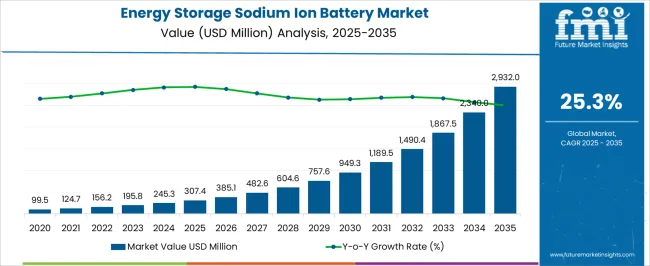

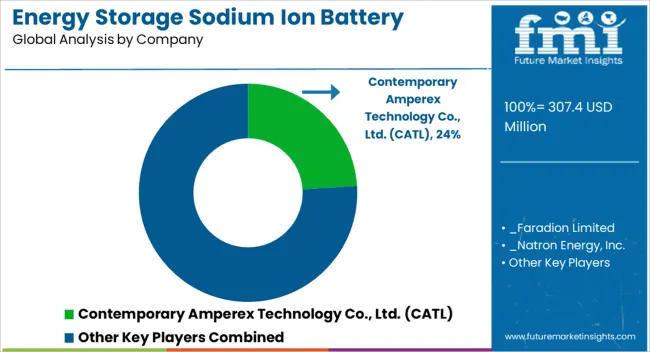

The energy storage sodium ion battery market is estimated to be valued at USD 307.4 million in 2025 and is projected to reach USD 2932.0 million by 2035, registering a compound annual growth rate (CAGR) of 25.3% over the forecast period.

A decade-long comparison underscores how the market is set to evolve from its early commercialization phase into a robust global segment, fueled by the increasing demand for cost-effective, sustainable, and high-performance alternatives to lithium-ion batteries. In the initial five years, growth is expected to be exponential, with the market expanding from USD 307.4 million in 2025 to more than USD 757.6 million by 2030, driven by pilot-scale projects, advancements in cathode and anode materials, and support from clean energy policies. By the mid-decade point of 2030, the industry is expected to move beyond testing into large-scale adoption, particularly in grid storage, renewable energy integration, and electric mobility.

The latter half of the decade will see even stronger momentum, with the market forecasted to cross USD 1,867.5 million by 2033 and peak at USD 2,932.0 million by 2035. This surge reflects the role sodium-ion batteries will play in addressing resource security concerns, reducing reliance on lithium, and enabling energy transition targets. When compared across the 10-year span, the market’s more than nine-fold expansion highlights how continuous technological refinements, collaborations between battery innovators and energy utilities, and government-backed commercialization incentives will position sodium-ion as a mainstream energy storage solution by 2035.

| Metric | Value |

|---|---|

| Energy Storage Sodium Ion Battery Market Estimated Value in (2025 E) | USD 307.4 million |

| Energy Storage Sodium Ion Battery Market Forecast Value in (2035 F) | USD 2932.0 million |

| Forecast CAGR (2025 to 2035) | 25.3% |

The energy storage sodium ion battery market holds a vital role within the global next-generation battery ecosystem, accounting for nearly 20–22% share of the broader emerging energy storage technologies segment, owing to its cost-effectiveness and reliance on abundant sodium resources. Within the stationary grid-scale storage category, sodium ion batteries represent about 15–17% share, supported by their ability to deliver stable performance for renewable energy integration and peak load management. In the electric mobility solutions domain, they capture close to 10–12% share, driven by rising interest from two-wheeler and small EV manufacturers seeking alternatives to lithium-ion systems where cost and safety are prioritized.

Their presence in consumer electronics remains smaller, around 6–8%, yet expanding as manufacturers experiment with sodium-based chemistries for mid-range devices. The market is also strengthening its position within the sustainable materials and recycling domain, holding about 12–14% share, due to the non-toxic, widely available, and environmentally safer profile of sodium compared to lithium. Growth momentum is underpinned by ongoing R&D, scale-up of pilot projects, and government initiatives promoting diversification of energy storage technologies to reduce lithium dependence. While challenges such as lower energy density and limited cycle life compared to advanced lithium-ion systems remain, sodium ion batteries are gaining traction as an affordable and scalable solution. Partnerships between energy utilities, automotive OEMs, and material suppliers are accelerating deployment, positioning the sodium ion battery market as an increasingly influential pillar in global energy storage strategies.

The market is experiencing notable growth as demand for sustainable and cost-effective energy storage solutions increases across various sectors. With sodium-based chemistries offering advantages in raw material availability and lower cost compared to lithium-based counterparts, adoption is gaining momentum in stationary storage, grid balancing, and renewable integration applications.

Advancements in electrode materials, electrolyte formulations, and manufacturing processes are improving performance, cycle life, and safety profiles, enhancing the competitiveness of sodium ion technologies. Government policies promoting clean energy deployment and localized battery manufacturing are further accelerating market uptake.

The market outlook remains positive, supported by increasing renewable penetration, decentralized energy systems, and industrial decarbonization initiatives As production scales and supply chains mature, sodium ion batteries are expected to capture a larger share of the global energy storage space, positioning them as a viable alternative for both short and long-duration storage requirements.

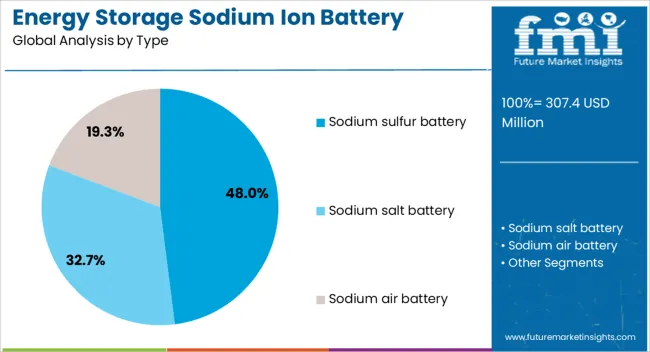

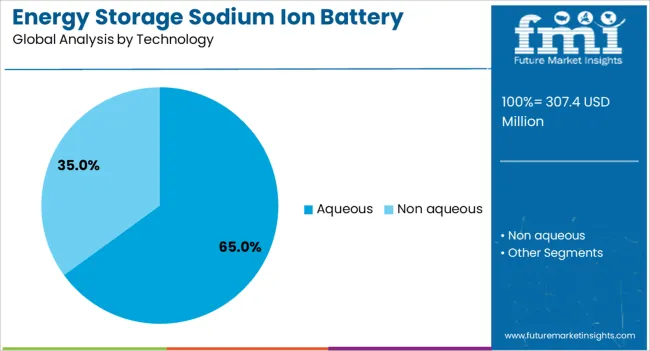

The energy storage sodium ion battery market is segmented by type, technology, and geographic regions. By type, energy storage sodium ion battery market is divided into sodium sulfur battery, sodium salt battery, and sodium air battery. In terms of technology, energy storage sodium ion battery market is classified into aqueous and non aqueous. Regionally, the energy storage sodium ion battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sodium sulfur battery technology segment is projected to hold 48% of the energy storage sodium ion battery market revenue share in 2025, making it the leading technology type. This dominance has been driven by the technology’s high energy density, long cycle life, and strong performance in large-scale stationary storage applications. Its capability to operate efficiently in high-temperature environments has made it suitable for grid-scale deployments, particularly in renewable integration and peak load shifting. The segment has benefited from ongoing innovations in materials engineering that enhance thermal stability and reduce degradation rates, thereby lowering total cost of ownership. The compatibility of sodium sulfur batteries with long-duration storage needs has strengthened their position in utility-scale projects Additionally, increased investment from power utilities and industrial sectors in resilient and scalable storage infrastructure has reinforced the adoption of this technology, ensuring its continued leadership in the market.

The aqueous technology segment is anticipated to command 65% of the market revenue share in 2025, establishing it as the dominant technology format. Growth in this segment has been supported by its inherent safety advantages, as aqueous electrolytes significantly reduce fire risks compared to non-aqueous alternatives. The segment has also gained traction due to cost efficiencies in manufacturing and the abundance of raw materials, aligning with the growing emphasis on sustainable and localized production. Aqueous systems exhibit strong performance in moderate-temperature environments, making them suitable for commercial, residential, and certain grid-level applications. Furthermore, research advancements have improved energy density and extended operational lifespan, enabling broader adoption in distributed energy systems The ability to integrate with renewable energy sources and provide reliable storage without complex thermal management systems has made aqueous technology an attractive choice, reinforcing its leadership within the market.

The sodium ion battery industry is shaped by rising grid demand, cost efficiency, growing mobility applications, and technical challenges. Its affordability and resource abundance position it as a strong alternative to lithium-based systems.

The energy storage sodium ion battery industry is experiencing heightened demand as governments and utilities prioritize grid stability. Renewable integration requires reliable storage, and sodium ion technology offers a cost-effective alternative to lithium-based systems. These batteries are being adopted in peak load management, renewable balancing, and rural electrification projects. Their reliance on abundant sodium resources provides an economic advantage, making them attractive in regions with high energy needs but limited lithium access. With performance improvements enabling stable cycling and enhanced safety, sodium ion batteries are gradually gaining trust in utility-scale deployments. Their role in strengthening power networks positions them as an important solution for growing global energy requirements.

Affordability is a decisive factor propelling sodium ion battery adoption across both developed and emerging markets. Unlike lithium, sodium is inexpensive and widely available, reducing dependence on geographically concentrated supply chains. This economic advantage makes sodium ion batteries appealing for large-scale stationary storage, where cost per cycle is critical. Manufacturers are scaling pilot projects that demonstrate competitiveness in terms of price while ensuring adequate performance. Lower raw material costs, combined with simplified extraction and processing, continue to support industry expansion. These cost-related strengths reinforce sodium ion batteries as a pragmatic choice for applications requiring scalable and economical energy storage.

Sodium ion batteries are finding growing relevance in the electric mobility sector, particularly for two-wheelers, three-wheelers, and small EVs where cost and safety are prioritized over high energy density. Their thermal stability and lower flammability risks enhance safety compared to certain lithium chemistries. Manufacturers in Asia are testing sodium ion batteries as substitutes for lead-acid systems, offering improved efficiency and reduced lifecycle costs. While not yet dominant in passenger EVs, their adoption in light mobility represents an expanding opportunity. This trend illustrates how sodium ion technology is carving a niche in mobility solutions that demand affordability, reliability, and resilience.

Sodium ion batteries continue to face challenges related to energy density and cycle life when compared to advanced lithium-ion counterparts. Their lower storage capacity limits application in high-performance EVs and energy-intensive devices. Shorter cycle life also raises concerns over long-term reliability, especially for large-scale grid storage requiring extensive durability. Manufacturers are focusing on refining electrode materials and optimizing system design to address these hurdles. Although these constraints hinder penetration into certain premium applications, steady improvements and cost benefits ensure continued adoption. Overcoming these technical barriers will be key to unlocking broader opportunities across multiple industries.

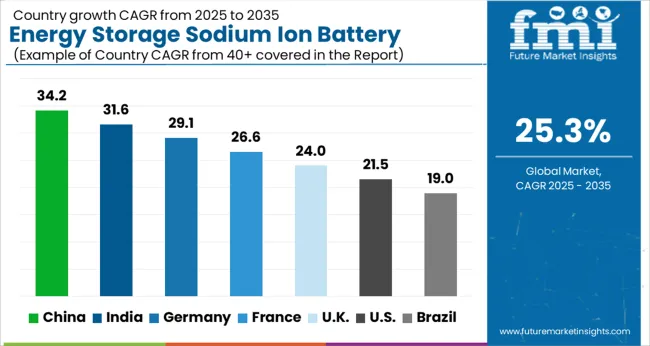

| Country | CAGR |

|---|---|

| China | 34.2% |

| India | 31.6% |

| Germany | 29.1% |

| France | 26.6% |

| UK | 24.0% |

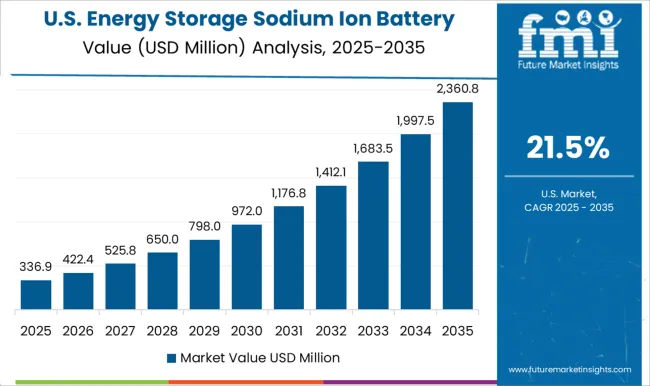

| USA | 21.5% |

| Brazil | 19.0% |

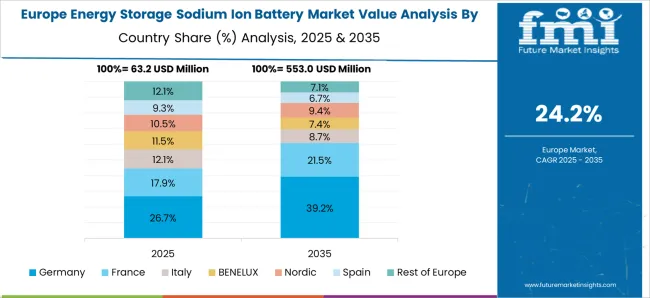

The energy storage sodium ion battery market is projected to expand globally at a CAGR of 25.3% from 2025 to 2035, supported by its affordability, raw material abundance, and suitability for large-scale storage applications. China leads with a CAGR of 34.2%, driven by government-backed energy transition programs, mass-scale renewable integration, and domestic manufacturing capacity. India follows at 31.6%, supported by electrification initiatives, rising renewable power installations, and early adoption in two- and three-wheeler EVs. France posts 26.6%, shaped by renewable integration projects and defense-related storage applications. The United Kingdom achieves 24.0%, with growth influenced by the inclusion of sodium ion technology in energy diversification and smart grid strategies. The United States records 21.5%, reflecting steady but slower adoption due to mature lithium-ion infrastructure, though progress is driven by pilot projects in grid-scale storage and transportation. This performance highlights Asia-Pacific as the fastest-growing region, Europe as a research- and compliance-driven market, and North America as a gradually advancing but mature adopter within the sodium ion battery ecosystem.

China is projected to record a CAGR of 34.2% for 2025–2035, surpassing the global average of 25.3%. During 2020–2024, growth was near 28.7%, supported by pilot deployments in renewable energy storage and localized EV trials. The increase to 34.2% is driven by government-backed renewable integration, domestic manufacturing expansion, and active R&D programs. Large-scale adoption in grid stabilization projects and electric mobility, coupled with cost advantages due to abundant sodium resources, has provided a solid foundation. Provincial subsidies and industrial park investments have accelerated capacity building. In my view, China will continue to dominate global deployment as production scales and export demand rises.

India is forecasted to achieve a CAGR of 31.6% for 2025–2035, above the global 25.3% baseline. Between 2020–2024, CAGR stood at 26.9%, propelled by rural electrification programs, distributed energy systems, and initial EV trials. The progression to 31.6% is shaped by expanding solar and wind projects, government funding for energy diversification, and rising demand for cost-efficient storage technologies. Local startups and public-private collaborations are advancing sodium ion battery adoption across telecom, mobility, and grid balancing applications. In my assessment, India’s growth trajectory signals its emerging role as a leading hub for affordable storage solutions.

France is anticipated to post a CAGR of 26.6% across 2025–2035, higher than the global benchmark of 25.3%. During 2020–2024, CAGR was about 22.1%, driven by EU-backed research programs and trial deployments in grid flexibility projects. The increase reflects strong government support for renewable integration, aerospace-linked research collaborations, and defense-related energy storage needs. France’s policy-driven ecosystem has encouraged domestic manufacturers to invest in sodium ion battery pilot lines while utilities test grid-scale applications. From my perspective, France is set to maintain its growth path as regulatory compliance and innovation clusters strengthen adoption across multiple sectors.

The United Kingdom is projected to register a CAGR of 24.0% for 2025–2035, compared with around 19.8% during 2020–2024, slightly below the global 25.3% benchmark. Early growth was moderate due to limited funding and lithium’s dominance in legacy projects. The shift to 24.0% stems from greater emphasis on grid balancing, offshore renewable projects, and trials of sodium ion technology in urban transport. National energy diversification strategies and collaborations with European technology firms have contributed to momentum. My view is that the UK’s improved adoption pace reflects its transition toward diversified storage options, ensuring long-term resilience.

The United States is expected to deliver a CAGR of 21.5% for 2025–2035, compared with an estimated 17.2% in 2020–2024, under the global 25.3% benchmark. Early adoption was shaped by pilot deployments in universities, research labs, and localized grid storage. The rise to 21.5% is explained by greater interest from utilities, federal research grants, and deployment of sodium ion technology in telecom and mobility sectors. While lithium-ion remains dominant, sodium ion’s cost advantage and resource security are improving its role in diversification strategies. In my opinion, the US will witness gradual but steady growth as policy support and private sector investments evolve.

The energy storage sodium ion battery market is shaped by a mix of global leaders and specialized innovators, including Contemporary Amperex Technology Co., Ltd. (CATL), Faradion Limited, Natron Energy, Inc., TIAMAT / Tiamat Energy, HiNa Battery Technology Co., Ltd., Altris AB, and other manufacturers. These companies compete on scalability, material innovation, cost efficiency, and integration into grid, mobility, and consumer applications. CATL has emerged as the dominant force, leveraging its large-scale manufacturing capacity and partnerships with automotive OEMs to accelerate sodium ion deployment. Faradion, recognized as one of the early pioneers, has built strong credibility in Europe with a focus on commercializing cost-effective sodium ion technology for mobility and stationary storage. Natron Energy emphasizes its Prussian blue electrode technology, offering enhanced cycle life and rapid charge capabilities.

TIAMAT Energy and HiNa Battery Technology have advanced research-driven portfolios, with HiNa leading pilot-scale commercial projects in China and Tiamat driving adoption across European applications. Altris AB is positioning itself through innovations in cathode materials and expanding partnerships across Nordic energy ecosystems. Other regional players and start-ups are entering the market with tailored solutions, often backed by government funding and R&D programs. The competitive landscape reflects a balance between large incumbents with scale advantages and smaller innovators driving breakthroughs in chemistry and performance. Strategic directions focus on expanding pilot deployments, improving cycle stability, reducing production costs, and integrating sodium ion batteries into mainstream energy storage and mobility applications. Industry growth is expected to accelerate as collaborations between utilities, automotive manufacturers, and research institutions mature, positioning sodium ion batteries as a viable alternative to lithium-ion in the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 307.4 million |

| Type | Sodium sulfur battery, Sodium salt battery, and Sodium air battery |

| Technology | Aqueous and Non aqueous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Contemporary Amperex Technology Co., Ltd. (CATL), Faradion Limited, Natron Energy, Inc., Tiamat Energy, HiNa Battery Technology Co., Ltd., Altris AB |

| Additional Attributes | Dollar sales, share, raw material availability, cost advantages over lithium, regional adoption trends, competitor pipelines, utility partnerships, and EV integration prospects. |

The global energy storage sodium ion battery market is estimated to be valued at USD 307.4 million in 2025.

The market size for the energy storage sodium ion battery market is projected to reach USD 2,932.0 million by 2035.

The energy storage sodium ion battery market is expected to grow at a 25.3% CAGR between 2025 and 2035.

The key product types in energy storage sodium ion battery market are sodium sulfur battery, sodium salt battery and sodium air battery.

In terms of technology, aqueous segment to command 65.0% share in the energy storage sodium ion battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

New Energy Vehicle Electric Drive Systems Market Size and Share Forecast Outlook 2025 to 2035

USA Energy Gel Market Outlook – Size, Share & Forecast 2025–2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA