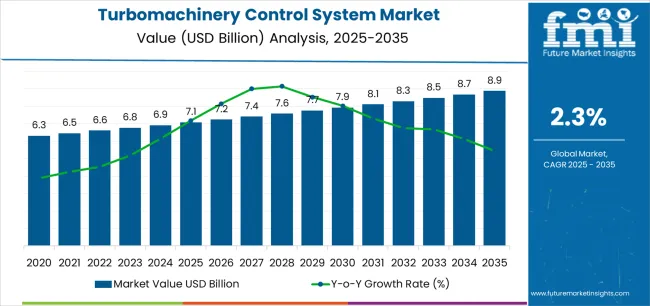

The global turbomachinery control system market is projected to grow from USD 7,073.5 million in 2025 to approximately USD 8,879.5 million by 2035, recording an absolute increase of USD 1,806.0 million over the forecast period. This translates into a total growth of 25.5%, with the market forecast to expand at a CAGR of 2.3% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.3X during the same period, supported by increasing global demand for industrial automation solutions, growing adoption of advanced control technologies in critical infrastructure, and rising operational efficiency requirements driving comprehensive control system procurement across various industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7,073.5 million |

| Market Forecast Value (2035) | USD 8,879.5 million |

| Forecast CAGR (2025 to 2035) | 2.3% |

| INDUSTRIAL AUTOMATION ADVANCEMENT | OPERATIONAL EFFICIENCY REQUIREMENTS | INFRASTRUCTURE MODERNIZATION DEMANDS |

|---|---|---|

| Global Industrial Digitalization Continuous expansion of Industry 4.0 adoption across established and emerging industrial markets driving demand for intelligent control solutions. Predictive Maintenance Integration Growing emphasis on asset health monitoring and failure prevention creating demand for advanced control and diagnostic capabilities. Operational Excellence Enhancement Superior precision control and real-time optimization making advanced turbomachinery control systems essential for competitive industrial operations. | Sophisticated Process Requirements Modern industrial operations require control systems delivering precise performance management and enhanced operational reliability. Efficiency Optimization Demands Industrial operators investing in advanced control platforms offering consistent performance optimization while maintaining safety standards. Quality and Reliability Standards Certified control system providers with proven track records required for critical turbomachinery applications. | Safety Compliance Standards Regulatory requirements establishing performance benchmarks favoring high-reliability control solutions. Emission Control Requirements Environmental standards requiring superior operational precision and resistance to performance degradation in industrial operations. Asset Management Requirements Diverse industrial requirements and reliability standards driving need for sophisticated control system capabilities. |

| Category | Segments Covered |

|---|---|

| By Application | Generator Controls, Compressor Controls, Turbine Controls, Others |

| By End-Use Industry | Oil & Gas, Chemical & Petrochemical, Transportation, Power Generation Sector, Food and Beverages |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

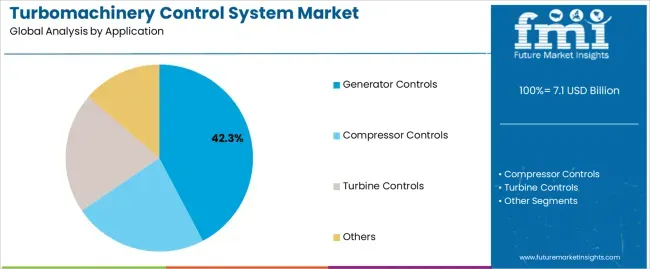

| Generator Controls | Leader in 2025 with 42.3% market share; likely to maintain leadership through 2035. Broadest use across power generation, industrial cogeneration, and renewable energy applications with mature supply chain and predictable control architectures. Critical for grid stability, load sharing, and synchronization requirements in distributed generation systems. Momentum: steady growth driven by renewable energy integration and distributed generation expansion. Watchouts: technology disruption from digital control platforms and renewable energy intermittency management complexity. |

| Compressor Controls | Strong segment with 28.6% share, essential for oil and gas processing, chemical manufacturing, and industrial gas applications. Provides surge prevention, load optimization, and multi-stage coordination for critical compression operations. Momentum: moderate-to-strong growth driven by LNG expansion, hydrogen infrastructure development, and industrial gas demand. Watchouts: energy transition pressures affecting fossil fuel infrastructure investment and competition from variable speed drive alternatives. |

| Turbine Controls | Established segment with 21.4% share covering steam turbines, gas turbines, and combined cycle applications in power generation and mechanical drive services. Critical for startup sequencing, speed control, and protective shutdown functions. Momentum: steady growth supported by power generation modernization and efficiency upgrade projects. Watchouts: renewable energy displacement of fossil generation and aging thermal power infrastructure in developed markets. |

| Others | Diverse applications with 7.7% share including pump controls, expander controls, and specialized turbomachinery applications. Niche segments serving specific industrial requirements. Momentum: selective growth in specialized applications including waste heat recovery and industrial process optimization. Limited volume potential constrains broader market significance. |

| Segment | 2025 to 2035 Outlook |

|---|---|

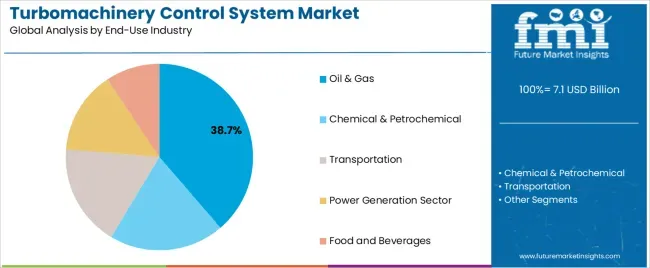

| Oil & Gas | At 38.7%, largest end-use segment in 2025 with established applications across upstream production, midstream processing, and downstream refining operations. Dominant consumer of turbomachinery control systems for compressor stations, LNG facilities, and refinery operations. Momentum: moderate growth driven by LNG infrastructure expansion and existing asset modernization, offset by energy transition pressures. Watchouts: declining long-term fossil fuel investment and accelerating renewable energy substitution affecting new project pipelines. |

| Chemical & Petrochemical | Strong segment with 23.5% share encompassing process compressors, steam turbine drives, and cogeneration systems serving chemical manufacturing operations. Critical for ethylene crackers, ammonia plants, and specialty chemical production. Momentum: steady growth supported by chemical industry capacity additions in Asia and petrochemical integration projects. Watchouts: feedstock transition pressures and circular economy initiatives affecting traditional petrochemical demand trajectories. |

| Transportation | Growing segment with 16.8% share including marine propulsion controls, pipeline compression systems, and industrial transportation infrastructure. Increasingly relevant for LNG carrier propulsion and hydrogen transmission applications. Momentum: rising through 2030 driven by LNG shipping expansion and alternative fuel infrastructure development. Watchouts: maritime decarbonization pressures and battery-electric competition in certain transportation segments. |

| Power Generation Sector | Established segment with 14.3% share covering utility-scale generation, industrial power, and district energy systems utilizing steam and gas turbine generators. Traditional stronghold for turbomachinery controls with mature installed base. Momentum: flat-to-moderate growth as renewable additions offset fossil retirement but efficiency upgrades sustain control system demand. Watchouts: accelerating coal plant retirements and renewable energy cost competitiveness limiting thermal generation investment. |

| Food and Beverages | Niche segment with 6.7% share focused on refrigeration compressors, process steam systems, and cogeneration facilities serving food processing operations. Specialized applications requiring hygienic design and food-grade certifications. Momentum: steady growth driven by cold chain expansion and food processing industrialization in emerging markets. Watchouts: limited turbomachinery intensity versus other industrial sectors and alternative refrigeration technology development. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Asset Optimization Continuing expansion of predictive maintenance and performance optimization across established and emerging industrial markets driving demand for intelligent control solutions. Energy Efficiency Recognition Increasing recognition of precise turbomachinery control importance in operational efficiency and energy consumption reduction. Safety and Reliability Focus Growing demand for control systems that support both operational safety and equipment reliability in critical industrial infrastructure. | Capital Investment Cycles Industrial capital expenditure volatility affecting control system upgrade timing and large project deployment schedules. Technology Transition Complexity Legacy system integration challenges and cybersecurity concerns requiring significant modernization investments and risk management strategies. Energy Transition Uncertainty Fossil fuel infrastructure investment hesitation and renewable energy substitution influencing long-term market dynamics. Skilled Workforce Constraints Specialized engineering expertise requirements and control system programming skills influencing deployment capabilities and operational effectiveness. | Digital Twin Integration of virtual commissioning, performance simulation, and predictive analytics enabling superior operational optimization. Edge Computing Adoption Enhanced real-time processing, reduced latency, and autonomous control capabilities compared to traditional centralized architectures. Cybersecurity Enhancement Development of industrial-grade security protocols and intrusion detection technologies providing improved protection for critical infrastructure. Cloud Connectivity Expansion Integration of remote monitoring capabilities and centralized fleet management for distributed turbomachinery assets. |

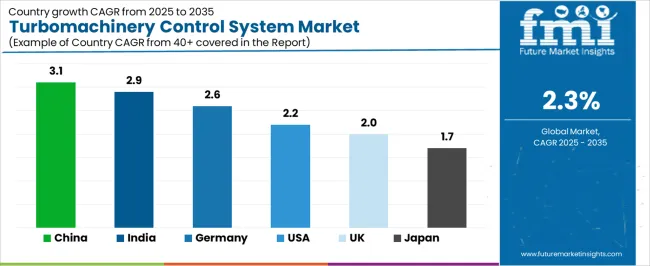

| Country | CAGR (2025-2035) |

|---|---|

| China | 3.1% |

| India | 2.9% |

| Germany | 2.6% |

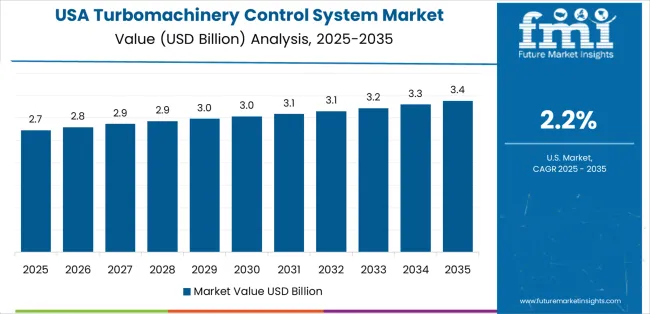

| United States | 2.2% |

| United Kingdom | 2.0% |

| Japan | 1.7% |

Revenue from turbomachinery control systems in China is projected to grow at a CAGR of 3.1% through 2035, driven by expanding petrochemical infrastructure and the adoption of industrial automation, creating substantial opportunities for control system suppliers across refinery operations, chemical manufacturing facilities, and power generation sectors. The country’s established manufacturing leadership and expanding LNG import infrastructure are driving significant demand for both domestic and imported turbomachinery control solutions. Major industrial companies and automation providers are establishing local engineering facilities to support large-scale operations and meet the growing demand for efficient control system solutions.

Revenue from turbomachinery control systems in India is projected to grow at a CAGR of 2.9% through 2035, supported by significant refinery capacity additions and the expansion of power generation infrastructure, creating sustained demand for reliable control systems across various industrial sectors and energy production segments. The country’s ambitious infrastructure development programs and growing petrochemical industry are driving the need for control solutions that ensure consistent operational performance while meeting cost-effective project execution requirements. Control system suppliers and industrial automation providers are investing in local engineering capabilities to support the expanding industrial operations and infrastructure development needs.

Demand for turbomachinery control systems in Germany is projected to grow at a CAGR of 2.6% through 2035, supported by the country’s leadership in industrial automation and advanced control technologies that require sophisticated system architectures for chemical processing and power generation applications. German industrial companies are adopting cutting-edge control platforms that support advanced analytics, operational efficiency, and comprehensive safety protocols. The market is characterized by a focus on engineering excellence, system integration expertise, and compliance with stringent industrial safety and performance standards.

Revenue from turbomachinery control systems in the United States is growing at a CAGR of 2.2% through 2035, driven by aging infrastructure modernization programs and increasing operational efficiency requirements, creating sustained opportunities for control system suppliers serving both oil and gas operations and power generation facilities. The country's extensive industrial base and expanding LNG export capacity are generating demand for control systems that support diverse operational requirements while maintaining reliability standards. Industrial operators and automation service providers are developing modernization strategies to support regulatory compliance and performance optimization.

Demand for turbomachinery control system in United Kingdom is expanding at a CAGR of 2.0%, driven by North Sea infrastructure modernization and flexible power generation capabilities supporting renewable energy integration and comprehensive grid stability applications. The country's established oil and gas sector and evolving energy system are creating demand for control systems that support operational flexibility and transitioning energy infrastructure. Control system manufacturers and industrial automation suppliers are maintaining comprehensive development capabilities to support diverse energy transition requirements.

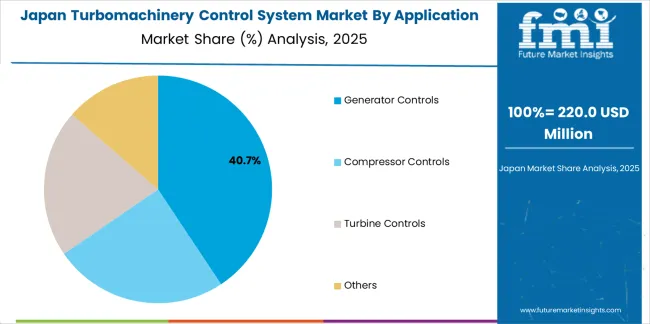

Demand for turbomachinery control system in Japan is projected to reach USD 153.1 million by 2035, expanding at a CAGR of 1.7%, driven by industrial efficiency optimization and sophisticated maintenance practices supporting chemical manufacturing and power cogeneration applications. The country's established industrial excellence and meticulous operational standards are creating demand for ultra-reliable control systems that support exacting performance and longevity requirements. Control system manufacturers and automation specialists are maintaining rigorous development capabilities to support demanding Japanese industrial specifications.

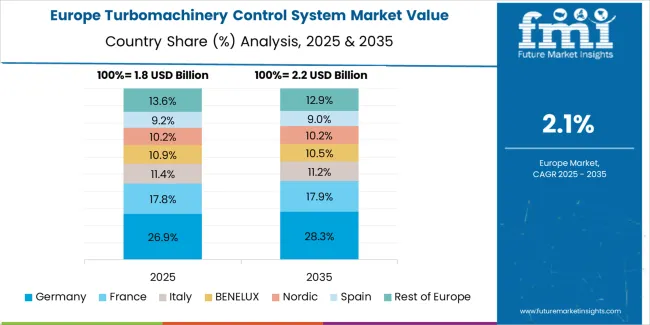

The turbomachinery control system market in Europe is projected to grow from USD 187.2 million in 2025 to USD 234.9 million by 2035, registering a CAGR of 2.3% over the forecast period. Germany is expected to maintain its leadership position with a 27.2% market share in 2025, supported by its advanced chemical industry infrastructure and comprehensive industrial automation capabilities across major petrochemical clusters in North Rhine-Westphalia, Bavaria, and Lower Saxony regions.

United Kingdom follows with a 20.1% share in 2025, projected to reach 19.8% by 2035, driven by North Sea oil and gas infrastructure modernization and power generation flexibility enhancement programs. France holds a 17.8% share in 2025, expected to reach 18.2% by 2035 due to refinery modernization and chemical industry automation investments. Italy commands a 15.4% share, while Netherlands accounts for 13.7% in 2025. The Rest of Europe region is anticipated to maintain stable momentum with 5.8% share, attributed to increasing industrial automation adoption in Nordic countries and emerging Eastern European petrochemical facilities implementing control system upgrade programs.

European turbomachinery control system operations are increasingly defined by the contrast between Western European technology leadership and cost-competitive Eastern European industrial development. German and French automation providers dominate advanced control system integration and digital technology deployment, leveraging sophisticated engineering capabilities and strict safety protocols that command premium pricing in critical industrial applications. German companies maintain leadership in Industry 4.0 integration and predictive analytics applications, with major chemical and power generation operators driving technical specifications that smaller system integrators must meet to access high-value projects.

British and Norwegian operations focus on offshore oil and gas applications requiring specialized control systems for harsh environments and remote operations. Decades of North Sea experience create competitive advantages in subsea compression, floating production systems, and extreme reliability applications. However, declining offshore investment and energy transition pressures challenge long-term market sustainability.

Eastern European industrial facilities in Poland, Czech Republic, and Romania increasingly adopt turbomachinery control systems as manufacturing modernization accelerates and foreign direct investment flows into petrochemical and power generation infrastructure. These markets offer growth opportunities for established Western suppliers while local engineering companies develop integration capabilities and regional service networks.

The regulatory environment shapes market dynamics. EU emissions regulations and industrial safety directives drive control system upgrade cycles as operators implement enhanced monitoring and environmental compliance capabilities. Cybersecurity requirements for critical infrastructure create barriers for unproven suppliers while favoring established automation companies with demonstrated security frameworks and compliance track records.

Consolidation continues as major automation groups acquire specialized turbomachinery control expertise and expand geographic coverage through regional integrator acquisitions. However, specialized applications and proprietary legacy systems maintain opportunities for independent engineering firms with deep domain expertise and long-standing customer relationships.

Japanese turbomachinery control system operations reflect the country's exacting reliability standards and long-term asset management philosophies. Major industrial operators including Mitsubishi Chemical, JGC Corporation, and Tokyo Electric Power Company maintain rigorous supplier qualification processes emphasizing proven track records, comprehensive documentation, and long-term technical support capabilities that can require multi-year relationship development before major project awards.

The Japanese market demonstrates unique preferences for integrated control system architectures combining turbomachinery protection with broader process control integration. Companies value seamless coordination between rotating equipment controls and distributed control systems, driving demand for comprehensive automation platforms from suppliers offering both turbomachinery expertise and process control capabilities.

Regulatory oversight through the Ministry of Economy, Trade and Industry and High Pressure Gas Safety Institute establishes comprehensive safety validation and equipment certification requirements exceeding most international standards. The approval processes require extensive testing documentation and reliability demonstration, creating advantages for established suppliers with Japanese market experience and local engineering support.

Supply chain management emphasizes long-term partnerships and technical collaboration rather than transactional procurement. Japanese companies typically maintain stable supplier relationships spanning decades, with contract structures emphasizing lifecycle support, spare parts availability, and continuous improvement collaboration over initial purchase pricing. This relationship approach supports supplier investment in Japan-specific product adaptations and dedicated technical resources.

The market faces headwinds from industrial stagnation and aging infrastructure limiting new project opportunities. However, control system obsolescence and cybersecurity upgrade requirements drive modernization investments. Japanese operators increasingly prioritize remote monitoring capabilities and predictive maintenance technologies to address workforce aging and maintain operational expertise as experienced personnel retire.

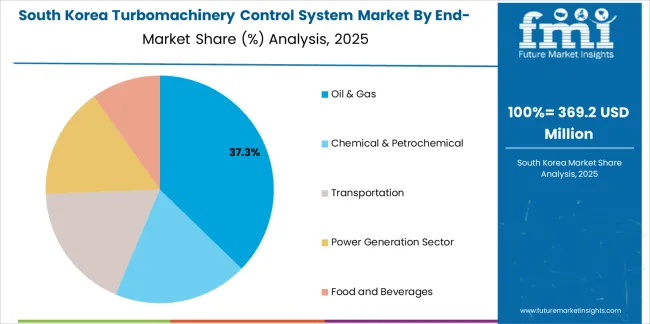

South Korean turbomachinery control system operations reflect the country's world-class petrochemical industry and advanced shipbuilding capabilities. Major industrial conglomerates including Samsung Engineering, Hyundai Engineering, and SK Innovation drive sophisticated control system procurement strategies, establishing relationships with international automation suppliers to secure advanced technologies for their domestic and international project portfolios.

The Korean market demonstrates particular strength in LNG-related applications reflecting the country's position as a leading LNG importer and liquefaction technology provider. Control systems for LNG receiving terminals, regasification facilities, and LNG carrier propulsion represent significant market segments with exacting performance requirements and comprehensive safety protocols.

Regulatory frameworks emphasize industrial safety and environmental compliance, with Korean Occupational Safety and Health Agency standards requiring extensive control system documentation and periodic performance validation. These requirements create barriers for unproven suppliers but benefit established automation companies who can demonstrate comprehensive compliance capabilities and quality management systems.

Supply chain efficiency remains critical given Korea's export-oriented industrial structure and competitive project execution requirements. Engineering, procurement, and construction companies increasingly pursue standardized control system platforms enabling design replication across multiple projects while maintaining supplier competition through multi-vendor qualification strategies.

The market faces pressure from Chinese competition in cost-sensitive applications and declining domestic petrochemical investment as global capacity additions shift to Middle Eastern and North American markets. However, Korea's engineering excellence and niche technology leadership in LNG and offshore applications continue to support demand for sophisticated turbomachinery control systems meeting stringent performance specifications for challenging operating environments.

Profit pools are consolidating around comprehensive control platforms integrating advanced diagnostics, predictive analytics, and cybersecurity capabilities with established industrial relationships and proven reliability in critical applications. Value is migrating from standalone control hardware to integrated automation ecosystems where lifecycle services, remote monitoring, and performance optimization command recurring revenue streams.

Several archetypes set the pace: global automation leaders defending share through technology breadth and installed base leverage; specialized turbomachinery control providers with deep domain expertise and original equipment manufacturer partnerships; diversified industrial conglomerates offering integrated solutions; and innovative technology firms providing cloud connectivity and artificial intelligence analytics.

Switching costs-engineering replication, operator training, spare parts inventory, legacy system integration-stabilize customer relationships for incumbents, while digital transformation initiatives and cybersecurity requirements reopen opportunities for technology-forward suppliers.

Consolidation continues as automation majors acquire specialized capabilities while software and analytics increasingly differentiate offerings beyond traditional control hardware. Do now: secure long-term service agreements with performance guarantees and remote monitoring capabilities; hard-wire cybersecurity certifications and digital twin integration; option: develop artificial intelligence-driven optimization algorithms with co-branded efficiency improvement validation.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global automation leaders | Technology breadth, installed base, lifecycle services | Long-term service contracts, digital transformation partnerships, multi-site standardization |

| Specialized turbomachinery control providers | Domain expertise, OEM relationships, application knowledge | Equipment package integration, specialized algorithms, technical consulting |

| Diversified industrial conglomerates | Comprehensive solutions, project execution, financing capabilities | EPC integration, turnkey delivery, performance guarantees |

| Innovative technology firms | Cloud platforms, AI analytics, cybersecurity | Remote monitoring SaaS, predictive maintenance, performance optimization services |

| Regional integrators & service providers | Local presence, rapid response, customization | Emergency support, retrofit expertise, legacy system maintenance |

| Items | Values |

|---|---|

| Quantitative Units | USD 7,073.5 million |

| Application | Generator Controls, Compressor Controls, Turbine Controls, Others |

| End-Use Industry | Oil & Gas, Chemical & Petrochemical, Transportation, Power Generation Sector, Food and Beverages |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, India, Japan, and other 40+ countries |

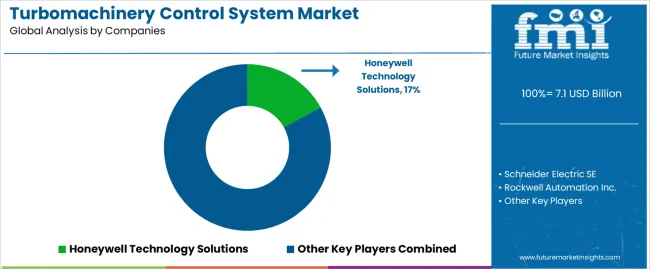

| Key Companies Profiled | Honeywell Technology Solutions, Schneider Electric SE, Rockwell Automation Inc., Woodward Inc., ABB Group, Siemens AG, Emerson Electric Co., General Electric Company, Voith Group, Compressor Controls Corporation |

| Additional Attributes | Dollar sales by application/end-use industry, regional demand (NA, EU, APAC), competitive landscape, new installation vs. retrofit adoption, digital transformation integration, and cybersecurity innovations driving operational efficiency, asset reliability, and predictive maintenance capabilities |

By Application

The global turbomachinery control system market is estimated to be valued at USD 7,073.5 million in 2025.

The market size for the turbomachinery control system market is projected to reach USD 8,879.5 billion by 2035.

The turbomachinery control system market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in turbomachinery control system market are generator controls, compressor controls, turbine controls and others.

In terms of end-use industry, oil & gas segment to command 38.7% share in the turbomachinery control system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Riot Control Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA