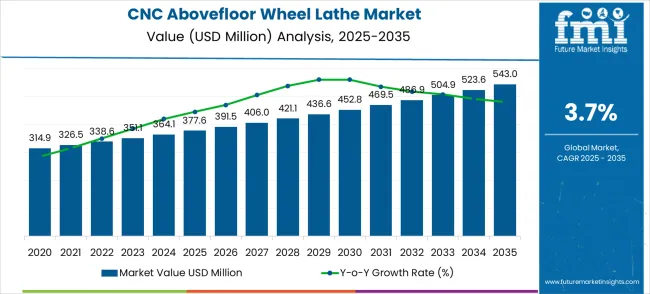

The CNC abovefloor wheel lathe market is expected to reach USD 377.6 million in 2025 and grow to USD 543.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.7%. This growth is driven by increasing demand for precision wheel machining in railways and industrial transportation systems. The adoption of advanced CNC technology allows manufacturers to achieve higher accuracy, reduce turnaround times, and optimize operational efficiency. Rising investments in railway infrastructure and modernization programs worldwide are also contributing to market expansion. As rail operators focus on safety, durability, and performance, CNC abovefloor wheel lathes are becoming essential equipment, supporting maintenance efficiency and reducing lifecycle costs of rolling stock, thereby solidifying their role in the global railway maintenance ecosystem.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 377.6 million |

| Forecast Value in (2035F) | USD 543.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

A key factor influencing market growth is the focus on operational efficiency and precision maintenance in railway workshops. Year-on-year (YoY) growth indicates a gradual upward trend, with market values increasing from USD 314.9 million in 2023 to USD 377.6 million in 2025, and continuing a steady rise over the next decade. CNC abovefloor wheel lathes offer consistent machining quality, reduced manual intervention, and shorter maintenance cycles, which are crucial for minimizing downtime in rail operations. Strategic collaborations between equipment manufacturers and railway maintenance providers are also accelerating adoption. Additionally, technological advancements in automated control systems, tool monitoring, and energy efficiency enhance the value proposition, making these machines an integral part of modern rail maintenance facilities.

Looking forward, the CNC abovefloor wheel lathe market is expected to maintain moderate growth, with market values reaching USD 452.8 million by 2030 and eventually USD 543.0 million by 2035, reflecting a CAGR of 3.7%. The five-year growth block analysis indicates consistent progress across the forecast period, driven by the ongoing expansion of rail networks and fleet upgrades globally. As rail operators increasingly adopt automated and precise maintenance equipment, demand for CNC abovefloor wheel lathes will continue to rise. Improvements in machine durability, software integration, and energy efficiency will further support adoption. Overall, the market outlook points to sustained incremental growth, highlighting the strategic importance of advanced wheel lathes in ensuring safe, reliable, and efficient railway operations.

Market expansion is being supported by the increasing global demand for flexible rail maintenance solutions and the corresponding shift toward versatile machining systems that can provide superior accessibility and operational convenience while meeting industry requirements for precise and reliable wheel reconditioning operations. Modern railway maintenance facilities and mobile service providers are increasingly focused on incorporating CNC above-floor wheel lathes to enhance maintenance flexibility while satisfying demands for improved operational efficiency and reduced maintenance downtime. CNC above-floor wheel lathes' proven ability to deliver superior machining precision, operational flexibility, and maintenance accessibility makes them essential equipment for railway depot operations and mobile maintenance services.

The growing emphasis on railway operational efficiency and maintenance cost optimization is driving demand for high-quality CNC above-floor wheel lathe products that can support distinctive maintenance capabilities and premium equipment positioning across passenger rail, freight rail, and urban transit categories. Equipment manufacturer preference for systems that combine machining excellence with operational flexibility is creating opportunities for innovative above-floor wheel lathe implementations in both traditional depot maintenance and emerging mobile maintenance applications. The rising influence of predictive maintenance and digital fleet management is also contributing to increased adoption of premium CNC above-floor wheel lathe products that can provide authentic high-performance rail maintenance characteristics.

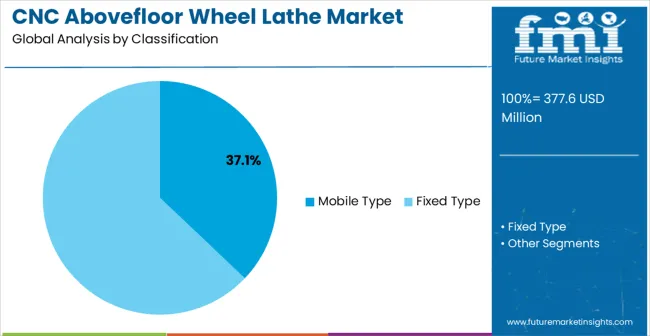

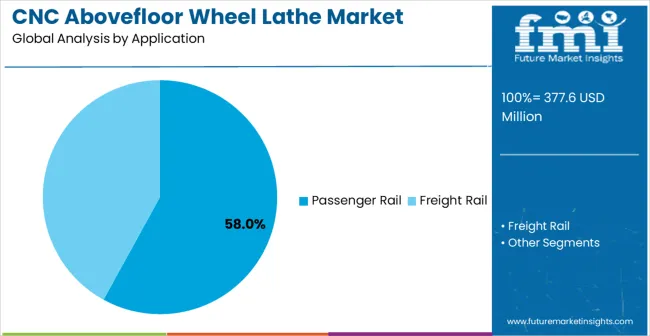

The market is segmented by machine type, application, and region. By machine type, the market is divided into mobile and fixed types. Based on application, the market is categorized into passenger rail and freight rail. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The mobile type segment is projected to account for 37.1% of the CNC above-floor wheel lathe market in 2025, reaffirming its position as the leading machine type category. Railway maintenance operators and service providers increasingly utilize mobile above-floor wheel lathes for their superior flexibility characteristics, operational versatility, and ability to provide on-site maintenance across diverse railway maintenance applications. Mobile type technology's portable design and adaptable configuration directly address the operational requirements for flexible maintenance services and efficient resource utilization in railway maintenance operations.

This machine type segment forms the foundation of modern flexible maintenance applications, as it represents the technology with the greatest operational adaptability and established service efficiency across multiple railway maintenance scenarios. Manufacturer investments in mobile platform optimization and portability enhancement continue to strengthen adoption among railway maintenance providers. With maintenance operators prioritizing operational flexibility and service efficiency, mobile CNC above-floor wheel lathes align with both versatility objectives and resource optimization requirements, making them the central component of comprehensive flexible maintenance strategies.

Passenger rail applications are projected to represent 58% market share of CNC above-floor wheel lathe demand in 2025, underscoring their critical role as the primary application for precision wheel maintenance in passenger train operations and urban transit systems. Railway operators prefer CNC above-floor wheel lathes for their exceptional precision capabilities, safety compliance characteristics, and ability to maintain consistent wheel profiles while supporting passenger service reliability requirements during rail operations. Positioned as essential equipment for high-performance passenger rail maintenance, CNC above-floor wheel lathes offer both safety assurance and operational efficiency advantages.

The segment is supported by continuous growth in passenger rail services and the growing availability of specialized maintenance technologies that enable enhanced safety performance and service quality optimization at the operational level. Additionally, passenger rail operators are investing in advanced maintenance technologies to support service reliability and safety compliance. As passenger rail continues to expand and operators seek superior maintenance automation solutions, passenger rail applications will continue to dominate the application landscape while supporting safety advancement and operational efficiency strategies.

The CNC above-floor wheel lathe market is advancing steadily due to increasing railway maintenance investments and growing demand for flexible maintenance solutions that emphasize superior accessibility and operational convenience across passenger rail and freight rail applications. However, the market faces challenges, including higher equipment costs compared to traditional maintenance alternatives, technical complexity in operating mobile systems, and space constraints in certain depot configurations. Innovation in automation enhancement and mobility optimization continues to influence market development and expansion patterns.

The growing adoption of CNC above-floor wheel lathes in mobile maintenance and field service applications is enabling equipment manufacturers to develop systems that provide distinctive operational capabilities while commanding premium positioning and enhanced service flexibility. Advanced applications provide superior maintenance accessibility while allowing more sophisticated service development across various rail transport categories and maintenance segments. Manufacturers are increasingly recognizing the competitive advantages of mobile maintenance positioning for premium equipment development and flexible service market penetration.

Modern CNC above-floor wheel lathe suppliers are incorporating digital monitoring technologies, automated control systems, and remote diagnostics capabilities to enhance maintenance precision, improve operational efficiency, and meet railway demands for intelligent and connected maintenance solutions. These programs enhance operational performance while enabling new applications, including predictive maintenance integration and automated quality control systems. Advanced technology integration also allows suppliers to support premium market positioning and maintenance innovation leadership beyond traditional commodity machining equipment.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| Brazil | 3.9% |

| USA | 3.5% |

| UK | 3.1% |

| Japan | 2.8% |

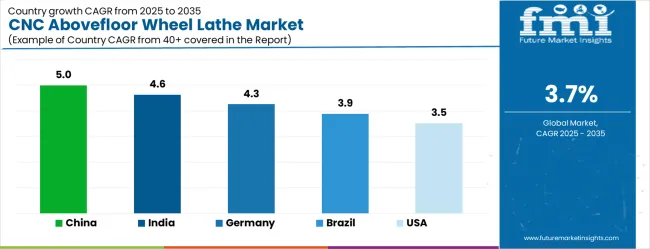

The CNC above-floor wheel lathe market is experiencing robust growth globally, with China leading at a 5.0% CAGR through 2035, driven by the rapidly expanding railway network, massive investments in rail infrastructure, and increasing adoption of advanced maintenance technologies. India follows at 4.6%, supported by growing railway modernization, rising infrastructure investments, and expanding maintenance capabilities. Germany shows growth at 4.3%, emphasizing advanced engineering technology and premium rail maintenance solutions. Brazil records 3.9%, focusing on emerging rail infrastructure applications and maintenance development. The USA demonstrates 3.5% growth, prioritizing rail infrastructure modernization and innovation in maintenance. The UK exhibits 3.1% growth, supported by rail network development and advanced maintenance capabilities. Japan shows 2.8% growth, emphasizing precision manufacturing excellence and high-quality maintenance equipment production.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from CNC above-floor wheel lathes in China is projected to exhibit exceptional growth with a CAGR of 5.0% through 2035, driven by the rapidly expanding railway network and massive government investments in rail infrastructure development across major transportation corridors. The country's growing rail maintenance capacity and increasing adoption of advanced CNC technologies are creating substantial demand for versatile wheel maintenance equipment in both established and emerging rail applications. Major rail equipment manufacturers and maintenance companies are establishing comprehensive production and service capabilities to serve both domestic infrastructure needs and export markets.

CNC above-floor wheel lathes market in India is expanding at a CAGR of 4.6%, supported by growing railway modernization, increasing infrastructure investments, and expanding maintenance applications. The country's developing rail infrastructure and expanding maintenance capabilities are driving demand for efficient maintenance equipment across both existing network upgrades and new rail construction applications. International rail equipment companies and domestic manufacturing specialists are establishing comprehensive distribution and service capabilities to address growing market demand for advanced rail maintenance solutions.

CNC above-floor wheel lathes market in Germany is projected to grow at a CAGR of 4.3% through 2035, driven by the country's advanced rail technology sector, premium maintenance equipment manufacturing capabilities, and leadership in precision engineering solutions. Germany's sophisticated railway system and willingness to invest in high-performance maintenance equipment are creating substantial demand for both standard and specialized CNC above-floor wheel lathe varieties. Leading technology companies and rail equipment manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Revenue from CNC above-floor wheel lathes in Brazil is projected to grow at a CAGR of 3.9% through 2035, supported by the country's expanding rail infrastructure, growing transportation applications, and increasing adoption of modern maintenance technologies requiring efficient rail maintenance solutions. Brazilian rail operators and international companies consistently seek reliable maintenance equipment that enhances operational efficiency for both freight transportation and passenger service markets. The country's position as a regional transportation hub continues to drive innovation in rail maintenance applications and operational standards.

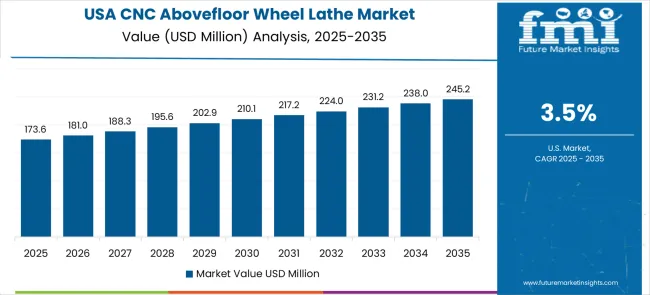

Demand for CNC above-floor wheel lathes in the United States is projected to grow at a CAGR of 3.5% through 2035, supported by the country's advanced rail infrastructure sector, maintenance technology innovation capabilities, and established leadership in transportation solutions. American rail operators and equipment manufacturers prioritize safety, reliability, and efficiency, making CNC above-floor wheel lathes essential equipment for both freight rail operations and the development of passenger services. The country's comprehensive rail infrastructure and technical expertise support continued market development.

CNC above-floor wheel lathes market in the United Kingdom is projected to grow at a CAGR of 3.1% through 2035, supported by the country's rail network development sector, advanced maintenance capabilities, and established expertise in transportation solutions. British rail operators' focus on service reliability, safety, and operational excellence creates steady demand for reliable CNC above-floor wheel lathe equipment. The country's attention to maintenance quality and network optimization drives consistent adoption across both traditional rail services and emerging high-speed applications.

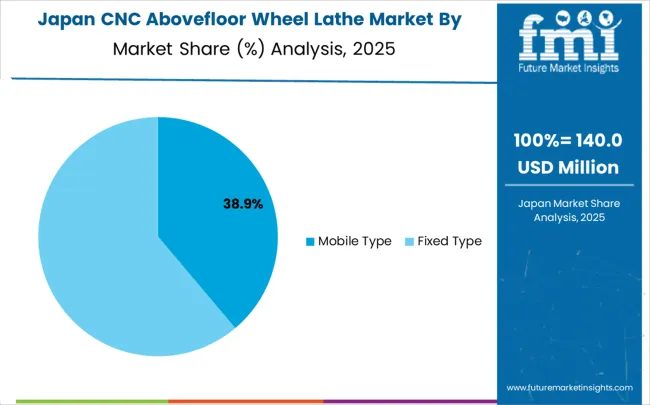

CNC above-floor wheel lathes market in Japan is projected to grow at a CAGR of 2.8% through 2035, supported by the country's precision rail manufacturing excellence, advanced maintenance technology expertise, and established reputation for producing superior rail equipment while working to enhance maintenance efficiency capabilities and develop next-generation rail technologies. Japan's rail industry continues to benefit from its reputation for delivering high-quality transportation equipment while focusing on innovation and precision engineering.

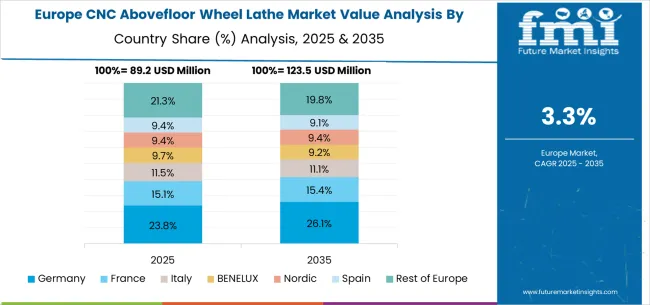

The CNC above-floor wheel lathe market in Europe is projected to grow from USD 98.3 million in 2025 to USD 134.2 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 30.4% market share in 2025, remaining stable at 30.2% by 2035, supported by its advanced rail technology sector, precision maintenance equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 20.1% share in 2025, projected to reach 20.3% by 2035, driven by rail network development programs, advanced maintenance capabilities, and growing focus on precision rail maintenance solutions for premium applications. France holds a 17.6% share in 2025, expected to maintain 17.4% by 2035, supported by high-speed rail demand and advanced transportation applications, but facing challenges from market competition and infrastructure investment considerations. Italy commands a 13.2% share in 2025, projected to reach 13.4% by 2035, while Spain accounts for 10.8% in 2025, expected to reach 11.0% by 2035. The Netherlands maintains a 4.7% share in 2025, growing to 4.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 14.9% in 2025, declining slightly to 14.6% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced rail markets balanced by slower growth in smaller countries implementing rail infrastructure development programs.

The CNC above-floor wheel lathe market is characterized by competition among established rail equipment companies, specialized CNC machinery manufacturers, and integrated maintenance solution suppliers. Companies are investing in advanced CNC technologies, mobility optimization systems, application-specific equipment development, and comprehensive technical support capabilities to deliver consistent, high-precision, and versatile above-floor wheel lathe products. Innovation in automation enhancement, mobility advancement, and customized rail maintenance solutions is central to strengthening market position and customer satisfaction.

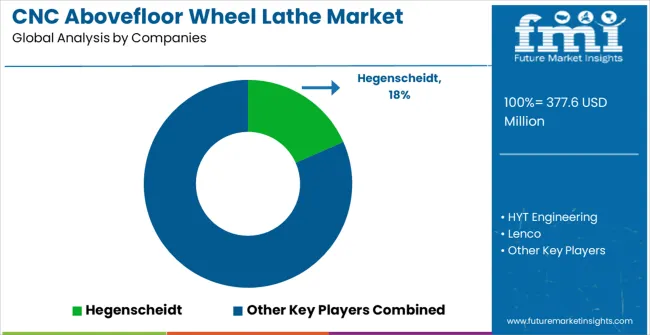

Hegenscheidt leads the market with a strong focus on rail maintenance innovation and comprehensive wheel lathe solutions, offering sophisticated CNC above-floor wheel lathe products that emphasize precision assurance and operational flexibility. HYT Engineering provides specialized rail equipment capabilities with a focus on maintenance applications and international rail networks. Lenco delivers advanced CNC technology with a focus on innovation and premium equipment development. WMT CNC specializes in precision machining solutions with emphasis on technical expertise and automation optimization. TOP-ONE MACHINERY focuses on CNC manufacturing technologies and advanced rail maintenance systems. Rafamet emphasizes precision machining expertise with a focus on rail applications and operational reliability.

CNC above-floor wheel lathes are precision machining systems designed to restore wheel profiles on railway vehicles while positioned at track level or above, offering enhanced accessibility and operational flexibility compared to underfloor configurations while maintaining the precision required for safety-critical rail operations. With the market projected to grow from USD 377.6 million in 2025 to USD 543.0 million by 2035 at a 3.7% CAGR, these machines serve railway operators seeking versatile maintenance solutions that balance operational efficiency with capital investment considerations. The dominance of mobile type configurations (37.1% market share) and passenger rail applications reflects the industry's emphasis on operational flexibility and safety-critical maintenance requirements. However, market expansion faces challenges, including higher equipment costs compared to traditional alternatives, technical complexity in mobile operations, space constraints in existing facilities, and the need for specialized operator training. Maximizing growth potential requires coordinated efforts across precision machinery manufacturers and mobile technology developers, railway maintenance service providers and depot operators, technical training and workforce development organizations, maintenance facility design and infrastructure specialists, and financing and market access partners.

How Precision Machinery Manufacturers and Mobile Technology Developers Could Drive Innovation?

Mobile Platform Engineering: Develop advanced mobile CNC above-floor wheel lathe systems that combine precision machining capabilities with true portability, including self-contained power systems, automated setup procedures, and rapid deployment features, enabling efficient field maintenance operations without compromising machining accuracy.

Modular System Design: Create flexible, modular wheel lathe platforms that can be configured for both fixed installation and mobile applications, allowing operators to optimize their equipment investment based on specific operational requirements and facility constraints while maintaining upgrade pathways.

Advanced Automation Integration: Implement sophisticated automation systems, including automated wheel measurement, adaptive machining parameters, and real-time quality monitoring that reduce operator skill requirements while ensuring consistent results across different operational environments and varying wheel conditions.

Precision Engineering Excellence: Develop cutting-edge machining technologies that maintain extremely tight tolerances and surface finish requirements even in challenging mobile or above-ground installation environments, incorporating vibration isolation, thermal stability, and environmental protection features.

Digital Integration and Connectivity: Create comprehensive digital platforms that enable remote monitoring, predictive maintenance, performance analytics, and integration with fleet management systems, providing operators with real-time insights into equipment performance and maintenance effectiveness.

How Railway Maintenance Service Providers and Depot Operators Could Optimize Utilization?

Strategic Deployment Planning: Develop comprehensive strategies for CNC above-floor wheel lathe deployment that optimize equipment utilization across multiple locations, considering factors such as fleet size, maintenance schedules, and geographical distribution to maximize return on investment.

Operational Excellence Programs: Implement lean maintenance practices and continuous improvement initiatives that maximize equipment uptime and efficiency while maintaining quality standards. Develop standardized operating procedures that ensure consistent results regardless of operator or location.

Fleet-Wide Maintenance Integration: Integrate CNC above-floor wheel lathe operations with broader fleet maintenance programs, optimizing maintenance schedules and resource allocation to minimize service disruptions while maximizing wheel life and safety performance.

Mobile Service Development: For mobile configurations, develop specialized service delivery models that bring precision wheel maintenance directly to remote locations or smaller depots, expanding market reach while optimizing equipment utilization across wider geographical areas.

Performance Monitoring and Analytics: Establish comprehensive monitoring systems that track equipment performance, maintenance effectiveness, and cost metrics to optimize operations and demonstrate value to stakeholders. Use data analytics to identify improvement opportunities and justify continued investment.

How Technical Training and Workforce Development Organizations Could Address Skills Gaps?

Specialized CNC Training Programs: Develop comprehensive training curricula specifically for CNC above-floor wheel lathe operation that combine precision machining skills with railway safety requirements and mobile equipment operation procedures. Create certification programs that validate operator competency.

Mobile Equipment Expertise: Establish training programs that address the unique challenges of mobile CNC operations, including equipment setup, transportation safety, field troubleshooting, and maintaining precision in varying environmental conditions.

Cross-Platform Competency: Develop training that enables operators to work effectively across different wheel lathe configurations (mobile, fixed, above-floor) and various equipment manufacturers, increasing workforce flexibility and career opportunities.

Maintenance and Service Training: Create technical training programs for maintenance technicians covering equipment servicing, preventive maintenance, and advanced troubleshooting for complex CNC systems operating in diverse environments.

Career Development Pathways: Establish clear progression paths for railway maintenance technicians that encourage specialization in CNC wheel lathe operations while providing opportunities for advancement and skill development.

How Maintenance Facility Design and Infrastructure Specialists Could Enable Adoption?

Facility Optimization Solutions: Provide expertise in designing maintenance facilities that can accommodate CNC above-floor wheel lathes while optimizing workflow, space utilization, and operational efficiency. Address challenges such as crane systems, power distribution, and environmental control.

Mobile Operation Infrastructure: Develop infrastructure solutions that support mobile CNC wheel lathe operations, including portable power systems, equipment storage and transport solutions, and temporary installation foundations that enable field deployment.

Retrofit and Modernization Services: Offer specialized services for retrofitting existing maintenance facilities to accommodate CNC above-floor wheel lathes, addressing structural modifications, utility upgrades, and workflow optimization while minimizing operational disruption.

Multi-Purpose Facility Design: Create facility designs that maximize flexibility by enabling facilities to handle both above-floor and underfloor wheel lathe operations, providing operators with maximum flexibility and investment protection.

Safety and Compliance Integration: Ensure all facility modifications and installations meet stringent railway safety standards while optimizing operational efficiency and maintaining compliance with evolving regulations.

How Financing and Market Access Partners Could Facilitate Market Growth?

Flexible Equipment Financing: Develop specialized financing solutions for CNC above-floor wheel lathes, including lease-to-own programs, performance-based contracts, and shared-use arrangements that make advanced equipment accessible to smaller operators and emerging markets.

Mobile Equipment Business Models: Create innovative business models for mobile CNC wheel lathe services, including equipment-as-a-service offerings, regional service cooperatives, and mobile maintenance contracts that enable operators to access advanced technology without full ownership costs.

Technology Upgrade Pathways: Provide financing structures that support technology upgrades and modernization programs, enabling operators to transition from traditional maintenance methods to CNC systems while managing capital expenditure over time.

Market Development Support: Support market expansion in high-growth regions like China (5.0% CAGR) and India (4.6% CAGR) through local financing programs, technology transfer initiatives, and partnerships that address regional market conditions and requirements.

Risk Management Solutions: Develop comprehensive risk management and insurance products that address the unique challenges of mobile CNC equipment operation, including transportation risks, field operation hazards, and equipment performance guarantees.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 377.6 million |

| Machine Type | Mobile Type, Fixed Type |

| Application | Passenger Rail, Freight Rail |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Hegenscheidt, HYT Engineering, Lenco, WMT CNC, TOP-ONE MACHINERY, Rafamet, OKUMA, FOCUSCNC, HBC System, Danobat, Koltech, Talgo, SAFOP, HYT, and Atlasrail |

| Additional Attributes | Dollar sales by machine type and application, regional demand trends, competitive landscape, technological advancements in CNC machining, mobility optimization development initiatives, automation enhancement programs, and rail maintenance integration strategies |

The global CNC abovefloor wheel lathe market is estimated to be valued at USD 377.6 million in 2025.

The market size for the CNC abovefloor wheel lathe market is projected to reach USD 543.0 million by 2035.

The CNC abovefloor wheel lathe market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in CNC abovefloor wheel lathe market are mobile type and fixed type.

In terms of application, passenger rail segment to command 58.0% share in the CNC abovefloor wheel lathe market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

CNC Slitting Lathes Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

CNC Industrial Paper Cutter Market Size and Share Forecast Outlook 2025 to 2035

CNC Plasma Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

CNC Tool Storage System Market

Lathe Machines Market

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA