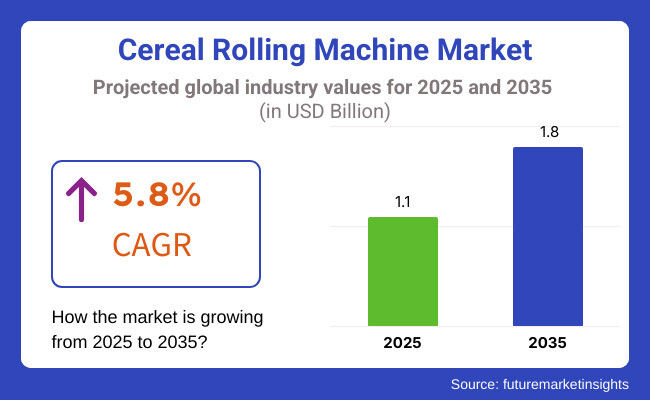

The global cereal rolling machine market is estimated to account for USD 1.1 billion in 2025. It is anticipated to grow at a CAGR of 5.8% during the assessment period and reach a value of USD 1.8 billion by 2035.

Industry Outlook

From 2025 to 2035, the cereal rolling machine market is expected to grow substantially, fueled by the growing worldwide demand for ready-to-eat breakfast cereals. This expansion is primarily attributed to consumers' hectic lifestyles and a growing need for easy meals. Food processing equipment advances are anticipated to enhance production efficiency and quality, further propelling market expansion.

Additionally, additional development of retail infrastructures, particularly in emerging economies, is also poised to facilitate greater market penetration. However, these kinds of manufacturers would be likely to face problems like price fluctuations of raw materials and meeting rigorous food safety regulations. Otherwise, the outlook for the industry is relatively positive, and there are a lot of prospects for innovation and expansion of the market.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased consumption of ready-to-eat (RTE) cereals due to changing lifestyles | Further demand growth due to health-conscious consumers, automation, and technological innovation |

| Preference for convenience foods amid urbanization & busy work schedules | Shift towards healthier, organic, and fortified cereals to meet wellness trends |

| The initial phase of automation and innovation in cereal processing | Advanced AI-driven automation, energy-efficient machines, and smart processing systems |

| Supply chain disruptions due to COVID-19, high raw material costs | Rising regulatory requirements, sustainability concerns, and fluctuating raw material prices |

| Strong market in North America and Europe, emerging demand in Asia-Pacific | Rapid expansion in Asia-Pacific and Latin America due to growing middle-class populations |

| Dominated by major players like Nestlé, Kellogg’s, and PepsiCo | Increased competition with new entrants, product diversification, and regional expansions |

Increased Demand for Whole-Grain Cereals and High-Fiber Ingredients

As per FMI analysis, consumers are getting increasingly health- and wellness-conscious, leading to the demand for whole-grain cereals, high-fiber ingredients, and natural sweeteners. Cereal rolling machine producers are addressing this challenge by designing advanced equipment that is capable of efficiently processing organic, fortified, and gluten-free grains. With increasingly ingredient-conscious consumers, businesses are focusing on clean-label processing that does not include artificial additives but preserves nutrients.

The growing demand for convenience and ready-to-eat (RTE) food is fueling market growth

Urban lifestyles and urbanization are leading consumers to seek out cereals that entail less prep time. Cereal rolling machine manufacturers are adopting automation and artificial intelligence-based technology to enhance production speed and consistency. These developments enable food companies to address the increasing demand for on-the-go breakfast options, especially in urban cities.

Sustainability issues are driving the purchase decisions with consumers looking for brands that practice green and energy-efficient production processes. Cereal companies are spending money on equipment that minimizes energy use, saves waste, and uses recyclable packaging material. The need for carbon-free production is also forcing machine companies to go out of the box when it comes to green technology according to world agendas of sustainability.

Personalization is coming into focus as a top trend with consumers searching for customized nutrition based on nutritional needs and personal taste. A trend toward machine flexibility is prevailing in the market, allowing processors to create an entire line of cereal items that go from high-protein to low-sugar. Equipment relying on machine learning supports the small-batch process, offering specialty niches for unique tastes, textures, and nutritional values.

Direct-to-consumer (DTC) and online channels are transforming the cereal industry. As more consumers purchase cereals online, brands require efficient and scalable manufacturing processes to match demand. High-tech cereal rolling machines are assisting businesses in streamlining operations, ensuring quality control, and providing quick delivery. Subscription-based cereal services are also driving investment in high-capacity and multi-functional rolling machines.

These megatrends confirm that the market for cereal rolling machines will continue to evolve on the basis of health-driven consumers, advancements in technology, and sustainable measures. The players adopting these changes will get an advantage over competitors in the highly burgeoning business.

Based on product type, the market is divided into hot cereal, ready-to-eat cereal, flaked cereals, puffed cereals, shredded cereals, and others. Cereal rolling machines find extensive applications in the manufacturing of Hot Cereal, Ready-to-Eat (RTE) Cereal, Flaked Cereals, Puffed Cereals, and Shredded Cereals as they help increase efficiency, consistency, and product quality. Increasing demand for RTE cereals, as customers increasingly opt for easy breakfast alternatives, is leading manufacturers to make significant investments in high-speed rolling machines that have the capability to grind grains to different textures.

Flaked cereals like cornflakes need exact rolling to create the thin, uniform sheets necessary for maximum crispness and texture. Puffed cereals, on the other hand, that are subjected to high-pressure rolling prior to their puffing rely on specific machines to maintain the integrity of structure and lightness.

Based on end-use, the market is divided into roots, grain, mixtures for dairy substitutes, the milling industry, agricultural, and balanced feed mix. Cereal rolling machines are widely applied in root, grain, dairy substitute mixture processing, milling industry, agriculture, and compound feed mixes because they can process raw materials into high-quality, uniform products.

In the milling sector, cereal rolling machines are very important in flattening and grinding grains such as wheat, corn, and barley to yield flour, semolina, and meal for human and industrial use. The farming industry depends on cereal rolling machines to mill animal feed, producing the best particle sizes that maximize digestibility and nutrient uptake in livestock.

The growing need for dairy alternatives has also boosted the application of rolling machines in processing oat, almond, and rice-based blends, which are used as main ingredients for plant-based milk substitutes. The machines facilitate the grinding of grains and roots into fine, consistent flakes, allowing for improved extraction of natural starches and proteins. In the manufacture of balanced feed mixes, cereal rolling machines assist in homogenizing feed ingredients, and maximizing nutritional content for livestock and poultry.

Based on automation, the market is divided into automatic, manual, and semi-automatic. Automatic, Manual, and Semi-Automatic cereal rolling machines find extensive applications in different industries owing to their suitability for different scales of production, efficiency requirements, and budgets.

Automatic cereal rolling machines are immensely sought after for large-scale industrial production, wherein high-speed processing, precise control, and least human intervention are essential. Such machines provide quality consistency, uniformity, and efficiency, thus being best suited for mass-scale production of ready-to-eat cereals, flaked cereals, and puffed cereals.

The USA is experiencing increasing demand for cereal rolling machines because of the increased popularity of ready-to-eat and hot cereals. Consumers are looking for convenience and nutrition, and hence manufacturers are investing in sophisticated rolling machines that increase the efficiency and consistency of the product. The growth of supermarkets and hypermarkets, as well as growing innovations in cereal formulations, also drives market growth.

With the transition to processed and healthy breakfast cereals gaining pace in India, demand for cereal rolling machines is being driven. Urbanization, changing lifestyles, and rising disposable incomes are influencing consumption. The industry is also gaining from the rising health awareness levels, which are inducing manufacturers to switch over to effective rolling technology in making high-fiber, multigrain, and fortified breakfast cereals.

Germany is experiencing a shift from traditional breakfast options to healthier alternatives, leading to increased demand for cereal rolling machines. Consumers are opting for low-carb, high-protein, and organic cereals, pushing manufacturers to innovate their production processes. Small-scale firms are also launching nutrient-rich cereals, further boosting the need for modern, high-precision rolling equipment.

In China, the changing diet, fueled by government programs that encourage cereal grain consumption, is driving market expansion. The call for greater production quality and more varied cereal varieties is resulting in greater investment in high-tech rolling machines for cereals. Manufacturers are adding new products to their lines, including whole grains and fortified cereals, to address health-conscious consumers.

Japan is experiencing gradual expansion in the market for cereal with Western nutritional trends continuing to impact consumer demands. The emphasis on health and wellbeing has stimulated growing demand for healthier breakfast alternatives, prompting companies to upgrade production methods. The development of new cereals through changing formulation and upgrading process automation through new rolling machines are driving growth in advanced rolling machine adoption.

In Brazil, the growing middle class and urbanization are fueling the popularity of ready-to-eat cereals. The consumer is looking for healthy and convenient products, and hence manufacturers are upgrading their capacity. The market for cereal rolling machines is increasing as manufacturers aim to improve efficiency, serve the domestic market, and target the export market in the Latin American region.

The market for cereal rolling machines is still moderately concentrated, with a combination of renowned global giants and up-and-coming regional producers vying for market share. Major players reign supreme through technology upgrades, mechanization, and mass production capacities that assure high efficiency and uniformity in the process of cereal processing to meet growing global demand.

Regional players expand their role proactively with an emphasis on inexpensive solutions and individualized rolling machinery to suit distinct cereals. With the advantage of being able to provide flexibility at a cost, they manage to compete against multinational companies, especially in up-and-coming economies where the need for localized as well as smaller-scale cereal making is growing.

Strategic mergers and acquisitions lead to market concentration as industry giants invest in R&D to optimize machine efficiency, minimize energy expenditure, and attain sustainability targets. Firms relentlessly modernize equipment with AI-enabled automation and precision rolling technology to meet the surging demand for varied cereal items.

As health-aware and sustainability-oriented consumers become more prominent, producers incorporate green and energy-saving designs into their equipment. They create adjustable and modular rolling systems to facilitate the manufacture of organic, gluten-free, and nutrient-dense cereals, further consolidating their market leadership in the face of shifting industry trends.

Major Developments

The market for cereal rolling machines is competitive, with international players emphasizing technological innovation to improve production efficiency. Top players invest in automation, artificial intelligence-based control systems, and energy-efficient designs to address changing industry needs. Their capacity to provide high-speed, precision rolling solutions provides them with a strong competitive edge.

Regional players compete on affordability and tailor-made solutions for medium and small-scale cereal manufacturers. They serve specialty cereal types like organic, gluten-free, and fortified cereals. Their capacity to adjust locally and provide support services after selling enhances their acceptability in increasingly expanding cereal demand in emerging countries.

Market leaders increase their footprint through strategic alliances, acquisitions, and investments in research and development. They partner with food companies to create rolling machines that can handle new cereal recipes, such as plant-based and protein-fortified varieties. Their focus on innovation allows them to continue leading in a changing food processing environment.

Sustainability is instrumental in determining the competitive landscape, as companies invest in energy-saving, environmentally friendly, and waste-minimizing rolling technologies. Manufacturers with lower-carbon-emitting rolling machines and biodegradable packaging solutions are favored by ecologically aware brands willing to cooperate with sustainability objectives, thereby gaining a competitive advantage in the global market.

With respect to product type, the market is classified into hot cereal, ready-to-eat cereal, flaked cereals, puffed cereals, shredded cereals, and others.

In terms of end-use, the market is segmented into roots, grain, mixtures for dairy substitutes, the milling industry, agricultural, and balanced feed mix.

In terms of automation, the market is divided into automatic, manual, and semi-automatic.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is anticipated to reach USD 1.1 billion in 2025.

The market is predicted to reach a size of USD 1.8 billion by 2035.

Prominent players include Maseto Technologies, FH SCHULE Mühlenbau, Nestle, Kellogg Co., and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Automation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Automation, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Automation, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Automation, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Automation, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Automation, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Automation, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Automation, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Automation, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Automation, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Automation, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by End Use Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Automation, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Automation, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by End Use Application, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Automation, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Automation, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by End Use Application, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Automation, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Automation, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Automation, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Automation, 2023 to 2033

Figure 189: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by End Use Application, 2023 to 2033

Figure 191: MEA Market Attractiveness by Automation, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Cereal Flake Market

Instant Cereals Market Growth & Demand Forecast 2025-2035

Extruded Cereals Market

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Rolling Stocks Market Size and Share Forecast Outlook 2025 to 2035

Rolling Papers Market Trends - Growth & Demand 2025 to 2035

Rolling Stock Management Market Growth – Trends & Forecast 2024-2034

Rolling Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Leaf Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wire Rolling Machine Market Share, Trends & Forecast 2024-2034

Boat Trolling Motor Market Size and Share Forecast Outlook 2025 to 2035

Kayak Trolling Motor Market Growth – Trends & Forecast 2025 to 2035

Railway Rolling Stock Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA