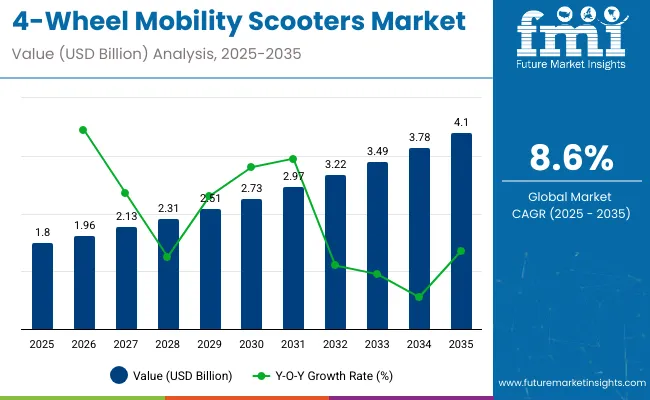

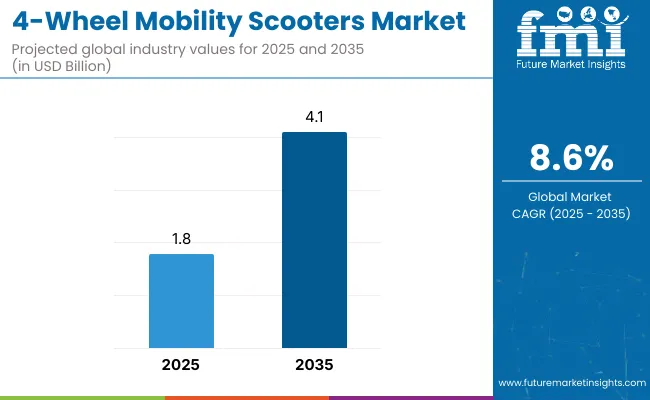

The global 4-wheel mobility scooters market is projected to reach USD 1.8 billion in 2025 and USD 4.1 billion by 2035, expanding at a compound annual growth rate of 8.6% with a multiplying factor of about 2.3 over the decade. The Growth Contribution Index reflects how different drivers influence market expansion across technology, demographics, and infrastructure.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1.8 billion |

| Market Forecast Value in (2035F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

Rising demand for personal mobility solutions among elderly users, coupled with improvements in healthcare access, contributes a strong share to overall growth. Advancements in battery technology, ergonomic design, and enhanced safety features also add significant weight to the index, pushing adoption across both developed and emerging economies.

By 2035, the Growth Contribution Index highlights that demographic shifts, affordability, and accessibility will remain core contributors, while technology integration such as lightweight materials, longer battery life, and smart assist features will further accelerate uptake. Regional contributions differ, with North America and Europe driving adoption through established healthcare support systems, while Asia Pacific shows increasing growth from urban mobility demand and improving purchasing power. The multiplying effect of these contributors creates a steady long-term expansion curve. The index illustrates how balanced inputs from technology, demographics, and policy support collectively shape sustainable value creation in the 4-wheel mobility scooters market.

The 4-wheel mobility scooters market is shaped by multiple connected industries. Medical devices and mobility aids account for around 42%, as scooters are widely adopted in healthcare and elder mobility solutions. Automotive components and drive systems contribute nearly 23%, supplying motors, axles, and braking units. Battery and energy storage sector represents about 18%, where lithium-ion and sealed lead-acid batteries directly influence performance. Consumer electronics and control systems make up close to 10%, covering joystick controllers, displays, and navigation features. Retail distribution and service providers hold roughly 7%, handling sales channels, rentals, and aftercare support.

The 4-wheel mobility scooters market is evolving with advancements in comfort, design, and energy efficiency. Manufacturers are introducing lightweight frames and foldable designs to enhance portability. Lithium-ion powered models are replacing older battery technologies, offering longer ranges and quicker charging. Enhanced suspension systems and ergonomic seating are improving ride comfort for users with limited mobility. Connectivity features, such as GPS tracking and smart displays, are being integrated to improve safety and monitoring. Industry players are collaborating with healthcare institutions and insurance providers to expand access, while customization options and modular components are becoming standard in premium offerings.

The 4 wheel mobility scooters market is expected to grow from USD 1.8 billion in 2025 to USD 4.1 billion by 2035, registering a CAGR of 8.6% with a multiplying factor of 2.3. Unit shipments are projected to increase from 0.9 million to 2.1 million over the same period. Battery electric scooters dominate, making up nearly 85% of sales. Average ranges vary between 15 km for compact indoor models and 60 km for heavy duty outdoor units. Replacement cycles range from 5 to 8 years, supporting consistent aftermarket and service revenue. Growing adoption among aging populations and users with mobility limitations, combined with enhanced safety features and urban mobility needs, is driving market expansion steadily across global regions.

Driving Force Aging Population and Urban Needs

The rising global population aged 65 and above, expected to reach 9% by 2035, is a primary growth driver. Short-distance travel under 10 km in urban and suburban areas supports strong demand for compact and reliable scooters. Improvements in battery technology have increased average ranges by 20-35%, reducing the frequency of charging and enhancing convenience. Expanded retail and e-commerce channels have reduced delivery lead times to 3-7 days in key regions. Regional healthcare reimbursement programs further improve affordability. Advanced safety features, including anti-tip wheels and enhanced suspension systems, increase user confidence, promoting adoption among elderly and mobility-challenged consumers.

Growth Avenue Commercial Fleet Deployment

Fleet adoption for rental services, medical mobility providers, and campus operations is creating new revenue opportunities. Mid-range scooters with swappable batteries achieve utilization rates of 60-75% in high-demand urban areas. Fleet operators typically see payback periods between 12 and 24 months. Subscription and rental models reduce upfront costs for temporary users. Modular designs and standardized spare parts simplify maintenance and minimize downtime. Commercial deployments are encouraging innovations in battery swapping, durability, and operational efficiency. Expansion of fleets in urban and institutional settings is expected to accelerate market growth significantly over the next decade.

Emerging Trend Smart Features and Connectivity

Technological advancements such as regenerative braking, onboard diagnostics, and telematics are shaping market offerings. Regenerative braking can recover 5-8% of energy in mixed-use scenarios, extending range while reducing brake wear. Telematics and predictive maintenance reduce unplanned service calls by around 15%. Higher energy density batteries enable longer range without adding weight. Connectivity features provide fleet operators with real-time usage and maintenance data, optimizing operational efficiency. User-friendly interfaces, modular batteries, and advanced control systems enhance the appeal of scooters for personal and commercial users alike. These innovations support growth and differentiate products in a competitive market.

Market Challenge Price Sensitivity and Supply Risks

Price sensitivity limits adoption of premium models in certain regions. Fluctuations in battery, motor, and electronic controller supply can extend lead times by 6-12 weeks, affecting production schedules. Raw material cost swings impact production costs by 8-14%, while limited repairability and spare parts availability increase downtime and reduce resale value. Warranty obligations and maintenance requirements influence total cost of ownership, prompting larger manufacturers to adopt standardized platforms and modular designs to maintain service continuity. Smaller players are more vulnerable to supply chain disruptions, potentially limiting their market share and operational efficiency in high-demand regions.

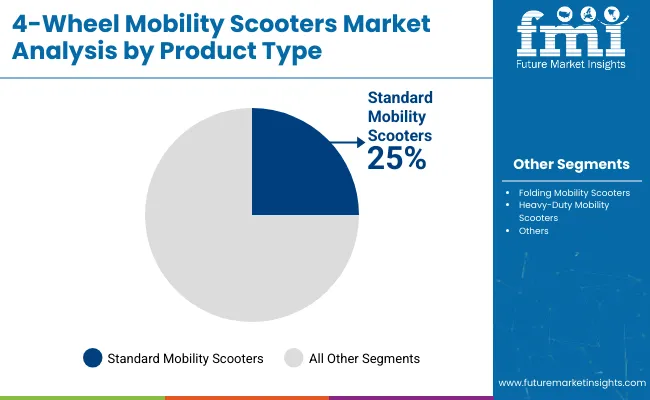

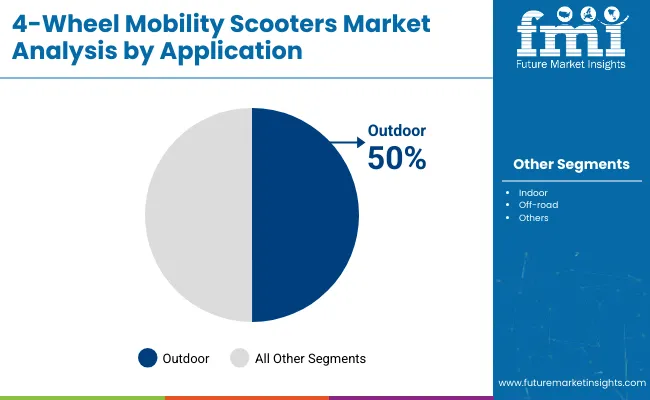

The 4-wheel mobility scooters market is divided by product type, application, and battery type. Standard mobility scooters powered by lithium-ion batteries dominate due to their lightweight design, faster charging, and higher durability. Outdoor applications drive demand, as users prefer stable scooters for long-distance usage. Lithium-ion batteries remain the preferred choice across product categories because of their superior energy density and cycle life. Companies such as Pride Mobility, Invacare, Afikim, and Sunrise Medical focus on developing lithium-powered models with folding and heavy-duty variants for specific user groups.

Standard mobility scooters with lithium-ion batteries hold 25% market share, leading product adoption due to their balance of performance, price, and efficiency. These scooters offer ranges between 20-40 km per charge and suit both urban and suburban users. Lithium-ion batteries reduce maintenance, allow faster charging cycles, and extend lifespan compared to lead acid counterparts. Pride Mobility, Invacare, and Sunrise Medical have introduced lithium-powered standard scooters designed for daily mobility. Their popularity is also linked to improved portability and weight efficiency, making them the most accessible option for end-users. The combination of affordability, ease of operation, and improved travel ranges ensures strong dominance in this segment.

Outdoor use accounts for 50% of applications, making it the largest demand segment. These scooters are equipped with larger wheels, reinforced suspensions, and higher ground clearance for stability across uneven terrains. Average travel ranges extend to 25-45 km per charge, meeting the needs of elderly users who prioritize independence in mobility. Heavy-duty lithium-ion scooters are particularly aligned with outdoor use. Manufacturers such as Afikim and Drive Medical cater to this segment with models that combine durability and comfort. Outdoor scooters remain popular across Europe and North America where accessibility in public areas and parks is supported by policy initiatives. Their dominance reflects a focus on reliability, longer distance coverage, and all-terrain performance.

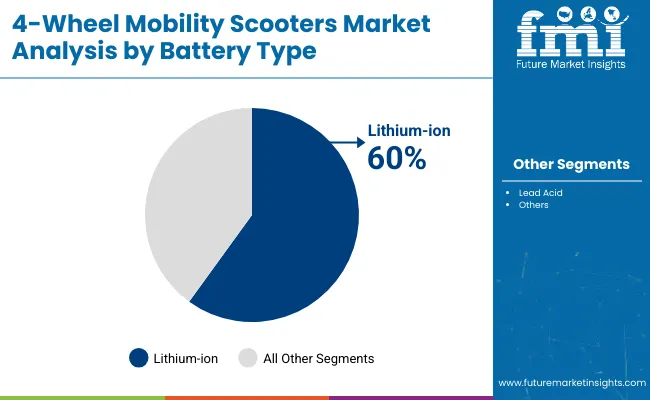

Lithium-ion batteries represent 60% of the market, becoming the primary choice across standard, folding, and heavy-duty mobility scooters. Their advantages include lighter weight, faster charging, and up to double the lifespan of lead acid batteries. Models powered by lithium-ion typically support travel ranges up to 50 km per charge, depending on motor power and design. Manufacturers such as Pride Mobility, Sunrise Medical, and Afikim invest heavily in lithium battery integration due to user preference for efficiency and durability. Lead acid batteries, while still used in low-cost scooters, face decline in market penetration. The growth of lithium-ion battery production capacity across Asia and Europe further strengthens its dominance in the mobility scooter segment.

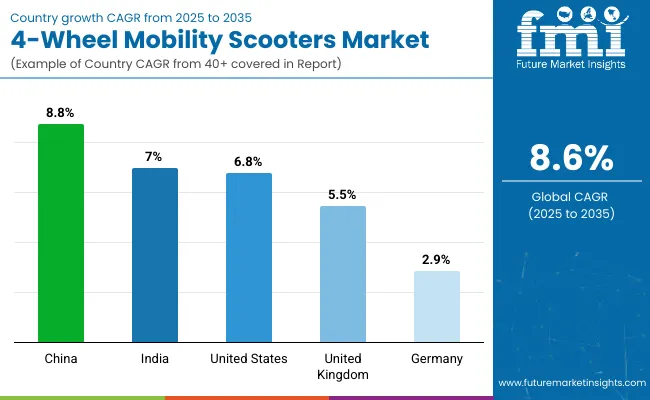

The global 4-wheel mobility scooters market is growing at a CAGR of 8.6% from 2025 to 2035. China leads at 8.8%, slightly above the global level, driven by BRICS-supported manufacturing growth and increasing adoption in urban areas. India follows at 7.0%, below the global rate, reflecting growing domestic demand but limited infrastructure expansion. The United States records 6.8%, moderately under the global average, shaped by OECD-led technological improvements and regulatory frameworks for mobility solutions. The United Kingdom posts 5.5%, constrained by mature market conditions in OECD economies. Germany stands at 2.9%, considerably below the global rate, where growth is slowed by established mobility networks and limited market expansion opportunities.

China records a CAGR of 8.8%, slightly above the global rate of 8.6%. Strong demand is driven by expanding e-mobility infrastructure and increasing adoption among senior and differently-abled populations. Government incentives for electric personal mobility devices have encouraged local manufacturers to scale production. Rising awareness of low-speed personal transport solutions in urban and semi-urban areas is further accelerating growth. China also benefits from a robust supply chain of batteries and electric motors, making products more affordable for consumers.

India is growing at a CAGR of 7.0%, slightly below China and the global rate. Increased awareness of mobility solutions among elderly and differently-abled consumers is driving sales. The market is concentrated in urban centers, with e-commerce platforms enabling wider distribution. Local manufacturing hubs are reducing dependency on imports while lowering prices. Rising demand in medical institutions and senior care facilities is supporting growth in specialized designs.

The United States shows a CAGR of 6.8%, slightly below global 8.6%. Growth is driven by aging populations and adoption in assisted living and healthcare sectors. Insurance coverage for medical mobility devices supports consumer uptake. Technological advancements in battery efficiency and lightweight frames enhance usability and consumer preference. Regional adoption is higher in the Northeast and Midwest, where mobility assistance programs are widely implemented.

The United Kingdom is growing at a CAGR of 5.5%, below the global average of 8.6%. Government regulations on electric vehicles and mobility assistance policies support moderate adoption. Healthcare institutions and senior care facilities are key buyers, while consumer demand is concentrated in suburban areas. Manufacturers are introducing compact and easy-to-store designs to meet UK consumer preferences.

Germany registers a CAGR of 2.9%, significantly below the global 8.6%. Regulatory compliance for safety and certifications makes entry challenging for new manufacturers. Market demand is concentrated among healthcare providers and assisted living facilities. High labor and production costs have slowed consumer adoption, while preference for conventional mobility aids remains strong. Expansion is focused on premium models with advanced features.

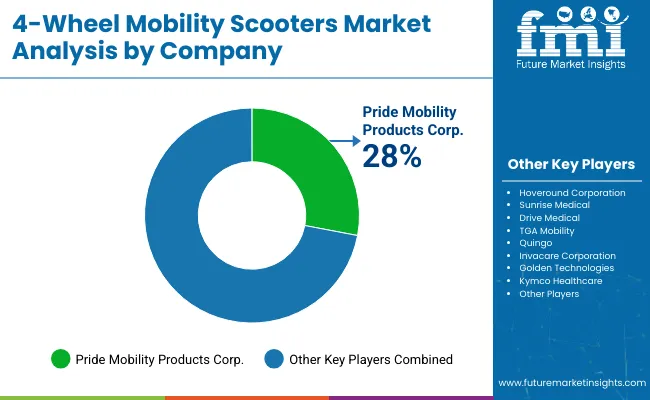

Pride Mobility Products Corp. - 28% (market leader)

The 4-wheel mobility scooter market includes a mix of established manufacturers and emerging players that focus on comfort, safety, and ease of use. Pride Mobility Products Corp. has become a prominent leader through a diverse range of scooters designed for different user needs, frequent product launches, and strong dealer networks across North America and Europe. Hoveround Corporation strengthens its market position by offering customizable solutions and direct-to-consumer sales. Sunrise Medical integrates advanced battery systems and lightweight frames in its scooters, appealing to both individual and institutional buyers.

Other players are shaping the market with targeted strategies. TGA Mobility emphasizes high-performance scooters suited for outdoor use, while Quingo focuses on compact designs for urban navigation. Drive Medical expands its presence through collaborations with healthcare providers and regular upgrades to its models. Invacare Corporation and Golden Technologies invest in research and development to improve battery life, suspension systems, and user-friendly controls. Emerging brands such as Merits Health Products and Kymco Healthcare concentrate on affordable, reliable scooters for global distribution. Companies continue to differentiate themselves with enhancements in comfort, portability, and safety features, maintaining strong competition in the global market.

Recent Industry Trends

In March 2024, Hoveround launched Hoveround Mobility Solutions (HMS). This new branch is opened for developing power wheelchairs, alternative positioning systems, adaptive seating systems and mobility devices across the USA

| Report Attributes | Details |

|---|---|

| Market Size, 2025 | USD 1.8 billion |

| Projected Market Size, 2035 | USD 4.1 billion |

| CAGR, 2025 to 2035 | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Type Segments Analyzed | Standard Mobility Scooters (Lead Acid, Lithium-ion), Folding Mobility Scooters (Lead Acid, Lithium-ion), Heavy-Duty Mobility Scooters (Lead Acid, Lithium-ion) |

| Application Segments Analyzed | Indoor, Outdoor, Off-road |

| Battery Type Segments Analyzed | Lead Acid, Lithium-ion |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Netherlands, Sweden, Poland, China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand, United Arab Emirates, Saudi Arabia, South Africa, Turkey, Egypt |

| Leading Players | Pride Mobility Products Corp., Hoveround Corporation, Sunrise Medical, Drive Medical, TGA Mobility, Quingo , Invacare Corporation, Golden Technologies, Kymco Healthcare |

| Additional Attributes | Dollar sales by product type, battery type, and application, demand dynamics across indoor, outdoor, and off-road use, regional adoption trends across Europe, Asia Pacific, and North America, innovation in lightweight frames and battery efficiency, environmental impact of recyclable batteries, and emerging use in connected mobility and personal transport solutions |

The 4-wheel mobility scooter market is projected to reach USD 4.1 billion by 2035.

The market is expected to grow at a CAGR of 8.6% during 2025–2035.

Standard mobility scooters are expected to dominate the market in 2025.

Indoor use segment is projected to hold the largest share in 2025.

Pride Mobility Products Corp. is the market leader with a 28% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobility On Demand (MOD) Market Size and Share Forecast Outlook 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Mobility Aids and Transportation Equipment Market is segmented by Product and Distribution Channel from 2025 to 2035

Ion Mobility Spectrometry Market

Micromobility Platform Market by Vehicle Type, Platform Type, End User, and Region through 2035

Micro Mobility Market Size and Share Forecast Outlook 2025 to 2035

Micro-mobility Charging Infrastructure Market – Trends & Forecast 2025 to 2035

Managed Mobility Services Market Size and Share Forecast Outlook 2025 to 2035

Clinical Mobility Market Size and Share Forecast Outlook 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Eldercare Mobility Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Smart Crop Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

BYOD and Enterprise Mobility Market Analysis and Forecast 2025 to 2035, By Security, Software, Deployment Type, End-Use, Organization Size, and Region

Electric Motorcycles And Scooters Market Size and Share Forecast Outlook 2025 to 2035

Conventional Motorcycles & Scooters Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA