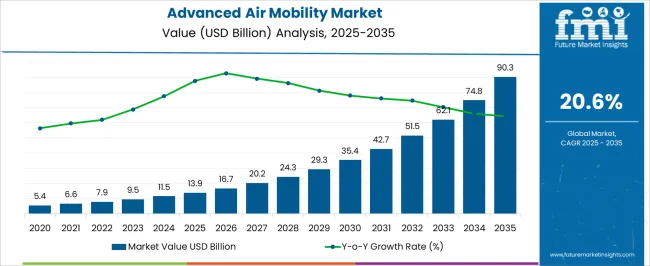

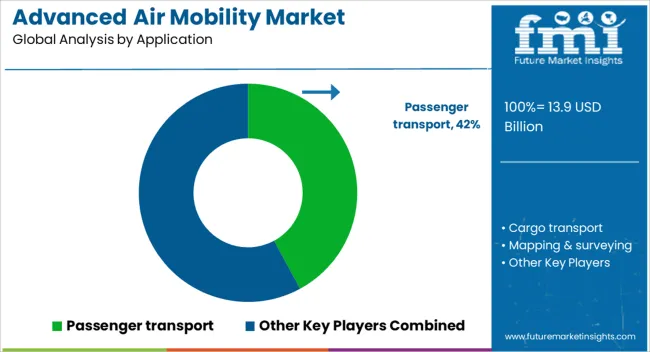

The advanced air mobility market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 90.3 billion by 2035, registering a compound annual growth rate (CAGR) of 20.6% over the forecast period.

The advanced air mobility market, estimated at USD 13.9 billion in 2025 and projected to reach USD 90.3 billion by 2035 with a CAGR of 20.6%, exhibits substantial contribution differences across its core technologies, driven by variations in adoption, cost, and performance. Electric Vertical Take-Off and Landing (eVTOL) aircraft are emerging as the most influential technology segment, accounting for the largest share of early adoption due to their ability to provide urban and regional air transport with low operational noise and zero direct emissions.

The rapid increase in eVTOL production, alongside advancements in battery density and propulsion efficiency, is a primary factor contributing to market expansion, as indicated by the steep growth trajectory in the forecast period. Hybrid-electric aircraft technology contributes moderately, with gradual adoption driven by longer range capabilities and flexibility in energy sources. Fuel cell-powered designs and other innovative propulsion methods represent smaller contributions currently but are expected to gain traction as technology maturation and infrastructure development progress.

Investment in charging, maintenance, and fleet management technologies further supports the relative contribution of electric-based systems, creating interdependencies within the technology value chain. The market’s composition indicates a strong skew toward electric and hybrid-electric solutions, with eVTOLs dominating value contribution, while incremental growth from emerging propulsion technologies complements the overall technology mix. The compounded effect of efficiency, regulatory acceptance, and infrastructure readiness defines the relative share of each technology segment over the ten-year forecast horizon.

| Metric | Value |

|---|---|

| Advanced Air Mobility Market Estimated Value in (2025 E) | USD 13.9 billion |

| Advanced Air Mobility Market Forecast Value in (2035 F) | USD 90.3 billion |

| Forecast CAGR (2025 to 2035) | 20.6% |

The advanced air mobility market represents a specialized segment within the global aerospace and urban air transportation industry, emphasizing electric propulsion, autonomous flight, and low-emission urban mobility solutions. Within the broader aerospace sector, it accounts for about 2.9%, driven by emerging eVTOL, air taxi, and cargo drone applications. In the urban air mobility and next-generation aviation segment, its share is approximately 3.4%, reflecting investment in infrastructure, air traffic management, and safety certification. Across the electric aircraft and hybrid propulsion systems market, it holds around 2.6%, supporting adoption of energy-efficient aircraft designs. Within the air transportation and logistics innovation category, it represents 2.1%, highlighting applications in intracity and regional cargo and passenger transport.

In the global smart mobility ecosystem, the market contributes about 1.8%, emphasizing its role in enabling sustainable, connected, and autonomous aerial solutions. Recent developments in the advanced air mobility market focus on electric propulsion, autonomous control systems, and infrastructure integration. Groundbreaking trends include eVTOL aircraft capable of vertical takeoff and landing for urban air taxis, cargo drones, and regional commuter operations. Key players are partnering with air traffic management providers, battery manufacturers, and urban planners to ensure safe and scalable operations. Regulatory authorities are piloting certification frameworks for autonomous flight and airspace integration.

Investment in noise reduction technologies, modular aircraft platforms, and rapid charging infrastructure is gaining momentum. Strategic collaborations are emerging to integrate AAM with smart city initiatives and multi-modal transportation networks. These innovations demonstrate how technology, safety, and connectivity are shaping the next-generation urban and regional air mobility market.

The advanced air mobility (AAM) market is evolving rapidly as a transformative force in urban transportation, supported by technological advancements, increased investment in sustainable aviation, and regulatory progress. The integration of autonomous systems, lightweight materials, and electric propulsion technologies is redefining short-distance air travel by enabling quieter, more efficient, and eco-friendly flight solutions.

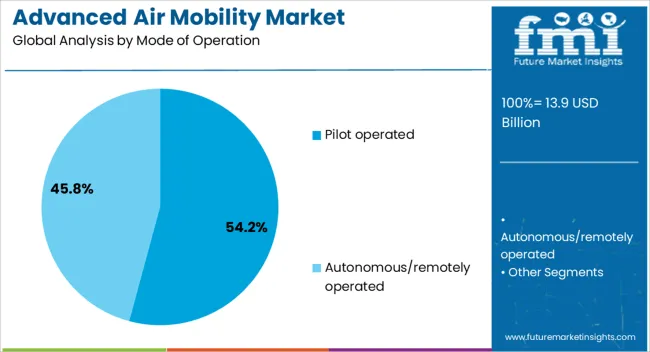

The initial deployment focus remains on piloted aircraft, offering controlled scalability and regulatory alignment, with autonomous operation anticipated to follow as certification frameworks mature. Urban congestion, environmental concerns, and demand for faster intra-city connectivity are major growth drivers for AAM, especially in megacities with constrained ground infrastructure.

Over the coming years, market expansion is expected to be reinforced by increasing prototype testing, public-private partnerships, and infrastructure development for vertiports and air traffic management systems. The sector’s growth trajectory remains strong as governments and aerospace firms continue to prioritize next-generation mobility solutions with a focus on safety, noise reduction, and zero-emission goals

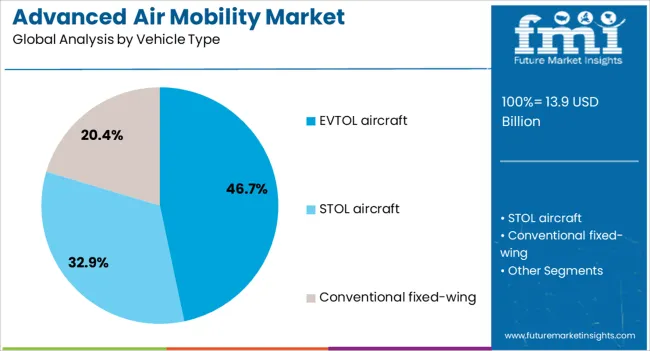

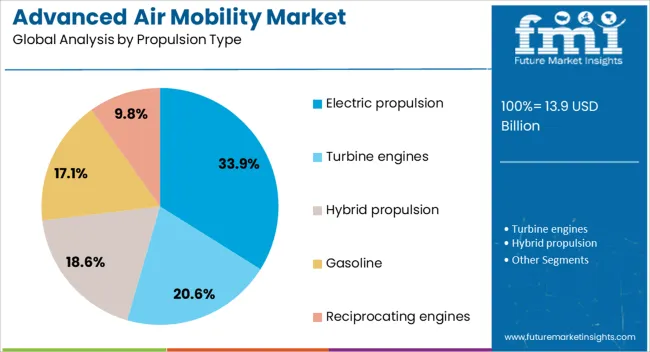

The advanced air mobility market is segmented by mode of operation, vehicle type, propulsion type, range, and geographic regions. By mode of operation, advanced air mobility market is divided into pilot operated and autonomous/remotely operated. In terms of vehicle type, advanced air mobility market is classified into EVTOL aircraft, STOL aircraft, and conventional fixed-wing. Based on propulsion type, advanced air mobility market is segmented into electric propulsion, turbine engines, hybrid propulsion, gasoline, and reciprocating engines. By range, advanced air mobility market is segmented into 100 km – 250 km, below 100 km, 250 km – 500 km, and more than 500 km. Regionally, the advanced air mobility industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pilot operated segment leads the mode of operation category with a 54.2% market share, reflecting the current regulatory and operational preference for manned flight during the early stages of advanced air mobility deployment. This segment benefits from existing aviation infrastructure and pilot licensing frameworks, allowing smoother integration into controlled airspace and alignment with air traffic regulations.

Industry stakeholders favor piloted operations as they offer a more manageable path for certification, public acceptance, and risk mitigation during initial service rollouts. Additionally, the presence of a trained pilot ensures immediate decision-making in dynamic flight environments, which is critical for safety and trust-building.

The transition to autonomous operations is expected to occur gradually, with pilot operated models serving as a foundation for operational data and consumer familiarity. In the short to medium term, sustained investment and regulatory preference will likely uphold the dominance of this segment in commercial AAM applications

Within the vehicle type category, EVTOL (electric vertical takeoff and landing) aircraft hold a leading 46.7% market share, underscoring their pivotal role in the development of advanced air mobility networks. EVTOLs are specifically designed for efficient urban and regional air transport, offering vertical lift capabilities that eliminate the need for conventional runways and enable seamless point-to-point travel.

Their electric propulsion systems contribute to low noise emissions and reduced environmental impact, aligning with sustainability goals and easing community integration. Numerous aerospace and automotive companies have entered the EVTOL space, accelerating innovation through competitive development, flight testing, and strategic partnerships.

Regulatory support for certifying EVTOL platforms is also gaining momentum, encouraging investment in manufacturing and infrastructure. As cities prepare for commercial rollout of urban air mobility services, EVTOL aircraft are expected to dominate due to their compact design, low operating cost, and suitability for short-haul, high-frequency routes

Electric propulsion leads the propulsion type category with a 33.9% share, highlighting its foundational role in enabling sustainable and efficient flight operations within the advanced air mobility ecosystem. The preference for electric propulsion stems from its ability to deliver zero-emission performance, low operational noise, and higher energy efficiency compared to traditional fuel-based systems.

This propulsion type supports the design of lightweight and compact aircraft, making it ideal for urban mobility solutions that demand minimal environmental impact and operational versatility. Ongoing advancements in battery technology, power density, and thermal management systems are further reinforcing the viability of electric propulsion for commercial applications.

Manufacturers are increasingly aligning with global decarbonization efforts, positioning electric propulsion as a long-term strategic choice. As infrastructure for electric charging and energy storage expands, the segment is expected to maintain strong momentum and attract sustained investment across both private and public sectors

The AAM market has been expanding rapidly as urban air transport and innovative aerial mobility solutions gain traction. AAM encompasses electric vertical takeoff and landing (eVTOL) aircraft, autonomous drones, and hybrid-electric urban air vehicles that are designed to address congestion, improve logistics efficiency, and enhance emergency response capabilities. Governments, private operators, and technology developers are investing in infrastructure, regulatory frameworks, and pilot programs to enable commercial adoption. Increased focus on reducing carbon emissions, integrating digital air traffic management, and improving safety standards has accelerated market growth.

Urban air mobility is a major driver for the adoption of advanced air mobility solutions, particularly in metropolitan areas with dense traffic congestion. eVTOL aircraft and autonomous air taxis are being developed to provide point-to-point passenger transport, reducing travel times and enhancing urban connectivity. Air corridors and vertiports are being planned and constructed to accommodate these vehicles, while city governments and regulators are defining operational guidelines for safety, noise, and airspace management. The adoption of AAM for passenger transport is expected to enhance commuting efficiency and reduce ground traffic congestion. Public-private partnerships and pilot programs are further enabling the integration of AAM into urban transportation ecosystems.

Advanced air mobility is increasingly leveraged for logistics and cargo operations, including last-mile delivery, medical supply transport, and urgent freight movement. Drones and autonomous aerial vehicles are deployed to transport lightweight and time-sensitive packages efficiently, reducing dependency on traditional road transport. The adoption of AAM in logistics enhances operational flexibility, reduces delivery lead times, and supports e-commerce and critical healthcare supply chains. Regulatory approvals, autonomous navigation technologies, and battery efficiency improvements are key factors supporting the use of AAM in commercial cargo applications. Companies are testing hybrid and electric aerial cargo vehicles to optimize payload capacity while maintaining energy efficiency and operational reliability.

Technological advancements in propulsion systems, battery technology, and autonomous flight control have been central to AAM market development. Electric and hybrid-electric propulsion reduces noise and emissions while enhancing efficiency for short-range flights. Innovations in lightweight materials, energy storage, and AI-driven navigation systems enable longer flight durations, increased payload capacities, and safer operations. Integration with digital air traffic management systems allows for real-time flight monitoring, route optimization, and collision avoidance. Continuous research in electric propulsion, charging infrastructure, and advanced sensors is enabling scalable deployment of AAM platforms for both passenger and cargo applications, strengthening market growth globally.

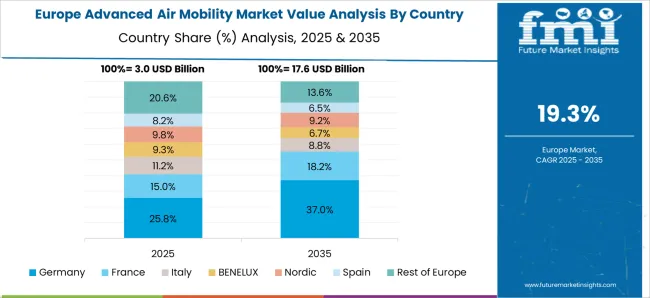

North America and Europe are leading regions for AAM adoption due to regulatory support, technological capabilities, and investment in urban infrastructure. Asia Pacific is emerging rapidly with growing urban populations, government-backed pilot projects, and investments in electrified aerial vehicles. Key market players are focusing on developing certified eVTOL platforms, autonomous cargo drones, and urban mobility networks. Strategic partnerships, testing programs, and government collaborations are shaping competitive dynamics. Market growth is influenced by airspace integration policies, safety regulations, and demand for sustainable transport. As infrastructure and regulatory frameworks mature, AAM adoption is expected to expand significantly across urban mobility, cargo logistics, and emergency services globally.

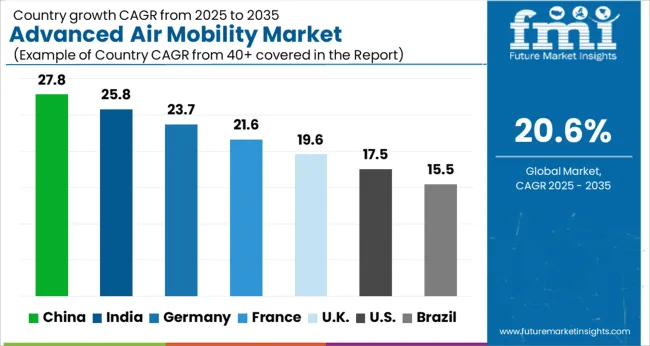

| Country | CAGR |

|---|---|

| China | 27.8% |

| India | 25.8% |

| Germany | 23.7% |

| France | 21.6% |

| UK | 19.6% |

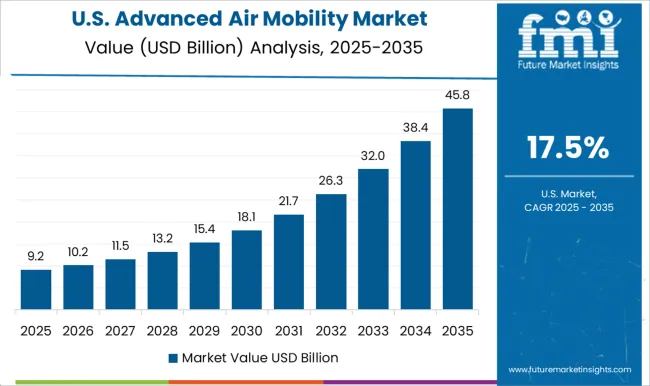

| USA | 17.5% |

| Brazil | 15.5% |

The market is expected to expand at a CAGR of 20.6% from 2025 to 2035. Growth is driven by rapid technological developments and rising urban air transportation initiatives. China leads with 27.8%, reflecting aggressive adoption of air mobility solutions and investment in infrastructure. India follows at 25.8%, supported by increasing interest in electric vertical takeoff and landing aircraft and government incentives. Germany records 23.7%, benefiting from strong aerospace engineering capabilities and safety regulations. The UK stands at 19.6%, reflecting a focus on pilot projects and air traffic integration, while the USA at 17.5% shows steady advancement through private sector innovation and regulatory support. These factors collectively indicate a global push toward efficient and sustainable aerial transportation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is experiencing a CAGR of 27.8%, driven by rapid urban transportation development, government support for eVTOL initiatives, and investment in urban air mobility infrastructure. The market is focused on reducing congestion in mega-cities through aerial mobility solutions for passengers and cargo. Domestic manufacturers collaborate with international technology providers to deploy test corridors and autonomous flight systems. Key developments include integration of advanced navigation systems, electric propulsion technologies, and air traffic management platforms, aimed at enhancing safety and efficiency for future urban air mobility networks.

India is projected to grow at a CAGR of 25.8%, fueled by urban air mobility trials, defense applications, and private sector investment. Key cities are exploring aerial taxi systems and cargo drones to address traffic congestion and improve logistics efficiency. Technology adoption focuses on autonomous flight systems, energy-efficient propulsion, and smart air traffic integration. Indian start-ups and global partners collaborate to develop certification pathways and conduct pilot operations. Government initiatives targeting smart transportation infrastructure further drive market penetration.

Germany, with a CAGR of 23.7%, benefits from strong aerospace engineering expertise, regulatory support, and pilot urban mobility programs. The market emphasizes eVTOL vehicles for passenger transport and emergency response applications. Integration with smart city frameworks, advanced navigation, and energy-efficient propulsion systems are key drivers. German aerospace firms collaborate with European consortia to advance autonomous flight, certification, and airspace management, supporting both commercial and defense applications.

The United Kingdom is projected to grow at a CAGR of 19.6%, driven by government-backed aerial mobility initiatives and adoption of urban air taxi services. Key cities are implementing testing corridors and partnerships with aerospace companies for eVTOL technology. Focus areas include autonomous navigation, safety monitoring systems, and energy-efficient electric propulsion. Integration with smart city transport networks and regulatory compliance are major factors enhancing deployment potential.

The United States is expanding at a CAGR of 17.5%, driven by strong aerospace infrastructure, technological innovation, and pilot programs for passenger and cargo eVTOL vehicles. Federal aviation authorities are facilitating certification frameworks, while private aerospace companies deploy urban air mobility solutions for metropolitan areas. Focus on autonomous flight, safety systems, and electric propulsion is significant. Strategic partnerships between start-ups and legacy aerospace firms accelerate adoption across multiple applications.

The AAM market is shaped by aerospace giants and emerging innovators, combining experience in aviation with new mobility technologies. Airbus and The Boeing Company leverage decades of aerospace engineering, regulatory expertise, and global manufacturing networks to advance eVTOL, autonomous flight, and urban air mobility solutions. Their investments in research and development, partnerships with cities, and certification pathways provide a competitive edge in large-scale deployment and safety assurance.

Aurora Flight Sciences, a Boeing subsidiary, emphasizes experimental aircraft development, autonomous flight systems, and electric propulsion, offering agility in design and rapid prototyping compared to traditional aerospace manufacturers. Bell Textron Inc. focuses on hybrid-electric vertical lift and air taxi concepts, leveraging legacy rotorcraft expertise and extensive testing infrastructure to deliver scalable solutions for urban and regional mobility. Guangzhou EHang Technology differentiates through commercial autonomous aerial vehicles, integrated software platforms, and first-mover deployment in Asia, targeting urban transport corridors and public mobility services.

The market is highly competitive, driven by technological innovation, regulatory approvals, infrastructure integration, and pilot programs, with companies investing in partnerships, battery technology, and air traffic management solutions to secure leadership in the rapidly evolving AAM ecosystem.

| Items | Values |

|---|---|

| Quantitative Units | USD 13.9 billion |

| Mode of Operation | Pilot operated and Autonomous/remotely operated |

| Vehicle Type | EVTOL aircraft, STOL aircraft, and Conventional fixed-wing |

| Propulsion Type | Electric propulsion, Turbine engines, Hybrid propulsion, Gasoline, and Reciprocating engines |

| Range | 100 km – 250 km, Below 100 km, 250 km – 500 km, and More than 500 km |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Passenger transport, Cargo transport, Mapping & surveying, Special mission, Surveillance & monitoring, Others, Company, Airbus, The Boeing Company, Aurora Flight Sciences, Bell Textron Inc., and Guangzhou EHang Technology |

| Additional Attributes | Dollar sales by aircraft type and application, demand dynamics across urban air mobility, regional transport, and emergency services, regional trends in eVTOL and autonomous aviation adoption, innovation in electric propulsion, flight control systems, and safety integration, environmental impact of reduced urban congestion and emissions, and emerging use cases in on-demand air taxi services, medical evacuation, and cargo delivery. |

The global advanced air mobility market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the advanced air mobility market is projected to reach USD 90.3 billion by 2035.

The advanced air mobility market is expected to grow at a 20.6% CAGR between 2025 and 2035.

The key product types in advanced air mobility market are pilot operated and autonomous/remotely operated.

In terms of vehicle type, evtol aircraft segment to command 46.7% share in the advanced air mobility market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Process Control Market Size and Share Forecast Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Advanced Driver Assistance System (ADAS) Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Energy Storage System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sports Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA