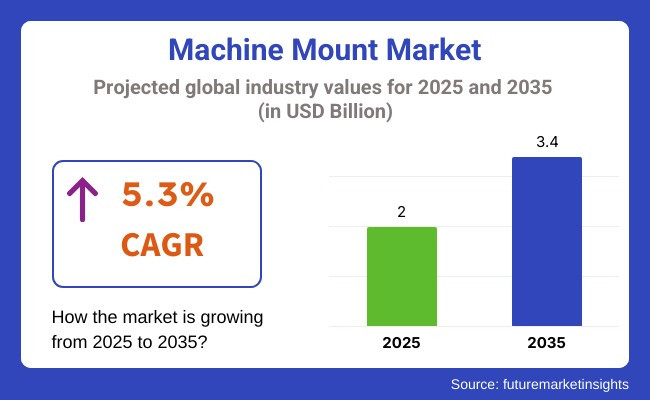

The machine mount market globally is expected to grow steadily, with an estimated value of USD 2 billion in 2025, expected to reach around USD 3.4 billion by 2035, growing at a CAGR of 5.3%. Demand is fueled by growing industrial automation and the requirement for precision machinery stabilization. Anti-vibration mounts or leveling feet play a critical function in the structural stability and performance of a machine. They facilitate shock, vibration, and noise absorption to extend equipment life and enhance overall production efficiency and workplace safety.

Applications such as automotive, aerospace, electronics, packaging, and food processing are highly reliant on precision machining, wherein stability is a major concern. Machine mounts provide a stable mounting, ensure correct leveling, and assist in keeping machines aligned even with high-speed or heavy-duty work.

The direction towards Industry 4.0 and intelligent manufacturing is driving the demand for high-performance parts even more. More robots, CNC equipment, and precision tools coming into factories translate to machine mounts that resist the vibrations that might otherwise reduce the quality of product or destabilize calibration-based gears.

Another major driving force is increasing interest in operator comfort and occupational health. Minimization of vibration transmission saves equipment, but also enhances work environment, especially in facilities where there is continuous or high-duty usage of machines. Advances in elastomeric materials, modular construction, and self-leveling technology are opening up new application possibilities. Corrosion-resistant mounts, load-carrying flexibility, and high thermal stability are being designed to cater to more demanding applications such as mining, marine, and heavy engineering.

North America and Europe are close behind, driven by a robust base of high-precision industries and growing focus on automation, safety, and machine longevity. Retrofitting of existing facilities with new mounts is also driving industry growth in these mature markets. The industry occupies a critical although frequently overlooked role in contemporary business. As more manufacturing processes get increasingly sensitive, automated, and performance-oriented and will remain critical in providing structural steadiness, precision, and ultimate operational efficiency.

The industry is witnessing incredible growth that is being driven by increasing demands in various industries such as automotive, construction, and agricultural machinery. The growth is due to factors such as the increasing need for equipment and machinery, government regulation, and expanding applications in emerging industries. There is a vast range of various types of products for various uses such as leveling mounts, anti-vibration mounts, and sandwich mounts.

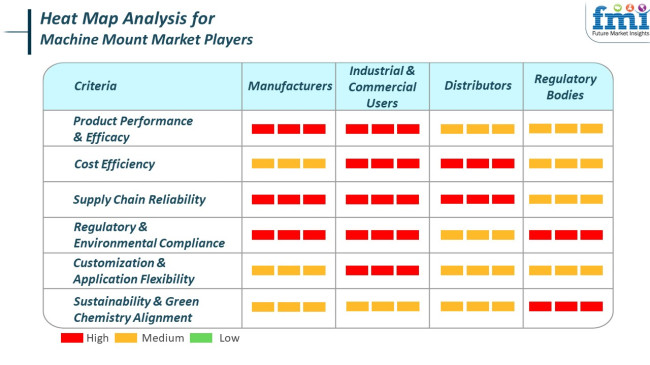

Producers focus on making best-in-class mounts that meet the stringent requirements of business and industrial clients. They spend on green production strategies and aim to ensure a safe supply chain for the purpose of meeting growing worldwide demand. Industrial & Commercial Applications, like automotive, construction, and farm equipment, appreciate cost-effective and reliable solutions with excellent performance in various applications.

They seek highly effective, eco-friendly, and customizable products to meet exact operational needs. Distributors attach considerable importance to having a safe supply chain in order to meet the needs of industrial and commercial clients. Distributors deal with offering diverse products meeting different applications within a timely and cost-effective basis.

The industry grew steadily between 2020 and 2024, sustained by growing use of vibration and shock isolation solutions in different industry applications. Machine mounts were implemented in manufacturing, automotive, and aerospace industries for improving equipment efficiency and prolonging service life.

The emphasis within this timeframe rested on product life and compatibility with installed machinery. Regional expansion was observed in developed economies which already had a well-settled industrial base setup, whereas developing countries started enjoying the advantages in terms of boosting operating efficiency.

Between 2025 and 2035, the industry will likely experience significant growth. The convergence of intelligent technologies, including IoT and AI, will facilitate real-time monitoring and predictive maintenance, further improving equipment reliability and minimizing downtime. Also, the focus on sustainability and energy efficiency will spur the creation of environmentally friendly options. The emerging economies are also expected to contribute significantly to industry growth on account of swift industrialization and infrastructure development.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing need for vibration and shock isolation technology. | Convergence of smart technologies and emphasis on sustainability. |

| Increased adoption for improved equipment performance. | Usage of IoT and AI for real-time monitoring and predictive maintenance. |

| Highlighting product durability and compatibility with installed equipment. | Emphasis on environmentally friendly solutions and minimal environmental footprint. |

| Developed industry growth with established industrial base. | Growth in emerging economies due to rapid industrialization. |

| First steps towards energy-efficient solutions. | Heavy focus on sustainable and green machine mount development. |

The industry which plays a critical role in maintaining the stability and isolation from vibration of industrial machinery, is set to rise with escalating automation and precision needs in sectors. Nevertheless, numerous ongoing and projected threats may affect its direction

One major ongoing threat is the volatility of raw material prices, especially for rubber and metal-based parts. Volatility in these costs has the potential to influence manufacturing costs and margins for producers.

Besides, the industry is vulnerable to threats from other vibration control technologies like active vibration cancellation systems that could provide more sophisticated solutions in some applications. Economic recessions also threaten, as they can bring diminished capital spending on industrial equipment, ultimately causing a low demand.

In the future, the industry might face threats due to strict environmental laws. In efforts to cut their environmental impact, companies can invest in environmentally friendly materials and production methods, raising the cost of doing business.

There are also possibilities of other solutions or mounting options for machines that could affect the industry. The performance of the industrial sector would also greatly affect the business; demand is influenced by the change in growth rate of any industrial sector.

Leveling mounts will hold 55% of the industry in 2025, while anti-vibration mounts will hold 20% of it. These products are essential for stabilizing, aligning, and operating industrial machinery effectively.

Leveling mounts are widely used in the manufacturing, automotive, and electronics industries with extreme precision and alignment of machines. Such mounts are vital for equipment stability to ensure that any misalignment does not result in inefficient operational performance or mechanical failure. Top manufacturers like Vibra Systems and Karman Rubber provide leveling mounts for applications ranging from heavy machines to fragile electronic equipment. Most industries favor leveling mounts for their ability to adjust heights or level machinery even in uneven conditions.

Conversely, more anti-vibration mounts are used to suppress machine vibration from both the equipment and its environment. They perform this function when used in the automotive, aerospace, and construction sectors, absorbing and isolating vibrations from this equipment, thus enhancing safety in operation and longevity in the equipment.

Boge Compressors and Schaeffler are examples of companies that manufacture anti-vibration mounts, which contribute to ensuring the good performance of industrial machines, reducing noise, and prolonging the life of equipment. These mounts afford great benefits to operations characterized by high speed and frequency, where control of vibration becomes paramount for smooth running.

These product types serve a vital role in ensuring the operational efficiency and life of industrial machines in various sectors.

General machine tools will take the lead type of machine by 2025, with an industry share of 47%, while CNC machines will have an industry share of 18%. Both kinds of machines are much needed for manufacturing processes; however, they highly differ in providing and changing the requirements of different industries.

General machine tools are a major type among all tool categories in applications such as automotive, metalworking, and electronics. A general machine can almost be described as multipurpose, with operations ranging from cutting and drilling to grinding. Such top names in the field as Doosan Machine Tools and Mazak offer general machine tools and equipment for diverse customized applications. Another feature that makes these tools much accepted is flexibility and adaptability- small to medium manufacturers looking for a cost-effective and multipurpose solution for the production process commonly depend on such types of tools.

CNC machines, or Computerized Numerical Controlled Machines, will take a small share in number but will always be important in the industry. They operate with high efficiency and are widely employed for precision and incision in bulk production where machining needs are very tight tolerances, such as in airspace sectors, ward instrument making, and precision engineering.

CNC machines are accepted as they can fully automate complex tasks needing very high levels of precision and repeatability, such as Haas Automation and DMG Mori, among major players. Even though the share of these machines will be smaller, CNC machines will remain relevant in holding spaces in industries where tolerances are very high and surfaces work at extreme speeds.

Applications, unlike general machine tools and CNC machines, are very important for ensuring proper efficiency and accuracy in producing goods for various sectors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.4% |

| France | 5.2% |

| Germany | 5.9% |

| Italy | 5% |

| South Korea | 6.1% |

| Japan | 5.7% |

| China | 7.4% |

| Australia-New Zealand | 4.8% |

The USA industry will expand at 6.8% CAGR during the forecast period. The industry in the USA is experiencing significant growth as a result of increased investments in industrial automation and precision manufacturing. Increasing demand for machinery requiring effective vibration isolation is driving the adoption of advanced mounts.

With a preponderant presence of large manufacturing sectors, including aerospace, automotive, and heavy machinery, the country is continuously expanding the base of applications. In addition, the rapid uptake of smart technologies in factory systems is also boosting demand for high-performance anti-vibration mounts that ensure stability and operational efficiency. Also, the USA industry has stringent regulatory norms that necessitate safety and noise reduction in manufacturing environments.

This kind of regulatory atmosphere compels enterprises to replace machines with reliable mount solutions. Further, in a rising culture of sustainability, energy-loss-reducing and longevity-enhancing machine mounts are gaining popularity by being adopted in mass volumes.

The industry is also witnessing an increased demand for customized mounting solutions that cater to unique industrial requirements, thereby expanding product offerings for companies. With the pace of industrial growth and infrastructure upgradation in the nation, the sales opportunities in the USA are bright till 2035.

The UK industry will grow at 5.4% CAGR over the forecast period. Industrialization across various sectors is a significant growth driver for the industry in the UK The expansion is underpinned by substantial investments in replacing aging equipment and higher standards of workplace safety. Precision engineering and automation technology are the focus areas, driving demand for equipment that requires effective vibration isolation.

The trend is most prominent in the aerospace and defense sectors, which are prime drivers of the country's manufacturing economy. Moreover. The UK Industry. Initiative to low-noise operations and clean energy. It has found broader applications, such as reducing structural vibrations and acoustic insulation. Government policies in favor of industrial innovation and productivity enhancement are generating a favorable environment for manufacturers of state-of-the-art mounting technology.

Increasing. Application of modular manufacturing setups. Also supports the demand for flexible, high-load-bearing mounts. As business establishments look to minimize machine wear and lower maintenance costs, vibration control systems are becoming increasingly popular. The UK industry also experiences growth in after-market replacement and services, which in turn contributes to the segment achieving consistent growth over the forecast period.

The French industry is expected to grow at 5.2% CAGR over the study period. The French manufacturing landscape is slowly transforming with digital manufacturing technologies, which in turn is propelling the requirement that deliver precision and durability. The automotive and electronics manufacturing industries are big drivers of this demand, as they increasingly require equipment that delivers mechanical balance and stability during high-speed runs.

Growing emphasis on workplace safety and reduced downtime are motivating industries to spend on heavy-duty vibration-damping solutions. France's focus on energy-saving and green operations is leading to additional opportunities for environmentally friendly mounting systems. With manufacturing plants turning to Industry 4.0 solutions, the need for high-level machine support systems is becoming crucial.

French industry is also investing in research and development to develop higher-level machine mounts with improved shock absorption. Moreover, local demand is complemented by growing export-oriented production, which emphasizes a high premium on machine stability and performance. With these proactive developments, the French industry will develop steadily through 2035.

The German industry will register a growth rate of 5.9% CAGR through the forecast period. As the premier manufacturing center in Europe, Germany showcases strong momentum toward the use, particularly in the automotive, heavy engineering, and precision tools industries. The country's emphasis on operational efficiency and mechanical precision necessitates advanced vibration and noise control systems, making machine mounts a critical component in manufacturing infrastructure.

German producers maintain elevated product dependability standards, and vibration-isolation technology is an integral part of that dedication. Germany's export-oriented manufacturing economy also drives the demand for heavy-duty machine mount systems to protect sensitive equipment from wear and loss of performance.

Additionally, the increased application of robotics and automation systems in German manufacturing has created new applications. Efforts toward improving energy efficiency, reducing machine downtime, and ensuring workplace safety are driving the adoption of innovative mounting solutions. As industrial policy continues to encourage digital transformation and smart manufacturing, the German industry is expected to keep a steady upward trajectory during the forecasted period.

The Italian industry will develop at 5% CAGR during the research period. Italy's industry is transforming because of growing emphasis on improving the performance of industrial equipment, especially in conventional sectors such as textiles, automotive components, and packaging. Italian manufacturers are increasingly realizing the importance of vibration control to ensure production accuracy and reduce long-term equipment wear.

This consciousness is being translated into greater investment in high-performance machine mounts with the ability to withstand varied operating conditions. Apart from local production needs, Italy's place in the European machinery supply chain ensures sustained demand for industrial mounts that meet local and foreign quality standards.

Technological advancement among Italy's small and medium enterprises (SMEs) is driving diversification and customization of machine mount solutions. With factories striving to achieve higher efficiency levels while meeting environmental and safety laws, the adoption of engineered mounts is on the rise. With the additional advantage of reducing machine noise and extending equipment life, the Italian industry is also expected to be a key driver in the European industry during the forecast period.

South Korea industry is expected to register a 6.1% CAGR during the study period. The developed electronics and semiconductor sectors of South Korea offer a significant source of demand that provide greater stability and control of vibration. With accuracy increasingly becoming crucial to micro-manufacturing processes, high-performance mounting systems are increasingly becoming a part of manufacturing installations. South Korea's quest for innovation and technological development in industrial automation also supports the growth of this industry. South Korea is also heavily investing in smart factory ecosystems where machine reliability is the priority.

This is fueling strong demand for intelligent system-compatible machine mounts with real-time monitoring capabilities. The shift towards energy-efficient manufacturing processes is accompanied by the evolution of mounts that not only suppress vibration but also conserve energy and safeguard machines. With continuous advances in industrial infrastructure and a high rate of technology adoption, the South Korean industry is expected to follow a strong growth trajectory until 2035.

The Japanese industry is expected to grow by 5.7% CAGR during the study period. Japan's image of precision manufacturing and automation has a direct correlation with its need for stable vibration control solutions. Japanese industry is benefiting from increasing sophistication in machinery used in automobile production, electronics, and robotics. These applications require vibration isolation solutions that promote longer machinery life and deliver ideal operating output with no defect, particularly in automated and high-speed use.

Aging machinery in Japan and ongoing industrial equipment modernization are spurring replacement demand for high-tech machine mounts. In addition, a concern for sustainability and workplace ergonomics is forcing producers to design products that optimize efficiency while using environmentally responsible materials.

With industries making the transition towards Industry 4.0 paradigms, there is increasing demand that encompass monitoring and diagnostic capabilities. With such visionary developments in technology adoption and an unrelenting focus on quality, Japan will remain a prime industry for advanced industry solutions.

The China industry will register a 7.4% CAGR during the study period. With one of the world's most rapidly expanding industrial economies, China's demand is picking up due to rapid growth in automobile manufacturing, consumer electronics, and infrastructure development. The growth in manufacturing activity, particularly in high-speed and high-volume production environments, necessitates efficient vibration isolation to protect equipment and maintain production accuracy.

China's geographically dispersed manufacturing base and capacity expansion plans are also fueling solid industry growth. Government incentives for factory modernization and the addition of more advanced production equipment have spurred demand for high-quality machine mounts. Smart manufacturing initiatives and automation integration also remain key drivers of demand for vibration-damping technologies that can be utilized to facilitate intelligent machinery.

Additionally, with Chinese manufacturers attempting to meet global quality levels, investment in high-end mounting technologies is becoming more prevalent. With mega-sized industrial initiatives and shifting regulatory needs, China is the most vibrant growth opportunity in the global industry throughout the forecast period.

The Australia-New Zealand industry will increase at 4.8% CAGR throughout the study period. Though relatively smaller in size compared to other industries, Australian and New Zealand industrial growth is increasingly led by mining, energy, and food processing industries.

These sectors require constant and dependable support systems for machines, propelling demand that can support harsh environmental conditions and heavy loads. A transition toward advanced manufacturing and utilization of automation technologies is also contributing to industry growth.

As operating-industrial-equipment companies desire increased operational safety and extending equipment lifetimes, investments in high-duration mounts are growing. The industry is also supported by imports and strategic partnerships with foreign manufacturers providing engineered mount products tailored to geographic needs. With a mission to enhance working conditions and minimize machine wear attributed to vibration, the Australia-New Zealand industry will experience steady but moderate growth in the industry through 2035.

The industry is characterized by three giant corporations- Trelleborg AB, Cummins Inc., and LORD Corporation- which are taking the lead position in engineered vibration isolation and industrial noise control solutions. The three players are working on advanced materials and technologies, focusing particularly on elastomer and composite mounts engineered especially for harsh industrial environments. In 2024, Trelleborg expanded its vibration isolation product portfolio with the introduction of smart mounts featuring sensor-based diagnostics for predictive maintenance.

The newly integrated LORD Corporation's research and development focus has been multi-axis damping systems for CNC machines as well as industrial automation, with Cummins Inc. strengthening its portfolio within the heavy-duty engine and generator mounts used across global OEM networks.

Hutchinson SA and Total Vibration Solutions Ltd. are scaling custom-engineered mounting systems targeting high-precision sectors like defense as well as aerospace. VibraSystems, Inc. has developed modular machine mount kits for middle-size industrial applications, which are now gaining traction.

Asian players such as Kurashiki Kako and NHK Group have ridden on the back of growth within automotive and electronics manufacturing, supplying cost-effective and reliable machine mounts. The two companies, Rosta AG and Vishwaraj Rubber Industries, are moving into emerging industries by employing localized distribution and pricing based on value strategies.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Trelleborg AB | 16 - 20% |

| Cummins Inc. | 14 - 18% |

| LORD Corporation | 12 - 15% |

| Hutchinson SA | 10 - 13% |

| Total Vibration Solutions | 8 - 11% |

| Other Players | 28 - 35% |

| Company Name | Offerings & Activities |

|---|---|

| Trelleborg AB | Smart machine mounts with real-time diagnostics for industrial machinery. |

| Cummins Inc. | Advanced anti-vibration engine mounts for heavy equipment. |

| LORD Corporation | High-damping elastomer-based mounts integrated into Parker's industrial systems. |

| Hutchinson SA | Customized vibration solutions for aerospace and transport sectors. |

| Total Vibration Solutions | Engineered mounts as well as noise control systems tailored for precision machining. |

Key Company Insights

Trelleborg AB (16-20%)

Leading the industry through innovation in intelligent vibration isolation systems, particularly targeting industrial IoT-enabled factories.

Cummins Inc. (14-18%)

Dominates in the generator and engine mount segment, leveraging its strong OEM and distribution networks globally.

LORD Corporation (12-15%)

Strong in elastomer technology, LORD integrates smart sensor systems and remains a premium brand after the acquisition of Parker Hannifin.

Hutchinson SA (10-13%)

A key player in aerospace-grade mounts and metal-rubber hybrid isolators, expanding contracts across Europe and Asia.

Total Vibration Solutions (8-11%)

Focused on custom noise and vibration systems for high-precision equipment in small and mid-sized enterprises.

Other Key Players

By machine type, the industry is segmented into CNC machines, general machine tools, cutting machines, injection molding machines, forming presses, EDM machines, and air compressors.

By sales channel, the industry is categorized into OEM and aftermarket.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is expected to reach USD 2 billion in 2025.

The industry is anticipated to grow to USD 3.4 billion by 2035, expanding at a CAGR of 5.3% during the forecast period.

Key players include Trelleborg AB, Cummins Inc., LORD Corporation, Hutchinson SA, Total Vibration Solutions Ltd., VibraSystems Inc., Sunnex Group, Nu-Tech Engineering Services Ltd., Rosta AG, Vishwaraj Rubber Industries, Industrial Components Group, Fibet Group, Kurashiki Kako Co., Ltd., NHK Group, and IAC Acoustics.

Growth is driven by the increasing use of automated machinery, demand for noise and vibration reduction in manufacturing environments, and expansion of industrial production globally.

Asia-Pacific leads in market growth due to its robust manufacturing base.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Machine Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Machine Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mountain E-Bike Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Mountain and Ski Resorts Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Mountain and Snow Tourism Market Analysis – Trends, Growth & Forecast 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Market Share Insights of Leading Mountain and Ski Resorts

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA