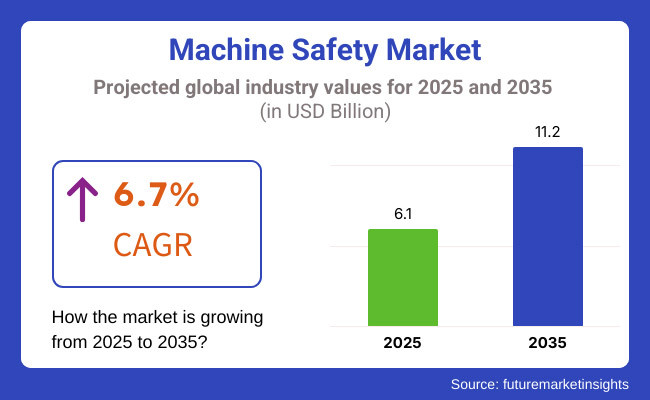

The global machine safety market is set to observe USD 6.1 billion in 2025. The industry is poised to depict 6.7% CAGR from 2025 to 2035, reaching USD 11.2 billion by 2035.

Machine safety deals with the safety system for machines that protect workers, machinery, and industrial processes from failure or accident. It includes safety interlocks, safety sensors, and safety. Additionally, the products include safety interlocks, sensors, and emergency stops, including artificial intelligence-based machine safety systems that ensure compliance with strict workplace safety regulations.

As the industry progresses and automation becomes more widespread throughout diverse sectors, organizations are deploying IoT-based safety devices and smart control systems to enhance better secure operations, lower risks, and improve productivity.

Increased employee safety concerns and government-mandated safety measures drive additional investment in machine safety technologies. As workplace safety standards become more stringent internationally, the need to avoid human risk in industries such as manufacturing, automotive, aerospace, and healthcare has led to adopting automated safety systems.

These safety technologies are also becoming more effective due to the synergy between real-time monitoring and predictive maintenance solutions. The Industry is transforming because of technological innovation, and the leaders of workplace safety enhancement are AI, IoT, and industrial robots.

AI surveillance cameras observe machine behavior, pick up unusual activity, and generate predictive alerts for accidents in advance. IoT-enabled safety devices allow equipment performance to be monitored instantly and an immediate response in case of safety breaches. Further, intelligent safety interlocks and automatic emergency stop systems improve machine safety reliability, reduce downtime, and improve productivity.

Since production processes are becoming more automated across industries, the demand for machine safety solutions will likely grow significantly. Firms are working on scalable, interoperable safety tech with industrial management systems and factory control automation platforms. The expansion of collaborative robots (cobots) and autonomous manufacturing cells is also fueling demand for intelligent safety mechanisms that keep human operators and robotic systems safe.

The industry will grow steadily due to continuous progress in AI-based analytics, IoT-enabled safety systems, and technical preventative control techniques. As organizations focus on increasing workplace safety levels and lowering operational risks, spending on intelligent safety technology will only grow. The future of industrial safety will be shaped by machine learning and digitalized solutions leveraging automation to facilitate a worldwide safe and efficient production landscape.

Presence sensing safety sensors are projected to lead the industry in 2025. Sensors are often deployed in high-risk industrial environments for which real-time hazard detection is a necessity, such as robotic welding stations, hydraulic presses, automated packaging systems, and others.

For instance, companies like SICK AG and Omron Corporation provide advanced safety light curtains and laser scanners that prevent accidental contact with dangerous machinery. Their Presence-sensing sensors help with infrared, ultrasonic, and capacitive sensing of human movement, pausing operations to avoid injury.

With tightening workplace safety regulations, the automotive, electronics, and pharmaceutical industries are highly focused on investing in presence-sensing safety solutions to meet the ISO 13849 and OSHA safety standards.

Safety interlock switches prevent machines from operating without protective barriers in place, safely restricting access to hazardous areas. These connect switches can be electromechanical, non-contact, tongue, or trapped secret switches, each tailored to the needs and demands of different industries.

Rockwell Automation offers trapped key interlock systems applicable to industrial conveyors, which prevent the full opening of doors until the machinery has come to a complete stop. Schneider Electric, for instance, produces non-contact safety interlock switches for food processing industries to help minimize risks of contamination while ensuring compliance with safety environments.

Industries are increasingly focused on automation and worker protection, leading to increased demand for smart safety interlock systems that offer IoT connectivity and remote monitoring capabilities, ultimately driving market growth.

One such dominant sector is the automotive industry. The continual automation of factories and the introduction of robotics, automated guided vehicles (AGVs), and high-speed assembly lines, among others, mean that machine safety must evolve, keeping workers safe and productivity levels high.

Safety manufacturers implement safety light curtains, emergency stop devices, and digital safety indicators in accordance with ISO 13849-1, OSHA, that comply with automotive manufacturers like Toyota, Ford, and BMW. Some safety sensor manufacturers such as SICK AG and Keyence Corporation manufacture presence-sensing safety middleman that helps to stop unauthorized entry into areas such as robotic welding stations and lower the numbers of workplace accidents.

Machine safety systems in the food and beverage industry are another major contributor to the system in the murky kitchen environment that demands hygiene and safety compliance with strict regulations from the FDA, HACCP, and ISO 22000. They use non-contact interlock switches, automatic shut-off valves, and motion sensors in processing facilities to avoid contamination and injuries. Schneider Electric also makes stainless steel safety interlocks for food-grade applications that can accommodate your cleanroom standards.

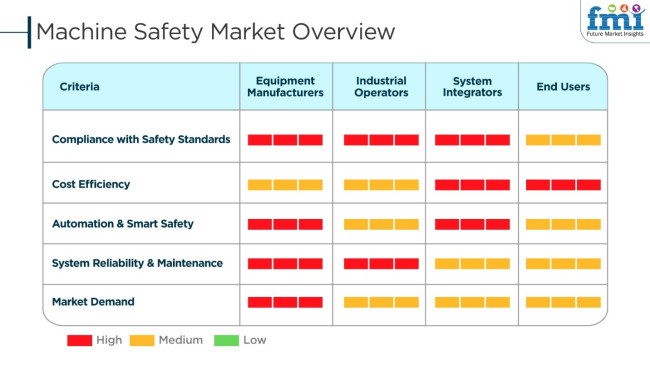

The Industry reflects bull market conditions because of the stringent focus on workplace safety rules, increased automation and the prevalence of Industry 4.0 work environments. Equipment manufacturers are focusing on the conformity and on high-tech security features like emergency stop systems, safety relays, and interlock switches. Industrial operators look for trustworthy and inexpensive security solutions that cut down on downtime and help increase production.

System integrators lean towards advanced safety automation by merging IoT-enabled monitoring systems for predictive maintenance and real-time safety analytics. End users such as manufacturing and processing industries regard safe yet affordable and compliant safety prototypes are the best alternatives to risk reduction and employee protection.

Robotic safety, AI-based hazard detection, and cloud-based safety monitoring are the market trends that are redefining it, thus affecting purchasing decisions in several sectors. This sector is still fueled by the growing interest in plug and play safety systems, modular solutions, and adherence to global safety standards.

| Company | ABB Ltd. |

|---|---|

| Contract/Development Details | ABB Ltd. secured a contract to provide comprehensive machine safety systems for a new automotive manufacturing plant in North America. The project includes the installation of advanced safety sensors, interlock switches, and emergency stop controls to ensure compliance with stringent safety regulations and enhance operational efficiency. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 150 - USD 200 |

| Estimated Renewal Period | 3 years |

| Company | Siemens AG |

|---|---|

| Contract/Development Details | Siemens AG entered into an agreement with a leading food and beverage company to implement machine safety solutions across multiple processing facilities in Europe. The initiative aims to integrate safety controllers and programmable safety systems to minimize operational risks and ensure worker safety in compliance with industry standards. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 100 - USD 120 |

| Estimated Renewal Period | 5 years |

| Company | Rockwell Automation |

|---|---|

| Contract/Development Details | Rockwell Automation was awarded a contract to upgrade the machine safety infrastructure of a major oil and gas company's offshore drilling platforms. The project focuses on deploying advanced safety interlock systems and real-time monitoring solutions to enhance equipment safety and prevent accidents in hazardous environments. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 200 - USD 250 |

| Estimated Renewal Period | 5 years |

| Company | Schneider Electric |

|---|---|

| Contract/Development Details | Schneider Electric announced a partnership with a prominent pharmaceutical manufacturer to design and implement machine safety systems in their new production lines. The collaboration involves the integration of safety modules, emergency stop devices, and compliance with global safety standards to ensure a safe working environment and efficient operations. |

| Date | January 2025 |

| Contract Value (USD Million) | Approximately USD 80 - USD 100 |

| Estimated Renewal Period | 3 years |

In 2024 and early 2025, the industry experienced significant growth, driven by strategic contracts and technological advancements across various industries. ABB Ltd.'s contract to equip a North American automotive plant with advanced safety systems underscores the automotive sector's commitment to enhancing worker safety and operational efficiency.

Siemens AG's agreement with a European food and beverage company highlights the increasing adoption of machine safety solutions to comply with stringent industry regulations and protect workers in processing facilities. Rockwell Automation's project to upgrade safety infrastructure on offshore drilling platforms reflects the oil and gas industry's focus on preventing accidents in hazardous environments through advanced safety technologies.

Additionally, Schneider Electric's partnership with a pharmaceutical manufacturer to implement comprehensive machine safety systems indicates the growing emphasis on safety and compliance in the pharmaceutical sector. These developments signify a broader trend towards the integration of sophisticated machine safety solutions to mitigate risks, ensure regulatory compliance, and enhance productivity across diverse industrial landscapes.

The industry grew between 2020 to 2024. Several factors help in this growth, some of them being greater industrial automation and more regulatory safety measures, alongside growing interest in labour protection. Automated high-end safety solutions like safety sensors and emergency stop equipment were implemented in manufacturing, automobile, and food and beverage industries to provide maximum workplace safety consistent with safety standards like ISO 13849 and IEC 62061. Integrating digital safety systems helped to monitor in real time. Also, the quality of diagnostics improved.

Between 2025 and 2035, the trend of this continuous evolution in the market will establish smart safety ecosystems based on cognitive artificial intelligence, 5G connectivity, and digital twins. The machines are becoming increasingly autonomous and predictive, as well as adaptive to the evolving context of operation within its environment.

It is that context that will guarantee workplaces free of harm. Attention will also shift from the safety of machines to human-robot collaboration, context-aware safety solutions, and sustainability-led safety systems. AI-based safety analytics, alongside blockchain-based compliance, will complete the picture of safety governance and operational resilience.

The industry is poised for a transformative evolution, owing to the confluence of cognitive AI , human robot collaboration and intelligent safety ecosystems. Organizations can leverage these transformative innovations and create zero-harm environments, adaptive risk mitigation, and regulatory compliance outcomes, thus reinventing the future of industrial safety and operational resilience in the digital age.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Safety sensors, light curtains, and interlocks made sure that workers remained safe and equipment are also protected. | Cognitive AI-powered sensors with contextual awareness and real-time anomaly detection will enable predictive safety measures and adaptive risk mitigation. |

| Collaborative robots (cobots) required safety-rated monitoring systems for safe human-robot interaction. | AI-driven human-robot collaboration with context-aware safety systems will enable dynamic safety zones and intuitive human-machine interaction. |

| AI-powered diagnostics identified safety hazards and improved predictive maintenance. | Cognitive AI models will provide real-time safety analytics, proactive risk assessments, and autonomous decision-making for incident prevention. |

| The IoT-based safety systems allowed for monitoring and diagnosing from remote places. | 5G-enabled safety ecosystems with edge computing will enable processing the data in real time for remote safety management and instant alerts during critical incidents. |

| Digital twins simulated safety scenarios for risk assessment and safety system testing. | AI-driven digital twins will provide real-time simulations, predictive risk modeling, and dynamic safety optimization for complex industrial systems. |

| Safety systems focused on accident prevention, emergency shutdowns, and safety compliance. | Autonomous safety systems with AI-driven behavioral analytics will promote zero-harm workplaces, proactive safety culture, and mental health monitoring. |

| Safety standards compliance (e.g., ISO 13849, IEC 62061, and OSHA) guaranteed regulatory compliance. | Blockchain-based compliance, real-time regulatory tracking, and AI-implemented safety governance will ease safety audits and border-to-border compliance. |

| Simple safety systems initiated alarms and emergency stops based on pre-established conditions. | Safety systems powered with cognitive AI are able to dynamically modify safety measures and foresee possible hazards for improving safety workflows. |

| Energy-saving safety devices minimize power consumption and expenses. | Self-powered sensors, energy harvesting solutions, and recyclable parts will allow for green manufacturing practices within safety systems. |

| Major adopter industries for worker safety and compliance were industrial manufacturing, automotive, and food & beverages. | Growing demand for intelligent safety ecosystems, human-robot collaboration, and predictive safety analytics will be seen by smart manufacturing, healthcare, and logistics. |

In the near future, the industry will be confronted with risks which primarily result from compliance with regulatory laws, difficulties with the technological integration, and operational interruptions. Governments and safety organizations, including OSHA (Occupational Safety and Health Administration), ISO 13849, IEC 61508, and ANSI standards, enforce very stringent machinery operating safety regulations in the industry. Not adhering to these standards may bring about heavy fines, legal penalties, closing down of operations, and damage to the company's image.

The issue of integration may be a second serious risk. Safety machines such as enabling stop systems, .Light Beams, interlocks, and programmable controllers need be effectively integrated into the pre-existing industrial automation systems, PLCs (Programmable Logic Controllers), and IoT platforms. Bad integration could result in operational inefficiencies, more downtime, and safety vulnerabilities.

Surplus supplies, omitted components that impact the availability of sensors, relays, and circuit breakers will push delays in manufacture and deployment. Geopolitical tensions, the shortage of semiconductor chips, and trade restrictions may, in fact, give rise to these difficulties, subsequently affecting pricing and timeframes for delivery.

Cybersecurity threats are also experienced in industries connected to the Industry 4.0 and the system of safety. Machines that are connected with cloud and edge computing for safety are also likely to attacks, breaches in the system, and unauthorized accesses which are detrimental not only to worker safety but also to the efficiency of on-going operation.

Recession and strict expenditure are major determinants affecting enterprises such as manufacturing, oil, fishing, automobile, among others, thus, reducing funds meant for upgrading of machine security. Industries may give precedence to practices that would generate more profit instead of making available resources for employee safety training.

Resistance to the introduction of safety systems based on automation and knowledge gap are factors that curtail the acceptance of these innovations in energy deficient areas where traditional safety mechanisms are mostly relied on. Training and legislative control are critical for the surmounting of this barrier.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 9.0% |

| European Union | 9.2% |

| Japan | 9.1% |

| South Korea | 9.3% |

The USA industry grows as organizations adopt automation, industrial IoT (IIoT), and AI-based safety technologies to ensure safer workplaces and improve productivity. Firms invest in sensor-based safety solutions, hazard monitoring in real-time, and predictive maintenance to comply with regulations and avoid hazards.

Dominant players such as Rockwell Automation, Honeywell, and Siemens propel industrial control systems, robotics, and industrial safety. USA government efforts such as Occupational Safety and Health Administration (OSHA) norms and National Institute of Standards and Technology (NIST) programs also boost market growth. FMI sees the USA industry growing at a 9.5% CAGR during the forecast period.

| Key Drivers in The USA | Detail |

|---|---|

| AI-Driven Hazard Detection | Firms utilize AI-driven risk analysis software for occupational safety. |

| Growing Smart Manufacturing | Robotics and IoT integration advance automated safety. |

| Governmental Occupational Safety Initiatives | OSHA and NIST encourage compliance with machine safeguarding. |

The UK industry expands as businesses invest more in employees' safety, industrial automation, and artificial intelligence-based risk mitigation measures. The Health and Safety Executive (HSE) is responsible for triggering the adoption of machine guarding and real-time safety monitoring.

Manufacturing companies and research facilities like Cambridge University create AI-based safety analytics and predictive maintenance capabilities. Occupational safety regulations and automation of hazard prevention accelerate the creation of safer industrial facilities.

| Key Drivers in the UK | Detail |

|---|---|

| AI-Based Hazard Prevention | Institutions create analytics for real-time proactive monitoring for safety. |

| Automation Integration into Industries | Companies integrate safety automation into manufacturing and logistics. |

| Safety Standards at Workplace | HSE enforces machine safeguarding standards to ensure compliance. |

The EU industry grows as businesses embrace automated risk assessment, machine safeguarding, and safety compliance technology. Germany, France, and Italy are the leaders in smart manufacturing, robotics, and automation for safety. Schneider Electric and ABB are among the companies that produce sensor-based safety monitoring, IoT-enabled factory floors, and smart machine interlocks. FMI anticipates that the European Union industry will register a 9.2% CAGR during the forecast period.

| Key Drivers in the European Union | Detail |

|---|---|

| Horizon Europe Investments | The EU is funding AI technology to develop safety. |

| Smart Manufacturing Leadership | France, Germany, and Italy lead in industrial automation and safety solutions. |

| IoT-Based Factory Safety | Firms have real-time monitoring of machines included in manufacturing. |

Japan's Industry grows as companies adopt AI-driven safety technology, robotics, and predictive maintenance. Government initiatives spur risk minimization in the workplace and machine guarding adoption. Firms like Omron, Fanuc, and Keyence have led the commercialization of advanced technology in industrial automation. Integrating robotics-based workplace protection and real-time hazard detection improves industrial efficiency and safety.

| Key Drivers in Japan | Detail |

|---|---|

| Government Safety Technology Investment | MHLW invests ¥600 billion in workplace safety research and development. |

| Integration of Robotics and AI | Companies leverage machine safety through robotics-based automation. |

| Predictive Maintenance Growth | Companies utilize AI-based safety systems to reduce downtime. |

South Korea Industry expands as industries embrace AI-based safety monitoring, industrial automation, and IoT-based protection systems. Hyundai Robotics and Samsung lead the expansion of smart factories and future-proof safety solutions.

South Korea's government invests significant amounts in workplace safety and industrial automation, which drives the growth of smart safety solutions in manufacturing, logistics, and automotive industries. FMI believes South Korea's Industry will expand at a 9.3% CAGR over the forecast period.

| Key Drivers in South Korea | Detail |

|---|---|

| Smart Factory Growth | The top companies embrace IoT-based safety solutions. |

| Government-Sponsored Safety Expenditures | USD 2.9 billion is allocated to workplace safety and automation. |

| AI-Driven Safety Monitoring | Predictive analytics is employed by firms to detect industrial hazards. |

The highly competitive global industry is propelled by increasing industrial automation, stringent workplace safety regulations, and the growing need for operational efficiency. Therefore, manufacturing, energy, and logistics organizations have pushed towards investing in machine safety solutions with the view to minimizing workplace hazards, minimizing downtime, and aligning operations with global safety standards like ISO 13849, IEC 62061, and OSHA requirements.

Rockwell Automation, Siemens, Schneider Electric, and ABB are the leading players in the market through their advanced safety controllers, emergency stops, interlock systems, and predictive safety solutions powered by artificial intelligence. They focus more on developing IoT, machine learning, and integrated real-time monitoring of their safety systems with risk prevention and compliance enhancement in mind.

The market currently witnesses the heating-up in competition with specialized companies entering with sensor-based automation systems, safety light curtains, and adaptive safety techniques tailored for specific industries. Cost-effective, cloud-integrated, and AI-empowered safety solutions meet the growing demand for smart factories through the traction that startups and niche players are gaining.

The mergers and acquisitions strategic landscape, with cooperation between industrial automation firms and regulatory agencies, will continue adding steam to the competitive environment. Alongside these, machine safety solutions will constantly advance alongside evolving innovations in robotics safety, cybersecurity for safety systems, and human-machine interaction, whereby companies that thrive will integrate technology advancement, regulatory compliance, and end-to-end safety integration to sustain their market position.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Rockwell Automation | 20-25% |

| Siemens AG | 15-20% |

| Schneider Electric | 10-15% |

| ABB Ltd. | 8-12% |

| Honeywell International | 5-10% |

| Omron Corporation | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Rockwell Automation | Advanced safety controllers, emergency stop devices, as well as risk assessment solutions. |

| Siemens AG | AI-powered safety automation systems, programmable logic controllers, and industrial safety sensors. |

| Schneider Electric | Smart safety interlocks, real-time monitoring systems, and machine safeguarding solutions. |

| ABB Ltd. | Integrated safety solutions, robotic safety applications, and emergency stop mechanisms. |

| Honeywell International | Personal protective equipment, gas detection systems, as well as industrial safety monitoring. |

| Omron Corporation | Safety light curtains, area scanners, and fail-safe automation technology. |

Key Company Insights

Rockwell Automation (20-25%)

With advanced safety controllers and emergency stop devices for compliance with global safety regulations, Rockwell Automation is the leader in the industry. The company is still relentlessly innovating in AI-powered safety solutions for industrial automation.

Siemens AG (15-20%)

Siemens is a prominent player in the world of industrial automation safety, integrating programmable logic controllers and AI-driven safety monitoring systems that uplift workplace efficiency and compliance.

Schneider Electric (10-15%)

Schneider Electric focuses on machine-safeguarding solutions, smart safety interlocks, and real-time risk assessment tools for industrial safety management.

ABB Ltd. (8-12%)

ABB integrates safety solutions within robotics and industrial automation by providing emergency stop mechanisms and real-time safety analytics that reduce operational risk.

Honeywell International (5-10%)

Honeywell has a wide range of industrial safety applications that include gas detection systems and personal protective equipment for various industrial sectors.

Omron Corporation (4-8%)

Omron is famous for its safety light curtains, area scanners, and automation solutions to improve machine safety in a manufacturing environment.

Other Key Players (30-38% Combined)

The market is segmented product-wise into presence sensing safety sensors and safety interlock switches.

The market is segmented by industry into automotive, food & beverages, packaging, material processing, pharmaceuticals, electronics & semiconductors, and others.

Region-wise, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 6.1 billion in 2025.

The industry is predicted to reach USD 11.2 billion by 2035.

The key companies in the industry include ABB Ltd., Emerson Electric Co., General Electric, Honeywell International Inc., Schneider Electric SE, Rockwell Automation, Inc., Siemens AG, Yokogawa Electric Corp., Omron Corporation, and Keyence Corporation.

The USA, slated to grow at 9.5% CAGR during the forecast period, is poised for the fastest growth.

Presence-sensing safety sensors are being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 13: Global Market Attractiveness by Component, 2023 to 2033

Figure 14: Global Market Attractiveness by Industry, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 28: North America Market Attractiveness by Component, 2023 to 2033

Figure 29: North America Market Attractiveness by Industry, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 58: Europe Market Attractiveness by Component, 2023 to 2033

Figure 59: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 118: MEA Market Attractiveness by Component, 2023 to 2033

Figure 119: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

BMI Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA