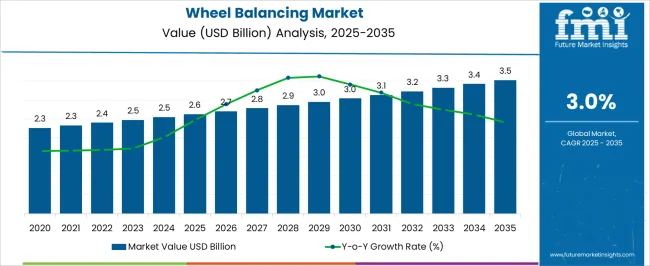

The wheel balancing market is projected to reach USD 2.6 billion in 2025 and expand to USD 3.5 billion by 2035, growing at a CAGR of 3.0%. Market performance is influenced by seasonal and cyclical patterns in automotive maintenance and repair services. Demand typically peaks during pre-summer and pre-winter periods, as vehicle owners prepare for extreme weather conditions, ensuring tire and wheel performance, safety, and ride comfort.

Replacement cycles of tires and alignment checks drive periodic surges, while off-peak months witness moderate activity. OEM production schedules, fleet maintenance timelines, and promotional campaigns by tire manufacturers also contribute to cyclical demand. Regional variations are significant, with colder climates showing strong winter-related service spikes, whereas regions with consistent temperatures exhibit steadier demand. Technological upgrades in wheel balancing machines, coupled with preventive maintenance awareness, gradually smooth cyclical fluctuations. The integration of digital diagnostics, alignment sensors, and automated balancing systems influences service frequency and enhances shop throughput, making seasonality management crucial for service providers and distributors.

Market participants strategically plan inventory, workforce allocation, and service promotions to align with these recurring demand cycles, optimizing revenue and minimizing downtime during low-demand periods. Global expansion in passenger vehicles and commercial fleets also supports sustained growth despite seasonal variations.

| Metric | Value |

|---|---|

| Wheel Balancing Market Estimated Value in (2025 E) | USD 2.6 billion |

| Wheel Balancing Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The wheel balancing market is influenced by multiple interconnected parent markets, each contributing uniquely to overall demand and growth. The automotive aftermarket segment holds the largest share at approximately 40%, driven by repair shops, service centers, and tire dealers offering wheel balancing services to maintain vehicle safety, ride quality, and tire longevity. Regular maintenance cycles, alignment checks, and seasonal tire changes are key drivers in this segment.

The OEM service and maintenance market contributes around 25%, with manufacturers incorporating wheel balancing into routine vehicle servicing and warranty programs to enhance performance and customer satisfaction. The commercial fleet and logistics market accounts for roughly 15%, as trucking companies, delivery services, and bus operators prioritize balanced wheels to reduce tire wear, improve fuel efficiency, and minimize vehicle downtime. The motorsport and specialty vehicle segment adds about 10%, driven by high-performance applications requiring precise wheel alignment and balance for safety and optimal handling. The automotive retail and distribution segment represents around 10%, encompassing tire retailers, auto parts stores, and e-commerce platforms providing wheel balancing equipment and services. Aftermarket, OEM, and commercial fleet segments account for nearly 80% of the overall market, underscoring that maintenance, operational efficiency, and safety remain the primary growth drivers, while specialty and retail applications offer complementary expansion opportunities for the global wheel balancing market.

The wheel balancing market is experiencing steady growth driven by the rising global vehicle production, increasing focus on driving safety, and advancements in automotive servicing equipment. The growing consumer demand for improved vehicle performance and reduced tire wear has encouraged widespread adoption of precision wheel balancing solutions across workshops and service centers.

Technological innovations such as automated balancing systems, improved measurement accuracy, and user friendly interfaces are contributing to efficiency in operations. Stringent regulatory norms related to vehicle safety and performance are also influencing market expansion.

Additionally, the rise in electric vehicle adoption and the global trend toward regular preventive maintenance are creating new opportunities for manufacturers. The market outlook remains optimistic, supported by ongoing modernization of service infrastructure and an increasing emphasis on operational efficiency in automotive maintenance.

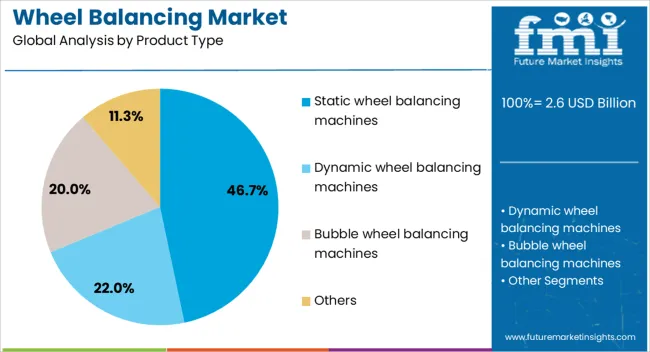

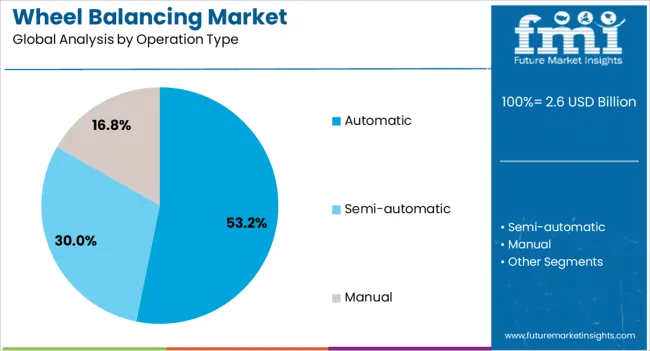

The wheel balancing market is segmented by product type, operation type, sales channel, application, and geographic regions. By product type, wheel balancing market is divided into Static wheel balancing machines, Dynamic wheel balancing machines, Bubble wheel balancing machines, and Others. In terms of operation type, wheel balancing market is classified into Automatic, Semi-automatic, and Manual.

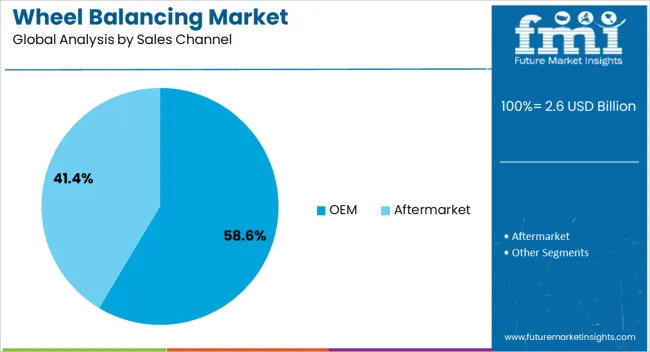

Based on sales channel, wheel balancing market is segmented into OEM and Aftermarket. By application, wheel balancing market is segmented into Commercial vehicle and Passenger vehicle. Regionally, the wheel balancing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The static wheel balancing machines segment is projected to account for 46.70% of total market revenue by 2025 within the product type category, making it the leading segment. This dominance is attributed to its cost effectiveness, ease of operation, and suitability for a wide range of vehicles.

Static machines are valued for their ability to provide accurate balancing without requiring complex mechanisms, making them particularly appealing to small and medium sized service providers. Their low maintenance requirements and adaptability to various tire sizes have further contributed to their widespread adoption.

The segment’s strong presence is reinforced by continued demand from markets prioritizing affordability and reliability in wheel balancing solutions.

The automatic segment is expected to represent 53.20% of the total market revenue by 2025 within the operation type category, positioning it as the dominant segment. This leadership is driven by the ability of automatic systems to deliver faster cycle times, higher accuracy, and reduced operator dependency.

The integration of advanced sensors and user friendly software enables precise measurements and consistent results, which are essential for high volume automotive service centers. The growing trend toward workshop automation and the need to enhance productivity have further boosted adoption.

As service facilities increasingly focus on efficiency and precision, automatic wheel balancing machines are expected to remain the preferred choice.

The OEM segment is anticipated to hold 58.60% of total market revenue by 2025 within the sales channel category, making it the largest segment. This is due to the strong relationships between manufacturers and automotive OEMs, which ensure a steady demand for wheel balancing machines during the production and assembly stages.

OEM partnerships facilitate the integration of advanced balancing systems into manufacturing lines, ensuring vehicles leave the factory with optimal wheel balance. Additionally, OEM-supplied equipment is often perceived as more reliable and compatible, encouraging long-term use.

The segment’s dominance is reinforced by continuous automotive industry growth and the emphasis on quality assurance during initial vehicle production.

The wheel balancing market growth is primarily driven by automotive aftermarket, OEM integration, and commercial fleet maintenance. Skilled technicians and advanced equipment further strengthen service adoption and market expansion globally.

The wheel balancing market is strongly influenced by the automotive aftermarket sector, which holds the largest share due to the essential role of wheel balancing in vehicle safety, tire longevity, and ride quality. Regular tire rotations, seasonal changes, and maintenance cycles encourage frequent service adoption. Independent garages, chain service centers, and tire retailers offer wheel balancing as part of routine maintenance, boosting market activity. Customer awareness regarding improved fuel efficiency, reduced tire wear, and enhanced driving comfort further drives demand. Technicians are increasingly trained to use automated and dynamic balancing machines, which enhance accuracy and efficiency. The growth of passenger vehicles and two-wheelers globally reinforces the aftermarket’s dominance, ensuring continuous demand for balancing services and equipment.

Original equipment manufacturers (OEMs) contribute significantly to wheel balancing demand, as balancing is integrated into routine vehicle assembly and warranty servicing programs. OEMs prioritize precision, reliability, and compliance with manufacturer specifications, ensuring wheel performance aligns with overall vehicle safety and efficiency. Automakers collaborate with balancing equipment providers to offer pre-installed solutions and certified maintenance procedures at dealerships. This integration helps in maintaining tire uniformity, reducing vibration, and enhancing fuel economy across vehicle fleets. Premium and electric vehicle segments increasingly adopt high-precision balancing solutions to complement advanced suspension and drivetrain systems. OEM-driven programs also create long-term service contracts, training initiatives, and customer loyalty, reinforcing market stability and predictable growth for wheel balancing equipment and services.

The commercial fleet and logistics sector represents a key growth driver for the wheel balancing market. Trucking companies, delivery fleets, buses, and taxis adopt wheel balancing practices to extend tire life, reduce operational costs, and improve fuel efficiency. Regular fleet maintenance programs incorporate balancing inspections to prevent uneven wear, vibrations, and potential vehicle downtime. Fleet operators increasingly rely on mobile and in-house balancing solutions to streamline operations and minimize service disruptions. Maintenance scheduling and predictive tire replacement strategies support market growth. Additionally, regulatory requirements in some regions for roadworthiness and safety inspections mandate wheel balancing, further driving adoption. Commercial fleets also invest in automated equipment for high-volume balancing to reduce labor costs and enhance operational efficiency.

Skilled technicians and specialized equipment play a central role in the wheel balancing market. Training programs focus on proper use of static and dynamic balancing machines, alignment tools, and diagnostic software to ensure accurate wheel adjustment. Equipment manufacturers continuously introduce advanced machines with automated calibration, vibration analysis, and digital reporting features, enhancing service efficiency. Technicians are also educated on balancing for new vehicle types, including electric and hybrid models with heavier drivetrains and specialized tires. Dealer networks and aftermarket service providers emphasize training and certification programs to ensure service quality. The availability of portable and compact balancing equipment also supports smaller garages and mobile service providers, expanding the market’s reach and versatility globally.

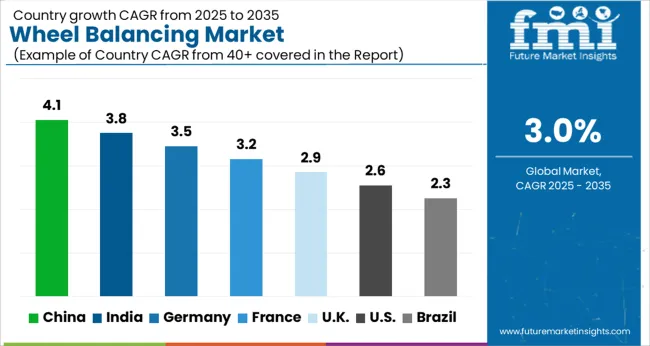

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global wheel balancing market is projected to grow at a CAGR of 3.0% from 2025 to 2035. China leads with a share of 4.1%, followed by India at 3.8%, Germany at 3.5%, the UK at 2.9%, and the USA at 2.6%. Market growth is driven by increasing passenger vehicle production, rising demand for automotive maintenance services, and the expansion of commercial fleets. China and India are experiencing strong aftermarket adoption due to growing vehicle populations and maintenance awareness. Germany, the UK, and the USA focus on OEM service programs, precision balancing technologies, and high-quality workshop solutions, ensuring consistent adoption. Seasonal tire changes, fleet management maintenance, and safety regulations further reinforce market demand globally. The analysis encompasses over 40+ countries, highlighting the top markets detailed below.

The wheel balancing market in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by the rapid expansion of passenger vehicle production, commercial fleets, and two-wheeler adoption. Automotive service centers and dealerships are increasingly deploying precision wheel balancing machines to improve tire longevity, ride quality, and fuel efficiency. Domestic manufacturers are scaling production of advanced balancing equipment compatible with alloy and steel wheels while integrating digital diagnostics and alignment features. The rise of aftermarket service networks, combined with mandatory vehicle safety inspections, is further boosting demand. E-commerce platforms and distributor networks are improving accessibility to workshops across urban and semi-urban regions, enabling faster adoption.

The wheel balancing market in India is expected to grow at a CAGR of 3.8% from 2025 to 2035, fueled by increasing vehicle ownership, rising awareness of tire safety, and expansion of automotive workshops. Both passenger and commercial vehicles require frequent wheel maintenance, especially due to diverse road conditions and seasonal tire changes. Domestic manufacturers are developing cost-effective balancing machines for small and medium workshops, while international players focus on premium digital solutions for large-scale fleet operators. OEM service programs and fleet maintenance contracts are driving recurring demand, whereas e-commerce and local distributors enhance reach in Tier-2 and Tier-3 cities. Regulatory compliance on tire maintenance further accelerates adoption.

Germany’s wheel balancing market is projected to grow at a CAGR of 3.5% from 2025 to 2035, supported by advanced automotive manufacturing and high vehicle safety standards. Workshops and dealerships are increasingly adopting high-precision balancing equipment for passenger cars, commercial trucks, and electric vehicles to meet OEM quality requirements. Local manufacturers emphasize smart, automated systems integrated with wheel alignment diagnostics and sensor technology. Fleet operators and automotive OEM service centers prioritize rapid, reliable maintenance to ensure performance and regulatory compliance. Seasonal tire swaps and winter/summer tire usage further create cyclical demand, enhancing revenue predictability. Partnerships with aftermarket suppliers and distributors expand accessibility to professional workshops across the country.

The UK wheel balancing market is anticipated to grow at a CAGR of 2.9% from 2025 to 2035, driven by increasing vehicle parc, demand for passenger comfort, and emphasis on road safety regulations. Dealerships, service chains, and independent workshops are investing in digital wheel balancers that accommodate alloy and low-profile tires. Fleet maintenance programs and contract servicing for commercial vehicles create steady adoption opportunities. Manufacturers are introducing compact, cost-efficient machines suitable for small workshops, while premium equipment targets OEM-aligned service centers. E-commerce and distributor networks ensure accessibility across urban and suburban regions. Consumer awareness campaigns highlighting vehicle longevity and fuel efficiency further stimulate demand.

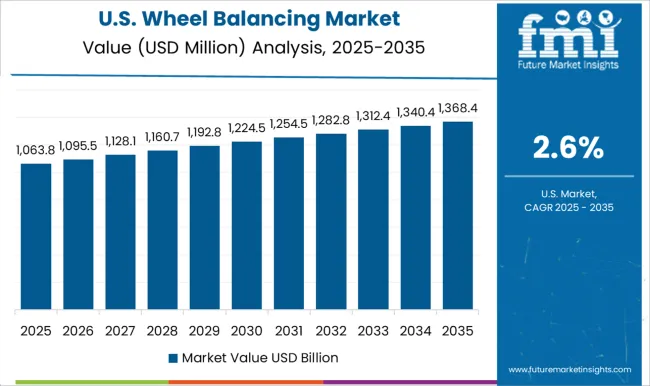

The wheel balancing market in the USA is projected to grow at a CAGR of 2.6% from 2025 to 2035, with growth driven by passenger vehicle maintenance, commercial fleet management, and increasing aftermarket awareness. Independent garages and dealership service centers are investing in high-accuracy balancing machines for alloy, steel, and specialty tires. OEMs emphasize periodic wheel maintenance programs to enhance safety and ride quality. Domestic and international manufacturers are offering solutions integrated with alignment, vibration diagnostics, and automated calibration. E-commerce platforms and distributor networks ensure wide availability for professional workshops. Seasonal demand for tire rotation and alignment services contributes to cyclical sales patterns, providing predictable revenue streams.

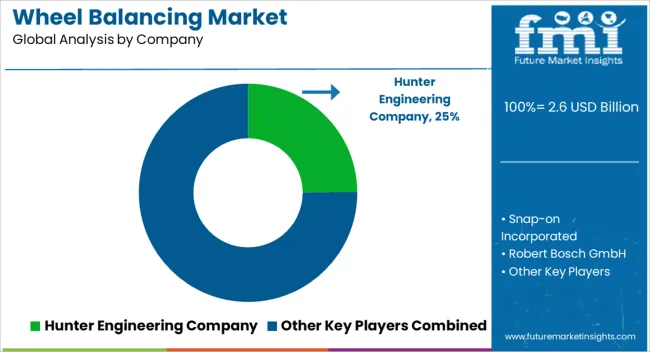

Competition in the wheel balancing market is defined by precision, efficiency, and adaptability to diverse vehicle types and wheel configurations. Hunter Engineering Company leads with a broad portfolio of digital and mechanical wheel balancers, offering automated diagnostics, alignment integration, and high-speed balancing capabilities for passenger cars, commercial vehicles, and light trucks. Snap-on Incorporated competes through premium workshop solutions that emphasize durability, accuracy, and connectivity with vehicle onboard diagnostics systems, targeting professional garages and dealer service centers. Robert Bosch GmbH differentiates with technologically advanced balancing machines that integrate laser-guided systems, vibration analysis, and digital reporting features for fleet operators and automotive OEMs. 3M provides complementary solutions and calibration tools that enhance balancing accuracy and extend equipment life, appealing to both small and large-scale workshops. Corghi S.p.A. focuses on specialized, European-style wheel balancers that combine compact design with high precision, catering to multi-brand dealerships and independent service centers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Product Type | Static wheel balancing machines, Dynamic wheel balancing machines, Bubble wheel balancing machines, and Others |

| Operation Type | Automatic, Semi-automatic, and Manual |

| Sales Channel | OEM and Aftermarket |

| Application | Commercial vehicle and Passenger vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hunter Engineering Company, Snap-on Incorporated, Robert Bosch GmbH, 3M, Corghi S.p.A., ravaglioli.com, and BendPak Holdings LLC. |

| Additional Attributes | Dollar sales, share, key regional demand, adoption by OEMs vs. aftermarket, growth by vehicle type (passenger, commercial, EVs), pricing trends, technological differentiation (automatic, semi-automatic, manual), distribution channels, fleet vs. independent garage demand, service and maintenance revenue, and competitive landscape insights. |

The global wheel balancing market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the wheel balancing market is projected to reach USD 3.5 billion by 2035.

The wheel balancing market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in wheel balancing market are static wheel balancing machines, dynamic wheel balancing machines, bubble wheel balancing machines and others.

In terms of operation type, automatic segment to command 53.2% share in the wheel balancing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Suspension System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA