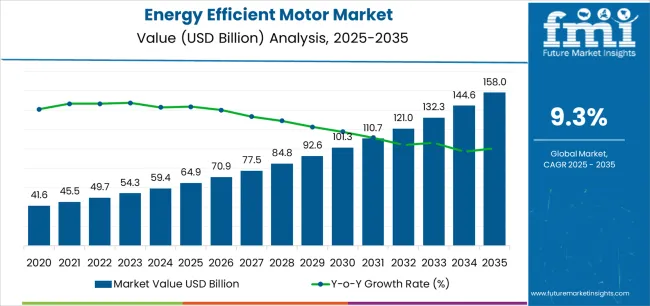

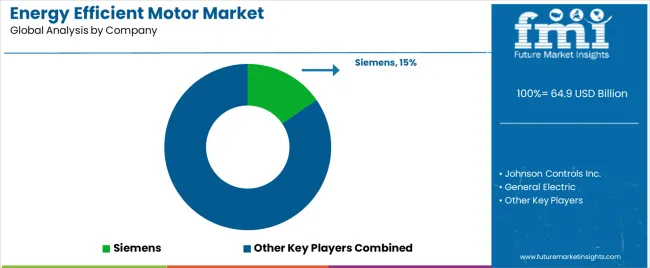

The Energy Efficient Motor Market is estimated to be valued at USD 64.9 billion in 2025 and is projected to reach USD 158.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.3% over the forecast period.

The energy efficient motor market is witnessing robust expansion, propelled by growing emphasis on energy conservation, stringent efficiency regulations, and the transition toward sustainable industrial practices. Rising electricity costs and increasing awareness of lifecycle savings have encouraged industries to replace conventional motors with high-efficiency alternatives.

Governments and regulatory bodies are mandating minimum efficiency standards, further accelerating adoption. Technological advancements in motor design, coupled with integration of variable frequency drives and smart control systems, are enhancing overall performance.

The market outlook is strengthened by its critical role in reducing carbon emissions and optimizing operational productivity across sectors such as manufacturing, HVAC, and water treatment. Continued investment in automation and renewable energy integration will further drive market growth..

| Metric | Value |

|---|---|

| Energy Efficient Motor Market Estimated Value in (2025 E) | USD 64.9 billion |

| Energy Efficient Motor Market Forecast Value in (2035 F) | USD 158.0 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

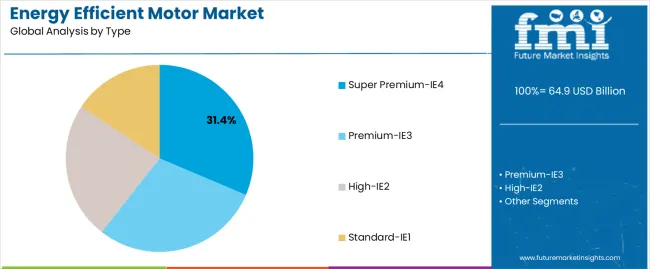

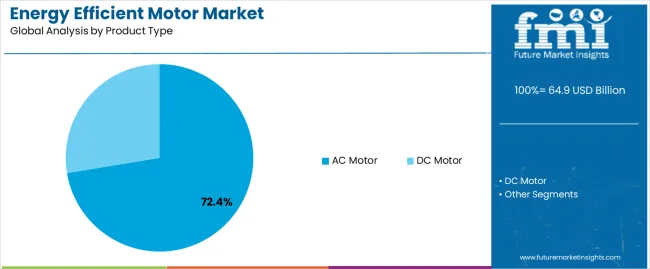

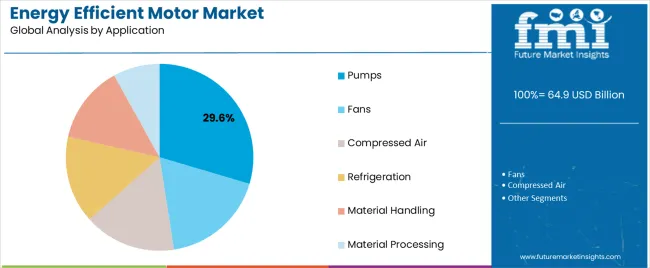

The market is segmented by Type, Product Type, Application, and End User and region. By Type, the market is divided into Super Premium-IE4, Premium-IE3, High-IE2, and Standard-IE1. In terms of Product Type, the market is classified into AC Motor and DC Motor. Based on Application, the market is segmented into Pumps, Fans, Compressed Air, Refrigeration, Material Handling, and Material Processing. By End User, the market is divided into Industrial, Commercial, Residential, Agriculture Sector, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

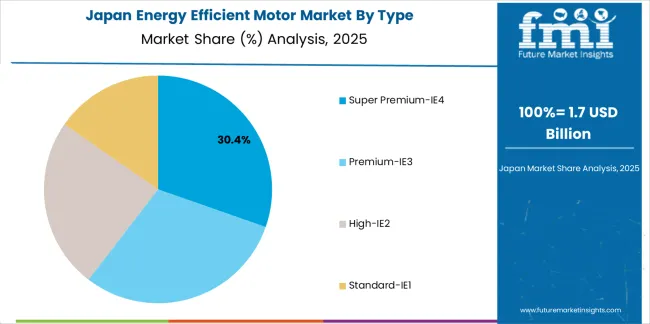

The super premium-IE4 segment holds approximately 31.40% share in the type category, representing the most advanced efficiency class in electric motors. Its superior performance in minimizing energy losses and operational costs has made it increasingly preferred in high-duty applications.

The segment’s expansion is reinforced by regulatory frameworks promoting IE4 compliance and end-user initiatives aimed at reducing total energy consumption. Although initial costs are higher, long-term savings and enhanced reliability justify investment.

Industries with continuous operation cycles, such as process manufacturing and utilities, have shown strong adoption. With the global shift toward sustainable production, the super premium-IE4 segment is expected to gain further traction during the forecast period..

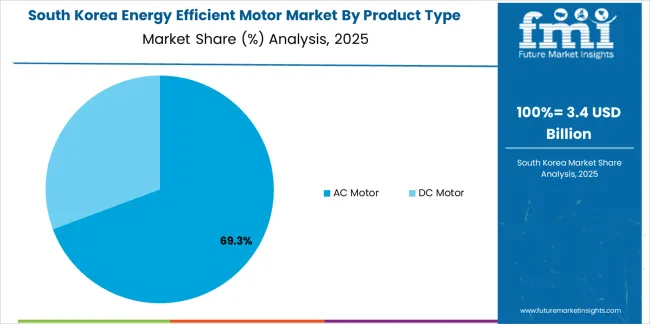

The AC motor segment dominates the product type category with approximately 72.40% share, driven by its versatility, scalability, and efficiency across industrial and commercial applications. AC motors are favored for their simple design, low maintenance, and ability to handle varying loads efficiently.

Technological advancements, including the incorporation of permanent magnet and synchronous designs, have enhanced energy savings and operational flexibility. The segment also benefits from wide availability and compatibility with modern automation systems.

With ongoing modernization of industrial equipment and strong regulatory support for efficient drive systems, the AC motor segment is expected to retain its leadership position globally..

The pumps segment holds approximately 29.60% share of the application category, supported by extensive use of energy efficient motors in water supply, wastewater management, and industrial fluid handling. Motors used in pumping systems account for a significant portion of global electricity consumption, making efficiency improvements a key focus area.

The segment benefits from ongoing infrastructure development, urbanization, and the increasing demand for sustainable water management solutions. Energy savings, reduced operating costs, and compliance with environmental standards have accelerated adoption.

As water treatment and irrigation projects expand worldwide, the pumps segment is expected to remain a primary driver of energy efficient motor demand..

The energy efficient motor market is anticipated to surpass a valuation of USD 158.0 billion by 2035, expanding at a growth rate of 9.8% CAGR. Despite the growth of the market, higher upfront costs can deter customers, especially in price-sensitive markets or industries.

| Attributes | Details |

|---|---|

| Top Type | Super premium IE4 |

| CAGR (2025 to 2035) | 9.5% |

Super premium IE4 dominates the market based on the type. The segment is expected to expand at a 9.5% CAGR through 2035. This rising popularity of the segment is attributed to:

| Attributes | Details |

|---|---|

| Top Product Type | AC Motor |

| CAGR (2025 to 2035) | 9.3% |

Based on the product type, AC motors dominate the market, expanding at an annual growth of 9.3% CAGR over the forecast period. The segment’s rising popularity is attributed to:

The section analyzes the energy efficient market by country, including the United States, the United Kingdom, China, Japan, and South Korea. The table presents the CAGRs for each country, indicating the expected market growth through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 10.2% |

| United Kingdom | 11.2% |

| China | 10.7% |

| Japan | 11.0% |

| South Korea | 7.8% |

The United Kingdom is the leading European country in the energy efficiency motor market, and it is predicted to register an annual growth rate of 11.2% through 2035.

The United States dominates the energy efficiency motor market in the North American region. It is expected to exhibit an annual growth rate of 10.2% until 2035.

China is another Asian country in the global energy efficient motor market. The Chinese market is anticipated to register a CAGR of 10.7% through 2035.

Japan is one of the leading Asian countries in the energy efficient motor market. The Japanese market is anticipated to register a CAGR of 11.0% through 2035.

South Korea is another Asian country in the energy efficient motor market. The Korean market is expected to grow annually at a CAGR of 7.8% until 2035.

Siemens AG is a leading player in the energy efficient motor market, with a wide range of innovative solutions across various industries. The company's commitment to technology, sustainability, and digitalization has helped it become a market leader.

ABB Ltd. is another key player focused on sustainability; its global presence and strategic partnerships have made it a leading provider of energy-efficient motor solutions, driving market growth and innovation.

The emphasis on research and development, strong manufacturing capabilities, and global distribution network of WEG Industries enables it to meet the unique needs of industries seeking energy-efficient solutions.

Nidec Corporation has extensive expertise in motor technologies and a focus on sustainability, continuous innovation, and strategic investments to help drive growth and foster market expansion by providing cutting-edge motor solutions tailored to the unique requirements of diverse industries and applications.

Recent Developments

The global energy efficient motor market is estimated to be valued at USD 64.9 billion in 2025.

The market size for the energy efficient motor market is projected to reach USD 158.0 billion by 2035.

The energy efficient motor market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in energy efficient motor market are super premium-ie4, premium-ie3, high-ie2 and standard-ie1.

In terms of product type, ac motor segment to command 72.4% share in the energy efficient motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Energy Gel Market Outlook – Size, Share & Forecast 2025–2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA