The machine condition monitoring market is advancing steadily, driven by the increasing adoption of predictive maintenance strategies across manufacturing and industrial sectors. Reports from engineering journals and automation system manufacturers have pointed to a significant shift from reactive to data-driven maintenance, with real-time monitoring technologies playing a central role.

Industries such as oil & gas, power generation, and automotive manufacturing are integrating advanced condition monitoring systems to minimize downtime, enhance asset life, and reduce maintenance costs. The rising complexity of modern machinery has also necessitated continuous health diagnostics, supported by sensors, data loggers, and software analytics.

Moreover, the growing reliance on Industrial Internet of Things (IIoT) and cloud-based platforms has enabled seamless monitoring, data visualization, and automated alerts for potential failures. Looking forward, market growth is expected to be influenced by the development of wireless monitoring solutions, integration of AI for predictive analytics, and increasing deployment of machine condition monitoring systems across small and medium enterprises. Segmental growth is being led by vibration monitoring techniques, hardware components, and online monitoring processes, each driven by their unique application strengths and technological maturity.

| Metric | Value |

|---|---|

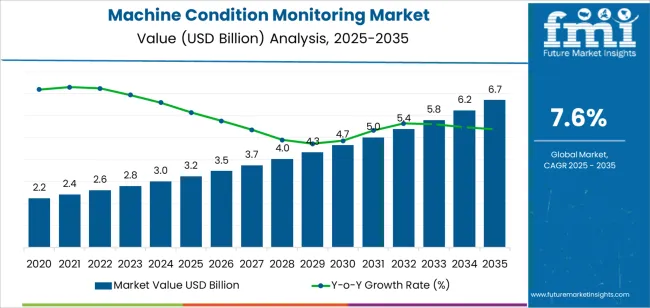

| Machine Condition Monitoring Market Estimated Value in (2025 E) | USD 3.2 billion |

| Machine Condition Monitoring Market Forecast Value in (2035 F) | USD 6.7 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The market is segmented by Monitoring Techniques, Component, Monitoring Process, Deployment Type, and Industry and region. By Monitoring Techniques, the market is divided into Vibrating Monitoring, Thermography, Oil Analysis, Corrosion Monitoring, Motor Current Analysis, and Ultrasound Emission Monitoring. In terms of Component, the market is classified into Hardware and Software. Based on Monitoring Process, the market is segmented into Online and Portable. By Deployment Type, the market is divided into On‑Premises and Cloud. By Industry, the market is segmented into Oil And Gas, Power Generation, Automotive, Chemical, Aerospace, Food And Beverage, Metal And Mining, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

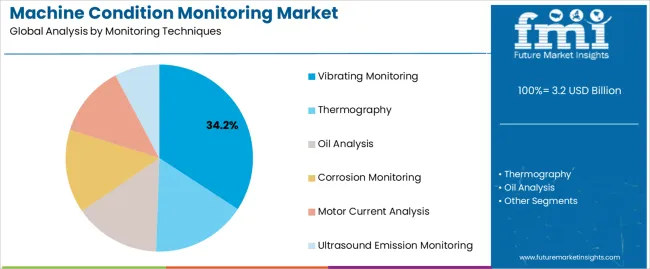

The Vibration Monitoring segment is projected to hold 34.20% of the machine condition monitoring market revenue in 2025, leading the monitoring techniques category. This growth has been driven by the technique’s proven reliability in detecting early-stage faults such as misalignment, imbalance, and bearing wear.

Engineering publications and maintenance audits have consistently cited vibration analysis as the most cost-effective and widely implemented technique across rotating machinery. Its ability to detect anomalies before they escalate into critical failures has made it indispensable in sectors like manufacturing, power generation, and mining.

The availability of portable vibration analyzers and integrated sensors has facilitated easy deployment across legacy and modern systems. Moreover, recent advancements in wireless sensor networks and real-time data interpretation have further increased its effectiveness and adoption. With increased awareness of equipment lifecycle optimization and unplanned downtime reduction, the Vibration Monitoring segment is expected to maintain its position as the foundational technique in condition monitoring programs.

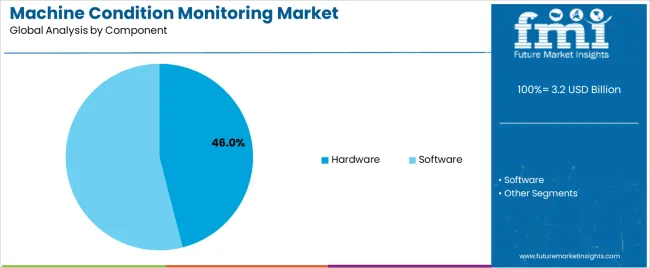

The Hardware segment is projected to contribute 46.0% of the machine condition monitoring market revenue in 2025, securing its lead among component types. This dominance has been attributed to the essential role of physical infrastructure such as sensors, transducers, data acquisition systems, and portable diagnostic equipment in facilitating accurate and real-time condition monitoring.

Industry suppliers and automation solution providers have reported sustained demand for robust, durable hardware capable of operating in harsh industrial environments. Hardware components form the core of monitoring systems, converting mechanical signals into digital data streams for interpretation.

The integration of modular hardware with existing plant equipment has also enabled cost-effective scaling of condition monitoring capabilities. Furthermore, advancements in MEMS sensor technology and edge computing devices have enhanced hardware functionality, allowing for faster data capture and analysis. As industrial sectors prioritize system reliability and predictive diagnostics, the Hardware segment is expected to remain the largest revenue contributor in the condition monitoring ecosystem.

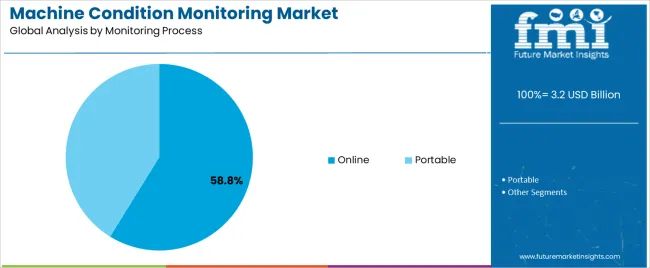

The Online segment is projected to account for 58.8% of the machine condition monitoring market revenue in 2025, establishing itself as the dominant monitoring process. This segment’s growth has been driven by the increasing demand for continuous equipment surveillance in mission-critical environments where downtime is highly disruptive.

Online monitoring enables real-time data collection and immediate fault detection, supporting predictive maintenance and enhancing operational safety. Industries such as energy, petrochemicals, and transportation have prioritized online systems to ensure uninterrupted performance of high-value machinery.

Technological advancements in cloud connectivity, wireless sensors, and remote monitoring platforms have significantly improved the accessibility and scalability of online monitoring systems. These systems also support integration with AI-powered analytics tools, enabling early anomaly detection and maintenance scheduling. With operational efficiency and equipment reliability being key metrics for industrial success, the Online segment is expected to remain the preferred monitoring process, offering superior insight, responsiveness, and long-term cost savings.

Innovations in Sensor Technology and Predictive Maintenance Fuel Demand

Continuous innovations in sensor technology, data analytics, and artificial intelligence drive the development of more sophisticated and effective condition monitoring solutions.

Industries increasingly adopt predictive maintenance strategies to minimize downtime, optimize operational efficiency, and reduce maintenance costs, thereby boosting the demand for condition monitoring systems.

Stringent regulatory requirements regarding equipment safety, environmental sustainability, and worker safety compel companies to invest in condition monitoring solutions to ensure compliance and avoid penalties.

Risk of Data Theft and Technical Challenges to Hamper Demand

The initial cost of implementing condition monitoring systems, including sensors, software, and infrastructure, can be prohibitive for some organizations, particularly small-scale businesses with limited budgets.

Integrating condition monitoring systems with existing infrastructure and legacy equipment may pose technical challenges and require additional investments in training and system integration. The collection and analysis of sensitive equipment data raise concerns about data privacy and security, particularly in industries where proprietary information is at risk of theft or unauthorized access.

Integration of Machine Learning to Create Novel Opportunities

Ongoing expansion of industries such as renewable energy, aerospace, and automotive presents new opportunities for condition monitoring solution providers, as these sectors require reliable monitoring of critical assets to ensure operational efficiency and safety.

The proliferation of Internet of Things (IoT) devices and connectivity enables real-time monitoring of equipment health, opening up opportunities for predictive maintenance and proactive interventions to prevent costly downtime.

The integration of machine learning algorithms and predictive analytics into condition monitoring platforms enhances the accuracy and timeliness of fault detection and enables proactive maintenance strategies, offering new avenues for innovation and differentiation.

Margin Erosion and Price Wars Might Impede the Industry

The machine condition monitoring market is highly competitive, with numerous players offering a wide range of solutions. Intense competition may lead to price wars, margin erosion, and commoditization of products and services.

Rapid technological advancements and disruptive innovations could render existing condition monitoring solutions obsolete, forcing companies to continuously invest in research and development to stay ahead of the curve.

Strict regulations governing data privacy and protection, such as the General Data Protection Regulation (GDPR), could impose compliance challenges and increase operating costs for condition monitoring solution providers.

Country-wise insights offer a glimpse into how leading countries are shaping the machine condition monitoring market, each with its unique strengths, challenges, and opportunities.

The United States boasts one of the most significant machine condition monitoring markets globally, driven by its extensive industrial base across various sectors such as manufacturing, energy, aerospace, and automotive.

The country is a hub for technological innovations, with numerous companies and research institutions pioneering advancements in sensor technology, data analytics, and artificial intelligence for condition monitoring applications.

Stringent regulatory requirements regarding equipment safety, environmental compliance, and worker safety incentivize industries in the United States to invest in condition monitoring solutions to ensure compliance and mitigate operational risks.

Key drivers of market growth in the country include increasing adoption of predictive maintenance strategies, emphasis on operational efficiency and asset reliability, and the need to minimize downtime and maintenance costs.

Germany is renowned for its engineering prowess and manufacturing expertise, making it a significant player in the global machine condition monitoring market. Companies in the country lead the way in developing high-quality monitoring solutions for various industries.

The country's emphasis on industrial automation and Industry 4.0 initiatives pushes the adoption of advanced condition monitoring technologies as manufacturers seek to optimize production processes and maintain competitive advantage.

Germany benefits from a collaborative ecosystem comprising industry associations, research institutions, and government agencies, fostering innovation and knowledge exchange in the field of condition monitoring.

Condition monitoring solution providers in the country capitalize on export opportunities, leveraging Germany’s strong reputation for reliability and quality to serve international markets across Europe, Asia, and beyond.

China's status as a global manufacturing powerhouse fuels the demand for machine condition monitoring solutions as companies prioritize operational efficiency, quality control, and asset reliability to remain competitive in domestic and international markets.

Government initiatives such as Made in China 2025 and the Belt and Road Initiative boost investments in advanced manufacturing technologies, including condition monitoring, as China seeks to upgrade its industrial infrastructure and move up the value chain.

Rapid urbanization and industrialization in China have led to increased demand for condition monitoring solutions in sectors such as infrastructure, construction, energy, and transportation as companies strive to ensure the reliability and safety of critical assets.

China-based companies are increasingly investing in research and development to develop indigenous condition monitoring technologies tailored to the needs of domestic industries, presenting opportunities for homegrown solutions to gain market share domestically and globally.

Thermography is set to be particularly useful for detecting faults in electrical systems, motors, and process equipment. It is projected to be widely used in industries such as power generation, manufacturing, and utilities.

Thermography solutions represent a significant portion of the machine condition monitoring market, driven by the growing adoption of infrared technology for predictive maintenance applications.

Online condition monitoring has the ability to provide real-time visibility into equipment health, enabling operators and maintenance personnel to identify anomalies and abnormalities as they occur.

By leveraging sensors, data acquisition systems, and connectivity technologies, online monitoring solutions continuously collect and analyze data from machinery, detecting deviations from normal operating conditions and triggering alarms or notifications when issues are detected.

Online condition monitoring also facilitates predictive maintenance strategies and can forecast potential equipment failures and recommend appropriate maintenance actions by analyzing historical data and trends and predictive algorithms.

It is set to be a critical enabler of predictive maintenance and asset management strategies, offering real-time visibility, proactive insights, and operational intelligence for organizations across various industries.

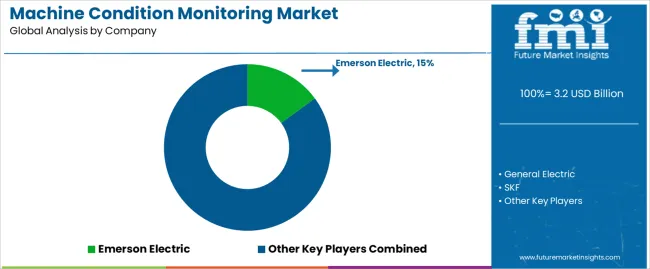

The competitive landscape in the machine condition monitoring market is characterized by intense competition among a diverse range of players, including multinational corporations, small and medium-sized enterprises, and start-ups. These companies offer a wide array of products and services tailored to various industries and applications within the condition monitoring ecosystem.

The machine condition monitoring market is highly competitive, with a mix of established players, specialized providers, start-ups, and technology innovators vying for a high share.

These companies differentiate themselves based on their technological capabilities, industry expertise, and ability to deliver value-added services for predictive maintenance and asset management. As the demand for condition monitoring solutions continues to grow, competition is expected to intensify, driving further innovation and consolidation in the market.

Insights into Key Players

Based on monitoring techniques, the machine condition monitoring market is segmented into vibrating monitoring, thermography, oil analysis, corrosion monitoring, motor current analysis, and ultrasound emission monitoring.

By component, the sector is divided into hardware and software.

Based on the monitoring process, the industry is distributed in online and portable condition monitoring.

The machine condition monitoring market is deployed in two parts, namely, on-premises and cloud.

Based on industry, the sector is segregated into power generation, oil and gas, automotive, chemical, aerospace, food and beverage, metal and mining, and others.

By region, the machine condition monitoring market is spread across North America, Latin America, Europe, East Asia, South Asia, Pacific, and the Middle East and Africa.

The global machine condition monitoring market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the machine condition monitoring market is projected to reach USD 6.7 billion by 2035.

The machine condition monitoring market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in machine condition monitoring market are vibrating monitoring, thermography, oil analysis, corrosion monitoring, motor current analysis and ultrasound emission monitoring.

In terms of component, hardware segment to command 46.0% share in the machine condition monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

BMI Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA