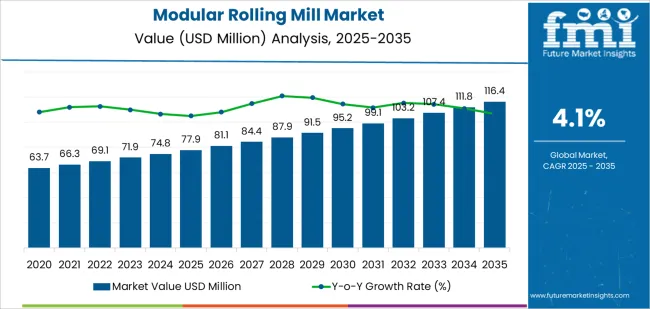

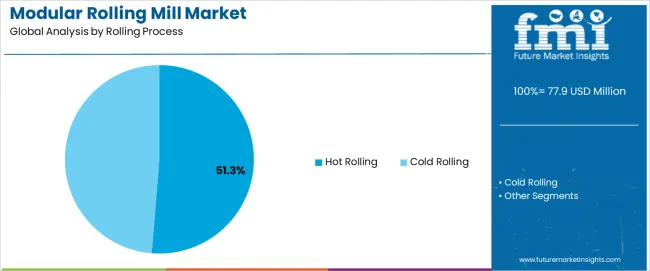

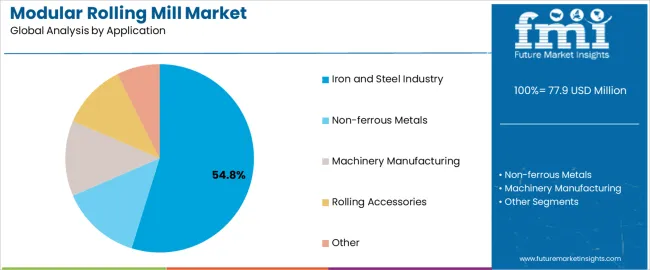

The modular rolling mill market is projected to rise from USD 77.9 million in 2025 to USD 116.4 million by 2035, expanding at a CAGR of 4.1% and adding USD 38.5 million in value. This steady growth of 49.4% highlights a manufacturing shift toward flexible, scalable, and energy-efficient metal processing systems. Modular configurations are becoming a preferred alternative to large integrated mills due to their lower capital intensity, rapid installation timelines, and ability to support phased capacity expansion. Early growth from 2025 to 2030 will be led by modernization in the iron and steel industry, which accounts for 54.8% of market share, driven by the need for adaptable hot rolling systems capable of handling variable feedstock and alloy compositions.

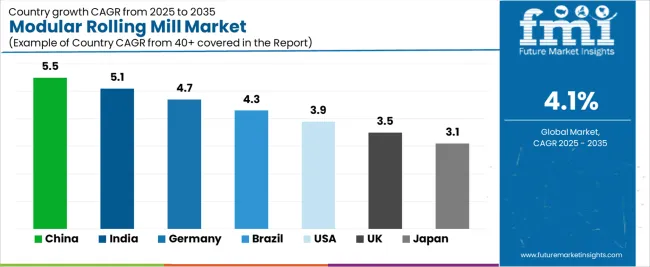

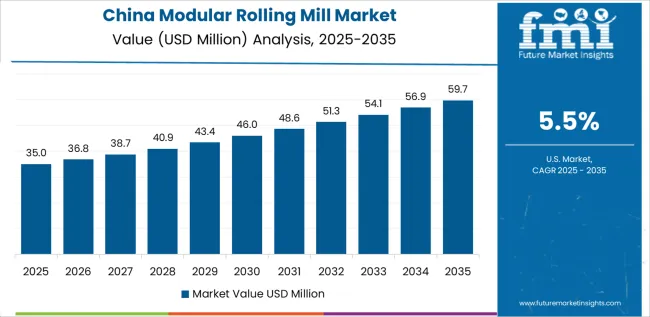

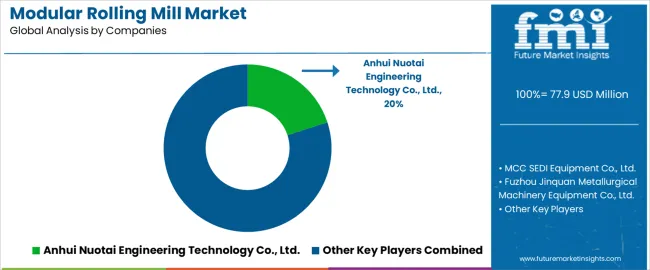

During 2030–2035, the focus will pivot toward automated and digitalized mill architectures, integrating predictive maintenance, remote monitoring, and digital twin models for operational optimization. Hot rolling processes retain leadership with 51.3% share, serving as the backbone for rebar, rod, and section production, while cold rolling gains traction in high-precision applications such as automotive steel and specialty alloys. China remains the largest growth hub at a 5.5% CAGR, supported by industrial upgrading and small-scale steel producer expansion, followed by India (5.1%) driven by infrastructure-led steel capacity additions and Make in India programs. Germany (4.7%), Brazil (4.3%), and the United States (3.9%) sustain demand through advanced automation and modernization initiatives. Key manufacturers, including Anhui Nuotai Engineering Technology, MCC SEDI Equipment, Fuzhou Jinquan Metallurgical Machinery, and SMS Group, are focusing on standardized modular architectures, energy-efficient drive systems, and automation control platforms to enhance product quality, uptime reliability, and cost competitiveness.

Growing emphasis on operational efficiency is driving demand for modular configurations that enable phased capacity expansion, simplified maintenance through standardized components, and reduced downtime during equipment upgrades or repairs. The development of advanced automation systems and digital monitoring technologies integrated with modular mill designs is addressing requirements for precision rolling, quality control, and predictive maintenance capabilities. Regulatory pressures for energy efficiency and environmental compliance are creating sustained demand for modern rolling mill technologies that demonstrate superior energy consumption characteristics and reduced emissions compared to older equipment generations.

The market is characterized by convergence of metallurgical engineering, modular design principles, and automation technologies, with manufacturers developing standardized equipment platforms that can be customized for specific applications while maintaining economies of scale in production, spare parts availability, and technical support infrastructure that reduces total cost of ownership for metal processing operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 77.9 million |

| Market Forecast Value (2035) | USD 116.4 million |

| Forecast CAGR (2025-2035) | 4.1% |

| MANUFACTURING FLEXIBILITY DEMANDS | TECHNOLOGY & EFFICIENCY DRIVERS | ECONOMIC & INFRASTRUCTURE FACTORS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Rolling Process | Hot Rolling, Cold Rolling |

| By Application | Iron and Steel Industry, Non-ferrous Metals, Machinery Manufacturing, Rolling Accessories, Other |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hot Rolling |

|

| Cold Rolling |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Iron and Steel Industry |

|

| Non-ferrous Metals |

|

| Machinery Manufacturing |

|

| Rolling Accessories |

|

| Other |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025-2035) |

|---|---|---|---|

| China | 29.4 | 69 | 5.5% |

| India | 2.4 | 3.9 | 5.1% |

| Germany | 63.7 | 95.2 | 4.7% |

| Brazil | 66.3 | 99.1 | 4.3% |

| United States | 69 | 103.2 | 3.9% |

| United Kingdom | 71.9 | 107.4 | 3.5% |

| Japan | 81.1 | 111.8 | 3.1% |

Revenue from modular rolling mills in China is projected to reach USD 69 million by 2035, driven by continuous expansion of steel production capacity and growing adoption of flexible manufacturing solutions across metallurgical industries creating substantial opportunities for modular equipment suppliers. The country's position as the world's largest steel producer and continuous investments in production capacity modernization are generating sustained demand for rolling mill equipment. Government initiatives promoting industrial upgrading and environmental compliance are driving replacement of aging equipment with modern efficient systems. Modular rolling mills particularly attractive for China's numerous small and medium-scale steel producers, specialty steel manufacturers, and non-ferrous metal processors requiring flexible production capabilities. Domestic equipment manufacturers have developed strong capabilities in modular rolling mill design and production, offering competitive pricing and rapid delivery compared to imported alternatives. Technical innovation focus includes automation integration, energy efficiency improvements, and digital monitoring systems aligned with Industry 4.0 initiatives. Growing non-ferrous metal processing sector, particularly aluminum and copper rolling for construction and electrical applications, creates additional demand beyond traditional steel applications. Regional development programs encouraging manufacturing investments in interior provinces support geographic expansion of rolling mill installations beyond traditional coastal industrial regions.

Revenue from modular rolling mills in India is expanding to reach USD 3.9 million by 2035, supported by government initiatives promoting domestic steel production and infrastructure development creating demand for flexible rolling mill solutions serving growing steel industry. The country's National Steel Policy targets significant capacity expansion with emphasis on improving self-sufficiency and reducing imports. Modular rolling mills align well with India's predominant mini-mill based steel production model where smaller-scale integrated facilities serve regional markets. Growing secondary steel sector including re-rolling mills and specialty product manufacturers creates demand for cost-effective rolling equipment. Price sensitivity and capital constraints favor modular solutions offering lower initial investments and phased expansion capabilities compared to large integrated mill projects. Technical considerations include adaptation to varying power supply reliability, availability of skilled maintenance personnel, and parts supply infrastructure. Domestic equipment manufacturing capabilities developing with government support for indigenous production under Make in India programs. Growing construction and infrastructure sectors driving steel demand support ongoing capacity additions and equipment modernization.

Demand for modular rolling mills in Germany is projected to reach USD 95.2 million by 2035, supported by the country's advanced manufacturing sector and engineering expertise in metallurgical equipment creating sustained demand for precision rolling solutions. German metal processing industry emphasizes quality, flexibility, and technical sophistication with modular rolling mills serving specialty steel producers, non-ferrous metal processors, and research institutions. The market is characterized by emphasis on advanced automation, energy efficiency, and integration with digital manufacturing systems. German equipment manufacturers maintain global leadership in rolling mill technology with exports representing significant portion of production. Domestic market serves high-value applications including automotive steel processing, precision strip production, and specialty alloy rolling requiring superior product quality and process control. Research and development activities in metallurgical institutes and corporate research centers utilize modular mills for process development and pilot production. Environmental regulations and energy costs drive continuous improvement in equipment efficiency and emission control technologies. Skilled workforce and established maintenance infrastructure support adoption of sophisticated equipment with advanced capabilities.

Revenue from modular rolling mills in Brazil is growing to reach USD 99.1 million by 2035, driven by steel industry modernization and infrastructure development programs creating opportunities for flexible rolling mill installations serving domestic metal processing sector. The country's significant iron ore resources and established steel industry provide foundation for ongoing equipment investments. Modular rolling mills particularly relevant for long steel products including rebar, wire rod, and structural sections serving construction and infrastructure markets. Growing emphasis on supply chain localization and import substitution supports domestic rolling capacity expansion. Economic considerations favor modular solutions offering capital efficiency and flexibility adapting to market demand fluctuations common in cyclical steel industry. Technical requirements include robustness handling varied raw material quality, adaptability to tropical climate conditions, and maintainability given infrastructure challenges in certain regions. Equipment suppliers must provide comprehensive technical support and spare parts availability given distances and logistics considerations. Automotive industry expansion creates demand for higher-quality rolled products requiring modern equipment capabilities.

Revenue from modular rolling mills in United States is projected to reach USD 103.2 million by 2035, supported by ongoing manufacturing sector revitalization and specialty metal processing growth creating demand for flexible rolling solutions. The country's steel industry restructuring around electric arc furnace mini-mills creates natural market for modular rolling equipment serving these smaller-scale integrated operations. Specialty steel and non-ferrous metal processors utilize modular mills for flexible production capabilities serving aerospace, automotive, and industrial applications requiring specific material properties and dimensional tolerances. Reshoring initiatives and emphasis on domestic manufacturing resilience support investments in production capacity and equipment modernization. Technical sophistication and automation requirements higher than many international markets with emphasis on productivity, quality consistency, and labor efficiency. Equipment procurement processes emphasize total cost of ownership including energy consumption, maintenance requirements, and production efficiency rather than focusing primarily on initial capital costs. Regulatory compliance including occupational safety and environmental standards influences equipment design and operational requirements. Service and support infrastructure critical given North American geography and expectations for rapid response to equipment issues.

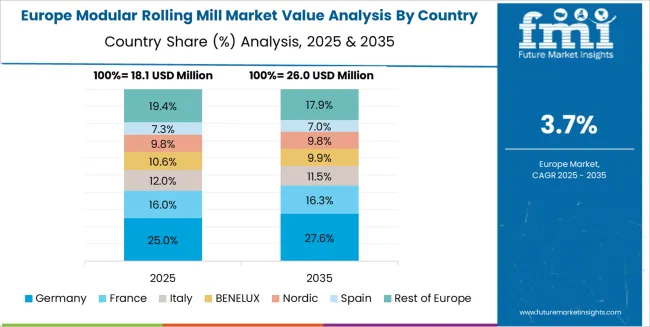

The modular rolling mill market in Europe is projected to grow from USD 69.8 million in 2025 to USD 102.4 million by 2035, registering a CAGR of 3.9% over the forecast period. Germany is expected to maintain its leadership position with a 38.2% market share in 2025, projected to expand to 39.1% by 2035, supported by its advanced metallurgical equipment industry and strong metal processing sector serving automotive and industrial applications. The United Kingdom follows with a 26.4% share in 2025, anticipated to reach 26.8% by 2035, driven by specialty steel processing and non-ferrous metal rolling operations. Italy holds a 19.3% share, while France accounts for 11.7% in 2025, reflecting ongoing steel industry modernization and specialty metal processing activities. The Rest of Europe region is projected to maintain approximately 4.4% collectively through 2035, with Poland, Austria, and other countries implementing rolling mill upgrades as part of manufacturing sector modernization programs.

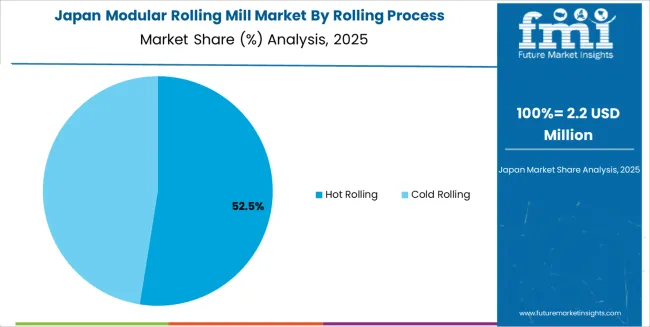

Japanese modular rolling mill operations reflect the country's emphasis on precision manufacturing and technological excellence. Metal processing industry maintains stringent quality requirements with rolling mills expected to deliver consistent dimensional accuracy, superior surface finish, and minimal product variation. Equipment manufacturers emphasize robust construction, advanced control systems, and comprehensive quality monitoring capabilities. The market demonstrates unique requirements for compact designs suitable for space-constrained Japanese industrial facilities and integration with sophisticated production management systems. Steel industry consolidation has reduced number of major integrated producers but specialty steel and non-ferrous metal sectors maintain active equipment investments. Technical preferences include preference for high-precision rolling capabilities, advanced automation reducing labor requirements, and energy-efficient designs addressing high Japanese electricity costs. Established relationships between equipment suppliers and metal producers create stable market with long-term partnerships rather than purely transactional procurement. Service and maintenance capabilities critical with emphasis on minimizing downtime and maintaining consistent production quality. Research collaborations between equipment manufacturers, steel companies, and universities drive continuous technology improvement. Export-oriented metal processing operations utilize rolling mills producing high-quality products meeting international customer specifications.

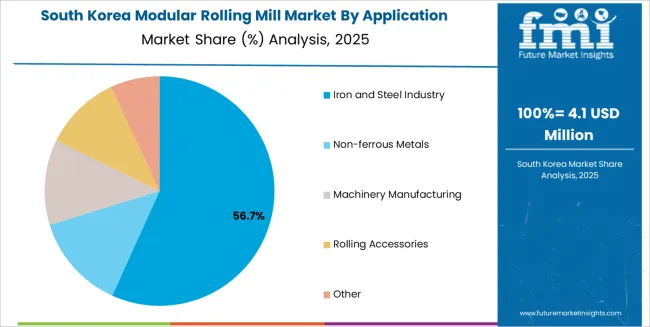

South Korean modular rolling mill operations reflect the country's advanced manufacturing capabilities and integrated steel industry structure. Major steel producers including POSCO maintain sophisticated rolling operations with ongoing equipment modernization programs incorporating latest technologies. Modular rolling mills find applications in specialty steel production, non-ferrous metal processing, and component manufacturing for automotive and electronics industries. Government support for manufacturing competitiveness drives investments in advanced production equipment and automation technologies. Technical requirements emphasize productivity, energy efficiency, and quality consistency supporting Korean manufacturers' position in global supply chains. Equipment procurement processes emphasize proven technology, reliable vendor support, and integration capabilities with existing production systems. Domestic equipment manufacturing capabilities exist but significant equipment imports occur for specialized applications requiring specific technical capabilities. Research institutions and corporate R&D centers collaborate on developing advanced rolling technologies including smart manufacturing integration and predictive maintenance systems. Market characteristics include preference for established equipment brands, emphasis on comprehensive technical support, and expectations for equipment longevity and reliability. Environmental regulations drive adoption of energy-efficient equipment and emission control technologies. Growing focus on high-value specialty products creates demand for flexible rolling capabilities supporting rapid product changeovers and small-batch production.

The modular rolling mill market demonstrates concentration among specialized metallurgical equipment manufacturers and engineering companies. Profit focus centers on comprehensive turnkey solutions including equipment supply, installation supervision, commissioning support, and ongoing technical services rather than equipment-only sales. Value migration favors companies demonstrating proven track records, strong after-sales support capabilities, and expertise across diverse rolling applications. Several competitive archetypes define market dynamics: specialized rolling mill manufacturers focusing exclusively on metal forming equipment with deep metallurgical engineering expertise; diversified industrial equipment companies offering rolling mills as part of broader metallurgical equipment portfolios; regional engineering firms providing customized solutions for local markets; and technology-focused innovators developing advanced automation and control systems integrated with rolling mill hardware.

Market differentiation centers on rolling precision and product quality capabilities, equipment reliability and uptime performance, energy efficiency and operating cost optimization, and flexibility accommodating diverse product specifications within single mill configurations. Switching costs remain significant with primary barriers including substantial capital investments, installation and commissioning complexity, operator training requirements, and production disruption during equipment transitions. Competition intensifies around technical support and service capabilities recognizing that equipment performance and longevity depend heavily on proper operation, maintenance practices, and timely technical assistance. Geographic presence proves critical given importance of local technical support, spare parts availability, and rapid response to equipment issues. Successful companies maintain extensive service networks, comprehensive spare parts inventories, and trained field service personnel.

Technical credibility established through reference installations, performance guarantees, and demonstrated expertise in specific rolling applications. Market segmentation by application creates opportunities for specialized suppliers focusing on particular metal types, product forms, or industry sectors where deep domain expertise provides competitive advantages. Emerging market growth particularly important given concentration of new capacity additions in developing economies where established relationships with local steel producers and engineering firms prove valuable. Innovation focus includes developing more efficient drive systems, implementing advanced automation reducing operator skill requirements, creating predictive maintenance capabilities through sensor integration and data analytics, and designing modular architectures enabling easier capacity expansion and technology upgrades. Strategic partnerships between equipment manufacturers and steel producers drive technology development aligned with evolving market requirements and emerging applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 77.9 million |

| Rolling Process | Hot Rolling, Cold Rolling |

| Application | Iron and Steel Industry, Non-ferrous Metals, Machinery Manufacturing, Rolling Accessories, Other |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Anhui Nuotai Engineering Technology Co., Ltd., MCC SEDI Equipment Co., Ltd., Fuzhou Jinquan Metallurgical Machinery Equipment Co., Ltd., Beijing Xilian Aogang Technology Co., Ltd., Sinosteel International Engineering Technology Co., Ltd., PP Rolling Mills, SMS Group, Invimec |

| Additional Attributes | Dollar sales by rolling process and application, regional demand across key markets, competitive landscape, metal processing technology adoption, modular equipment integration, and manufacturing flexibility development driving capacity expansion, operational efficiency, and metallurgical equipment modernization |

The global modular rolling mill market is estimated to be valued at USD 77.9 million in 2025.

The market size for the modular rolling mill market is projected to reach USD 116.4 million by 2035.

The modular rolling mill market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in modular rolling mill market are hot rolling and cold rolling.

In terms of application, iron and steel industry segment to command 54.8% share in the modular rolling mill market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Modular Fiber Optical Spectrometers Market Size and Share Forecast Outlook 2025 to 2035

Modular Process Skid Packages Market Forecast and Outlook 2025 to 2035

Modular Robotic Market Size and Share Forecast Outlook 2025 to 2035

Modular Trailer Market Forecast and Outlook 2025 to 2035

Modular Substation Market Size and Share Forecast Outlook 2025 to 2035

Modular Rotary Table Market Size and Share Forecast Outlook 2025 to 2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Modular Palletizer Cells Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Modular Self-Contained Aisle and Racking Systems Market Size and Share Forecast Outlook 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Modular Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Fitness Furniture Market Size and Share Forecast Outlook 2025 to 2035

Modular Chillers Market Size and Share Forecast Outlook 2025 to 2035

Modular & Prefabricated Construction Market Size and Share Forecast Outlook 2025 to 2035

Modular Kitchen Baskets Market Size and Share Forecast Outlook 2025 to 2035

Modular Data Center Market Analysis - Size, Share, and Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modular UPS Market Growth - Trends & Forecast 2025 to 2035

Modular Energy Control System Market Growth – Trends & Forecast 2025 to 2035

Modular Construction Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA