The Rolling Mill Machine Market is estimated to be valued at USD 20.2 billion in 2025 and is projected to reach USD 28.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Rolling Mill Machine Market Estimated Value in (2025 E) | USD 20.2 billion |

| Rolling Mill Machine Market Forecast Value in (2035 F) | USD 28.6 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The rolling mill machine market is witnessing significant momentum as industrial modernization, demand for precision manufacturing, and emphasis on operational efficiency continue to shape its trajectory. Increasing investments in advanced metal forming technologies and the need for consistent product quality have positioned rolling mill machines as indispensable assets across key industries.

The integration of automation, energy-efficient systems, and modular designs is enabling manufacturers to achieve higher throughput while reducing downtime and material wastage. Future growth is expected to be supported by expanding infrastructure projects, rising adoption of Industry 4.0 practices, and the push toward sustainable manufacturing processes.

Opportunities are being unlocked through continuous innovation in control systems, improved durability of components, and strategic collaborations between machinery producers and end users to develop customized solutions tailored for evolving industrial needs.

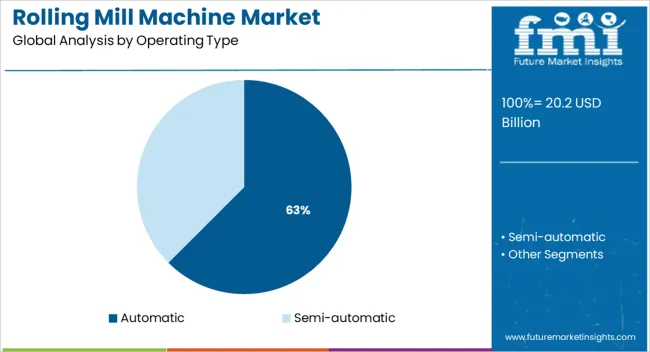

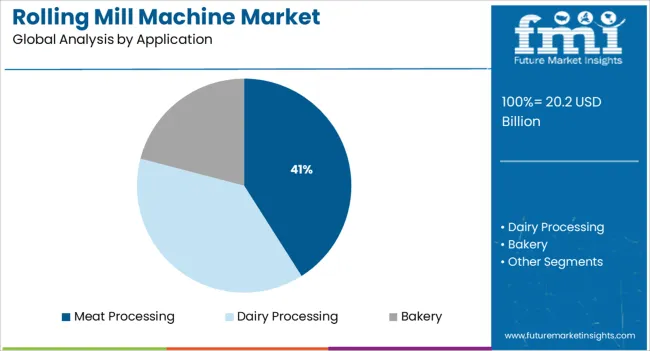

The market is segmented by Operating Type and Application and region. By Operating Type, the market is divided into Automatic and Semi-automatic. In terms of Application, the market is classified into Meat Processing, Dairy Processing, and Bakery. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by operating type, the automatic segment is anticipated to hold 62.5 % of the market revenue in 2025, emerging as the leading category. This dominance is being driven by the increasing preference for fully automated systems that minimize human intervention, enhance productivity, and improve safety standards on the shop floor.

Automatic rolling mill machines have been increasingly adopted as they ensure consistent product specifications, enable real-time process monitoring, and reduce operational errors. Advances in programmable logic controllers and sensor technologies have facilitated seamless integration of automatic systems into existing production lines, thereby improving overall equipment effectiveness.

The ability to optimize resource utilization, lower labor costs, and deliver high output with minimal downtime has positioned the automatic segment as the preferred choice among manufacturers aiming to remain competitive and compliant with modern industrial benchmarks.

Segmented by application, meat processing is projected to command 41.0 % of the market revenue in 2025, establishing itself as the most prominent application area. This leadership is being attributed to the rising demand for efficient, hygienic, and high-throughput machinery capable of handling the rigorous requirements of the meat industry.

Rolling mill machines configured for meat processing have been widely deployed to achieve uniform cuts, consistent textures, and adherence to stringent food safety standards. Their ability to process large volumes with precision while maintaining product integrity has proven invaluable for meeting the growing consumer demand for packaged and processed meat products.

Improvements in machine design to facilitate easy cleaning, resistance to contamination, and compliance with food-grade certifications have further reinforced their adoption. The sector’s focus on operational efficiency, waste minimization, and regulatory compliance has ensured that the meat processing application continues to dominate within the rolling mill machine market.

The global rolling mill machine market is set to expand from USD 17 Billion in 2020 to USD 20.2 Billion in 2025. It exhibited steady growth at a CAGR of 4.5% during the historical period from 2020 to 2025.

The food & beverage industry is one of the largest users of rolling mill machines. These machines are used for various applications such as flour milling, pasta production, and similar others. Growing demand for processed and packaged food products is driving growth in the market.

The increasing use of automation in manufacturing processes is another major growth driver of the global rolling mill machine market. These machines are extensively used in automated assembly lines for various applications such as automotive parts production and electronic components production.

This helps to reduce labor costs and improve efficiency. Owing to the aforementioned factors, the rolling mill machine market value is expected to climb from USD 20.2 Billion in 2025 to USD 28.6 Billion in 2035. The market is estimated to exhibit growth at 3.5% CAGR during the evaluation period between 2025 and 2035.

A number of influential factors have been identified to stir the soup in the rolling mill machine market. Apart from the proliferating aspects prevailing in the market, lead analysts at FMI have also evaluated the restraining factors, lucrative opportunities, and upcoming threats that can pose a challenge to the progression of the rolling mill machine market.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Rising Popularity of Healthy Food to Push Sales of Aluminum Rolling Mill Machinery in the USA

The food and beverage industry in the USA is a booming market. With the increasing popularity of healthy eating and the rise of new food and beverage companies, demand for rolling mill machines is surging at a rapid pace in the country.

Rolling mill machines are used to create thin sheets of metal, which are then used to develop products like cans, foil, and other food packaging solutions. These machines are also used to create textured surfaces on metals, which can add an aesthetic appeal to products like jewelry and kitchenware. The rolling mill machine market receives nearly 33.1% of its total income from the USA, says FMI.

Demand for Aluminum Rolling Machines to Surge in the UK among Food Companies

Rolling mill machines are used in a wide range of industries, but they have become increasingly popular in the food and beverage industry due to the benefits that they offer. These machines can help to improve productivity and efficiency by streamlining the overall production process. In addition, rolling mill machines can help to improve product quality by ensuring that products are evenly rolled and correctly sized.

Demand for rolling mill machines in the UK food and beverage industry is expected to grow in the assessment period as more companies look to invest in these machines to improve their businesses. As per FMI, the UK market is likely to exhibit considerable growth at a CAGR of 6.1% over the projected period. Germany, on the other hand, is projected to account for around 23.3% of the rolling mill machine market share in the next ten years.

Sales of Rolling Mill Machinery to Grow in India and China with Rising Need to Expand Production Capacity

The Asia Pacific region is one of the most important markets for food and beverages. The region is home to some of the world’s largest economies such as China and India. These countries are expected to experience significant economic growth in the evaluation period.

The food and beverage industry in India and China is highly competitive, with a large number of companies operating in the market. Some of the leading players in the market are focusing on expanding their production capacities to meet the rising demand from consumers.

India and China are the market leaders in Asia Pacific, and their most recent CAGRs in the rolling mill machine market are 6.6% and 6.2%, respectively. Japan would contribute to nearly 3.3% of the overall market share.

Demand for Plate Mill Machines among Meat Processing Firms to Grow by the End of 2035

The rolling mill machine is a versatile and efficient option for meat processing. This type of machinery can be used to process a wide variety of meats, including poultry, pork, and beef. The rolling mill machine is also considered to be an ideal solution for processors who are looking for a way to streamline their operations.

There are many advantages to using a rolling mill machine in the food and beverage industry. This type of machinery is designed to be durable and reliable, making it an ideal choice for processors who need a dependable piece of equipment. Thus, by application, the meat processing segment is estimated to drive the demand for rolling mill machines in the next ten years.

The rolling mill machine market is highly competitive with numerous players operating worldwide. These players are constantly striving to gain a competitive edge over their rivals by investing in research & development activities and introducing new and innovative products. These players are also expanding their geographical footprint to gain a larger share of the market.

Some of the leading players in the global market are ABB Ltd., Andritz AG, Robert Bosch GmbH, Fives Group, Hitachi Ltd., JTEKT Corporation, Mitsubishi Heavy Industries Ltd., Primetals Technologies Ltd., SMS Group GmbH, ThyssenKrupp AG among others. These players hold a significant share of the market owing to their strong brand equity, innovative product portfolio, and efficient customer service networks.

For instance:

| Attribute | Details | |

|---|---|---|

| Estimated Market Size (2025) | USD 20.2 billion | |

| Projected Market Valuation (2035) |

|

|

| Value-based CAGR (2025 to 2035) | 3.5% | |

| Forecast Period | 2025 to 2035 | |

| Historical Data Available for | 2020 to 2025 | |

| Market Analysis | Value (USD Billion) | |

| Key Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa (MEA); RoW | |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Russia, Brazil, Argentina, Japan, Australia, China, India, Indonesia, South Korea | |

| Key Segments Covered | Operating Type, Application, Region | |

| Key Companies Profiled | ABB Ltd.; Andritz AG; Robert Bosch GmbH; Fives Group; Hitachi Ltd.; JTEKT Corporation; Mitsubishi Heavy Industries Ltd.; Primetals Technologies Ltd.; SMS group GmbH; ThyssenKrupp AG | |

| Report Coverage | Strategic Growth Initiatives, Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, and Competitive Landscape. |

The global rolling mill machine market is estimated to be valued at USD 20.2 billion in 2025.

The market size for the rolling mill machine market is projected to reach USD 28.6 billion by 2035.

The rolling mill machine market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in rolling mill machine market are automatic and semi-automatic.

In terms of application, meat processing segment to command 41.0% share in the rolling mill machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rolling Stock Management Market Forecast Outlook 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wire Rolling Machine Market Share, Trends & Forecast 2024-2034

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Kayak Trolling Motor Market Growth – Trends & Forecast 2025 to 2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Modular Rolling Mill Market Size and Share Forecast Outlook 2025 to 2035

Portable Rolling Toolbox Market

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Korea Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

Industrial Rolling Ladder Market Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA