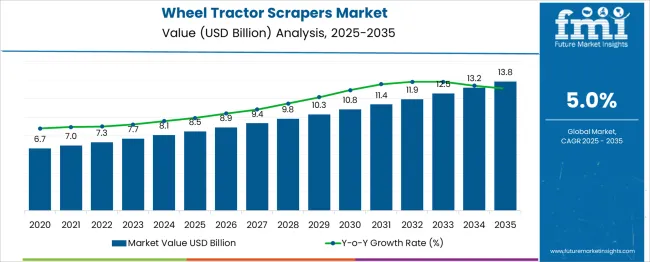

The Wheel Tractor Scrapers Market is estimated to be valued at USD 8.5 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Examining the rolling CAGR over smaller intervals within this period reveals steady growth throughout the decade. From 2025 to 2030, the market expands from USD 8.5 billion to approximately USD 10.3 billion, reflecting a CAGR of about 4.2%.

This initial phase is supported by ongoing demand in construction and earthmoving projects where these machines are essential for efficient soil movement and site preparation. Replacement of older equipment also sustains steady growth during this period. Between 2030 and 2035, growth picks up slightly, with the market increasing from USD 10.3 billion to USD 13.8 billion, corresponding to a CAGR of 6.5%.

This acceleration is driven by increased infrastructure development and maintenance activities requiring efficient and reliable earthmoving solutions. Equipment replacement cycles for machines purchased earlier further boost market momentum. Overall, the rolling CAGR analysis highlights a consistent upward trend with a stronger growth pace in the latter half of the decade. This steady expansion emphasizes the wheel tractor scrapers market’s critical role in supporting large-scale construction and infrastructure projects through 2035.

| Metric | Value |

|---|---|

| Wheel Tractor Scrapers Market Estimated Value in (2025 E) | USD 8.5 billion |

| Wheel Tractor Scrapers Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Wheel Tractor Scrapers market is experiencing a phase of consistent growth, supported by increasing demand for efficient earthmoving equipment across construction, mining, and infrastructure development sectors. Government investments in road expansion, dam building, and airport projects are creating a sustained need for high-volume material handling machinery. The integration of telematics and intelligent control systems into scrapers is also enhancing productivity, enabling real-time performance monitoring and maintenance planning.

Manufacturers are focusing on fuel-efficient engines and ergonomically advanced cabins to improve operator comfort and reduce lifecycle costs. As environmental regulations grow stricter, there is a rising interest in scrapers equipped with emission-compliant engines, driving further innovation.

Rental demand for heavy machinery is increasing globally, especially in developing regions, as contractors aim to optimize capital expenditures. These combined factors are contributing to the long-term expansion of the Wheel Tractor Scrapers market, with strong adoption expected in both large-scale public works and private sector infrastructure activities..

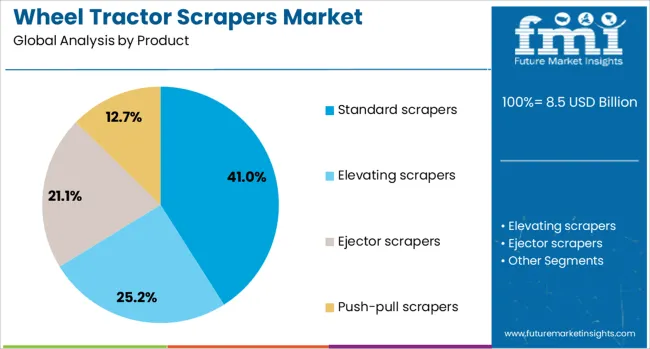

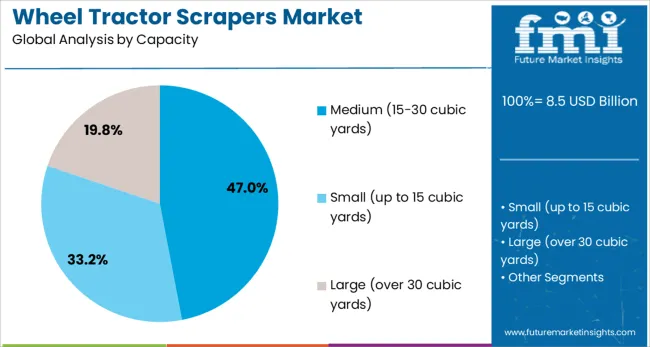

The wheel tractor scrapers market is segmented by product, capacity, engine, application, and geographic regions. The product of the wheel tractor scrapers market is divided into Standard scrapers, elevating scrapers, Ejector scrapers, and Push-pull scrapers. In terms of capacity, the wheel tractor scrapers market is classified into Medium (15-30 cubic yards), Small (up to 15 cubic yards), and Large (over 30 cubic yards).

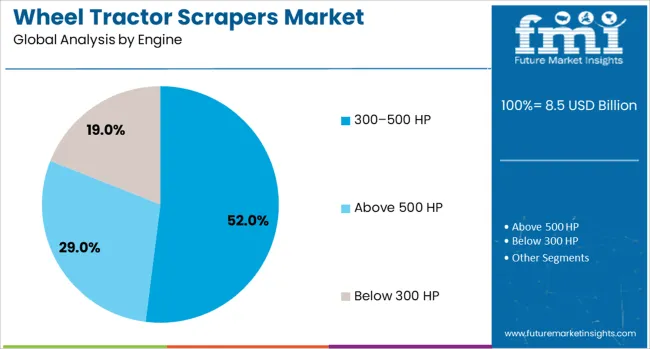

The engine of the wheel tractor scrapers market is segmented into 300–500 HP, Above 500 HP, and Below 300 HP. By application, the wheel tractor scrapers market is segmented into Construction, Mining, Agriculture, and Environmental. Regionally, the wheel tractor scrapers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standard scrapers subsegment in the product category is projected to hold 41% of the Wheel Tractor Scrapers market revenue share in 2025, positioning it as the leading product type. This dominance is being attributed to the balanced performance offered by standard scrapers in terms of haul distance, load capacity, and maneuverability.

These units are being favored in mid-size earthmoving operations where versatility, ease of operation, and reduced maintenance are critical. The ability of standard scrapers to operate efficiently across varying soil types and gradients has supported widespread deployment across infrastructure and construction projects.

Their compatibility with commonly available power units and lower upfront investment requirements have further increased accessibility for contractors and fleet operators. As demand grows for multi-purpose machines that can perform both loading and hauling functions within a single system, the operational simplicity and cost-effectiveness of standard scrapers continue to support their market leadership..

The medium capacity segment, defined by carrying volumes between 15 to 30 cubic yards, is expected to account for 47% of the market share in 2025. This segment’s leadership has been supported by the optimal balance it offers between productivity and equipment size, making it suitable for a wide range of mid-scale earthmoving projects.

Medium-capacity scrapers have been selected increasingly due to their ability to deliver efficient load cycles without requiring the substantial horsepower or site clearance of larger units. The segment has also benefited from rising demand in infrastructure and utility projects where site constraints make oversized equipment less viable.

Operators are finding value in the reduced fuel consumption and enhanced control offered by these machines, especially in applications where flexibility and maneuverability are prioritized. As the construction sector emphasizes cost efficiency and operational adaptability, medium-capacity scrapers are continuing to gain preference among project managers and contractors alike..

The 300 to 500 HP engine category is anticipated to lead the engine segment with a 52% market share in 2025. This growth has been driven by the high-performance requirements of mid-to-large-scale operations, where power output in this range ensures optimal material loading, hauling efficiency, and terrain adaptability.

Scrapers equipped with 300 to 500 HP engines have been increasingly deployed in projects requiring consistent speed and control under varying load conditions. These power ratings provide the torque necessary for efficient earthmoving while maintaining manageable fuel consumption, contributing to lower total cost of ownership.

The segment’s expansion has also been supported by advances in engine technology that enhance durability and compliance with emission regulations, without sacrificing performance. Additionally, manufacturers are offering integrated systems with GPS, telematics, and automated grading features that pair effectively with engines in this class, making them the preferred choice for performance-oriented buyers across construction and mining industries..

The wheel tractor scrapers market is growing steadily as construction, mining, and infrastructure projects increase globally. These machines are essential for earthmoving and land leveling, offering efficiency in material transportation over short to medium distances. Rising demand for large-scale infrastructure development and mining expansion fuels market growth. Challenges include high equipment costs and the need for skilled operators. Innovations such as enhanced fuel efficiency and operator comfort improve usability. Growth opportunities arise from emerging economies investing in infrastructure and technological integration like GPS and automation in scrapers.

Infrastructure development, including highways, airports, and urban construction, requires efficient earthmoving equipment like wheel tractor scrapers. These machines combine the functions of a scraper and tractor, enabling fast soil excavation and transport, which reduces project timelines. Mining operations also use scrapers for overburden removal and site preparation. Increasing government investments in infrastructure, especially in developing regions, drive demand. The versatility of wheel tractor scrapers in handling varying soil types makes them valuable. As project scales grow, equipment with greater capacity and reliability is preferred, supporting market expansion.

Wheel tractor scrapers are high-value capital equipment, posing affordability challenges for smaller contractors. Maintenance and repair costs add to the total cost of ownership, requiring efficient service networks. Operating these machines demands skilled personnel trained in handling complex controls and optimizing performance. Harsh working environments lead to wear and tear, causing downtime if not managed properly. Seasonal and terrain-related factors affect usage rates, complicating operational planning. Manufacturers must balance advanced features with user-friendly designs to broaden adoption. Rental models and financing options provide alternatives to reduce upfront cost barriers for end users.

Recent innovations focus on improving fuel efficiency, reducing emissions, and enhancing operator comfort to boost productivity. GPS-based machine control systems enable precise earthmoving and grading, minimizing material wastage. Automation features such as semi-autonomous operation reduce operator fatigue and increase safety. Telemetry systems provide real-time monitoring of machine health and performance, enabling predictive maintenance and minimizing downtime. Advances in materials and design improve scraper durability and reduce weight, allowing higher payloads. These technological improvements help manufacturers differentiate products and meet evolving environmental regulations, attracting customers looking for reliable, efficient solutions.

Emerging economies in the Asia Pacific, Latin America, and Africa are key growth regions due to increasing infrastructure investments and expanding mining activities. Urbanization and industrialization in these areas create a steady demand for earthmoving machinery. Developed markets focus on equipment replacement and upgrades, integrating new technologies to improve project efficiency. Regional supply chain enhancements and dealer networks improve equipment availability and after-sales service. Tailoring product offerings to local soil conditions and project requirements supports market penetration. Government infrastructure programs and mining sector growth in these regions continue to drive demand for wheel tractor scrapers.

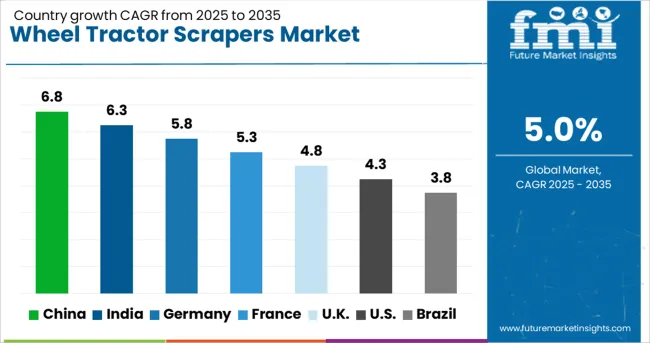

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

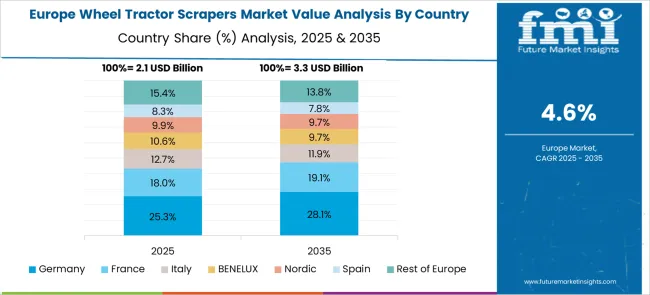

The global wheel tractor scrapers market is growing steadily at a 5.0% CAGR, driven by infrastructure development and modernization. Among BRICS nations, China leads with 6.8% growth, supported by large-scale construction projects and increased mechanization. India follows at 6.3%, fueled by expanding road and urban development initiatives. Within the OECD group, Germany reports 5.8% growth, reflecting adoption of advanced machinery and strict regulatory standards. The United Kingdom grows at 4.8%, supported by infrastructure upgrades and equipment innovations. The United States, as a mature market, records 4.3% growth, shaped by demand for reliable and efficient machinery. These countries collectively influence market trends through advancements in fuel efficiency, automation, and operator comfort. This report includes insights on 40+ countries; the top countries are shown here for reference.

The wheel tractor scrapers market in China is growing at a 6.8% CAGR. Rapid urbanization and infrastructure development projects drive demand for efficient earthmoving equipment. Construction companies and government initiatives focused on road building, land leveling, and mining activities contribute to market expansion. Domestic manufacturers are increasing production capacity and introducing technologically advanced scrapers to improve operational efficiency. The demand for high-capacity and fuel-efficient machines is rising as companies seek to reduce project timelines and costs. Growth in the mining sector further supports the need for reliable scrapers capable of handling large volumes of material.

India’s wheel tractor scrapers market is expanding at a 6.3% CAGR. Government investments in highway construction, smart cities, and industrial parks create strong demand for earthmoving machinery. The rise of the construction and mining industries drives the need for reliable and cost-effective scrapers. Indian manufacturers are focusing on improving equipment durability and fuel efficiency to meet local market requirements. Additionally, increased adoption of mechanized equipment in rural development projects enhances market growth. Competitive pricing and after-sales services help domestic brands capture greater market share.

The market in Germany is growing at a 5.8% CAGR, supported by strong construction and mining sectors. The demand for high-performance and environmentally friendly scrapers is increasing due to stringent emission norms. German manufacturers emphasize advanced technology integration, such as telematics and automation, to enhance scraper productivity and safety. The market also benefits from government incentives promoting sustainable construction practices. Rental and leasing models are common, providing flexibility for construction companies managing varying project demands. The focus on reducing carbon footprints leads to innovations in fuel-efficient and electric-powered equipment.

The United Kingdom market grows at a 4.8% CAGR. Infrastructure modernization and urban redevelopment projects contribute to steady demand for wheel tractor scrapers. Construction companies prefer versatile and fuel-efficient machines suitable for a range of applications including earthmoving and site preparation. The UK market sees growing interest in equipment with low emissions to comply with environmental regulations. Service and maintenance support from manufacturers is a key factor influencing purchasing decisions. Rental options remain attractive for companies aiming to optimize capital expenditure.

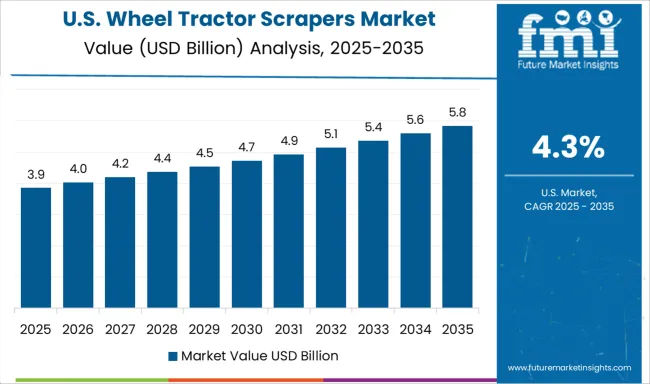

The United State market is growing at a 4.3% CAGR, driven by expanding construction and mining activities. Demand for efficient, high-capacity scrapers is rising as companies seek to improve project timelines and reduce operational costs. Technological advancements such as GPS guidance and automation improve equipment precision and productivity. Environmental regulations encourage adoption of fuel-efficient models. Rental and leasing services are widely used by construction firms to manage equipment needs dynamically. The strong aftermarket support and availability of replacement parts further support market growth.

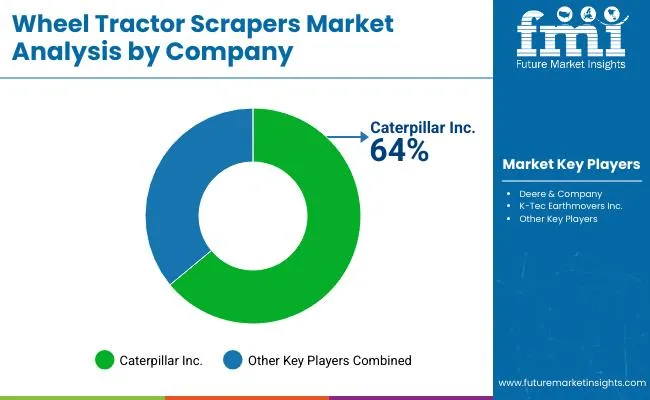

The Wheel Tractor Scrapers Market is dominated by leading heavy equipment manufacturers such as Caterpillar Inc., Deere & Company, K-Tec Earthmovers Inc., Volvo Construction Equipment, and CNH Industrial N.V. These companies supply a range of advanced wheel tractor scrapers designed to efficiently handle earthmoving and material transportation tasks in construction, mining, and infrastructure projects.

Caterpillar and Deere & Company offer robust and versatile models known for their high capacity, fuel efficiency, and advanced operator controls, aimed at improving productivity and reducing operational downtime.

K-Tec Earthmovers Inc. specializes in innovative scraper designs that emphasize durability and ease of maintenance, catering to customers looking for cost-effective and reliable earthmoving solutions. Volvo Construction Equipment integrates modern technology to enhance machine performance and operator comfort, focusing on improving maneuverability and reducing fuel consumption.

CNH Industrial, with its Case and New Holland brands, provides wheel tractor scrapers designed for versatility across diverse job sites, balancing power and precision. The market is shaped by the need for equipment capable of handling challenging terrains and large volumes of soil with minimal environmental impact and operational costs.

Advances in engine technology, hydraulics, and control systems have made these scrapers more efficient and easier to operate. Demand for wheel tractor scrapers continues to grow alongside global infrastructure development and mining activities.

Market players focus on developing machines that deliver higher productivity, lower emissions, and enhanced safety features to meet evolving customer requirements and regulatory standards. The Wheel Tractor Scrapers Market features strong competition among key manufacturers, all working to improve equipment performance, operational efficiency, and reliability for large-scale earthmoving operations.

In September 2023, Albemarle Corporation and Caterpillar Inc. announced a major partnership focused on advancing sustainable mining technologies and operations, particularly in lithium production. Central to this collaboration is the Kings Mountain site in North Carolina, which is set to become North America’s first zero-emissions lithium mine.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.5 Billion |

| Product | Standard scrapers, Elevating scrapers, Ejector scrapers, and Push-pull scrapers |

| Capacity | Medium (15-30 cubic yards), Small (up to 15 cubic yards), and Large (over 30 cubic yards) |

| Engine | 300–500 HP, Above 500 HP, and Below 300 HP |

| Application | Construction, Mining, Agriculture, and Environmental |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Deere & Company, K-Tec Earthmovers Inc., Volvo Construction Equipment, and CNH Industrial N.V. |

| Additional Attributes | Dollar sales vary by scraper type, including single-engine pull-type and tandem-engine push–pull scrapers; by capacity, such as medium and high-capacity models; and by region, led by Asia‑Pacific’s infrastructure growth, and North America and Europe focusing on modernization and automation. Growth is driven by large-scale earthmoving demand, automation integration, and mining and civil construction expansion. |

The global wheel tractor scrapers market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the wheel tractor scrapers market is projected to reach USD 13.8 billion by 2035.

The wheel tractor scrapers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in wheel tractor scrapers market are standard scrapers, elevating scrapers, ejector scrapers and push-pull scrapers.

In terms of capacity, medium (15-30 cubic yards) segment to command 47.0% share in the wheel tractor scrapers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA