The CNC controller market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. This trajectory reflects a compound annual growth rate (CAGR) of 5.5%, signaling steady expansion driven by the increasing adoption of automation and advanced manufacturing technologies. CNC controllers play a critical role in precision machining, allowing manufacturers to achieve higher efficiency, consistency, and flexibility across sectors such as automotive, aerospace, electronics, and medical devices.

The growth is fueled by multiple factors, including rising demand for high-precision components, the integration of Industry 4.0 and IoT-enabled solutions, and advancements in multi-axis machining capabilities. Additionally, the shift toward smart factories and automation in emerging economies is expected to contribute significantly to market expansion. Technological innovations, such as AI-driven CNC controllers and cloud-based monitoring systems, are also enhancing operational efficiency and predictive maintenance, further boosting adoption.

However, challenges like high initial investment costs and the need for skilled personnel to operate sophisticated CNC systems may moderate the growth rate. Despite these barriers, the market outlook remains positive, underpinned by the global trend toward digitization, automation, and the continuous demand for precision manufacturing, making CNC controllers a cornerstone of modern industrial operations.

| Metric | Value |

|---|---|

| CNC Controller Market Estimated Value in (2025 E) | USD 7.2 billion |

| CNC Controller Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The CNC controller market is witnessing notable growth, supported by increasing industrial automation, rising demand for precision manufacturing, and the need for consistent production efficiency across multiple industries. As manufacturers strive for reduced downtime, enhanced accuracy, and optimized throughput, the adoption of CNC controllers has accelerated.

Technological advancements have allowed these controllers to integrate seamlessly with computer-aided manufacturing systems, enabling enhanced control over machining operations. Industries such as automotive, aerospace, electronics, and heavy equipment are increasingly relying on advanced CNC systems to meet high-volume production needs.

Future market expansion is expected to be driven by innovations in multi-axis control, real-time monitoring capabilities, and compatibility with smart factory environments. Additionally, growing investments in upgrading legacy manufacturing systems and expanding capabilities in emerging economies are paving the way for wider adoption of flexible and intelligent CNC control solutions.

The CNC controller market is segmented by component, machine type, axis, end-user, sales channel, and geographic regions. By component, the CNC controller market is divided into Hardware, Software, and Services. In terms of machine type, the CNC controller market is classified into Machine Center and Turning Center. Based on axis, the CNC controller market is segmented into Three-axis, Two-axis, Four-axis, Five-axis, and Multi-axis.

By end-user, the CNC controller market is segmented into Automotive, Aerospace, Metals & Mining, Semiconductor & Electronics, Medical Devices, and Others. By sales channel, the CNC controller market is segmented into Offline and Online. Regionally, the CNC controller industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component is projected to account for 46.2% of the CNC Controller market revenue in 2025, making it the leading segment in terms of component type. This dominance is being supported by the critical role hardware plays in ensuring operational reliability and real-time responsiveness in CNC systems.

Hardware elements such as control panels, servo drives, input and output modules, and embedded processors are essential for executing precise machining commands. The preference for robust hardware systems has grown due to the need for high-speed data processing and continuous machine control under demanding operational conditions.

Manufacturing environments that require durability and uninterrupted performance have contributed to the strong uptake of hardware-based control solutions. The evolution of compact, modular, and high-efficiency hardware units has further strengthened this segment’s position, allowing seamless integration into new and existing production lines without compromising performance or scalability.

The machine center type is expected to capture 58.7% of the CNC Controller market revenue in 2025, making it the most prominent machine category. This leadership position is being driven by the widespread deployment of machine centers in industries that require versatile, high-precision machining. Machine centers are valued for their ability to perform multiple operations, such as milling, drilling, and boring, with minimal reconfiguration.

This has made them a preferred choice for both high-mix low-volume and high-volume production scenarios. The need for flexible manufacturing systems that can adapt to changing product specifications has further supported the demand for machine centers.

CNC controllers used in these systems offer enhanced control algorithms and real-time feedback loops, allowing operators to optimize tool paths and cycle times. As industries continue to adopt automated and intelligent manufacturing setups, the machine center segment is expected to maintain its leadership due to its operational efficiency and capability to handle complex machining tasks.

The three-axis configuration is anticipated to hold 34.5% of the CNC Controller market revenue in 2025, marking it as a significant axis category within the market. This share is being driven by the segment’s widespread application in general-purpose machining tasks that require precision and repeatability. Three-axis CNC machines offer a balance of affordability, functionality, and ease of use, making them a foundational choice for manufacturers across various sectors.

The simplicity of programming and setup, combined with reduced maintenance costs, has contributed to the sustained demand for three-axis systems. They are particularly effective for standard milling, engraving, and cutting applications where complex multi-directional tool movement is not essential.

The integration of advanced control software and enhanced motion control technologies into these machines has further expanded their capabilities. As small to mid-sized manufacturers look for reliable and cost-effective automation solutions, the three-axis segment is expected to remain a stable contributor to overall market growth.

The CNC controller market is driven by increased demand for automation and precision, with strong adoption in the machine tools sector. Industry 4.0 integration and regulatory requirements further boost market growth.

The CNC controller market's growth is primarily driven by the increasing demand for automation in manufacturing processes. Manufacturers are seeking ways to improve productivity, reduce operational costs, and enhance precision in production. The rise of smart factories is also contributing significantly, as CNC controllers are central to controlling complex, automated systems that are integral to modern manufacturing environments. The demand for high-precision and high-speed manufacturing in industries such as automotive, aerospace, and electronics continues to propel the need for advanced CNC control systems.

The machine tools sector is a major contributor to the CNC controller market, accounting for a significant portion of overall demand. CNC controllers provide enhanced accuracy, speed, and efficiency in the machining process, making them indispensable in industries that require intricate component fabrication. As manufacturers seek to upgrade older systems or invest in new machinery, the adoption of advanced CNC controllers is becoming a standard. Machine tools are evolving to meet the increasing demand for customization, and the integration of sophisticated CNC controllers allows for higher-quality products to be produced in a shorter time frame.

Industry 4.0 is playing a pivotal role in the evolution of CNC controllers. The need for smart, interconnected manufacturing systems has created a growing demand for CNC controllers that can communicate seamlessly with other machines and devices. With the integration of IoT and data analytics, CNC controllers now enable real-time monitoring, predictive maintenance, and greater operational efficiency. The rise of interconnected devices within manufacturing environments is expected to fuel the adoption of these advanced systems further, as businesses look for ways to optimize production processes and reduce downtime through data-driven insights.

Government regulations and standards related to energy efficiency, safety, and quality control are influencing the adoption of CNC controllers. Manufacturers are increasingly required to meet stringent safety and environmental standards, which can be achieved by implementing precise control systems like CNC controllers. Global demand for high-quality, reliable products across sectors such as automotive, aerospace, and electronics is pushing manufacturers to adopt advanced CNC technologies. As countries around the world continue to emphasize quality manufacturing, the demand for CNC controllers that comply with international standards is expected to rise significantly.

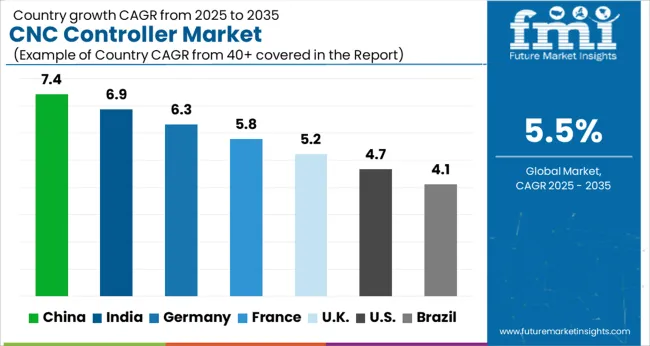

The CNC controller market is expected to grow steadily from 2025 to 2035, driven by industrial automation and the increasing demand for high-precision manufacturing across various sectors. China leads with a 7.4% market share, supported by its expanding manufacturing sector and rapid adoption of automated machinery in industries like automotive and electronics. India follows closely with a 6.9% share, benefiting from growing demand for precision machining in the automotive and aerospace sectors, as well as a surge in smart factory initiatives. France accounts for 5.8%, driven by the integration of CNC controllers in advanced manufacturing and high-tech industries. The United Kingdom holds 5.2%, supported by its focus on automation and robotics in the manufacturing industry. The United States captures 4.7%, bolstered by technological advancements in CNC systems and a strong industrial base focused on precision manufacturing. This distribution demonstrates how industrial demand, technological integration, and sector-specific needs are driving CNC controller adoption across key global markets.

China registered a CAGR of about 7.1% from 2020–2024, which increased to 7.4% for 2025–2035, driven by widespread industrial automation and the growing demand for precision in sectors like automotive, aerospace, and electronics. Early growth was supported by substantial government investments in advanced manufacturing infrastructure and modernization projects. Over the next decade, the expansion of smart factories, coupled with the rise of AI-driven manufacturing systems and robotics, will further drive the adoption of CNC controllers. Strategic collaborations between machine manufacturers and technology providers are expected to boost market penetration across various sectors.

India saw a CAGR of approximately 6.2% during 2020–2024, which moved up to 6.9% for 2025–2035, fueled by the demand for automation in industries such as automotive, industrial machinery, and aerospace. Initial growth came from the need for precision manufacturing and operational efficiency. Looking ahead, India's emphasis on smart factories and industrial automation will drive further demand for CNC controllers. The country’s growing industrial base and government policies focused on advanced manufacturing technologies will provide long-term growth opportunities for CNC systems, especially with a growing push toward robotic automation and additive manufacturing.

France's CNC controller market grew at a CAGR of 5.4% from 2020–2024 and is expected to rise to 5.8% during 2025–2035. Early market growth was supported by France’s strong industrial base in high-precision sectors like aerospace and automotive. Adoption surged due to the demand for enhanced manufacturing efficiency and quality control. Over the next decade, the integration of CNC controllers into robotics, AI-driven production lines, and 3D printing applications is expected to accelerate. France’s focus on maintaining technological leadership in high-tech manufacturing will significantly boost CNC controller adoption rates.

The UK CNC controller market saw a CAGR of approximately 4.2% during 2020–2024, with expectations to rise to 5.2% for the period from 2025–2035. The initial growth was driven by automation in traditional manufacturing sectors like automotive and heavy machinery. As the UK transitions to Industry 4.0, the need for digitalization and smarter manufacturing processes is expected to increase CNC controller adoption. The rise of additive manufacturing and the shift toward automation across the UK’s industrial base will further fuel growth in CNC controller demand, positioning the UK as a leader in advanced manufacturing.

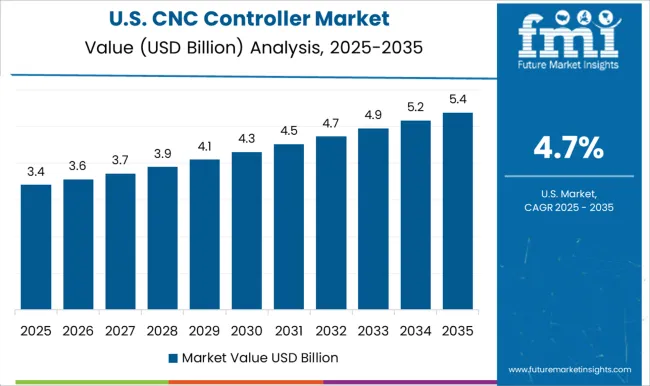

The USA CNC controller market experienced a CAGR of 3.8% during 2020–2024, with expectations to rise to 4.7% for the 2025–2035 period. Growth during the initial period was driven by the need for precision and quality in key industries such as automotive, aerospace, and industrial machinery. The transition to smarter manufacturing processes, increased automation, and the adoption of AI-driven systems are expected to drive the next phase of growth. With significant technological advancements and the continued push toward digital manufacturing, the US is poised to experience sustained demand for CNC controllers across a wide range of applications.

The CNC controller market is driven by prominent industry players such as Fanuc Corporation, Bosch Rexroth AG, DMG MORI, Haas Automation, Inc., Heidenhain Corporation, Mitsubishi Electric Corporation, and Siemens AG. Competition within the market focuses on precision, system integration, and customization of CNC solutions to cater to diverse manufacturing needs.

Leading players are enhancing their offerings by focusing on energy efficiency, integration with Industry 4.0 technologies, and automation solutions. Market leaders are also incorporating advanced software systems and AI to improve machine-tool coordination and predictive maintenance. These companies leverage their strong global presence, research capabilities, and strategic partnerships to expand their market share. Fanuc Corporation is a key player in the market, known for its innovation in robotics and CNC controllers, providing high-precision control solutions. Bosch Rexroth AG offers a range of CNC solutions focusing on industrial automation, where its controllers are integrated into complex manufacturing systems. DMG MORI specializes in high-end CNC machine tools and provides robust control systems that ensure precision in sectors such as aerospace and automotive.

Haas Automation, Inc. has a strong presence in the small to medium-sized manufacturing sector, offering CNC controllers that focus on ease of use and cost-effectiveness. Heidenhain Corporation is a leading supplier of precision measurement and CNC systems, with a focus on high-quality performance in industries requiring tight tolerances. Mitsubishi Electric Corporation’s advanced CNC systems integrate seamlessly with automation and robotics, delivering high-speed and high-precision control solutions. Siemens AG stands out by providing fully integrated digital solutions, combining CNC controllers with automation systems to deliver an advanced manufacturing experience. Strategic priorities among these players include enhancing connectivity for Industry 4.0, improving user interfaces, and integrating advanced machine learning algorithms for predictive maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Component | Hardware, Software, and Services |

| Machine Type | Machine Center and Turning Center |

| Axis | Three-axis, Two-axis, Four-axis, Five-axis, and Multi-axis |

| End-user | Automotive, Aerospace, Metals & Mining, Semiconductor & Electronics, Medical Devices, and Others |

| Sales Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fanuc Corporation, Bosch Rexroth AG, DMG MORI, Haas Automation, Inc., Heidenhain Corporation, Mitsubishi Electric Corporation, and Siemens AG |

| Additional Attributes | Dollar sales and share by region and industry, to assess growth opportunities |

The global CNC controller market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the CNC controller market is projected to reach USD 12.4 billion by 2035.

The CNC controller market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in CNC controller market are hardware, software and services.

In terms of machine type, machine center segment to command 58.7% share in the CNC controller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CNC Abovefloor Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

CNC Industrial Paper Cutter Market Size and Share Forecast Outlook 2025 to 2035

CNC Plasma Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Woodworking CNC Tools

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Unit Market Size and Share Forecast Outlook 2025 to 2035

Microcontroller Socket Market – Trends & Forecast 2025 to 2035

Door Controller Systems Market

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

AC-DC Controller Market Size and Share Forecast Outlook 2025 to 2035

Robot Controller & Software Market Trends & Forecast 2024-2034

Charge Controller System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Motion Controllers Market

Pipette Controller Market – Trends & Forecast 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA