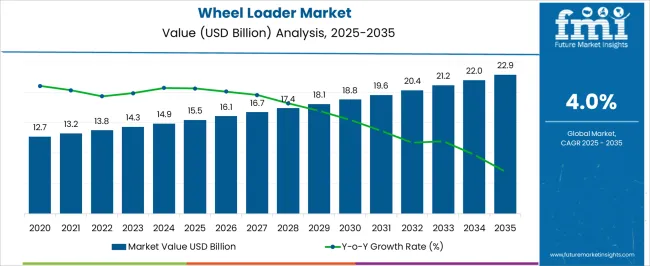

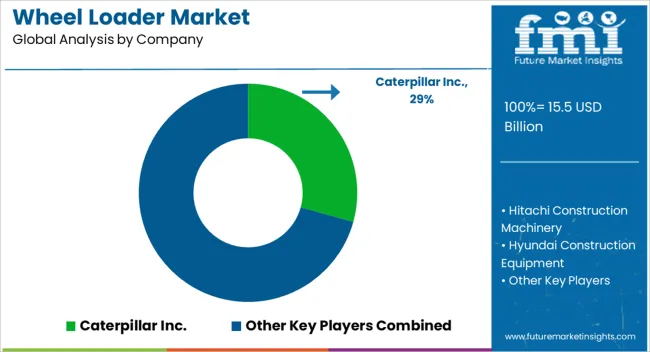

The wheel loader market is anticipated to reach USD 15.5 billion in 2025 and is projected to grow to USD 22.9 billion by 2035, creating an absolute dollar opportunity of USD 7.4 billion during the forecast period at a CAGR of 4.0%. This growth momentum is driven by the increasing demand for efficient material handling solutions across sectors such as construction, mining, and agriculture.

By 2028, the market is expected to reach USD 14.3 billion and continue growing to USD 14.9 billion in 2029, with key investments in heavy machinery and equipment upgrades. Projections beyond 2026 indicate values of USD 16.1 billion in 2027, USD 16.7 billion in 2028, and USD 17.4 billion in 2029, supported by rising demand in emerging markets and technological advancements in equipment design. By 2030, the market is expected to hit USD 18.1 billion, and continue its growth trajectory, reaching USD 19.6 billion in 2032, and USD 21.2 billion in 2034, with a final projection of USD 22.9 billion in 2035, driven by infrastructure projects, technological adoption, and the growing demand for versatile machinery across industries.

| Metric | Value |

|---|---|

| Wheel Loader Market Estimated Value in (2025 E) | USD 15.5 billion |

| Wheel Loader Market Forecast Value in (2035 F) | USD 22.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The wheel loader market is shaped by several interconnected parent markets that collectively influence its growth trajectory and demand. The construction equipment market holds the largest share at 40%, as wheel loaders are critical in managing material handling tasks across large-scale construction projects, roadworks, and earthmoving operations. The mining machinery market contributes around 25%, driven by the need for high-efficiency loaders to move large quantities of material in mining sites, where productivity and durability are key.

The agriculture equipment market represents 15%, with the demand for wheel loaders rising as modern farming practices require versatile machines for loading, lifting, and moving materials. The infrastructure development market accounts for 10%, reflecting the growing need for wheel loaders in public works, road maintenance, and urban expansion projects. The remaining 10% comes from the logistics and warehousing market, where the role of wheel loaders in material handling and logistics operations in distribution centers continues to expand. These parent markets highlight that the wheel loader market's growth is primarily driven by construction, mining, and agriculture, with the increase in infrastructure projects and logistics operations offering additional avenues for market expansion.

The wheel loader market is experiencing robust expansion driven by rising infrastructure development, increased mining activities, and the adoption of advanced construction machinery across emerging and developed economies. Demand is being supported by large scale urbanization projects, modernization of mining operations, and the need for high efficiency material handling equipment.

Technological advancements such as telematics integration, fuel efficient engines, and automated control systems are enhancing operational productivity and lowering ownership costs. Environmental regulations are also encouraging the development of loaders with improved emission control technologies, further boosting market adoption.

The outlook remains positive as governments and private sectors continue to invest heavily in road construction, real estate, and mining projects, positioning wheel loaders as a critical asset for bulk material movement and heavy-duty operational requirements.

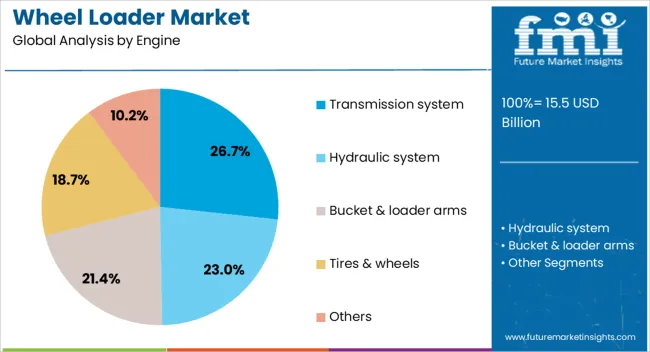

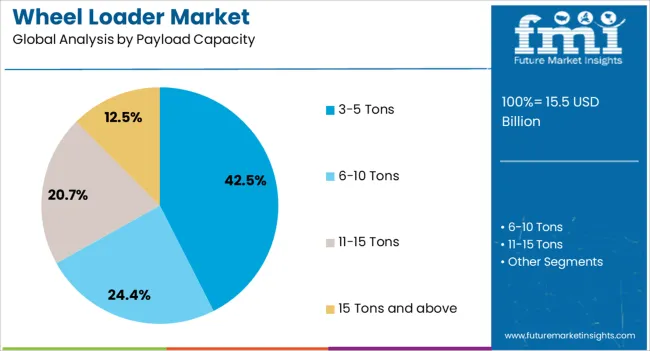

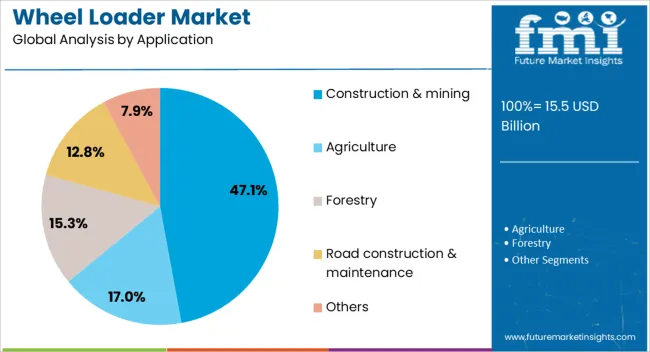

The wheel loader market is segmented by engine, payload capacity, application, and geographic regions. By engine, wheel loader market is divided into Transmission system, Hydraulic system, Bucket & loader arms, Tires & wheels, and Others. In terms of payload capacity, wheel loader market is classified into 3-5 Tons, 6-10 Tons, 11-15 Tons, and 15 Tons and above. Based on application, wheel loader market is segmented into Construction & mining, Agriculture, Forestry, Road construction & maintenance, and Others. Regionally, the wheel loader industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transmission system segment within the engine category is projected to account for 26.70% of total market revenue by 2025, establishing its prominence. Growth is being fueled by the need for smoother power delivery, improved fuel economy, and enhanced machine control in demanding operational environments.

Transmission systems are enabling wheel loaders to achieve higher productivity through optimized torque distribution and better adaptability to varied terrain conditions. The demand is further strengthened by the increasing shift toward automated and electronically controlled transmissions, which reduce operator fatigue and improve precision in material handling.

As equipment owners prioritize operational efficiency and lifecycle performance, the transmission system segment continues to hold a strong position in the market.

The 3–5 tons payload capacity segment is expected to command 42.50% of the total market share by 2025, making it the dominant capacity range. This growth is supported by its versatility in serving both mid scale construction sites and smaller mining operations.

The segment offers a balance between maneuverability and load carrying capability, making it suitable for diverse applications from urban construction projects to quarry operations. Its popularity is further boosted by lower fuel consumption compared to higher capacity loaders, while still delivering sufficient performance for heavy duty tasks.

The combination of cost efficiency, adaptability, and operational flexibility has secured the leading position of this capacity range in the market.

The construction and mining application segment is anticipated to hold 47.10% of the total market revenue by 2025, emerging as the primary end use sector. Expansion in infrastructure projects, particularly in developing regions, coupled with increased mineral extraction activities, is driving demand for durable and high performance wheel loaders.

Their capability to handle bulk materials efficiently and operate in challenging conditions has cemented their role in these sectors. Additionally, technological enhancements such as real time equipment monitoring and improved safety systems have increased adoption rates.

As global demand for raw materials and infrastructure continues to grow, the construction and mining application segment is set to remain the largest contributor to wheel loader market revenue.

Wheel loader market growth is driven by demand from infrastructure, mining, agriculture, and ongoing product enhancements. These sectors provide the foundation for consistent market expansion

The wheel loader market sees significant growth due to the expanding infrastructure and construction sectors. As large-scale projects increase, especially in developing regions, the demand for efficient machinery, such as wheel loaders, is rising. These machines are essential for moving heavy materials like soil, gravel, and concrete in road construction, urban development, and commercial infrastructure. With increasing urban expansion, infrastructure upgrades are essential, making wheel loaders an integral part of construction operations. This demand is expected to continue, driven by both public and private investments in the construction industry.

The mining sector is a major contributor to the wheel loader market. These loaders are essential in handling heavy materials, such as ores, rocks, and minerals, in mining operations. As the global demand for minerals and metals increases, mining companies are investing in advanced machinery, including wheel loaders, to enhance operational efficiency. The need for loaders with high lifting capacities and versatility in rough terrains is growing. Increased exploration activities and mining projects, particularly in emerging economies, are expected to sustain this growth trend in the market.

The agricultural sector is another driving force behind the wheel loader market. As modern farming methods evolve, the need for equipment that can handle multiple tasks is rising. Wheel loaders are essential for loading, lifting, and transporting materials such as feed, fertilizer, and soil in farming and horticulture applications. The agricultural industry's adoption of larger and more efficient machinery is pushing the demand for wheel loaders. With farming practices becoming more mechanized and agricultural land being developed, the need for wheel loaders in this sector is projected to grow steadily.

Manufacturers are continuously improving wheel loader designs to enhance efficiency and operator productivity. Key innovations include the development of loaders with improved fuel efficiency, enhanced lift capacities, and advanced hydraulic systems. These improvements make wheel loaders more adaptable and effective in a variety of work conditions. The growing need for fuel-efficient, easy-to-operate, and durable machines has spurred the demand for high-performance wheel loaders. Market players are also focusing on reducing maintenance costs and increasing the lifespan of these machines to provide long-term value to end users.

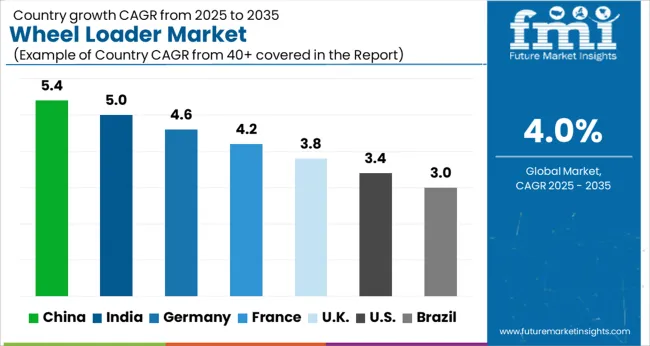

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global wheel loader market is projected to grow at a CAGR of 4.0% between 2025 and 2035. China leads the expansion at 5.4%, followed by India at 5.0%, while France posts 4.2%, the United Kingdom 3.8%, and the United States 3.4%. Growth is primarily driven by rising infrastructure demands, mining projects, and agricultural mechanization. China and India are expanding rapidly due to large-scale infrastructure projects and industrialization, supported by government investments in public works. France, the UK, and the USA are seeing steady growth, focusing on equipment upgrades and technological advancements to improve productivity. The USA market is particularly driven by the construction and mining sectors, while European countries are emphasizing equipment reliability and operational efficiency. The analysis includes over 40+ countries, with the leading markets detailed below.

The wheel loader market in China is projected to grow at a CAGR of 5.4% from 2025 to 2035. As the largest construction and mining market globally, China’s demand for wheel loaders is driven by rapid infrastructure development and large-scale mining operations. The country’s expansive urbanization and the continuous construction of residential, commercial, and industrial complexes are contributing to increased demand for heavy machinery. The mining sector in China, one of the largest globally, is another key driver for wheel loaders, with demand for material handling equipment growing alongside the country’s increased focus on resource extraction. The government’s push for technological upgrades in machinery, focusing on energy-efficient and automated equipment, also plays a critical role in expanding the market. With significant investments in transportation infrastructure, including ports, railways, and highways, the wheel loader market is poised to experience strong growth over the next decade.

The wheel loader market in India is expected to expand at a CAGR of 5.0% from 2025 to 2035. As one of the fastest-growing economies, India’s demand for wheel loaders is shaped by increasing industrialization, infrastructure projects, and agricultural mechanization. The country’s emphasis on infrastructure development, particularly in road construction, metro systems, and airports, is spurring demand for high-performance wheel loaders. The mining industry, with its vast mineral resources, also contributes significantly to the market, as mining companies seek durable, efficient machines for material handling. Agriculture, which remains a cornerstone of the Indian economy, is also evolving with the adoption of mechanized equipment. The government’s push towards modernizing agriculture and improving rural infrastructure further supports this demand. With growing industrialization in sectors like manufacturing and construction, India’s wheel loader market is set to experience sustained growth.

The wheel loader market in France is projected to grow at a CAGR of 4.2% from 2025 to 2035. France, with its strong industrial base and ongoing infrastructure development, is witnessing a steady rise in the demand for wheel loaders. The construction industry, which continues to see growth through urban renewal projects, residential housing, and transportation infrastructure, is a major contributor to the market. Additionally, France’s mining and agricultural sectors are also critical, as demand for versatile machinery in these industries grows. The European Union’s emphasis on environmental standards and energy efficiency also plays a role in driving the demand for advanced, eco-friendly wheel loaders. Manufacturers are responding by introducing innovative models with improved fuel efficiency and lower emissions. As these trends continue, France is expected to see consistent growth in the wheel loader market.

The wheel loader market in the United Kingdom is anticipated to grow at a CAGR of 3.8% from 2025 to 2035. The UK remains a key player in Europe’s construction, mining, and agriculture industries. The demand for wheel loaders is driven by large-scale infrastructure projects, including housing development, transportation upgrades, and industrial expansions. The UK also faces significant environmental goals, which push the market towards more energy-efficient and sustainable machinery. In the mining sector, wheel loaders are integral in moving materials from mines to processing plants. The construction industry continues to rely on heavy machinery for earthmoving, lifting, and material handling. With ongoing investment in infrastructure and a focus on upgrading equipment to meet environmental standards, the UK wheel loader market is set to experience steady growth throughout the forecast period.

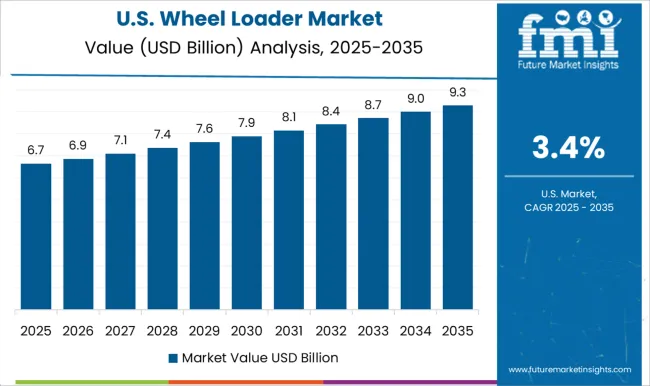

The wheel loader market in the United States is projected to grow at a CAGR of 3.4% from 2025 to 2035. The USA market for wheel loaders is primarily driven by the need for heavy equipment in construction, mining, and agricultural sectors. With large-scale projects like highways, residential developments, and energy infrastructure, demand for wheel loaders continues to rise. The mining sector also plays a vital role, as extraction operations require reliable and durable material handling machines. The shift towards more energy-efficient and automated equipment is reshaping the USA market, with manufacturers focusing on fuel efficiency and lower emissions. Despite challenges like cost sensitivity and compliance with regional standards, the USA wheel loader market is expected to remain steady, bolstered by ongoing infrastructure investments.

The wheel loader market is highly competitive, with a mix of global construction equipment giants and regional machinery manufacturers vying for market share. Leading players such as Caterpillar, Komatsu, Volvo Construction Equipment, XCMG, Liebherr, and Doosan Infracore dominate through expansive product portfolios, global dealer networks, and continuous product upgrades. These firms compete on performance, fuel efficiency, operational reliability, and after-sales service capabilities to secure large construction, mining, and infrastructure contracts.

Regional manufacturers, especially from China and India, are increasing their market footprint by offering cost-competitive wheel loaders tailored for local operating conditions. They often leverage aggressive pricing strategies and flexible financing options to win contracts in developing markets. Technological advancements in telematics, operator safety systems, and hybrid powertrains are becoming major differentiators among top players, while rental and leasing services are being used as strategic tools to expand customer bases. Aftermarket support, including parts availability and maintenance services, also plays a vital role in competitive positioning. Companies that combine advanced technology integration, strong brand reputation, and wide distribution reach are best positioned to strengthen their standing in the wheel loader market.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.5 Billion |

| Engine | Transmission system, Hydraulic system, Bucket & loader arms, Tires & wheels, and Others |

| Payload Capacity | 3-5 Tons, 6-10 Tons, 11-15 Tons, and 15 Tons and above |

| Application | Construction & mining, Agriculture, Forestry, Road construction & maintenance, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Hitachi Construction Machinery, Hyundai Construction Equipment, JCB, John Deere, Komatsu Ltd., Larsen & Toubro, Liebherr Group, Sany Global, and Volvo Construction Equipment |

| Additional Attributes | Dollar sales by product type (e.g., compact, heavy-duty), regional market share (Asia-Pacific, North America, Europe), CAGR projections, competitive landscape, and key trends (automation, fuel efficiency). |

The global wheel loader market is estimated to be valued at USD 15.5 billion in 2025.

The market size for the wheel loader market is projected to reach USD 22.9 billion by 2035.

The wheel loader market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in wheel loader market are transmission system, _hydrostatic transmission pump, _others, hydraulic system, bucket & loader arms, tires & wheels and others.

In terms of payload capacity, 3-5 tons segment to command 42.5% share in the wheel loader market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Compact Wheel Loaders Market Size and Share Forecast Outlook 2025 to 2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA