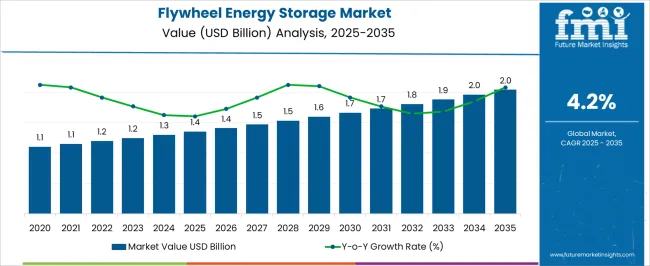

The flywheel energy storage market is projected to reach USD 1.3 billion in 2025 and expand to USD 2.0 billion by 2035, advancing at a CAGR of 4.2 % during this period. A 10-year growth comparison reveals a consistent yet measured trajectory, with the market moving from USD 1.1 billion in its earlier stages to USD 1.3 billion by 2025 and then scaling up gradually to USD 2.0 billion in 2035. The first half of the forecast period shows incremental adoption as industries test integration with existing grids, renewable projects, and critical infrastructure backup systems.

By the second half, stronger adoption emerges through broader grid modernization efforts, increasing renewable penetration, and the need for fast-response storage technologies. Flywheels are gaining traction in data centers, rail systems, and microgrids where high cycle durability and rapid discharge capability create strong advantages over chemical batteries. While the overall growth is moderate compared to battery storage, the 10-year comparison highlights the stability and resilience of this segment, supported by specialized applications where reliability and longevity matter most. The compounding opportunity rests on utilities and industries recognizing flywheels not as a direct competitor to batteries but as a complementary solution in the global energy storage mix.

| Metric | Value |

|---|---|

| Flywheel Energy Storage Market Estimated Value in (2025 E) | USD 1.4 billion |

| Flywheel Energy Storage Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The flywheel energy storage market draws demand from five core end-use sectors that shape its overall structure, with utilities and grid stabilization holding the largest share at 35% due to increasing reliance on flywheels for frequency regulation, renewable balancing, and rapid-response support. Data centers and IT infrastructure follow with 25%, as the need for uninterrupted power supply and operational resilience makes flywheels attractive for mission-critical environments where downtime is not tolerated. Transportation and rail account for around 15%, particularly in regenerative braking and hybrid locomotive systems where high cycle durability is vital, while the industrial and manufacturing sector also holds 15%, supported by applications in backup energy, equipment protection, and voltage stabilization.

The remaining 10% is concentrated in aerospace, defense, and niche projects where reliability and high-power bursts are essential for advanced systems. The combined dominance of utilities and data centers, together making up 60% of the market, illustrates how reliability, grid integration, and uninterrupted operations are the strongest growth anchors. At the same time, transportation and industrial demand add balance, while aerospace and defense introduce diversification.

The current market environment is shaped by the increasing deployment of flywheel systems in applications requiring rapid response and high cycle durability, particularly as energy grids become more decentralized and complex.

The shift towards cleaner energy sources has underscored the importance of reliable energy storage that can smooth fluctuations and support peak load management. Furthermore, technological advancements in flywheel materials and control systems are enhancing efficiency and lowering costs, which positively impacts market growth.

The outlook remains promising as industries and utilities increasingly adopt flywheel energy storage to meet regulatory requirements, improve energy efficiency, and support sustainability goals, particularly in regions prioritizing green energy transitions.

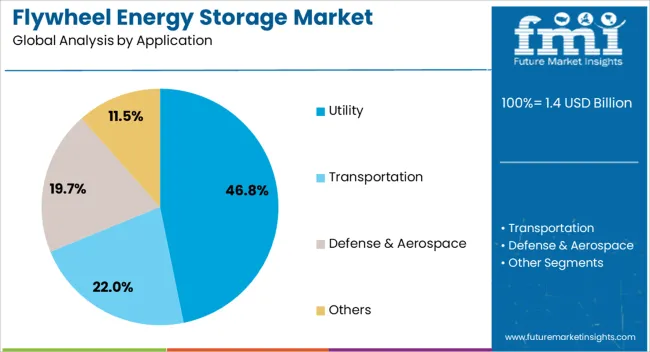

The flywheel energy storage market is segmented by application, and geographic regions. By application, flywheel energy storage market is divided into Utility, Transportation, Defense & Aerospace, and Others. Regionally, the flywheel energy storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Utility application segment is projected to hold 46.8% of the Flywheel Energy Storage market revenue share in 2025, marking it as the leading application area. This prominence is attributed to the critical role flywheel technology plays in grid stabilization, frequency regulation, and uninterruptible power supply systems within utility infrastructures.

The growth of this segment has been supported by the technology’s ability to provide rapid discharge and recharge cycles, high reliability, and low maintenance requirements, which are essential for maintaining grid resilience. The utility sector’s increasing focus on integrating renewable energy sources has created demand for flywheel storage solutions capable of addressing intermittency and improving power quality.

As energy transition efforts intensify globally, the utility segment is expected to continue dominating due to its strategic importance in ensuring energy stability and meeting evolving regulatory standards.

Flywheel energy storage is advancing through demand from utilities, data centers, transportation, and industrial sectors. Its unique strengths in reliability and rapid discharge ensure stable, long-term growth across diverse applications.

Flywheel energy storage is increasingly relied upon by utilities for grid stabilization and frequency regulation. The ability to provide an instantaneous response to fluctuations makes it particularly effective where renewable penetration is high. Grid operators prefer flywheels in regions facing rising intermittency, as the technology provides short bursts of energy with exceptional reliability. This sector accounts for the largest demand share, reflecting the strong link between renewable integration and energy balance. The growing complexity of energy networks will keep utilities as the prime adopters, ensuring consistent use of flywheels as a complementary technology to batteries rather than a competitor.

Data centers represent a significant opportunity for flywheel adoption due to their need for uninterrupted power. Unlike chemical batteries, flywheels provide rapid, repeatable bursts of energy, ensuring operations continue seamlessly during outages or grid instabilities. Operators appreciate their long cycle life, reduced maintenance, and ability to bridge power gaps until backup generators activate. This reliability supports the increasing importance of data centers in global digital economies. The rise of AI computing, cloud storage, and edge data facilities will further elevate demand, as downtime carries massive financial risks. Flywheels are positioned to serve this high-value segment with stability and performance.

Flywheel systems are gaining visibility in transportation and rail applications, particularly for regenerative braking in trains and hybrid locomotives. Their ability to cycle endlessly without significant degradation makes them ideal for high-frequency braking and acceleration cycles. Rail networks are adopting them as a cost-saving and efficiency-improving solution, while hybrid vehicle applications are being explored for specific commercial uses. The sector benefits from growing urban and intercity rail investments, where energy recovery is critical. This segment, though smaller than utilities or data centers, provides significant proof of flywheel resilience in high-demand operational environments, demonstrating versatility beyond stationary storage.

Industries are turning to flywheels for equipment protection, voltage stabilization, and backup energy, particularly in heavy-duty environments where downtime is costly. Aerospace and defense also represent emerging opportunities, using flywheels in specialized projects that require durability, reliability, and rapid power discharge.

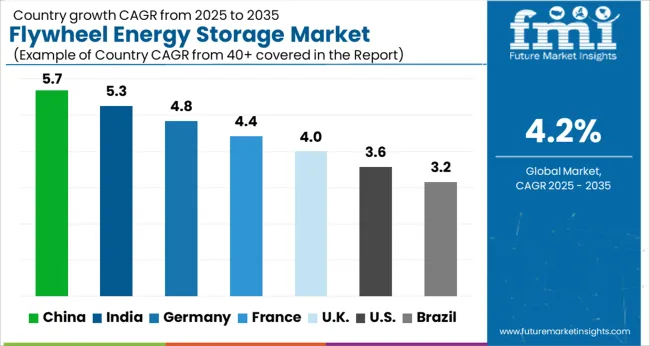

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

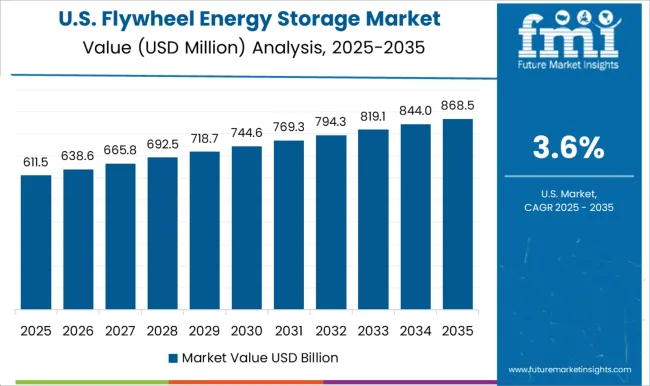

| USA | 3.6% |

| Brazil | 3.2% |

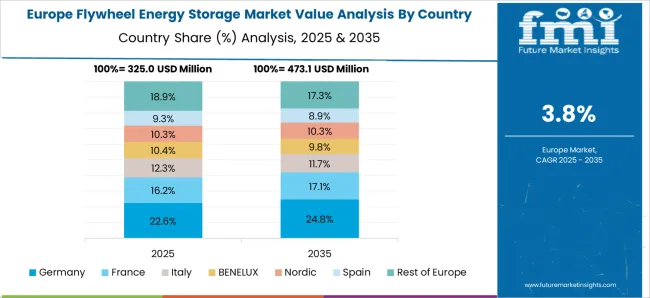

The global flywheel energy storage market is projected to grow at a CAGR of 4.2% between 2025 and 2035. China leads with 5.7%, driven by rapid adoption in grid stabilization, renewable integration, and large-scale infrastructure projects. India follows at 5.3%, supported by its expanding renewable sector, growing industrial demand, and government-backed investments in advanced storage technologies. Germany, with 4.8%, benefits from strong regulatory frameworks, engineering expertise, and its focus on energy efficiency within industrial and grid systems. France records 4.4%, reflecting growth in aerospace, defense, and renewable energy integration, where reliability and resilience are critical. The UK, at 4.0%, emphasizes niche adoption across rail, defense, and industrial applications, while the USA., with 3.6%, maintains steady progress with data centers, microgrids, and specialized energy storage projects. Asia leads in scale and adoption speed, while Europe highlights compliance, engineering standards, and sector-specific integration, with North America reflecting steady yet highly specialized growth. The analysis spans over 40 countries, with the leading contributors highlighted below.

The flywheel energy storage market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035, driven by the nation’s strong grid modernization initiatives and renewable integration efforts. China’s expanding solar and wind power capacity requires advanced frequency regulation systems, where flywheels are becoming an attractive solution. Industrial applications are also contributing, as manufacturing clusters seek reliable backup and power stabilization. Domestic technology firms are increasing production and partnering with research institutions to enhance flywheel performance and reduce costs. China’s combination of policy-driven renewable adoption and strong industrial activity ensures that it will remain the leading global hub for flywheel deployment.

The flywheel energy storage market in India is forecasted to grow at a CAGR of 5.3% between 2025 and 2035, supported by government-backed clean energy policies and rapid industrial growth. The expansion of renewable power, particularly solar, has intensified the need for fast-response energy storage. Flywheels are also finding a role in metro rail systems through regenerative braking and in data centers requiring reliable short-duration backup. Domestic startups are collaborating with global technology providers to develop cost-effective systems suited to India’s conditions. India’s market is gaining momentum from its dual push toward renewable energy and digital infrastructure, creating a wide array of adoption opportunities.

The flywheel energy storage market in France is projected to grow at a CAGR of 4.4% from 2025 to 2035, supported by the nation’s energy transition strategy and aerospace applications. Utilities are adopting flywheels for frequency regulation as renewable sources increase grid variability. The aerospace and defense industries are exploring specialized flywheel designs for advanced power systems, strengthening demand beyond conventional energy markets. Research institutions in France are also engaged in advancing flywheel materials to improve efficiency and durability. France’s growth trajectory highlights how sectoral diversification, especially into aerospace and defense, positions it uniquely compared to other European markets.

The flywheel energy storage market in the United Kingdom is expected to grow at a CAGR of 4.0% between 2025 and 2035, shaped by applications in rail networks, defense, and industrial infrastructure. The UK rail sector is adopting flywheels to improve efficiency in regenerative braking, while defense projects are evaluating high-performance energy storage systems for operational resilience. Industrial users are showing interest in flywheels to stabilize power fluctuations and protect equipment. The UK market stands out for its reliance on niche applications rather than large-scale adoption, but this diversification ensures steady growth despite moderate overall expansion.

The flywheel energy storage market in the United States is projected to grow at a CAGR of 3.6% from 2025 to 2035, expanding steadily but with specialized adoption. Data centers are leading the demand, using flywheels as reliable short-duration backup systems. Microgrids in universities, hospitals, and military bases are integrating flywheels for rapid-response capabilities and resilience. Industrial applications also play a role, particularly in sectors where equipment protection and high uptime are critical. The US market remains defined by niche, high-value applications rather than broad deployment, but its emphasis on reliability and specialized use cases keeps flywheels relevant in the energy storage mix.

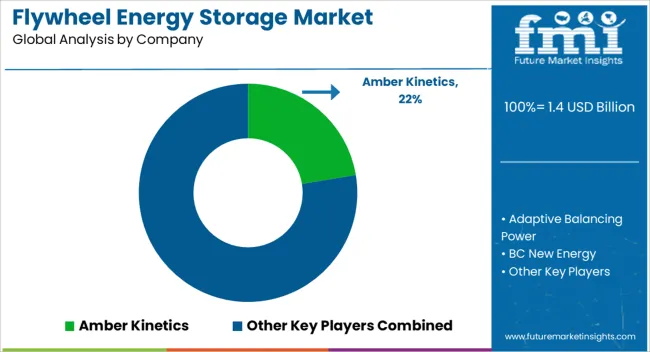

Competition in the flywheel energy storage market is characterized by efficiency in energy density, system scalability, operational lifetime, and cost competitiveness across grid balancing, renewable integration, UPS systems, and transport applications. Leading players such as Amber Kinetics, VYCON, and POWERTHRU maintain an edge with large-scale deployments, commercial readiness, and proven track records in data centers, healthcare, and industrial backup solutions. Their global presence and partnerships with utilities strengthen their foothold in advanced energy storage ecosystems. European innovators like Adaptive Balancing Power, OXTO Energy, and STORNETIC are driving regional growth through compact, modular flywheel systems that enhance frequency regulation and short-duration storage.

These companies emphasize precision engineering, lower maintenance needs, and flexible integration with renewable grids. Niche developers such as Energiestro and BC New Energy focus on novel designs and cost-reduction strategies, targeting specific applications like decentralized storage and emerging renewable installations. Mid-tier specialists such as PUNCH Flybrid apply flywheel technology to transportation and hybrid systems, capitalizing on high-efficiency energy recovery in automotive and motorsport applications. Langley Holdings leverages industrial engineering and manufacturing depth to strengthen flywheel adoption in mission-critical power systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Application | Utility, Transportation, Defense & Aerospace, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amber Kinetics, Adaptive Balancing Power, BC New Energy, Energiestro, Langley Holdings, OXTO Energy, PUNCH Flybrid, POWERTHRU, STORNETIC, and VYCON |

| Additional Attributes | Dollar sales by product type, share across utilities, data centers, and transport, regional adoption rates, and cost dynamics including CAPEX vs OPEX. |

The global flywheel energy storage market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the flywheel energy storage market is projected to reach USD 2.0 billion by 2035.

The flywheel energy storage market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in flywheel energy storage market are utility, transportation, defense & aerospace and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Energy Gel Market Outlook – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA