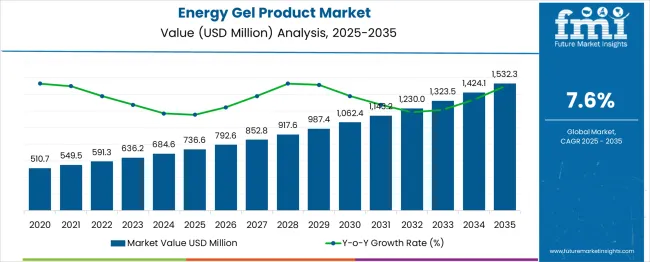

The Energy Gel Product Market is estimated to be valued at USD 736.6 million in 2025 and is projected to reach USD 1479.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The energy gel product market is experiencing steady expansion due to the growing popularity of endurance sports, rising consumer focus on fitness nutrition, and increasing awareness regarding rapid energy replenishment solutions. Market growth is being supported by product innovation, advancements in formulation technology, and the development of gels enriched with electrolytes, amino acids, and natural ingredients.

The current scenario reflects a surge in demand among athletes, fitness enthusiasts, and recreational runners who prefer portable and quick-consumption energy formats. Manufacturers are emphasizing clean labeling, sugar reduction, and natural flavor enhancement to align with evolving health-conscious preferences.

The future outlook remains positive as distribution channels expand globally and brand penetration increases across both developed and emerging regions Growth rationale is anchored on rising disposable incomes, greater participation in sports and fitness events, and continuous improvement in packaging convenience, all contributing to sustained consumption and a favorable long-term market trajectory.

| Metric | Value |

|---|---|

| Energy Gel Product Market Estimated Value in (2025 E) | USD 736.6 million |

| Energy Gel Product Market Forecast Value in (2035 F) | USD 1479.1 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

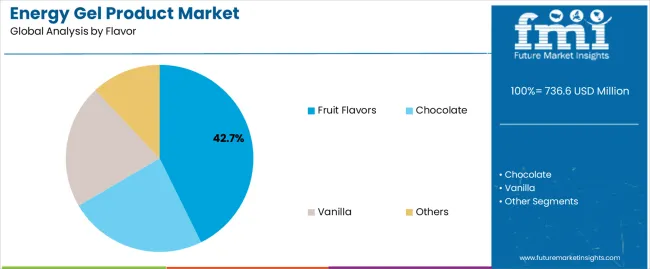

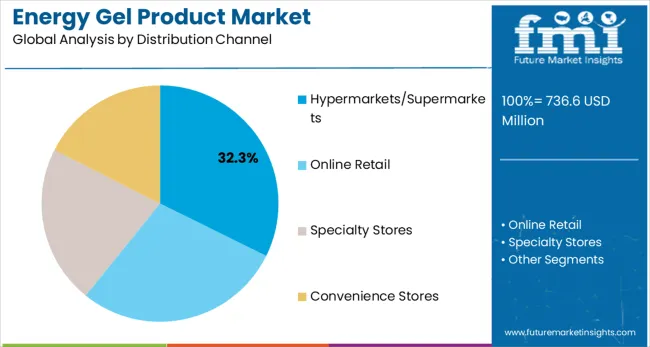

The market is segmented by Flavor and Distribution Channel and region. By Flavor, the market is divided into Fruit Flavors, Chocolate, Vanilla, and Others. In terms of Distribution Channel, the market is classified into Hypermarkets/Supermarkets, Online Retail, Specialty Stores, and Convenience Stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fruit flavors segment, accounting for 42.70% of the flavor category, has emerged as the dominant segment due to its wide consumer appeal and perceived natural profile. Its popularity has been reinforced by consistent product launches offering familiar and refreshing taste options such as citrus, berry, and tropical variants.

Demand has been strengthened by consumer preference for natural ingredients and clean formulations that complement active lifestyles. The segment’s stability is further supported by high adoption in endurance sports, where flavor variety plays a key role in maintaining user compliance during long training sessions or events.

Manufacturers are leveraging flavor innovation as a primary differentiation strategy to enhance brand recognition and loyalty Continued focus on organic and natural fruit-based formulations is expected to drive segment growth, ensuring that fruit flavors remain integral to the energy gel product market landscape.

The hypermarkets and supermarkets segment, holding 37.40% of the distribution channel category, has maintained a leading position due to its extensive consumer reach and established retail infrastructure. This segment benefits from high product visibility, wide brand assortment, and promotional accessibility, which collectively enhance consumer purchasing confidence.

Availability of multi-brand offerings and convenience of bulk purchasing have contributed to sustained sales momentum. Retailers are increasingly collaborating with sports nutrition brands to expand shelf space and integrate in-store sampling initiatives that promote product trial.

The channel’s dominance is reinforced by the rising trend of health and wellness aisles within large retail formats, ensuring accessibility to a diverse consumer base Expansion of organized retail networks, coupled with growing urbanization and fitness awareness, is expected to further consolidate the role of hypermarkets and supermarkets as a primary distribution hub for energy gel products.

Fruit flavor energy gel products are preferred by a vast number of consumers. Hypermarkets/supermarkets are the predominant place where consumers are obtaining energy gel products.

Fruit flavor energy gel products are expected to account for 33.7% of the market share by flavor in 2025. Some of the factors influencing the progress of fruit flavor energy gel products are:

| Attributes | Details |

|---|---|

| Top Flavor | Fruit Flavors |

| Market Share (2025) | 33.7% |

Hypermarkets/supermarkets are anticipated to account for 32.3% of the market share by sales channel in 2025. Some of the reasons for the progress of hypermarkets/supermarkets sales of the product are:

| Attributes | Details |

|---|---|

| Top Sales Channel | Hypermarkets/supermarkets |

| Market Share (2025) | 32.3% |

The Asia Pacific is emerging as a significant hub for the region due to its notable fitness culture. The increasing urban population of the region is also contributing to the market’s acceleration in the region.

Europe’s ever-continuing sports culture helps the market’s cause in the region. The lives of customers in the region getting increasingly busy is also propelling the demand for energy-boosting products in the region, including energy gel products.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Poland | 11.3% |

| Russia | 8.9% |

| Japan | 9.5% |

| China | 8.5% |

| South Korea | 10.3% |

The CAGR of the market for the forecast period in Poland is anticipated to be 11.3%. Some of the factors influencing the growth of the market in the country are:

The market is expected to have a CAGR of 8.9% in Russia through 2035. Some of the factors responsible for the growth of the market are:

The market is expected to progress at a CAGR of 9.5% in Japan for the forecast period. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 8.5% in China throughout the forecast period. Some factors influencing the progress are:

The market is expected to progress at a CAGR of 10.3% in South Korea. Some factors influencing the progress are:

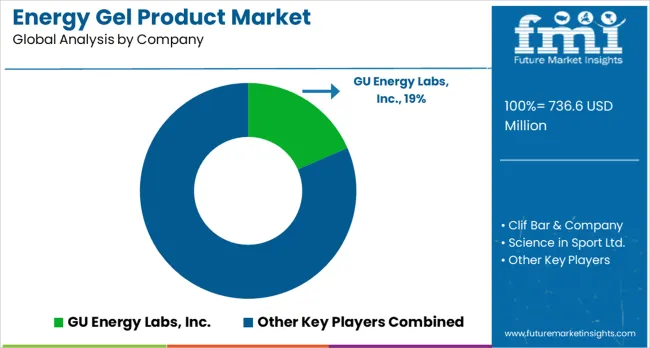

Market players in the energy gel product landscape are taking the help of celebrity endorsements to expand their reach. The development of new products to keep an ever-widening roster available to consumers is concentrated on by market players.

Fitness brands are entering the energy gel product market, sensing the opportunities lurking in it. Collaborative as well as acquisition strategies are being practiced by market players.

Recent Developments in the Energy Gel Product Market

The global energy gel product market is estimated to be valued at USD 736.6 million in 2025.

The market size for the energy gel product market is projected to reach USD 1,479.1 million by 2035.

The energy gel product market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in energy gel product market are fruit flavors, chocolate, vanilla and others.

In terms of distribution channel, hypermarkets/supermarkets segment to command 37.4% share in the energy gel product market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Window and Door Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Leading Providers & Market Share in Energy Gel Industry

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA