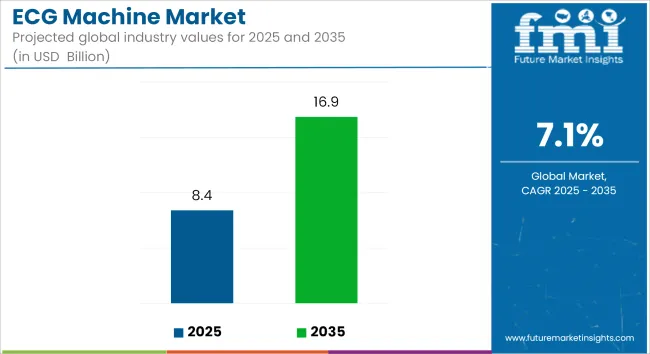

The ECG machine market is anticipated to be valued at USD 8.40 billion in 2025. It is expected to grow at a CAGR of 7.1% during the forecast period and reach a value of USD 16.86 billion in 2035.

An electrocardiography machine is an instrument that assesses and documents the electrical activity of the human heart and is useful for diagnosing and monitoring ailments, including different arrhythmias, heart attacks, and other heart diseases. It is accessed in various institutions, hospitals, clinics, ambulances, and at home for regular and emergency cardiovascular assessments.

The ECG machine market covers devices that record heart activity to diagnose cardiovascular conditions. The market is growing owing to the rising incidence of heart diseases, an aging population, advancements in portable and AI-powered ECGs, increasing healthcare spending, and the demand in hospitals, clinics, and home healthcare settings worldwide.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth is driven by increasing cardiovascular diseases and demand for diagnostic tools. | Rapid expansion is due to progress in AI, remote monitoring, and marrying with wearable technologies. |

| Introduction of portable and wireless ECG machines with cloud storage capabilities. | AI-powered, real-time ECG diagnostics with automated analysis and predictive healthcare solutions. |

| Primarily used in hospitals, clinics, and specialized cardiac centers. | Widespread utilization across home healthcare, remote monitoring initiatives, and telemedicine platforms. |

| Greater cardiovascular health consciousness increases the application of ECG devices for preventive reasons. | Higher consumer involvement with self-monitoring ECG devices and AI-powered health applications. |

| The emergence of smartwatches and mobile ECG patches, but with limited clinical acceptance. | Advanced, clinically validated wearable ECGs integrated into daily health monitoring routines. |

| Strengthen regulations to ensure the accuracy and safety of ECG devices. | Stricter guidelines on AI-based ECG diagnostics and cross-border telemedicine ECG solutions. |

| Limited focus on eco-friendly materials and energy-efficient devices. | Strong push for green medical technology, including sustainable materials and low-energy ECG machines. |

| Early-stage AI applications for ECG interpretation require manual verification. | Entirely automated high-accuracy AI-based ECG diagnostics, mitigating reliance on human analysis. |

| Growing adoption of cloud-based ECG data storage and remote access for specialists. | Mass real-time ECG monitoring using 5G-supported telehealth platforms and continuous data synchronization. |

| Competition among established medical device manufacturers and emerging tech-driven startups. | Market consolidation, with AI and wearable technology firms collaborating with traditional medical device companies. |

Wearable and AI-Driven ECG Monitoring

With AI-powered insights, wearable ECG technology provides real-time heart monitoring, which consumers readily adopt. Therefore, ECG functionality is embedded in smartwatches, fitness trackers, and wearable patches to allow users to maintain healthy hearts without entering a clinic.

The smart devices scan heart rhythms, identify irregularities, and send immediate alerts that empower proactive cardiac care. People seek easy solutions around their busy schedules as heart diseases become commonplace.

Home-Based and Remote ECG Diagnostics

As telemedicine gains popularity, consumers are shifting toward home-based ECG machines that enable remote diagnostics. Portable, wireless ECG devices allow users to perform medical-grade tests on their heart and share live data with healthcare organizations while sitting at home.

Such devices empower chronic heart patients to care for their health by reducing many hospital visits. The increase in personalized care, along with an increase in accessibility, is pushing the home-use ECG systems to change the way patients monitor and respond to heart health conditions.

| Attributes | Details |

|---|---|

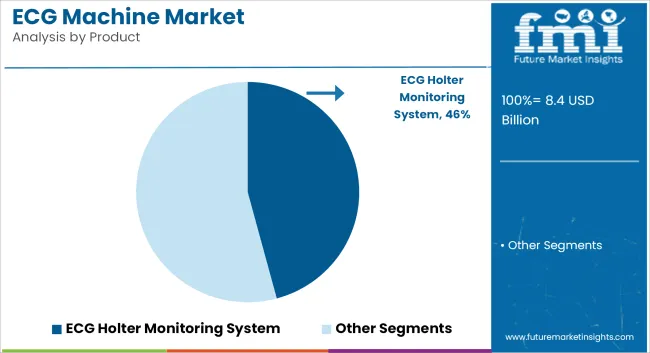

| Top Product | ECG Holter Monitoring System |

| Market Share in 2025 | 45.8% |

The ECG Holter Monitoring System is still the leading product in the ECG machine market, with a 45.8% market share in 2025. Ongoing monitoring of heart rhythm makes it an essential tool for arrhythmia detection and cardiac conditions. Increasing cardiovascular cases and a higher share of outpatients are driving the market towards growth.

AI-assisted and digital ECG Holter monitors have improved the accuracy and efficiency of remote monitoring. These devices conduct real-time analysis of the heart to identify abnormalities quicker, without the necessity of hospital visits. The increasing adoption of ECG portable devices for the sake of long-term monitoring of patients creates demand, especially among the elderly and high-risk cardiac patients.

| Attributes | Details |

|---|---|

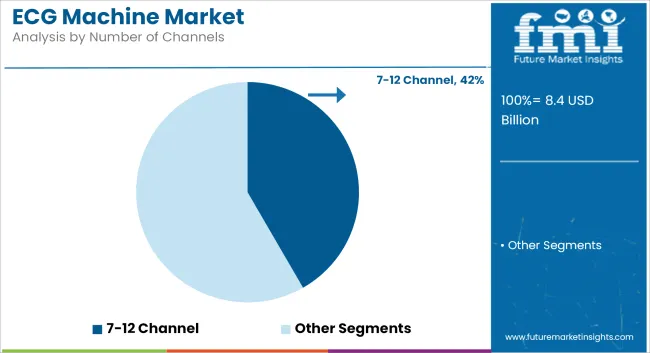

| Top Number of Channels | 7-12 Channel |

| Market Share in 2025 | 41.7% |

The 7-12 channel ECG systems dominate the market with a 41.7% market share in 2025, providing higher accuracy and detailed cardiac diagnostics. Specifically, multi-channel ECGs are frequently employed within hospitals and cardiac care facilities to identify complicated heart ailments more effectively using a less sophisticated technique than lower-channel options. As per FMI analysis, the need for 7-12 channel ECG systems arises from the growing need for precise ECG results for the diagnosis of atrial fibrillation, myocardial infarction, and conduction disorders. Since health networks are moving toward early detection and preventive care, this system remains the preferred choice for cardiologists and emergency medical professionals.

| Attributes | Details |

|---|---|

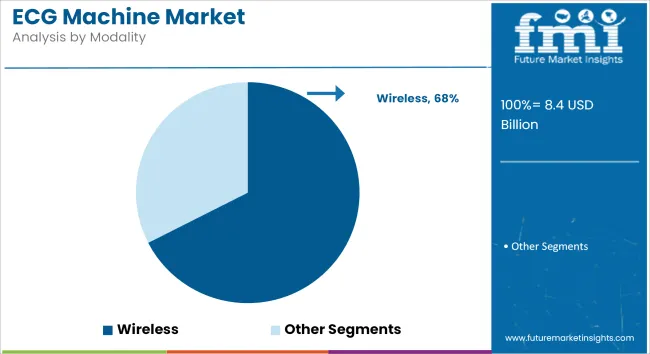

| Top Modality | Wireless |

| Market Share in 2025 | 67.5% |

The wireless ECG segment dominates the ECG machine market, capturing a 67.5% market share in 2025. The demand for telemedicine adoption and home-based patient monitoring has grown since wireless ECGs enable efficient continuous monitoring that does not restrict patient mobility, and thus are well suited to the management of chronic disease and home care.

Technological innovations in smart monitoring devices and wearable ECG patches have increased real-time heart health tracking. These platforms are connected to mobile apps and cloud platforms, allowing healthcare providers instant access to information. As digital healthcare solutions expand in scope, demand, and innovation in the wireless ECG market, continue to be thriving.

| Countries | CAGR |

|---|---|

| USA | 6.9% |

| Germany | 5.9% |

| Japan | 8.4% |

| China | 9.5% |

| France | 7.3% |

The Surging Prevalence of Cardiovascular Diseases Drives Demand in the USA

During the projected period, the demand for ECG machines in the USA is anticipated to rise at a CAGR of 6.9% from 2025 to 2035. Increased prevalence of cardiovascular diseases and the mortality rates caused due to heart complications continue to be the most significant drivers for growth. Poor dietary habits and a sedentary lifestyle are continuing to rise with heart conditions and need frequent monitoring and diagnostics.

The USA has a well-developed health infrastructure, along with advancements in technology for medical devices. Portable and AI-supported ECG devices are widely adopted along with the growth of telemedicine. Both of these factors would augment penetration into the market. Additionally, the increasing aging population will also increase the demand for ECG machines, thus ensuring uninterrupted growth in the years to come.

Strategic Alliances with Technology Giants Propel Sales in Japan

Japan is anticipated to witness a CAGR of 8.4% from 2025 to 2035. Most of the reasons for the industry growth are attributed to the strategic collaborations that ECG device manufacturers enter into with major Japanese technology companies like Sony, Panasonic, and Toshiba. With this partnership, innovative healthcare solutions of effective and efficient ECG monitoring will be developed.

The rising elderly population in Japan, combined with the rising prevalence of cardiovascular illnesses, increases the demand for ECG machines. Besides, government programs in healthcare are being enhanced by technological innovations, most specifically AI-integrated ECG monitoring, regarding their ability for early detection and treatment. This trend toward strong innovation and digital-based healthcare will continue to propel growth in the market.

Favorable Government Policies Fuel Demand in Germany

Germany is projected to witness a CAGR of 5.9% between 2025 and 2035. The major growth drivers include favorable healthcare policies and attractive insurance coverage for cardiovascular diagnostics. The NHS in Germany assures the availability of medical services, which motivates regular heart health checks and increases the requirement for ECG machines.

Focusing on technological innovation and digital healthcare has allowed Germany to embark upon the use of AI-powered and remote ECG devices. The increase in home-based healthcare and government incentives that support the adoption of the latest diagnostic tooling are also strengthening the market. An increase in R&D investments by larger healthcare firms is expected to increase the efficacy and quality of ECG devices in Germany.

Expanding Exports Boost ECG Machine Market in China

The projected annual growth rate of China is 9.5% from 2025 to 2035. China is one of the leading manufacturers of medical devices worldwide and is strongly into the exports of ECG machines. The growing demand for cost-effective, high-quality ECG devices from international markets is significantly boosting China’s market expansion.

Domestically, rising cardiovascular disease cases and increased healthcare spending have propelled demand for ECG machines in hospitals and clinics. Government-backed healthcare initiatives and rapid urbanization are improving accessibility to diagnostic tools. Additionally, advancements in portable and wearable ECG technologies are further enhancing the adoption of these devices in home healthcare settings.

Rising Demand for Home-Based Monitoring Solutions Spurs Growth in France

Between 2025 and 2035, France registered a compound annual growth rate of 7.3%. Rising consumer preference for home-based healthcare is driving demand for portable ECG devices. Consumers want easy, inexpensive, and convenient ways to monitor their hearts, which will propel the adoption of smart ECG solutions.

The fusion of telemedicine services with digital health platforms has spurred demand for advanced ECG monitoring equipment in France. Encouraging preventive healthcare initiatives for government, coupled with user-friendly smart ECGs, have stimulated the progress made in this country. As awareness about heart health rises and technological advancements take the forefront in innovation, the ECG market in France will witness steady growth.

Throughout the globe, the manufacturing companies of medical devices make use of high technology, a strong distribution network, and expertise in regulations to corner the ECG machine industry. The advanced diagnostic capability and seamless integration with digital health systems reinforce their authority over the industry. Advancing one kind of exclusive collaboration with hospitals and specializing solutions will extend their reach to all health systems, clinics, and first responders.

These advanced companies are significantly investing in research and development to improve accuracy, portability, and connectivity in machines. Furthermore, they have developed a machine learning diagnostic tool, AI diagnostics, and data storage management in the cloud to enhance their competitive edge in the market.

Firms maintain the integrity of their core trust among qualified medical practitioners with the quality of the devices certified by the FDA and CE, thus strengthening their exclusive control in hospital-grade and consumer-use ECG segments.

Mature companies dominate costs and the culture by developing proprietary technologies and exclusive service agreements. Economies of scale allow them to produce cheaply without compromising quality. Such strong recognition of the brand, together with strategic acquisitions and a broad service network, limit opportunities for new entrants in the market, thus enabling the former to maintain their leadership position across developed and developing regions.

The competitive landscape is very much limited to high concentration since the top firms keep on breaking through by innovating and complying with regulatory standards. Through wearable ECG technology and integrated remote monitoring solutions, they are now adjusting to the changing face of healthcare demands. Their supremacy in both the institutional and home diagnostic markets leaves little opportunity for smaller competitors to shake their stronghold.

There are very few players constituting the ECG machine market, which is well consolidated by advanced technology and strong distribution networks.The increasing prevalence of cardiovascular diseases, along with an enhanced focus on early diagnosis and preventive healthcare, is boosting the growth of the electrocardiograph (ECG) machine market.

Moreover, the market expansion is further backed by the latest technological developments by portable and user-friendly ECG devices, facilitating more cardiac monitoring in different healthcare settings.

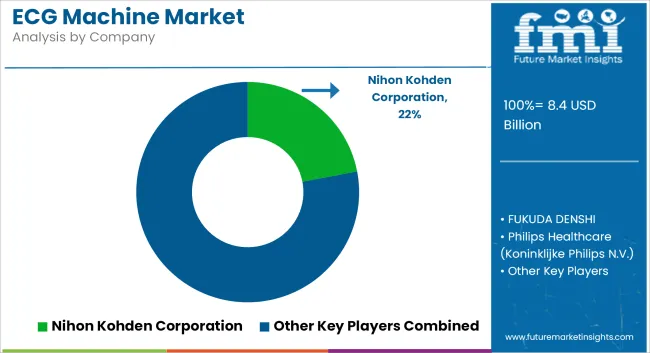

Some of the prominent players in the ECG market include GE Healthcare, Philips Healthcare, BioTelemetry, Inc., Nihon Kohden Corporation, and Schiller AG. When it comes to the highest quality ECG devices, GE Healthcare is a renowned name. High-quality devices are rendered suitable for hospital and home-based patients. Philips Healthcare provides highly advanced systems integrated with digital health and remote monitoring elements for efficient patient care.

With growing trends in home care, BioTelemetry, Inc. specializes in remote cardiac monitoring with mobile and wearable ECG technology. Nihon Kohden Corporation, which hails from Japan, offers mobile and energetic ECG devices working efficiently within most hospitals in the Asia-Pacific area. Schiller AG specializes in high-end diagnostic equipment for cardiovascular monitoring and produces modern yet easy-to-use ECG solutions.

Companies are consistently innovative, trying to improve or introduce newer technology, such as making devices more portable, accurate, and easy to operate. Companies make strategic partnerships and further acquire other companies to expand their market reach and provide comprehensive cardiac care solutions.

The revolution toward digital and mobile ECG devices has added more spice to the already stiff competition in the industry and has increased the need for organizations to come up with affordable solutions to address the diverse healthcare providers and settings.

Emerging players in the market include AliveCor and CardiacSense Ltd, both contributing significantly to market activity. Founded in 2011, AliveCor has rolled out its ECG hardware and software devices compatible with the smartphone for remote heart rhythm monitoring and arrhythmia detection. Their products, KardiaMobile and KardiaMobile 6L, are both FDA-cleared and have a huge following among consumers and health specialists alike.

Another Israeli firm is CardiacSense Ltd, which provides wearables for continuous detection of cardiac arrhythmia and vital signs monitoring. Its product offering, the CSF-3 watch, is now FDA cleared and has received CE marks, allowing the firm to penetrate markets in Europe, Asia, and South America.

The market is segmented by product into ECG resting system, ECG holter monitoring system, ECG stress testing system, and cardiopulmonary stress testing system.

Based on the number of channels, the market is segmented into 1-6 channel, 7-12 channel, and 12-18 channel.

The market is categorized based on technology, including digital and analog.

Based on modality, the market is segmented into wireless and wired.

Based on end user, the market is segmented into Hospitals, ambulatory surgical centers, and specialty clinics.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market is expected to be valued at USD 8.40 billion in 2025 and reach USD 16.86 billion by 2035.

Sales prospects are strong due to increasing demand for portable, AI-powered, and wireless ECG devices.

Key manufacturers of ECG machines include GE Healthcare, Philips Healthcare, Nihon Kohden Corporation, and Schiller AG.

China is expected to generate lucrative opportunities for market players due to rapid growth and expanding exports.

Table 01: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Region

Table 02a: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 02b: Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 03: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 04: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 05: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 06: Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 07: North America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 08: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 09: North America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 13: North America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 14: Latin America Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 19: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 20: Latin America Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 21: Europe Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 23: Europe Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 24: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 25: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 26: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 27: Europe Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 28: South Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 31: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 32: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 33: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 34: South Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 35: East Asia Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 36: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 38: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 39: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 40: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 41: East Asia Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 42: Oceania Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 43: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 45: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 46: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 47: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 48: Oceania Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Table 49: Middle East & Africa Market Value (US$ Million) Analysis 2019 to 2023 and Forecast 2024 to 2034, by Country

Table 50: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Product

Table 51: Middle East & Africa Market Volume (Units) Analysis and Forecast 2019 to 2034, by Product

Table 52: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Number of Channels

Table 53: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Technology

Table 54: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by Modality

Table 55: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2019 to 2034, by End User

Figure 01: Market Volume (Units), 2019 to 2023

Figure 02: Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2024 to 2034

Figure 03: Pricing Analysis per unit (US$), in 2023

Figure 04: Pricing Forecast per unit (US$), in 2034

Figure 05: Market Value (US$ Million) Analysis, 2019 to 2023

Figure 06: Market Forecast & Y-o-Y Growth, 2024 to 2034

Figure 07: Market Absolute $ Opportunity (US$ Million) Analysis, 2024 to 2034

Figure 08: Market Value Share (%) Analysis 2024 to 2034, by Product

Figure 09: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Product

Figure 10: Market Attractiveness Analysis 2024 to 2034, by Product

Figure 11: Market Value Share (%) Analysis 2024 to 2034, by Number of Channels

Figure 12: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Number of Channels

Figure 13: Market Attractiveness Analysis 2024 to 2034, by Number of Channels

Figure 14: Market Value Share (%) Analysis 2024 to 2034, by Technology

Figure 15: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Technology

Figure 16: Market Attractiveness Analysis 2024 to 2034, by Technology

Figure 17: Market Value Share (%) Analysis 2024 to 2034, by Modality

Figure 18: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Modality

Figure 19: Market Attractiveness Analysis 2024 to 2034, by Modality

Figure 20: Market Value Share (%) Analysis 2024 to 2034, by End User

Figure 21: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by End User

Figure 22: Market Attractiveness Analysis 2024 to 2034, by End User

Figure 23: Market Value Share (%) Analysis 2024 to 2034, by Region

Figure 24: Market Y-o-Y Growth (%) Analysis 2023 to 2034, by Region

Figure 25: Market Attractiveness Analysis 2024 to 2034, by Region

Figure 26: North America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 27: North America Market Value (US$ Million) Forecast, 2024 to 2034

Figure 28: North America Market Value Share, by Product (2023 E)

Figure 29: North America Market Value Share, by Number of Channels (2023 E)

Figure 30: North America Market Value Share, by Technology (2023 E)

Figure 31: North America Market Value Share, by Modality (2023 E)

Figure 32: North America Market Value Share, by End User (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 35: North America Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 36: North America Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 37: North America Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 38: North America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 39: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 40: U.S. Market Value Proportion Analysis, 2023

Figure 41: Global Vs. U.S. Growth Comparison

Figure 42: U.S. Market Share Analysis (%) by Product, 2023 to 2034

Figure 43: U.S. Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 44: U.S. Market Share Analysis (%) by Technology, 2023 to 2034

Figure 45: U.S. Market Share Analysis (%) by Modality, 2023 to 2034

Figure 46: U.S. Market Share Analysis (%) by End User, 2023 to 2034

Figure 47: Canada Market Value Proportion Analysis, 2023

Figure 48: Global Vs. Canada. Growth Comparison

Figure 49: Canada Market Share Analysis (%) by Product, 2023 to 2034

Figure 50: Canada Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 51: Canada Market Share Analysis (%) by Technology, 2023 to 2034

Figure 52: Canada Market Share Analysis (%) by Modality, 2023 to 2034

Figure 53: Canada Market Share Analysis (%) by End User, 2023 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis, 2019 to 2023

Figure 55: Latin America Market Value (US$ Million) Forecast, 2024 to 2034

Figure 56: Latin America Market Value Share, by Product (2023 E)

Figure 57: Latin America Market Value Share, by Number of Channels (2023 E)

Figure 58: Latin America Market Value Share, by Technology (2023 E)

Figure 59: Latin America Market Value Share, by Modality (2023 E)

Figure 60: Latin America Market Value Share, by End User (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 63: Latin America Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 64: Latin America Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 65: Latin America Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 66: Latin America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 67: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 68: Mexico Market Value Proportion Analysis, 2023

Figure 69: Global Vs Mexico Growth Comparison

Figure 70: Mexico Market Share Analysis (%) by Product, 2023 to 2034

Figure 71: Mexico Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 72: Mexico Market Share Analysis (%) by Technology, 2023 to 2034

Figure 73: Mexico Market Share Analysis (%) by Modality, 2023 to 2034

Figure 74: Mexico Market Share Analysis (%) by End User, 2023 to 2034

Figure 75: Brazil Market Value Proportion Analysis, 2023

Figure 76: Global Vs. Brazil. Growth Comparison

Figure 77: Brazil Market Share Analysis (%) by Product, 2023 to 2034

Figure 78: Brazil Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 79: Brazil Market Share Analysis (%) by Technology, 2023 to 2034

Figure 80: Brazil Market Share Analysis (%) by Modality, 2023 to 2034

Figure 81: Brazil Market Share Analysis (%) by End User, 2023 to 2034

Figure 82: Argentina Market Value Proportion Analysis, 2023

Figure 83: Global Vs Argentina Growth Comparison

Figure 84: Argentina Market Share Analysis (%) by Product, 2023 to 2034

Figure 85: Argentina Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 86: Argentina Market Share Analysis (%) by Technology, 2023 to 2034

Figure 87: Argentina Market Share Analysis (%) by Modality, 2023 to 2034

Figure 88: Argentina Market Share Analysis (%) by End User, 2023 to 2034

Figure 89: Europe Market Value (US$ Million) Analysis, 2019 to 2023

Figure 90: Europe Market Value (US$ Million) Forecast, 2024 to 2034

Figure 91: Europe Market Value Share, by Product (2023 E)

Figure 92: Europe Market Value Share, by Number of Channels (2023 E)

Figure 93: Europe Market Value Share, by Technology (2023 E)

Figure 94: Europe Market Value Share, by Modality (2023 E)

Figure 95: Europe Market Value Share, by End User (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 98: Europe Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 99: Europe Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 100: Europe Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 101: Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 102: Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 103: UK Market Value Proportion Analysis, 2023

Figure 104: Global Vs. UK Growth Comparison

Figure 105: UK Market Share Analysis (%) by Product, 2023 to 2034

Figure 106: UK Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 107: UK Market Share Analysis (%) by Technology, 2023 to 2034

Figure 108: UK Market Share Analysis (%) by Modality, 2023 to 2034

Figure 109: UK Market Share Analysis (%) by End User, 2023 to 2034

Figure 110: Germany Market Value Proportion Analysis, 2023

Figure 111: Global Vs. Germany Growth Comparison

Figure 112: Germany Market Share Analysis (%) by Product, 2023 to 2034

Figure 113: Germany Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 114: Germany Market Share Analysis (%) by Technology, 2023 to 2034

Figure 115: Germany Market Share Analysis (%) by Modality, 2023 to 2034

Figure 116: Germany Market Share Analysis (%) by End User, 2023 to 2034

Figure 117: Italy Market Value Proportion Analysis, 2023

Figure 118: Global Vs. Italy Growth Comparison

Figure 119: Italy Market Share Analysis (%) by Product, 2023 to 2034

Figure 120: Italy Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 121: Italy Market Share Analysis (%) by Technology, 2023 to 2034

Figure 122: Italy Market Share Analysis (%) by Modality, 2023 to 2034

Figure 123: Italy Market Share Analysis (%) by End User, 2023 to 2034

Figure 124: France Market Value Proportion Analysis, 2023

Figure 125: Global Vs France Growth Comparison

Figure 126: France Market Share Analysis (%) by Product, 2023 to 2034

Figure 127: France Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 128: France Market Share Analysis (%) by Technology, 2023 to 2034

Figure 129: France Market Share Analysis (%) by Modality, 2023 to 2034

Figure 130: France Market Share Analysis (%) by End User, 2023 to 2034

Figure 131: Spain Market Value Proportion Analysis, 2023

Figure 132: Global Vs Spain Growth Comparison

Figure 133: Spain Market Share Analysis (%) by Product, 2023 to 2034

Figure 134: Spain Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 135: Spain Market Share Analysis (%) by Technology, 2023 to 2034

Figure 136: Spain Market Share Analysis (%) by Modality, 2023 to 2034

Figure 137: Spain Market Share Analysis (%) by End User, 2023 to 2034

Figure 138: Russia Market Value Proportion Analysis, 2023

Figure 139: Global Vs Russia Growth Comparison

Figure 140: Russia Market Share Analysis (%) by Product, 2023 to 2034

Figure 141: Russia Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 142: Russia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 143: Russia Market Share Analysis (%) by Modality, 2023 to 2034

Figure 144: Russia Market Share Analysis (%) by End User, 2023 to 2034

Figure 145: BENELUX Market Value Proportion Analysis, 2023

Figure 146: Global Vs BENELUX Growth Comparison

Figure 147: BENELUX Market Share Analysis (%) by Product, 2023 to 2034

Figure 148: BENELUX Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 149: BENELUX Market Share Analysis (%) by Technology, 2023 to 2034

Figure 150: BENELUX Market Share Analysis (%) by Modality, 2023 to 2034

Figure 151: BENELUX Market Share Analysis (%) by End User, 2023 to 2034

Figure 152: East Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 153: East Asia Market Value (US$ Million) Forecast, 2024 to 2034

Figure 154: East Asia Market Value Share, by Product (2023 E)

Figure 155: East Asia Market Value Share, by Number of Channels (2023 E)

Figure 156: East Asia Market Value Share, by Technology (2023 E)

Figure 157: East Asia Market Value Share, by Modality (2023 E)

Figure 158: East Asia Market Value Share, by End User (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 161: East Asia Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 162: East Asia Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 163: East Asia Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 164: East Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 166: China Market Value Proportion Analysis, 2023

Figure 167: Global Vs. China Growth Comparison

Figure 168: China Market Share Analysis (%) by Product, 2023 to 2034

Figure 169: China Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 170: China Market Share Analysis (%) by Technology, 2023 to 2034

Figure 171: China Market Share Analysis (%) by Modality, 2023 to 2034

Figure 172: China Market Share Analysis (%) by End User, 2023 to 2034

Figure 173: Japan Market Value Proportion Analysis, 2023

Figure 174: Global Vs. Japan Growth Comparison

Figure 175: Japan Market Share Analysis (%) by Product, 2023 to 2034

Figure 176: Japan Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 177: Japan Market Share Analysis (%) by Technology, 2023 to 2034

Figure 178: Japan Market Share Analysis (%) by Modality, 2023 to 2034

Figure 179: Japan Market Share Analysis (%) by End User, 2023 to 2034

Figure 180: South Korea Market Value Proportion Analysis, 2023

Figure 181: Global Vs South Korea Growth Comparison

Figure 182: South Korea Market Share Analysis (%) by Product, 2023 to 2034

Figure 183: South Korea Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 184: South Korea Market Share Analysis (%) by Technology, 2023 to 2034

Figure 185: South Korea Market Share Analysis (%) by Modality, 2023 to 2034

Figure 186: South Korea Market Share Analysis (%) by End User, 2023 to 2034

Figure 187: South Asia Market Value (US$ Million) Analysis, 2019 to 2023

Figure 188: South Asia Market Value (US$ Million) Forecast, 2024 to 2034

Figure 189: South Asia Market Value Share, by Product (2023 E)

Figure 190: South Asia Market Value Share, by Number of Channels (2023 E)

Figure 191: South Asia Market Value Share, by Technology (2023 E)

Figure 192: South Asia Market Value Share, by Modality (2023 E)

Figure 193: South Asia Market Value Share, by End User (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 196: South Asia Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 197: South Asia Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 198: South Asia Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 199: South Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 200: South Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 201: India Market Value Proportion Analysis, 2023

Figure 202: Global Vs. India Growth Comparison

Figure 203: India Market Share Analysis (%) by Product, 2023 to 2034

Figure 204: India Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 205: India Market Share Analysis (%) by Technology, 2023 to 2034

Figure 206: India Market Share Analysis (%) by Modality, 2023 to 2034

Figure 207: India Market Share Analysis (%) by End User, 2023 to 2034

Figure 208: Indonesia Market Value Proportion Analysis, 2023

Figure 209: Global Vs. Indonesia Growth Comparison

Figure 210: Indonesia Market Share Analysis (%) by Product, 2023 to 2034

Figure 211: Indonesia Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 212: Indonesia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 213: Indonesia Market Share Analysis (%) by Modality, 2023 to 2034

Figure 214: Indonesia Market Share Analysis (%) by End User, 2023 to 2034

Figure 215: Malaysia Market Value Proportion Analysis, 2023

Figure 216: Global Vs. Malaysia Growth Comparison

Figure 217: Malaysia Market Share Analysis (%) by Product, 2023 to 2034

Figure 218: Malaysia Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 219: Malaysia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 220: Malaysia Market Share Analysis (%) by Modality, 2023 to 2034

Figure 221: Malaysia Market Share Analysis (%) by End User, 2023 to 2034

Figure 222: Thailand Market Value Proportion Analysis, 2023

Figure 223: Global Vs. Thailand Growth Comparison

Figure 224: Thailand Market Share Analysis (%) by Product, 2023 to 2034

Figure 225: Thailand Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 226: Thailand Market Share Analysis (%) by Technology, 2023 to 2034

Figure 227: Thailand Market Share Analysis (%) by Modality, 2023 to 2034

Figure 228: Thailand Market Share Analysis (%) by End User, 2023 to 2034

Figure 229: Oceania Market Value (US$ Million) Analysis, 2019 to 2023

Figure 230: Oceania Market Value (US$ Million) Forecast, 2024 to 2034

Figure 231: Oceania Market Value Share, by Product (2023 E)

Figure 232: Oceania Market Value Share, by Number of Channels (2023 E)

Figure 233: Oceania Market Value Share, by Technology (2023 E)

Figure 234: Oceania Market Value Share, by Modality (2023 E)

Figure 235: Oceania Market Value Share, by End User (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Product, 2024 to 2034

Figure 238: Oceania Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 239: Oceania Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 240: Oceania Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 241: Oceania Market Attractiveness Analysis by End User, 2024 to 2034

Figure 242: Oceania Market Attractiveness Analysis by Country, 2024 to 2034

Figure 243: Australia Market Value Proportion Analysis, 2023

Figure 244: Global Vs. Australia Growth Comparison

Figure 245: Australia Market Share Analysis (%) by Product, 2023 to 2034

Figure 246: Australia Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 247: Australia Market Share Analysis (%) by Technology, 2023 to 2034

Figure 248: Australia Market Share Analysis (%) by Modality, 2023 to 2034

Figure 249: Australia Market Share Analysis (%) by End User, 2023 to 2034

Figure 250: New Zealand Market Value Proportion Analysis, 2023

Figure 251: Global Vs New Zealand Growth Comparison

Figure 252: New Zealand Market Share Analysis (%) by Product, 2023 to 2034

Figure 253: New Zealand Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 254: New Zealand Market Share Analysis (%) by Technology, 2023 to 2034

Figure 255: New Zealand Market Share Analysis (%) by Modality, 2023 to 2034

Figure 256: New Zealand Market Share Analysis (%) by End User, 2023 to 2034

Figure 257: Middle East & Africa Market Value (US$ Million) Analysis, 2019 to 2023

Figure 258: Middle East & Africa Market Value (US$ Million) Forecast, 2024 to 2034

Figure 259: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Number of Channels (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Technology (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Modality (2023 E)

Figure 263: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 266: Middle East & Africa Market Attractiveness Analysis by Number of Channels, 2024 to 2034

Figure 267: Middle East & Africa Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 268: Middle East & Africa Market Attractiveness Analysis by Modality, 2024 to 2034

Figure 269: Middle East & Africa Market Attractiveness Analysis by End User, 2024 to 2034

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 271: GCC Countries Market Value Proportion Analysis, 2023

Figure 272: Global Vs GCC Countries Growth Comparison

Figure 273: GCC Countries Market Share Analysis (%) by Product, 2023 to 2034

Figure 274: GCC Countries Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 275: GCC Countries Market Share Analysis (%) by Technology, 2023 to 2034

Figure 276: GCC Countries Market Share Analysis (%) by Modality, 2023 to 2034

Figure 277: GCC Countries Market Share Analysis (%) by End User, 2023 to 2034

Figure 278: Türkiye Market Value Proportion Analysis, 2023

Figure 279: Global Vs. Turkey Growth Comparison

Figure 280: Turkey Market Share Analysis (%) by Product, 2023 to 2034

Figure 281: Turkey Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 282: Turkey Market Share Analysis (%) by Technology, 2023 to 2034

Figure 283: Turkey Market Share Analysis (%) by Modality, 2023 to 2034

Figure 284: Turkey Market Share Analysis (%) by End User, 2023 to 2034

Figure 285: South Africa Market Value Proportion Analysis, 2023

Figure 286: Global Vs. South Africa Growth Comparison

Figure 287: South Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 288: South Africa Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 289: South Africa Market Share Analysis (%) by Technology, 2023 to 2034

Figure 290: South Africa Market Share Analysis (%) by Modality, 2023 to 2034

Figure 291: South Africa Market Share Analysis (%) by End User, 2023 to 2034

Figure 292: North Africa Market Value Proportion Analysis, 2023

Figure 293: Global Vs North Africa Growth Comparison

Figure 294: North Africa Market Share Analysis (%) by Product, 2023 to 2034

Figure 295: North Africa Market Share Analysis (%) by Number of Channels, 2023 to 2034

Figure 296: North Africa Market Share Analysis (%) by Technology, 2023 to 2034

Figure 297: North Africa Market Share Analysis (%) by Modality, 2023 to 2034

Figure 298: North Africa Market Share Analysis (%) by End User, 2023 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Holter ECG Market Size and Share Forecast Outlook 2025 to 2035

Mobile ECG Devices Market

Multi-channel Remote ECG Monitors Market Trends - Growth & Forecast 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Glazed Kraft Paper Market Growth - Demand & Forecast 2024 to 2034

Machine Condition Monitoring Market Insights – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA