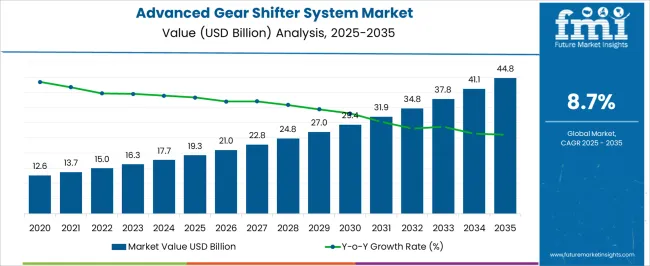

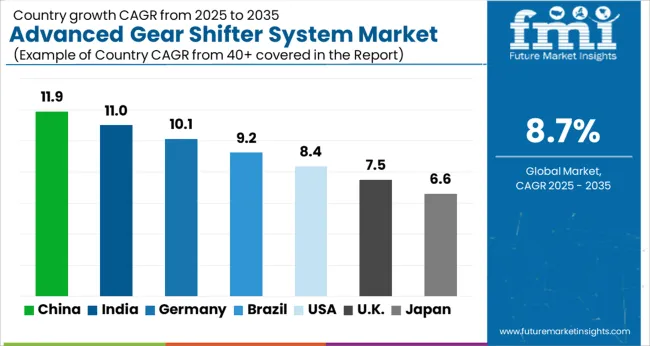

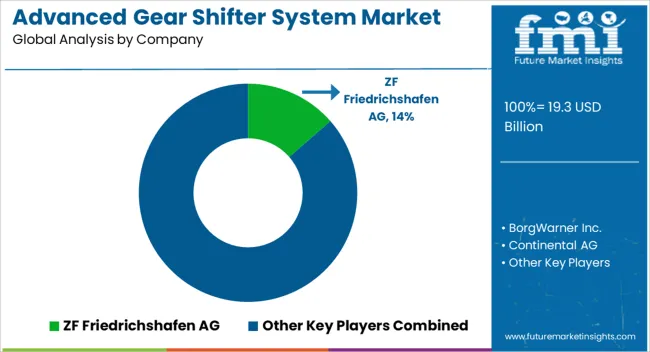

The Advanced Gear Shifter System Market is estimated to be valued at USD 19.3 billion in 2025 and is projected to reach USD 44.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Advanced Gear Shifter System Market Estimated Value in (2025 E) | USD 19.3 billion |

| Advanced Gear Shifter System Market Forecast Value in (2035 F) | USD 44.8 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The advanced gear shifter system market is growing steadily, influenced by rising consumer demand for driving comfort, enhanced vehicle safety, and the integration of smart transmission technologies. Market expansion is supported by increasing adoption of automatic transmission systems in passenger and commercial vehicles, alongside regulatory mandates for fuel efficiency and emission reduction.

Technological innovations such as shift-by-wire, electronic actuators, and adaptive transmission controls are driving product evolution, offering higher precision and reduced mechanical complexity. The current market is shaped by strong adoption in light-duty vehicles, particularly in regions with a preference for automatic driving systems.

Looking forward, the shift toward hybrid and electric vehicles is expected to create new opportunities for advanced shifter systems, as manufacturers adapt designs to meet evolving drivetrain architectures.

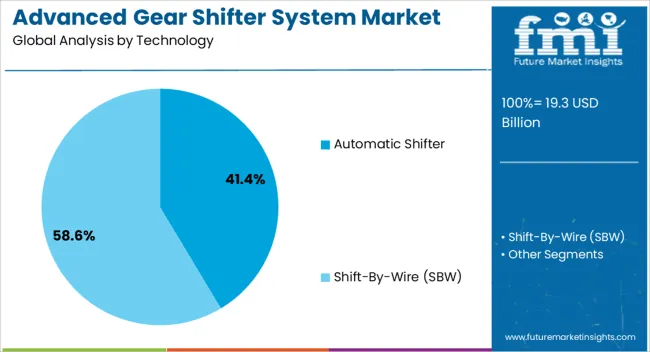

The automatic shifter segment accounts for approximately 41.40% share of the technology category in the advanced gear shifter system market. Its dominance is driven by the rising penetration of automatic transmissions across passenger vehicles and the growing consumer preference for convenience in urban driving environments.

Automatic shifters enable smoother gear transitions, reducing driver fatigue and improving vehicle performance in traffic conditions. The segment benefits from advancements in electronic and shift-by-wire technologies, which enhance reliability and reduce mechanical wear.

With automotive OEMs increasingly standardizing automatic shifters in mid- and high-end models, the segment is positioned to maintain a strong growth trajectory in the forecast period.

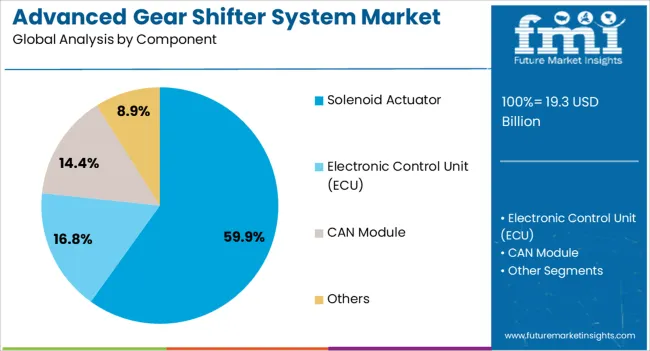

The solenoid actuator segment leads the component category, holding approximately 59.90% share. This dominance stems from its critical role in enabling precise and efficient gear shifting in advanced transmission systems.

Solenoid actuators are widely adopted due to their fast response times, durability, and compatibility with electronic control units. Their integration supports seamless shifting, contributing to improved fuel efficiency and reduced emissions.

Technological improvements in actuator design have further enhanced reliability and cost-effectiveness. With the growing adoption of electronically controlled transmissions, solenoid actuators are expected to remain an essential component, reinforcing their leading share in the market.

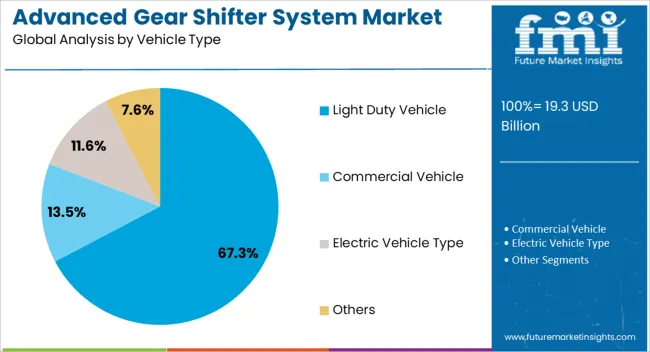

The light duty vehicle segment dominates the vehicle type category, representing approximately 67.30% share of the advanced gear shifter system market. This segment’s leadership is supported by high global production volumes of passenger cars and light trucks, where advanced gear shifting solutions are increasingly integrated.

Rising urbanization and consumer preference for comfort-oriented driving have accelerated adoption in this category. OEMs are equipping light duty vehicles with advanced shifters as standard offerings, particularly in automatic and hybrid models, to enhance performance and market competitiveness.

With continued consumer demand for driving convenience and efficiency, the light duty vehicle segment is expected to sustain its strong position in the forecast horizon.

Soaring Electric and Hybrid Vehicle Sales Spur Market Demand

The increasing popularity of hybrid and electric cars has spurred demand for intelligent gear shift systems designed specifically for these vehicles. Product portfolios are carefully aligned by automakers with the changing propulsion landscape, making gear shifters suited for electric powertrains necessary.

This change is a calculated move to gain market share in the rapidly growing electric automobile sector, where modern gear shifter designs are essential to maximize efficiency and customer satisfaction, helping businesses gain a competitive edge in the auto industry.

Introduction of Dynamic Shifting Profiles Enhances Market Appeal and Versatility

Dynamic shifting profiles are a thoughtful solution to modern gear shift systems' wide range of driving preferences. Automakers are creating shifting profiles that adjust to various driving conditions, such as eco-friendly modes for fuel-efficient commuting and performance-oriented shifts for aggressive driving.

This tactical approach enhances the vehicles' market appeal and adaptability by catering to a wide range of consumer preferences. Brand loyalty and competitive distinction in the congested automotive sector are fostered by firms positioning themselves as cognizant of consumer demands through customizable driving experiences.

Businesses Aim to Gain a Competitive Edge Using Integration with ADAS

In line with the industry's strategic objective of augmenting vehicle safety and automation, electronic automotive shifter systems are being incorporated with advanced driver assistance systems (ADAS). In order to enable features like automated parking and cooperation with adaptive cruise control, automakers are deliberately integrating intelligent gear shift systems into larger ADAS frameworks.

In addition to improving overall vehicle safety, this smart move gives businesses a competitive edge in a market where improvements in automation and safety are rapidly defining the industry. Companies are also positioned as leaders in the integration of smart technology.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Top Technology | Automatic Shifter |

|---|---|

| CAGR (2025 to 2035) | 8.6% |

Based on technology, the automatic shifter segment is projected to lead the market, growing at an 8.6% CAGR through 2035. This is attributable to the following reasons:

| Top Component | Solenoid Actuator |

|---|---|

| CAGR (2025 to 2035) | 8.4% |

Based on the component, the solenoid actuator segment is predicted to thrive at an 8.4% CAGR through 2035. The key factors driving the segment’s growth are:

The demand for advanced gear shifter systems in the United States is predicted to rise at a 9.1% CAGR through 2035. The key drivers are:

Sales of advanced gear shifter systems in the United Kingdom are projected to increase at a 9.1% CAGR through 2035. The key factors are:

The advanced gear shifter system market growth in China is estimated at a 9.6% CAGR through 2035. The key drivers are:

The demand for advanced gear shifter systems in Japan is anticipated to surge at a 10.3% CAGR through 2035. The key drivers are:

The advanced gear shifter systems market in South Korea is projected to thrive at an 11.1% CAGR through 2035. The key factors propelling the market growth are:

The competitive environment of the advanced gear shifter system market is defined by constant competition among traditional automotive suppliers, new tech-focused startups, and their strategic partners. With a wide range of cutting-edge gear shifter options, leading companies in the automotive component industry include ZF Friedrichshafen AG, BorgWarner Inc., Continental AG, etc.

These industry titans retain a competitive edge by utilizing their vast R&D skills and worldwide production networks to meet the various demands of automakers in multiple locations.

Recent Developments

The global advanced gear shifter system market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the advanced gear shifter system market is projected to reach USD 44.8 billion by 2035.

The advanced gear shifter system market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in advanced gear shifter system market are automatic shifter and shift-by-wire (sbw).

In terms of component, solenoid actuator segment to command 59.9% share in the advanced gear shifter system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Advanced Airport Technologies Market Size and Share Forecast Outlook 2025 to 2035

Advanced Air Mobility Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sensor Market Size and Share Forecast Outlook 2025 to 2035

Advanced Combat Helmet Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Advanced Functional Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Drill Data Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Coating Market Size and Share Forecast Outlook 2025 to 2035

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Advanced Tires Market Size and Share Forecast Outlook 2025 to 2035

Advanced Therapy Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Advanced Glass Market Size and Share Forecast Outlook 2025 to 2035

Advanced Server Energy Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Advanced Sports Materials Market Size and Share Forecast Outlook 2025 to 2035

Advanced Wound Management Market Growth - Industry Outlook 2025 to 2035

Advanced Packaging Market Size & Share Forecast 2025 to 2035

Advanced Polymer Composites Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA