and servo systems. The machine tool industry's export focus helps maintain technology leadership while supporting domestic applications in precision manufacturing. Research and development investments in advanced materials and manufacturing processes create demand for specialized machining capabilities incorporating rotary positioning systems. The emphasis on quality and reliability in Japanese manufacturing culture supports continued demand for premium positioning technologies despite moderate overall market growth rates compared to emerging industrial economies.

The modular rotary table market operates with a fragmented but competitive structure featuring approximately 25-30 meaningful players, with the top five companies holding roughly 45-50% market share. Competition centers on precision engineering capabilities, modular design flexibility, and comprehensive application support rather than price competition alone. Market leaders include Haas, HIWIN, and NORELEM, which maintain competitive positions through established manufacturing capabilities, comprehensive product portfolios, and strong customer support networks. These companies benefit from scale advantages in precision manufacturing, extensive distribution networks, and established relationships with key machine tool manufacturers and automation companies worldwide.

Challenger companies include Detron, GSA, and Kitagawa, which compete through specialized positioning solutions and regional market focus, particularly in specific application areas or geographic regions. These companies differentiate through innovative mechanical designs, competitive pricing strategies, and targeted customer service approaches. Lehmann, Nikken, Sankyo Automation, Troyke, Tsudakoma, UCAM, Yukiwa, WDS, ESA, Eppinger GmbH, FANUC, igus, CYTEC Zylindertechnik, IKO International, and CNC Rotary PRO-TECHNIC represent additional significant players with established presence in precision machinery markets and strong technical capabilities in rotary positioning and automation technologies.

Competition intensifies around design innovation, with companies investing in modular system architectures, enhanced precision capabilities, and integrated control platforms that improve manufacturing flexibility and operational efficiency. Market dynamics reflect the importance of technical support services, application engineering programs, and ongoing maintenance capabilities that influence customer purchasing decisions. Strategic partnerships with machine tool manufacturers and automation system integrators shape competitive positioning across different regional markets and application segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 298.3 million |

| Drive Type | Electric, Pneumatic, Other |

| Application | CNC Machining Center, Semiconductor, Robots, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Haas, HIWIN, NORELEM, Detron, GSA, Kitagawa, Lehmann, Nikken, Sankyo Automation, Troyke, Tsudakoma, UCAM, Yukiwa, WDS, ESA, Eppinger GmbH, FANUC, igus, CYTEC Zylindertechnik, IKO International, CNC Rotary PRO-TECHNIC |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across machine tool manufacturers and automation system integrators, integration with CNC machining centers and automated production lines, innovations in electric and pneumatic drive technologies, and development of specialized modular rotary table solutions with enhanced precision positioning and manufacturing flexibility capabilities. |

The global modular rotary table market is estimated to be valued at USD 298.3 million in 2025.

The market size for the modular rotary table market is projected to reach USD 529.2 million by 2035.

The modular rotary table market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in modular rotary table market are electric, pneumatic and other.

In terms of application, CNC machining center segment to command 58.0% share in the modular rotary table market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rotary Tables with Torque Motor Drive Market Size and Share Forecast Outlook 2025 to 2035

Industrial Rotary Table Market Analysis by By Type of Motion, Drive Mechanism, Size and Load Capacity, Application, Construction Material, and Region: Forecast for 2025 to 2035

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Table Knife Market Size and Share Forecast Outlook 2025 to 2035

Rotary Shaping File Market Size and Share Forecast Outlook 2025 to 2035

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Rotary DIP Switch Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Tablet Hardness Testers Market Size and Share Forecast Outlook 2025 to 2035

Table Tents Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rotary Band Heat Sealer Market Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA